Office Insight – Birmingham Q3 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Guide to Business in Birmingham

A Guide to Business in Birmingham Photography by Tony Hisgett on Flickr A guide to business in Birmingham Contents Introduction 3 Key commercial property trends 4 Industry overview 5 Aerospace 6 Automotive 7 Food and drink 8 Professional 8 Information technology and media 9 Tourism and retail 10 Economic growth and employment 11 Infrastructure and environment 12 References 13 About us 14 Commercial Property – Industrial Units, Office Space to Rent 2 A guide to business in Birmingham Introduction Outside of London, Birmingham is the UK’s second largest market for doing business, with a thriving manufacturing industry and growing service and tourism sector. The much publicised HS2 rail project, which will unite the area with London, is likely to stimulate further investment, making the city one of the most commercially attractive cities in Europe. Significant investment from home and abroad should help to alleviate the city’s unemployment problem in the coming years, making Birmingham a European hub for international business. The city is regarded as the 18th best city in Europe in which to locate a business (1), providing access to over 100,000 graduates, with competitive advantage in areas like automotive and aerospace research. Commercial Property – Industrial Units, Office Space to Rent 3 A guide to business in Birmingham Key commercial property trends With the development of the HS2 rail project, Birmingham is bracing itself for a boom in commercial property demand, with multi-national firms encouraged to use the city as their primary British base. While demand has slowed down following the financial crisis, the office, industrial and retail sectors are expected to exceed the rest of the UK average until 2015: Source: GVA Regional Cities Seminar: Invest in Birmingham/IPD REFL Jan 2011 Speculative developments like the city centre Paradise Circus project are likely to be completed, offering new Grade-A office plots, along with retail space, hotel and entertainment facilities. -

ST JAMES HOUSE Birminghambirmingham, B1 1DB HOTEL DEVELOPMENT OPPORTUNITY

St James House ST JAMES HOUSE BIRMINGHAMBirmingham, B1 1DB HOTEL DEVELOPMENT OPPORTUNITY 1 www.realestate.bnpparibas.co.uk St James House Birmingham, B1 1DB HOTEL DEVELOPMENT OPPORTUNITY SUMMARY • To be sold on behalf of the Joint LPA Receivers • Planning consent granted May 2021 for redevelopment to 10 storey ‘Aparthotel’ with 156 apartments • Terms agreed with Residence Inn by Marriott on franchise agreement • 0.25 miles to Birmingham New Street Station and Grand Central and close by to Birmingham CBD • Existing building – 35,894 sq ft GIA • 999 year long leasehold interest at a peppercorn rent • Prominently situated on the edge of Birmingham’s CBD on the busy A38 Bristol Road • Price on Application For more information, please contact: Simon Robinson +44 (0) 7771 860 985 Senior Director [email protected] Mark Robinson +44 (0) 7342 069 808 Senior Director [email protected] BNP Paribas Real Estate 9 Colmore Row, Birmingham B3 2BJ St James House Birmingham, B1 1DB WELL CONNECTED Motorways Airlines Railways The city benefits from 3 main stations, Birmingham is situated Birmingham airport is due a further New Street, Moor Street and Snowhill. within the heart of expansion at a cost of £500m. This is England’s motorway expected to increase passengers numbers All offer regular services reaching network linking the M1, by a further 40% over the next 15 years. the majority of the UK. M5, M6, M40 and M42 resulting in over 90% of the Paris 1hr 15 mins population being within London (Euston) 1hr 20 mins Edinburgh 1hr 10 mins 4 hour travel time. -

Samant Narula Partner and Practice Group Leader - Real Estate UK London

Samant Narula Partner and Practice Group Leader - Real Estate UK London T: +44 (0) 20 3400 4987 M: +44 (0)7912 240936 E: [email protected] • Experienced in a broad range of corporate real Practices estate matters with a particular emphasis on Commercial Real Estate investment work for private equity real estate Real Estate funds, domestic and overseas institutional Real Estate Private Equity, Investments and REITs investors including pension funds as well as Logistics and Industrial property companies and a variety of lenders. • Over the past 2 years has advised on over £3 Admissions billion worth of deals, leading multi-disciplinary England and Wales teams on complex high value transactions across a range of sectors including offices, student, Page 1 of 5 BTR/Multi-family, hotels, logistics, retirement living and retail. • Advises clients on the use of a variety of corporate structures and the purchasing of different types of corporate entities. • Provides advice to clients on joint venture arrangements, and recently advised Northwood Investors on its joint venture with Platform_ in creating a new UK focused BTR platform . • Advises client on acquisition and sale structures. He has recently advised overseas clients on the purchase of debt positions. He is experienced working at all levels of the capital stack. • Acts for a number of lenders (senior and mezzanine) and has advised on both investment and development finance. Also advises investors and lenders on the purchase of non-performing loan portfolios, and on the purchase of tranches of debt. • Member of the Association of Real Estate Funds (“AREF”). Page 2 of 5 Representative Experience Advising Northwood Investors, on the creation of a new £1billion BTR JV platform with developer Platform_. -

Greater Birmingham and Solihull LEP Birmingham City Centre Enterprise Zone Investment Plan 2013/14 to 2022/23

Greater Birmingham and Solihull LEP Birmingham City Centre Enterprise Zone Investment Plan 2013/14 to 2022/23 July 2014 Contact Economy Directorate Birmingham City Council Click: Email: [email protected] Web: www.birminghamenterprisezone.org Call: Telephone: (0121) 303 3075 Visit: Office: 1 Lancaster Circus Birmingham B4 7DJ Post: PO Box 28 Birmingham B1 1TU You can ask for a copy of this document in large print, another format or another language. We aim to supply what you need within ten working days. Call (0121) 303 3075 If you have hearing difficulties please call us via Typetalk 18001 0121 303 3075 or e-mail us at the address above. Plans contained within this document are based upon Ordnance Survey material with the permission of Ordnance Survey on behalf of the Controller of Her Majesty’s Stationery Office. © Crown Copyright. Unauthorised reproduction infringes Crown Copyright and may lead to prosecution or civil proceedings. Birmingham City Council. Licence number 100021326, 2014. Contents Foreword 3 Introduction 4 Progress 6 Investment strategy 10 Investment programme 16 Financial strategy 22 Economic impact of the EZ investment programme to 2022/23 28 Governance and project delivery 30 Appendix 32 Risk register contents / birmingham city centre enterprise zone investment plan Birmingham Curzon concourse entrance birmingham city centre enterprise zone investment plan / foreword Foreword 3 The Birmingham City Centre Enterprise Zone (EZ) is truly exciting. It is enabling us to deliver significant growth and jobs for the benefit of the whole of the Greater Birmingham and Solihull area. One of the major benefits of the EZ designation is the ability for the Local Enterprise Partnership (LEP) to retain all of the uplift in business rates in the Zone for 25 years from April 2013. -

Welcome to Birmingham East & Green Is a Striking Modern Development Situated in the Beating Heart of Digbeth's Regeneration

Welcome to Birmingham East & Green is a striking modern development situated in the beating heart of Digbeth's regeneration, just a 5-minute walk from The Custard Factory and Smithfield. The building is comprised of high specification one- and two-bedroom apartments with floor-to-ceiling windows overlooking vistas of the City Centre. With the new tram stop to the HS2 Curzon Station on its doorstep, East & Green is ideally positioned to attract the growing young demographic moving to Birmingham from London. Computer generated images are intended for illustrative purposes only Fastfacts - 1 EAST & GREEN FASTFACTS Developer Payment process Merchant Square Capital • 15% upon Exchange of Contracts (company under the Apex Airspace Group) • 85% upon Completion Architect PHD Architects Mortgage finance Exclusive IPG units • Up to 70% LTV* 74 Apartments *Subject to condition. Please contact us for details - 35 x 1 bedroom - 39 x 2 bedroom Purchaser solicitor Car parking spaces 23 spaces Riseam Sharples LLP 2 Tower Street, London WC2H 9NP Location 250 & 251 Bradford Street and 25-30 Green Developer's solicitor Street, Digbeth, Birmingham, B12 0RG Price range Travers Smith LLP One Beds - From £198,000 to £233,000 10 Snow Hill, London, EC1A 2AL (exclu. Parking) Two Beds - From £247,000 to £299,000 Mortgage process (exclu. Parking) Please contact our preferred partner Liquid Expat Avg. PSF Mortgages for more details. £381psf 24/7 hotline Car parking T: +44 (0) 161 871 1216 £20,000 E: [email protected] (first come first serve for 2 beds only) W: www.liquidexpatmortgages.com Size Range SQFT One Beds – 540 sqft to 606 sqft Two Beds – 702 sqft to 771 sqft Leasehold Length 250 Years Ground Rent (per annum) 0.1% of Selling Price. -

Town of Waukesha

TITLE 13 Zoning Chapter 1 Introduction Chapter 2 General Provisions Chapter 3 Zoning Districts CHAPTER 1 Introduction 13-1-1 Zoning Regulations Amended 13-1-2 Purpose 13-1-3 Scope 13-1-4 Definitions SEC. 13-1-1 ZONING REGULATIONS AMENDED. The Zoning Ordinance of the Town of Waukesha passed and adopted by the Town Board on September 22, 1948; November 21, 1956; and July 24, 1979 approved by the Waukesha County Board of Supervisors, is amended as hereafter provided. SEC. 13-1-2 PURPOSE. The provisions of this ordinance shall be held to be minimum requirements adopted to promote the health, safety, morals, comfort, prosperity and general welfare of the Town of Waukesha. Among other purposes, such provisions are intended to provide for adequate light, air, convenience of access, and safety from fire and other dangers; to promote the safety and efficiency of the public streets and highways; to aid in conserving and stabilizing the economic values of the community; to promote the orderly development of land; to preserve and promote the general attractiveness and character of the community environment; to guide the proper distribution and location of population and of the various land uses; and otherwise provide for the healthy and prosperous growth of the community. SEC. 13-1-3 SCOPE. It is not intended by this ordinance to repeal, abrogate, annul, impair or interfere with any existing easement, covenants or agreements between parties or with any rules, regulations, or permits previously adopted or issued pursuant to laws; provided, however, that where this ordinance imposes a greater restriction upon the use of buildings or premises, or upon the height of a building or structure or requires larger open spaces than are required by other rules, regulations or permits or by easements, covenants or agreements, the provisions of this ordinance shall govern. -

Firetex Fx5090 Cellulosic Passive Fire Protection Water-Based Intumescent

FROM SPEC TO PROTECT TRACK RECORD ® FIRETEX FX5090 CELLULOSIC PASSIVE FIRE PROTECTION WATER-BASED INTUMESCENT Project name Location city Location country Date Muzeum of Polish History, Warsaw Phase 1 Bydgoscz Poland 2020 Xerox Pensions Limited - 11 York Street Manchester United Kingdom 2020 Bowmer & Kirkland Schools Package 1 Various Locations United Kingdom 2020 Parkside Phase 1 - Student Accommodation, Coventry Coventry United Kingdom 2020 Lincoln Medical School Lincoln United Kingdom 2020 Cumberland United Kingdom 2020 103 Colmore Row AKA Natwest Tower Birmingham United Kingdom 2020 Manchester Goods Yard AKA St Johns- Office Development Manchester United Kingdom 2020 Princes Limited - Warehouse and processing centre Lincolnshire United Kingdom 2020 GR Wright Flour Mill Essex AKA Project Polaris Ireland Ireland 2020 DHL Warehouse Buckinghamshire - AKA Project Nautilus Milton Keynes United Kingdom 2020 Maths And Computer Science Centre - Cardiff University Cardiff United Kingdom 2020 Park Yacht Club- Nottingham - AKA Charlotte Park Nottingham United Kingdom 2020 Grangemouth CHP Plant AKA Ineos New Energy Plant - Protective Coatings Package Grangemouth United Kingdom 2020 Durham Gate Development Centre - Millburngate House Redevelopment - Durham Durham United Kingdom 2020 Riverside - Zone 1 John Street -Apartments & Car park Warrington Warrington United Kingdom 2020 20 Ropemaker Street London United Kingdom 2020 New Covent Garden Market - Phase 2 London United Kingdom 2019 YMCA Milton Keynes aka North Row Central Milton Keynes United -

The Council House, Victoria Square, Birmingham, B1 1BB Listed

Committee Date: 27/06/2013 Application Number: 2013/01613/PA Accepted: 16/04/2013 Application Type: Listed Building Target Date: 11/06/2013 Ward: Ladywood The Council House, Victoria Square, Birmingham, B1 1BB Listed Building Consent for the installation of 4 no. internal recording cameras to Committee Rooms 3 & 4. Applicant: Acivico - Birmingham City Council The Council House, Victoria Square, Birmingham, B1 1BB Agent: Acivico - Development Dept 1 Lancaster Circus, Queensway, Birmingham, B2 2WT Recommendation Refer To The Dclg 1. Proposal 1.1. This application seeks Listed Building Consent for the installation of 4 no. internal recording cameras at The Council House in Victoria Square. 1.2. The cameras would be 0.14m (w) x 0.16m (h) x 0.16m (d) to be installed in each corner of Committee Rooms 3 and 4 used to record meetings. They would be coloured white. 2. Site & Surroundings 2.1. The Birmingham Council House occupies a site between Chamberlain Square, Eden Place, Victoria Square and Chamberlain Square. The present building was designed by Yeoville Thomason and built between 1874 and 1879 on what was once Ann Street. 2.2. The building is three storeys plus basement made of stone with a tile roof. The site forms part of the Colmore Row and Environs Conservation Area designated in October 1971 and extended in March and then July 1985. 2.3. The building provides office accommodation for both employed council officers, Chief Executive and elected council members. There is also a large and ornate banqueting suite complete with minstrels gallery. Committee Rooms 3 & 4 are located on the ground floor fronting onto Victoria Square. -

Travelling to UCE Birmingham Conservatoire

Travelling to UCE Birmingham Conservatoire ROAD From M6 South or North-West Leave the M6 at Junction 6 and follow the A38(M). Follow signs to ‘City centre, Bromsgrove, (A38)’. Do not take any left exit. Go over 1 flyover and through just 1 Queensway tunnel (sign posted ‘Bromsgrove and Queen Elizabeth Hospital’). Leave this tunnel indicating left but stay in the right hand lane of the slip road. UCE Birmingham Conservatoire is located on the Paradise Circus island. Follow directions below for parking and/or loading & unloading. Parking Car parking at the Conservatoire is very limited and we regret we cannot offer parking spaces to visitors. However, there are several NCP car parks located close by, including two located on Cambridge Street. To access these car parks, at the Paradise Circus island, immediately after you pass the exit for the A456 (Broad Street), move into the left lane and take the first left into Cambridge Street. Loading & Unloading To access the Conservatoire’s car park (for loading and unloading only), pass under the bridge and turn right as if to access the Copthorne Hotel, and then right again into the underground road. Follow the road around to the left to gain access to the Conservatoire’s car park, which is at the end of the road. A goods lift is available. From M5 South-West Leave the M5 at Junction 3 and travel towards Birmingham City Centre along the A456 (Hagley Road) for 5 miles to the Five Ways island. This is easily distinguishable as it is surrounded by large office blocks and a Tesco store. -

TPWM News: Project Updates

Artists’ News & Opportunities Bulletin Issue 43: 14 June 2012 Click on the headings below to go straight to your preferred section of the bulletin... o Funding o Opportunities o Commissions o Calls for work o Prizes o Residencies o Traineeships o Jobs o Voluntary Positions o Festivals o Courses/ workshops o Graduate Exhibitions o What’s happening o Ongoing exhibitions TPWM News: Project Updates Artist Development In summer 2012 a professional development programme for artists will be launched by TPWM in collaboration with The Art Gallery Walsall and other partners. It will take place across the West Midlands and will be aimed at artists at varying levels of career development. Details will be available soon on www.tpwestmidlands.org.uk New Art West Midlands 2013: Call for Applications from recent Visual Arts Graduates Application forms available from: http://www.tpwestmidlands.org.uk/new-art-west-midlands-2013/ Deadline: 14 September 2012. Residencies Four organisations in the West Midlands will lead on TPWM new artist residency opportunities: The Library of Birmingham, University of Worcester with Movement Gallery and Worcester City Museum, Eastside Projects and The National Trust at Dudmaston. Two of the four residencies will have an open submission application process. More details will be available soon on www.tpwestmidlands.org.uk Writing Bursary TPWM has awarded a writing bursary to Grand Union (in association with Eastside Projects), in order to offer an opportunity for a new or emerging writer to develop skills in critical writing for publication and encourage writing practice within the West Midlands. The writing bursary will be awarded following an open submission. -

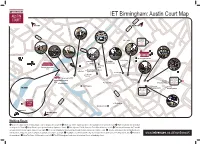

IET Birmingham: Austin Court Map

IET Birmingham: Austin Court Map GRAHAM ST A4400 S A41/M5 M6/M1/M42 U NEWHALL ST M M CAMDEN ST NEW HALL HILL E R H A38 IL L R O A D S UM A457M ER H ILL RD Birmingham Snow Hill CHARLOTTE ST BT Tower Driving Distance SAND PITS 4 mins Walking Distance SAND PITS 15 mins PARADE GREAT CHARLES STREET QUEENSWAY NEWHALL ST A457 LIONEL ST COLMORE ROW ST MARKS CRESCENT Birmingham Cathedral Art Gallery 694m Baskerville Birmingham House Central Library H Council T S Copthorne T House N National Indoor Arena 10 E Hotel C IN 273m T. V 12 New Birmingham Library S C AM 11T BRIIDGE S The Rep (opens Sept 2013) CORPORATION ST Town Hall 6 8 P Centenary A PINFOLD ST NEW ST R 5 9 A 7 Square D I Y SE WA C S Birmingham Symphony Hall/ICC I N HILL ST RC EE U QU HE Moor Street S STEP NSON National Sea Life Centre ST 3 2 Pavillion Driving Distance 342m 4 5 mins Crowne Plaza Shopping Centre Walking Distance Brindleyplace 25 mins BROAD ST H Hyatt Regency 1 Pallasades ST Bullring N IO Birmingham Shopping Centre AT Shopping Centre BRIDGE ST IG New Street AV KING EDWARDS ROAD N Driving Distance A38 4 mins Walking Distance 12 mins HOLIDAY ST E KINGSTON ROW S O L HILL ST C C I V SUFFOLK STREET QUEENSWAY I C A456 BERKLEY ST The Mailbox Malmaison Hotel H SEVERN ST C A GRANVILLE ST MB RID BROAD ST Malt House GE ST M5/M42/M40 Walking Route 1 Leave the station via the ‘Victoria Square’ exit, keeping Boots to your left. -

Birmingham, Q2 2019

BIRMINGHAM ABERDEEN SHEFFIELD GLASGOW BRISTOL BIRMINGHAM OFFICEEDINBURGH CARDIFF MARKETNEWCASTLE MANCHESTER LEEDS OCCUPIER HEADLINES TAKE-UP* AVAILABILITY PRIME RENT • Leasing activity improved in Q2 2019 with (sq ft) (sq ft) (£ per sq ft) take-up reaching 320,595 sq ft, a 65% increase £34.50 £35.00 Q2 2019 320,469 Q2 2019 125,000 compared to last quarter. This is 74% above the 10 year quarterly average and is the highest level Q2 2019 vs 10 year Q2 2019 vs 10 year of take-up for Birmingham since Q4 2017. quarterly average 81% quarterly average -68% • The occupational market has been dominated by the arrival of WeWork who has leased 229,042 Q2 2019 Year end 2019 sq ft at three different office locations located 320,595 320,595 220,000 DEVELOPMENT PIPELINE in 55 Colmore Row, Louisa Ryland House and 220,000 277,790 (sq ft) 6 Brindleyplace. With the serviced office sector 277,790 791,000 190,000 growing, B2B accounted for 72% of take-up in Q2. 190,000 486,480 153,000 • Grade A supply continues to fall with 125,000 sq 153,000 194,014 194,014 ft being marketed across three buildings (No 1. 225,000 169,929 169,929 125,000 125,000 120,000 120,000 158,935 Colmore Square, Baskerville House and 1 Newhall 158,935 0 0 Street) at the end of Q2. This is 68% below the 10 Speculative 320,595 year quarterly average. Taking into consideration 320,595 Dates indicate the potential completion date 220,000 220,000 requirements, the market has only four months of of schemes under construction as at Q2 2019.