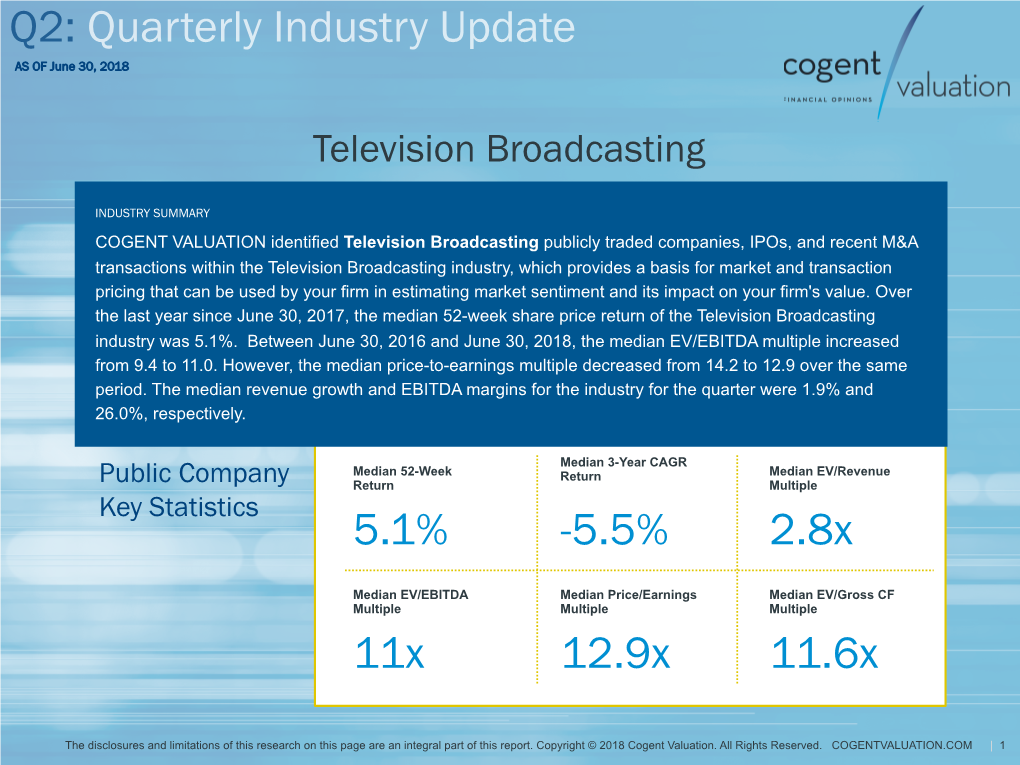

Television Broadcasting 2018 Q2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![BUSINESS Klan Plans Teacher's Halli Boston College,] I N B R Ie F ' 5; to Return Remembered Villanova Lose 8.6% Real GNP](https://docslib.b-cdn.net/cover/4009/business-klan-plans-teachers-halli-boston-college-i-n-b-r-ie-f-5-to-return-remembered-villanova-lose-8-6-real-gnp-284009.webp)

BUSINESS Klan Plans Teacher's Halli Boston College,] I N B R Ie F ' 5; to Return Remembered Villanova Lose 8.6% Real GNP

20 - MANCHESTER HERALD. Sat., March 20, 1982 BUSINESS Klan plans Teacher's Halli Boston College,] I n b r ie f ' 5; to return remembered Villanova lose 8.6% Real GNP ... page 4 ... page 9 ... page 13 Hale elected Barter thrives Gross National Product ~ Seasonally adjusted annual CHICAGO — William H. Hale, president of ra te Heritage Savings and Loan Association of Manchester, Conn., has been appointed to the 1982 as mofiey tight Secondary Market Committee of the United States League of Savings Associations. Percentages reflect change The appointment was announced by Roy G. METAIRIE, La. (UPI) — Businesses ’That means members continue to earn from previous quarter Green, chairman of the league and president of and professionals are turning more and their full profit margin under the system Fair tonight Manchester, Conn. Fidelity Federal Savings and Loan Association, more to bartering in today’s depressed when “selling.” And, when "buying,” and Tuesday Jacksonville, Fla. economy, making a growth industry of the members do not have to spend cash Mon., March 22, 1982 The U.S. League is the principal trade organiza the centuries-old system of exchange. that could be used for inventory or — See page 2 tion for the savings and loan business and “The thing is cash flow,’’ said George capital improvements. 1982 Single copy 25<( represents over 4,000 associations throughout the Hesse, director of the New Orleans ’That television dealer who received a country. Trade Exchange. $1,000 debit will receive credits when Savings and loan associations are the second “People have inventory but no cash. If someone in the system comes to him for largest t> pe of financial Institution in America and they can spend $2,(X)0 on buying things a TV set. -

1 of 6 a I R L I N E S FAA/Shrinking Seats the Federal Aviation

AIRLINES FAA/Shrinking The Federal Aviation Administration has been directed to investigate the case of the Seats incredible shrinking airline seat. Issues: safety concerns, cramped conditions and the plight of large passengers. Note: In 2016, the House and Senate rejected measures that would have required the F.A.A. to set minimum seat-size standards. AUTOMOTIVE Sales The Wall Street Journal reported that auto sales declined sharply in July, continuing a 7-month slowdown punctuated by manufacturers’ reluctance to sell discounted cars through leases and car rental chains, which has driven sales in recent years. According to Autodata Corp., sales fell 7% last month compared with a year earlier. Uber/Barclay Ride hailing entity Uber is partnering with British bank Barclays to issue its own co- branded credit card. BROADCAST E.W. Scripps/Katz TV station group E.W. Scripps (33 TV stations) purchased Katz Broadcasting’s four Networks networks (diginets) – Bounce (African America centric), Grit (action and western), Escape (mystery and investigative) and Laff (comedy) – for $302 million. Fox/ION Rumors are circulating that 21st Century Fox and ION Media Networks (60 TV stations) are contemplating creating a joint venture that would combine their respective local TV station holdings. CABLE Discovery/Scripps Discovery agreed to acquire Scripps Networks for $11.9 billion. Two benefits sighted from a combined entity: redundancy reductions and leverage in negotiating higher distribution fees. The Wall Street Journal reported that a combined Discovery -

Cablefax Dailytm Tuesday — October 3, 2017 What the Industry Reads First Volume 28 / No

www.cablefaxdaily.com, Published by Access Intelligence, LLC, Tel: 301-354-2101 Cablefax DailyTM Tuesday — October 3, 2017 What the Industry Reads First Volume 28 / No. 189 Crisis Averted: Altice, Disney Avoid Blackouts with Last-Minute Carriage Deal There was a sense in the industry that the carriage negotiations between Disney and Altice USA were too important for both sides going forward for either to give an inch. Facing potential blackouts for NY-area Optimum customers late Sunday afternoon, however, the two sides reached a deal in principle that they could both tolerate. As of press time Monday, neither side would confirm that the deal has been finalized or discuss terms. But sources cited by SportsBusi- ness Journal shed some light on victories and concessions for the folks on each side of the table. Disney reportedly negotiated a price increase for its channels, including ESPN. The size of that increase isn’t clear, but a Bloomberg report cites sources as saying it wasn’t as significant as Disney had hoped. Disney, however, did reportedly score carriage of the SEC Network and soon-to-launch ACC Network despite the fact that neither conference has significant geographic ties to Optimum’s footprint. Other aspects of the deal, including whether Disney was able to obtain a higher penetration threshold for ESPN, remained unavailable Monday. That’s a critical detail for Disney as it seeks to limit distributors’ ability to leave ESPN—the highest-priced cable net—out of bundles. The Altice deal is the first one Disney has had to negotiate since late 2014, when ESPN was still a growth engine. -

NAB Comments Re: Video Competition

Before the Federal Communications Commission Washington, D.C. 20554 In the Matter of ) ) Annual Assessment of the Status of ) MB Docket No. 16-247 Competition in the Market for the ) Delivery of Video Programming ) To: The Commission COMMENTS OF THE NATIONAL ASSOCIATION OF BROADCASTERS Rick Kaplan Jerianne Timmerman Erin L. Dozier Patrick McFadden Scott Goodwin Emmy Parsons 1771 N Street, NW Washington, DC 20036 (202) 429-5430 Terry Ottina NAB Research September 21, 2016 TABLE OF CONTENTS EXECUTIVE SUMMARY .................................................................................................................... i I. AS THE MARKET FOR VIDEO DISTRIBUTION SHIFTS, DATA SHOW THAT FREE OVER-THE- AIR BROADCASTING CONTINUES TO SERVE AN IMPORTANT ROLE IN AMERICAN LIVES . 2 A. Over-the-Air Reliance and Cord-Cutting Trends Continue ............................................. 2 B. Local Stations Take a Multifaceted Approach to Providing High Quality News and Entertainment Content ................................................................................................... 6 II. AUTHORIZATION OF THE NEXT GENERATION TV STANDARD WILL SET THE STAGE FOR THE FUTURE OF TELEVISION ............................................................................................... 14 III. CONCLUSION ........................................................................................................................ 16 EXECUTIVE SUMMARY The state of competition in the video programming marketplace is stronger than ever. Today, in television’s -

TV Broadcasting 2021 Q1

AS OF March 31, 2021 Television Broadcasting INDUSTRY SUMMARY COGENT VALUATION identified Television Broadcasting publicly traded companies, IPOs, and recent M&A transactions within the Television Broadcasting industry, which provides a basis for market and transaction pricing that can be used by your firm in estimating market sentiment and its impact on your firm's value. Over the last year since March 31, 2020, the median 52-week share price return of the Television Broadcasting industry was 5.4%. Between March 31, 2020 and March 31, 2021, the median EV/EBITDA multiple increased from 9.8 to 9.9. However, the median price-to-earnings multiple decreased from 14.5 to 11.9 over the same period. The median revenue growth and EBITDA margins for the industry for the quarter were 1.9% and 23.1%, respectively. Median 3-Year CAGR Median 52-Week Return Median EV/Revenue Public Company Return Multiple Key Statistics 5.4% -.5% 2.7x Median EV/EBITDA Median Price/Earnings Median EV/Gross CF Multiple Multiple Multiple 9.9x 11.9x 11.6x TheThe disclosures disclosures and and limitations limitations of thisof this research research on onthis this page page are are an anintegral integral part part of thisof this report. report. Copyright Copyright © 2021© 2021 Cogent Cogent Va luaValuation.tion. All AllRights Rights Reserved. Reserved. COGENTVALUATION.COM COGENTVALUATION.COM | 1 INDUSTRY: Q1 2021 TELEVISION BROADCASTING Comparable Public Company Market Price Returns as of March 31, 2021 2021 3 Month 1 Year 2 Year 3 Year 2020 2019 2018 AMC Networks Inc. -4.4% -4.4% -11.9% -14.9% -4.6% 3.3% -29.9% 17.1% CBS Corporation -12.9% -12.9% -25.9% 11.9% 0.9% -7.3% 35.0% -14.8% Central European Media Enterprises -9.7% -9.7% 35.5% 31.5% 12.4% 82.4% -5.2% -16.2% Crown Place VCT PLC 4.3% 4.3% 14.1% -3.6% -9.8% 9.0% -14.8% -10.1% Discovery Communications, Inc. -

Broadcast Diginets Come Of

www.spotsndots.com Subscriptions: $350 per year. This publication cannot be distributed beyond the office of the actual subscriber. Need us? 888-884-2630 or [email protected] The Daily News of TV Sales Tuesday, October 10, 2017 Copyright 2017. BROADCAST DIGINETS COME OF AGE SOME TOP CABLE NET COVERAGE ADVERTISER NEWS The switch from analog to digital transmission in 2009 Retail giant Walmart unveiled a new service on Monday gave American broadcasters their long-sought multiple called Mobile Express Returns, a simplified process that channels to compete with cable. Since then, more than a will be available in early November for items sold and dozen new broadcast “diginets” have launched to provide shipped by Walmart.com and the service will be available content on those multi-cast channels. A new report from for store purchases in early 2018. The company said Katz Media Group (KMG) finds that the new networks are Mobile Express Returns handles customers who initiate a drawing audiences and providing a “compelling alternative” return using the Walmart App and finish it at the store via to cable for advertisers. a Mobile Express lane at the customer service desk. The “They’re relative uncluttered. They’re a good customer scans the QR code displayed on the advertising environment,” Stacey Schulman, card reader with the Walmart app, then hands KMG’s EVP of Strategy and Analytics, told us. the items over to an associate. Refunds will be The report found that the diginets air roughly credited to the customer’s payment account as 11-12 minutes of national and local spots per soon as the following day. -

Gray Television, Inc. (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): November 1, 2018 (November 1, 2018) Gray Television, Inc. (Exact name of registrant as specified in its charter) Georgia 001-13796 58-0285030 (State or other jurisdiction (Commission (IRS Employer of incorporation) File Number) Identification No.) 4370 Peachtree Road, Atlanta GA 30319 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code 404-504-9828 Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company ☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

Piccirillo Becomes

BOB CHRISTY ACTING PD I N S I D E: Piccirillo Becomes MARKET SIZE POINT VP /GM At WCLS SYSTEM After an 18-month stint as Di- py road since we bought the sta- TO REPLACE rector/Advertising Sales for tion, and have had to take a few 12 -12 RADIO RULE? Warner -Amex's Cincinnati bad turns. But I'm just tickled cable system, longtime broad- to death to find such a pro. Rep. Mickey Leland is proposing an caster John Piccirillo has John's a guy who really wants ownership limit based on points assigned returned to radio as VP /GM at to work with me on putting by market size - so that small market sta- A/C outlet WCLS/Detroit. The WCLS on the map, and that's tions could be accumulated in greater Liggett Broadcast Group sta- exactly what we're planning to RerI do, with both barrels." numbers than large market outlets. Full tion had been without a GM for several weeks since Grant San - A 19 -year radio veteran, Pic - details from Brad Woodward in the chillo spent two years as Re- Washington Report. timore stepped down for health reasons. gional VP for Heftel, supervis- Page 4 RADIO & RECORDS President Bob Liggett told ing its Indianapolis and Cincin- R&R, "His appointment means nati properties. His manage- hope springing eternal. We've ment background also includes EVALUATING AOR'S had kind of a complicated, bum- WNDE & WFBQ /Indianapolis RATINGS PERFORMANCE and WLEE /Richmond. "I en- HARRIS, MUSUMECI (R l3ERR my stay with cable Jhan Hiber RESIGN ly," Piccirillo said, examines AOR's overall tally in TAOMSOL N SST..AOTOO 41K NLI D]PYede the spring '84 Arbitron book, while Steve but I missed radio to death." Feinstein Following the departures of spotlights AORs that ranked No. -

Digital Media & Entertainment

Where Georgia Leads: Digital Media & Entertainment Georgia stands as a clear leader in the digital media and entertainment software industry. From interactive game design, filmed entertainment, music, and broadcast radio and television, to animation and digital effects, and augmented/immersive entertainment, the state is truly an industry powerhouse. More than 13 national/regional media outlets are based in Georgia including CNN and Turner Broadcasting, Cox Communications, Fox Sports South, the Weather Company and others. Over 10,000 individuals are employed full-time in the broadcast sector (radio, TV, network and cable) throughout the ten-county metro Atlanta region. Another 4,000 professionals are employed in the motion picture and sound recording sectors. This highly skilled workforce, along with the state’s infrastructure, industry innovators, incentives and world-class educational institutions, create a vibrant ecosystem that entertains the world. Gaming: Georgia’s video game industry accounted Film and Television: TV networks, Hollywood studios, for nearly 2,000 direct jobs in 2012 and $1.6 billion and more created $6B in economic impact in FY15 in total economic activity. The state has about 75 and the state is the 3rd most profitable in the nation game studios and more than 4,000 Georgia college when it comes to entertainment, behind California students are pursuing game-related degrees. and New York, respectively Music: Georgia is home to GRAMMY® winners in multiple categories and genres, and has 300-plus recording studios. Roughly 20,000 individuals work in various aspects of Georgia’s music industry and generates an annual economic impact of $3.7 billion according to 2011 study. -

7.83 Billion U.S

AUGUST 1, 2016 56.7% Share of U.S. Hispanic smartphone owners 56.6 million who have Androids Hispanics or Latinos living in the U.S. in 2015, or 17.6% of the population 13:15 Average hours:minutes Hispanics spent listening to radio each week $7.83 billion U.S. Hispanic major-media spending on TV, cable, newspaper, magazines and radio 13TH ANNUAL HISPANIC FACT PACK Hulu Has the Content Latino Audiences Love +36% Growth in Latino Unique Viewers YOY SOURCE: Hulu Internal data Q1 2016 Choice Drives Engagement Nearly 1 in 4 Hulu Users are Latino SOURCE: Hulu Internal data Q2 2016 With our ad selector, bilingual viewers can select their preferred language. Contact your sales rep at [email protected] Connect with Hulu. Connect with Latinos. YOUNGER LIGHTER UNSKIPPABLE INDUSTRY-LEADING #1 SAFE SITE 100% AUDIENCE AD LOAD ADS VIEWABILITY FOR BRANDS AD COMPLETION ACCORDING TO MYERSBIZNET http://www.hulu.com/advertising/multicultural Hulu Has the Content Latino Audiences Love +36% Growth in Latino Unique Viewers YOY SOURCE: Hulu Internal data Q1 2016 Choice Drives Engagement Nearly 1 in 4 Hulu Users are Latino SOURCE: Hulu Internal data Q2 2016 With our ad selector, bilingual viewers can select their preferred language. Contact your sales rep at [email protected] Connect with Hulu. Connect with Latinos. YOUNGER LIGHTER UNSKIPPABLE INDUSTRY-LEADING #1 SAFE SITE 100% AUDIENCE AD LOAD ADS VIEWABILITY FOR BRANDS AD COMPLETION ACCORDING TO MYERSBIZNET http://www.hulu.com/advertising/multicultural HISPANIC FACT PACK 2016 SUBSCRIBE TO AD AGE DATACENTER INSIDE Ad Age Datacenter subscribers get exclusive access to expanded content. -

Scripps Acquires Four Fast-Growing, Audience-Targeted Television Networks

Scripps acquires four fast-growing, audience-targeted television networks Aug. 1, 2017 CINCINNATI — The E.W. Scripps Company (NYSE: SSP) has acquired the Katz broadcast networks, which distribute programming for targeted audiences over the air, in a deal worth $302 million. The four national networks — Bounce, Grit, Escape and Laff — each reach more than 80 percent of all U.S. households and are among the fastest-growing in television today. “In today’s fragmented television ecosystem, a growing number of viewers are consuming content from new over-the-air networks as a complement to over-the-top services,” said Rich Boehne, chairman, president and CEO of Scripps. “The entrepreneurs at Katz were among the first to take full advantage of this resurgence in over-the-air viewing. We were early investors in the company, and it’s a strategy and team we know well. “Acquiring these innovators will increase our opportunity to serve the nation’s largest advertisers, who see tremendous value in the networks’ content and the large, targeted audiences they draw.” Scripps was already a 5 percent owner in a portion of the business, so its net purchase price is $292 million. The deal will be treated as a purchase of assets for tax purposes. After including the present value of the future tax benefits, the purchase multiple is about 8x, based on our forecast for 2018 segment profit. Because of the strong corporate debt market, Scripps intends to finance the transaction with $250 million of new debt and about $50 million of cash on hand. Upon closing, Scripps’ leverage is expected to be about 3x on a pro forma 2017/18 blended basis. -

Digitalizace Televizního Vysílání Ve Spojených Státech

Univerzita Karlova v Praze FAKULTA SOCIÁLNÍCH VĚD Institut komunikačních studií a žurnalistiky Katedra mediálních studií Digitalizace televizního vysílání ve Spojených státech Diplomová práce Mgr. Bc. Vítězslav Boch Praha, 2017 Autor práce: Mgr. Bc. Vítězslav Boch Vedoucí práce: doc. MgA. Martin Štoll, Ph.D. Rok obhajoby: 2017 Bibliografický záznam BOCH, Vítězslav. Digitalizace televizního vysílání ve Spojených státech. Praha, 2017. 115 s. Diplomová práce (Mgr.) Univerzita Karlova, Fakulta sociálních věd, Institut komunikačních studií a žurnalistiky. Katedra mediálních studií. Vedoucí diplomové práce doc. MgA. Martin Štoll, Ph.D. Abstrakt Tato diplomová práce se zabývá přechodem na zemské digitální televizní vysílání ve Spojených státech. Jejím cílem je představit způsob, jakým ve Spojených státech došlo k zavedení digitálního vysílání a vypnutí analogového vysílání a jak se tato změna projevila na televizním trhu a využití rádiového spektra. V úvodní části je vysvětlen kontext, v jakém americký televizní trh vznikal a vyvíjel se až do počátku 90. let, kdy byla zahájena jednání o digitální televizní vysílání. Důvodem pro vývoj nové televizní normy byla touha vysílat ve vysokém rozlišení obrazu. Způsob, jakým byla ustanovena vysílací norma ATSC, je vysvětlen ve 4. kapitole. Následná kapitola popisuje, jak se postupně rozšiřovalo pokrytí digitální televize a jaké náklady to přineslo divákům. Práce dále popisuje aukce rádiového spektra a změny vysílacího trhu, které digitalizace televizního vysílání ve Spojených státech přinesla. Po dokončení digitalizace vyvstala potřeba znovu otevřít debatu o standardu pozemního vysílání, protože stávající norma již zastarávala a neumožňovala vysílání v ultra vysokém rozlišení obrazu, což vyústilo ve vývoj normy ATSC 3.0, která umožňuje umístit do pozemního vysílání větší počet programů a zároveň rozšířit televizní vysílání i na další zařízení.