Gray Television, Inc. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HHS in the News

May 2021 Topics • Texas Receives $2.5B for Pandemic EBT • Emergency SNAP Benefits Extended for May • WIC Food Benefits Temporarily Expanded • HHSC Mental Health Programs and Services • Nursing Facilities Decrease Use of Antipsychotic Drugs • COVID-19 Cases Decrease at Senior Living Facilities • HHSC Connects with Older Texans • Nursing Home Hurricane Preparedness • HHSC Encourages Women’s Health Screenings • New Certification Rules for Certified Nurse Aides Texas Receives $2.5B for Pandemic EBT Federal pandemic food benefit enters 2nd round in Texas: What families of kids with free, reduced school meals need to know Amanda Cochran KPRC-TV Houston May 20, 2021 Gov. Abbott, HHSC announce approval of $2.5B in pandemic food benefits KIDY-TV San Angelo May 20, 2021 Texans Receive $2.5B in 2nd Round of Federal Pandemic Food Benefits: Gov. Abbott KXAS-TV - Dallas/Fort Worth May 20, 2021 1 Texas families with students receiving free or reduced-price lunches could be eligible for up to $1,200 in food aid Neelam Bohra Texas Tribune May 21, 2021 Texas families without access to school meals to get 2nd round of food assistance KTRK-TV Houston May 21, 2021 Gov. Abbott Announces Additional Food Benefits for Children Yantis Green San Angelo Live May 21, 2021 Texas families to get $2.5B in federal food benefits Corsicana Daily Sun May 24, 2021 Governor Abbott, HHSC Announce $2.5 Billion In Pandemic Food Benefits For Texas Families Irving Weekly May 25, 2021 Editorial: Helping Children: Low-income Texas parents to see something extra on their Lone Star -

Volume XII, No

March 31—April 6, 2011 Volume XII, No. 13 Willie Nelson added to line-up for “Kokua For Japan” on April 10 World-renowned entertainer Willie Nelson will perform at “Kokua For Japan,” a Hawai‘i-based radio, television and Internet fund raising event for the victims of the earthquake and tsunami in Japan. The event, staged by Clear Channel Radio Hawaii and Oceanic Time Warner Cable, will take place at the Great Lawn at the Hilton Hawaiian Village Beach Resort & Spa on April 10, 2011 from noon to 5 p.m. All proceeds to benefit the American Red Cross for the Japan earthquake and Pacific tsunami relief efforts. Nelson will join previously announced entertainers including: Henry Kapono with special guests Michael McDonald and Mick Fleetwood; Loretta Ables Sayre; The Brothers Cazimero; Cecilio & Kapono; Kalapana; Cecilio & Kompany; Amy Hanaialii; Na Leo; John Cruz; Natural Vibrations; ManoaDNA; Robi Kahakalau; Mailani; Taimane; Go Jimmy Go; Jerry Santos; Gregg Hammer Band; and Kenny Endo Taiko. On-air personalities from Clear Channel Radio and local broadcast and cable TV stations will host the program. “Kokua For Japan,” a Hawai‘i-based radio, television and Internet fund raising event for the victims of the earthquake and tsunami in Japan, will be held on Sunday, April 10, 2011 from noon to 5 p.m. The event, staged by Clear Channel Radio Hawaii and Oceanic Time Warner Cable, will take place at the Great Lawn at the Hilton Hawaiian Village Beach Resort & Spa. Tickets are available for $15 via Honolulu Box Office. Visit HonoluluBoxOffice.com for on-line purchasing or call 808-550-8457 for charge-by-phone. -

PUBLIC NOTICE Federal Communications Commission 445 12Th St., S.W

PUBLIC NOTICE Federal Communications Commission 445 12th St., S.W. News Media Information 202 / 418-0500 Internet: https://www.fcc.gov Washington, D.C. 20554 TTY: 1-888-835-5322 DA 18-782 Released: July 27, 2018 MEDIA BUREAU ESTABLISHES PLEADING CYCLE FOR APPLICATIONS FILED FOR THE TRANSFER OF CONTROL AND ASSIGNMENT OF BROADCAST TELEVISION LICENSES FROM RAYCOM MEDIA, INC. TO GRAY TELEVISION, INC., INCLUDING TOP-FOUR SHOWINGS IN TWO MARKETS, AND DESIGNATES PROCEEDING AS PERMIT-BUT-DISCLOSE FOR EX PARTE PURPOSES MB Docket No. 18-230 Petition to Deny Date: August 27, 2018 Opposition Date: September 11, 2018 Reply Date: September 21, 2018 On July 27, 2018, the Federal Communications Commission (Commission) accepted for filing applications seeking consent to the assignment of certain broadcast licenses held by subsidiaries of Raycom Media, Inc. (Raycom) to a subsidiary of Gray Television, Inc. (Gray) (jointly, the Applicants), and to the transfer of control of subsidiaries of Raycom holding broadcast licenses to Gray.1 In the proposed transaction, pursuant to an Agreement and Plan of Merger dated June 23, 2018, Gray would acquire Raycom through a merger of East Future Group, Inc., a wholly-owned subsidiary of Gray, into Raycom, with Raycom surviving as a wholly-owned subsidiary of Gray. Immediately following consummation of the merger, some of the Raycom licensee subsidiaries would be merged into Gray Television Licensee, LLC (GTL), with GTL as the surviving entity. The jointly filed applications are listed in the Attachment to this Public -

Broadcast Actions 12/22/2016

Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 48887 Broadcast Actions 12/22/2016 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 12/15/2016 FM TRANSLATOR APPLICATIONS FOR ASSIGNMENT OF LICENSE GRANTED PA BALFT-20161004AAU W288BO EDUCATIONAL MEDIA Voluntary Assignment of License, as amended 148465 FOUNDATION From: EDUCATIONAL MEDIA FOUNDATION E To: FM RADIO LICENSES, LLC 105.5 MHZ PA , PITTSBURGH Form 345 *GRANTED WITH CONDITIONS* OH BALFT-20161004AAV W244BR EDUCATIONAL MEDIA Voluntary Assignment of License, as amended 139038 FOUNDATION From: EDUCATIONAL MEDIA FOUNDATION E To: FM RADIO LICENSES, LLC 96.7 MHZ OH , SPRINGFIELD Form 345 *GRANTED WITH CONDITIONS* Actions of: 12/16/2016 DIGITAL TV APPLICATIONS FOR TRANSFER OF CONTROL GRANTED TX BTCCDT-20161209AAO KAUZ-TV 6864 KAUZ LICENSE SUBSIDIARY, LLC Voluntary Transfer of Control From: SOUTHEASTERN MEDIA ACQUISITION, INC. E CHAN-22 TX , WICHITA FALLS To: AMERICAN SPIRIT MEDIA, LLC Form 316 Page 1 of 13 Federal Communications Commission 445 Twelfth Street SW PUBLIC NOTICE Washington, D.C. 20554 News media information 202 / 418-0500 Recorded listing of releases and texts 202 / 418-2222 REPORT NO. 48887 Broadcast Actions 12/22/2016 STATE FILE NUMBER E/P CALL LETTERS APPLICANT AND LOCATION N A T U R E O F A P P L I C A T I O N Actions of: 12/16/2016 DIGITAL TV APPLICATIONS FOR TRANSFER OF CONTROL GRANTED IA BTCCDT-20161209AAP KYOU-TV KYOU LICENSE SUBSIDIARY, LLC Voluntary Transfer of Control 53820 From: SOUTHEASTERN MEDIA ACQUISITION, INC. -

Journal, Summer 2009 | National Association of Black Journalists

Journal, Summer 2009 | www.nabj.org | National Association of Black Journalists | 1 2 | National Association of Black Journalists | www.nabj.org | Journal, Summer 2009 Table of Contents Features 6 – Prime Movers. Program started by former NABJ President grooms future journalists 8 – The Contenders. Angelo Henderson and Kathy Times are both able, willing and passionate about being the next NABJ President. See how the candidates, as well as the candidates for the 2009-2011 Board of Directors, stack up. Cover Story – NABJ Special Honors 12 – Journalist of the Year – National Public Radio’s Michele Norris 16 – Lifetime Achievement – Michael Wilbon 18 – Legacy Award – Sandra Rosenbush and Leon Carter 20 – Student Journalist of the Year – Jamisha Purdy 22 – Educator of the Year – Lawrence Kaggwa 24 – Hall of Famers – Caldwell, Norment, Peterman and Whiteside inducted 26 – Emerging Journalist of the Year – Cynthia Gordy, Essence Magazine 27 – Community Service Award – The Chauncey Bailey Project 27 – Percy Qoboza Foreign Journalist Award – Andrison Shadreck Manyere NABJ Convention 30 – Welcome to Tampa. Departments President’s Column .............................................................4 8 – Election 2009: Kathy Times, the current NABJ Executive Director .............................................................5 VP of Broadcast, and Angelo Henderson, a former Comings and Goings .......................................................34 parliamentarian, are both now seeking the organization’s Passages .........................................................................35 presidency. Read more on page 8. Photos by Ad Seymour. Cover Photo by Mark Gail / Washington Post The NABJ Journal (USPS number pending) is published quarterly by the National Association of Black Journalists (NABJ) at 8701-A Adelphi Road, Adelphi, MD 20783-1716. Pending periodicals postage is paid at Adelphi, MD. NABJ is the largest organization of journalists of color in the nation. -

![BUSINESS Klan Plans Teacher's Halli Boston College,] I N B R Ie F ' 5; to Return Remembered Villanova Lose 8.6% Real GNP](https://docslib.b-cdn.net/cover/4009/business-klan-plans-teachers-halli-boston-college-i-n-b-r-ie-f-5-to-return-remembered-villanova-lose-8-6-real-gnp-284009.webp)

BUSINESS Klan Plans Teacher's Halli Boston College,] I N B R Ie F ' 5; to Return Remembered Villanova Lose 8.6% Real GNP

20 - MANCHESTER HERALD. Sat., March 20, 1982 BUSINESS Klan plans Teacher's Halli Boston College,] I n b r ie f ' 5; to return remembered Villanova lose 8.6% Real GNP ... page 4 ... page 9 ... page 13 Hale elected Barter thrives Gross National Product ~ Seasonally adjusted annual CHICAGO — William H. Hale, president of ra te Heritage Savings and Loan Association of Manchester, Conn., has been appointed to the 1982 as mofiey tight Secondary Market Committee of the United States League of Savings Associations. Percentages reflect change The appointment was announced by Roy G. METAIRIE, La. (UPI) — Businesses ’That means members continue to earn from previous quarter Green, chairman of the league and president of and professionals are turning more and their full profit margin under the system Fair tonight Manchester, Conn. Fidelity Federal Savings and Loan Association, more to bartering in today’s depressed when “selling.” And, when "buying,” and Tuesday Jacksonville, Fla. economy, making a growth industry of the members do not have to spend cash Mon., March 22, 1982 The U.S. League is the principal trade organiza the centuries-old system of exchange. that could be used for inventory or — See page 2 tion for the savings and loan business and “The thing is cash flow,’’ said George capital improvements. 1982 Single copy 25<( represents over 4,000 associations throughout the Hesse, director of the New Orleans ’That television dealer who received a country. Trade Exchange. $1,000 debit will receive credits when Savings and loan associations are the second “People have inventory but no cash. If someone in the system comes to him for largest t> pe of financial Institution in America and they can spend $2,(X)0 on buying things a TV set. -

![[Fill with Station Call Signs]](https://docslib.b-cdn.net/cover/3934/fill-with-station-call-signs-293934.webp)

[Fill with Station Call Signs]

WAFB, WBXH-CD EEO PUBLIC FILE REPORT FEBRUARY 1, 2020– JANUARY 31, 2021 I. VACANCY LIST See Section II, the “Master Recruitment Source List” (“MRSL”) for recruitment source data Recruitment Sources (“RS”) RS Referring Job Title Used to Fill Vacancy Hiree DIGITAL PRODUCER 1-20, 26-45 27 TECHNICAL MEDIA PRODUCER 1-20, 24-45 28 NEWS PRODUCER 1-20, 24-37, 39-40, 44-45 27 LOUISIANA WEEKEND PRODUCER 1-20, 24-45 28 REPORTER / MMJ 1-20, 24-37, 39-40, 44-45 27 DIGITAL PRODUCER 1-20, 24-28, 30-45 27 SR DIGITAL SALES SPECIALIST 1-20, 21, 24-28, 30-45 27 WEEKEND METEOROLOGIST 1-20,24-28, 30-43, 45 27 DIGITAL PRODUCER 1-20, 24-28, 30-43, 45 27 WAFB, WBXH-CD EEO PUBLIC FILE REPORT FEBRUARY 1, 2020 – JANUARY 31, 2021 II. MASTER RECRUITMENT SOURCE LIST (“MRSL”) Source Entitled No. of Interviewees RS Referred by RS RS Information to Vacancy Number Notification? Over (Yes/No) Reporting Period 1 LA ASSOC OF BROADCASTERS N Polly Johnson 660 Florida Blvd. Baton Rouge, LA 70801 225-267-4522 [email protected] 2 LSU MANSHIP SCHOOL OF MASS COMM N Maryann Sternberg LSU Baton Rouge, LA 70803 As of 11/05/2020 Sadie Wilks 225-388-2336 [email protected] now [email protected] 3 MEDIALINE TALENT N Rick or Vicky https://medialinetalent.com/ 800-237-8073 [email protected] 4 SALES & MARKETING EXECUTIVES N Teri White P.O. Box 86336 Baton Rouge, LA 70879 225-927-8014 [email protected] 5 LSU DEPT OF COMM STUDIES N Mike Applin 117-A Prescott Hall Baton Rouge, LA 70803 225-578-6079 [email protected] 6 SOUTHERN UNIVERSITY N Mercedes Mackey P.O. -

Candidate's Report

CANDIDATE’S REPORT (to be filed by a candidate or his principal campaign committee) 1.Qualifying Name and Address of Candidate 2. Office Sought (Include title of office as OFFICE USE ONLY well JASON ARD Report Number: 50673 SHERIFF PO BOX 1515 LIVINGSTON PARISH Date Filed: 9/24/2015 LIVINGSTON, LA 70754 PARISH Report Includes Schedules: Schedule A-1 Schedule A-3 Schedule E-1 Schedule E-2 3. Date of Primary 10/24/2015 This report covers from 1/1/2015 through 9/14/2015 4. Type of Report: 180th day prior to primary 40th day after general 90th day prior to primary Annual (future election) X 30th day prior to primary Supplemental (past election) 10th day prior to primary 10th day prior to general Amendment to prior report 5. FINAL REPORT if: Withdrawn Filed after the election AND all loans and debts paid Unopposed 6. Name and Address of Financial Institution 7. Full Name and Address of Treasurer (You are required by law to use one or more banks, savings and loan associations, or money market mutual fund as the depository of all FIRST GUARANTY BANK-- PO BOX 2009 HAMMOND, LA 70404 9. Name of Person Preparing Report Daytime Telephone 10. WE HEREBY CERTIFY that the information contained in this report and the attached 8. FOR PRINCIPAL CAMPAIGN COMMITTEES ONLY schedules is true and correct to the best of our knowledge, information and belief, and that no a. Name and address of principal campaign committee, expenditures have been made nor contributions received that have not been reported herein, committee’s chairperson, and subsidiary committees, if and that no information required to be reported by the Louisiana Campaign Finance Disclosure any (use additional sheets if necessary). -

Federal Register/Vol. 85, No. 103/Thursday, May 28, 2020

32256 Federal Register / Vol. 85, No. 103 / Thursday, May 28, 2020 / Proposed Rules FEDERAL COMMUNICATIONS closes-headquarters-open-window-and- presentation of data or arguments COMMISSION changes-hand-delivery-policy. already reflected in the presenter’s 7. During the time the Commission’s written comments, memoranda, or other 47 CFR Part 1 building is closed to the general public filings in the proceeding, the presenter [MD Docket Nos. 19–105; MD Docket Nos. and until further notice, if more than may provide citations to such data or 20–105; FCC 20–64; FRS 16780] one docket or rulemaking number arguments in his or her prior comments, appears in the caption of a proceeding, memoranda, or other filings (specifying Assessment and Collection of paper filers need not submit two the relevant page and/or paragraph Regulatory Fees for Fiscal Year 2020. additional copies for each additional numbers where such data or arguments docket or rulemaking number; an can be found) in lieu of summarizing AGENCY: Federal Communications original and one copy are sufficient. them in the memorandum. Documents Commission. For detailed instructions for shown or given to Commission staff ACTION: Notice of proposed rulemaking. submitting comments and additional during ex parte meetings are deemed to be written ex parte presentations and SUMMARY: In this document, the Federal information on the rulemaking process, must be filed consistent with section Communications Commission see the SUPPLEMENTARY INFORMATION 1.1206(b) of the Commission’s rules. In (Commission) seeks comment on several section of this document. proceedings governed by section 1.49(f) proposals that will impact FY 2020 FOR FURTHER INFORMATION CONTACT: of the Commission’s rules or for which regulatory fees. -

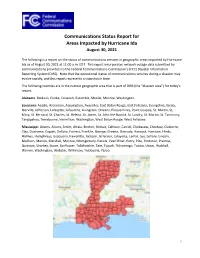

Communications Status Report for Areas Impacted by Hurricane Ida August 30, 2021

Communications Status Report for Areas Impacted by Hurricane Ida August 30, 2021 The following is a report on the status of communications services in geographic areas impacted by Hurricane Ida as of August 30, 2021 at 11:00 a.m. EDT. This report incorporates network outage data submitted by communications providers to the Federal Communications Commission’s (FCC) Disaster Information Reporting System (DIRS). Note that the operational status of communications services during a disaster may evolve rapidly, and this report represents a snapshot in time. The following counties are in the current geographic area that is part of DIRS (the “disaster area”) for today’s report. Alabama: Baldwin, Clarke, Conecuh, Escambia, Mobile, Monroe, Washington. Louisiana: Acadia, Ascension, Assumption, Avoyelles, East Baton Rouge, East Feliciana, Evangeline, Iberia, Iberville, Jefferson, Lafayette, Lafourche, Livingston, Orleans, Plaquemines, Point Coupee, St, Martin, St, Mary, St. Bernard, St. Charles, St. Helena, St. James, St. John the Baptist, St. Landry, St. Martin, St. Tammany, Tangipahoa, Terrebonne, Vermillion, Washington, West Baton Rouge, West Feliciana. Mississippi: Adams, Alcorn, Amite, Attala, Benton, Bolivar, Calhoun, Carroll, Chickasaw, Choctaw, Claiborne, Clay, Coahoma, Copiah, DeSoto, Forrest, Franklin, George, Greene, Grenada, Hancock, Harrison, Hinds, Holmes, Humphreys, Issaquena, Itawamba, Jackson, Jefferson, Lafayette, Lamar, Lee, Leflore, Lincoln, Madison, Marion, Marshall, Monroe, Montgomery, Panola, Pearl River, Perry, Pike, Pontotoc, Prentiss, Quitman, Sharkey, Stone, Sunflower, Tallahatchie, Tate, Tippah, Tishomingo, Tunica, Union, Walthall, Warren, Washington, Webster, Wilkinson, Yalobusha, Yazoo. 1 911 Services The Public Safety and Homeland Security Bureau (PSHSB) learns the status of each Public Safety Answering Point (PSAP) through the filings of 911 Service Providers in DIRS, reporting to the FCC’s Public Safety Support Center, coordination with state 911 Administrators and, if necessary, direct contact with individual PSAPs. -

Avian Mortality at Man-Made Structures, an Annotated Bibliography

Biological Services Program FWSIOBS-78/58 July 1978 Avian Mortality at -Man-made Structures: . An Annotated Bibliography I '8/58 1nd Wildlife Service U.S. Department of the Interior !Xl&!ru~& c ~00&~©@ Susitna Joint Venture Document Number ~~OL{ · Please Return To DOGUMENT CONTROL ·).' f. t ~ -~ I I ~ .. - ; ... .. J . ~ -. ~ L;.;.,, .. ;L~i~.':-~~- ··-·~. .-.;:··-. -~ .... _-,.- ...... -. ..;.~;. •.:. < • The Biological Services Program was .established·within:the·U.S.' -Fish ·and Wildlife Seryke, to supply·scientific inforrnat·i'bn and·'meth-· odologies on key"'environmental issues which impact fish ahd w·ildlife resources and their supporting ecosystems. The mission of the Program is as follows: 1. To strengthen the Fish and Wildli.fe Service in its role as a primary sours;e .of information on national fish and wildlife resoilr<;'es;; ·'parj;.icuJ ar-ly in respect to environmenta 1 impact assessment. ' . ·- 2. To gather, analyze, and present information that \'Jill aid decision makers in the identification and resolution of problems associated with major land and water use changes. 3. To provide better ecological information and evaluation for Department of the Interior development programs, such as those relating to energy development. Information developed by the Biological Services Program is in tended for use in the planning and decision making process to prevent or minimize the impact of development on fish and wildlife. Biological Services research activities and technical assistance services are based on an analysis of the issues, the decision makers involved and their information needs, and an evaluation of the state of the art to identify information gaps and determine priorities. This is a strategy to assure that the products produced and disseminated will be timely and useful. -

Hearst Television Inc

HEARST TELEVISION INC 175 198 194 195 203 170 197 128 201 DR. OZ 3RD QUEEN QUEEN MIND OF A SEINFELD 4TH SEINFELD 5TH DR. OZ CYCLE LATIFAH LATIFAH MAN CYCLE CYCLE KING 2nd Cycle KING 3rd Cycle RANK MARKET %US STATION 2011-2014 2014-2015 2013-2014 2014-2015 2015-2016 4th Cycle 5th Cycle 2nd Cycle 3rd Cycle 7 BOSTON (MANCHESTER) MA 2.13% WCVB/WMUR WFXT WFXT WBZ/WSBK WBZ/WSBK WBZ/WSBK WBZ/WSBK WBZ/WSBK WBZ/WSBK 13 TAMPA-ST PETERSBURG (SARASOTA) FL 1.60% WMOR WFLA WFTS WTOG WTOG WTTA WTTA WTOG WTOG 18 ORLANDO-DAYTONA BEACH-MELBOURNE FL 1.29% WESH/WKCF WFTV/WRDQ WOFL/WRBW WKMG WKMG WESH/WKCF WFTV/WRDQ WFTV/WRDQ WFTV/WRDQ 20 SACRAMENTO-STOCKTON-MODESTO CA 1.18% KCRA/KCRA-DT2/KQCA KCRA/KQCA KCRA/KQCA KMAX/KOVR KMAX/KOVR KTXL KTXL KMAX/KOVR 22 PITTSBURGH PA 1.03% WTAE WTAE WTAE KDKA/WPCW KDKA/WPCW WPGH/WPMY WPGH/WPMY KDKA/WPCW KDKA/WPCW 26 BALTIMORE MD 0.96% WBAL/WBAL-DT2 WBAL WBAL WBFF/WNUV/WUTB WBFF/WNUV/WUTB WBFF/WNUV/WUTB WBFF/WNUV WBFF/WNUV 31 KANSAS CITY MO 0.81% KCWE/KMBC KCWE/KMBC KCWE/KMBC WDAF WDAF WDAF WDAF KMCI/KSHB KMCI 35 MILWAUKEE WI 0.79% WISN WISN WISN WDJT/WMLW WDJT/WMLW WITI WITI WCGV/WVTV 36 CINCINNATI OH 0.77% WLWT WLWT WLWT WLWT WKRC/WSTR EKRC/WKRC EKRC/WKRC/WSTR WXIX WXIX 37 GREENVILLE-SPARTANBURG (SC)-ASHEVILLE 0.74% WYFF WYFF WYFF WLOS/WMYA WLOS/WMYA WSPA/WYCW WSPA/WYCW WYCW WSPA/WYCW 38 WEST PALM BEACH-FT PIERCE FL 0.69% WPBF WPBF WPBF WPTV WPTV WFLX WFLX WTCN/WTVX 43 BIRMINGHAM (ANNISTON-TUSCALOOSA) AL 0.62% WVTM WBMA WBMA WBRC WBRC WABM/WTTO WABM/WTTO WABM/WTTO 44 OKLAHOMA CITY OK 0.62% KOCO KOCO KOCO KOCB/KOKH KOCB/KOKH