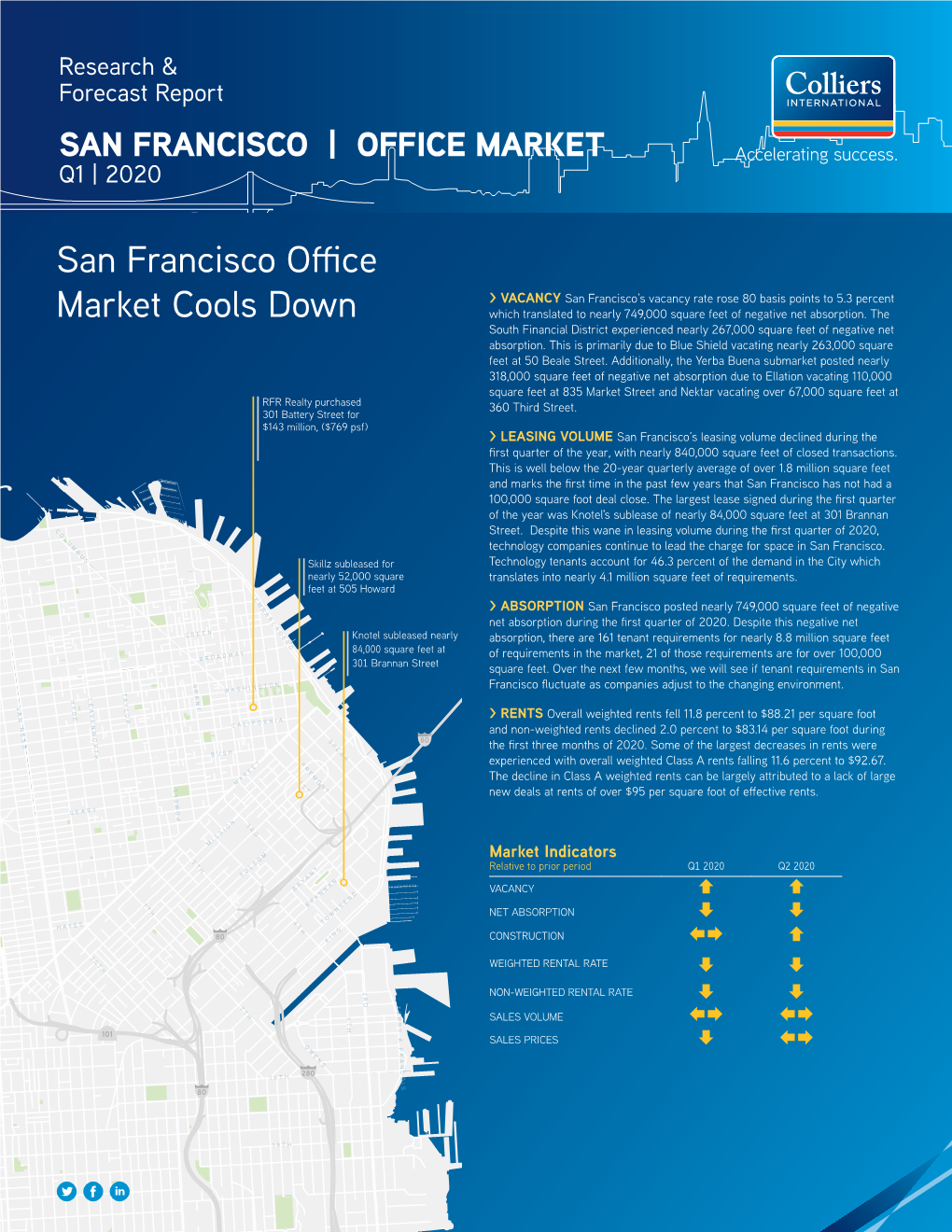

San Francisco Office Market Cools Down

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States Bankruptcy Court District of Delaware

Case 20-11779-LSS Doc 55 Filed 07/09/20 Page 1 of 19 UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE ------------------------------------------------------------ x In re : Chapter 11 : VIVUS, INC., et al., : Case No. 20–11779 (LSS) : : Debtors.1 : (Joint Administration Requested) ------------------------------------------------------------ x NOTICE OF FILING OF PROPOSED REDACTED VERSION OF THE CREDITOR MATRIX PLEASE TAKE NOTICE that, pursuant to Rule 9018-1(d)(ii) of the Local Rules of Bankruptcy Practice and Procedure of the United States Bankruptcy Court for the District of Delaware, VIVUS, Inc. and its debtor affiliates, as debtors and debtors in possession in the above-captioned chapter 11 cases, hereby file the attached proposed redacted version of the Creditor Matrix2 with the United States Bankruptcy Court for the District of Delaware, 824 North Market Street, Wilmington, Delaware 19801. 1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, as applicable are: Vivus B.V. (1942); Vivus Digital Health Corporation (0625); VIVUS, Inc. (6179); and Vivus Pharmaceuticals Limited (9329). The Debtors’ corporate headquarters and service address is 900 E. Hamilton Avenue, Suite 550, Campbell, CA 95008. 2 Contemporaneously herewith, the Debtors have filed the Motion of Debtors for Entry of Order (I) Authorizing Debtors to Redact Certain Personal Identification Information in Creditor Matrix and Certain Other Documents and (II) Granting Related Relief. RLF1 23325296v.1 Case 20-11779-LSS Doc 55 Filed 07/09/20 Page 2 of 19 Dated: July 9, 2020 Wilmington, Delaware /s/ Sarah E. Silveira RICHARDS, LAYTON & FINGER, P.A. Mark D. -

Company First Name Last Name #Smartcohort David Capelli #Smartcohort Carla Mays 10 Jennifer Walker 123 Contracting Michael Friedman 4083716800 Muhie Maaz A

Company First Name Last Name #SmartCohort David Capelli #SmartCohort Carla Mays 10 Jennifer Walker 123 Contracting Michael Friedman 4083716800 Muhie Maaz A. Esteban & Company, Inc Alfonso C. Esteban A3GEO, Inc. Dona Mann Abtahi Engineering ManagementAfshin Consulting Abtahi Abundance Worldwide EnterprisesDollene Jones ACCIONA Fernando Vara ACCIONA Jesús García Acciona Luis Palazzi Acciona Jesus Garcia Acciona Fernando Vara ACCIONA Luis Palazzi ACCIONA CONSTRUCTION FERNANDO VARA ORTIZ DE LA TORRE Acciona Infrastructure North AmericaRafael Sanchez Achievement Engineering Corp. Arash Firouzjaei ActiveWayz Engineering Constance Farris ActiveWayz Engineering Admas Zewdie Acumen Building Enterprise Inc. Gian Fiero Acumen Building Enterprise Inc. Robert Pilgrim ADA Takuya Nagai Adelaide Strategies marvin williams ADKO Engineering, Inc. President Kanaan Advantage Supply David Ibanez Doria AECOM Mel Sears AECOM nasri munfah AECOM Paul Nicholas AECOM Paul Boddie AECOM Emile Jilwan AECOM Russel Rudden AECOM Jon Porterfield AerialZeus, LLC Luis Robles Aero-Environmental Consulting, JorgeINC. Vizcaino All Trade Coordinators, Inc. Thelma King Ally Rail Consutling Douglas Deming Alpine Rail Group Buzz Berger ALSTOM Transportation Inc. Muriel LUO Anrak Corporation Mark Hamilton ANTHONIO, INC. TONY OGBEIDE Apadana Engineering, Inc. sopida siadat Aptim Environmental & Infrastructure,Rob LLC Delnagro Arad Adam Rad Arcadis U.S., Inc. Girish Kripalani Arora Engineers, Inc. Adam Oliver Arup Orion Fulton Arup North America LTD Luis Piek ASC Rahul Vaishnav ASC Henry Adley ASC Lorda Rumbaua ASC Dots Oyenuga ASC Dots Oyenuga Assurant Innovations Takeo Kimura Atkins Sergio Callen ATKINSON CONSTRUCTION ROHIT SHETTY Auriga Corporation Thomas Gibson Auriga Corporation Parkash Daryani Azad Engineering PC Mahsa Azad A-Zone Environmental Services, LLCMike Bruzzesi AZTEC/TYPSA Karim Dada AZTEC/TYPSA Carlos Tarazaga BabEng LLC Rene Reichl Badger Dalighting Inc. -

April 25, 2008 Comments on the ALJ Ruling on Cost

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA Order Instituting Rulemaking Regarding Policies and Protocols for Demand Response, Load Impact Estimates, Cost-Effectiveness Rulemaking 07-01-041 Methodologies, Megawatt Goals and (January 25, 2007) Alignment with California Independent System Operator Market Design Protocols COMMENTS OF THE CALIFORNIA INDEPENDENT SYSTEM OPERATOR ON THE ALJ RULING REGARDING THE COST EFFECTIVENESS FRAMEWORK The California Independent System Operator Corporation (“CAISO”) submits its comments regarding the ALJ’s Ruling re Comments on the Cost Effectiveness Framework, dated April 4, 2008, (“Ruling”) and Attachment A to the Ruling, “Draft Demand Response Cost Effectiveness Protocols” (“Staff Protocols”). Introduction As the Ruling states, the methodology set forth in the Staff Protocols is based largely upon the Cost Effectiveness Framework (aka Consensus Parties Framework) that the Joint Parties submitted in this proceeding in November 2007. (Ruling at pp. 1-2.) The Ruling further notes that party comments should address “the completeness, accuracy, and feasibility of the staff proposal.” (Ruling at p. 2.). The CAISO’s comments herein are intended either (1) to raise points for further refinement of the protocol’s interim methodologies or (2) to raise points that the CAISO believes should be included within the document, so that they are “teed up” for consideration when the - 1 - R.07-01-041 CAISO COMMENTS ON DRAFT DR CE PROTOCOLS protocols are revised with reformulated criteria intended to replace the interim methodologies1. Overall, the CAISO considers the Staff Protocols to be a sound basis for interim review of DR programs that will be presented to the Commission in 2009 for the procurement cycle period of 2009 to 2011. -

Engineer's Report Prepared by a Registered Professional Engineer Certified by the State of California.3

SECTION 10: ASSESSMENT ENGINEER’S REPORT Downtown Community Benefit District Including the Historic Financial District and Jackson Square of San Francisco and South Side of Market Street Formed under the California Streets and Highway Code Section 36600 et seq. Property and Business Improvement District Law of 1994, Augmented by Article 15 of the San Francisco Business and Tax Regulations Code DISTRICT ASSESSMENT ENGINEER’S REPORT Prepared by Edward V. Henning California Registered Professional Engineer # 26549 Edward Henning & Associates April 15, 2019 V 3 1 DOWNTOWN COMMUNITY BENEFIT DISTRICT – ENGINEER’S REPORT TABLE OF CONTENTS ENGINEER’S CERTIFICATION ...............................................................................................3 ENGINEER’S REPORT: SECTION A: Legislative and Judicial Review ............................................................4 SECTION B: Programs, Improvements and Activities ..............................................7 SECTION C: District Boundaries ................................................................................9 SECTION D: Proportional Benefits ...........................................................................13 SECTION E: Special and General Benefits ...............................................................13 SECTION F: Program, Improvement and Activity Costs .......................................19 SECTION G: Assessment Methodolgy .......................................................................22 SECTION H: Assessment Roll ....................................................................................25 -

Investment Sales Activity on the Rise

Research & Forecast Report SAN FRANCISCO | OFFICE MARKET Q2 | 2018 Investment Sales Activity > VACANCY The overall vacancy rate shed 40 basis points to 6.1 percent and continues to reflect historic lows for San Francisco. In the City Class A assets continue to drive market absorption with over 2.8 million square feet year-to- on the Rise date. This has translated into the Class A vacancy rate dropping 40 basis points to 6.0 percent. Vacant sublease space remained flat during the past three months at 0.8 percent. The key driver for the vacancy shrinking during the first half of Cruise Automation snaps this year was the South Financial District which has posted 2.3 million square up the Dropbox sublease feet of net absorption which saw its vacancy rate drop 270 basis points since the Northwood Investors space at 333 & 345 beginning of the year to 4.6 percent. purchased 123 Mission Brannan Street as well as Street for $290 million 301 Brannan Street ($839 psf) > LEASING VOLUME San Francisco experienced a surge of leasing activity during the second quarter of the year which translated into nearly 2.8 million square feet of transactions closing. Technology companies continue to gobble up space in the City and their appetite for space doesn’t seem to be quenched. Four deals closed over 100,000 square feet this quarter and all these deals were companies securing expansion space. The market experienced the largest lease Facebook secures the largest lease in ever signed in San Francisco when Facebook leased all 773,000 square feet at the City’s history, 250 Howard Street (Park Tower). -

The Investment Landscape PRIEST CLAY ST

FISHERMAN'S P WHARF JEFFERSON ST. P P P P P P BEACH ST. P P P P P NORTHPOINT ST. COLUMBUS ST P P . P P BAY ST. BAY ST. ST . AY E VANDEWATER ST. RT MIDW HA P BRET WORDEN ST FRANCISCO ST. FRANCISCO ST. THE EMBARCADERO P WATER ST. HOUSTON ST. PFEIFFER ST. AIR ST BELL CHESTNUT ST. CHESTNUT ST. ST A VENARD P . ST CULEBR WINTHRO NEWELL P 101 LOMBARD ST. LOMBARD ST. P . TELEGRAPH STONE BLACK HILL JANSEN ST GREENWICH ST. GREENWICH ST. T E L E ROACH ST G VALPARAISO ST. R A HARRIS PL. P 101 H RUSSIAN HILL B L V TRIDGE D . AT FILBERT ST. FILBERT ST. HAVENS ST. REDFIELD ALLADIN TER. E ALLEN ST. HASTINGS MOOR MARION PL BLACK PL UNION ST. UNION ST. P WARNER SHAR ROCKLAND . RUSSELL ST. MACONDRAY LN. P DELGADO . P . HAMLIN EASTMAN ST ST Y GREEN ST. TH ST GREEN ST. VE. VE. ST . ST . A . A ST ST ST T RY T A ON ST . VENWOR VI BONITA ST. TTE TA POWELL YLOR ST GRAN N NESS P POLK ST MONTGOMER LEA FRON BA OCKT JONES ST HYDE ST LARKIN ST GOUGH ST WHITE ST KEARNY TA MASON ST OC SANSOME ST VA FRANKLIN ST ST RUSSIAN HILL VALLEJO ST. VALLEJO ST. P . P WALDO GLOVER ST. VIS ST DA BROADWAY BROADWAY S . CYRU ST BERNHARD ST. LYNCH ST. YNE PL COLUMBUS ST SALMON ST WA HIMMELMAN ST MORRELL PACIFIC AVE. PACIFIC AVE. K . P P . BURGOYNE McCORMAC . PL AUBURN ST P LL WA JACKSON ST. -

2019 Kicks Off with Strong Leasing Activity

Research & Forecast Report SAN FRANCISCO | OFFICE MARKET Q1 | 2019 > VACANCY The overall vacancy rate in San Francisco rose 90 basis points 2019 Kicks off with to 6.0 percent this quarter due to new construction hitting the market, but the vacancy rate remains at historic lows. Facebook preleased all the office space in the new construction and will be moving in later this year. Additionally, much Strong Leasing Activity of the spaces vacated by tenants this quarter has already been leased. Watch for the vacancy rate to shrink later this year as the tenants move into their new space. Gap, Inc. acquired 550 > LEASING VOLUME San Francisco experienced very strong leasing activity Terry Francois Blvd. for nearly $343 million during the first quarter, which translated to nearly 2.6 million square feet of ($1,211 psf) closed transactions. This is well above the 10-year average of nearly 1.9 million square feet. Technology companies continued their space grab in the City, and demand shows no signs of slowing. All six deals that closed over 100,000 square feet this quarter were new leases or expansions. Pinterest secured 490,000 square The largest transaction this quarter was Pinterest securing 490,000 square feet at 88 feet at 88 Bluxome Street. This is the second deal over the past six months Bluxome Street that completely preleased space in a proposed property that does not yet have COLUMBUS Slack leased Prop M allocations. Additionally, Asana leased nearly 266,000 square feet at 208,000 square 633 Folsom Street, Slack leased 208,000 square feet at 45 Fremont Street and feet at 45 Fremont Samsara leased 154,000 square feet at 2 Henry Adams Street. -

OMA Bulletin Cypress Security, LLC Is Published Bi-Monthly

MARCH/APRIL 2007 www.bomasf.org BOMA San Francisco advances the commercial real estate industry through advocacy, professional development, and information exchange “The BOMA CareerCenter BOMA Addresses Career Management is an excellent resource for reaching people interested in working in property Needs of Real Estate Professionals— management. I posted an opening Unveils BOMA SF CareerCenter & New Task Force for an Administrative Assistant position at Embarcadero Center to Promote Real Estate Management Careers and received resumes from three qualified candidates in the first week.” Kirsten Walraven Young, RPA, FMA Stephen L. Austin, RPA CB Richard Ellis at PG&E Regional Property Manager Boston Properties OMA San Francisco has been doing use of search agents that notify them a lot to support, and call attention when new candidates who match their to the career criteria have posted their On the Inside management needs of résumés. Job seekers benefit commercial real estate from free and confidential Bprofessionals. Responding to résumé posting, weekly, MEMBERSHIP CAMPAIGN increased demand by automated email notification UPDATE employers and recruiters for of new job listings, the ability access to highly qualified to save jobs for later review ••• 4 ••• property managers, we and related career unveiled the BOMA SF development services. CALENDAR CareerCenter in late February. This interactive job Another key element of the ••• 8 ••• board – found at CareerCenter is the dedicated http://careers.bomasf.org – Customer Support Center. We BOMA YP enables employers and have partnered with recruiters to reach a wide Kirsten Walraven, RPA, FMA Boxwood Technology, the ••• 9 ••• CB Richard Ellis at range of commercial real leading provider of online Pacific Gas & Electric estate management career center technology and 7TH ANNUAL PAC candidates. -

Annual Report 96.4% Total Leased Occupancy Paramount Group, Inc

2018 ANNUAL REPORT 96.4% TOTAL LEASED OCCUPANCY PARAMOUNT GROUP, INC. // ANNUAL REPORT 2018 01 11.9MM TOTAL SQUARE FOOTAGE 02 PARAMOUNT GROUP, INC. // ANNUAL REPORT 2018 TO OUR LEASING continues to be robust and availability is scarce, Leasing and a hands-on approach to managing so we are confident in our position in the market. SHAREHOLDERS our assets remains one of Paramount’s greatest strengths and key differentiators. 2018 was The significant outperformance in San Francisco another in a series of successful years for our and more specifically the success we have had at leasing team since we came public. We signed One Front Street and 50 Beale Street were key leases on just over one million square feet of factors that led us to increase our exposure in space, well ahead of our original guidance of San Francisco with the acquisition of 111 Sutter between 500,000 to 700,000 square feet we Street. More on that shortly. expected at the beginning of the year. All that We ended the year in Washington, D.C. at 98.0% leasing increased our same store leased leased. Parts of the market may be challenged, Once again, with great pride, I can report that occupancy by 310 basis points to 96.4%. To top it but our strategy to concentrate on Class A Paramount continues to meet or exceed our off, we did all that leasing at robust cash mark-to- assets in certain key locations within the CBD goals in executing on our business plan. Those markets of positive 13.3%. -

After Latin American Studies: a Guide to Graduate Study and Employment for Latin Americanists

AFTER LATIN AMERICAN STUDIES: A GUIDE TO GRADUATE STUDY AND EMPLOYMENT FOR LATIN AMERICANISTS by SHIRLEY A. KREGAR and JORGE NALLIM Revised Edition Fall 2000 LATIN AMERICAN MONOGRAPH & DOCUMENT SERIES #10 Published by the Center for Latin American Studies University Center for International Studies 4E04 Wesley W. Posvar Hall University of Pittsburgh Pittsburgh, PA 15260 Telephone: 412-648-7392; Fax: 412-648-2199 E-mail: [email protected] Web: www.ucis.pitt.edu/clas/ AUTHOR'S NOTE Shirley A. Kregar is Associate Director of Academic Affairs at the Center for Latin American Studies, University of Pittsburgh. Readers/users of this work are encouraged to send corrections and suggestions concerning this volume to her: Shirley A. Kregar, Center for Latin American Studies, 4E32 Wesley W. Posvar Hall, University of Pittsburgh, Pittsburgh, PA 15260; or contact her via e- mail at [email protected]. Jorge Nallim is a doctoral student in the Department of History and a recipient of the Graduate Certificate in Latin American Studies, University of Pittsburgh. Jorge completed the onerous, monumental task of checking every and all addresses in this volume. He suggested the reorganization of sections and added greatly to the usefulness of this "workbook" by providing web sites. Jorge completed this research as a special student assistant in the summer of 2000. Without his efforts, you would not have this book in hand. SPECIAL THANKS TO: Those of you who took the time and trouble to advise me of corrections to be made and ideas for revision of this issue. Also many thanks to those of you who have let me know that this is a useful tool and service. -

59 Ahern Robert the Honorable R

Office_of_Career_and_Profession Last First Name Class of Agliano Nat Justice Nat Agliano '59 Ahern Robert The Honorable Robert Ahern '67 Alvarado Paul The Honorable Paul Alvarado '64 Ameral Ann The Honorable Ann Ameral '80 Anderson Clifford The Honorable Clifford Anderson '78 Anderson Lunell The Honorable Lunell Anderson '75 Antolini Lawrence The Honorable Lawrence Antolini '65 Appel Lawrence The Honorable Lawrence Appel '69 Armendariz Maria Judge Maria Armendariz '97 Atkins Don Commissioner Don Atkins '73 Austin Steven The Honorable Steven Austin '81 Ayabe Bert The Honorable Bert Ayabe '81 Barclay Fritz The Honorable Fritz Barclay '81 Barrett Thang The Honorable Thang Barrett '88 Bartholomew Lonny The Honorable Lonny Bartholomew '73 Bashant Cynthia The Honorable Cynthia Bashant '86 Baxter Marvin Justice Marvin Baxter '66 Beauchesne Roger The Honorable Roger Beauchesne '75 Biggar Thomas Comm. Thomas Biggar '71 Boeckman Bradley The Honorable Bradley Boeckman '70 Boessenecker Mark The Honorable Mark Boessenecker '86 Boren Terrence The Honorable Terrence Boren '68 Borick Arlene Commissioner Arlene Borick '84 Bounds Gary Comm. Gary Bounds '73 Boyack Douglas The Honorable Douglas Boyack '75 Bradbury Stephen The Honorable Stephen Bradbury '76 Brennan James The Honorable James Brennan '58 Brewster Bereola Gail The Honorable Gail Brewster Bereola '79 Brooks Nelson The Honorable Nelson Brooks '82 Burgess Rhonda The Honorable Rhonda Burgess '82 Burke James Judge James Burke '72 Bysshe Frederick The Honorable Frederick Bysshe '62 Cahill William -

THIS IS the BEGINNIN UF Tjr

FEDERAL ELECTION COMMISSION WAmSUcTO". OC 20,413 THIS ISTHE BEGINNIN UF tJR # IDTE FILMED CAERA NO. *~~ ND DELIVERED May 13, 1988 FEDERL EXPRESS Lawrence M. Noble, Esq. General Counsel Federal Elections commission - 999 E Street, NW* ~ Washington, D.C. 20463 Re: Complaint for Possible Federal Violations by Friends of Dan--Boatwig=h Committee- Dear Mr. Noble: Please consider this a formal complaint for your consideration under Section 111.4 of Volume 11 of the Code of Federal Regulations. our full names and addresses as complainants are set forth at the end of this letter. We are supporters of Reverend Jesse Jackson's candidacy for president and are involved in his campaign to secure delegates in the California presidential primary, June 7, 1988. Senator Daniel E. Boatwright is a candidate for re-election and renomination in the upcoming primary of the same date. We are concerned that Senator Boatwright's activities designed to create the illusion of a "slate" of himself and the Reverend Jackson in connection with the primary election are violative of federal campaign spending limitations and thereby threaten to tarnish Reverend Jackson's California campaign. Let us state at the forefront that Reverend Jackson's formal campaign organization has disavowed Senator Boatwright's activities and we believe that the Jackson campaign is not in any way responsible for these "slate" activities. (See enclosed article from the Saturday, April 9, 1988 issue of the West Contra Costa Times.) In conformance with 11 CFR 111.4(d), we set forth the following: 1. The respondent appearing to have possibly committed violations of Federal campaign spending regulations is the Friends of Dan Boatwright Committee, Michael A.