2019 Kicks Off with Strong Leasing Activity

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

United States Bankruptcy Court District of Delaware

Case 20-11779-LSS Doc 55 Filed 07/09/20 Page 1 of 19 UNITED STATES BANKRUPTCY COURT DISTRICT OF DELAWARE ------------------------------------------------------------ x In re : Chapter 11 : VIVUS, INC., et al., : Case No. 20–11779 (LSS) : : Debtors.1 : (Joint Administration Requested) ------------------------------------------------------------ x NOTICE OF FILING OF PROPOSED REDACTED VERSION OF THE CREDITOR MATRIX PLEASE TAKE NOTICE that, pursuant to Rule 9018-1(d)(ii) of the Local Rules of Bankruptcy Practice and Procedure of the United States Bankruptcy Court for the District of Delaware, VIVUS, Inc. and its debtor affiliates, as debtors and debtors in possession in the above-captioned chapter 11 cases, hereby file the attached proposed redacted version of the Creditor Matrix2 with the United States Bankruptcy Court for the District of Delaware, 824 North Market Street, Wilmington, Delaware 19801. 1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, as applicable are: Vivus B.V. (1942); Vivus Digital Health Corporation (0625); VIVUS, Inc. (6179); and Vivus Pharmaceuticals Limited (9329). The Debtors’ corporate headquarters and service address is 900 E. Hamilton Avenue, Suite 550, Campbell, CA 95008. 2 Contemporaneously herewith, the Debtors have filed the Motion of Debtors for Entry of Order (I) Authorizing Debtors to Redact Certain Personal Identification Information in Creditor Matrix and Certain Other Documents and (II) Granting Related Relief. RLF1 23325296v.1 Case 20-11779-LSS Doc 55 Filed 07/09/20 Page 2 of 19 Dated: July 9, 2020 Wilmington, Delaware /s/ Sarah E. Silveira RICHARDS, LAYTON & FINGER, P.A. Mark D. -

Before the Public Utilities Commission of the State of California

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA Order Instituting Rulemaking Regarding Policies and Protocols for Demand Response, Load Impact Estimates, Cost-Effectiveness Rulemaking 07-01-041 Methodologies, Megawatt Goals and (January 25, 2007) Alignment with California Independent System Operator Protocols RESPONSE OF THE CALIFORNIA INDEPENDENT SYSTEM OPERATOR TO CLECA MOTION TO STRIKE PORTIONS OF THE REVISED IOU’S STRAW PROPOSAL FOR DEMAND RESPONSE COST EFFECTIVENESS I. Introduction The California Independent System Operator Corporation (“CAISO”) submits this response to the motion of the California Large Energy Consumers Association (“CLECA”) to strike portions of the Revised IOU Straw Proposal for Demand Response Cost Effectiveness. CLECA has made this motion in the alternative to CLECA’s request for evidentiary hearings regarding three issues for which CLECA believes there are factual disputes. The CAISO’s response is prompted by the second factual issue raised by CLECA: 2. The proposed requirement that only DR programs qualifying for resource adequacy (RA) status be treated as avoiding capacity costs. In support of its request for hearings and/or motion to strike for this issue, CLECA purports to characterize certain positions of the CAISO regarding the valuation of Demand Response resources. The CAISO feels that CLECA has mischaracterized, somewhat, the CAISO’s position on the subject, and so the CAISO files these comments to clarify the record as to the CAISO’s position. R.07-01-041 CAISO RESPONSE TO CLECA MOTION TO STRIKE RE IOU CE STRAW PROPOSAL We note that the Commission’s recent Order Instituting Rulemaking 07-09-008 (issued September 25, 2007) articulated the foundational steps in determining when evidentiary hearings are necessary: Parties who believe that evidentiary hearings are necessary shall follow the procedure set forth below. -

2013-00985C3340.Pdf

SERVICE LIST JCCP 4765 ADDRESS PARTY Trenton H. Norris ABACO Partners LLC; Commonwealth Sarah Esmaili Soap & Toiletries, Inc.; E.T. Browne Arnold & Porter LLP Drug Company, Inc.; Home & Body Three Embarcadero Center, 10th Floor Company, Inc.; Method Products, Inc. San Francisco, CA 94111 [email protected] [email protected] Kevin C. Mayer Added Extras LLC Crowell & Moring LLP 515 S. Flower Street, 40th Floor Los Angeles, CA 90071 [email protected] John E. Dittoe Advanced Healthcare Distributors, Reed Smith LLP L.L.C.; CVS Pharmacy, Inc. 101 Second Street, Suite 1800 San Francisco, CA 94105 [email protected] Paul H. Burleigh Alberto-Culver Company; TIGI Linea LeclairRyan, LLP Corp. 725 S. Figueroa Street, Suite 350 Los Angeles, CA 90017 [email protected] Bruce Nye Albertson’s, LLC; Raani Corporation; Barbara Adams SUPERVALU, Inc. Adams Nye Becht LLP 222 Kearny Street, Seventh Floor San Francisco, CA 94108 [email protected] [email protected] Jason L. Weisberg Archipelago, Inc. Roxborough Pomerance Nye & Adreani 5820 Canoga Avenue, Suite 250 Woodland Hills, CA 91367 [email protected] Sophia B. Belloli Aspire Brands; Bonne Bell, LLC Michael Van Zandt Hanson Bridgett LLP 425 Market Street, 26th Floor San Francisco, CA 94105 [email protected] Richard E. Haskin Awesome Products, Inc. Gibbs Giden Locher Turner Senet Wittbrodt LLP 1880 Century Park East, 12th Floor Los Angeles, CA 90067 [email protected] Robert A. Randick Barbera Studio, Inc. Randick O’Dea & Tooliatos, LLP 5000 Hopyard Road, Suite 225 -

Offering Memorandum Union Square | San Francisco

OFFERING MEMORANDUM 166 GearyUNION SQUARE | SAN FRANCISCO A PRIDE-OF-OWNERSHIP COMMERCIAL ASSET ADJACENT TO SAN FRANCISCO’S FAMED UNION SQUARE 166 GEARY STREET exclusively listed by: Vincent Schwab Senior Managing Director Investments San Francisco Office [email protected] Cell: (415) 828-4372 Tel: (415) 625-2171 Fax: (415) 989-9220 UNION GLicense: CA 00840133 SQUARE SAN FRANCISCO CONFIDENTIALITY AGREEMENT The information contained in the following Marketing Brochure is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from Institutional Property Advisors, a Division of Marcus & Millichap (“IPA”) and should not be made available to any other person or entity without the written consent of IPA. This Marketing Brochure has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. IPA and Marcus & Millichap have not made any investigation, and make no warranty or representation, with respect to the income or expenses for the subject property, the future projected financial performance of the property, the size and square footage of the property and improvements, the presence or absence of contaminating substances, PCB’s or asbestos, the compliance with State and Federal regulations, the physical condition of the improvements thereon, or the financial condition or business prospects -

BOMA Bulletin-Spring 2010

SPRING 2010 www.bomasf.org BOMA San Francisco advances the commercial real estate industry through advocacy, professional development, and information exchange BOMA Membership An Investment in Local, State and National Advocacy for Commercial Real Estate would like to take this opportunity to issues, when the opportunity to influence thank you for renewing your decisions is greatest. Our local staff and On the Inside membership in BOMA San Francisco many members work closely with the paid for 2010. Your dues investment provides BOMA lobbyist in Sacramento. BOMA SF V ISITS DC our members with a variety of Ibenefits and services including BOMA International is a full- ••• 4 ••• luncheons, brown bag sessions, service trade association that seminars, social events, and advocates on behalf of our BOMA 360 opportunities to network with industry in Washington DC, professional colleagues and and provides a wide array of ••• 5 ••• expand your knowledge. Most educational programming for importantly, your investment commercial property YOUNG PROFESSIONALS and participation ensures practitioners. It is the only political advocacy on issues national real estate organization LEADERSHIP LUNCHEON affecting the regulations with a consistent and pro-active ••• 7 ••• governing our industry. presence in the various code Thomas Kruggel making bodies protecting your When assessing the value of a Hines interests. BOMA International is PAC AT THE PARK BOMA membership, we should also very active in the standard- ••• 8 ••• not overlook the portion of setting process and in bench- your dues that funds the activities of marking best practices, through vehicles TEXAS HOLD ’EM BOMA California and BOMA like the Experience and Exchange Report International. -

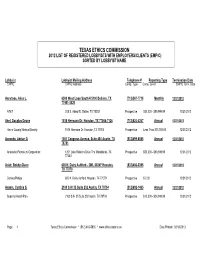

Texas Ethics Commission 2012 List of Registered Lobbyists with Employers/Clients (Emp/C) Sorted by Lobbyist Name

TEXAS ETHICS COMMISSION 2012 LIST OF REGISTERED LOBBYISTS WITH EMPLOYERS/CLIENTS (EMP/C) SORTED BY LOBBYIST NAME Lobbyist Lobbyist Mailing Address Telephone # Reporting Type Termination Date EMP/C EMP/C Address Comp. Type Comp. Level EMP/C Term. Date Aanstoos, Alice L. 6500 West Loop South # 5100 Bellaire, TX (713)567-7718 Monthly 12/31/2012 77401-3520 AT&T 208 S. Akard St. Dallas, TX 75202 Prospective $50,000 - $99,999.99 12/31/2012 Abel, Douglas Deane 1515 Hermann Dr. Houston, TX 77004-7126 (713)524-4267 Annual 12/31/2012 Harris County Medical Society 1515 Hermann Dr. Houston, TX 77004 Prospective Less Than $10,000.00 12/31/2012 Acevedo, Adrian G. 1001 Congress Avenue, Suite 400 Austin, TX (512)499-8085 Annual 12/31/2012 78701 Anadarko Petroleum Corporation 1201 Lake Robbins Drive The Woodlands, TX Prospective $50,000 - $99,999.99 12/31/2012 77380 Adair, Bobby Glenn 600 N. Dairy Ashford - 2WL 8024F Houston, (832)486-3395 Annual 12/31/2012 TX 77079 ConocoPhillips 600 N. Dairy Ashford Houston, TX 77079 Prospective $ 0.00 12/31/2012 Adams, Cynthia S. 2100 S IH 35 Suite 202 Austin, TX 78704 (512)692-1465 Annual 12/31/2012 Superior HeatlhPlan 2100 S IH 35 Suite 202 Austin, TX 78704 Prospective $10,000 - $24,999.99 12/31/2012 Page: 1 Texas Ethics Commission * (512) 463-5800 * www.ethics.state.tx.us Date Printed: 02/13/2013 Lobbyist Lobbyist Mailing Address Telephone # Reporting Type Termination Date EMP/C EMP/C Address Comp. Type Comp. Level EMP/C Term. -

400 Montgomery Street

400 Montgomery Street For Lease | Retail Space | North Financial District - San Francisco, CA This exceptionally well-located Downtown retail availability sits at the base of the historic 400 Montgomery Street - a 75,000 SF office building at the cross streets of Montgomery and California. Don’t miss this rare opportunity to front one of the Financial District’s busiest streets. Premises 1,951 Rentable Square Feet 20,253 Cars Per Day on Montgomery Ideal for Fitness, Non-Cooking Food, Estimated 22 Million Pedestrians or Service Per Year Pass the Intersection of Montgomery and California 101 PEIR 39 1 AQUATIC PARK JEFFERSON ST TAYLOR ST POWELL ST JONES ST MARINA GREEN NORTH POINT ST M BEACH ST A MASON ST Y R CASA WAY A IN W A KEARNY ST O B R L I V MARINA BLVD RICO WAY T JEFFERSON ST D STOCKTON ST BRODERICK ST E R GOLDEN GATE NATIONAL WEBSTER ST FORT BAY ST RECREATION AREA MASON NORTH POINT ST BUCHANAN ST GRANT AVE C PRADO ST CERVANTES BLVD R JEFFERSON ST BEACH ST HYDE ST IS S Y BAKER ST FI POLK ST BAY ST FRANCISCO ST CHESTNUT ST ELD A BEACH ST V BEACH ST MONTGOMERY ST E AVILA ST NORTH POINT ST GOUGH ST LARKIN ST T DIVISADERO ST BAY ST CHESTNUT ST H 101 E SCOTT ST E FILLMORE ST LOMBARD ST M CAPRA WAY FRANKLIN ST BAY ST B NORTH POINT ST A T SANSOME ST T E R S M FRANCISCO ST L C E A A G A D R L LOMBARD ST R D V B L A O GREENWICH ST E L M A LEAVENWORTH ST P R R B BAY ST H COLUMBUS AVE H L C O A A OCTAVIA ST CHESTNUT ST H PIERCE ST AY L N W W IL D O L BLV LIN S O A D Y LOMBARD ST C H TAYLOR ST CO TOLE GREENWICH ST K N L E E I N FILBERT ST L -

2013-00985C3548.Pdf

SERVICE LIST JCCP 4765 ADDRESS PARTY Robert A. Randick Barbera Studio, Inc. Randick O’Dea & Tooliatos, LLP 5000 Hopyard Road, Suite 225 Pleasanton, CA 94588 [email protected] Carol Brophy Big Lots, Inc.; Big Lots Stores, Inc. Jonathan Lee Sedgwick LLP 333 Bush Street, 30th Floor San Francisco, CA 94104 [email protected] Jeffrey Margulies Bloomingdale’s, Inc.; Burlington Coat Factory William L. Troutman Warehouse Corporation; Dermstore LLC; Julie Glazer Marshalls of MA, Inc.; Marshalls of CA, LLC; Fulbright & Jaworksi LLP Nordstrom, Inc.; Ross Stores, Inc.; Target 555 South Flower Street, 41st Floor Corporation; The TJX Companies, Inc. Los Angeles, CA 90071 [email protected] [email protected] [email protected] [email protected] [email protected] Mark N. Todzo Center for Environmental Health Howard Hirsch Lexington Law Group 503 Divisadero Street San Francisco, CA 94117 [email protected] [email protected] [email protected] [email protected] Ben D. Whitwell Colomer USA Inc. Jennifer Levin Venable LLP 2049 Century Park East, Suite 2100 Los Angeles, CA 90067 [email protected] [email protected] Michael R. O’Neil Crown Laboratories, Inc. Peter A. Austin Murphy Austin Adams Schoenfeld LLP 304 “S” Street Post Office Box 1319 Sacramento, CA 95812 [email protected] [email protected] Thomas H. Clarke, Jr. CSI Products, Inc.; Davion, Inc. Ropers, Majeski, Kohn & Bentley 75 Broadway, Suite 202 San Francisco, CA 94111 [email protected] [email protected] John E. Dittoe CVS Pharmacy, Inc. Reed Smith LLP 101 Second Street, Suite 1800 San Francisco, CA 94105 [email protected] Margaret Carew Toledo Dollar Tree Stores, Inc.; Dollar Tree Stacy E. -

National Banks Active As of 7/31/2021

National Banks Active As of 8/31/2021 CHARTER NO NAME ADDRESS (LOC) CITY STATE CERT RSSD 12072 First National Bank Alaska 101 West 36th Avenue Anchorage AK 16130 114260 10697 First National Bank and Trust 111 South Main Street Atmore AL 2779 670430 16708 Town-Country National Bank 118 Broad Street Camden AL 22621 180537 9681 The First National Bank of Dozier 7825 South Main Street Dozier AL 2794 496434 16579 First National Bank 341 Military Street South Hamilton AL 22271 330239 7592 The First National Bank of Hartford 101 South 3rd Avenue Hartford AL 2804 112332 16553 Commonwealth National Bank 2214 St. Stephens Road Mobile AL 22229 578237 10406 First National Bank of North Arkansas 305-307 Public Square Berryville AR 3854 864846 21165 The First National Bank of Izard County 2184 AR Highway 56 Calico Rock AR 11252 379649 13637 First National Bank of Eastern Arkansas 101 North Washington Street Forrest City AR 3863 251745 1950 The First National Bank of Fort Smith 602 Garrison Avenue Fort Smith AR 3864 397540 23202 The Malvern National Bank 1 Money Place Malvern AR 14644 906241 10004 First National Bank 200 West Court Street Paragould AR 3887 42448 14209 The First National Bank at Paris 11 East Main Street Paris AR 14534 45047 15482 Relyance Bank, National Association 912 South Poplar Street Pine Bluff AR 19371 49241 24573 Legacy National Bank 4055 West Sunset Springdale AR 57953 3306280 11312 The First National Bank of Lawrence County at Walnut Ridge 206 West Main Street Walnut Ridge AR 3896 799948 24224 BNC National Bank 20175 North -

Before the Public Utilities Commission of the State Of

BEFORE THE PUBLIC UTILITIES COMMISSION FILED OF THE STATE OF CALIFORNIA 09/14/20 04:59 PM Order Instituting Rulemaking to Develop an R.16-02-007 Electricity Integrated Resource Planning (Filed February 11, 2016) Framework and to Coordinate and Refine Long- Term Procurement Planning Requirements. CERTIFICATE OF SERVICE I hereby certify that I have this day served a copy of COMMENTS OF ENVIRONMENTAL DEFENSE FUND ON THE ADMINISTRATIVE LAW JUDGE’S PROPOSED DECISION GRANTING THE CALIFORNIA COMMUNITY CHOICE ASSOCIATION’S PETITION FOR MODIFICATION on all known parties to R.16-02-007 by transmitting an electronic mail message with the document attached to each person named in the official service list. Executed on September 14, 2020 in Williamson, New York. s/ Sara Breckenridge SARA BRECKENRIDGE 1 / 35 9/14/2020 CPUC - Service Lists - R1602007 CPUC Home CALIFORNIA PUBLIC UTILITIES COMMISSION Service Lists PROCEEDING: R1602007 - CPUC - OIR TO DEVELO FILER: CPUC LIST NAME: LIST LAST CHANGED: SEPTEMBER 3, 2020 Download the Comma-delimited File About Comma-delimited Files Back to Service Lists Index Parties DAMON FRANZ DAVID LYONS DIR - POLICY & ELECTRICITY MARKETS ATTORNEY TESLA, INC. PAUL HASTINGS LLP EMAIL ONLY EMAIL ONLY EMAIL ONLY, CA 00000 EMAIL ONLY, CA 00000 FOR: TESLA, INC. (FORMERLY: SOLARCITY FOR: LA PALOMA GENERATING COMPANY,LLC CORPORATION) JEFFREY KEHNE JOHN W. LESLIE, ESQ. CHIEF DEVELOPMENT OFFICE / GEN.COUNSEL ATTORNEY MEGELLAN WIND LLC DENTONS US LLP EMAIL ONLY EMAIL ONLY EMAIL ONLY, DC 00000 EMAIL ONLY, CA 00000 FOR: MAGELLAN WIND LLC FOR: SHELL ENERGY NORTH AMERICA (U.S.), L.P. MATTHEW FREEDMAN MERRIAN BORGESON STAFF ATTORNEY SR. -

Company First Name Last Name #Smartcohort David Capelli #Smartcohort Carla Mays 10 Jennifer Walker 123 Contracting Michael Friedman 4083716800 Muhie Maaz A

Company First Name Last Name #SmartCohort David Capelli #SmartCohort Carla Mays 10 Jennifer Walker 123 Contracting Michael Friedman 4083716800 Muhie Maaz A. Esteban & Company, Inc Alfonso C. Esteban A3GEO, Inc. Dona Mann Abtahi Engineering ManagementAfshin Consulting Abtahi Abundance Worldwide EnterprisesDollene Jones ACCIONA Fernando Vara ACCIONA Jesús García Acciona Luis Palazzi Acciona Jesus Garcia Acciona Fernando Vara ACCIONA Luis Palazzi ACCIONA CONSTRUCTION FERNANDO VARA ORTIZ DE LA TORRE Acciona Infrastructure North AmericaRafael Sanchez Achievement Engineering Corp. Arash Firouzjaei ActiveWayz Engineering Constance Farris ActiveWayz Engineering Admas Zewdie Acumen Building Enterprise Inc. Gian Fiero Acumen Building Enterprise Inc. Robert Pilgrim ADA Takuya Nagai Adelaide Strategies marvin williams ADKO Engineering, Inc. President Kanaan Advantage Supply David Ibanez Doria AECOM Mel Sears AECOM nasri munfah AECOM Paul Nicholas AECOM Paul Boddie AECOM Emile Jilwan AECOM Russel Rudden AECOM Jon Porterfield AerialZeus, LLC Luis Robles Aero-Environmental Consulting, JorgeINC. Vizcaino All Trade Coordinators, Inc. Thelma King Ally Rail Consutling Douglas Deming Alpine Rail Group Buzz Berger ALSTOM Transportation Inc. Muriel LUO Anrak Corporation Mark Hamilton ANTHONIO, INC. TONY OGBEIDE Apadana Engineering, Inc. sopida siadat Aptim Environmental & Infrastructure,Rob LLC Delnagro Arad Adam Rad Arcadis U.S., Inc. Girish Kripalani Arora Engineers, Inc. Adam Oliver Arup Orion Fulton Arup North America LTD Luis Piek ASC Rahul Vaishnav ASC Henry Adley ASC Lorda Rumbaua ASC Dots Oyenuga ASC Dots Oyenuga Assurant Innovations Takeo Kimura Atkins Sergio Callen ATKINSON CONSTRUCTION ROHIT SHETTY Auriga Corporation Thomas Gibson Auriga Corporation Parkash Daryani Azad Engineering PC Mahsa Azad A-Zone Environmental Services, LLCMike Bruzzesi AZTEC/TYPSA Karim Dada AZTEC/TYPSA Carlos Tarazaga BabEng LLC Rene Reichl Badger Dalighting Inc. -

April 25, 2008 Comments on the ALJ Ruling on Cost

BEFORE THE PUBLIC UTILITIES COMMISSION OF THE STATE OF CALIFORNIA Order Instituting Rulemaking Regarding Policies and Protocols for Demand Response, Load Impact Estimates, Cost-Effectiveness Rulemaking 07-01-041 Methodologies, Megawatt Goals and (January 25, 2007) Alignment with California Independent System Operator Market Design Protocols COMMENTS OF THE CALIFORNIA INDEPENDENT SYSTEM OPERATOR ON THE ALJ RULING REGARDING THE COST EFFECTIVENESS FRAMEWORK The California Independent System Operator Corporation (“CAISO”) submits its comments regarding the ALJ’s Ruling re Comments on the Cost Effectiveness Framework, dated April 4, 2008, (“Ruling”) and Attachment A to the Ruling, “Draft Demand Response Cost Effectiveness Protocols” (“Staff Protocols”). Introduction As the Ruling states, the methodology set forth in the Staff Protocols is based largely upon the Cost Effectiveness Framework (aka Consensus Parties Framework) that the Joint Parties submitted in this proceeding in November 2007. (Ruling at pp. 1-2.) The Ruling further notes that party comments should address “the completeness, accuracy, and feasibility of the staff proposal.” (Ruling at p. 2.). The CAISO’s comments herein are intended either (1) to raise points for further refinement of the protocol’s interim methodologies or (2) to raise points that the CAISO believes should be included within the document, so that they are “teed up” for consideration when the - 1 - R.07-01-041 CAISO COMMENTS ON DRAFT DR CE PROTOCOLS protocols are revised with reformulated criteria intended to replace the interim methodologies1. Overall, the CAISO considers the Staff Protocols to be a sound basis for interim review of DR programs that will be presented to the Commission in 2009 for the procurement cycle period of 2009 to 2011.