Industry Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

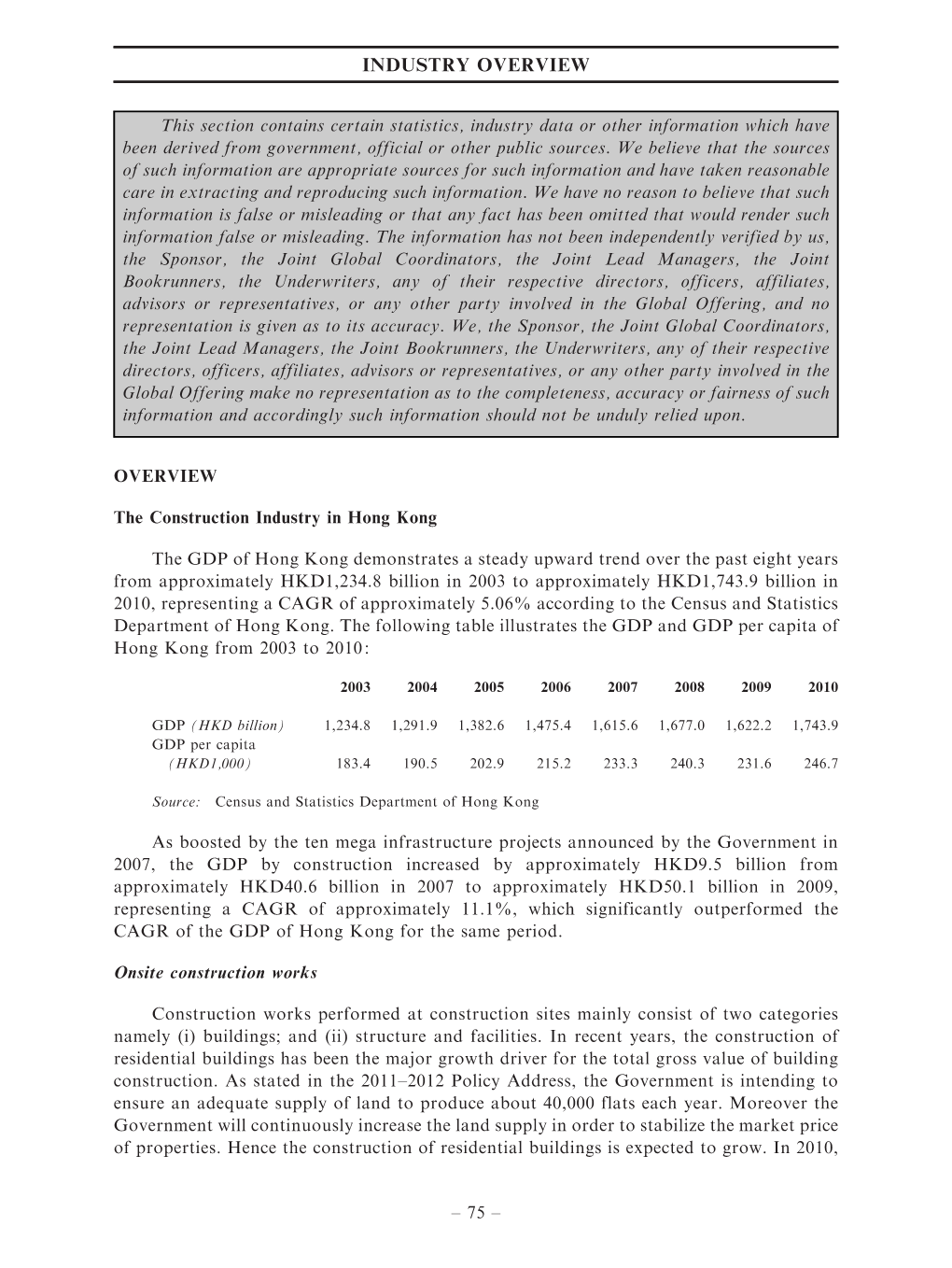

-

IO Brachenreport China Hongkong Smart City

AUSSEN WIRTSCHAFT BRANCHENREPORT CHINA, HONGKONG SMART CITY UND URBANE TECHNOLOGIEN STADTPLANUNG UMWELTTECHNOLOGIE SMART GOVERNANCE /INFORMATIONS- UND KOMMUNIKATIONSTECHNOLGIEN/OFFENE DATENVERWALTUNG CHANCEN FÜR ÖSTERREICHISCHE UNTERNEHMEN EXKURS: SMART CITY UND URBANE TECHNOLOGIEN IN SÜDCHINA MESSEN, ANSPRECHPARTNER UND LINKS AUSSENWIRTSCHAFTSCENTER HONGKONG MÄRZ 2020 1 Unser vollständiges Angebot zu dem Thema Urban Technologies (Veranstaltungen, Publikationen, Schlagzeilen etc.) finden Sie unter: https://www.wko.at/service/aussenwirtschaft/urban-technologies.html. Eine Information des AußenwirtschaftsCenters Hongkong Wirtschaftsdelegierter Mag. Franz Rössler T +852 2522 2388 F +852 2810 6493 E [email protected] fb.com/aussenwirtschaft twitter.com/wko_aw linkedIn.com/company/aussenwirtschaft-austria youtube.com/aussenwirtschaft flickr.com/aussenwirtschaftaustria www.austria-ist-ueberall.at Dieser Branchenreport wurde im Rahmen der Internationalisierungsoffensive go-international, einer Förder- initiative des Bundesministeriums für Digitalisierung und Wirtschaftsstandort und der Wirtschaftskammer Österreich erstellt. Das Werk ist urheberrechtlich geschützt. Alle Rechte, insbesondere die Rechte der Verbreitung, der Vervielfältigung, der Übersetzung, des Nachdrucks und die Wiedergabe auf fotomechanischem oder ähnlichem Wege durch Fotokopie, Mikrofilm oder andere elektronische Verfahren sowie der Speicherung in Datenverarbeitungsanlagen bleiben, auch bei nur auszugsweiser Verwertung, der Wirtschaftskammer Österreich – AUSSENWIRTSCHAFT AUSTRIA -

D8014 2018 年第39 期憲報第4 號特別副刊s. S. No. 4 to Gazette No

D8014 2018 年第 39 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 39/2018 G.N. (S.) 41 of 2018 BOOKS REGISTRATION ORDINANCE (CHAPTER 142) A CATALOGUE OF BOOKS PRINTED IN HONG KONG 1ST QUARTER 2018 (Edited by Books Registration Office, Hong Kong Public Libraries, Leisure and Cultural Services Department) This catalogue lists publications which have been deposited with the Books Registration Office during the first quarter of 2018 in accordance with the above Ordinance. These include:— (1) Books published or printed in Hong Kong and have been deposited with the Books Registration Office during this quarter. Publications by the Government Logistics Department, other than separate bills, ordinances, regulations, leaflets, loose-sheets and posters are included; and (2) First issue of periodicals published or printed in Hong Kong during this quarter. Details of their subsequent issues and related information can be found at the fourth quarter. (Please refer to paragraph 3 below) The number in brackets at the bottom right-hand corner of each entry represents the order of deposit of the book during the year, whereas the serial number at the top left-hand corner of each entry is purely an ordering device, linking the annual cumulated author index with the main body of the catalogue. In the fourth quarter, in addition to the list of publications deposited with the Books Registration Office during that quarter, the catalogue also includes the following information for the year:— (1) Chinese and English Author Index; (2) Publishers’ Names and Addresses; (3) Printers’ Names and Addresses; and (4) Chinese and English Periodicals Received;- their title, frequency, price and publisher. -

Budget Speech

THE 2020-21 BUDGET Speech by the Financial Secretary, the Hon Paul MP Chan moving the Second Reading of the Appropriation Bill 2020 Wednesday, 26 February 2020 Contents Paragraphs Introduction 2 – 6 Economic Situation in 2019 7 – 11 Economic Outlook for 2020 and 12 – 22 Medium-term Outlook Riding Out the Crisis Together 23 – 24 Overcoming Current Challenges 25 – 26 Support Enterprises and Safeguard Jobs 27 – 28 Support Employees 29 – 32 Relieve People’s Burden 33 Cash Payout 34 – 37 Strengthening the Healthcare System Fight the Epidemic 38 – 39 Enhance Services 40 – 49 Developing a Diversified Economy 50 Financial Services 51 – 64 Innovation and Technology 65 – 74 Transport and Logistics 75 – 79 Paragraphs Tourism 80 Trade 81 Professional Services 82 – 83 Cultural and Creative Industries 84 – 90 Nurturing Talent 91 – 102 Guangdong-Hong Kong-Macao 103 – 109 Greater Bay Area Belt and Road 110 – 112 Building A Liveable City 113 Land Resources 114 – 123 Environmental Protection 124 – 133 Smart City 134 – 139 Sports Development 140 – 141 City Development 142 – 146 Caring Society 147 – 151 Revised Estimates for 2019-20 152 – 156 Estimates for 2020-21 157 – 161 Paragraphs Medium Range Forecast 162 – 167 Public Finance Deficit Budget 168 – 176 Face the Challenge 177 – 182 Future Fund 183 – 184 Concluding Remarks 185 – 188 This speech, together with the supplement and appendices relating to the 2020-21 Budget, is available at www.budget.gov.hk. Introduction Mr President, Honourable Members and fellow citizens, I move that the Appropriation Bill 2020 be read a second time. Introduction 2. 2019 was an unsettling year fraught with obstacles and an unforgettable one for all Hong Kong people. -

The Growth of Fintech in Hong Kong Patricia Yeung, Senior Manager of Fintech, Invest Hong Kong

The Growth of FinTech in Hong Kong Patricia Yeung, Senior Manager of FinTech, Invest Hong Kong © 2018 Calastone Limited Hong Kong Asia’s Largest Financial Center and Gateway to China Q2 2018 Calastone Conference 2018 Fundamentals of financials services in HK economy 17.7% 6.7% of of HKG GDP workforce 12% of export Fundamentals • Global Financial Center • China In / Outbound Gateway • #1 Asset Management hub in Asia. Fund management business USD1.6Tr - 2016 • FinServ Renovation • Offshore RMB Center - evolution RMB trade settlement handled by HK banks : RMB 4.4 Tr – 2017 • 157 Licensed Banks • #1 insurance hub in Asia 159 authorized insurers. • 2.9% unemployment rate #1 Asia #2 Globally - Insurance density (premium / capita) USD7.679 – 2016 • #1 most competitive economy • Regional Connectivity IMD 2017 – Greater Bay – One Belt One Road initiatives Fintech Journey An organic FinTech ecosystem Private sector led Supported by Government 2018 + Belt & Road Initiative 2017 2016 Faster Payment System HKMASandbox Fintech Association SVF Licenses Feb 15 Virtual Bank license SFC - cross border 3 Sandboxes accopening Government Cross border Fintech week Nov 14 HK Fintech week Greater Bay Area Budget Speech 2 Cyberport 4000m Trade Finance Blockchain INVESTHK 4 Liaison Offices Fintech space StartmeUp Standardized QR code Jul 14 Hong Kong FinTech Day First FinTech Accelerator 2014 2015 2016 2017 2018 Growth 150+ 2 5 FinTech FinTech FinTech Start-ups Poles of excellence Accelerators 200+ 4 3 FinTech Events liaison offices Sandboxes Big 4 consulting FinTech -

Hong Kong Contents

MICE Meetings Incentives Conferences & Exhibitions Hong Kong Contents 01 About Tour East Hong Kong 02 Destination Hong Kong 09 Recommended Hotels 14 Destination Macau 19 Destination China About Tour East Hong Kong Tour East, an established leader in destination management services was founded in 1972, Since then, we have developed an extensive network in the key cities throughout the Asia Pacific region with sales offices in Australia, Russia, UK, Europe and in America. Tour East Hong Kong has played a leading role in the Hong Kong tourism industry, providing quality and reliable services in Hong Kong, Macau and China. We are a member of Hong Kong Association of Travel Agent and Travel Industry Council in Hong Kong. We provide one-stop-shop solution and specialized services for the meetings, incentives, conferences and exhibitions sector. Scope of services: No matter your event size, occasion production of participants’ event collateral, or budget, we have an exciting range conference secretariat and hospitality desk. of venues, ideas and a dedicated MICE • Special interest tours and companion management team to help you bring it to programmes. life. Enjoy: • Creative themed events. From conceptualizing • Support from concept to completion for the event theme to arranging the logistics, let every event. We work closely with PCO/ our professional event planners handle every PEO/ Meeting Planners to ensure absolute detail for you. success. • Extended programmes to other Tour East • Full hospitality arrangements, with an destinations – pre or post event option. extensive range of hotels to meet every budget. Site inspection, coordination and supervision of all operational details, We are delighted to showcase what we can offer your clients in the upcoming events or incentive trip to our destinations. -

U.S. Ambassador to China Terry Branstad

U.S. Ambassador to China Terry Branstad On December 7, 2016, Governor Branstad announced that he had accepted the nomination from President-elect Donald Trump to serve as Ambassador of the United States to the People’s Republic of China. He was confirmed by the Senate on May 22, 2017, and was sworn in on May 24, 2017. Ambassador Terry Branstad was born, raised and educated in Iowa. A native of Leland, Branstad was elected to the Iowa House in 1972, ’74 and ’76, and elected as Iowa’s lieutenant governor in 1978. Branstad was Iowa’s longest-serving governor, from 1983 to 1999. As the state’s chief executive, he weathered some of Iowa’s worst economic turmoil, during the farm crisis of the ‘80s, while helping lead the state’s resurgence to a booming economy in the ‘90s. At the end of his tenure, Iowa enjoyed record employment, an unprecedented $900 million budget surplus, and the enactment of historic government overhauls that led to greater efficiencies in state government. As a result of Governor Branstad’s hands-on, round-the-clock approach to economic development, Iowa’s unemployment rate went from 8.5 percent when he took office to a record low 2.5 percent by the time he left in 1999. Following his four terms as governor, Branstad served as president of Des Moines University (DMU). During his 6-year tenure, he was able to grow the university into a world-class educational facility. Its graduates offer health care in all 50 states and in nearly every Iowa county. -

Legislative Council

立法會 Legislative Council LC Paper No. ESC80/17-18 (These minutes have been seen by the Administration) Ref : CB1/F/3/2 Establishment Subcommittee of the Finance Committee Minutes of the 9th meeting held in Conference Room 3 of Legislative Council Complex on Monday, 22 January 2018, at 4:30 pm Members present: Hon Mrs Regina IP LAU Suk-yee, GBS, JP (Chairman) Hon Alvin YEUNG (Deputy Chairman) Hon James TO Kun-sun Hon LEUNG Yiu-chung Hon Abraham SHEK Lai-him, GBS, JP Hon WONG Ting-kwong, GBS, JP Dr Hon Priscilla LEUNG Mei-fun, SBS, JP Hon WONG Kwok-kin, SBS, JP Hon Steven HO Chun-yin, BBS Hon WU Chi-wai, MH Hon Charles Peter MOK, JP Hon CHAN Chi-chuen Hon KWOK Wai-keung, JP Dr Hon Fernando CHEUNG Chiu-hung Hon IP Kin-yuen Dr Hon Elizabeth QUAT, BBS, JP Hon POON Siu-ping, BBS, MH Dr Hon CHIANG Lai-wan, JP Ir Dr Hon LO Wai-kwok, SBS, MH, JP Hon CHUNG Kwok-pan Hon CHU Hoi-dick Hon Holden CHOW Ho-ding Hon SHIU Ka-fai Hon SHIU Ka-chun Hon YUNG Hoi-yan - 2 - Dr Hon Pierre CHAN Hon CHAN Chun-ying Hon KWONG Chun-yu Hon Jeremy TAM Man-ho Members absent: Dr Hon KWOK Ka-ki Hon Martin LIAO Cheung-kong, SBS, JP Hon HO Kai-ming Public Officers attending: Ms Carol YUEN Siu-wai, JP Deputy Secretary for Financial Services and the Treasury (Treasury) 1 Mr Eddie MAK Tak-wai, JP Deputy Secretary for the Civil Service 1 Mr CHEUK Wing-hing, JP Permanent Secretary for Innovation and Technology Mrs Millie NG, JP Deputy Secretary for Innovation and Technology Mr Allen YEUNG, Ir, JP Government Chief Information Officer Mr Davey CHUNG, JP Deputy Government Chief Information -

The Pearl River Delta Region Portion of Guangdong Province) Has Made the Region Even More Attractive to Investors

The Greater Pearl River Delta Guangzhou Zhaoqing Foshan Huizhou Dongguan Zhongshan Shenzhen Jiangemen Zhuhai Hong Kong Macao A report commissioned by Invest Hong Kong 6th Edition The Greater Pearl River Delta 6th Edition Authors Michael J. Enright Edith E. Scott Richard Petty Enright, Scott & Associates Editorial Invest Hong Kong EXECUTIVE SUMMARY The Greater Pearl River Delta Executive Authors Michael J. Enright Edith E. Scott Summary Richard Petty Enright, Scott & Associates Editorial Invest Hong Kong Background First Published April 2003 Invest Hong Kong is pleased to publish the sixth edition of ‘The Greater Pearl Second Edition June 2004 Third Edition October 2005 River Delta’. Much has happened since the publication of the fifth edition. Fourth Edition October 2006 Rapid economic and business development in the Greater Pearl River Delta Fifth Edition September 2007 (which consists of the Hong Kong Special Administrative Region, the Macao Sixth Edition May 2010 Special Administrative Region, and the Pearl River Delta region portion of Guangdong Province) has made the region even more attractive to investors. © Copyright reserved The region has increased in importance as a production centre and a market within China and globally. Improvements in connectivity within the region and ISBN-13: 978-988-97122-6-6 Printed in Hong Kong Published by Invest Hong Kong of the HKSAR Government EXECUTIVE SUMMARY EXECUTIVE SUMMARY with the rest of the world have made it easier to access for investors than ever The third part of the report provides brief profi les of the jurisdictions of the before. And a range of key policy initiatives, such as ‘The Outline Plan for the Greater Pearl River Delta region, highlighting the main features of the local Reform and Development of the Pearl River Delta (2008-2020)’ from China’s economies, including the principal manufacturing and service sectors, National Development and Reform Commission (NDRC), hold great promise economic development plans, location of development zones and industrial for the future. -

Paper on the Hong Kong-Shenzhen Innovation and Technology

1 立法會 Legislative Council LC Paper No. CB(1)150/20-21(05) Ref. : CB1/PL/CI Panel on Commerce and Industry Meeting on 17 November 2020 Updated background brief on the Hong Kong-Shenzhen Innovation and Technology Park Purpose This paper provides updated background information on the development of Hong Kong-Shenzhen Innovation and Technology Park ("the Park") in the Lok Ma Chau Loop ("the Loop"). This paper also summarizes the views and concerns expressed by members on the subject matter in previous discussions of the Panel on Commerce and Industry ("the Panel"). Background 2. The Loop development,1 as one of the 10 major infrastructure projects announced in the 2007-2008 Policy Address for economic growth, is a mega and complex project. 3. On 3 January 2017, the Hong Kong Special Administrative Region ("HKSAR") Government and Shenzhen Municipal People's Government signed a memorandum of understanding ("the MOU"), agreeing to, under the "one country, two systems" principle and in accordance with the Basic Law, jointly develop the Loop into the Park and establish a key base for cooperation in scientific research with related higher education, cultural and creative and other complementary facilities in the Park. 1 The Loop occupies 87 hectares of land and is originally within the administrative boundary of Shenzhen. In accordance with Order No. 221 of the State Council of the People's Republic of China promulgated on 1 July 1997, after the training of the Shenzhen River, the boundary will follow the new centre line of the river. The Loop, originally within the administrative boundary of Shenzhen, has since been included within the administrative boundary of the Hong Kong Special Administrative Region. -

Emerging Cross Border Tourism Region Macau-Zhuhai: Place in Play/Place to Play

Emerging Cross Border Tourism Region Macau-Zhuhai: Place in Play/Place to Play Hendrik Tieben School of Architecture, Thes Chinese University of Hong Kong Wong Foo Yuan Bld. 610G, CUHK Campus, Shatin, NT, Hong Kong SAR Email: [email protected] Abstract: n This paper explores the new tourism region Macau-Zhuhai which is emerging in the south-western part of the Pearl River Delta (PRD). Since Macau’s handover to the People’s Republic of China in 1999, the former Portuguese enclave is becoming increasingly integrated into the PRD. Together with its mainland neighbor Zhuhai it is creating a bi-city region; although without coordinated planning. Currently, both cities embark on a first joint project encouraged by the Chinese Central Government on the island Hengqin. The paper is investigating the attempts of both cities to re- invent themselves as places to play and how they find themselves on the playing field of global and national forces. The paper ends with the suggestion of an alternative understanding of tourism and destinations which learns from spatial practices of a new generation of tourists in Asia. Key words: Zhuhai, Macau, tourism, heritage, eco-city Producing a region to play n The paper investigates the transformation of the emerging cross-boundary tourism region Macau-Zhuhai in the Pearl River Delta (PRD). The investigation departs from Sheller and Urry’s observation of Places to Play/Places in Play (Sheller & Urry, 2004) which allows capturing the way how cities re-invent themselves to attract investments, tourists, and residents, and how, at the same time, they can become exposed to forces which undermine the qualities which originally made them attractive. -

Cyclic Organosilicon Compounds in Ambient Air in Guangzhou, Macau and Nanhai, Pearl River Delta

Applied Geochemistry 16 (2001) 1447–1454 www.elsevier.com/locate/apgeochem Cyclic organosilicon compounds in ambient air in Guangzhou, Macau and Nanhai, Pearl River Delta X.M. Wang a, S.C. Lee b,*, G.Y. Sheng a, L.Y. Chan b, J.M. Fu a, X.D. Li b, Y.S. Min a, C.Y. Chan b aSKLOG, Guangzhou Institute of Geochemistry, Chinese Academy of Sciences, Guangzhou 510640, China bDepartment of Civil and Structural Engineering, The Hong Kong Polytechnic University, Kowloon, Hong Kong Abstract Silicon is present in the Earth’s atmosphere as a consequence of several processes including the release of Si com- pounds from anthropogenic sources, but little information is available on airborne Si compounds of anthropogenic origins. In this study ambient air samples from Guangzhou, Macau and Nanhai in the Pearl River Delta, South China were collected by sorbent tubes for the determination of concentrations of volatile organosilicon compounds. Samples were analysed by thermal desorption followed by a GC–MSD technique for compound identification and quantitative analysis. Hexamethylcyclotrisiloxane (D3) and octamethylcyclotetrasilo-xane (D4) were found to be the two dominant organosilicon compounds in the air. In Guangzhou, higher total D3 and D4 concentrations were observed in the industrial area, landfill and waste water treatment plant, while the lowest levels occurred in suburb forest. Two types of linear correlation between D3 and D4 were found in Guangzhou samples, indicating different sources of these orga- nosilicon compounds. Samples in Macau and Nanhai showed different D3 and D4 relationships from the samples in Guangzhou. # 2001 Elsevier Science Ltd. All rights reserved. -

CHINA COUNTRY of ORIGIN INFORMATION (COI) REPORT COI Service

CHINA COUNTRY OF ORIGIN INFORMATION (COI) REPORT COI Service 12 October 2012 CHINA 12 OCTOBER 2012 Contents Preface REPORTS ON CHINA PUBLISHED OR ACCESSED BETWEEN 24 SEPTEMBER 10 OCTOBER 2012 Paragraphs Background Information 1. GEOGRAPHY ............................................................................................................ 1.01 Map ........................................................................................................................ 1.05 Infrastructure ........................................................................................................ 1.06 Languages ........................................................................................................... 1.07 Population ............................................................................................................. 1.08 Naming conventions ........................................................................................... 1.10 Public holidays ................................................................................................... 1.12 2. ECONOMY ................................................................................................................ 2.01 Poverty .................................................................................................................. 2.03 Currency ................................................................................................................ 2.05 3. HISTORY .................................................................................................................