1. Executive Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Actions Synthétiques France Heures De Négociation : 9:00 - 17:30 (CET) Frais Et Commissions : 0.1% Du Montant De La Transaction, Min

Actions Synthétiques France Heures de négociation : 9:00 - 17:30 (CET) Frais et Commissions : 0.1% du montant de la transaction, min. 8 EUR (Marge sur commission: 70% - 99.9%). Symbole Instrument dont le prix est basé sur Nombre d'actions par lot Taille minimale d'un ordre en lots Vente à découvert Taux d'emprunt de titre (%) AC.FR Accor SA CFD 1 1 OUI -3 ACA.FR Credit Agricole SA CFD 1 1 OUI -3 ADP.FR Aeroports de Paris CFD 1 1 OUI -3 AF.FR Air France-KLM CFD 1 1 OUI -3 AI.FR Air Liquide SA CFD 1 1 OUI -3 AIR.FR Airbus Group NV CFD 1 1 NON - AKE.FR Arkema SA CFD 1 1 OUI -3 ALO.FR Alstom SA CFD 1 1 OUI -3 ALT.FR Altran Technologies SA CFD 1 1 OUI -3 ATO.FR AtoS CFD 1 1 OUI -3 BB.FR Societe BIC SA CFD 1 1 OUI -3 BIM.FR BioMerieux CFD 1 1 OUI -3 BN.FR Danone CFD 1 1 OUI -3 BNP.FR BNP Paribas CFD 1 1 OUI -3 BOL.FR Bollore SA CFD 1 1 OUI -3 BVI.FR Bureau Veritas SA CFD 1 1 OUI -3 CA.FR Carrefour SA CFD 1 1 OUI -3 CAP.FR Cap Gemini SA CFD 1 1 OUI -3 CGG.FR CGG SA CFD 1 1 NON - CNP.FR CNP Assurances CFD 1 1 OUI -3 CO.FR Casino Guichard Perrachon SA CFD 1 1 OUI -3 COFA.FR Coface SA CFD 1 1 OUI -4,5 CS.FR AXA SA CFD 1 1 OUI -3 DEC.FR JCDecaux SA CFD 1 1 OUI -3 DG.FR Vinci SA CFD 1 1 OUI -3 DSY.FR Dassault Systemes CFD 1 1 OUI -3 EDEN.FR Edenred CFD 1 1 OUI -3 EDF.FR EDF SA CFD 1 1 OUI -3 EI.FR Essilor International SA CFD 1 1 OUI -3 ELE.FR Euler Hermes Group CFD 1 1 OUI -4,5 EN.FR Bouygues SA CFD 1 1 OUI -3 ENGI.FR ENGIE CFD 1 1 OUI -3 ENX.FR Euronext NV CFD 1 1 OUI -3 EO.FR Faurecia CFD 1 1 OUI -3 ERA.FR Eramet CFD 1 1 OUI -5 ERF.FR Eurofins -

Smartetn P.L.C. Cirdan Capital Management

FINAL TERMS 16th October 2018 SMARTETN P.L.C. (incorporated as a public company with limited liability in Ireland with its registered office at 2nd Floor, Palmerston House, Fenian Street, Dublin 2, Ireland) (as "Issuer") Issue of Series R2018-3 1,000,000 Made in Italy 30-70 EUR TR Index due 2028 (the "Certificates") under the €2,000,000,000 Structured Medium Term Certificate Programme guaranteed by CIRDAN CAPITAL MANAGEMENT LTD (incorporated as a private company with limited liability in England) (as "Guarantor") Any person making or intending to make an offer of the Certificates may only do so: i. in those Non-exempt Offer Jurisdictions mentioned in Paragraph 7.5 of Part B below, provided such person is of a kind specified in that paragraph and that the offer is made during the Offer Period specified in that paragraph; or ii. otherwise, in circumstances in which no obligation arises for the Issuer or the Dealer to publish a prospectus pursuant to Article 3 of the Prospectus Directive or to supplement a prospectus pursuant to Article 16 of the Prospectus Directive, in each case, in relation to such offer. Neither the Issuer nor the Dealer has authorised, nor do they authorise, the making of any offer of Certificates in any other circumstances. MIFID II product governance / Retail investors, professional investors and ECPs target market – Solely for the purposes of the manufacturer’s product approval process, the target market assessment in respect of the Certificates has led to the conclusion that: (i) the target market for the Certificates is eligible counterparties, professional clients and retail clients, each as defined in Directive 2014/65/EU (as amended, "MiFID II"); (ii) all channels for distribution to eligible counterparties and professional clients are appropriate; and (iii) the following channels for distribution of the Certificates to retail clients are appropriate - investment advice, portfolio management, and non-advised sales, subject to the distributor’s suitability and appropriateness obligations under MiFID II, as applicable. -

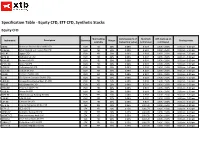

Specification Table - Equity CFD, ETF CFD, Synthetic Stocks Equity CFD

Specification Table - Equity CFD, ETF CFD, Synthetic Stocks Equity CFD Short selling Commission (% of Minimum XTB mark-up on Instrument Description Currency Margin Trading Hours available transaction value) commission commission ABI.BE Anheuser-Busch InBev SA/NV CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm ACKB.BE Ackermans & van Haaren NV CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm AGS.BE Ageas CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm BEFB.BE Befimmo SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm BEKB.BE Bekaert SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm BPOST.BE bpost SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm COFB.BE Cofinimmo SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm COLR.BE Colruyt SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm DIE.BE Dieteren SA/NV CFD EUR NO 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm ELI.BE Elia System Operator SA/NV CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm GBLB.BE Groupe Bruxelles Lambert SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm KBC.BE KBC Groep NV CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm PROX.BE Proximus SADP CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm SOLB.BE Solvay SA CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm TNET.BE Telenet Group Holding NV CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm UCB.BE UCB SA CFD EUR YES 25% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm UMI.BE Umicore SA CFD EUR YES -

DAVIDE CAMPARI-MILANO S.P.A. (Incorporated with Limited Liability Under the Laws of the Republic of Italy) €600,000,000 2.75 Per Cent

DAVIDE CAMPARI-MILANO S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) €600,000,000 2.75 per cent. Notes due 30 September 2020 The issue price of the €600,000,000 2.75 per cent. Notes due 30 September 2020 (the Notes) of Davide Campari-Milano S.p.A. (the Issuer) is 99.715 per cent. of their principal amount. Unless previously redeemed or purchased and cancelled, the Notes will be redeemed at their principal amount on 30 September 2020. The Notes are subject to redemption in whole at their principal amount at the option of the Issuer at any time in the event of certain changes affecting taxation in the Republic of Italy. See “Terms and Conditions of the Notes – Redemption and Purchase”. The Notes will bear interest from 30 September 2015 at the rate of 2.75 per cent. per annum payable annually in arrear on 30 September each year commencing on 30 September 2016. Payments on the Notes will be made in Euros without deduction for or on account of taxes imposed or levied by the Republic of Italy to the extent described under “Terms and Conditions of the Notes – Taxation”. Application has been made to the Luxembourg Commission de Surveillance du Secteur Financier (the CSSF), which is the Luxembourg competent authority for the purpose of Directive 2003/71/EC as amended (which includes the amendments made by Directive 2010/73/EU) (the Prospectus Directive) and for the purposes of the Luxembourg Act dated 10 July 2005 on prospectuses for securities, as amended (the Prospectus Act 2005) to approve this document as a Prospectus. -

Instruments List For

Instruments Full Instruments List for Below you will find a full list of instruments offered by a X Spot Markets (EU) Ltd. Please note that the figures below are purely for information purposes. Contents: Forex Indices Commodities Equity CFDs: Belgium Finland Italy Portugal Czech Republic France Netherlands Spain Denmark Germany Norway Sweden Switzerland UK United Kingdom - International US Poland (on demand) ETF CFDs: EU US Instrument List FOREX Minimum Instrument Nominal value of Size of one quotation Trading hours Instrument name Reference source symbol the lot pip step (in (CET) points) 24h from Sunday Interbank market Australian Dollar to AUDCAD AUD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier Canadian Dollar 10:00 pm banks 24h from Sunday Interbank market Australian Dollar to AUDCHF AUD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier Swiss Frank 10:00 pm banks 24h from Sunday Interbank market Australian Dollar to AUDJPY AUD 100 000 0,01 0,001 11:00pm to Friday price from top-tier Japanese Yen 10:00 pm banks 24h from Sunday Interbank market Australian Dollar to AUDNZD AUD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier New Zealand Dollar 10:00 pm banks 24h from Sunday Interbank market Australian Dollar to AUDUSD AUD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier American Dollar 10:00 pm banks 24h from Sunday Interbank market Canadian Dollar to CADCHF CAD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier Swiss Frank 10:00 pm banks 24h from Sunday Interbank market Canadian -

BJB Key Information

Header First Page Key Information – 4 April 2016 SSPA Swiss Derivative Map©/ EUSIPA Derivative Map© Tracker Certificate (1300) JB Tracker Certificate on the Peripheral Basket III (the "Products") Participation on Share Basket – EUR – Cash Settlement This document is for information purposes only. A Product does not constitute a collective investment scheme within the meaning of the Swiss Federal Act on Collective Investment Schemes. Therefore, it is not subject to authorisation by the Swiss Financial Market Supervisory Authority FINMA ("FINMA") and potential investors do not benefit from the specific investor protection provided under the CISA and are exposed to the credit risk of the Issuer. I. Product Description Terms Swiss Security Number 30689176 (Valor) Initial Fixing Date ISIN CH0306891760 01 April 2016, being the date on which the Initial Level and the Symbol JFRAG Weight are fixed. Issue Size up to 150,000 Products (EUR 15,000,000) Issue Date/Payment Date (may be increased/decreased at any time) 08 April 2016, being the date on which the Products are issued Issue Currency EUR and the Issue Price is paid. Issue Price EUR 99.60 (per Product; including the Final Fixing Date Distribution Fee) 31 March 2017, being the date on which the Final Level will be Denomination EUR 100.00 fixed. Last Trading Date 30 March 2017, until the official close of trading on the SIX Swiss Exchange, being the last date on which the Products may be traded. Final Redemption Date 07 April 2017, being the date on which each Product will be redeemed at the Final Redemption Amount, unless previously redeemed, repurchased or cancelled. -

The Ipsos Reputation Council: Thirteenth Sitting 03

GLOBAL PERSPECTIVES THE IPSOS ON SECTOR REPUTATIONS THE ROLE OF THE CEO IN REPUTATION EXTERNAL COMMUNICATIONS WHAT KEEPS COMMUNICATORS COUNCIL AWAKE AT NIGHT? Findings from the thirteenth sitting WHEN DOES REPUTATION – exploring the latest thinking and TURBULENCE BECOME A FULL-BLOWN CRISIS? practice in corporate reputation management across the world GLOBAL VS LOCAL THE SPREAD OF ‘TECHLASH’ reputation.ipsos.com @ipsosreputation IPSOS CORPORATE REPUTATION For business leaders who aspire to better decision-making in reputation, corporate communications and corporate policy development, the Ipsos Corporate Reputation team is the insight industry’s most trusted source of specialist research and guidance. The Ipsos Corporate Reputation team helps organisations build resilient reputations and stronger relationships. Our approach is tailored and carefully designed to meet each client’s individual needs, and our research directly drives business performance: Measuring reputation performance relative to peers Identifying the drivers that create reputational value Defining the stakeholders that influence reputation Shaping a stakeholder engagement strategy Building communications campaigns and measuring impact Understanding future opportunities and risks around reputation Measuring the impact of and responding to a crisis Clarifying the actions necessary to deliver on strategic objectives This support helps organisations strengthen their reputation capital – the ability of a brand to command preference in the marketplace – and optimise its relationships across its stakeholders. The Ipsos Reputation Council: Thirteenth Sitting 03 Welcome to the latest briefing from the Ipsos Reputation Council. This – our thirteenth sitting – has been the biggest and most international yet, involving 154 senior communicators from 20 countries. s Paul Polman, CEO of Unilever, once for CEO-led communications, and look at how the CCO said: “reputation has a habit of arriving can ensure that these communications build, rather than A on foot and departing on horseback”. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F (Mark One) អ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR អ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 1-10421 LUXOTTICA GROUP S.p.A. (Exact name of Registrant as specified in its charter) (Translation of Registrant’s name into English) REPUBLIC OF ITALY (Jurisdiction of incorporation or organization) VIA C. CANTU` 2, MILAN 20123, ITALY (Address of principal executive offices) Michael A. Boxer, Esq. Executive Vice President and Group General Counsel 44 Harbor Park Drive Port Washington, NY 11050 Tel: (516) 484-3800 Fax: (516) 484-9010 (Name, Telephone, Email and/or Facsimile Number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act. Title of each class Name of each exchange of which registered ORDINARY SHARES, PAR VALUE NEW YORK STOCK EXCHANGE EURO 0.06 PER SHARE* AMERICAN DEPOSITARY NEW YORK STOCK EXCHANGE SHARES, EACH REPRESENTING ONE ORDINARY SHARE * Not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the New York Stock Exchange Securities registered or to be registered pursuant to Section 12(g) of the Act. -

Leader Della Sostenibilità Rapporti

Supplemento al numero odierno del Sole Ore Poste italiane Sped. in A.P. - D.L. / Leader conv. L. /, articolo , comma , DCB Milano della sostenibilità Rapporti Pmi Manifatturiero BANCHE IN PRIMA FILA Le piccole medie Il made in Italy Istituti di credito e assicura- zioni sono in prima fila nella imprese migliori vincente ha una lista dei 150 Leader italiani sono quotate o forte sensibilità della sostenibilità 2021 Sole 24 Ore - Statista. Come ad aderenti a Elite o green, fini sociali esempio Unicredit (nella foto, Global Compact Onu e bilanci in ordine la Head of Group ESG Strategy & impact banking, 29/04 —pag. 4 —pag. 12-17 2021 Roberta Marracino) ANSA L’analisi IL BILANCIO DIVENTA SEMPRE PIÙ VERDE di Vitaliano D’Angerio l aprile c’è stato il big bang della finanza sostenibile. La ICommissione europea presieduta da Ursula Von der Leyen ha pubblicato la proposta di modifica della Dichiarazione non finanziaria (Dnf) insieme agli atti delegati sulla tassonomia green. La novità è una doppia estensione dell’obbligo che vedrà aumentare da mila a mila le aziende tenute a pubblicare la Dnf. Una prima estensione riguarda le non quotate: anche le grandi aziende fuori dai listini dovranno fornire informazioni Obiettivo zero emissioni. Le migliori società al mondo sono paladine della lotta ai cambiamenti climatici e lo dimostrano lavorando all’obiettivo di zero emissioni entro qualche anno legate ai parametri Esg; ancora non è chiaro quale sarà la soglia dei dipendenti (o di fatturato) per entrare in tale categoria. La seconda estensione della Dnf riguarda invece le aziende I report spingono il business listate: cade infatti la soglia dei dipendenti, e sia le grandi che le piccole dovranno pubblicare il rendiconto sostenibile. -

ECCIA Position Paper on the Recovery from the COVID-19 Crisis Implications and Policy Recommendations

ECCIA Position Paper on the Recovery from the COVID-19 Crisis Implications and Policy Recommendations June 2020 ECCIA Covid-19 Recovery Position Paper Table of content 1. Executive Summary ............................................................................................................. 2 2. Introduction ........................................................................................................................... 3 3. Impact of the COVID-19 pandemic on the European cultural and creative sector ......................................................................................................................................... 3 4. Unprecedented mobilisation from ECCIA members to help fight the crisis ... ………………………………………………………………………………………………………………4 5. ECCIA policy recommendations to recover from the crisis ................................. 5 i. Emergency support for companies and their workforce ........................... 6 a) Overcome liquidity shortages in otherwise financially sound companies ......................................................................................................................... 6 b) Safeguard employment in the high-end cultural and creative sectors ......................................................................................................................... 7 c) Ensure access to EU funding for creative and cultural industries, including the EU solidarity fund ................................................................... 7 d) Maintain the efficient functioning -

Mscprograms.Pdf

2022-2023 Guidance and Recruitment Office piazza Sraffa 11 Milano www.unibocconi.eu/graduateguidance Contact Center + 39 02.40.3434 Skype: unibocconi Explore the Bocconi campus through virtual reality. VISIT OUR WEBSITE! OUR DNA www.unibocconi.eu Our website is constantly being updated and is designed to offer you a great browsing experience! You can easily find insights into our University and any other information you may need: • everything you need to know about our programs (including program structures and international opportunities) Since its founding in 1902, Bocconi has always stood for pluralism, independence and entrepreneurial spirit that support the socioeconomic progress of Italy and Europe through scientific innovation, advanced research and the training of tomorrow’s business leaders. You • indications on admissions, fees and funding, and on-campus housing will learn from expert faculty, attending programs at the forefront of modern higher learning. A Bocconi education is a springboard to • recruitment and guidance initiatives improved professional prospects and enables our graduates to make a significant contribution to society: This is the meaning behind our motto, “Knowledge That Matters.” ONE OF THE TOP 5 UNIVERSITIES IN EUROPE To boost your browsing, whenever you see this icon Bocconi is recognized internationally for its academics and research in the social sciences, in the fields of economics, management, finance, political science, data science and legal studies. We continue to invest in and attract talented faculty from all over the world, who help build our reputation both in research and teaching. INNOVATION AND RESEARCH you will be taken directly to additional material on that topic. -

Venture Capital All Rounds in the First 8 Months of 2020

September 2020 Venture capital All rounds in the first 8 months of 2020 EdiBeez srl - head office Corso Venezia, 8 - 20121 Milan - registered office Corso Italia, 22 - 20122 Milan – VAT N° 09375120962 1 In the first eight months of 2020 there were 181 investment rounds, of which 103 rounds concluded by venture capital investors in the broad sense and 78 rounds concluded through equity crowfunding campaigns (net of real estate campaigns). All for a total of 420 million euros invested by venture capital funds, investment holding companies, corporate venture capital, business angels and crowdfunding equity platform crowdfunding crowdfunding crowdfunding crowd, but also by venture debt funds and other lenders, including banks. Excluding the latter, venture capital raised in total 364 million euros. Focusing on the first six months of 2020 alone, 138 investment rounds were counted, including 78 rounds concluded by venture capital investors in the broadest sense and 60 rounds concluded through equity crowfunding campaigns (net of real estate campaigns). Excluding the latter transactions, which in the first half of the year were reduced to only e 5 million of Casavo's minibonds subscribed by Amundi's private debt fund (see other article of BeBeez), it fell to e 259 million. In the first half of The data come from BeBeez Private Data (the BeBeez database available on subscription, click here for the year, information and an upgrade of your BeBeez News Premium subscription) and from Italian startups CrowdfundingBuzz (published by EdiBeez srl as BeBeez). On the latter front, in particular, 60 campaigns were successfully completed in the six months, net of real estate, for a total of 28 million euros.