Venture Capital All Rounds in the First 8 Months of 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Actions Synthétiques France Heures De Négociation : 9:00 - 17:30 (CET) Frais Et Commissions : 0.1% Du Montant De La Transaction, Min

Actions Synthétiques France Heures de négociation : 9:00 - 17:30 (CET) Frais et Commissions : 0.1% du montant de la transaction, min. 8 EUR (Marge sur commission: 70% - 99.9%). Symbole Instrument dont le prix est basé sur Nombre d'actions par lot Taille minimale d'un ordre en lots Vente à découvert Taux d'emprunt de titre (%) AC.FR Accor SA CFD 1 1 OUI -3 ACA.FR Credit Agricole SA CFD 1 1 OUI -3 ADP.FR Aeroports de Paris CFD 1 1 OUI -3 AF.FR Air France-KLM CFD 1 1 OUI -3 AI.FR Air Liquide SA CFD 1 1 OUI -3 AIR.FR Airbus Group NV CFD 1 1 NON - AKE.FR Arkema SA CFD 1 1 OUI -3 ALO.FR Alstom SA CFD 1 1 OUI -3 ALT.FR Altran Technologies SA CFD 1 1 OUI -3 ATO.FR AtoS CFD 1 1 OUI -3 BB.FR Societe BIC SA CFD 1 1 OUI -3 BIM.FR BioMerieux CFD 1 1 OUI -3 BN.FR Danone CFD 1 1 OUI -3 BNP.FR BNP Paribas CFD 1 1 OUI -3 BOL.FR Bollore SA CFD 1 1 OUI -3 BVI.FR Bureau Veritas SA CFD 1 1 OUI -3 CA.FR Carrefour SA CFD 1 1 OUI -3 CAP.FR Cap Gemini SA CFD 1 1 OUI -3 CGG.FR CGG SA CFD 1 1 NON - CNP.FR CNP Assurances CFD 1 1 OUI -3 CO.FR Casino Guichard Perrachon SA CFD 1 1 OUI -3 COFA.FR Coface SA CFD 1 1 OUI -4,5 CS.FR AXA SA CFD 1 1 OUI -3 DEC.FR JCDecaux SA CFD 1 1 OUI -3 DG.FR Vinci SA CFD 1 1 OUI -3 DSY.FR Dassault Systemes CFD 1 1 OUI -3 EDEN.FR Edenred CFD 1 1 OUI -3 EDF.FR EDF SA CFD 1 1 OUI -3 EI.FR Essilor International SA CFD 1 1 OUI -3 ELE.FR Euler Hermes Group CFD 1 1 OUI -4,5 EN.FR Bouygues SA CFD 1 1 OUI -3 ENGI.FR ENGIE CFD 1 1 OUI -3 ENX.FR Euronext NV CFD 1 1 OUI -3 EO.FR Faurecia CFD 1 1 OUI -3 ERA.FR Eramet CFD 1 1 OUI -5 ERF.FR Eurofins -

20100527-NOXXON Pharma AG Raises -200 33 Million in Series D

NOXXON Pharma AG raises €33 million in Series D Round Berlin, Germany, May 27, 2010 – NOXXON Pharma AG (NOXXON), a company focused on the development of mirror image oligonucleotide therapeutics called Spiegelmers ®, announced today the successful closing of a €33 million Series D round of financing. The round was led by new investor, NGN Capital, and joined by existing investors TVM Capital, Sofinnova Partners, Edmond de Rothschild Investment Partners, Seventure Partners, VC Fonds Technologie Berlin GmbH, Dow Venture Capital, FCP OP MEDICAL BioHealth- Trends, IBG Beteiligungsgesellschaft Sachsen-Anhalt mbH, the Dieckell Group, and others. The funds raised will be used primarily for the ongoing clinical and pre-clinical development of NOXXON´s lead products NOX-E36, NOX-A12, and NOX-H94 in the fields of diabetic complications, oncology and hematology. These products are high-potency inhibitors of their respective targets, generated with NOXXON’s proprietary Spiegelmer ® technology. Spiegelmers ® are marked by their biostability and an extremely low potential for toxic or immunogenic side effects. “This investment provides NOXXON with the funds to advance the clinical development of our three most advanced in-house programs without the need for additional external support. NGN´s decision to lead this round is a testament to the value of the Spiegelmer ® technology and the commercial potential of the development programs pursued by NOXXON.” stated NOXXON’s CEO Dr. Frank Morich. Peter Johann, a Managing General Partner at NGN Capital, commented: “We are very excited about NOXXON’s platform and the product opportunities which can be created from it. The Company and its experienced management team made significant progress over the last years bringing two Spiegelmers ® into the clinic and one more close to clinical development. -

Smartetn P.L.C. Cirdan Capital Management

FINAL TERMS 16th October 2018 SMARTETN P.L.C. (incorporated as a public company with limited liability in Ireland with its registered office at 2nd Floor, Palmerston House, Fenian Street, Dublin 2, Ireland) (as "Issuer") Issue of Series R2018-3 1,000,000 Made in Italy 30-70 EUR TR Index due 2028 (the "Certificates") under the €2,000,000,000 Structured Medium Term Certificate Programme guaranteed by CIRDAN CAPITAL MANAGEMENT LTD (incorporated as a private company with limited liability in England) (as "Guarantor") Any person making or intending to make an offer of the Certificates may only do so: i. in those Non-exempt Offer Jurisdictions mentioned in Paragraph 7.5 of Part B below, provided such person is of a kind specified in that paragraph and that the offer is made during the Offer Period specified in that paragraph; or ii. otherwise, in circumstances in which no obligation arises for the Issuer or the Dealer to publish a prospectus pursuant to Article 3 of the Prospectus Directive or to supplement a prospectus pursuant to Article 16 of the Prospectus Directive, in each case, in relation to such offer. Neither the Issuer nor the Dealer has authorised, nor do they authorise, the making of any offer of Certificates in any other circumstances. MIFID II product governance / Retail investors, professional investors and ECPs target market – Solely for the purposes of the manufacturer’s product approval process, the target market assessment in respect of the Certificates has led to the conclusion that: (i) the target market for the Certificates is eligible counterparties, professional clients and retail clients, each as defined in Directive 2014/65/EU (as amended, "MiFID II"); (ii) all channels for distribution to eligible counterparties and professional clients are appropriate; and (iii) the following channels for distribution of the Certificates to retail clients are appropriate - investment advice, portfolio management, and non-advised sales, subject to the distributor’s suitability and appropriateness obligations under MiFID II, as applicable. -

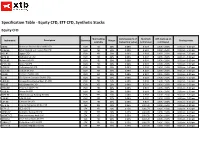

Specification Table - Equity CFD, ETF CFD, Synthetic Stocks Equity CFD

Specification Table - Equity CFD, ETF CFD, Synthetic Stocks Equity CFD Short selling Commission (% of Minimum XTB mark-up on Instrument Description Currency Margin Trading Hours available transaction value) commission commission ABI.BE Anheuser-Busch InBev SA/NV CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm ACKB.BE Ackermans & van Haaren NV CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm AGS.BE Ageas CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm BEFB.BE Befimmo SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm BEKB.BE Bekaert SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm BPOST.BE bpost SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm COFB.BE Cofinimmo SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm COLR.BE Colruyt SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm DIE.BE Dieteren SA/NV CFD EUR NO 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm ELI.BE Elia System Operator SA/NV CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm GBLB.BE Groupe Bruxelles Lambert SA CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm KBC.BE KBC Groep NV CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm PROX.BE Proximus SADP CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm SOLB.BE Solvay SA CFD EUR YES 20% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm TNET.BE Telenet Group Holding NV CFD EUR YES 50% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm UCB.BE UCB SA CFD EUR YES 25% 0.08% 8 EUR 100% - 250% 9:00 am - 5:30 pm UMI.BE Umicore SA CFD EUR YES -

Shareholder Meeting

17 June 2009 HarbourVest Global Private Equity Limited Informal Meeting for Shareholders Welcome Sir Michael Bunbury Chairman, HVPE HarbourVest and HVPE Attendees Sir Michael Bunbury Chairman of HVPE D. Brooks Zug Senior Managing Director and Founder of HarbourVest; Director of HVPE George Anson Managing Director of HarbourVest; Director of HVPE Steve Belgrad CFO of HVPE Amanda McCrystal Head of Investor Relations and Communications for HVPE 2 Agenda I. Welcome Sir Michael Bunbury II. Overview of the Manager – HarbourVest D. Brooks Zug III. HVPE Review Steve Belgrad • Financial Highlights • Portfolio • Commitments and Balance Sheet • Trading and Investor Relations • HVPE Outlook IV. Outlook for Private Equity George Anson V. Summary / Questions and Answers Steve Belgrad 6/1/2009 3 Overview of the Manager – HarbourVest D. Brooks Zug Senior Managing Director and Founder, HarbourVest Director, HVPE Overview of the Investment Manager – HarbourVest Partners Largest Private Independent, 100% owner-managed private equity fund-of-funds Equity Founders began private equity investing in 1978 Fund-of-Funds Manager with Total capital raised over 25 years of $30 billion Experienced, Global 78 investment professionals in Boston, London and Hong Kong Team together with a support staff of more than 140 Focus on three private equity investment strategies: primary Consistent partnerships, secondary investments, direct investments Private Equity Strategy Four principal product lines: U.S. fund-of-funds, non-U.S. fund-of-funds, secondary-focused funds, direct / co-investment funds Demonstrated One of the longest track records in the industry Upper Quartile Achieved by the same professionals that manage the portfolio today Investment Demonstrated top quartile performance across all private equity Performance strategies1 __________________ Note: (1) Where relevant benchmarks exist. -

What to Consider Before Contacting a Venture Capital Investor

Deliverable 6: Network of private investors Background material for AAL project participants March 2014 (updated NHG 15.1.2016) Copyright statement AAL2Business - Report titled “Network of private investors - Background material for AAL project participants“ Report for Ambient Assisted Living Association, Brussels Date April 2014 Author(s) Nordic Healthcare Group Responsible Administrator: AAL Association Brussels Project name: AAL2Business Publisher: Ambient Assisted Living Association Rue de Luxembourg, 3, 2nd floor B-1000 Brussels, Belgium Phone +32 (0)2 219 92 25 email: [email protected] About Ambient Assisted Living Association: The Ambient Assisted Living Association (AALA) is organizing the Ambient Assisted Living Joint Programme (AAL JP). The AAL JP aims at enhancing the quality of life of older people and strengthening the industrial base in Europe through the use of Information and Communication Technologies (ICT). Therefore, the AAL JP is an activity that operates in the field of services and actions to enable the active ageing among the population. The programme is financed by the European Commission and the 22 countries that constitute the Partner States of this Joint Programme. See more at: http://www.aal-europe.eu/ The information and views set out in this report are those of the author(s) and do not necessarily reflect the official opinion of the AALA. The AALA does not guarantee the accuracy of the data included in this study. Neither the AALA nor any person acting on the AALA’s behalf may beheld responsible for the use which may be made of the information contained therein. All rights reserved by AALA. © 2014 Ambient Assisted Living Association, Brussels 2 Contents 1 Introduction and content overview 2 Funding opportunities and availability in Europe 3 Considerations before seeking funding 4 Choosing the right type of funding 5 Investor contacts and event listings • Accelerator Programs & Business angels • Venture capital • Events • Other useful sources 3 Introduction to material . -

DAVIDE CAMPARI-MILANO S.P.A. (Incorporated with Limited Liability Under the Laws of the Republic of Italy) €600,000,000 2.75 Per Cent

DAVIDE CAMPARI-MILANO S.p.A. (incorporated with limited liability under the laws of the Republic of Italy) €600,000,000 2.75 per cent. Notes due 30 September 2020 The issue price of the €600,000,000 2.75 per cent. Notes due 30 September 2020 (the Notes) of Davide Campari-Milano S.p.A. (the Issuer) is 99.715 per cent. of their principal amount. Unless previously redeemed or purchased and cancelled, the Notes will be redeemed at their principal amount on 30 September 2020. The Notes are subject to redemption in whole at their principal amount at the option of the Issuer at any time in the event of certain changes affecting taxation in the Republic of Italy. See “Terms and Conditions of the Notes – Redemption and Purchase”. The Notes will bear interest from 30 September 2015 at the rate of 2.75 per cent. per annum payable annually in arrear on 30 September each year commencing on 30 September 2016. Payments on the Notes will be made in Euros without deduction for or on account of taxes imposed or levied by the Republic of Italy to the extent described under “Terms and Conditions of the Notes – Taxation”. Application has been made to the Luxembourg Commission de Surveillance du Secteur Financier (the CSSF), which is the Luxembourg competent authority for the purpose of Directive 2003/71/EC as amended (which includes the amendments made by Directive 2010/73/EU) (the Prospectus Directive) and for the purposes of the Luxembourg Act dated 10 July 2005 on prospectuses for securities, as amended (the Prospectus Act 2005) to approve this document as a Prospectus. -

Instruments List For

Instruments Full Instruments List for Below you will find a full list of instruments offered by a X Spot Markets (EU) Ltd. Please note that the figures below are purely for information purposes. Contents: Forex Indices Commodities Equity CFDs: Belgium Finland Italy Portugal Czech Republic France Netherlands Spain Denmark Germany Norway Sweden Switzerland UK United Kingdom - International US Poland (on demand) ETF CFDs: EU US Instrument List FOREX Minimum Instrument Nominal value of Size of one quotation Trading hours Instrument name Reference source symbol the lot pip step (in (CET) points) 24h from Sunday Interbank market Australian Dollar to AUDCAD AUD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier Canadian Dollar 10:00 pm banks 24h from Sunday Interbank market Australian Dollar to AUDCHF AUD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier Swiss Frank 10:00 pm banks 24h from Sunday Interbank market Australian Dollar to AUDJPY AUD 100 000 0,01 0,001 11:00pm to Friday price from top-tier Japanese Yen 10:00 pm banks 24h from Sunday Interbank market Australian Dollar to AUDNZD AUD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier New Zealand Dollar 10:00 pm banks 24h from Sunday Interbank market Australian Dollar to AUDUSD AUD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier American Dollar 10:00 pm banks 24h from Sunday Interbank market Canadian Dollar to CADCHF CAD 100 000 0,0001 0,00001 11:00pm to Friday price from top-tier Swiss Frank 10:00 pm banks 24h from Sunday Interbank market Canadian -

BJB Key Information

Header First Page Key Information – 4 April 2016 SSPA Swiss Derivative Map©/ EUSIPA Derivative Map© Tracker Certificate (1300) JB Tracker Certificate on the Peripheral Basket III (the "Products") Participation on Share Basket – EUR – Cash Settlement This document is for information purposes only. A Product does not constitute a collective investment scheme within the meaning of the Swiss Federal Act on Collective Investment Schemes. Therefore, it is not subject to authorisation by the Swiss Financial Market Supervisory Authority FINMA ("FINMA") and potential investors do not benefit from the specific investor protection provided under the CISA and are exposed to the credit risk of the Issuer. I. Product Description Terms Swiss Security Number 30689176 (Valor) Initial Fixing Date ISIN CH0306891760 01 April 2016, being the date on which the Initial Level and the Symbol JFRAG Weight are fixed. Issue Size up to 150,000 Products (EUR 15,000,000) Issue Date/Payment Date (may be increased/decreased at any time) 08 April 2016, being the date on which the Products are issued Issue Currency EUR and the Issue Price is paid. Issue Price EUR 99.60 (per Product; including the Final Fixing Date Distribution Fee) 31 March 2017, being the date on which the Final Level will be Denomination EUR 100.00 fixed. Last Trading Date 30 March 2017, until the official close of trading on the SIX Swiss Exchange, being the last date on which the Products may be traded. Final Redemption Date 07 April 2017, being the date on which each Product will be redeemed at the Final Redemption Amount, unless previously redeemed, repurchased or cancelled. -

Private Equity Analyst

PRIVATE EQUITY ANALYST NOVEMBER 2020 Women to Private Equity’s Top Female Talent of Today and Tomorrow p. 7 10 VCs Grooming Game-Changing Startups p. 13 Watch LP Cycles Ad HFA+PEA-Ltr DR080420.pdf 1 8/4/20 5:43 PM Private equity investing has its cycles. Work with a secondary manager who’s C experienced them all. M Y CM MY As leaders of the secondary market, the Lexington Partners team CY draws on more than 400 years of private equity experience. CMY Through all types of business cycles, we have completed over K 500 secondary transactions, acquiring more than 3,000 interests managed by over 750 sponsors with a total value in excess of $53 billion. Our team has excelled at providing customized alternative investment solutions to banks, financial institutions, pension funds, sovereign wealth funds, endowments, family offices, and other fiduciaries seeking to reposition their private investment portfolios. If you have an interest in the secondary market, our experience is second to none. To make an inquiry, please send an email to [email protected] or call us at one of our offices. Innovative Directions in Alternative Investing New York • Boston • Menlo Park • London • Hong Kong • Santiago • Luxembourg www.lexingtonpartners.com Includes information regarding six funds managed by Lexington’s predecessor formed during the period 1990 to 1995. This information is provided for informational purposes only and is not an offer to sell or solicitation of offers to purchase any security. Private Equity Analyst November 2020 contents Volume XXX, Issue 11 Fund News u The Roundup Comment Clayton Dubilier Collects About $14B for Latest Buyout Fund 26 H.I.G. -

View, a Private Real Estate Investment Manager Focused Primarily on Private Real Estate Debt Strategies

FOCUS Ranan Z. Well Corporate & Securities Mergers & Acquisitions Chair, Investment Management M&A Private Equity Co-Chair, Private Equity Investment Management Mergers & Acquisitions Washington, DC Insurance Transactional & Regulatory 202.419.8404 Solutions Financial Services [email protected] Investment Management Private Investment Funds Institutional Investors Health Law Ranan Well represents public and private companies, private equity firms and Special Situations other financial services firms and investors in a broad range of corporate and BAR ADMISSIONS transactional matters, including mergers and acquisitions, joint ventures and strategic transactions, equity investments and restructurings. District of Columbia Maryland As chair of Stradley Ronon’s Investment Management Mergers & Acquisitions Practice, Ranan works within the firm’s premier Investment Management EDUCATION Group in representing asset management, wealth management, private equity J.D., Boston University School of Law and other financial services firms and investors in purchases and sales of B.A., Yeshiva University registered investment advisers, mutual fund adoptions and mergers of registered investment companies, joint ventures and strategic transactions, and equity investments. In addition, Ranan advises institutional investors in their investments into hedge funds and private equity funds, including the negotiation and execution of side letter agreements, and has successfully negotiated more than 45 investments, totaling in excess of $3.9 billion. He further counsels sponsors in connection with the structuring and formation of private investment funds. Ranan earned a certificate in FinTech from Harvard’s Office of the Vice Provost for Advances in Learning (VPAL), and previously served as a member of the Law360 Mergers & Acquisitions Editorial Advisory Board. RESULTS Ranan’s experience includes the representation of:* Investment Management . -

Proxy Statement to a Term of Three Years Each, Or Until Their Successors Have Been Elected and Qualified; and 2

MESSAGE FROM OUR CHAIRMAN AND OUR CEO Dear Stockholders: We are pleased to invite you to join us for the 2020 significant experience in the life sciences industry, Annual Meeting of Stockholders of NextCure, Inc., to serve as Class I directors for three-year terms our first as a public company, to be held on ending in 2023. Beginning on page 6, you will find Thursday, June 11, at 10 a.m. Eastern Time, detailed information about the qualifications of virtually over the internet at both our director nominees and our continuing www.virtualshareholdermeeting.com/NXTC2020, directors, who we believe are a strong group to during which time you will be able to vote your represent your interests. Our Board of Directors is shares electronically and submit questions. committed to governance practices that are appropriately tailored to our business and to 2019 was a transformative one for our company. guiding NextCure to deliver on our commitment to We reported positive initial clinical data from the discovering and developing novel, first-in-class Phase 1 portion of our Phase 1/2 clinical trial of our immunomedicines to treat cancer and other lead product candidate, NC318, and initiated the immune-related diseases by restoring normal Phase 2 portion of that trial. We successfully immune function. completed our initial public offering and a follow-on offering, raising an aggregate of We extend our gratitude to Tim Shannon, who left $258.5 million. In addition, in connection with our the Board of Directors in March after more than initial public offering, we adopted a four years of service, for his invaluable comprehensive suite of public company contributions to our early growth and direction.