PPP Wealth Machine

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Item C1 SW/09/894 – Installation of a Small Scale Biomass Power Plant

SECTION C MINERALS AND WASTE DISPOSAL Background Documents - the deposited documents, views and representations received as referred to in the reports and included in the development proposals dossier for each case and also as might be additionally indicated. Item C1 SW/09/894 – Installation of a small scale biomass power plant within an existing and extended building for the generation of renewable energy from low grade waste wood at Ridham Dock Road, Iwade, Sittingbourne, Kent A report by Head of Planning Applications Group to Planning Applications Committee on 11 May 2010. SW/09/894 – Installation of a small scale biomass power plant within an existing and extended building for the generation of renewable energy from low grade waste wood at Ridham Dock Road, Iwade, Sittingbourne, Kent ME9 8SR (MR. 921 674) Recommendation: Permission BE GRANTED subject to conditions. Local Member: Mr A Willicombe Classification: Unrestricted Background 1. Planning permission was granted in 2006, for a material recovery facility (MRF), in-vessel composting facility and the continuation of secondary aggregate recycling operations at the Countrystyle Recycling site, Ridham Dock, under planning consent reference SW/05/1392. Under its current consent the site is permitted to handle some 31,000 tonnes of compostable waste and 35,000 tonnes per year of recyclable waste through the MRF. Whilst the permission also allows for the continuation of 10,000 tonnes per annum of secondary aggregate recycling, this activity appears to have all but ceased and replaced with shredding of low grade wood waste. Site Description and Proposal 2. The site itself lies some 2km north of Kemsley, 2.1 km to the east of Iwade and 1.2km to the east of the A249. -

HICL Infrastructure PLC Annual Report 2020 Delivering Real Value

HICL Infrastructure PLC Annual Report 2020 Delivering Real Value. Bangor and Nendrum Schools, UK Contents 2020 Highlights 2 Overview 01 1.1 Chairman’s Statement 6 Strategic Report 02 2.1 The Infrastructure Market 12 2.2 Investment Proposition 17 2.3 HICL’s Business Model & Strategy 18 2.4 Key Performance & Quality Indicators 20 2.5 Investment Manager’s Report 22 Strategic Report: Performance & Risk 03 3.1 Operating Review 30 3.2 Sustainability Report 34 3.3 Financial Review 50 3.4 Valuation of the Portfolio 55 3.5 The Investment Portfolio 68 3.6 Portfolio Analysis 70 3.7 Risk & Risk Management 72 3.8 Viability Statement 84 3.9 Risk Committee Report 85 3.10 Strategic Report Disclosures 89 Directors’ Report 04 4.1 Board and Governance 94 4.2 Board of Directors 96 4.3 The Investment Manager 98 4.4 Corporate Governance Statement 99 4.5 Audit Committee Report 113 4.6 Directors’ Remuneration Report 118 4.7 Report of the Directors 122 4.8 Statement of Directors’ Responsibilities 126 Financial Statements 05 5.1 Independent Auditor’s Report 130 5.2 Financial Statements 136 5.3 Notes to the Financial Statements 140 Glossary 180 Directors & Advisers 182 Front cover image: Salford Hospital, UK HICL Infrastructure Company Limited (or “HICL Guernsey”) announced on 21 November 2018 that, following consultation with investors, the Board was of the view that it would be in the best interests of shareholders as a whole to move the domicile of the investment business from Guernsey to the United Kingdom. -

NRMA 2020-21 NSW Budget Submission

NRMA NSW Budget Submission 2020–21 2 Table of Contents Centenary of the NRMA ........................................................................................................ 3 Priorities for the NRMA ......................................................................................................... 4 Regions .............................................................................................................................. 4 Mobility ............................................................................................................................... 4 Technology......................................................................................................................... 4 Sustainability ...................................................................................................................... 4 Key Recommendations ......................................................................................................... 5 Infrastructure & Services .................................................................................................. 6 Metropolitan........................................................................................................................... 7 Roads ................................................................................................................................. 7 Transport ............................................................................................................................ 8 Regional ................................................................................................................................ -

South East Sydney Transport Strategy

Contents 1 EXECUTIVE SUMMARY 2 1.1 Vision and objectives 4 1.2 The problem 6 1.3 The response 7 1.4 Next steps 8 2 INTRODUCTION 10 2.1 What is the plan? 10 2.2 Strategic land use and transport plans 11 2.2.1 Why South East Sydney now? 12 2.3 Working with our stakeholders 15 3 SOUTH EAST SYDNEY 2026: THE CHALLENGE 16 3.1 Overview 17 3.2 Why not business as usual? 17 3.3 Problem statement 19 4 A VISION FOR SOUTH EAST SYDNEY 2056 23 4.1 Developing a vision for South East Sydney 23 4.2 Vision 23 4.3 Objectives and indicators 24 4.3.1 Why the South East Sydney Transport Strategy approach will work 26 4.4 Integrated land use and transport scenarios 27 4.4.1 Reference Case 27 4.4.2 Compact City 28 4.4.3 Economic 29 4.4.4 Mass Transit Corridors 30 4.4.5 Mass Transit Nodes 31 4.4.6 Dispersed 32 4.5 Development of the preferred scenario 33 5 PREFERRED LAND USE AND TRANSPORT FUTURE 34 5.1 Preferred scenario 35 5.1.1 Proposed land use changes 35 5.1.2 Policy change 38 5.1.3 Freight network improvement 43 5.1.4 Place development 45 5.1.5 Principal Bicycle Network 47 5.1.6 Randwick 49 5.1.7 Green Square – Waterloo Precinct 51 5.1.8 Sydney Airport and Port Botany Precinct 53 5.2 Co-dependency of catalytic transport investment and major redevelopment and uplift 55 5.3 The delivery 55 5.3.1 The cost 55 5.3.2 The benefits and trade-offs 57 5.3.3 Innovation and Technology 58 5.3.4 How will we measure success? 58 5.3.5 Next steps 59 List of figures Figure 1 – Study Area 3 Figure 2 – Preferred scenario and major initiatives listed in proposed priority for -

Tackling High Risk Regional Roads Safer Roads Fund Full

Mobility • Safety • Economy • Environment Tackling High-Risk Regional Roads Safer Roads Fund 2017/2018 FO UND Dr Suzy Charman Road Safety Foundation October 2018 AT ION The Royal Automobile Club Foundation for Motoring Ltd is a transport policy and research organisation which explores the economic, mobility, safety and environmental issues relating to roads and their users. The Foundation publishes independent and authoritative research with which it promotes informed debate and advocates policy in the interest of the responsible motorist. RAC Foundation 89–91 Pall Mall London SW1Y 5HS Tel no: 020 7747 3445 www.racfoundation.org Registered Charity No. 1002705 October 2018 © Copyright Royal Automobile Club Foundation for Motoring Ltd Mobility • Safety • Economy • Environment Tackling High-Risk Regional Roads Safer Roads Fund 2017/2018 FO UND Dr Suzy Charman Road Safety Foundation October 2018 AT ION About the Road Safety Foundation The Road Safety Foundation is a UK charity advocating road casualty reduction through simultaneous action on all three components of the safe road system: roads, vehicles and behaviour. The charity has enabled work across each of these components and has published several reports which have provided the basis of new legislation, government policy or practice. For the last decade, the charity has focused on developing the Safe Systems approach, and in particular leading the establishment of the European Road Assessment Programme (EuroRAP) in the UK and, through EuroRAP, the global UK-based charity International Road Assessment Programme (iRAP). Since the inception of EuroRAP in 1999, the Foundation has been the UK member responsible for managing the programme in the UK (and, more recently, Ireland), ensuring that these countries provide a global model of what can be achieved. -

A26 Cycle Route Business Case

Transport Business Case Report A26 Cycle Route, Tunbridge Wells CO04300618/002 Revision 02 July 2017 Document Control Sheet Project Name: A26 Cycle Route, Tunbridge Wells Project Number: CO04300618 Report Title: Transport Business Case Report Report Number: 002 Issue Prepared Reviewed Approved Status/Amendment 00 (Draft for Name: Various County & Name: Comment) Paul Beecham Borough Council Jeff Webb officers Signature: Signature: Date: 14/06/2017 Date: 19/06/2017 01 (Issue for Gate 1 Name: Various County & Name: submission to SELEP) Paul Beecham Borough Council Jeff Webb officers Signature: Signature: Signature: Date: 22/06/2017 Date: Date: 22/06/2017 02 (Issue for Gate 2 Name: Various County & Name: submission to SELEP) Paul Beecham Borough Council Steve Whittaker officers Signature: Signature: Signature: Date: 22/07/2017 Date: 24/07/17 Date: 25/07/17 Name: Name: Name: Signature: Signature: Signature: Date: Date: Date: Project Name A26 Cycle Route, Tunbridge Wells Document Title Transport Business Case Report Contents 1 Introduction ....................................................................................................... 4 1.1 SELEP Schemes – Business Case Preparation ....................................................... 4 1.2 Purpose of Report ............................................................................................. 4 1.3 Specific Scheme ................................................................................................ 4 2 Scheme Summary ............................................................................................. -

M6 Stage 1 Design and Construction Deed

M6 Stage 1 D&C Deed M6 Stage 1 Design and Construction Deed Transport for NSW (ABN 18 804 239 602) and CPB Contractors Pty Limited (ABN 98 000 893 667) Ghella Pty Ltd (ABN 85 142 392 461) UGL Engineering Pty Limited (ABN 96 096 365 972) Confidential Sensitive: NSW Government M6 Stage 1 D&C Deed CONTENTS CLAUSE PAGE 1. Definitions and Interpretation ................................................................................. 14 1.1 Definitions .............................................................................................. 14 1.2 Interpretation .......................................................................................... 62 1.3 Contra proferentem ................................................................................. 65 1.4 Business Day .......................................................................................... 65 1.5 Certification ............................................................................................ 65 1.6 Ambiguous terms..................................................................................... 65 1.7 Order of precedence ................................................................................. 66 1.8 Severability ............................................................................................. 66 1.9 Electronic file .......................................................................................... 67 2. D&C Documents ................................................................................................... 67 -

(Public Pack)Agenda Document for Planning Committee, 04/03/2021

Public Document Pack AGENDA PLANNING COMMITTEE MEETING Date: Thursday, 4 March 2021 Time: 7.00 pm Venue: Virtual Meeting Via Skype* Membership: Councillors Cameron Beart, Monique Bonney, Roger Clark, Simon Clark, Richard Darby, Mike Dendor, Tim Gibson (Chairman), James Hall, James Hunt, Carole Jackson, Elliott Jayes (Vice-Chairman), Peter Marchington, Ben J Martin, David Simmons, Paul Stephen, Tim Valentine and Tony Winckless. Quorum = 6 RECORDING NOTICE Please note: this meeting may be recorded and the recording may be published on the Council’s website. At the start of the meeting the Chairman will confirm if all or part of the meeting is being audio recorded. The whole of the meeting will be recorded, except where there are confidential or exempt items. You should be aware that the Council is a Data Controller under the Data Protection Act. Data collected during this recording will be retained in accordance with the Council’s data retention policy. Therefore by attending the meeting and speaking at Committee you are consenting to being recorded and to the possible use of those sound records for training purposes. If you have any queries regarding this please contact Democratic Services. Pages Information for the Public *Members of the press and public can listen to this meeting live. Details of how to join the meeting will be added to the website after 4pm on Wednesday 3 March 2021. Privacy Statement Swale Borough Council (SBC) is committed to protecting the privacy and security of your personal information. As data controller we ensure that processing is carried out in accordance with the Data Protection Act 2018 and the General Data Protection Regulations. -

Private Wealth Machine ESSU Research Report No 6

European Services Strategy Unit Research Report No. 6 PPP Wealth Machine __________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________ UK and Global trends in trading project ownership Dexter Whitfield Financialisation of public infrastructure Market values imposed on public assets Growth of offshore infrastructure funds Secondary market trading UK and Global PPP equity databases PPP Wealth Machine: UK and Global trends in trading project ownership European Services Strategy Unit PPP Equity Database The database can be accessed and downloaded at http://www.european-services-strategy.org.uk/ppp-database/ppp-equity-database/ December 2012 Amended January 2014: Table 4: Annual rate and value of UK PPP equity transactions (1998-2012) Many thanks to Stewart Smyth, Lecturer, Queens University Management Schools, Belfast for advice and comments on the draft and to Jo Chadwick for design of the ESSU database. Dexter Whitfield, Director Adjunct Associate Professor, Australian Workplace Innovation and Social Research Centre, University of Adelaide Mobile +44 (0)777 6370884 Tel. +353 (0)66 7130225 Email: [email protected] Web: www.european-services-strategy.org.uk The European Services Strategy Unit is committed to social justice, through -

The Impact of Road Projects in England

The Impact of Road Projects in England The Impact of Road Projects in England Lynn Sloman, Lisa Hopkinson and Ian Taylor Transport for Quality of Life March 2017 Commissioned by: Project name: The Impact of Road Projects in England Client: Campaign to Protect Rural England (CPRE) Date: March 2017 The preferred citation of this report is: Sloman L, Hopkinson L and Taylor I (2017) The Impact of Road Projects in England Report for CPRE Licensed under a Creative Commons Attribution 4.0 International Licence Acknowledgments The following people provided information and help during the course of this project, which we gratefully acknowledge: James Abbott, Michele Allen, Sarah Arnold, Andy Bennett, Kerris Casey-St Pierre, Jackie Copley, Amy Cowburn, Steve Donagain, Tony Duckworth, Robin Field, Peter Foreman, Alan Gray, Chantelle Grundy, David Harby, Tony Forward, Jeffery Kenyon, Bettina Lange, Ian Lings, No M65 Link Road Protest Group, David Penney, Martin Porter, Oliver Scott, Stuart Scott, Ralph Smyth, Jack Taylor, James Syson, Trinley Walker, Petra Ward, Paula Whitney, Louise Wootton, Hadyn Yeo. It would not have been possible to make this assessment of the impact of roads projects without the POPE evaluation process that was put in place by the Highways Agency twenty years ago. Although our assessment of the evidence has drawn some markedly different conclusions from those reached in the POPE meta-analyses, we acknowledge the value and importance of the POPE process itself. We also acknowledge and are grateful for the willingness of Highways England to assist with this research, by supplying data and information from their archives. We also thank Tony Forward for access to his archive of planning documents. -

Public-Private Partnerships Best Practices Summary

ADDENDUM - Public-Private Partnerships Best Practices Summary The United States Congress has passed legislation encouraging states to pursue public- private partnerships (PPPs) to meet their transportation needs. Specifically, congress has authorized a program allowing states to issue up to $15 billion in tax-exempt debt, for use in combination with private equity. This program offers an efficient finance plan for user fee-supported highway infrastructure. So far however, California has not passed the necessary State legislation to qualify for these funds. Until recently, most US transportation agencies (and their advisors) generally favored issuing tax-exempt debt to the exclusion of private equity. However, increasing market evidence suggests that private equity captures the “growth wedge” in future project revenues more effectively than tax-exempt markets. Thus, private equity offers agencies greater leverage on limited tax revenues in capital finance plans. California was once at the forefront of public-private partnership use in transportation. Led by the Orange County Transportation Corridor Agencies, California pioneered the successful development and implementation of these tools. Other states quickly realized the value of such partnerships, however, and today have moved ahead of California in identifying projects and preparing and submitting applications. This is a critical time for California. If our leadership commits to a long-term PPP program, it could attract billions of dollars in private investment for new construction. The following is a look at what vital tools are needed for California to “re-launch” PPPs, criteria that businesses look for in PPPs, and examples of best practices from successful PPPs around the nation and the world. -

Alternatives to Non-Compete Clauses in Toll Development Agreements

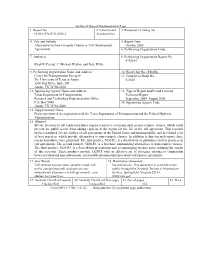

Technical Report Documentation Page 1. Report No. 2. Government 3. Recipient’s Catalog No. FHWA/TX-07/0-5020-1 Accession No. 4. Title and Subtitle 5. Report Date Alternatives to Non-Compete Clauses in Toll Development October 2005 Agreements 6. Performing Organization Code 7. Author(s) 8. Performing Organization Report No. 0-5020-1 Khali R. Persad, C. Michael Walton, and Julie Wilke 9. Performing Organization Name and Address 10. Work Unit No. (TRAIS) Center for Transportation Research 11. Contract or Grant No. The University of Texas at Austin 0-5020 3208 Red River, Suite 200 Austin, TX 78705-2650 12. Sponsoring Agency Name and Address 13. Type of Report and Period Covered Texas Department of Transportation Technical Report Research and Technology Implementation Office September 2004–August 2005 P.O. Box 5080 14. Sponsoring Agency Code Austin, TX 78763-5080 15. Supplementary Notes Project performed in cooperation with the Texas Department of Transportation and the Federal Highway Administration. 16. Abstract Private investors in toll roads sometimes request restrictive covenants such as non-compete clauses, which could prevent the public sector from adding capacity in the region for the life of the toll agreement. This research project examined 20 case studies of toll agreements in the United States and internationally, and developed a set of best practices, which provide alternatives to non-compete clauses. In addition to this research report, three research products were generated. The first product, 5020-P1, is a detailed set of guidelines on best practices in toll agreements. The second product, 5020-P2, is a brochure summarizing alternatives to non-compete clauses.