Kindred Group Plc Year End Report January – December 2019 (Unaudited)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kindred Group Plc – Interim Report

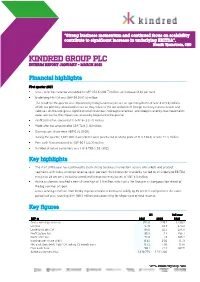

“Strong business momentum and continued focus on scalability contribute to significant increase in underlying EBITDA”. Henrik Tjarnstrom, CEO KINDRED GROUP PLC INTERIM REPORT JANUARY - MARCH 2021 Financial highlights First quarter 2021 Gross winnings revenue amounted to GBP 352.6 (249.7) million, an increase of 41 per cent. Underlying EBITDA was GBP 98.0 (42.5) million. The result for the quarter was impacted by foreign currency losses on operating items of GBP 8.0 (1.8) million which are primarily unrealised losses as they relate to the retranslation of foreign currency current assets and liabilities. As the Group has significant cash balances in foreign currencies, and foreign currency rate movements were substantial, the impact was unusually large during the quarter. Profit before tax amounted to GBP 85.3 (2.4) million. Profit after tax amounted to GBP 72.6 (1.0) million. Earnings per share were GBP 0.32 (0.00). During the quarter, 1,032,500 shares/SDRs were purchased at a total price of SEK 146.0, or GBP 12.4, million. Free cash flow amounted to GBP 90.1 (22.3) million. Number of active customers was 1,818,759 (1,531,302). Key highlights The start of the year has continued to show strong business momentum across all markets and product segments with Gross winnings revenue up 41 per cent. Strict focus on scalability has led to an underlying EBITDA margin of 28 per cent, including unrealised foreign currency losses of GBP 8.0 million. Active customers reached a new all-time high of 1.8 million, which puts the Group in a strong position ahead of the big summer of sport. -

Kindred Goes Online in Pennsylvania

Kindred Group Press Release Malta, 15 November 2019 Kindred goes online in Pennsylvania Only a few weeks after launching the Unibet Sportsbook at Mohegan Sun Pocono, Kindred Group goes live with both online sports and casino in Pennsylvania. As of today, Unibet customers in Pennsylvania will be able to experience a full range of first-class sportsbook and casino products in a safe and secure environment. Kindred Group (previously Unibet Group) takes its next significant step in the US market with the launch of both online sports and casino in Pennsylvania. The announcement is in line with the Group’s strategy to establish a presence in what will most likely become the largest gambling market in the world. Kindred continues to adopt a local focus and global expertise wherever it operates, ensuring that customers can enjoy Unibet’s full range of first-class sportsbook and casino products in a familiar, safe and secure environment. “After a successful launch of our betting lounge, Unibet Sportsbook at Mohegan Sun Pocono, we are thrilled to take the partnership with Mohegan Sun online and bring the Pennsylvanian guests a state-of-the-art online gambling experience, including the best online casino games and an impressive online sportsbook”, says Manuel Stan, SVP Kindred US. “We’re thrilled to introduce to our customers an opportunity to place bets and game online within the state borders,” said Aviram Alroy, Vice President of Interactive Gaming at Mohegan Gaming & Entertainment. “Our sportsbook lounge is a highly engaging and joyful experience on-premises and Kindred Group are able to extend that experience online through our strategic partnership.” This is Kindred’s second state in the US, after launching online casino and sportsbook earlier this year in New Jersey in partnership with Hard Rock Hotel & Casino Atlantic City. -

Kindred Group Press Release

Kindred Group Press Release Malta, 6 November 2019 Kindred - winner of Sweden´s Best Looking Office Kindred Group is the proud winner of ‘Sweden´s Best Looking Office’. The competition puts the spotlight on companies that have successfully combined aesthetic and compelling environments with a smart and flexible working space adapted to fit the organisations specific needs. Kindred Group moved into its award-winning, purpose-built facility in April this year. Kindred Group (former Unibet Group) is the proud winner of Sweden´s Best Looking Office. A competition arranged annually by Fastighetssverige and Lokalnytt.se. Kindred moved into their new office at Urban Escape in central Stockholm in April after a close cooperation with the architect bureau Studio Stockholm. The process of designing a first-class international tech hub started with a survey completed by Kindred employees to get an understanding of the needs and wishes of employees. From these responses a sustainable and flexible working environment that symbolises Kindred´s culture, values and technological business, was formed. The facilities also mirror the diversity of Kindred's employees, who come from 48 different nations. “Kindred is a growing business are therefore in need of a flexible and modern office that can accommodate our future needs. Sustainability is an important component for Kindred, and this is reflected in how we chose to design our workspace. I believe that this is something that we - in cooperation with Studio Stockholm – can be very proud of”, says Kajsa Ericsson, Head of Facilities Management at Kindred Group. “Studio Stockholm has for several years worked with a line of gambling- and tech companies which gives us an understanding of the sector and suggestions on different type of solutions that can create value over time. -

Kindred Group Plc Players First

Kindred Group plc plc Kindred Group Annual Report and Accounts 2018 The Kindred Brain: The insight to put players first. Kindred Group plc Annual Report and Accounts 2018 Utilising data: The Kindred Brain The core of our operations is our unique insight and data we collect and analyse. We call this insight the Kindred Brain, and it informs everything we do. Contents Strategic report Governance Financial statements 1 Highlights 33 Introduction to governance 53 Independent auditors’ report 2 At a glance 34 Board of Directors 59 Consolidated income statement 4 Chief Executive Officer’s review 36 Executive Committee 59 Consolidated statement 6 Revenue model 38 Corporate governance statement of comprehensive income 8 Business model 41 Audit Committee report 60 Consolidated balance sheet 10 Analysing data to fuel the Kindred Brain 42 Nomination Committee Report 61 Consolidated statement of changes 12 Exploring markets and licences 43 General legal environment in equity 14 A uniquely focused brand portfolio 46 Shares and share capital 62 Consolidated cash flow statement 16 Creating a strong and scalable model 49 Remuneration Committee report 63 Notes to the consolidated 18 Key performance indicators 51 Directors’ report financial statements 20 Sustainability 26 Risk management Other information 28 Principal risks and uncertainties 88 Annual General Meeting 30 Financial review IBC Definitions This document is the English original. In the event of any discrepancy between the original English document and the Swedish translation, the English original shall prevail. Highlights report Strategic Kindred is one of the largest online gambling operators in the European market with over 24 million registered customers worldwide. -

Kindred Group Press Release Kindred Group Strengthens Its Efforts In

Kindred Group Press Release Malta, 13 February 2018 Kindred Group strengthens its efforts in protecting sports betting integrity in the United Kingdom by joining the Sports Betting Intelligence Forum and also signing a Memorandum of Understanding (MoU) with the Rugby Football Union (RFU). The Sports Betting Integrity Forum works to develop Britain's approach to protecting sports and sports betting being corrupted. It brings together representatives from sports governing bodies, betting operators, sport and betting trade associations, law enforcement and gambling regulation. Kindred Group (previously Unibet Group) actively seeks to cooperate with national platforms where possible and is delighted to join this Forum. Kindred has also signed a Memorandum of Understanding with the RFU of England. Under this agreement, RFU and Kindred will cooperate in keeping English rugby free of betting- related match-fixing. The agreement enables Kindred to pro-actively report suspicious betting patterns directly to RFU. Furthermore, Kindred and RFU, together with other key stakeholders in the fight against match-fixing, will collaborate on prevention and educational projects. The RFU is the national governing body for grassroots and elite rugby in England, with 2,000 autonomous rugby clubs in its membership. The RFU works to protect the integrity of the game by ensuring that all matches are contested on a level playing field and are won on merit. Eric Konings, Sports Betting Integrity Officer at Kindred Group, says: “Cooperation is key in the battle against betting-related match-fixing, and we actively seek engagement with all parties, especially law enforcement, involved to keep sports clean of these criminal influences. -

Kindred Group Plc Annual Report and Accounts 2020

Kindred Group plc Kindred Group plc Level 6, The Centre Tigne Point, Sliema TPO 0001, Malta. Tel: +356 2133 3532 Company No: C39017. Registered in Malta. Annual Report and Accounts 2020 Registered office c/o Camilleri Preziosi, Level 2, Valletta Buildings Kindred Group plc South Street, Valletta VLT 1103, Malta. Annual Report and www.kindredgroup.com Accounts 2020 Delivering value through our data-driven approach. 23090_Kindred_AR20_COVER_210318.indd 1-3 18/03/2021 12:23 Data and relationships – our keys to success Kindred prides itself on being a trusted source of entertainment to nearly 30 million customers worldwide and on contributing positively to society. Our success is built on offering a truly personal, seamless and sustainable experience to our players and the long-term relationships that flow from this approach. We use data to adapt to market changes; develop new and engaging products; and launch in new territories. Compliance and sustainability have always been core strategic enablers for us, while through operational efficiency and platform excellence, we achieve greater scalability. Strategic report Governance 01 Highlights 33 Introduction to governance 02 Kindred at a glance 34 Board of Directors 04 Chairman’s statement 36 Executive Committee 05'LMIJ)\IGYXMZI3ƾGIVƅWVIZMI[ 38 Corporate governance statement 07 Business model 41 Audit Committee report 09 Revenue model 42 Nomination Committee report 10 Customer-centred 43 General legal environment 12 Insights-led 467LEVIWERHWLEVIGETMXEP 14 Growing market 49 Remuneration Committee -

Kindred Group Press Release Kindred Group Has Signed an Agreement to Acquire the Remaining Outstanding Shares in Relax Gaming, A

Kindred Group Press Release Malta, 2 July 2021 Kindred Group has signed an agreement to acquire the remaining outstanding shares in Relax Gaming, a leading and rapidly growing B2B iGaming supplier, at an implied valuation of up to EUR 320 million for 100 per cent of the shares on a cash free and debt free basis. Kindred has been invested in Relax Gaming since 2013 and the transaction will allow Kindred to acquire the remaining 66.6 per cent of the outstanding shares. The acquisition accelerates Kindred’s strategy to increase its focus on product and customer experience by strengthening Kindred’s product control and product differentiation capabilities. Kindred Group plc (Kindred) has signed an agreement to acquire the remaining 66.6 per cent of the outstanding shares in Relax Gaming. The transaction values the company at up to EUR 320 million on a cash and debt free basis (Enterprise value) and a total value of the outstanding shares of approximately EUR 295 million (Equity value). Kindred will pay an initial consideration, settled in cash upon completion, of approximately EUR 80 million (on a cash and debt free basis). In addition to the initial consideration, the maximum earn-out payments amount to EUR 113 million and may become payable in 2022 and 2023, subject to Relax Gaming achieving certain earnings thresholds. The transaction will be financed through Kindred’s existing cash and credit facilities. Relax Gaming is a market leading B2B iGaming software supplier that designs and develops online casino games, supported by an open distribution platform for third party aggregation as well as proprietary poker and bingo products. -

Unibet First UK Operator to Integrate Blocking Software Into Self-Exclusion Process

Kindred Group Press Release Malta, 10 June 2019 Unibet first UK operator to integrate blocking software into self-exclusion process Unibet, part of Kindred Group, is working with the software company Gamban, to become the first UK bookmaker to integrate blocking software into the self-exclusion process. The extended collaboration means an innovative approach to further help people who self- exclude on their Unibet website. Kindred Group have pioneered responsible gambling procedures including their detection system PS-EDS and was the first operator to offer free blocking gambling software licenses to its customers. Kindred have always advocated blocking software and are now extending their relationship with Gamban in an innovative approach to further help people who self- exclude on their Unibet website. Kindred will be the first to offer Gamban’s blocking software for an exclusion period which mirrors the self-exclusion length on-site. This will be a new addition to the current one-year offer that Gamban currently provides. All customers will have unlimited access to Gamban free of charge courtesy of Kindred. “Responsible gambling is at the top of the agenda at Kindred and we are proud to be the first UK operator to fully integrate Gamban’s product within our self-exclusion process for the Unibet brand. We are strong advocates for education around responsible gambling and ensuring all of our customers are able to make an informed choice. All of our customers should have the tools and support they need to enjoy our products responsibly and by offering this service for free to all of our customers we are certainly taking a step in the right direction. -

Kindred Receives Sanction Fee from the Swedish Gambling Authority

Kindred Group Press Release Malta den 18 mars 2020 Kindred receives sanction fee from the Swedish Gambling Authority Kindred Group has received a warning and sanction fee in the sum of SEK 100 million from the Swedish Gambling Authority for offering incentives in a way that is non-compliant with the new Swedish Gambling Act. Spooniker Ltd, a wholly owned subsidiary of Kindred Group (previously Unibet Group) has today received a warning and a sanction fee in the sum of SEK 100 million by the Swedish Gambling Authority (SGA) for offering customers financial incentives which are in breach of the new gambling legislation. In its decision the SGA held that some of Spooniker’s offers, competitions and promotions are to be considered as financial incentives and therefore as bonuses. To offer these was according to the SGA contrary to the new gambling legislation. Kindred initially made a different interpretation of what is considered a bonus and it is this interpretation which the SGA has disputed. During the spring in 2019, Kindred adopted a more restrictive interpretation of the law. Kindred will appeal the SGA’s decision to obtain judicial guidance on how the new legislation should be interpreted. Until recently issued warnings and fines issued to other licence holders are tried in court and enforced, Kindred will continue to adopt a strict interpretation. Kindred is of the opinion that the Swedish Gambling Act adopted on 1 January 2019 has been vague in areas related to commercial activities and thereby creating unnecessary ambiguity. Kindred welcomes more clarity in these areas and continues to improve its operations to ensure full compliance. -

AV SPELARE, FÖR SPELARE VÄNLIGHET, PASSION, Kunskap UNIBET FÖRNYAR ONLINESPELEN

Unibet Group plc Unibet Group plc Årsredovisning och bokslut 2013 Årsredovisning och bokslut Årsredovisning och AV SPELARE, 2013 FÖR SPELARE VÄNLIGHET, PASSION, KUnskap UNIBET FÖRNYAR ONLINESPELEN... Detta dokument utgör en översättning av det engelska originalet. I händelse av avvikelser mellan den svenska översättningen och det engelskspråkiga originaldokumentet har det engelskspråkiga originaldokumentet företräde. AV SPELARE, FÖR SPELARE Unibet är en av Europas största och snabbast växande leverantörer av onlinespel. Bolaget grundades 1997 och har nu över 8,6 miljoner registrerade kunder i över 100 länder och mer än 16 års erfarenhet av den digitala ekonomin. Varumärket är byggt kring mottot “Av spelare, för spelare” och sätter kunden i fokus. Det står för lättidentifierbara produkter som i kombination med utmärkt kundservice skapar konkurrensfördelar. VI GER VÅRA KUNDER EN BÄTTRE UPPLEVELSE... GENOM LIVESPEL OCH LIVESTREAMING 52,3 miljoner GBP Spelöverskott från livespel Unibets snabbväxande varumärke erbjuder branschledande produkter med sportbok, casino och games, poker och bingo via datorer, surfplattor och mobiltelefoner och ger kunderna tillgång dygnet runt, alla dagar i veckan till sina favoritsporter och favoritspel oavsett var de befinner sig. Sportboken Sportboksprodukterna genererar nära 42 procent av vårt spelöverskott och driver vår tillväxt. Våra sportfantaster har lagt 122 miljoner spel (innan matcher och live) under 2013 – en ökning med 33 procent jämfört med föregående år (2012: 92 miljoner). Spelarna älskar spänningen i livespelen, som nu står för 46,5 procent av spelöverskottet från sportboken tack vare de över 80 000 liveevenemang och över 20 000 livestreamingevenemang som vi har erbjudit under året. Av dem streamades 10 000 på mobila enheter. Fotboll är huvudsporten. -

G3 June 2018

Sweden New dawn for the gaming industry After years working under a gambling monopoly, Sweden is opening up its online industry to private operators and the face of the gambling sector looks set to change. The country has been planning a re-regulation of by the Swedish Gaming Authority for any private the market for the last few years and finally in operations although these are few and far August 2018 the Swedish Gambling Authority between. began to accept licence applications for a new law which finally kicked into play in January In 2002 changes to the lottery act enabled 2019. This basically means new tax rates and Svenska Spel to embrace digital platforms with new licences for the online sector. Apart from instant scratchcards games and bingo online the increase in revenue the main objective of the whilst ATG could also offer its services online. In re-regulation is to create a safer market place. 2005 Svenska Spel was also given the right to introduce online poker. Historically, gambling in Sweden dates back to the third century AD whilst card games arrived in The monopoly situation has long been a bone of the 1400s and the first casino Ramlosa Brunn contention for private operators eager for a piece opened in the 18th century. By the mid 19th of the lucrative Swedish gambling pie. But their century casinos were banned and a revised view attempts to enter the market have been largely of the sector was implemented to bring gambling unsuccessful and they can still only operate slots under a governmental control so they were legal in restaurants which rakes in a share of around and regulated. -

Playing to Win

Unibet Group plc Annual Report and Accounts 2009 A NNU A l REPORT www.unibetgroupplc.com 2009 plAying to win Unibet Group plc Group Unibet by plAyers for plAyers Unibet Group plc PROFIT BEFORE tAX Fawwara Buildings Msida Road, Gzira GZR1402, Malta. Tel: +356 2133 3532 +161% Company No: C39017. PBT GBP 28.9m Registered in Malta. Registered office: c/o Camilleri Preziosi, Level 2, Valletta Buildings South Street, Valletta VLT11, Malta. Active customers pioneer in the moneytAinment® +25% industry 365,865 Active customers worldwide Unibet was founded in 1997. With over 4.1 million registered customers AnnuAl generAl meeting in more than 100 countries, the Group is one of Europe’s largest online gaming operators. Gaming products include pre-game sports betting, live betting, casino, poker, The Annual General Meeting (AGM) of Unibet Group plc will be held at 15.00 CET on Thursday 6 May 2010, at the Grand Hotel, Södra Blasieholmshamnen bingo and soft games. Customers can bet via websites in 27 languages, 8, Stockholm in Sweden. and increasingly via mobile phones and other mobile devices. Right to participate Unibet creates products and services intended for the global market, Holders of Swedish Depositary Receipts (SDRs) who wish to attend the AGM must be registered at Euroclear Sweden AB/VPC on Monday 26 April 2010 and customises them to suit local needs. This “glocal” approach – global and notify Skandinaviska Enskilda Banken AB (publ) of their intention to attend reach and mindset combined with local understanding – helps Unibet the AGM no later than 11.00 CET on Friday 30 April 2010, by filling in the enrolment form provided at www.unibetgroupplc.com/AGM, Notification to make all customers feel at home.