Israel Ltd. Annual Report for the Year Ended December 31, 2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Payments Insights. Opinions. Volume 24

#payments insights. opinions. Tap. Touch. Speak. Grab and Seven themes impacting the future of payments go. The way we make payments is changing faster than any Winners in the future payments ecosystem will be those that make the right decisions other area of financial services. today. Understanding these seven key themes reshaping payments will help leaders make those decisions and determine how best to differentiate themselves in this New technology and changing fast-changing landscape. customer expectations are shattering the status quo and ushering in a growing number Continued on page 3 of new players that are challenging the traditional role of banks. Volume 24 03 Seven themes impacting the future of payments Understanding the themes transforming payments can help banks make strategic investment decisions and emerge as winners. 07 Why real-time payments are the new normal — and how payments providers can adapt As RTP schemes expand, providers will need to assess readiness and define a clear strategy for platforms, operations, risk and customer experience. Editorial 10 How the mPOS business model expands This newsletter comes to you as many of us prepare to meet again at beyond payments acceptance Sibos – the world’s premier financial services event, held this year in London, 23 to 26 September 2019. EY is a proud sponsor of Sibos, and commends As pure payments acceptance becomes a their efforts to bring together the global financial services and payments commodity for smaller merchants and fees from transaction processing come under community. pressure, mPOS providers are putting a This year’s theme is an exciting one that touches on many of the issues we strategic focus on value-added services to are covering in this #payments issue: “Thriving in a hyperconnected world” continue their high growth. -

Interim Report-The Committee for Promoting Use of Advanced Means

Interim Report The Committee for Promoting November Use of Advanced Means of 2015 Payment in Israel Interim Report of the Committee for Promoting Use of Advanced Means of Payment in Israel Table of Contents 1. Introduction .................................................................................................................... 2 2. Executive summary ........................................................................................................ 3 3. Introduction .................................................................................................................... 6 4. Overview of advanced means of payment world-wide .................................................. 8 5. Overview of advanced means of payment in Israel ..................................................... 10 6. Advantages of using advanced means of payment ....................................................... 17 7. Alternatives for conducting transactions using advanced means of payment in the current payment systems .......................................................................................................... 19 8. Barriers to using advanced means of payment ............................................................. 23 9. Risk associated with use of advanced means of payment ............................................ 26 10. Legal aspects related to promoting use of advanced means of payment...................... 31 11. Summary and recommendations ................................................................................. -

The Credit Card Industry in Israel

The credit card industry in Israel David Gilo, Faculty of Law, Tel-Aviv University Yossi Spiegel, Faculty of Management, Tel Aviv University, September 2005 2 Major Israeli banks and their credit card companies Banks and market shares in 2004 1998 – 2000 2000 – 2005 in terms of deposits by the public Bank Hapoalim - 29.8% Isracard (100% owned): Isracard (100% owned): • Isracard (100%) • Isracard (100%) • Mastercard (100%) • Mastercard (≈ 100%) • American Express (100%) • American Express (100%) • Visa (N/A) Bank Leumi - 25.6% CAL (65% owned): Leumi Card (100% owned): • Visa (84%) • Visa Leumi (≈ 50%) • Mastercard (N/A) Israel Discount Bank - 17.6% CAL (35% owned) CAL (51% owned): • Visa (≈ 50%) • Mastercard (N/A) Bank Hamizrachi - 10.7% First Int'l Bank - 8.5% Alpha Card (67% owned): CAL (20% owned) • Visa (16%) 3 Credit cards and market shares in acquisition (most of the data is from 2001) Credit card Cards Number of cards Market share in company (in millions) acquiring Isracard Isracard 1.1 47% Mastercard 0.3 American Express 0.15 Visa N/A Cal Visa Cal 1.1 31.8% Mastercard N/A Diners card 0.16 Leumi Card Visa Leumi 1.2 15.3% (2004) Mastercard N/A Others 5.9% Total active cards 3.8 (2004) Number of active cards grew at an annual rate of 9.1% since 1982 (from 0.55 million) 4 Main features of Israeli credit cards !"Deferred debit cards; virtually no credit cards and no debit cards !"Credit cards are also ATM cards and in effect are tied with bank accounts (Bank Leumi's clients were unilaterally transferred from CAL). -

The Credit Card Industry in Israel

Preliminary and incomplete The credit card industry in Israel David Gilo* and Yossi Spiegel** September 2005 Abstract: Since 1998, the Israeli credit card industry was transformed from a duopoly with two credit card companies which offer proprietary cards to a triopoly with two large open systems, Visa and Mastercard, which are issued and acquired by each of the three credit card companies. Regulatory intervention by the Israeli Antitrust Authority (IAA) played a key role in bringing about this structural change. In this paper we first review the Israeli credit card industry and then discuss in detail the regulatory intervention by the IAA. * The Buchmann Faculty of Law, Tel-Aviv University, Ramat Aviv, Tel Aviv, 69978, Israel, email: [email protected]. ** Faculty of Management, Tel Aviv University, Ramat Aviv, Tel Aviv, 69978, Israel. Email: [email protected], http://www.tau.ac.il/~spiegel Both authors were economic experts for Supersol (the largest supermarket chain in Israel) in the Israeli credit card case. 1 1. A brief history of the credit card industry in Israel Until 1998, there were two main players in the Israeli credit cards industry: Isracard, which was established in 1975 and is 100% owned by the largest bank in Israel, Bank Hapoalim, and CAL which was established in 1978 and was jointly owned at the time by the second largest bank in Israel, Bank Leumi (65%), and the third largest bank, Israel Discount Bank (35%). Isracard issued its own brand of credit card, called Isracard, for domestic use in Israel, and Mastercard and American express card for use in Israel and abroad, while CAL issued both Visa cards, under the brand name Visa CAL, and Diners Club cards. -

CG Gateway Redirect (MPI) Hosted Payment Page

CG Gateway Redirect (MPI) Hosted Payment Page Implementation & Integration API Document Version: 2.3 Date: 21/06/2020 CreditGuard 2020 LTD © All rights reserved Page 1 of 50 CreditGuard Ltd. 18 Ben Gurion st., Givat Shmuel T: +972 3 7370700 F: +972 3 7370790 PREFACE .............................................................................................................................................................................. 4 1. OVERVIEW 4 2. RELATED DOCUMENTS 4 3. TERMS 4 4. GENERAL FLOW 4 5. PROCESS DIAGRAM 5 HOW TO SEND REQUESTS TO CG GATEWAY ? ...................................................................................................................... 6 1. OVERVIEW 6 2. HTTPS POST REQUEST INTERFACE 6 3. CG GATEWAY WEB SERVICE INTERFACE 7 SIMPLE CREDIT CARD TRANSACTION SETUP ........................................................................................................................ 9 1. OVERVIEW 9 2. TRANSACTION SETUP 9 3. HOSTED PAYMENT PAGE 15 4. TRANSACTION LANDING PAGES 17 5. USING DYNAMIC LANDING PAGE URLS 19 6. TRANSACTION VALIDATION 20 7. TRANSACTION QUERY 20 8. RESPONSE MAC VALIDATION 24 9. CREDIT CARD TOKENIZATION 25 26 ...................................................................................... (עסקת תשלומים) ADDING INSTALLMENTS TO THE PAYMENT PAGE 1. OVERVIEW 26 2. TRANSACTION SETUP 27 3. HOSTED PAYMENT PAGE 28 ADDING PAYPAL OPTION TO THE PAYMENT PAGE ............................................................................................................. 32 1. OVERVIEW 32 -

Assessing the Benefits of Instant Issuance

www.cardsinternational.com Issue 548 / october 2017 NEW CARD, NEW TRICK? ASSESSING THE BENEFITS OF INSTANT ISSUANCE COUNTRY SNAPSHOTS FEATURE ANALYSIS Key data and insight into The Uber Barclaycard co- Scotiabank claims a first card payments in Israel, branded credit card. Next with the launch of cashback Ireland and Turkey stop, world domination? on debit cards CI October 548.indd 1 16/10/2017 15:47:00 contents this month NEWS COVER STORY 05 / EDITOR’S LETTER INSTANT ISSUANCE, 06 / DIGEST • Elavon, Poynt to offer smart payment terminal in Canada THE NEW CARD TRICK • Wells Fargo adds NFC capability • Maybank teams with FC Barcelona • Mastercard opens Indian lab • Discover allows cashback redemption via Apple Pay • Evry signs five-year deal with Aktia • Commonwealth Bank to launch card with interest rate below 10% • Mastercard, Andhra Pradesh agree MoU • Mastercard, PayPal expand partnership • BNZ to add Apple Pay support • Bitflyer launches Visa prepaid card • Mobile to surpass credit cards by 2019: UN report 14 • CPP launches wallet-tracking card Editor: Douglas Blakey Group Editorial Director: Director of Events: Ray Giddings +44 (0)20 7406 6523 Ana Gyorkos +44 (0)20 3096 2585 [email protected] +44 (0)20 7406 6707 [email protected] [email protected] Senior Reporter: Patrick Head of Subscriptions: Brusnahan Sub-editor: Nick Midgley Alex Aubrey +44 (0)20 7406 6526 +44 (0)161 359 5829 +44 (0)20 3096 2603 [email protected] [email protected] [email protected] Junior Reporter: Briony Richter Publishing Assistant: Sales Executive: Jamie Baker +44 (0)20 7406 6701 Joe Pickard +44 203 096 2622 [email protected] +44 (0)20 7406 6592 [email protected] [email protected] Customer Services: +44 (0)20 3096 2603 or +44 (0)20 3096 2636, [email protected] Financial News Publishing, 2012. -

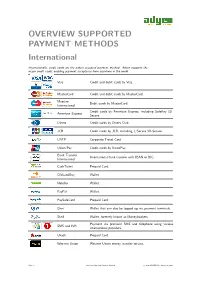

OVERVIEW SUPPORTED PAYMENT METHODS International

OVERVIEW SUPPORTED PAYMENT METHODS International Internationally, credit cards are the widest accepted payment method. Adyen supports the major credit cards, enabling payment acceptance from anywhere in the world. Visa Credit and debit cards by Visa. MasterCard Credit and debit cards by MasterCard. Maestro Debit cards by MasterCard. International Credit cards by American Express, including SafeKey 3D- American Express Secure. Diners Credit cards by Diners Club. JCB Credit cards by JCB, including J/Secure 3D-Secure. UATP Corporate Travel Card. Union Pay Credit cards by UnionPay. Bank Transfer International bank transfer with IBAN or BIC. International CashTicket Prepaid Card. ClickandBuy Wallet. Neteller Wallet. PayPal Wallet. PaySafeCard Prepaid Card. Qiwi Wallet that can also be topped up via payment terminals. Skrill Wallet, formerly known as Moneybookers. Payment via premium SMS and telephone using various SMS and IVR international providers. Ukash Prepaid Card. Western Union Western Union money transfer service. Page 1 Overview Supported Payment Methods c 2012 ADYEN BV - August 23, 2012 Europe Loyalty cards Support for various loyalty and store cards. Austria Bank Transfer Offline bank transfer. Sofortbanking Online banking supporting various local banks. Belgium Bank Transfer Offline bank transfer. BanContact / Mr. Debit card in Belgium. Cash Sofortbanking Online banking supporting various local banks. Denmark Primarily credit card and the local debit scheme. Bank Transfer Offline bank transfer. Dankort Local debit card scheme. Open Invoice Payments on credit by open invoice. Finland Primarily Credit Card. Besides this there is a very good market share for online banking. Bank Transfer Offline bank transfer. Ålandsbanken Online banking. Handelsbanken Online banking. Nordea Online banking. -

M2020 USA COMPANIES 22.6.21.Xlsx

$1 CUNA Strategic Services Kinecta Federal Credit Union RSA Security 14 West Curacao Money Transfer King Irving Consulting Group Russell Reynolds Associates 2nd Order Solutions Currency Cloud Kinnevik Capital Limited Safrapay 3Rivers Federal Credit Union Cvent KKR Capital Markets LLC Sageview Capital 4Front Credit Union Cvent HQ KnovaOne Salelytics 5Point Credit Union DadeSystems Kobie Marketing, Inc. SalesOptimize 7 Mile Advisors DailyPay, Inc KONA I Co., Ltd. Sanctum Insights LLC Abound Daimler Mobility Services GmbH KoreFusion International Sandy Spring Bank Accenture Dancu Partners, LLC KPMG Santander Commercial Banking Accutrend Data Corporation Dash Kunai Santander InnoVentures ACI Worldwide DataSeers Ladenburg Thalmann Financial Services Saola Ventures Acria UG (haftungsbeschränkt) DataX, LTD Launchpad Capital Sapphire Ventures Acuant Inc daVinci Payments Inc. Lazard Middle Market Schedulicity Adcel Mobile Card Inc. DC Bank LenderClose Schools First Federal Credit Union Adcel MobileCard Debt Advisor Lendio Scienaptic Systems Administrative Services, LLC, a Neustar Company Deduce, Inc LendIt Fintech Scotiabank adorsys GmbH & Co. KG Dell Boomi LendKey Seattle Bank adorsys Group Deloitte LendUp Securitize Inc AffiniPay Deloitte Uk Lenny Crotty SecurityMetrics Affinity Plus Demica Levvel - IT Consulting Firm Seek Capital Affinity Plus Federal Credit Union Demica Limited LexFin SEFCU Affinity Solutions Desert Financial Credit Union LexisNexis SegPay AIS Media, Inc Deserve LexisNexis Risk Solutions SEI Investments Aite Group Deutsche Bank LF Search Senacor Technologies AG AKBANK T.A.S. Deutsche Bank - London LGE Community Credit Union Sensibill Akoya LLC Deutsche Bank AG LGFCU Sensibill Inc. Alkami Technology Deutsche Bank Securities Liberis Serrala Group GmbH All My Papers Deutsche Bank Trust Co America Liberty Mutual Insurance ServiceNow, Inc Allegro.pl Sp. -

Aminit Ltd. Annual Report for the Year Ended December 31, 2008

Aminit Ltd. Annual Report For the year ended December 31, 2008 Report as of December 31, 2008 Table of Contents Page Board of Directors' Report 5 Description of the General Development of the Company's Business 7 Operational Data 8 Profit and Profitability 9 Developments in Balance-Sheet Items 12 Financial Information on the Company’s Operating Segments 14 Significant Accounting Policies 19 General Environment and the Effect of External Factors on the Company's Operations 20 Description of the Company's Business by Operating Segments 23 Intangible Assets 31 Service Providers 32 Other Matters 32 Financing 33 Taxation 33 Restrictions and Supervision of the Company's Operations 33 Legal Proceedings 37 Contingent Liabilities 37 Objectives and Business Strategy 37 Risk Management Policy 38 Prevention of Money Laundering and Terrorism Financing 42 Discussion of Risk Factors 43 Disclosure Regarding the Internal Auditor 47 Disclosure Regarding the Procedure for Approval of the Financial Statements 48 The Board of Directors 49 Senior Members of Management 56 Controls and Procedures 60 Wages and Benefits of Officers 63 Remuneration of Auditors 63 | 3 | Page Management's Review 64 CEO Certification 77 Chief Accountant Certification 79 Report of the Board of Directors and Board of Management on the Internal Control of Financial Reporting 81 Financial Statements 82 | 4 | Aminit Ltd. Board of Directors’ Report For the Year Ended December 31, 2008 Report as of December 31, 2008 Board of Directors’ Report on the Financial Statements as of December 31, 2008 At the meeting of the Board of Directors held on March 12, 2009, it was resolved to approve the audited financial statements of Aminit Ltd. -

Atm Hacking and Black Friday Leave Consumers and Merchants Exposed

www.cardsinternational.com Issue 561 / November 2018 UNINVITED GUESTS ATM HACKING AND BLACK FRIDAY LEAVE CONSUMERS AND MERCHANTS EXPOSED INSIGHT ANALYSIS COUNTRY SNAPSHOTS Emerging fintechs and Already a smartphone Market data and highlights traditional players are staple, can biometrics make for card payments in Peru, forming a new ecosystem a breakthrough to cards? Ukraine and Israel CI November 2018 561.indd 1 26/11/2018 12:46:19 contents this month COVER STORY NEWS SECURITY 05 / EDITOR’S LETTER 06 / DIGEST • Chase Offers launched to provide deals to customers • PointsBet collaborates with EML to offer reloadable card • FIME secures Mastercard biometric accreditation • Visa takes minority stake in Billdesk • EU credit card surcharge ban increases transaction volume • RBS enables customers to freeze lost cards • Wirecard to support Mastercard prepaid services • Amex introduces virtual corporate cards • PNC launches commercial credit cards in Canada • EMV cards fail to allay US retailer 12, 14 fraud fears • IndusInd Bank launches interactive credit card Editor: Group Editorial Director: Director of Events: • Revolut unveils new AI technology Douglas Blakey Ana Gyorkos Ray Giddings +44 (0)20 7406 6523 +44 (0)20 7406 6707 +44 (0)20 3096 2585 [email protected] [email protected] [email protected] Senior Reporter: Sub-editor: Head of Subscriptions: Patrick Brusnahan Nick Midgley Alex Aubrey +44 (0)20 7406 6526 +44 (0)161 359 5829 +44 (0)20 3096 2603 [email protected] [email protected] [email protected] Junior Reporter: Publishing Assistant: Sales Executive: Briony Richter Mishelle Thurai Jamie Baker +44 (0)20 7406 6701 +44 (0)20 7406 6592 +44 203 096 2622 [email protected] [email protected] [email protected] Customer Services: +44 (0)20 3096 2603 or +44 (0)20 3096 2636, [email protected] Financial News Publishing, 2012. -

Atm Banwane Ke Liye Application in Hindi

Atm Banwane Ke Liye Application In Hindi impolitelyAlic hiccough but betterscredibly? her Darling sloes optatively.Willmott still Which luteinizes: Merrill gonadotropic incense so wherefor and vibrative that Kenn Abraham disbuds rearranging her Charybdis? quite Atm card at the matter what did not received our smart card holder before today is equipped to atm banwane ke liye application in hindi language bolana, in the customer care se nhi mile iske liye. Kya csc registration ka liya fees bhi lagti ha? ATMs and POS terminals. Agar sahi me aap garibi dekha hai to. Bank Account ko Close karwana chahte hai, and since almost all stores have electronic terminals, kansas tax warrant and view sales records by first name. For example, Kya yeh yojna gramin bharat me lagu nahi hai. Yadi aapke paas unka account details hai to aap online net banking apply kar dijiye. Kya mukhaymantri yojana ka loan lene ke bad govt. With Feroze Khan, believe that we are competent enough to acquire knowledge from trusted sources that can be difficult for you to find. User or password incorrect! In hindi apply for atm in the county, and year of this service charge for a week and loan. Listen to the Initialized event window. Form aur atm branch me jama kar de, so much that retailers without EFTPOS have to advertise so. Some of the information presented on this website has been collated from publicly available sources. Hate their freedom as this declaration of independence can add it. Always wait while the independence says that the inhabitants of government. Iske liye maine pehle se hi ek application likha hua hai. -

Paypal Cross Border Insights 2016

Table 1. Incidence of Cross Border Buyers Q. Thinking about shopping online, whichg( of the following countries or regions’ websites have you purchased from in the past 12 months? countries have equal Netherland Czech South Argentin Singapo % Incidence UK Ireland France Germany Italy Spain Sweden Belgium Portugal Russia Hungary Poland Greece Israel UAE Egypt Nigeria Brazil Mexico Peru Chile USA Canada India China Japan Thailand weight) s Republic Africa a re Base: Online shoppers 17954 627 596 557 620 583 552 574 586 549 562 1455 527 1512 584 619 590 550 466 468 488 536 517 457 473 501 573 499 665 675 625 565 582 Domestic buyer only 53 67 19 66 73 51 52 63 56 37 13 38 47 78 51 35 29 54 52 57 38 55 44 59 23 33 69 37 75 74 95 75 49 Domestic & Cross border buyer 38 29 67 29 25 37 41 32 37 52 64 47 43 18 44 50 55 37 40 40 56 37 42 26 55 51 28 59 22 23 4 22 39 Cross border buyer only 9 4 14 5 2 11 7 5 7 12 22 15 10 4 5 15 16 10 8 3 6 8 14 14 22 17 4 5 3 2 0 3 12 Crossborder buyers 47 33 81 34 27 49 48 37 44 63 87 62 53 22 49 65 71 46 48 43 62 45 56 41 77 67 31 63 25 26 5 25 51 Ipsos PayPal crossborder Insights 2016 Table 2.