Financial Results: Q1 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alpha Asset Management Α.Ε.D.Α.Κ

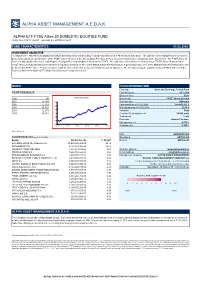

ALPHA ASSET MANAGEMENT Α.Ε.D.Α.Κ. ALPHA ETF FTSE Athex 20 DOMESTIC EQUITIES FUND HCMC Rule 789/13.12.2007 Gov.Gaz. s.n. 2474/B/31.12.07 FUND CHARACTERISTICS 01.02.2008 INVESTMENT OBJECTIVE The Alpha ETF FTSE Athex 20 DOMESTIC EQUITIES FUND is the first Exchange Traded Fund listed on the Athens Stock Exchange. The objective of the Mutual Fund’s investment policy is to replicate the performance of the FTSE® Athex 20 Index of the Athens Stock Exchange in Euro, by mirror matching the composition of the Benchmark. The FTSE® Athex 20 Index is a big capitalization Index, capturing the 20 largest blue chip companies listed on the ATHEX. The total value of investments in shares of the FTSE® Athex 20 Index and in FTSE® Athex 20 Index derivatives accounts for a regulatory minimum of 95% of the Mutual Fund’s Net Asset Value. A percentage up to 35% of the Mutual Fund’s Net Asset Value may be invested in FTSE® Athex 20 Index derivatives with the aim of achieving the Mutual Fund’s investment objectives. The derivatives may be tradable (such as FTSE® Athex 20 Index futures) and/or non-tradable (OTC Swap Transactions) in a regulated market. INDEX FUND INFORMATION Fund type Domestic Exchange Traded Fund PERFORMANCE First listing date 24.1.2008 Base currency Euro Year (%) FTSE Athex 20 Index Benchmark FTSE® Athex 20 Index 2007 15,79% 3300 Currency risk Minimum 2006 17,73% Fund assets as of 01.02.2008 141.403.221 € 2800 2005 30,47% Net unit price as of 01.02.2008 23,40 € 2004 32,27% 2300 Valuation Daily 2003 35,43% 1800 Creation / Redemption unit 50.000 units 1300 Trading unit 1 unit Dividends Annual - 30 June 800 Management fee 0,275% 300 31/12/02 31/12/03 31/12/04 31/12/05 31/12/06 31/12/07 Custodian fee 0,100% Source: Bloomberg ISIN GRF000013000 COMPOSITION (as of 01.02.2008) Bloomberg AETF20 GA Equity Market Cap (€) % Weight Reuters AETF20.AT NATIONAL BANK OF GREECE S.A. -

Marfin Investment Group Financial Results: First Half 2013

Investor Relations +30 210 3504046 www.marfininvestmentgroup.com Investor Release 2 September 2013 MARFIN INVESTMENT GROUP FINANCIAL RESULTS: FIRST HALF 2013 MIG achieves operating EBITDA profitability from recurring business operations (€11.1m vs. €1.6m losses in H1 2012) Consolidated H1 2013 revenues of €581.3m, 3.6% annual reduction, amid ongoing adverse economic and market conditions. Consolidated Q2 2013 revenues of €313.2m, vs. €323.3m in Q2 2012, implying a deceleration to the annual rate of revenue decline on a quarterly basis. H1 2013 EBITDA from recurring business operations 1 of €11.1m, a significant improvement vs. €1.6m loss in H1 2012, attributed to market share gains, expanding gross profit margins, cost containment effectiveness and improved efficiency. Reported group EBITDA of €4.0m, vs. €7.6m loss in H1 2012. Consolidated net loss, after tax and minorities, of €139.7m, adversely impacted by one-off deferred taxes (€35m) and discontinued operations’ losses (€22.8m), vs. €960.5m losses in H1 2012. H1 2013 Net Asset Value (NAV) of €1.23bn (vs. €1.30bn in FY2012), translating to a NAV per share of €1.59 (vs. €1.68 in FY2012). Cash balances, including restricted cash, of €177m at group and €100m at parent company level. Group receivables from the Greek state at €130m in H1 2013 vs. €146m in FY2012. Continuous dynamic asset rebalancing, aimed at deleveraging, yields the desired results, as consolidated gross debt declined by €61m vs. FY2012. Convertible Bond Loan (CBL) issue (29.07.2013) was covered by a total amount of €215m, of which €211.9m originated from the tender for exchange of bonds issued by the Company on 19.03.2010 and €3.1m represents new capital from the exercise of pre-emption rights. -

AXIA Research

AXIA Research Bloomberg <AXVA> Greece-Daily Note April 13, 2018 Headlines Athens General Index Macroeconomic News According to press, EuroWorking Group (EWG) officials told the Greek government that the draft growth strategy it presented for the day after Greece’s exit from the adjustment program, needs to be more precise in specific areas and to clearly account for the associated costs on the budget. According to Kathimerini, in parallel to the EWG meeting yesterday, there was also a Washington Group meeting yesterday. Debt relief and reforms will be the focus in today’s meeting between the Greek Finance Minister Euclid Tsakalotos and his German counterpart Olaf Scholz in Berlin. ELSTAT announced that the seasonally adjusted unemployment rate for January 2018 came to 20.6% compared to the upward revised 23.2% in January 2017 and 20.8% in December 2017. According to ELSTAT, total building activity in Jan’18 on the basis of issued permits increased close daily % Ytd % by 18.0% y-o-y, by 45.8% in volume terms while increased by 45.2% in surface terms. For the Athens General 806.08 0.85% 0.46% Market Turnover (EURm) 60.847 21.35% rolling 12-month period, building permits are up 9.2% (+20.7% surface, +23.5% volume). Market Cap (EURbn) 55.507 Market Cap / GDP* 29.67% Additional Headlines *2016 th ECB’s Governing Council on April 11 lowered the ELA ceiling for Greek banks by EUR 1.9bn to FTSE ASE movers (last trading day) EUR 14.7bn TOP Aegean Airlines announced that traffic volumes in 1Q18 increased by 12%. -

PRESS RELEASE Q1 2016 Results

27 May 2016 PRESS RELEASE Q1 2016 Results Consolidated EBITDA from business operations 1 increased 60.2% to €26.5m vs. €16.5m in Q1 2015 Consolidated Q1 2016 revenues amounted to €245m, recording a marginal decline of €1.2m, or -0.5% vs. Q1 2015. The marginal reduction is attributed to the prolonged economic recession in Greece, as the GDP in Q1 2016 declined by -1.3% vs. Q1 2015, as well as to the ongoing challenging economic and market conditions in the majority of the business sectors. Consolidated EBITDA from business operations increased 60.2% to €26.5m vs €16.5m in Q1 2015. The increase is primarily attributed to the marked profitability improvement of subsidiaries ATTICA, VIVARTIA and HYGEIA. Group consolidated EBITDA (including holding companies) increased 75.6% to €23.4m vs. €13.3m in Q1 2015. Group consolidated EBITDA margin almost doubled to 9.6% vs. 5.4% in Q1 2015. The widening margin is attributed to efficiency improvements as well as cost containment effectiveness. In May 2016, the Company issued a new common bond loan amounting to €150m, which EUROBANK ERGASIAS undertook to cover, to refinance an equivalent amount of an existing debt facility. The refinancing agreement provides for the long-term restructuring of the said debt, by extending the maturity by 3 years (October 2019). With this agreement, the Company completed the long-term restructuring of the entirety of its outstanding common bond loans, achieving the extension of the maturity horizon. 1 Consolidated EBITDA from business operations is defined as Group EBITDA excluding holding companies and non-recurring items. -

4Q:15 Results Release Tuesday March 29 PPC Wednesday March 30, OPAP,LAMDA Thursday March 31Frigoglass, Ellaktor, Gek Terna, Athens Water, Anemos

Weekly Review 24 03 2016 News Flow Eurogroup Head Jeroen Dijsselbloem in a formal statement stated that talks between the Greek government and institutions have been productive, with significant progress made on outstanding issues such as income tax and pension reforms, while work is ongoing and will continue over the Easter break. The statement also noted that mission chiefs will return to Athens on 2 April to resume the discussions with a view to conclude them as soon as possible. Greek Finance Minister Euclid Tsakalotos told Parliament that the government aims to conclude the negotiations over the program review by April 12-13, so an agreement with the institutions can be reached on both the obligations of Greece (under the new program) and the debt issue by April 22. German Finance Minister Wolfgang Schaeuble stated that alternatives must be found if Greece cannot deliver on pension reforms. At the same time, the Greek government continues to blame the stance of the IMF on the review negotiations, while US Treasury Secretary Jack Lew repeated that the IMF will not participate in the current Greek program if there is no debt relief. Macro/Political State Budget primary balance for Jan-Feb 2016 surplus EUR3.038bn vs. target of EUR1.065bn. Current account deficit (Jan-16) at EUR 742m, up EUR 461m y-o-y Reportedly GR deposits declined by EUR 1.0bn in February 2016 Turnover Index in Industry (Jan-16) -13.3% y-o-y. Travel receipts in January 2016 decreased by 4.7% y-o-y According to press Eurobank is in the final stages of entering -

A Policy for Success

bponline.amcham.gr MAY-JUNE 2014 Vol. XIII | No. 72 Thought Leaders Golden Bullets in Technolgy BUSINESS MATTERS— JIM DAVIS OF NEW BALANCE ▼ PANAGIOTIS G. MIHALOS, SECRETARY GENERAL, MFA ▼ GOOGLE, THE INTERNET, AND IMPACTING SOCIETY ▼ PLUS BIZ BUZZ TRENDS & TRADE MAKERS VIEWPOINT MetLife— AMERICAN-HELLENIC A Policy For Success CHAMBER OF COMMERCE www.amcham.gr Dimitris Mazarakis Vice Chairman BoD & Managing Director, MetLife Register Now Greek Investment June 11-12, 2014 Forum The Athens Exchange and the AEGEAN AIRLINES American-Hellenic Chamber of Commerce ALPHA BANK are pleased to invite you to this year’s ATTICA BANK Investment Forum: CORINTH PIPEWORKS ELLAKTOR Participants: GR for Growth EUROBANK EUROBANK PROPERTIES JUNE 11-12, 2014 FOLLI FOLLIE GROUP Harmonie Club, 4 East 60th St, GEK TERNA New York, NY 10022 GR. SARANTIS HELLENIC EXCHANGES The Forum will bring together HELLENIC PETROLEUM key government of cials and INTRALOT leading Greek and U.S. LAMDA DEVELOPMENT business leaders to explore Greece’s MARFIN INVESTMENT GROUP improving investment climate, METKA key privatization initiatives MOTOR OIL MYTILINEOS and investment opportunities. NATIONAL BANK of GREECE Institutional investors OPAP will also have the opportunity to meet PIRAEUS BANK with senior executives PLAISIO of Greece’s leading listed companies. TERNA ENERGY THRACE PLASTICS The Forum will take place on June 11. TITAN One-on-one investor meetings will take HELLENIC REPUBLIC ASSET place on June 11-12. DEVELOPMENT FUND Gold sponsors: Silver sponsors: Hellenic American -

Investor Release 1 April 2014

Investor Relations +30 210 3504046 www.marfininvestmentgroup.com Investor Release 1 April 2014 MARFIN INVESTMENT GROUP FINANCIAL RESULTS: FULL YEAR 2013 Significant profitability improvement: EBITDA from business operations at €62.0m vs. €29.1m in FY2012 Consolidated FY2013 revenues of €1,189.0m vs €1,264.4m a year ago, due to the prolonged challenging economic and market conditions and the exceptional impact to Hygeia Group (€28m charge booked in Q4 2013) related to the legal obligation to implement the automatic claw back and rebate mechanisms in the healthcare sector. Excluding this exceptional impact, consolidated revenues declined 3.7% y-o-y, matching the annual real GDP contraction in Greece. EBITDA from business operations 1 at €62.0m, 113% improvement vs. €29.1m in FY2012, attributed to widening gross profit margins, cost containment effectiveness and improved efficiency. The profitability improvement is primarily associated to better results from ATTICA, VIVARTIA and FAI. Reported consolidated EBITDA turns profitable at €8.6m, vs. €50.9m loss a year ago, reflecting the substantial profitability improvement of business operations, despite the significant €28m impact to Hygeia Group EBITDA related to the aforesaid government policy decisions in the healthcare sector. Consolidated net loss, after tax and minorities, of €203.3m, adversely impacted by one-off deferred taxes (€35m), negative revaluation of investment property (€10.8m vs €43.2m a year ago) and impairment charges (€47.5m vs. €1,091m in FY2012). The relevant bottom-line loss in FY2012 stood at €1,298.0m. Net Asset Value (NAV) at €967m (vs. €1,297m on 31.12.2012), translating to a NAV per share of €1.26 (vs. -

Company Presentation

Company Presentation Q1 2021 Table of Contents 01 Euroxx - The Company 02 Euroxx - Brokerage Services 03 Euroxx - Wealth Management 04 Euroxx - Investment Banking Company Presentation 3 4 01 THE COMPANY 02 BROKERAGE SERVICES 03 WEALTH MANAGEMENT 04 INVESTMENT BANKING 01 01.1 The History EUROXX SECURITIES Euroxx was established in 1993 as an investment – consulting company. Following regulatory approval in 1995 by the Hellenic 1990s Capital Markets Committee, it was converted into a full-scale Securities Firm, offering full range A member of the Athens of financial services. Exchange (ATHEX) and the Cyprus 2000s Stock Exchange (CSE), listed on the Alternative Market of the ATHEX since 2008. In 2012, Euroxx • Institutional Sales & Trading opened the Thessaloniki office to increase its penetration in the Euroxx is Greece’s largest • Derivatives & Bond Trading regional area. independent financial services firm, with strong capabilities in • Online Trading Investment Banking, a leading • Equity Research 2010s brokerage desk commanding a 14% market share in trading volumes on • Investment Banking / the ATHEX, and a fast-growing Corporate Finance Euroxx client portfolio includes all Wealth Management department PRESENT PRESENT • Wealth Management major foreign institutional (>€500m under management) with investors active in all facets of the a strong franchise among domestic • Internal Audit / Compliance Greek Equity market as well as HNW. Department numerous Tier II funds that follow closely the Greek ECM. Company Presentation 5 01 01.2 Organizational -

Eurex Circular 043/16

eurex circular 043/16 Date: 24 March 2016 Recipients: All Trading Participants of Eurex Deutschland and Eurex Zürich and Vendors Authorized by: Mehtap Dinc Greek Single Stock Futures and index-futures: Delisting Related Eurex Circulars: 126/15 Contact: Tobias Ehinger, Product R&D Equity and Index, T +49-69-211-1 23 13, [email protected] Content may be most important for: Attachment: Updated sections of the Contract Ü All departments Specifications for Futures Contracts and Options Contracts at Eurex Deutschland and Eurex Zürich Summary: The Management Board of Eurex Deutschland and the Executive Board of Eurex Zürich AG decided with effect from 25 April 2016 to delist ten Single Stock Futures on Greek underlying and index futures on MSCI Greece. Eurex Deutschland T +49-69-211-1 17 00 Management Board: Börsenplatz 4 F +49-69-211-1 17 01 Thomas Book, Mehtap 60313 Frankfurt/Main memberservices@ Dinc, Erik Tim Müller, Mailing address: eurexchange.com Michael Peters 60485 Frankfurt/Main Internet: Germany www.eurexchange.com ARBN: 101 013 361 eurex circular 043/16 Greek Single Stock Futures and index futures: Delisting The Management Board of Eurex Deutschland and the Executive Board of Eurex Zürich AG decided with effect from 25 April 2016 to delist ten Single Stock Futures on Greek underlying and index futures on MSCI Greece. Following products will be delisted: Eurex product Eurex product ID Aktien-Futures Alpha Bank ACBF Bank of Greece BGCG Bank of Piraeus BKPF Coca-Cola Hellenic Bottling HCBG Marfin Investment Group MIGF -

Mig Financial Statement Information 31

MARFIN INVESTMENT GROUP HOLDINGS SOCIETE ANONYME GENERAL COMMERCIAL REG. NR 3467301000 - SOCIÉTÉS ANONYMES REG. NR: 16836/06/Β/88/06 - ADDRESS : 67 THISSEOS, KIFISSIA, 146 71 FINANCIAL INFORMATION FOR THE YEAR 1st January 2015 up to the 31st of December 2015 (Published according to L. 2190/20, art. 135 for companies compiling their financial statements, consolidated & separate, according to IAS) (Amounts in Euro thousand) The figures and information presented below aim at providing general information on the financial position and results of the Group and the Company MARFIN INVESTMENT GROUP HOLDINGS S.A. We therefore propose to the reader, before proceeding to any investment or transaction decisions with the Company, to visit the Company's website where the Financial statements are available according to the International Financial Reporting Standards as well as the Report of the Chartered Certified Accountant. COMPANY INFORMATION Company website : www.marfininvestmentgroup.com Annual Financial Statement date of approval by the Board of Directors : 23 March 2016 Board of Directors: Andreas Vgenopoulos – Chairman of the Board, non-executive member, Emmanouil Xanthakis - Vice-Chairman of the Board, non-executive member, Iskandar Auditor' name : Manolis Michalios (Α.Μ.SOEL 25131) - Dimitra Pagoni (Α.Μ.SOEL 30821) Auditing Company : GRANT THORNTON S.A. (A.M. SOEL 127) Safa – Vice-Chairman of the Board, non-executive member, Efthimios Bouloutas - Chief Executive Officer, executive member, Panagiotis Throuvalas – Deputy Chief Executive Officer, -

Annual Report 2015 2 3

Annual Report 2015 2 3 Annual Report according to Article 4 of Law 3556/2007 for the Financial Year from January 1st, 2105 to December 31st, 2015 (amounts in € ‘000 unless mentioned otherwise) MARFIN INVESTMENT GROUP HOLDINGS S.A. Thisseos Ave. 67, 146 71 Kifissia, Greece Τ. +30 210 6893450 General Commercial Reg. Nr. 3467301000 (Societe Anonyme Reg. Nr. 16836/06/Β/88/06) 4 5 About MIG Marfin Investment Group MIG has been listed on the Athens Stock Exchange since July 2007. Its Holdings S.A. is an portfolio includes leading companies in sectors across the SEE region, international investment grouped into Transportation & Shipping, Food & Beverages, Healthcare, holding company based IT, Real Estate, Tourism & Leisure. Included amongst its portfolio and in Greece and throughout subsidiary companies is Attica Group, a leading passenger ferry opera- Southeast Europe (SEE). tor in the Eastern Mediterranean; Vivartia, a leading food and food retail The Company believes business in SEE; Hygeia Group, a prominent integrated private hospitals it is uniquely positioned and clinics group, with the leading general hospital facilities and mater- to take advantage of an nity clinics in Greece; SingularLogic, the leading IT operator in Greece; expanding array of invest- Sunce (Bluesun) a leading hospitality and leisure group in Croatia; Hilton ment opportunities in this Cyprus, the only 5-star hotel in the capital city of Nicosia and Robne Kuce region; opportunities in Beograd (RKB), owner of the largest commercial real-estate portfolio in which traditional invest- Serbia. ment vehicles lacking MIG’s regional focus, scale, expertise, and/or its investment flexibility and financial resources, may find difficult to identify and exploit. -

PRESS RELEASE 2017 Full Year

30 April 2018 PRESS RELEASE 2017 Full Year Results Stable consolidated sales at €1,080m and decrease of losses for MIG Group . Consolidated sales remained stable at €1,080m despite the challenging market conditions in the majority of the business sectors of our operating companies. EBITDA from business operations reached €141.6m vs €156.1m in 2016, affected positively by Vivartia Group by €10.2m and Hygeia Group by €3m and negatively by Attica Group by €19.7m due to fuel prices increase and SingularLogic Group by €9.3m. Group Consolidated EBITDA amounted to €117.8m vs €132.2m in 2016, whereas consolidated EBIT amounted to €40.8m vs €55.7 in 2016. Consolidated results after taxes and non-controlling interests amounted to a loss of €74.8m compared to losses of €84.9m in 2016. Cash & cash equivalents at Group level amounted to €130.5m. Consolidated gross debt amounted at €1,624m. Summary of key financials GROUP (consolidated in €m) 2016 2017 Sales 1,082.0(4) 1,079.9 EBITDA from business operations(1) 156.1(4) 141.6 % margin 14.4% 13.1% EBITDA consolidated(2) 132.2(4) 117.8 % margin 12.2% 10.9% EBIT consolidated(3) 55.7(4) 40.8 Losses after Tax and Non-Controlling Interests (84.9) (74.8) (1) Consolidated EBITDA from business operations is defined as Group consolidated EBITDA excluding holding companies, gains/losses from the sale of investment property, fixed & intangible assets as well as revaluation of investment property (2) Group consolidated Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (3) Group consolidated Earnings Before Interest, Taxes (EBIT) (4) Re-adjustment for the comparable period in order to include only continuing operations 1 Key highlights regarding subsidiaries performance for 2017: .