Southeast Asia Canned Tuna Ranking

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Optionalistapril2019.Pdf

Account Number Name Address City Zip Code County Signed Affidavit Returned Affidavit Option Final Notice Sent DL20768 Vons Market 1430 S Fairfax Ave Los Angeles 90019 Los Angeles 4/28/17 OPTION A 4/19/17 DL20769 Sunshine Liquor 5677 W Pico Blvd Los Angeles 90019 Los Angeles 4/25/17 OPTION A 4/19/17 DL20771 Selam Market 5534 W Pico Blvd Los Angeles 90019 Los Angeles 4/27/17 OPTION A 4/19/17 DL61442 7-Eleven Food Store 1075 S Fairfax Ave Los Angeles 90019 Los Angeles 5/8/17 OPTION A 4/19/17 DL63467 Walgreens Drug Store 5843 W Pico Blvd Los Angeles 90019 Los Angeles 5/2/17 OPTION A 4/19/17 DL141090.001 Jordan Market 1449 Westwood Blvd Los Angeles 90024 Los Angeles 7/28/14 OPTION A 7/17/14 DL220910.001 Target 10861 Weyburn Ave Los Angeles 90024 Los Angeles 12/4/14 OPTION A DL28742 7-Eleven 1400 Westwood Blvd Los Angeles 90024 Los Angeles 3/24/15 OPTION A 7/17/14 DL28743 Tochal Mini Market 1418 Westwood Blvd Los Angeles 90024 Los Angeles 7/29/14 OPTION A 7/17/14 DL28745 Bristol Farms 1515 Westwood Blvd Los Angeles 90024 Los Angeles 12/3/14 OPTION A 7/17/14 DL41783 Stop Market 958 Gayley Ave Los Angeles 90024 Los Angeles 7/21/14 OPTION A 7/17/14 DL54515 Ralphs Fresh Fare 10861 Weyburn Ave Los Angeles 90024 Los Angeles 11/24/14 OPTION A 7/17/14 DL55831 Chevron 10984 Le Conte Ave Los Angeles 90024 Los Angeles 11/24/14 OPTION A 7/17/14 DL60416 Whole Foods Market 1050 Gayley Ave Los Angeles 90024 Los Angeles 8/7/14 OPTION A 7/17/14 DL61385 CVS/pharmacy 1001 Westwood Blvd Los Angeles 90024 Los Angeles 4/23/15 OPTION A 7/17/14 DL61953 CVS/pharmacy -

Additional Case Information

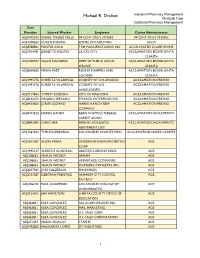

Michael R. Drobot Industrial Pharmacy Management MediLab Corp California Pharmacy Management Case Number Injured Worker Employer Claims Administrator ADJ7472102 ISMAEL TORRES VALLE 99 CENT ONLY STORES 99 CENT ONLY STORES ADJ1308567 CURTIS RIGGINS EMPIRE DISTRIBUTORS ACCA ADJ8768841 MARTIN AVILA TRM MANUFACTURING INC ACCELERATED CLAIMS IRVINE ADJ7014781 JEANETTE WILSON LA COUNTY ACCLAMATION 802108 SANTA CLARITA ADJ7200937 SUSAN NAVARRO DEPT OF PUBLIC SOCIAL ACCLAMATION 802108 SANTA SERVICE CLARITA ADJ8009655 MARIA PAEZ RUSKIN DAMPERS AND ACCLAMATION 802108 SANTA LOUVERS CLARITA ADJ1993776 ROBERTA VILLARREAL COUNTY OF LOS ANGELES ACCLAMATION FRESNO ADJ1993776 ROBERTA VILLARREAL COUNTY OF LOS ACCLAMATION FRESNO ANGELES/DPSS ADJ7117844 TOMMY ROBISON CITY OF MARICOPA ACCLAMATION FRESNO ADJ8162473 ONORIO SERRANO ESPARZA ENTERPRISES INC ACCLAMATION FRESNO ADJ8420600 JORGE LOZANO HARRIS RANCH BEEF ACCLAMATION FRESNO COMPANY ADJ8473212 DAREN HANDY KERN SCHOOLS FEDERAL ACCLAMATION SACRAMENTO CREDIT UNION ADJ8845092 CHAO HER FRESNO MOSQUITO ACCLAMATION SACRAMENTO ABATEMENT DIST ADJ1361532 THELMA JENNINGS LOS ANGELES COUNTY/DPSS ACCLAMATION SANTA CLARITA ADJ1611037 ALICIA MORA ANDERSON BARROWS METALS ACE CORP ADJ1995137 ALBERTO GUNDRAN ABLESTIK LABORATORIES ACE ADJ208633 SHAUN WIDNEY AMPAM ACE ADJ208633 SHAUN WIDNEY AMPAM RCR COMPANIES ACE ADJ208633 SHAUN WIDNEY PLUMBING CONCEPTS INC ACE ADJ2237965 JOSE CALDERON FMI EXPRESS ACE ADJ2353287 DEBORAH PRENTICE ANAHEIM CITY SCHOOL ACE DISTRICT ADJ246218 PAUL LIGAMMARI LOS ANGELES COLLEGE OF ACE CHIROPRACTIC -

Wikipedia List of Convenience Stores

List of convenience stores From Wikipedia, the free encyclopedia The following is a list of convenience stores organized by geographical location. Stores are grouped by the lowest heading that contains all locales in which the brands have significant presence. NOTE: These are not ALL the stores that exist, but a good list for potential investors to research which ones are publicly traded and can research stock charts back to 10 years on Nasdaq.com or other related websites. [edit ] Multinational • 7-Eleven • Circle K [edit ] North America Grouping is by country or united States Census Bureau regional division . [edit ] Canada • Alimentation Couche-Tard • Beckers Milk • Circle K • Couch-Tard • Max • Provi-Soir • Needs Convenience • Hasty Market , operates in Ontario, Canada • 7-Eleven • Quickie ( [1] ) [edit ] Mexico • Oxxo • 7-Eleven • Super City (store) • Extra • 7/24 • Farmacias Guadalajara [edit ] United States • 1st Stop at Phillips 66 gas stations • 7-Eleven • Acme Express gas stations/convenience stores • ampm at ARCO gas stations • Albertsons Express gas stations/convenience stores • Allsup's • AmeriStop Food Mart • A-Plus at Sunoco gas stations • A-Z Mart • Bill's Superette • BreakTime former oneer conoco]] gas stations • Cenex /NuWay • Circle K • CoGo's • Convenient Food Marts • Corner Store at Valero and Diamond Shamrock gas stations • Crunch Time • Cumberland Farms • Dari Mart , based in the Willamette Valley, Oregon Dion's Quik Marts (South Florida and the Florida Keys) • Express Mart • Exxon • Express Lane • ExtraMile at -

GQ APPAREL Donated 770 Kids and Adult Masks to SOS Children's

GQ APPAREL Donated 770 Kids and Adult Masks to SOS Children’s Villages Thailand ● GQ Apparel donates 770 of their liquid-repellent reusable fabric masks worth more than 100,000 baht to the SOS Children’s Villages Thailand to help partner with the non-profit during the COVID-19 crisis. ● GQ, together with its online and offline partners, are selling the GQWhite™ mask available in white and black for adults as well as masks for kids across the country to provide access to safe, reusable masks. In response to COVID-19, GQ Apparel, a leading tech apparel company in Thailand, donated 770 masks worth more than 100,000 thb to the staff and underprivileged children of the SOS Children’s Villages to help support the foundation and the staff during this difficult time. The SOS Foundation works to help children who have lost the care of their parents. There are currently 700 children under the care of the SOS Children’s Villages in 5 locations across Thailand. “When COVID-19 began to spread in Thailand, we quickly developed the GQWhite™ Mask as a response to the shortage of medical masks,” said Parawi Vachiramon, Chief People Officer of GQ Apparel. “We then focused on launching the kids mask for moms across the country because as a mom myself, I couldn’t find a mask that was safe for my kids. We knew that if it was difficult for us to find kids masks, we knew it must have been even harder for underprivileged kids and families to access safe protective equipment. -

Option a Dealer List 8/6/2019

Dealers that Returned Option A Affidavits (Redeem CRV Containers in the Store) Sorted in Order by City and then by Business Name To find the nearest location, select Control F (on your keyboard) to open the PDF search tool and enter your zip code. Name Address City Zip Code County Bonfare Market 1505 High St Alameda 94501 Alameda CVS/pharmacy 885 Island Dr Alameda 94502 Alameda Encinal Market 3211 Encinal Ave Alameda 94501 Alameda Harbor Bay 76 Svc 3255 Mecartney Rd Alameda 94502 Alameda Maitland Market 109 Maitland Dr Alameda 94502 Alameda Safeway Store 867 Island Dr Alameda 94502 Alameda 7-Eleven 1497 Danville Blvd Alamo 94507 Contra Costa Alamo Shell 3188 Danville Blvd Alamo 94507 Contra Costa MD Liquor and Food 3168 Danville Blvd Alamo 94507 Contra Costa Rite Aid Pharmacies 130 Alamo Plaza Alamo 94507 Contra Costa Rotten Robbie 1465 Danville Blvd Alamo 94507 Contra Costa Safeway Store 200 Alamo Plz Alamo 94507 Contra Costa Albany Hill Mini Mart 800 San Pablo Ave Albany 94706 Alameda Jay Vee Liquors 759 San Pablo Ave Albany 94706 Alameda 7-Eleven 1100 W Commonwealth Ave Alhambra 91803 Los Angeles 7-Eleven 512 S Chapel Ave Alhambra 91801 Los Angeles 7-Eleven 1723 W Main St Alhambra 91801 Los Angeles 7-Eleven 601 S Fremont Ave Alhambra 91803 Los Angeles 99 Cents Only Store 2810 W Alhambra Rd Alhambra 91801 Los Angeles 99 Ranch Market 345 E Main St Alhambra 91801 Los Angeles Albertsons 2400 W Commonwealth Ave Alhambra 91803 Los Angeles Aldi Food Store 2121 W Main St Alhambra 91801 Los Angeles Alhambra Market 2289 W Main St Alhambra 91801 Los Angeles Big T Mini Mart 240 W Main St Alhambra 91801 Los Angeles C.S.I. -

2016 Retail Foods Thailand

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/29/2016 GAIN Report Number: TH6160 Thailand Retail Foods 2016 Approved By: Christine Sloop, Agricultural Counselor Prepared By: Srisuman Ngamprasertkit, Marketing Specialist Report Highlights: At a value of $84.31 billion, Thailand's total retail sales grew 3-5 percent in 2015, representing approximately 25 percent of total GDP. Total grocery retail sales reached $52.56 billion. Overall retail sector growth was 4 percent in 2015 and is estimated to be at least 4 percent in 2016. Post: Bangkok Executive Summary: Thailand’s Gross Domestic Production (GDP) grew an average of 3.5 percent between 2012-2015. The Office of the National Economic and Social Development Board (NESDB) and the Bank of Thailand forecast that GDP will grow at a rate of 3.2 percent in 2016. The recent global economic downturn has led to lower exports and has caused several industries such as automobiles, advertising, and the broadcast media to reduce their operations and lay off employees. In response, Prime Minister Prayuth Chan-ocha and his government have implemented various policies to boost domestic consumption and spending. Additionally, the number of inbound tourists is expected to grow generating additional income for Thailand. Thailand’s total retail consumption is about 25 percent of total GDP. Total retail sales and total food retail sales (grocer retailers) in 2015 are valued respectively at $84.31 billion and $52.56 billion dollars. The Office of the National Economic and Social Development Board (NESDB) and the Bank of Thailand estimate that about 25 million tourists with total income receipts of approximatedly $38 billion visited Thailand during the first three quarters of 2016. -

Cover THA V3 Small Size

www.RETAILEXASEAN.com 2 EXHIBITONS | 3 CONFERENCES | 50 SPEAKERS | 8000 ATTENDEES | 200 BUYERS | 150 EXHIBITORS ASEAN’S FASTEST GROWING RETAIL TRENDS AND SOLUTIONS TRADE EXHIBITION ORGANISED BY Shop FITting Expo 2017 ASEAN’S FASTEST GROWING TRADE EXHIBITION FOR IN STORE EQUIPMENT & SOLUTIONS Who should exhibit? Who should visit? 1. Shop fittings 1. Advertising agency / graphic design 2. Shop furnishings 2. Brand owners 3. Store design & visual merchandising 3. Design consultancy 4. POP marketing 4. Fashion & apparel retail 5. Shopping trolleys & basket 5. Food retail 6. Lighting & AV 6. Marketing & PR 7. Refrigeration system 7. Pharmacy 8. Building service & system 8. Retailers 9. Shop fitting 10. Shopping malls 11. Supermarket & convenience store 12. Vendor suppliers Shop TECHnology Expo 2017 ASEAN’S FASTEST GROWING TECHNOLOGY TRADE EXHIBITION FOR THE RETAIL AND HOSPITALITY INDUSTRY Who should exhibit? Who should visit? 1. Payment system 1. Bank 2. ERP & merchandise management 2. Chain restaurant 3. Business analytics & big data management 3. Community mall 4. Mobile solutions 4. Distribution center & warehouse 5. POS hardware 5. E-Commerce 6. POS software 6. Fashion & cosmetic industries 7. Digital marketing solution 7. FMCG brands 8. Weighing equipment for food industry 8. Food supply chain & manufacturing 9. Supply chain / Inventory/stock control management 9. Government 10. In store communication & technology 10. Health care 11. Security / loss prevention equipment and solutions 11. Hospitality 12. RFID, IOT, smart card technology 12. Hypermarket 13. IT & security industry 14. Manufacturing 15. Shopping mall 16. Supermarket 17. System integrators & vendors 18. Transportation & logistic Philippines grocery retail market “stands out in Asia” due to the country’s strong financial backing and entrepreneur spirit. -

2017 Retail Foods Thailand

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/28/2017 GAIN Report Number: TH7171 Thailand Retail Foods 2017 Approved By: Paul Welcher, Agricultural Attaché Prepared By: Srisuman Ngamprasertkit, Marketing Specialist Report Highlights: In 2016, Thailand had total retail sales of U.S. $88.2 billion, representing approximately 22 percent of total GDP. Of the U.S. $88.2 billion in retail sales, U.S. $83.5 billion came from store-based retailing with the remaining U.S. $4.7 billion coming from non-store retailing (direct sales, home shopping, and internet retailing). Total food retail sales reached U.S. $52.1 billion comprising 59 percent of all retail sales. Overall, the retail sector grew by 4 percent in 2016. Post: Bangkok Executive Summary: In 2016, Thailand had total retail sales of U.S. $88.2 billion, representing approximately 22 percent of total GDP. Of the U.S. $88.2 billion in retail sales, U.S. $83.5 billion came from store-based retailing with the remaining U.S. $4.7 billion coming from non-store retailing (direct sales, home shopping, and internet retailing). This represents 4 percent growth in retail sales since 2015. For store-based retail sales, U.S. $52.1 billion (62.4 percent) came from food retail sales while U.S. $31.4 billion (37.6 percent) came from non-food retailing. In 2016, the value of Thailand’s consumer-oriented food product imports reached U.S. -

Globalwebindex Core Survey | Brand List Q1 2021

GlobalWebIndex Core Survey | Brand List Q1 2021 LUXURY FASHION: ENGAGEMENT** ....... 57 TECHNOLOGY BRANDS: ENGAGEMENT** Contents LUXURY FASHION: ADVOCACY** ............ 57 ......................................................................... 90 RETAILERS** .................................................. 57 TECHNOLOGY BRANDS: AIRLINES: ENGAGEMENT** ....................... 68 CONSIDERATION** ...................................... 90 BANKS / FINANCIAL INSTITUTIONS: AIRLINES: ADVOCACY** ............................. 68 TECHNOLOGY BRANDS: ADVOCACY** .. 90 AWARENESS** ................................................ 3 AUTOMOTIVE: ENGAGEMENT** .............. 72 NAMED SOCIAL MEDIA SERVICES USED * BANKS / FINANCIAL INSTITUTIONS: AUTOMOTIVE: ADVOCACY** ................... 72 ......................................................................... 91 ENGAGEMENT** ............................................. 3 PAYMENT SERVICES .................................... 73 FAVORITE SOCIAL MEDIA SERVICE * ........ 91 BANKS / FINANCIAL INSTITUTIONS: NAMED WEBSITES AND APPS USED ........ 78 MUSIC SERVICES: ENGAGEMENT** .......... 92 ADVOCACY** .................................................. 3 PC / LAPTOP OPERATING SYSTEMS ......... 83 MUSIC SERVICES: ACCOUNT TYPE** ....... 93 SPORTING EVENTS & LEAGUES ................... 8 MOBILE OPERATING SYSTEMS* ................ 83 MUSIC SERVICES: ACCOUNT USAGE**.... 93 SPORTS TEAMS: EUROPEAN FOOTBALL / TABLET OPERATING SYSTEMS .................. 83 INTERNATIONAL TV CHANNEL SOCCER** ..................................................... -

An Analysis of Consumer Cooperatives in Thailand

ISSN 2394-7322 International Journal of Novel Research in Marketing Management and Economics Vol. 6, Issue 2, pp: (19-22), Month: May - August 2019, Available at: www.noveltyjournals.com An Analysis of Consumer Cooperatives in Thailand Narong Koojaroenprasit Department of Cooperatives, Faculty of Economics, Kasetsart University, 50 Ngamwongwan Rd, Chathujak, Bangkok, Thailand E-mail Adress:[email protected] Abstract: The aims of this research were; 1) to analyze the present situation of consumer cooperatives in Thailand and 2) to examine the relationship between size and consumer cooperatives' profit. This study used secondary data. These data were collected from the Cooperating Auditing Department and Cooperation Promotion Department. Descriptive statistics (frequency, percentage, mean and standard deviation) and inferential statistics (Chi-square and Fisher's Exact Test) were used for data analysis. The finding indicated that profit per store was not high. Additionally, most consumer cooperatives had single branch. It also found that size had significant relationship with consumer cooperatives' profit. Thus, consumer cooperatives should add online business to compete with modern trade. Keywords: consumer cooperatives, Cooperating Auditing Department, Cooperating Promotion Department, profit, size, Thailand. I. INTRODUCTION Thailand used the cooperative concept in solving economic and social problems [Petchprapunkul, 2012]. The Wat Chan Cooperative Unlimited Liability (agricultural cooperative) was the first cooperative established in 1916 [Cooperative Promotion Department, 1994]. According to the Cooperative Act 1999 in Thailand, there are seven types of cooperatives (agricultural cooperatives, fishery cooperatives, land settlement cooperatives, consumer cooperatives, services cooperatives, thrift and credit cooperatives, and credit union coopertives [Cooperative Auditing Department, 2016]. The first consumer cooperative was established in 1937 [Yoosathaporn, 1994]. -

Preliminary Prospectus- CP Seven Eleven Public Company Limited

(Translation) - Preliminary Prospectus- C.P. Seven Eleven Public Company Limited Public Offering by C.P. Seven Eleven Public Company Limited of the new 40,000,000 Ordinary Shares of Baht 5 Par Value, at the price of Baht [●] per share and by existing Shareholders: Bangkok Produce Merchandising Public Company Limited N.T.K. Technology Co., Ltd. and Thaivest Pte, Limited. of up to 31,500,000 Existing Ordinary Shares with of Baht 5 Par Value at the price of Baht [●] per share Financial Advisor Merrill Lynch Phatra Securities Company Limited Submission date of the Registration Statement: 22 August 2003 Date of distribution of the draft Prospectus: 22 September 2003 Effective date for the Registration Statement: The translation of this preliminary prospectus dated 22 September 2003 has been prepared for your convenience only. It should not be relied upon as a complete description of the preliminary prospectus in the official Thai language, and is subject to changes. For a complete description of the offering, you must refer to the prospectus, which you should note will only be available in Thai. A copy of the preliminary prospectus in the official Thai language is being provided to you together with this translation. Warning: Before making any investment decision, investors must exercise due care in considering information relating to the issuer and conditions of the securities as well as investment soundness and related risks. The effectiveness of this Registration Statement does not indicate that the Securities and Exchange Commission or the Office of the Securities and Exchange Commission recommends an investment in the offered securities, nor does it guarantee a price or a return of the offered securities, completeness or accuracy of information contained in this Registration Statement. -

Thailand Retail Foods Retail Sector

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 7/2/2019 GAIN Report Number: TH9081 Thailand Retail Foods Retail Sector Approved By: Paul Welcher, Agricultural Attaché Prepared By: Srisuman Ngamprasertkit, Marketing Specialist Aidan Wiktorowiz, Agricultural Intern Paul Welcher, Agricultural Attaché Report Highlights: Thailand’s retail food sector continues to expand, driven by strong economic growth, private investment, and government spending. Thailand is a competitive market for food and beverage products. However, there is good sales potential for a number of products including food preparation ingredients, whey, frozen potatoes, apples, milk and cream, pet food, and raisins. Post: Bangkok Post: Market Fact Sheet: Thailand Executive Summary Top Growth Products in Host Country Driven by a growing younger generation and 1. Soy Sauce 2. Fish Sauce increasing wealth, the consumption of premium 3. Pasteurized Milk foods/beverages, internet retailing, and eating out 4. Frozen and Chilled Chicken Meat have risen. The recent surge of tourism has helped propagate growth and provides an additional sales Top Host Country Retailers source for exporters. Understanding the fluidity and Major retailers that target medium to diversity of the Thai economy is a necessary Thailand’shigh end consumers food processing include: industry Central precursor to success in exporting commodities to hasFood developed Hall, Gourmet rapidly Market, and is one Villa of the Thailand. mostMarket, developed and Foodland in South Supermarket. East Asia with more than 10,000 food and Imports of Consumer-Oriented Products In Chiang Mai, a key retailer beveragefocusing processingon imported factories.