2017 Retail Foods Thailand

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fuel Forecourt Retail Market

Fuel Forecourt Retail Market Grow non-fuel Are you set to be the mobility offerings — both products and Capitalise on the value-added mobility mega services trends (EVs, AVs and MaaS)1 retailer of tomorrow? Continue to focus on fossil Innovative Our report on Fuel Forecourt Retail Market focusses In light of this, w e have imagined how forecourts w ill fuel in short run, concepts and on the future of forecourt retailing. In the follow ing look like in the future. We believe that the in-city but start to pivot strategic Continuously pages w e delve into how the trends today are petrol stations w hich have a location advantage, w ill tow ards partnerships contemporary evolve shaping forecourt retailing now and tomorrow . We become suited for convenience retailing; urban fuel business start by looking at the current state of the Global forecourts w ould become prominent transport Relentless focus on models Forecourt Retail Market, both in terms of geographic exchanges; and highw ay sites w ill cater to long customer size and the top players dominating this space. distance travellers. How ever the level and speed of Explore Enhance experience Innovation new such transformation w ill vary by economy, as operational Next, w e explore the trends that are re-shaping the for income evolutionary trends in fuel retailing observed in industry; these are centred around the increase in efficiency tomorrow streams developed markets are yet to fully shape-up in importance of the Retail proposition, Adjacent developing ones. Services and Mobility. As you go along, you w ill find examples of how leading organisations are investing Further, as the pace of disruption accelerates, fuel their time and resources, in technology and and forecourt retailers need to reimagine innovative concepts to become more future-ready. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

537 the Impact of Foreign Retail and Wholesale Stores on Traditional

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by AMH International (E-Journals) Information Management and Business Review Vol. 4, No. 10, pp. 537-544, Oct 2012 (ISSN 2220-3796) The Impact of Foreign Retail and Wholesale Stores on Traditional Wholesale Stores in Nonthaburi Province, Thailand Supitcha Cheevapruk, John Walsh* School of Management, Shinawatra University, Thailand *[email protected] Abstract: The entrance of foreign retail and wholesale businesses in Thailand started some ten years ago and led to the closure of many Thai wholesale stores. The objective of this study is to determine the needs of Thai wholesalers in the Nonthaburi area and to identify suitable strategies for relevant managers to be able to compete with contemporary commercial strategies of the foreign enterprises. A total of 114 of the 120 Thai traditional wholesale stores in Nonthaburi were surveyed by questionnaire and results were analyzed by statistical means. It was found that low price strategy, location of store and full cycle service strategies were the principal approaches employed by the managers of the foreign wholesale and retail stores. Tesco Lotus was the foreign venture with the greatest impact on the Thai environment. With respect to managerial approach, it was found that Thai traditional wholesale stores should try to build stronger relationships with customers and regularly search for new markets. Employee performance should also be taken into consideration to some extent. Other issues of importance included the presentation of the store and visual merchandising, as well as transparency in management systems and the need for well–organized financial and accounting systems and their proper control. -

Aeon Report Report 20172017 Creating a Future Where Communities Flourish Trees Grow And

Aeon Report Report 20172017 Creating a future where communities flourish trees grow and AEON Report 2017 1 Aeon Basic Principles Pursuing peace, respecting humanity, and contributing to local communities, always with the customer’s point of view as its core. Peace The Customer People Community The word (Aeon) has its origins in a Latin root meaning “eternity.” The customers’ beliefs and desires comprise the central core of our philosophy. At Aeon, our eternal mission as a corporate group is to benefit our customers, and our operations are thus customer-focused to the highest degree. “Peace” Aeon is a corporate group whose operations are dedicated to the pursuit of peace through prosperity. “People” Aeon is a corporate group that respects human dignity and values personal relationships. “Community” Aeon is a corporate group rooted in local community life and dedicated to making a continuing contribution to the community. On the basis of the Aeon Basic Principles, Aeon practices its “Customer-First” philosophy with its everlasting innovative spirit. Editorial Policy Aeon Co., Ltd. believes its business activities contribute to a from the aspects of the environment and society. In addition, sustainable society. To further deepen its stakeholders’ with regard to its seven priority issues, including the four understanding of its business activities, from the current society-related priority issues newly specified in a materiality fiscal year Aeon has decided to publish an Integrated Report assessment conducted during fiscal 2016, this section reports that incorporates the Aeon Environmental and Social Report. in detail on management approaches, progress toward key The first half of the Report introduces the orientation of performance indicators and individual activities. -

Retail Foods

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/22/2016 GAIN Report Number: JA6522 Japan Retail Foods Retail Sector Approved By: Rachel Nelson, ATO Director Prepared By: Sumio Thomas Aoki, Senior Marketing Specialist Interns Amani Kidd, Takaaki Takeichi, Dianna Santodonato Report Highlights: Despite a high level of spending from a record influx of inbound tourists to Japan, the Japanese retail sector overall suffered in 2015 in response to lingering effects of the April 2014 consumption tax hike, a relatively weaker yen, and lower consumer spending overall. Competition for shelf space in intense, and convenience stores are a dynamic and powerful player in this sector. Post: Tokyo ATO Table of Contents Executive Summary Section1. Japan Retail Food Summary Structure and Overall Value International Competition and Imports Regional Sales Retailer Trends Advantages and Challenges table Section II. Roadmap for Market Entry Entry Strategy Market Structure Supermarkets Specialty Supermarkets Convenience Stores, Gas stations, Kiosks Department Store Food Sales Company Profiles Section III. Competition Section IV. Consumer Trends and Best Product Prospects Section V. Post Contact and Further Information Executive Summary The Japanese yen weakened in 2015, averaging 122.05 yen per 1 U.S. dollar. Consumer confidence rose slightly at the end of the year to 42.6 percent in December, from 39.2 percent at the beginning of the year, however consumption was weaker in 2015 than 2014. This reflected a lingering effect of the first consumption tax increase in 17 years. -

Optionalistapril2019.Pdf

Account Number Name Address City Zip Code County Signed Affidavit Returned Affidavit Option Final Notice Sent DL20768 Vons Market 1430 S Fairfax Ave Los Angeles 90019 Los Angeles 4/28/17 OPTION A 4/19/17 DL20769 Sunshine Liquor 5677 W Pico Blvd Los Angeles 90019 Los Angeles 4/25/17 OPTION A 4/19/17 DL20771 Selam Market 5534 W Pico Blvd Los Angeles 90019 Los Angeles 4/27/17 OPTION A 4/19/17 DL61442 7-Eleven Food Store 1075 S Fairfax Ave Los Angeles 90019 Los Angeles 5/8/17 OPTION A 4/19/17 DL63467 Walgreens Drug Store 5843 W Pico Blvd Los Angeles 90019 Los Angeles 5/2/17 OPTION A 4/19/17 DL141090.001 Jordan Market 1449 Westwood Blvd Los Angeles 90024 Los Angeles 7/28/14 OPTION A 7/17/14 DL220910.001 Target 10861 Weyburn Ave Los Angeles 90024 Los Angeles 12/4/14 OPTION A DL28742 7-Eleven 1400 Westwood Blvd Los Angeles 90024 Los Angeles 3/24/15 OPTION A 7/17/14 DL28743 Tochal Mini Market 1418 Westwood Blvd Los Angeles 90024 Los Angeles 7/29/14 OPTION A 7/17/14 DL28745 Bristol Farms 1515 Westwood Blvd Los Angeles 90024 Los Angeles 12/3/14 OPTION A 7/17/14 DL41783 Stop Market 958 Gayley Ave Los Angeles 90024 Los Angeles 7/21/14 OPTION A 7/17/14 DL54515 Ralphs Fresh Fare 10861 Weyburn Ave Los Angeles 90024 Los Angeles 11/24/14 OPTION A 7/17/14 DL55831 Chevron 10984 Le Conte Ave Los Angeles 90024 Los Angeles 11/24/14 OPTION A 7/17/14 DL60416 Whole Foods Market 1050 Gayley Ave Los Angeles 90024 Los Angeles 8/7/14 OPTION A 7/17/14 DL61385 CVS/pharmacy 1001 Westwood Blvd Los Angeles 90024 Los Angeles 4/23/15 OPTION A 7/17/14 DL61953 CVS/pharmacy -

Foodservice Underserviced: Unlocking Growth Opportunities for Grocery Retailers in Southeast Asia

Executive Insights Volume XVIII, Issue 49 Foodservice Underserviced: Unlocking Growth Opportunities for Grocery Retailers in Southeast Asia Khun Pimolpa runs a fusion Thai-Italian cuisine At the same time, the Big C hypermarket that she visits is also restaurant in the Sukhumvit district of Bangkok. struggling. Like-for-like sales at Big C have been under pressure in the past few years due to intense competition from new stores Business has been good for her over the past and new variations of store formats, combined with a sluggish decade, as she has been able to increase sales economy overall. by 4-5% annually, an upward trend that has Khun Pimolpa’s story is not the only one of its kind. Across been benefiting the rest of the Thai food service Southeast Asia, similar stories can be heard in various parts of the region, where grocery retailers are experiencing slowing industry. Despite the surge in income, Khun sales growth. However, a key customer segment — small and Pimolpa is tired — she starts the day at 5 a.m. medium-sized foodservice operators — remains underserved. and does not finish till 11 p.m. Aside from Growth in the foodservice industry the everyday operation of her outlet, she also Favorable trends such as rising income levels and urbanization spends a significant amount of time and effort are supporting the growth of “eating out” across Southeast Asia. In countries like Malaysia, Indonesia, the Philippines and sourcing inputs — fresh meats and vegetables Vietnam, growing populations and demographics (the young at the wet market, dry groceries at the Big C are more likely to dine out than older individuals) are further hypermarket — and purchasing emergency boosting demand. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Retail in Vietnam an Accelerated Shift Towards Omnichannel Retailing

Retail in Vietnam An accelerated shift towards omnichannel retailing July 2020 Retail in Vietnam | An accelerated shift towards omnichannel retailing Foreword 03 Economic resilience in the face of COVID-19 04 Robust and resilient economic fundamentals 05 How COVID-19 is changing the Vietnamese consumer 06 Stay home, stay healthy 07 Broad-based shift towards e-commerce 08 Segment analysis 09 Traditional grocery retailers 09 Convenience stores 10 Hypermarkets and supermarkets 11 e-Commerce 12 Looking ahead 14 Contact us 15 02 Retail in Vietnam | An accelerated shift towards omnichannel retailing Foreword As early and decisive COVID-19 containment efforts bear fruit, Vietnam is expected to remain one of the fastest-growing economies in Southeast Asia. On the back of strong and resilient economic fundamentals, Vietnamese consumers are also amongst the most optimistic despite the onset of the global pandemic. But that is not to say that retail will return to business as usual after the crisis. Within a few short weeks, COVID-19 has resulted in social distancing across Vietnam, isolating people in their homes and shutting down parts of the economy. From a retail sector perspective, products that were once basic needs have now become priority human needs, which now need to be delivered without the high degree of physical, in-person interaction that we have become accustomed to. Delivering this entails a mindset shift for many retails players. Before the onset of COVID-19, the retail sector did not need to think too hard about how to serve basic human needs: the focus then was primarily on investing in offerings to serve the Vietnamese consumer across varying levels of sophistication, and clearly articulating value propositions and brand associations. -

Vanguard Total World Stock Index Fund Annual Report October 31, 2020

Annual Report | October 31, 2020 Vanguard Total World Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

Annual Report 2007

Fully Global, Truly Local Annual Report 2007 Fiscal year ended February 20, 2007 A leading-edge, global-level operating and management infrastructure raises the quality and satisfaction of shopping with ÆON. 155 ÆON companies in Japan and overseas apply a “glocal (global + local) strategy”: global-class management systems tailored to local needs in a drive to be the best local retailer wherever we operate. Our business is based on large-scale shopping centers serving their respective communi- ties with tailored services comprising GMS (general merchandise store) retail, supermarkets, drugstores, home centers, convenience stores, specialty stores, shopping-mall development, financial services, entertainment, food services and more. ÆON is growing through internal expansion and strategic tie-ups that add new services, synergy and sales. Being the best local retailer means being the best at meeting local needs, with shuttle buses, environmental action and direct community involvement. Contents Highlights for the year 2 Financial section 29 The President’s message 4 Board of directors and executive officers 67 The Chairman’s message 6 Corporate responsibility 68 Review of operations 12 Corporate history 73 Environmental and social contribution activities 24 Major group companies 77 Shareholder information 77 ÆON ANNUAL REPORT 2007 1 Applying unique management know-how to develop and manage shopping malls centered on each community, ÆON is building a uniquely positioned retail network in Japan and overseas. In fact, ÆON shopping mall facilities -

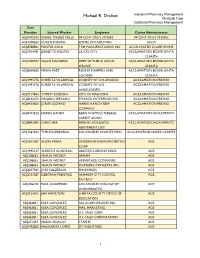

Additional Case Information

Michael R. Drobot Industrial Pharmacy Management MediLab Corp California Pharmacy Management Case Number Injured Worker Employer Claims Administrator ADJ7472102 ISMAEL TORRES VALLE 99 CENT ONLY STORES 99 CENT ONLY STORES ADJ1308567 CURTIS RIGGINS EMPIRE DISTRIBUTORS ACCA ADJ8768841 MARTIN AVILA TRM MANUFACTURING INC ACCELERATED CLAIMS IRVINE ADJ7014781 JEANETTE WILSON LA COUNTY ACCLAMATION 802108 SANTA CLARITA ADJ7200937 SUSAN NAVARRO DEPT OF PUBLIC SOCIAL ACCLAMATION 802108 SANTA SERVICE CLARITA ADJ8009655 MARIA PAEZ RUSKIN DAMPERS AND ACCLAMATION 802108 SANTA LOUVERS CLARITA ADJ1993776 ROBERTA VILLARREAL COUNTY OF LOS ANGELES ACCLAMATION FRESNO ADJ1993776 ROBERTA VILLARREAL COUNTY OF LOS ACCLAMATION FRESNO ANGELES/DPSS ADJ7117844 TOMMY ROBISON CITY OF MARICOPA ACCLAMATION FRESNO ADJ8162473 ONORIO SERRANO ESPARZA ENTERPRISES INC ACCLAMATION FRESNO ADJ8420600 JORGE LOZANO HARRIS RANCH BEEF ACCLAMATION FRESNO COMPANY ADJ8473212 DAREN HANDY KERN SCHOOLS FEDERAL ACCLAMATION SACRAMENTO CREDIT UNION ADJ8845092 CHAO HER FRESNO MOSQUITO ACCLAMATION SACRAMENTO ABATEMENT DIST ADJ1361532 THELMA JENNINGS LOS ANGELES COUNTY/DPSS ACCLAMATION SANTA CLARITA ADJ1611037 ALICIA MORA ANDERSON BARROWS METALS ACE CORP ADJ1995137 ALBERTO GUNDRAN ABLESTIK LABORATORIES ACE ADJ208633 SHAUN WIDNEY AMPAM ACE ADJ208633 SHAUN WIDNEY AMPAM RCR COMPANIES ACE ADJ208633 SHAUN WIDNEY PLUMBING CONCEPTS INC ACE ADJ2237965 JOSE CALDERON FMI EXPRESS ACE ADJ2353287 DEBORAH PRENTICE ANAHEIM CITY SCHOOL ACE DISTRICT ADJ246218 PAUL LIGAMMARI LOS ANGELES COLLEGE OF ACE CHIROPRACTIC