EU Market Research - Guinea Coffee

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

North America Other Continents

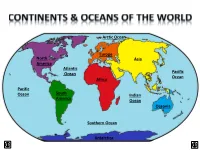

Arctic Ocean Europe North Asia America Atlantic Ocean Pacific Ocean Africa Pacific Ocean South Indian America Ocean Oceania Southern Ocean Antarctica LAND & WATER • The surface of the Earth is covered by approximately 71% water and 29% land. • It contains 7 continents and 5 oceans. Land Water EARTH’S HEMISPHERES • The planet Earth can be divided into four different sections or hemispheres. The Equator is an imaginary horizontal line (latitude) that divides the earth into the Northern and Southern hemispheres, while the Prime Meridian is the imaginary vertical line (longitude) that divides the earth into the Eastern and Western hemispheres. • North America, Earth’s 3rd largest continent, includes 23 countries. It contains Bermuda, Canada, Mexico, the United States of America, all Caribbean and Central America countries, as well as Greenland, which is the world’s largest island. North West East LOCATION South • The continent of North America is located in both the Northern and Western hemispheres. It is surrounded by the Arctic Ocean in the north, by the Atlantic Ocean in the east, and by the Pacific Ocean in the west. • It measures 24,256,000 sq. km and takes up a little more than 16% of the land on Earth. North America 16% Other Continents 84% • North America has an approximate population of almost 529 million people, which is about 8% of the World’s total population. 92% 8% North America Other Continents • The Atlantic Ocean is the second largest of Earth’s Oceans. It covers about 15% of the Earth’s total surface area and approximately 21% of its water surface area. -

From Operation Serval to Barkhane

same year, Hollande sent French troops to From Operation Serval the Central African Republic (CAR) to curb ethno-religious warfare. During a visit to to Barkhane three African nations in the summer of 2014, the French president announced Understanding France’s Operation Barkhane, a reorganization of Increased Involvement in troops in the region into a counter-terrorism Africa in the Context of force of 3,000 soldiers. In light of this, what is one to make Françafrique and Post- of Hollande’s promise to break with colonialism tradition concerning France’s African policy? To what extent has he actively Carmen Cuesta Roca pursued the fulfillment of this promise, and does continued French involvement in Africa constitute success or failure in this rançois Hollande did not enter office regard? France has a complex relationship amid expectations that he would with Africa, and these ties cannot be easily become a foreign policy president. F cut. This paper does not seek to provide a His 2012 presidential campaign carefully critique of President Hollande’s policy focused on domestic issues. Much like toward France’s former African colonies. Nicolas Sarkozy and many of his Rather, it uses the current president’s predecessors, Hollande had declared, “I will decisions and behavior to explain why break away from Françafrique by proposing a France will not be able to distance itself relationship based on equality, trust, and 1 from its former colonies anytime soon. solidarity.” After his election on May 6, It is first necessary to outline a brief 2012, Hollande took steps to fulfill this history of France’s involvement in Africa, promise. -

The North Caucasus: the Challenges of Integration (III), Governance, Elections, Rule of Law

The North Caucasus: The Challenges of Integration (III), Governance, Elections, Rule of Law Europe Report N°226 | 6 September 2013 International Crisis Group Headquarters Avenue Louise 149 1050 Brussels, Belgium Tel: +32 2 502 90 38 Fax: +32 2 502 50 38 [email protected] Table of Contents Executive Summary ................................................................................................................... i Recommendations..................................................................................................................... iii I. Introduction ..................................................................................................................... 1 II. Russia between Decentralisation and the “Vertical of Power” ....................................... 3 A. Federative Relations Today ....................................................................................... 4 B. Local Government ...................................................................................................... 6 C. Funding and budgets ................................................................................................. 6 III. Elections ........................................................................................................................... 9 A. State Duma Elections 2011 ........................................................................................ 9 B. Presidential Elections 2012 ...................................................................................... -

Country by Country Reporting

COUNTRY BY COUNTRY REPORTING PUBLICATION REPORT 2018 (REVISED) Anglo American is a leading global mining company We take a responsible approach to the management of taxes, As we strive to deliver attractive and sustainable returns to our with a world class portfolio of mining and processing supporting active and constructive engagement with our stakeholders shareholders, we are acutely aware of the potential value creation we operations and undeveloped resources. We provide to deliver long-term sustainable value. Our approach to tax is based can offer to our diverse range of stakeholders. Through our business on three key pillars: responsibility, compliance and transparency. activities – employing people, paying taxes to, and collecting taxes the metals and minerals to meet the growing consumer We are proud of our open and transparent approach to tax reporting. on behalf of, governments, and procuring from host communities – driven demands of the world’s developed and maturing In addition to our mandatory disclosure obligations, we are committed we make a significant and positive contribution to the jurisdictions in economies. And we do so in a way that not only to furthering our involvement in voluntary compliance initiatives, such which we operate. Beyond our direct mining activities, we create and generates sustainable returns for our shareholders, as the Tax Transparency Code (developed by the Board of Taxation in sustain jobs, build infrastructure, support education and help improve but also strives to make a real and lasting positive Australia), the Responsible Tax Principles (developed by the B Team), healthcare for employees and local communities. By re-imagining contribution to society. -

Chirac and ‘La Franc¸Afrique’: No Longer a Family Affair Tony Chafer

Modern & Contemporary France Vol. 13, No. 1, February 2005, pp. 7–23 Chirac and ‘la Franc¸afrique’: No Longer a Family Affair Tony Chafer Since political independence, France has maintained a privileged sphere of influence—the so-called ‘pre´ carre´’—in sub-Saharan Africa, based on a series of family-like ties with its former colonies. The cold war provided a favourable environment for the development of this special relationship, as the USA saw the French presence in this part of the world as useful for the containment of Communism. However, following the end of the cold war, France has had to adapt to a new international policy environment that is more competitive and less conducive to the maintenance of such family-like ties. This article charts the evolution of Franco-African relations in an era of globalisation, as French governments have undertaken a hesitant process of policy adaptation since the mid-1990s. Unlike decolonisation in Indochina and Algeria, the transfer of power in Black Africa was largely peaceful; as a result, there was no rupture of relations with the former colonial power. On the contrary, the years after independence were marked by an intensification of the links with France. Official rhetoric often referred to the great Franco-African family and the term ‘la Franc¸afrique’ testified to a symbiotic relationship in which ‘Africa is experienced in French representations as a natural extension where the Francophone world and Francophilia merge’ (Bourmaud, 2000). In fact, a wide variety of terms have been coined to describe -

Global Conservation Strategy for Coffee Genetic Resources

2017 GLOBAL CONSERVATION STRATEGY FOR COFFEE GENETIC RESOURCES Paula Bramel Sarada Krishnan Daniela Horna Brian Lainoff Christophe Montagnon ™ TABLE OF EXECUTIVE SUMMARY .................. 5 CONTENTS INTRODUCTION ...................... 8 STATUS OF THE MAJOR EX SITU ........... 20 COFFEE COLLECTIONS VISITS TO COFFEE EX SITU AND IN SITU SITES ... 26 FOFIFA Kianjavato Coffee Research Station, Madagascar ................................ 27 Kenya Coffee Research Institute ................... 30 Choche Field Genebank (Ethiopian Biodiversity Institute) ................... 33 Centre National de la Recherche Agronomique (CNRA) Coffee Genebank ............... 34 Centro Agronomico Tropical de Investigacion y Ensenanza (CATIE) ................ 36 Centro National de Investigaciones de Café (CENICAFE), Manizales, Colombia ............. 39 Instituto Agronomico do Parana (IAPAR), Londrina, Brazil ............................. 40 Central coffee research institute (CCRI), india ........... 42 Visit to other sites ............................ 44 Summary of site visits ......................... 44 GLOBAL STRATEGY TO SECURE CONSERVATION .. 48 AND USE OF COFFEE GENETIC RESOURCES FOR THE LONG TERM REFERENCES ........................ 58 ANNEXES .......................... 62 I Acronmyns ............................... 63 II List of Coffee Species ......................... 64 III Coffee Ex Situ Field Collections (Previously Reported) ....... 69 IV Acknowledgements ......................... 71 STATUS OF THE MAJOR EX SITU COFFEE COLLECTIONS | 3 4 | INTRODUCTION GLOBAL -

THE LIMITS of SELF-DETERMINATION in OCEANIA Author(S): Terence Wesley-Smith Source: Social and Economic Studies, Vol

THE LIMITS OF SELF-DETERMINATION IN OCEANIA Author(s): Terence Wesley-Smith Source: Social and Economic Studies, Vol. 56, No. 1/2, The Caribbean and Pacific in a New World Order (March/June 2007), pp. 182-208 Published by: Sir Arthur Lewis Institute of Social and Economic Studies, University of the West Indies Stable URL: http://www.jstor.org/stable/27866500 . Accessed: 11/10/2013 20:07 Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at . http://www.jstor.org/page/info/about/policies/terms.jsp . JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact [email protected]. University of the West Indies and Sir Arthur Lewis Institute of Social and Economic Studies are collaborating with JSTOR to digitize, preserve and extend access to Social and Economic Studies. http://www.jstor.org This content downloaded from 133.30.14.128 on Fri, 11 Oct 2013 20:07:57 PM All use subject to JSTOR Terms and Conditions Social and Economic Studies 56:1&2 (2007): 182-208 ISSN:0037-7651 THE LIMITS OF SELF-DETERMINATION IN OCEANIA Terence Wesley-Smith* ABSTRACT This article surveys processes of decolonization and political development inOceania in recent decades and examines why the optimism of the early a years of self government has given way to persistent discourse of crisis, state failure and collapse in some parts of the region. -

Tarapoto Facultad De Ingeniería Agroindustrial Escuela Profesional De Ingeniería Agroindustrial

UNIVERSIDAD NACIONAL DE SAN MARTÍN - TARAPOTO FACULTAD DE INGENIERÍA AGROINDUSTRIAL ESCUELA PROFESIONAL DE INGENIERÍA AGROINDUSTRIAL vii VII CICLO DE COMPLEMENTACIÓN ACADEMICA FIAI 2008 INFORME DE INGENIERÍA SISTEMA DE POSTCOSECHA DEL CAFÉ (Coffea arabica) EN LA REGIÓN SAN MARTÍN PRESENTADO POR: BACH. MAX HARRIS PHILIPPS PAREDES PARA OPTAR EL TÍTULO PROFESIONAL DE: INGENIERO AGROINDUSTRIAL. TARAPOTO – PERÚ 2017 UNIVERSIDAD NACIONAL DE SAN MARTÍN – TARAPOTO FACULTAD DE INGENIERÍA AGROINDUSTRIAL ESCUELA PROFECIONAL DE INGENIERÍA AGROINDUSTRIAL INFORME DE INGENIERÍA SISTEMA DE POSTCOSECHA DEL CAFÉ (Coffea arabica) EN LA REGIÓN SAN MARTÍN PRESENTADO POR: BACH. MAX HARRIS PHILIPPS PAREDES PARA OPTAR EL TITULO PROFESIONAL DE: INGENIERO AGROINDUSTRIAL TARAPOTO - PERÚ 2017 ii iii iv v DEDICATORIA Este trabajo está dedicado a mis padres Sr. César Augusto y la Sra. Licet, que siempre me motivaron y me apoyaron para cumplir mis metas. A mi esposa Nancy Luz y a mis hijos Max Harris y Stephany Carolina, a quienes dedico este trabajo expresándoles mi profundo cariño y amor. MAX HARRIS PHILIPPS PAREDES iv 13 AGRADECIMIENTO • A Dios por estar siempre conmigo para realizar mis sueños y mis metas. • Al Ing. Dr. Euler Navarro Pinedo, catedrático de la facultad de ingeniería agroindustria, por el asesoramiento del presente informe de ingeniería. • A mis hermanos que me apoyaron y me aconsejaron en todo momento. • A todos mis docentes, que me formaron para ser profesional, a los técnicos y administrativos que formaron parte de mi formación profesional. • A todos mis amigos que me apoyaron con la información y con su apoyo desinteresado en la culminación de mi trabajo. MAX HARRIS PHILIPPS PAREDES 14v INDICE GENERAL DEDICATORIA ..................................................................................................... -

Biogas Potential Assessment of Animal Waste in Macenta Prefecture (Republic of Guinea)

Vol-4 Issue-5 2018 IJARIIE-ISSN(O)-2395-4396 Biogas potential assessment of animal waste in Macenta prefecture (Republic of Guinea) Ansoumane SAKOUVOGUI1, Mamadou Foula BARRY1, Mamby KEITA2, Saa Poindo TONGUINO4 [email protected], [email protected], [email protected], [email protected] 1,2 Higher Institute of Technology of Mamou - Guinea 3Department of Physics, Gamal Abdel Nasser University of Conakry - Guinea 4Higher Institute Agronomic of Faranah - Guinea ABSTRACT This study focuses on the evaluation of the biogas potential of animal wastes in Macenta Prefecture. The census of the three types of herds living in 14 sub-prefectures and the urban commune of Macenta was carried out, of which: 13386 cattles, 17418 pigs and 20005 laying hens. The assessment of daily waste by type of animal was made .The results were 4.23 kg/day of dung per cow; 2.41 kg/d and 2.21 kg/d of pig slurry respectively in semi- improved and local breeding; 0.013 kg/day of droppings per hen. These values made possible to estimate the daily quantities of waste by type of livestock: cow dung (56622.78 kg), pig manure (40967.38 kg) and chicken manure (260.065 kg). The total daily biogas potential of the waste is therefor of the order of 8969.606 m3, distributed as follows: 6164.427 m3 for cow dung; 2332.117 m3 for pig manure and 473.063 m3 for chicken manure. This potential is distributed by locality and livestock types. Keywords: Evaluation, Potential, Biogas, Waste, Animal. 1. Introduction Biogas is a colorless and flammable gas produced by anaerobic digestion of animal, plant, human, industrial and municipal waste. -

Coffee Plant the Coffee Plant Makes a Great Indoor, Outdoor Shade, Or Office Plant

Coffee Plant The coffee plant makes a great indoor, outdoor shade, or office plant. Water when dry or the plant will let you know when it droops. Do not let it sit in water so tip over the pot if you over water the plant. Preform the finger test to check for dryness. When the plant is dry about an inch down, water thoroughly. The plant will stay pot bound about two years at which time you will transplant and enjoy a beautiful ornamental plant. See below. Coffea From Wikipedia, the free encyclopedia This article is about the biology of coffee. For the beverage, see Coffee. Coffea Coffea arabica trees in Brazil Scientific classification Kingdom: Plantae (unranked): Angiosperms (unranked): Eudicots (unranked): Asterids Order: Gentianales Family: Rubiaceae Subfamily: Ixoroideae Tribe: Coffeeae[1] Genus: Coffea L. Type species Coffea arabica L.[2] Species Coffea ambongensis Coffea anthonyi Coffea arabica - Arabica Coffee Coffea benghalensis - Bengal coffee Coffea boinensis Coffea bonnieri Coffea canephora - Robusta coffee Coffea charrieriana - Cameroonian coffee - caffeine free Coffea congensis - Congo coffee Coffea dewevrei - Excelsa coffee Coffea excelsa - Liberian coffee Coffea gallienii Coffea liberica - Liberian coffee Coffea magnistipula Coffea mogeneti Coffea stenophylla - Sierra Leonian coffee Coffea canephora green beans on a tree in Goa, India. Coffea is a large genus (containing more than 90 species)[3] of flowering plants in the madder family, Rubiaceae. They are shrubs or small trees, native to subtropical Africa and southern Asia. Seeds of several species are the source of the popular beverage coffee. After their outer hull is removed, the seeds are commonly called "beans". -

Fl. China 19: 90–92. 2011. 18. COFFEA Linnaeus, Sp. Pl. 1

Fl. China 19: 90–92. 2011. 18. COFFEA Linnaeus, Sp. Pl. 1: 172. 1753. 咖啡属 ka fei shu Chen Tao (陈涛); Charlotte M. Taylor Cafe Adanson. Shrubs or small trees, unarmed, often resinous on young growth; lateral branches usually spreading horizontally. Raphides absent. Leaves opposite or rarely in whorls of 3, distichous at least on lateral branches, often with foveolate and/or pilosulous doma- tia; stipules persistent, shortly united around stem, generally triangular, sometimes aristate. Inflorescences axillary, in each axil with 1 to several capitate to fasciculate, 1- to several-flowered cymes, these sessile to shortly pedunculate, bracteate; bracts often fused in cupulate pairs (i.e., forming a calyculus). Flowers sessile or shortly pedicellate, bisexual, monomorphic. Calyx limb obsolete or occasionally truncate or 4–6-toothed. Corolla white or pink, salverform or funnelform, inside glabrous or villous in throat; lobes 4–9, convolute in bud. Stamens 4–8, inserted in corolla throat, exserted; filaments absent or short; anthers dorsifixed near base. Ovary 2- celled, ovules 1 in each cell, attached at middle of septum; stigma 2-lobed, exserted. Fruit red, yellow, orange, blue, or black, drupa- ceous, globose to ellipsoid, fleshy or infrequently dry, with calyx limb when developed persistent; pyrenes 2, each 1-celled, with 1 seed, plano-convex, leathery or papery, on ventral (i.e., adaxial) face with longitudinal groove; seeds medium-sized to large, longitudinally grooved on ventral face; radicle terete, basiscopic. About 103 species: native to tropical Africa, Madagascar, and the Mascarene Islands, several species and hybrids cultivated in moist tropical regions worldwide; five species (all introduced) in China. -

Friday 27 Lifestyle | Features Friday, April 23, 2021

Friday 27 Lifestyle | Features Friday, April 23, 2021 This handout photograph released by CRB Coffea, IRD-CIRAD, shows harvested Coffea stenophylla at This handout photograph released by CRB Coffea, IRD-CIRAD, shows harvested Coffea stenophylla at the Coffea Biological Resources Centre/French Agricultural Research Centre for International the Coffea Biological Resources Centre/French Agricultural Research Centre for International Development (CIRAD) on the French Indian Ocean island of Reunion . Development (CIRAD) on the French Indian Ocean island of Reunion. and early 1900s, its popularity spreading to Change brewing importance of conserving the world’s wild the cafes of France. It fell out of use in the Having searched for stenophylla for years, plants and biodiversity. Researchers say 20th century, vanishing completely from the Davis was aware that historical reports sug- more work needs to be done to work out record in 1954, until scientists finally found it gested it could be as good as Arabica. In his exactly where it could adapt to be grown, but growing in the wild in Sierra Leone in 2018 book A Monograph of the Economic Species it could be in tropical areas where Arabica is and set about studying its temperature toler- of the Genus Coffea L, published in 1925, already under pressure from warming. — AFP ance-and its flavor. Last year they carried Ralph Holt Cheney said both local people out a blind taste test with a jury of industry and French merchants in Sierra Leone professionals from coffee brands Nespresso thought the stenophylla beans were “superior and Jacobs Douwe Egberts. to those of all other species”.