A Monetary Analysis of Ghana

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Code List 11 Invoice Currency

Code list 11 Invoice currency Alphabetical order Code Code Alfa Alfa Country / region Country / region A BTN Bhutan ngultrum BOB Bolivian boliviano AFN Afghan new afghani BAM Bosnian mark ALL Albanian lek BWP Botswanan pula DZD Algerian dinar BRL Brazilian real USD American dollar BND Bruneian dollar AOA Angolan kwanza BGN Bulgarian lev ARS Argentinian peso BIF Burundi franc AMD Armenian dram AWG Aruban guilder AUD Australian dollar C AZN Azerbaijani new manat KHR Cambodian riel CAD Canadian dollar B CVE Cape Verdean KYD Caymanian dollar BSD Bahamian dollar XAF CFA franc of Central-African countries BHD Bahraini dinar XOF CFA franc of West-African countries BBD Barbadian dollar XPF CFP franc of Oceania BZD Belizian dollar CLP Chilean peso BYR Belorussian rouble CNY Chinese yuan renminbi BDT Bengali taka COP Colombian peso BMD Bermuda dollar KMF Comoran franc Code Code Alfa Alfa Country / region Country / region CDF Congolian franc CRC Costa Rican colon FKP Falkland Islands pound HRK Croatian kuna FJD Fijian dollar CUC Cuban peso CZK Czech crown G D GMD Gambian dalasi GEL Georgian lari DKK Danish crown GHS Ghanaian cedi DJF Djiboutian franc GIP Gibraltar pound DOP Dominican peso GTQ Guatemalan quetzal GNF Guinean franc GYD Guyanese dollar E XCD East-Caribbean dollar H EGP Egyptian pound GBP English pound HTG Haitian gourde ERN Eritrean nafka HNL Honduran lempira ETB Ethiopian birr HKD Hong Kong dollar EUR Euro HUF Hungarian forint F I Code Code Alfa Alfa Country / region Country / region ISK Icelandic crown LAK Laotian kip INR Indian rupiah -

The Strategic Asset Allocation for Foreign Exchange Reserves Management in National Bank of Rwanda

THE STRATEGIC ASSET ALLOCATION FOR FOREIGN EXCHANGE RESERVES MANAGEMENT IN NATIONAL BANK OF RWANDA Dr. Satya K. Murty and Mr. Jotham Majyalibu School of Finance and Banking, Kigali - Rwanda 1. Background One of the complex businesses dedicated to the Central Banks is the management of foreign exchange reserves because of its requirements in terms of tight follow up of the global economy and financial markets trend and the challenges involved in its strategic asset allocation. “Formulating Strategic Asset Allocations (SAA) is of fundamental importance to investors, as numerous studies show that SAA is the primary determinant of performance in diversified portfolios”1 . Strategic asset allocation is well defined as the long-term allocation of capital to different asset classes such as bonds, equity, real estate and other investment opportunities with an aim of increasing the capital and making an appreciable and optimum return. The National Bank of Rwanda (BNR) herein referred as a case study, is the Central Bank of the Republic of Rwanda with the missions that include among others holding and managing the foreign exchange reserves2. To fulfill that, Central banks use to choose an appropriate strategic asset allocation of the foreign exchange reserves in agreement with the overall policy and corporate objectives. The chosen SAA impacts the overall performance and risk management over time. Basically, formation of a portfolio in the area of foreign exchange reserves investment is subject to decisions on the currency composition 1 Brinson, Gary,L. Randolph Hood and Beebower, Gilbert, (1986) “Determinants of Portfolio Performance”, Financial Analysts Journal, No 5 , pp. 39-44. -

Macroeconomic Performance Report 2019

Macroeconomic Performance Report 2019 Economic Strategy and Research Division AUGUST 2020 Acronyms and Abbreviations ABFA Annual Budget Funding Amount BoG Bank of Ghana CAPI Carried and Participating Interest CAR Capital Adequacy Ratio CARES Coronavirus Alleviation, Revitalisation, and Enterprise Support CSOs Civil Society Organizations CST Communication Service Tax DACF District Assemblies Common Fund DMBs Deposit Money Banks ECF Extended Credit Facility EMDEs Emerging Market and Developing Economies ESPV Electronic Salary Payment Voucher EU European Union FDI Foreign Direct Investment GCX Ghana Commodity Exchange GDP Gross Domestic Product GETFUND Ghana Education Trust Fund GFIM Ghana Fixed Income Market GIFMIS Ghana Integrated Financial Management Information System GNPC Ghana National Petroleum Corporation GNGC Ghana National Gas Company GoG Government of Ghana GPFs Ghana Petroleum Funds GRA Ghana Revenue Authority ii GSE Ghana Stock Exchange GSE-CI Ghana Stock Exchange Composite Index GSE-FSI Ghana Stock Exchange Financial Stocks Index GSF Ghana Stabilisation Fund GSS Ghana Statistical Service ICM International Capital Market IGF Internally Generated Fund IMF International Monetary Fund IPP Independent Power Producers M2+ Broad Money Supply MDBS Multi Donor Budget Support MFIs Microfinance Institutions MoF Ministry of Finance MPR Macroeconomic Performance Report MTDS Medium-Term Debt Management Strategy NBFIs Non-Bank Financial Institutions NDA Net Domestic Assets NDF Net Domestic Financing NFA Net Foreign Assets NHIF National Health -

Money Creation in the Modern Economy

14 Quarterly Bulletin 2014 Q1 Money creation in the modern economy By Michael McLeay, Amar Radia and Ryland Thomas of the Bank’s Monetary Analysis Directorate.(1) This article explains how the majority of money in the modern economy is created by commercial banks making loans. Money creation in practice differs from some popular misconceptions — banks do not act simply as intermediaries, lending out deposits that savers place with them, and nor do they ‘multiply up’ central bank money to create new loans and deposits. The amount of money created in the economy ultimately depends on the monetary policy of the central bank. In normal times, this is carried out by setting interest rates. The central bank can also affect the amount of money directly through purchasing assets or ‘quantitative easing’. Overview In the modern economy, most money takes the form of bank low and stable inflation. In normal times, the Bank of deposits. But how those bank deposits are created is often England implements monetary policy by setting the interest misunderstood: the principal way is through commercial rate on central bank reserves. This then influences a range of banks making loans. Whenever a bank makes a loan, it interest rates in the economy, including those on bank loans. simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money. In exceptional circumstances, when interest rates are at their effective lower bound, money creation and spending in the The reality of how money is created today differs from the economy may still be too low to be consistent with the description found in some economics textbooks: central bank’s monetary policy objectives. -

Crown Agents Bank's Currency Capabilities

Crown Agents Bank’s Currency Capabilities August 2020 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Majors Australia Australian Dollar AUD ✓ ✓ - - M Canada Canadian Dollar CAD ✓ ✓ - - M Denmark Danish Krone DKK ✓ ✓ - - M Europe European Euro EUR ✓ ✓ - - M Japan Japanese Yen JPY ✓ ✓ - - M New Zealand New Zealand Dollar NZD ✓ ✓ - - M Norway Norwegian Krone NOK ✓ ✓ - - M Singapore Singapore Dollar SGD ✓ ✓ - - E Sweden Swedish Krona SEK ✓ ✓ - - M Switzerland Swiss Franc CHF ✓ ✓ - - M United Kingdom British Pound GBP ✓ ✓ - - M United States United States Dollar USD ✓ ✓ - - M Africa Angola Angolan Kwanza AOA ✓* - - - F Benin West African Franc XOF ✓ ✓ ✓ - F Botswana Botswana Pula BWP ✓ ✓ ✓ - F Burkina Faso West African Franc XOF ✓ ✓ ✓ - F Cameroon Central African Franc XAF ✓ ✓ ✓ - F C.A.R. Central African Franc XAF ✓ ✓ ✓ - F Chad Central African Franc XAF ✓ ✓ ✓ - F Cote D’Ivoire West African Franc XOF ✓ ✓ ✓ ✓ F DR Congo Congolese Franc CDF ✓ - - ✓ F Congo (Republic) Central African Franc XAF ✓ ✓ ✓ - F Egypt Egyptian Pound EGP ✓ ✓ - - F Equatorial Guinea Central African Franc XAF ✓ ✓ ✓ - F Eswatini Swazi Lilangeni SZL ✓ ✓ - - F Ethiopia Ethiopian Birr ETB ✓ ✓ N/A - F 1 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Africa Gabon Central African Franc XAF ✓ ✓ ✓ - F Gambia Gambian Dalasi GMD ✓ - - - F Ghana Ghanaian Cedi GHS ✓ ✓ - ✓ F Guinea Guinean Franc GNF ✓ - ✓ - F Guinea-Bissau West African Franc XOF ✓ ✓ - - F Kenya Kenyan Shilling KES ✓ ✓ ✓ ✓ F Lesotho Lesotho Loti LSL ✓ ✓ - - E Liberia Liberian -

GMCIF Global Multi-Currency Input File

Global Multi-Currency Input File (GMCIF) Version 2.68 Global Multi-Currency Settlement File (GMCIF) Introduction ........................................................................................................................................... 4 Purpose of Document ..................................................................................................................................... 4 Supporting Documentation............................................................................................................................. 4 Support Services .............................................................................................................................................. 4 File Processing ...................................................................................................................................... 5 File Delivery ..................................................................................................................................................... 5 Processing Cycle .............................................................................................................................................. 5 Multiple Files ................................................................................................................................................... 5 Validation ....................................................................................................................................................... 5 Development Guidelines ..................................................................................................................... -

Ghana's Constitution of 1992 with Amendments Through 1996

PDF generated: 26 Aug 2021, 16:30 constituteproject.org Ghana's Constitution of 1992 with Amendments through 1996 This complete constitution has been generated from excerpts of texts from the repository of the Comparative Constitutions Project, and distributed on constituteproject.org. constituteproject.org PDF generated: 26 Aug 2021, 16:30 Table of contents Preamble . 14 CHAPTER 1: THE CONSTITUTION . 14 1. SUPREMACY OF THE CONSTITUTION . 14 2. ENFORCEMENT OF THE CONSTITUTION . 14 3. DEFENCE OF THE CONSTITUTION . 15 CHAPTER 2: TERRITORIES OF GHANA . 16 4. TERRITORIES OF GHANA . 16 5. CREATION, ALTERATION OR MERGER OF REGIONS . 16 CHAPTER 3: CITIZENSHIP . 17 6. CITIZENSHIP OF GHANA . 17 7. PERSONS ENTITLED TO BE REGISTERED AS CITIZENS . 17 8. DUAL CITIZENSHIP . 18 9. CITIZENSHIP LAWS BY PARLIAMENT . 18 10. INTERPRETATION . 19 CHAPTER 4: THE LAWS OF GHANA . 19 11. THE LAWS OF GHANA . 19 CHAPTER 5: FUNDAMENTAL HUMAN RIGHTS AND FREEDOMS . 20 Part I: General . 20 12. PROTECTION OF FUNDAMENTAL HUMAN RIGHTS AND FREEDOMS . 20 13. PROTECTION OF RIGHT TO LIFE . 20 14. PROTECTION OF PERSONAL LIBERTY . 21 15. RESPECT FOR HUMAN DIGNITY . 22 16. PROTECTION FROM SLAVERY AND FORCED LABOUR . 22 17. EQUALITY AND FREEDOM FROM DISCRIMINATION . 23 18. PROTECTION OF PRIVACY OF HOME AND OTHER PROPERTY . 23 19. FAIR TRIAL . 23 20. PROTECTION FROM DEPRIVATION OF PROPERTY . 26 21. GENERAL FUNDAMENTAL FREEDOMS . 27 22. PROPERTY RIGHTS OF SPOUSES . 29 23. ADMINISTRATIVE JUSTICE . 29 24. ECONOMIC RIGHTS . 29 25. EDUCATIONAL RIGHTS . 29 26. CULTURAL RIGHTS AND PRACTICES . 30 27. WOMEN'S RIGHTS . 30 28. CHILDREN'S RIGHTS . 30 29. RIGHTS OF DISABLED PERSONS . -

Bank Reserves and Broad Money in the Global Financial Crisis: a Quantitative Evaluation

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Chadha, Jagjit; Corrado, Luisa; Meaning, Jack; Schuler, Tobias Working Paper Bank reserves and broad money in the global financial crisis: A quantitative evaluation ECB Working Paper, No. 2463 Provided in Cooperation with: European Central Bank (ECB) Suggested Citation: Chadha, Jagjit; Corrado, Luisa; Meaning, Jack; Schuler, Tobias (2020) : Bank reserves and broad money in the global financial crisis: A quantitative evaluation, ECB Working Paper, No. 2463, ISBN 978-92-899-4380-2, European Central Bank (ECB), Frankfurt a. M., http://dx.doi.org/10.2866/73642 This Version is available at: http://hdl.handle.net/10419/229077 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. -

The State of the Economy: a Foundation of Concrete Or Straw?

THE STATE OF THE ECONOMY: A FOUNDATION OF CONCRETE OR STRAW? Speech Delivered by: Dr. Mahamudu Bawumia 2016 NPP Vice-Presidential Candidate At the: National Theatre September 8th, 2016 Accra 1 Mr. Chairman, H.E. John Agyekum Kufuor, Former President of the Republic of Ghana Presidential Candidate of the New Patriotic Party, Nana Addo Dankwa Akufo-Addo Honourable Members of Parliament Chiefs and Traditional Leaders Members of the Diplomatic Corps Representatives of other Political Parties Students Members of the Media Distinguished Invited Guests Fellow Ghanaians Ladies and Gentlemen Good evening! 2 I would like to thank all of you for taking the time out of your busy schedules to attend or listen to this lecture on the current state of our economy. First of all, I would like to assure all Ghanaians that this lecture, as has been the case with all my lectures, will be based on an objective analysis of the data that we have on the economy. Ultimately the data and the facts will speak for themselves. So what does the data say about the state of our economy after eight years of economic management under the NDC, with President John Mahama in charge as head of the economic management team for four years and as President for another four years. RESOURCE INFLOWS Mr. Chairman, any assessment of the state of the economy and the performance of the government must be against the background of the amount of resources at the disposal of the government. At a public lecture in September 2008, then Vice-Presidential candidate John Mahama said: "To whom much is given much is expected." I would like, with his permission, to borrow his exact words to describe his government’s exact performance in the last 8 years. -

Country Codes and Currency Codes in Research Datasets Technical Report 2020-01

Country codes and currency codes in research datasets Technical Report 2020-01 Technical Report: version 1 Deutsche Bundesbank, Research Data and Service Centre Harald Stahl Deutsche Bundesbank Research Data and Service Centre 2 Abstract We describe the country and currency codes provided in research datasets. Keywords: country, currency, iso-3166, iso-4217 Technical Report: version 1 DOI: 10.12757/BBk.CountryCodes.01.01 Citation: Stahl, H. (2020). Country codes and currency codes in research datasets: Technical Report 2020-01 – Deutsche Bundesbank, Research Data and Service Centre. 3 Contents Special cases ......................................... 4 1 Appendix: Alpha code .................................. 6 1.1 Countries sorted by code . 6 1.2 Countries sorted by description . 11 1.3 Currencies sorted by code . 17 1.4 Currencies sorted by descriptio . 23 2 Appendix: previous numeric code ............................ 30 2.1 Countries numeric by code . 30 2.2 Countries by description . 35 Deutsche Bundesbank Research Data and Service Centre 4 Special cases From 2020 on research datasets shall provide ISO-3166 two-letter code. However, there are addi- tional codes beginning with ‘X’ that are requested by the European Commission for some statistics and the breakdown of countries may vary between datasets. For bank related data it is import- ant to have separate data for Guernsey, Jersey and Isle of Man, whereas researchers of the real economy have an interest in small territories like Ceuta and Melilla that are not always covered by ISO-3166. Countries that are treated differently in different statistics are described below. These are – United Kingdom of Great Britain and Northern Ireland – France – Spain – Former Yugoslavia – Serbia United Kingdom of Great Britain and Northern Ireland. -

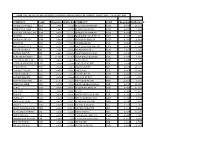

ZIMRA Rates of Exchange for Customs Purposes for Period 24 Dec 2020 To

ZIMRA RATES OF EXCHANGE FOR CUSTOMS PURPOSES FOR THE PERIOD 24 DEC 2020 - 13 JAN 2021 ZWL CURRENCY CODE CROSS RATEZIMRA RATECURRENCY CODE CROSS RATEZIMRA RATE ANGOLA KWANZA AOA 7.9981 0.1250 MALAYSIAN RINGGIT MYR 0.0497 20.1410 ARGENTINE PESO ARS 1.0092 0.9909 MAURITIAN RUPEE MUR 0.4819 2.0753 AUSTRALIAN DOLLAR AUD 0.0162 61.7367 MOROCCAN DIRHAM MAD 0.8994 1.1119 AUSTRIA EUR 0.0100 99.6612 MOZAMBICAN METICAL MZN 0.9115 1.0972 BAHRAINI DINAR BHD 0.0046 217.5176 NAMIBIAN DOLLAR NAD 0.1792 5.5819 BELGIUM EUR 0.0100 99.6612 NETHERLANDS EUR 0.0100 99.6612 BOTSWANA PULA BWP 0.1322 7.5356 NEW ZEALAND DOLLAR NZD 0.0173 57.6680 BRAZILIAN REAL BRL 0.0631 15.8604 NIGERIAN NAIRA NGN 4.7885 0.2088 BRITISH POUND GBP 0.0091 109.5983 NORTH KOREAN WON KPW 11.0048 0.0909 BURUNDIAN FRANC BIF 23.8027 0.0420 NORWEGIAN KRONER NOK 0.1068 9.3633 CANADIAN DOLLAR CAD 0.0158 63.4921 OMANI RIAL OMR 0.0047 212.7090 CHINESE RENMINBI YUANCNY 0.0800 12.5000 PAKISTANI RUPEE PKR 1.9648 0.5090 CUBAN PESO CUP 0.3240 3.0863 POLISH ZLOTY PLN 0.0452 22.1111 CYPRIOT POUND EUR 0.0100 99.6612 PORTUGAL EUR 0.0100 99.6612 CZECH KORUNA CZK 0.2641 3.7860 QATARI RIYAL QAR 0.0445 22.4688 DANISH KRONER DKK 0.0746 13.4048 RUSSIAN RUBLE RUB 0.9287 1.0768 EGYPTIAN POUND EGP 0.1916 5.2192 RWANDAN FRANC RWF 12.0004 0.0833 ETHOPIAN BIRR ETB 0.4792 2.0868 SAUDI ARABIAN RIYAL SAR 0.0459 21.8098 EURO EUR 0.0100 99.6612 SINGAPORE DOLLAR SGD 0.0163 61.2728 FINLAND EUR 0.0100 99.6612 SPAIN EUR 0.0100 99.6612 FRANCE EUR 0.0100 99.6612 SOUTH AFRICAN RAND ZAR 0.1792 5.5819 GERMANY EUR 0.0100 99.6612 -

Zimra Rates of Exchange for Customs Purposes for the Period 08 to 14 July

ZIMRA RATES OF EXCHANGE FOR CUSTOMS PURPOSES FOR THE PERIOD 08 TO 14 JULY 2021 USD BASE CURRENCY - USD DOLLAR CURRENCY CODE CROSS RATE ZIMRA RATE CURRENCY CODE CROSS RATE ZIMRA RATE ANGOLA KWANZA AOA 650.4178 0.0015 MALAYSIAN RINGGIT MYR 4.1598 0.2404 ARGENTINE PESO ARS 95.9150 0.0104 MAURITIAN RUPEE MUR 42.8000 0.0234 AUSTRALIAN DOLLAR AUD 1.3329 0.7503 MOROCCAN DIRHAM MAD 8.9490 0.1117 AUSTRIA EUR 0.8454 1.1829 MOZAMBICAN METICAL MZN 63.9250 0.0156 BAHRAINI DINAR BHD 0.3760 2.6596 NAMIBIAN DOLLAR NAD 14.3346 0.0698 BELGIUM EUR 0.8454 1.1829 NETHERLANDS EUR 0.8454 1.1829 BOTSWANA PULA BWP 10.9709 0.0912 NEW ZEALAND DOLLAR NZD 1.4232 0.7027 BRAZILIAN REAL BRL 5.1970 0.1924 NIGERIAN NAIRA NGN 410.9200 0.0024 BRITISH POUND GBP 0.7241 1.3810 NORTH KOREAN WON KPW 900.0228 0.0011 BURUNDIAN FRANC BIF 1983.5620 0.0005 NORWEGIAN KRONER NOK 8.7064 0.1149 CANADIAN DOLLAR CAD 1.2459 0.8026 OMANI RIAL OMR 0.3845 2.6008 CHINESE RENMINBI YUAN CNY 6.4690 0.1546 PAKISTANI RUPEE PKR 158.3558 0.0063 CUBAN PESO CUP 24.0957 0.0415 POLISH ZLOTY PLN 3.8154 0.2621 CYPRIOT POUND EUR 0.8454 1.1829 PORTUGAL EUR 0.8454 1.1829 CZECH KORUNA CZK 21.6920 0.0461 QATARI RIYAL QAR 3.6400 0.2747 DANISH KRONER DKK 6.2866 0.1591 RUSSIAN RUBLE RUB 74.2305 0.0135 EGYPTIAN POUND EGP 15.6900 0.0637 RWANDAN FRANC RWF 1001.5019 0.0010 ETHOPIAN BIRR ETB 43.9164 0.0228 SAUDI ARABIAN RIYAL SAR 3.7500 0.2667 EURO EUR 0.8454 1.1829 SINGAPORE DOLLAR SGD 1.3478 0.7419 FINLAND EUR 0.8454 1.1829 SPAIN EUR 0.8454 1.1829 FRANCE EUR 0.8454 1.1829 SOUTH AFRICAN RAND ZAR 14.3346 0.0698 GERMANY