EMEA Hydrogen a Revolution in Need of Realism; Separating the Opportunity from the Optimism

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Buses – Global Market Trends

2017 BUSES – GLOBAL MARKET TRENDS Markets – Competition – Companies – Key Figures Extract from the study BUSES – GLOBAL MARKET TRENDS Markets – Competition – Companies – Key figures In all regions across the globe, buses remain the most widespread public transport mode. Their demand goes hand in hand with several, mostly region-specific factors, including demographics, increasing mobility of people and environmental awareness, as well as public funding. Buses are comparatively to other transportation modes cheap and easy to use, since their use does not necessarily require the implementation of a specific infrastructure. This makes buses ideal vehicles for both short- and long-distance services. Based on the current developments, this Multi Client Study offers a comprehensive insight into the structure, volumes and development trends of the worldwide bus market. In concrete terms, the market study “BUSES – GLOBAL MARKET TRENDS” includes: A look at the worldwide market for buses differentiated by region An analysis of the relevant market data including present and future market volumes Information concerning the installed fleet and future procurement potential until 2022 An assessment of current developments and growth drivers of the worldwide bus markets in the individual regions An overview of bus manufacturers including an analysis of the market shares, financial backups as well as a brief description of the current product portfolio and strategy outlook A list of the major production facilities in each of the regions including product range as well as production capacities Presentation of the development stage of alternative propulsions, their manufacturers and their occurrence worldwide The study is available in English from the August 2017 at the price of EUR 3,400 plus VAT. -

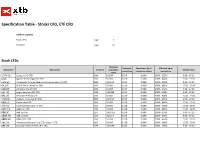

Specification Table - Stocks CFD, ETF CFD

Specification Table - Stocks CFD, ETF CFD Table of contents Stock CFDs page 1 ETF CFDs page 61 Stock CFDs Minimum Minimum Commission (% of XTB mark-up on Instrument Description Currency transaction Trading Hours commission transaction value) commission value 1COV.DE Covestro AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 A.US Agilent Technologies Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 A3M.ES Atresmedia Corp de Medios de Comunicacion SA CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AA.US* CLOSE ONLY / Alcoa Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAD.DE Amadeus Fire AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAL.UK Anglo American PLC CFD GBP 100 GBP 8 EUR 0.08% 100% - 200% 9:00 - 17:30 AAL.US American Airlines CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AALB.NL Aalberts Industries NV CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAN.US Aaron's Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAP.US Advance Auto Parts Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAPL.US Apple Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 ABB.SE ABB Ltd CFD SEK 1000 SEK 8 EUR 0.08% 100% - 430% 9:00 - 17:25 ABBN.CH ABB Ltd CFD CHF 150 CHF 8 EUR 0.08% 100% - 375% 9:00 - 17:20 ABBV.US Abbvie Inc. -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe SMID Cap 19 August 2021 Tradable Plus Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.72 UNITED Bureau Veritas S.A. 0.42 FRANCE Gjensidige Forsikring ASA 0.17 NORWAY KINGDOM Campari 0.31 ITALY Gn Store Nordic 0.53 DENMARK AAK 0.18 SWEDEN Carl Zeiss Meditec 0.33 GERMANY Halma 0.66 UNITED Aalberts NV 0.24 NETHERLANDS Castellum 0.32 SWEDEN KINGDOM ABN AMRO Bank NV 0.23 NETHERLANDS Centrica 0.2 UNITED Hargreaves Lansdown 0.39 UNITED Acciona S.A. 0.16 SPAIN KINGDOM KINGDOM Accor 0.32 FRANCE Chr. Hansen Holding A/S 0.43 DENMARK Hays 0.16 UNITED ACS Actividades Cons y Serv 0.3 SPAIN Clariant 0.21 SWITZERLAND KINGDOM Adecco Group AG 0.49 SWITZERLAND Coca-Cola HBC AG 0.33 UNITED HeidelbergCement AG 0.6 GERMANY Adevinta 0.21 NORWAY KINGDOM HelloFresh SE 0.67 GERMANY Admiral Group 0.43 UNITED Cofinimmo 0.21 BELGIUM Helvetia Holding AG 0.18 SWITZERLAND KINGDOM Commerzbank 0.35 GERMANY Hikma Pharmaceuticals 0.27 UNITED Aedifica 0.22 BELGIUM ConvaTec Group 0.25 UNITED KINGDOM Aegon NV 0.34 NETHERLANDS KINGDOM Hiscox 0.18 UNITED KINGDOM Aeroports de Paris 0.17 FRANCE Countryside Properties 0.16 UNITED Holmen AB 0.2 SWEDEN Ageas 0.46 BELGIUM KINGDOM Homeserve 0.17 UNITED Aker BP ASA 0.16 NORWAY Covestro AG 0.54 GERMANY KINGDOM Alfa Laval 0.52 SWEDEN Covivio 0.2 FRANCE Howden Joinery Group 0.3 UNITED Alstom 0.7 FRANCE Croda International 0.64 UNITED KINGDOM KINGDOM Alten 0.18 -

Quarterly Report, Q1 2020

Q1 2020 Quarterly Report: WilderHill Clean Energy Index®, March 31, 2020 The Clean Energy Index® (ECO) began 1st Quarter 2020 around 70 and it ended Q1 near 56, down -20%; but there was more to this Q1. A remarkable, volatile, exhilarating, frightening, roller coaster Q1 first had gone up sharply +30%, over 90 in mid-February, then crashed latter Q1 to below 50. Intra-day moves were abrupt: in a few hours March 24, ECO sprang up +15%. Or seen longer since 2017, when the ECO Index® was 38, last 3 years it’s risen some +55%. An independent tracking fund at start of 2017 was about 18.5, start of 2018 was about 25.5, start of 2019 was about 21.5, start of 2020 around 34 and at end of Q1 fell to around 27. ECO passively captures an emerging highly volatile theme; it thusly can & does at times also ‘drop like a rock’ – as was amply proven for instance Q1 2020. Big gains have occurred here – as well too as bigger declines. Plus we offer a mere observation: it’s counter-intuitive perhaps yet ECO’s theme has now spiked up at times in Bush II & Trump Presidencies - though neither greatly promoted green energy. Meanwhile drops were seen 8 years of an Obama Presidency that favored this sector (yet 2008-2016 was a bit singular as China undertook to enter and gain major market share in clean energy, a goal that since came to fruition). Look back last 5 years at Benchmark ECO Index®, live since 2004 & 1st for climate solutions, and it’s near nil, negligibly up a few percent. -

Arctic Norwegian Equities Monthly Report July 2020

Arctic Norwegian Equities Monthly Report July 2020 FUND COMMENTS Arctic Norwegian Equities gave 3.4% return in July (I-class) versus 4% for the OSEFX benchmark index. Year to date the fund has returned -14.3% compared to -10.1% for the OSEFX. Since inception the fund has returned 120.7% versus 100.2% for the benchmark index. In July many of the largest companies on the Oslo Stock Exchange an- nounced results for the 2nd quarter. Several companies delivered above market expectations. Of note is DNB which rose near 10 percent on the day of reporting, driven by lower loan losses and higher other income. A number of companies also announced positive profit warmings, including B2 Holding, XXL, Atea and Europris. In July positive attribution for the Fund versus the benchmark index came from overweights in Atea and Crayon, and underweight in Mowi. Atea announced positive results for the 2nd quarter. Revenues were up by 12 percent from Q2 last year, and the company’s operating profit and bottom line were 50 percent higher than market expec- tations. Atea has further strengthened its competitive position in the Nordics, with a marked share in excess of 20 percent. Crayon also rose in July, partly due to strong software sales for Atea. Crayon is a large global partner of Microsoft. Microsoft announced 2nd quarter results which exceeded market expectations on the top- and bottom line. Shares in salmon farming declined in July, partly due to weak salmon price development. Demand for air transport to China has been reduced after discovery of coronavirus on a salmon cutting board in Beijing. -

Renewable Hydrogen, Made Cost Competitive

SPECIAL FEATURE – HYDROGEN ENERGY Renewable hydrogen, made cost competitive An interview with Jon André Løkke, CEO of Nel ASA, by Joanna Sampson magine a time before petroleum and electricity – horse- drawn carriages dominated the highways and byways and candles provided artificial lighting. The world was I transformed by fossil solutions in just a few centuries. But we are currently being faced with the side effects of utilising fossil energy – climate change and pollution. The obvious solution to these problems is exchanging fossil fuels with new renewable energies like solar, wind, and wave power. According to one company in Norway, it’s time for another global transformation. This time, it will be transformed by hydrogen, the simplest and most abundant element in the universe. In 1940, Nel undertook the world’s largest water Nel ASA has a vision of empowering generations with clean electrolysis installation at Rjukan, Norway, with a total 3 energy forever. To achieve this, CEO Jon André Løkke hydrogen production capacity exceeding 30,000Nm /hour believes hydrogen, along with renewable energy, must from hydropower. play a main role in the biggest energy transition since the Just over a decade later, in 1953, Nel started up a second discovery of oil. large-scale hydro-powered electrolyser plant for supplying Three quarters of the sun is made from hydrogen, providing hydrogen to ammonia production in Glomfjord, Norway. us with all the clean energy we need for at least another And in 1959 the company completely redesigned the five billion years. Realising that we have unlimited access electrolyser unit, forming the basis for today’s atmospheric to the sun raises an interesting question though: how do we electrolyser. -

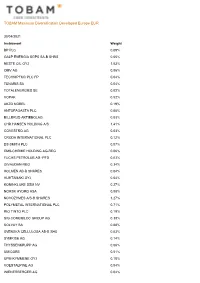

TOBAM Maximum Diversification Developed Europe EUR

TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight BP PLC 0.09% GALP ENERGIA SGPS SA-B SHRS 0.05% NESTE OIL OYJ 1.03% OMV AG 0.06% TECHNIPFMC PLC FP 0.04% TENARIS SA 0.04% TOTALENERGIES SE 0.02% VOPAK 0.52% AKZO NOBEL 0.19% ANTOFAGASTA PLC 0.05% BILLERUD AKTIEBOLAG 0.03% CHR HANSEN HOLDING A/S 1.41% COVESTRO AG 0.03% CRODA INTERNATIONAL PLC 0.12% DS SMITH PLC 0.07% EMS-CHEMIE HOLDING AG-REG 0.06% FUCHS PETROLUB AG -PFD 0.03% GIVAUDAN-REG 0.34% HOLMEN AB-B SHARES 0.04% HUHTAMAKI OYJ 0.04% KONINKLIJKE DSM NV 0.27% NORSK HYDRO ASA 0.08% NOVOZYMES A/S-B SHARES 1.27% POLYMETAL INTERNATIONAL PLC 0.71% RIO TINTO PLC 0.19% SIG COMBIBLOC GROUP AG 0.38% SOLVAY SA 0.08% SVENSKA CELLULOSA AB-B SHS 0.03% SYMRISE AG 0.14% THYSSENKRUPP AG 0.06% UMICORE 0.51% UPM-KYMMENE OYJ 0.18% VOESTALPINE AG 0.04% WIENERBERGER AG 0.04% TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight YARA INTERNATIONAL ASA 0.08% A P MOLLER - MAERSK A/S - A 0.06% A P MOLLER - MAERSK A/S - B 0.08% ACS ACTIVIDADES CONS Y SERV 0.07% ADDTECH AB-B SHARES 0.03% ADP 0.04% AENA SA 0.11% ALSTOM 0.17% ANDRITZ AG 0.03% ATLANTIA SPA 0.08% BELIMO HOLDING AG-REG 0.04% BUCHER INDUSTRIES AG-REG 0.04% BUNZL PLC 0.10% DEUTSCHE LUFTHANSA-REG 0.05% DIPLOMA PLC 0.04% DSV PANALPINA A/S 0.45% EASYJET PLC 0.20% ELIS SA 0.03% EPIROC AB-A 0.10% EPIROC AB-B 0.06% FERROVIAL SA 0.05% FLUGHAFEN ZURICH AG-REG 0.03% GEA GROUP AG 0.06% GEBERIT AG-REG 0.21% HAYS PLC 0.03% HOMESERVE PLC 0.04% HOWDEN JOINERY GROUP PLC 0.06% IMCD GROUP NV 0.07% IMI PLC 0.05% -

Ccn Tin Importer Im0006021794 430968150000 Daesang Ricor Corporation Im0002959372 003873536000 Westpoint Industrial Sales Co

CCN TIN IMPORTER IM0006021794 430968150000 DAESANG RICOR CORPORATION IM0002959372 003873536000 WESTPOINT INDUSTRIAL SALES CO. INC. IM0002992817 000695510000 ASIAN CARMAKERS CORPORATION IM0002963779 232347770000 STRONG LINK DEVELOPMENT CORPORATION IM0003299511 002624091000 TABAQUERIA DE FILIPINAS INC. IM0003063011 217711150000 ASIAWIDE REFRESHMENTS CORPORATION IM0002963639 001007787000 GX INTERNATIONAL INC. IM0006830714 456650820000 MOBIATRIX INC IM0003014592 002765139000 INNOVISTA TECHNOLOGIES INC. IM0003214699 005393872000 MONTEORO CHEMICAL CORPORATION IM0004340299 000126640000 LINKWORTH INTERNATIONAL INC. IM0006804179 417272052000 EATON INDUSTRIES PHILIPPINES LLC PH IM0002957590 000419293000 ALLEGRO MICROSYSTEMS PHILS. INC. IM0004143132 001030408000 PUENTESPINA ORCHIDS AND TROPICAL IM0003131297 004558769000 ARCHITECKS METAL SYSTEMS INC. IM0003025799 103873913000 MCMASTER INTERNATIONAL SALES IM0002973979 000296020000 CARE PRODUCTS INC IM0003014231 001026198000 INFRATEX PHILIPPINES INC. IM0002962691 000288655000 EURO-MED LABORATORIES PHILS. INC. IM0003031438 006818264000 NORTHFIELDS ENTERPRISES INT'L. INC. IM0003170217 002925850000 KENRICH INT'L . DISTRIBUTOR INC. IM0003259994 000365522000 KAMPILAN MANUFACTURING CORPORATION IM0003132498 103901522000 PEONY MERCHANDISING IM0002959496 204366533000 GLOBEWIDE TRADING IM0002966514 000070213000 NORKIS TRADING CO INC. IM0003232492 000117630000 ENERGIZER PHILIPPINES INC. IM0003131513 000319974000 HI-Q COMMERCIAL.INC IM0003035816 000237662000 PHILIPPINE INTERNATIONAL DEV'T INC. IM0003090795 113041122000 -

Bus & Coach International

BUY AND SELL BUSES WITH AUSTRALIA’S #1 BUS CLASSIFIEDS* BUY More than 340 buses and coaches to choose from SELL Maximise your ads’ exposure online & in ABC magazine. To list your ad call 03 9567 4154 today! INSIDE AUSTRALIA’S LARGEST BUS CLASSIFIEDS THETHE YEARYEAR AHEADAHEAD StateState associationsassociations pplanlan fforor 20152015 ECLECTICECLECTIC ELECTRICSELECTRICS BustechBustech designsdesigns eelectriclectric bbusus MAJORMAJOR MILESTONEMILESTONE Half-centuryHalf-century fforor HHinoino IssueIsIIssssueue 32932 JanuaryJJanuanuu ryy 2015201010 55$ $5.95$5.95 5 inci GSTGGSST PP100008045PP1PP10PPP 00080000080 040454 WIN AN SEE DETAILS INSIDE. WWW.BUSNEWS.COM.AU VALLEY Moonee Valley Coaches proves resilient BUSNEWS.COM.AU THE BUS YOU WANT IS NOW EASIER TO FIND ALREADY 25 UNITS SOLD 2005 MERCEDES BENZ 0500 46, 53 or 57 passenger option. 2007 VOLVO B7R 1999 SCANIA L94 6sp man, 12.5m Mills Tui bodies, 2011 BONLUCK 2007 HINO RB8 1995 MAN 11-190 1995 MOTORCOACH 46/49 lap/sash seat belted Auto,Coach Design body, 8sp manual, 57 passenger recliners, 2 door, Thermo King 8.5m,automatic, 5sp manual,Chiron body, 34 lap sash seat belted 6sp manual, PMC Apollo HI DECK 14.5M fixed lap sash seat belts just A/C, mid toilet, urn, DVD, ducted 28 leather lap sash seat belted 34 lap sash seat belted recliners,toilet, 2 door, body, 34 lap sash Detroit Series 60, retrimmed, Coachair A/C, vac, pull down blinds to salooon, recliners, toilet, A/C, seats,A/C,wheeelchair lift, A/C, underfloor bins, seat belted recliners, Allison auto,62 lap sash underfloor bins, DVD, bull bar, kneel, raise, alloys, many extras, underfloor bins, DVD, LCD screen,rear boot,school many extras, travelled A/C, toilet, DVD, seat belted recliners, tachograph, travelled approx. -

El Mercado De Componentes De Automoción En Australia

ESTUDIOS EM DE MERCADO 2019 El mercado de componentes de automoción en Australia Oficina Económica y Comercial de la Embajada de España en Sídney Este documento tiene carácter exclusivamente informativo y su contenido no podrá ser invocado en apoyo de ninguna reclamación o recurso. ICEX España Exportación e Inversiones no asume la responsabilidad de la información, opinión o acción basada en dicho contenido, con independencia de que haya realizado todos los esfuerzos posibles para asegurar la exactitud de la información que contienen sus páginas. ESTUDIOS EM DE MERCADO 11 de marzo de 2019 Sídney Este estudio ha sido realizado por Marta Picardo Tejera Bajo la supervisión de la Oficina Económica y Comercial de la Embajada de España en Sídney. Editado por ICEX España Exportación e Inversiones, E.P.E., M.P. NIPO: 114-19-038-4 EM EL MERCADO DE COMPONENTES DE AUTOMOCIÓN EN AUSTRALIA Índice 1. Resumen ejecutivo 5 2. Definición de sector 8 2.1. Situación actual de la industria 8 2.2. Partidas arancelarias 10 3. Oferta – Análisis de competidores 13 3.1. Tamaño del mercado 13 3.2. Importaciones 17 3.3. Exportaciones 24 3.4. Producción local 25 3.4.1. Fabricantes de componentes locales 25 3.4.2. Mayoristas de componentes 26 3.4.2.1. Mayoristas de componentes extranjeros establecidos en Australia 27 3.4.2.2. Mayoristas locales de componentes 28 3.4.3. Localización geográfica 28 4. Demanda 30 4.1. Vehículos en Australia 30 4.2. Demanda de componentes 35 4.2.1. Segmentación de la demanda por tipo cliente 35 4.2.2. -

2020 Zero Emissions Bus Forum Report and Key Findings

2020 Zero Emissions Bus Forum Report and Key Findings FEBRUARY | 2021 Foreword It has been an incredible opportunity to work with our members Transport for NSW, Arup and L.E.K. Consulting to bring together local and global expertise in a virtual forum format in which we shared examples, case studies, best practice and lessons learned to inform Zero Emission Bus (ZEB) transition pathways for Australia and New Zealand. Through the ZEB Forum we considered the key questions that government and industry need to solve for in order to integrate ZEB fleets into transport networks in our region. This report captures and analyses what was shared at the UITPANZ ZEB Forum in late 2020 and offers key insights to power the way forward in our region. We have an opportunity to emerge as global leaders in the zero emissions technology and sustainable transport space. While in some ways we’re playing catch up to Europe and Asia, we also have an opportunity to leap ahead by investing in the latest technology and learning from the lessons of our peers from countries around the world including China, Singapore, the United Kingdom, France, Netherlands, Norway, the United States and Canada. This is the benefit of the global UITP network, where we can harness the expertise, lessons and case studies of members from 100 countries around the world, to inform the ZEB transition in our region and support the sustainable mobility agenda more broadly. I’m delighted by the proactive response of many state and territory governments in Australia, as well as the regional and national governments in New Zealand, to move towards an accelerated ZEB transition in our region. -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only.