Chinese Sportswear, Fake Or Fabulous?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Xtep International (1368 HK)

Xtep International (1368 HK) Rating Maintain BUY A soft 3Q19 but still on the right track Target price HK$6.34 From HK$6.83 Current price HK$4.44 Upside.+42.7% Soft 3Q19 triggered sell off, still on track to achieve FY19E guidance Company Update Xtep posted a relatively soft 3Q19 operational data, with both SSSG and retail sales slightly decelerated to ~10% and ~20% Yoy (vs. mid-teens/>20% in 2Q19), 23 October 2019 with retail discount widened to 22-25% (vs. 20-25% in 2Q19). Xtep’s share price tumbled 16% after the release. Xtep attributed the mild slow down to warm Hayman Chiu weather, which hurt the retail sales of the newly launched fall winter products. [email protected] Xtep added that retail performance in the first half of October returned to similar levels as in July/August with similar retail discount in 3Q19, while inventory level (852) 2235 7677 continue to stay at a healthy level of ~4 months. Trading Data Though having faced a mild 3Q19, we believe Xtep is still on track to achieve its 52-Week Range (HK$) 6.74/3.81 FY19E revenue growth guidance of ~20%, driven by low teens growth in shoes 3 Mth Avg Daily Vol (m) 10.19 and ~30% growth in apparel, while keeping a stable GM in our view. No of Shares (m) 2,499.7 Market Cap (HK$m) 11,524.9 JV with Wolverine, K-Swiss and Palladium still in ramp up/ restructure Major Shareholders (%) Group Success (54.1%) stage, negligible contribution in the near term Auditors Ernst & Young Result Due FY19: Mar 2020 The acquisition of E-Land Footwear USA (incl. -

UNDER ARMOUR CONSULTING REPORT Heather Dommer University of Lynchburg

University of Lynchburg Digital Showcase @ University of Lynchburg Undergraduate Theses and Capstone Projects Spring 4-28-2015 UNDER ARMOUR CONSULTING REPORT Heather Dommer University of Lynchburg Follow this and additional works at: https://digitalshowcase.lynchburg.edu/utcp Part of the Business Administration, Management, and Operations Commons, and the Other Business Commons Recommended Citation Dommer, Heather, "UNDER ARMOUR CONSULTING REPORT" (2015). Undergraduate Theses and Capstone Projects. 142. https://digitalshowcase.lynchburg.edu/utcp/142 This Thesis is brought to you for free and open access by Digital Showcase @ University of Lynchburg. It has been accepted for inclusion in Undergraduate Theses and Capstone Projects by an authorized administrator of Digital Showcase @ University of Lynchburg. For more information, please contact [email protected]. UNDER ARMOUR CONSULTING REPORT Ms. Heather Dommer Management Graduating Senior April 28,2015 Dr. Maria L. Nathan, Chair Dr. Lee Schoemmeller, Committee Member Dr. Alka Gupta, Committee Member Under Armour Consulting Report Heather Dommer 1/23/2015 CONSULTING REPORT: UNDER ARMOUR 2 TABLE OF CONTENTS I. Executive Summary...................................................................................................................... 3 II. Section I: External Analysis i. Competitor Analysis........................................................................................................ 4 ii. Five Forces Analysis....................................................................................................... -

Athletic & Outdoor 20,616

ATHLETIC & OUTDOOR Living Laboratory Oregon and Washington’s legendary recreational opportunities aren’t just a perk to entice active talent; they serve as a living laboratory for testing products and observing customer behavior. The people making and marketing your products are the ones using them. TOP 10 ATHLETIC + OUTDOOR FIRMS WITH BIG BRANDS + HEADQUARTERS IN GREATER PORTLAND BEST TALENT 1. Nike 6. Nautilus #1 in US 12,000 Employees 469 Employees Portland is a major center for 2. Adidas North America 7. Danner Boots / the athletic and outdoor industry 1,700 Employees LaCrosse Footwear cluster. Portland has the highest 405 Employees 3. Columbia Sportswear concentration of athletic and Company 8. Leupold + Stevens outdoor firms of any of the 1,579 Employees 349 Employees nation’s 50 largest metro areas. 4. Leatherman Tool Group 9. Keen 503 Employees 250 Employees 5. Pendleton Woolen Mills 10. Benchmade 632 133 Employees 479 Employees Number of athletic and outdoor firms in Greater Portland. —PBJ Book of Lists 2017-18 20,616 A STEP AHEAD IN Total athletic and outdoor industry FOOTWEAR employment in Greater Portland. “Being home to the headquarters of —EMSI, 2018 Nike and Adidas, as well as Columbia, Keen and others, makes Portland the epicentre of US sneakers. The talent pool is incredible, and many brands have established offices in Portland to tap into the talent pool.” —Matt Powell, sports industry analyst, NPD Group ATHLETIC & OUTDOOR ECOSYSTEM ACCESSORIES + BAGS FOOTWEAR Belmont Blanket Adidas Orox Leather Co. Bogs Rumpl Chinook -

Sportswear Industry Data and Company Profiles Background Information for the Play Fair at the Olympics Campaign

Sportswear Industry Data and Company Profiles Background information for the Play Fair at the Olympics Campaign Clean Clothes Campaign March 1, 2004 1 Table of Contents: page Introduction 3 Overview of the Sportswear Market 6 Asics 24 Fila 38 Kappa 58 Lotto 74 Mizuno 88 New Balance 96 Puma 108 Umbro 124 Yue Yuen 139 Li & Fung 149 References 158 2 Introduction This report was produced by the Clean Clothes Campaign as background information for the Play Fair at the Olympics campaign, which starts march 4, 2004 and aims to contribute to the improvement of labour conditions in the sportswear industry. More information on this campaign and the “Play Fair at Olympics Campaign report itself can be found at www.fairolympics.org The report includes information on Puma Fila, Umbro, Asics, Mizuno, Lotto, Kappa, and New Balance. They have been labeled “B” brands because, in terms of their market share, they form a second rung of manufacturers in the sportswear industries, just below the market leaders or the so-called “A” brands: Nike, Reebok and Adidas. The report purposefully provides descriptions of cases of labour rights violations dating back to the middle of the nineties, so that campaigners and others have a full record of the performance and responses of the target companies to date. Also for the sake of completeness, data gathered and published in the Play Fair at the Olympics campaign report are copied in for each of the companies concerned, coupled with the build-in weblinks this provides an easy search of this web-based document. Obviously, no company profile is ever complete. -

2020 Annual Report Annual 2020

2020 ANNUAL REPORT 2020 ANNUAL SKECHERS USA, INC. 228 Manhattan Beach Blvd. REPORT Manhattan Beach, California 90266 February 2021 To our Shareholders, We would like to express our sincere hope that you and your loved ones are staying safe and healthy during this on-going health crisis. We began 2020 with the same positive momentum that drove record revenues in 2019. The first quarter showed significant growth until COVID-19 leaped from Asia to Europe, the United States and virtually every market around the globe. By the end of March, most of the world pressed pause as the pandemic took hold and within weeks, we temporarily closed offices and stores, and faced a new normal of doing business and living. At Skechers, the ability to pivot quickly has been a hallmark of our business and success since our beginning. 2020 put our flexibility to the test as we adapted to this new reality. With the global infrastructure we have in place, our teams around the world were able to effectively work from home. The speed of our actions early on allowed us to weather the worst of the pandemic in the first and second quarters with as minimal impact as possible considering the unprecedented challenges. By the close of the second quarter, China had already returned to sales growth of 11.5 percent, and many of our biggest international markets, including Germany and the United Kingdom, showed meaningful recovery. Our quick action and our efforts to efficiently manage both inventory and expenses also resulted in Skechers emerging in a relatively strong position as markets began to re-open. -

Brand Armani Jeans Celebry Tees Rochas Roberto Cavalli Capcho

Brand Armani Jeans Celebry Tees Rochas Roberto Cavalli Capcho Lady Million Just Over The Top Tommy Hilfiger puma TJ Maxx YEEZY Marc Jacobs British Knights ROSALIND BREITLING Polo Vicuna Morabito Loewe Alexander Wang Kenzo Redskins Little Marcel PIGUET Emu Affliction Bensimon valege Chanel Chance Swarovski RG512 ESET Omega palace Serge Pariente Alpinestars Bally Sven new balance Dolce & Gabbana Canada Goose thrasher Supreme Paco Rabanne Lacoste Remeehair Old Navy Gucci Fjallraven Zara Fendi allure bridals BLEU DE CHANEL LensCrafters Bill Blass new era Breguet Invictus 1 million Trussardi Le Coq Sportif Balenciaga CIBA VISION Kappa Alberta Ferretti miu miu Bottega Veneta 7 For All Mankind VERNEE Briston Olympea Adidas Scotch & Soda Cartier Emporio Armani Balmain Ralph Lauren Edwin Wallace H&M Kiss & Walk deus Chaumet NAKED (by URBAN DECAY) Benetton Aape paccbet Pantofola d'Oro Christian Louboutin vans Bon Bebe Ben Sherman Asfvlt Amaya Arzuaga bulgari Elecoom Rolex ASICS POLO VIDENG Zenith Babyliss Chanel Gabrielle Brian Atwood mcm Chloe Helvetica Mountain Pioneers Trez Bcbg Louis Vuitton Adriana Castro Versus (by Versace) Moschino Jack & Jones Ipanema NYX Helly Hansen Beretta Nars Lee stussy DEELUXE pigalle BOSE Skechers Moncler Japan Rags diamond supply co Tom Ford Alice And Olivia Geographical Norway Fifty Spicy Armani Exchange Roger Dubuis Enza Nucci lancel Aquascutum JBL Napapijri philipp plein Tory Burch Dior IWC Longchamp Rebecca Minkoff Birkenstock Manolo Blahnik Harley Davidson marlboro Kawasaki Bijan KYLIE anti social social club -

C 299 Officiella Tidning

Europeiska unionens C 299 officiella tidning femtiosjunde årgången Svensk utgåva Meddelanden och upplysningar 5 september 2014 Innehållsförteckning II Meddelanden MEDDELANDEN FRÅN EUROPEISKA UNIONENS INSTITUTIONER, BYRÅER OCH ORGAN Europeiska kommissionen 2014/C 299/01 Beslut om att inte göra invändningar mot en anmäld koncentration (Ärende M.7325 – ICG/KIRKBI/ Minimax Viking Group) (1) ..................................................................................................... 1 2014/C 299/02 Beslut om att inte göra invändningar mot en anmäld koncentration (Ärende M.7132 – Ineos/ Doeflex) (1) .......................................................................................................................... 1 2014/C 299/03 Beslut om att inte göra invändningar mot en anmäld koncentration (Ärende M.7309 – Bridgepoint/ EdRCP) (1) ........................................................................................................................... 2 2014/C 299/04 Beslut om att inte göra invändningar mot en anmäld koncentration (Ärende M.7338 – OJI/INCJ/Rank Group Pulp, Paper & Packaging Business) (1) .............................................................................. 2 IV Upplysningar UPPLYSNINGAR FRÅN EUROPEISKA UNIONENS INSTITUTIONER, BYRÅER OCH ORGAN Europeiska kommissionen 2014/C 299/05 Eurons växelkurs .................................................................................................................. 3 SV (1) Text av betydelse för EES UPPLYSNINGAR FRÅN MEDLEMSSTATERNA 2014/C 299/06 Uppgifter -

The Spirit of St. Luke's, Winter 1996

Advocate Aurora Health Advocate Aurora Health Institutional Repository Aurora St. Luke’s Medical Center Books, Documents, and Pamphlets Aurora St. Luke’s Medical Center May 2018 The Spirit of St. Luke's, Winter 1996 Aurora Health Care Follow this and additional works at: https://institutionalrepository.aah.org/aslmc_books This Pamphlet is brought to you for free and open access by the Aurora St. Luke’s Medical Center at Advocate Aurora Health Institutional Repository. It has been accepted for inclusion in Aurora St. Luke’s Medical Center Books, Documents, and Pamphlets by an authorized administrator of Advocate Aurora Health Institutional Repository. For more information, please contact [email protected]. _______ OF ST. LUKESRIT MKM SYSTEM .C N p %• The Spirit ofSt. Luke’s is produced three times a year by St. Luke’s Medical Center/Office of Philanthropy for friends and donors. President, St. Luke’s Medical Center: Mark Ambrosius Vice President for Philanthropy: Brad Holmes Director of Development: Laverne Schmidt Director of Planned Giving: Kelly Sachse Director of Pastoral Care: Harvey Berg Administrative Secretary: Judi Fellows Secretary: Shawnell Colson-Horton Secretary: Slielly Rosenstock Editorial Production Coordination: Susan J. Montgomery Graphic Design & Production: Matt Shockley Please direct gifts and requests for further information to: Office of Philanthropy St. Luke’s Medical Center 2900 W. Oklahoma Ave. , P0. Box 2901 Milwaukee,W1 53201-2901 414-649-7122 Cover: upper right: Dr.Arvind Ahuja; lower left: Dr. P Daniel Suberviola with the MKM microscope; lower right. Dr. Ahuja prepares for a neuroendovascular procedure. Advanced Neurosurgical Techniques Give Patients New Hope 2 Neurosurgeons Use 21st Century MKM Microscope at St. -

361 Degrees International Limited 361度國際有限公司

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 361 Degrees International Limited 361 度 國 際 有 限 公 司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1361) 2017 ANNUAL RESULTS ANNOUNCEMENT The board (the “Board”) of directors (the “Directors”) of 361 Degrees International Limited (the “Company”) is pleased to announce the audited consolidated results of the Company and its subsidiaries (together, the “Group”) for the year ended 31 December 2017. This announcement, containing the full text of the 2017 Annual Report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcements of annual results. – 1 – 361 DEGREES INTERNATIONAL LIMITED 361 DEGREES INTERNATIONAL LIMITED INCORPORATED IN THE CAYMAN ISLANDS WITH LIMITED LIABILITY THIS ANNUAL REPORT IS PRINTED ON ENVIRONMENTALLY FRIENDLY PAPER ANNUAL REPORT 2017 361 DEGREES INTERNATIONAL LIMITED Stock Code: 1361 ANNUAL REPORT 2017 02 Company Information 03 Financial Highlights 04 Five-Year Financial Summary 06 Chairman’s Statement 08 Management Discussion and Analysis 27 Report of the Directors 36 Corporate -

China Sports Market Is Expected Grow with Double Digit CAGR and to Be More Than US$ 100 Billion Industry by the Year 2020

Oct 04, 2016 13:13 IST China Sports Market is expected Grow with Double Digit CAGR and to be More than US$ 100 Billion industry by the year 2020 China Sports Market (Sports Apparel, Sports Footwear, Sports Equipment) & Forecast Size and Share Published in 2016-09-27 Available for US$ 1200 at Researchmoz.us Description China Sports Market Overview China sports market is expected to be more than US$ 100 Billion industry by the year 2020. To achieve this impressive growth China sports market is expected to grow with double digit CAGR. In the year 2010 Sports Apparel used to be the biggest market, but by 2015 Sports Equipment has overtaken Sports Apparel market. Company sales are highly fragmented and no single company holds double digit market share. Primarily because the sports market is a vast segment and it’s difficult for one company to be present in all segments. Rising awareness of a healthier lifestyle, acceleration of urbanization and proactive government support are the factors driving China Sports Market. Renub Research study titled “China Sports Market (Sports Apparel, Sports Footwear, Sports Equipment) & Forecast” is a 67 page report with 48 Figures and 4 Table it analyses the China sports market from 3 points A. China Sports – Segment Market (2010 to 2020): Sports Apparel, Sports Footwear, Sports Equipment, Others Sportswear B. China Sports - Type Market: Indoor sports and Outdoor sports and Marketing. C. Companies Sales Analysis: 361 Degrees International Limited, Belle International Holdings Limited, Hosa International Limited, China Dongxiang Company Limited, Li Ning Company Limited, Xtep International Holdings Limited and Anta Sports Products Limited. -

Company Report Hong Kong Equity Research

Monday, November 16, 2015 China Merchants Securities (HK) Co., Ltd. Company Report Hong Kong Equity Research 361 Degrees (1361 HK) Eugene MAK Lewis WONG 852-3189 6343 852-3189 6160 Attractive risk/return driven by strong sportswear sector [email protected] [email protected] ■ 361 Degrees (361) has been relatively overlooked despite the current sportswear sector upcycle due to company specific risks. WHAT’S NEW ■ We view the realization of the risks to be unlikely and hence 361 Assume coverage to be undervalued, making it a potential laggard play ■ Attractive risk/reward given 9x FY16E P/E vs 13x sector average BUY and earnings growth outlook. Assume coverage with BUY rating Previous N/A Riding the sportswear upcycle wave Price HK$2.99 We expect a FY15E/16E/17E earnings growth of 20%/11%/14% YoY with 12-month Target Price HK$3.61 (+21%) upcoming share price catalysts from i) FY15 annual results and ii) double (Potential upside) digit sales fair value YoY growth figures to be maintained for its upcoming 3Q/4Q16 sales fairs. Earnings growth will be driven by FY5E/16E/17E Previous N/A revenue growth of 11%/14%/13% YoY as China’s sportswear sector Price Performance continues to turnaround from increased consumer demand (from (%) increased demand in sports performance products as health awareness 60 1361 HSI Index grows and participation in sports by the Chinese increases). As one of the leading Chinese sportswear brands, we expect 361 to continue to 40 benefit from this sector upcycle which can be seen through successive 20 improvements in 361’s SSSG (1Q14’s 2% to 3Q15’s 8%) and sales fair figures while channel inventory remains healthy at 4x inventory-to- 0 monthly sales. -

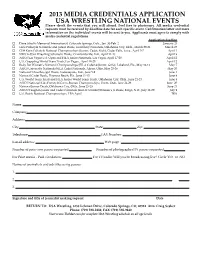

2013 MEDIA CREDENTIALS APPLICATION USA WRESTLING NATIONAL EVENTS Please Check the Events That You Will Attend

2013 MEDIA CREDENTIALS APPLICATION USA WRESTLING NATIONAL EVENTS Please check the events that you will attend. Feel free to photocopy. All media credential requests must be received by deadline date for each specific event. Confirmation letter and more information on the individual events will be sent to you. Applicants must agree to comply with media credential regulations. Application deadline o Dave Schultz Memorial International, Colorado Springs, Colo., Jan. 30‐Feb. 2 January 25 o Girls Folkstyle Nationals and Junior Duals, University Nationals, Oklahoma City, Okla., March 29‐31 March 25 o Cliff Keen Folkstyle National Championships (Junior, Cadet, Kids), Cedar Falls, Iowa., April 5‐7 April 1 o NWCA‐USA Wrestling Scholastic Duals, Crawfordsville, Ind., April 11‐13 April 9 o ASICS/Las Vegas U.S. Open and FILA Junior Nationals, Las Vegas, April 17‐20 April 12 o U.S. Grappling World Team Trials, Las Vegas., April 18‐20 April 12 o Body Bar Women’s National Championships (FILA Cadet & Junior, Girls), Lakeland, Fla., May 10‐12 May 7 o ASICS University Nationals/FILA Cadet Nationals, Akron, Ohio, May 23‐26 May 20 o National Schoolboy/girl Duals, Indianapolis, Ind., June 5‐9 June 1 o National Cadet Duals, Daytona Beach, Fla., June 11‐15 June 8 o U.S. World Team Trials and FILA Junior World Team Trials, Oklahoma City, Okla., June 21‐23 June 8 o ASICS National Kids Freestyle/Greco‐Roman Championships, Orem, Utah, June 24‐26 June 20 o National Junior Duals, Oklahoma City, Okla., June 25‐29 June 21 o ASICS/Vaughan Junior and Cadet Nationals (men & women)/Women’s Jr Duals, Fargo, N.D., July 12‐20 July 9 o U.S.