PSO Annual Report 2018.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

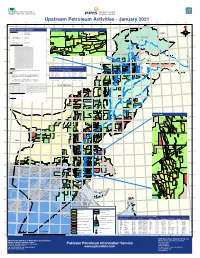

Upstream Petroleum Activities

Directorate General of Pakistan Petroleum Petroleum Concessions Information Service Upstream Petroleum Activities - January 2021 61.0.0 62.0.0 63.0.0 64.0.0 65.0.0 66.0.0 67.0.0 68.0.0 69.0.0 70.0.0 71.0.0 72.0.0 73.0.0 74.0.0 75.0.0 76.0.0 77.0.0 78.0.0 79.0.0 37.0.0 Inset North Average Production December ,2020 Oil 76,774.10 bbls /day BHAL SYEDAN 3371-10 Ʊ Ʋ Gas 3,582.33 mmcf/day OGDCL (KOHAT) Ʊ Ʋ LPG 2,263.61 m.tons/day OGDCL TOLANJ WEST SADKAL 36.0.0 MOL TOLANJ OGDCL Seismic Crews Active 07 MOL SOGHRI 3372-14 BDGBDU76GUDTU6I 2-D Seismic Acquisition Onshore 219.10 L.Kms. D&PL (FATEH JANG) 36.0.0 DHOK HUSSAIN 3-D Seismic Acquisition Onshore 91.75 Sq.Kms. OGDCL OGDCL 3371-17 OGDCL 4 (BARATAI) Gilgit Rigs Active 16 OGDCL Ʊ Ʋ 3370-3 DAKHNI Ʊ G I LG I T-BALTI STAN Area under Exploration Licences 206,736.00 Sq. Kms. (TAL) OGDCL Area under Mining/D&P Leases 14,010.00 Sq. Kms. MOL Area under Applications 114,396.00 Sq. Kms. MAMIKHEL 3371-5 RATANA (GURGALOT) OGDCL UCHRI OPI MAMIKHEL SOUTH DHURNAL BIDS OPENED FOR GRANT OF EL PARIWALI MOL POL OPI 3372-18 POL MAKORI&MAKORI DEEP 13 Bid round for following 20 blocks were held on January 15, 2021. MEYAL (IKHLAS) MOL MAKORI EAST 35.0.0 POL S.NO Block Name Zone POL MELA 3371-15 KHAUR 3372-23 OGDCL 1 Block No.3068-6 (Killa Saifullah) I (F) (DHOK SULTAN) POL (HISAL) 35.0.0 2 Block No.2762-2 (Desert) I (F) PPL PPL NASHPA DHULIAN 3 Block No.3067-7 (Sharan) I (F) OGDCL POL 4 Block No.3272-16 (Lilla) I CHANDA 5 Block No.3372-25 (Abbottabad) I OGDCL 6 Block No.3471-1 (Nowshera) I 3271-1 TOOT Ʊ Ʋ KALABAGH 10 (KARAK) OGDCL FC`7@SQ6FCUVIFCX6 7 Block No.3372-26 (Hazro) I MPCL MPCL HALINI 8 Block No.3273-5 (Jhelum) I MPCL 9 Block No.3372-27 (North Dhurnal) I Muzaffarabad 10 Block No.2668-23 (Khewari East) III 11 Block No. -

CFA Institute Research Challenge Hosted by CFA Society of Pakistan Institute of Business Administration – Karachi

CFA Institute Research Challenge hosted by CFA Society of Pakistan Institute of Business Administration – Karachi CFA Institute Research Challenge 2015-16 Institute of Business Administration (IBA) – Student Research This report is published for educational purposes only by [Oil & Gas Sector, Oil Marketing Company] Students competing in The CFA Institute Research Challenge. Pakistan Stock Exchange (PSX) Pakistan State Oil Date: 11/01/16 Current Price: 321.27 PKR/share Recommendation: BUY (33% upside) Ticker: PSO (PSX) Ticker: PSO PA (Bloomberg) PKR/USD: 105 Target Price: 428 PKR/share (4.08 USD) Market Profile Closing price (PKR) 321.27 PSO: Proxy for Pakistan’s economic revival 52-week price 283.75 - range (PKR) 415.40 We issue a BUY recommendation on Pakistan State Oil (PSO) with a one-year target price of PKR 428 using the Discounted Average daily Free Cash Flow to Firm (FCFF) and Relative Valuation Method. This offers a 33% upside from its closing price of PKR 321 volume (12M) 919,134 on January 11, 2016. PSO is one of the biggest and most liquid blue-chips on KSE with average daily volume being 0.34% As a % of shares of shares outstanding. Our investment thesis is based on PSO’s earnings growth, backed by volumes growth, outstanding 0.34% improving operating cash flows, and being a cheap blue-chip asset. PSO’s earnings growth is primarily driven by its volumetric sales growth during FY16-21 (CAGR: 12%) due to a changing energy mix, lower financing costs which will Dividend yield reduce over the years due to lower borrowings and positive operating cash flows. -

Habibmetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION)

A N N U A L R E P O R T 2017 1 HabibMetro Modaraba Management (AN(AN ISLAMICISLAMIC FINANCIALFINANCIAL INSTITUTION)INSTITUTION) 2 A N N U A L R E P O R T 2017 JOURNEY OF CONTINUOUS SUCCESS A long term partnership Over the years, First Habib Modaraba (FHM) has become the sound, strong and leading Modaraba within the Modaraba sector. Our stable financial performance and market positions of our businesses have placed us well to deliver sustainable growth and continuous return to our investors since inception. During successful business operation of more than 3 decades, FHM had undergone with various up and down and successfully countered with several economic & business challenges. Ever- changing requirement of business, product innovation and development were effectively managed and delivered at entire satisfaction of all stakeholders with steady growth on sound footing. Consistency in perfect sharing of profits among the certificate holders along with increase in certificate holders' equity has made FHM a sound and well performing Modaraba within the sector. Our long term success is built on a firm foundation of commitment. FHM's financial strength, risk management protocols, governance framework and performance aspirations are directly attributable to a discipline that regularly brings prosperity to our partners and gives strength to our business model which is based on true partnership. Conquering with the challenges of our operating landscape, we have successfully journeyed steadily and progressively, delivering consistent results. With the blessing of Allah (SWT), we are today the leading Modaraba within the Modaraba sector of Pakistan, demonstrating our strength, financial soundness and commitment in every aspect of our business. -

OICCI CSR Report 2018-2019

COMBINING THE POWER OF SOCIAL RESPONSIBILITY Corporate Social Responsibility Report 2018-19 03 Foreword CONTENTS 05 OICCI Members’ CSR Impact 06 CSR Footprint – Members’ Participation In Focus Areas 07 CSR Footprint – Geographic Spread of CSR Activities 90 Snapshot of Participants’ CSR Activities 96 Social Sector Partners DISCLAIMER The report has been prepared by the Overseas Investors Chamber of Commerce and Industry (OICCI) based on data/information provided by participating companies. The OICCI is not liable for incorrect representation, if any, relating to a company or its activities. 02 | OICCI FOREWORD The landscape of CSR initiatives and activities is actively supported health and nutrition related initiatives We are pleased to present improving rapidly as the corporate sector in Pakistan has through donations to reputable hospitals, medical care been widely adopting the CSR and Sustainability camps and health awareness campaigns. Infrastructure OICCI members practices and making them permanent feature of the Development was also one of the growing areas of consolidated 2018-19 businesses. The social areas such as education, human interest for 65% of the members who assisted communi- capital development, healthcare, nutrition, environment ties in the vicinity of their respective major operating Corporate Social and infrastructure development are the main focus of the facilities. businesses to reach out to the underprivileged sections of Responsibility (CSR) the population. The readers will be pleased to note that 79% of our member companies also promoted the “OICCI Women” Report, highlighting the We, at OICCI, are privileged to have about 200 leading initiative towards increasing level of Women Empower- foreign investors among our membership who besides ment/Gender Equality. -

2005 Information

• Company Information 2 • Committees of BOD & Management 4 • Notice of Meeting 6 • Operating Highlights 8 • Directors' Report 12 Agriculture and Fertilizer Environment 14 Company Performance 16 Balancing, Modernization & Replacement 20 Profitability 22 Equity Participation & Shareholding 24 Good Governance & Listing Regulations 26 Safety, Health & Environment 36 Future Outlook & WTO Challenges 38 • Standard of Conduct for Directors / Employees 39 • Core Values 40 • Financial Statements of FFC 41 Statement of Compliance 42 Review Report to the Members 44 Auditors’ Report to the Members 45 Balance Sheet 46 Profit and Loss Account 48 Cash Flow Statement 49 Statement of Changes in Equity 50 Notes to the Financial Statements 51 • Consolidated Financial Statements 77 Auditors’ Report to the Members 79 Consolidated Balance Sheet 80 Consolidated Profit and Loss Account 82 Consolidated Cash Flow Statement 83 Consolidated Statement of Changes in Equity 84 Notes to the Consolidated Financial Statements 85 • Pattern of Shareholding 116 • Form of Proxy 119 Our achievements over the years in every business sphere have developed FFC into “The House of Excellence” 1 Company 2005 Information BOARD OF DIRECTORS REGISTERED OFFICE Lt Gen Syed Arif Hasan, HI(M) (Retired) 93-Harley Street, Rawalpindi Cantt. Chairman Website: www.ffc.com.pk Tel No. 92-51-9272307-14 Lt Gen Mahmud Ahmed, HI(M) (Retired) Fax No. 92-51-9272316 Chief Executive and Managing Director E-mail: [email protected] Dr Haldor Topsoe PLANTSITES Mr Qaiser Javed Goth Machhi Brig Arshad Shah, SI(M) (Retired) Sadikabad Mr Tariq Iqbal Khan (Distt: Rahim Yar Khan) Brig Aftab Ahmed, SI(M) (Retired) Tel No. 92-68-5786420-9 Brig Ghazanfar Ali, SI(M) (Retired) Fax No. -

Pakistan Institute of Corporate Governance – PICG List of Directors Training Program NO

Pakistan Institute of Corporate Governance – PICG List of Directors Training Program NO. NAMES DESIGNATION COMPANY YEAR 1 Mr. Bazl Khan Chairman IGI Funds Limited 2007 2 Mr. Ali Azam Shirazee CEO IGI Funds Limited 2007 3 Mr. Hasanali Abdullah Joint MD EFU General Insurance Ltd 2007 4 Mr. Abdul Aziz Yousuf Director Gul Ahmed Textile Mills Ltd 2007 5 Mr. Iqbal AliMohammed Chairman / Director MYBANK Limited 2007 6 Mr. Mohammad Hanif Jakhura CEO Central Depository Company of Pakistan 2007 7 Mr. Kamran Ahmed Qazi CFO & Co. Secretary Central Depository Company of Pakistan 2007 8 Mr. Riyaz T. Chinoy Chief Operating Officer International Industries Ltd 2007 9 Mr. Tameez-ul-Haque Company Secretary Adamjee Insurance Company Limited 2007 10 Ms. Neelofar Hameed Company Secretary International Industries Limited 2007 11 Mr. Fuzail Abbas CFO & SEVP Habib Metropolitan Bank Ltd 2007 12 Mr. Ekhlaq Ahmed EVP / Secretary National Bank of Pakistan 2007 13 Mr. Zafar Hussain Memon Director M. Yousuf Adil Saleem & CO. 2007 14 Mr. Aleem Ahmed Dani Group Director Finance Dawood Hercules Chemicals Ltd 2007 15 Mr. Abdul Samad Dawood CEO Dawood Corporation (Pvt) Ltd. 2007 16 Mr. Shahid Mahmood Dir Finance & Company Secretary KSB Pumps Co. Ltd 2007 17 Syed Muhannad Ali Zamin SVP National Bank of Pakistan 2007 18 Mr. Moiz Ahmad Executive Director ICAP 2007 19 Ms. Sadia Khan Executive Director Delta Shipping (Pvt) Ltd 2007 20 Mr. Kaiser Naseem Manager PCG IFC 2007 M. Aslam & Company Chartered 21 Mr. Mohammed Aslam Principal 2007 Accountants Pakistan Institute of Corporate Governance – PICG List of Directors Training Program NO. NAMES DESIGNATION COMPANY YEAR 22 Mr. -

State-Owned Enterprises

STATE-OWNED ENTERPRISES- DO THE ENDS JUSTIFY THE MEANS? PreparedFor RONCO Consulting Corporation Analysis of Corporate Sector Constraints In Agriculture (ACSCA) Project PreparedBy Constance R. Church, C.P.A. Financial Analyst RONCO Consulting Corporation November 15, 1990 Islamabad, Pakistan The analysis on which this report is based is supported by the United States Agency for International Development under contract number 391-0470-C-00-9265-00 FOREWORD In the course of doing financial analysis on various agro-industries for the Analysis of Corporate Sector Constraints in Agriculture project undertaken by RONCO Consulting Corporation, in cooperation with Agri-Bi-Con International (Private) Ltd., under contract with the U.S. Agency for International Development (USAID), time and again I came across statements about the profits which Pakistani state-owned enterprises were making. Articles in the national press, often based on government press releases, would mention profits of XX million rupees for a given enterprise. Letters to shareholders from the Chairman of the Board in annual reports often gave rosy pictures of how the company was doing. Seldom mentioned was how much the government, the primary if not sole shareholder in these enterprises, had invested, either directly as equity or indirectly in loans and subsidies to the company or to its state-owned suppliers. Without the benchmark of total investment, the absolute numbers were meaningless. Thus was born the idea to analyze how state-owned enterprises are faring relative to capital invested and to compare their results with those of private companies in the same industries. The goal was to find out if running the myriad of state-owned enterprises which Pakistan has is an efficient means to providing goods and services or if the many state owned enterprises are a luxury which Pakistan can ill afford. -

Status of Petroleum Sector in Pakistan - a Review

STATUS OF PETROLEUM SECTOR IN PAKISTAN - A REVIEW Adeel Ahmad, Mithilesh Kumar Jha Energy Field of Study, School of Environment, Resources and Development Asian Institute of Technology, Bangkok 12120, Thailand Pakistan economy is growing steadily. This growth demands higher energy consumption and consequently putting high pressure on countries economy. Pakistan mainly depends upon oil and gas resources to fulfil energy requirements .Indigenous resources of Oil are not enough to quench energy thirst of the growing economy. As a result Pakistan has to import large quantity of oil and oil based products from Middle East countries. Gas reserves in the country are enough for current gas requirements. So natural gas is playing a key role in power sector. Currently in oil upstream and down stream sector there are some local and international companies involved and government of Pakistan is establishing such policies that it can attract more international investors in this sector but the rapid pace of change, high degree of uncertainty and unstable political situation of the country present significant challenges and risk to foreign investment .Objective of this paper to highlight the present status of petroleum industry in Pakistan and its future prospects keeping in view the internal fluid situation and geopolitical condition of the region. Key words: Hydrocarbon, Compressed Natural Gas, Pakistan The opinions and statements in this article are those of the author alone and do not, in any way, reflect the official policy or position of his government or employer Address correspondence to Adeel Ahmad, Energy Field of study, School of Environment, Resources and Development, Asian Institute of Technology, P.O. -

Teaming up for Success

. Real business . Real people . Real experience Teaming Up for Success Reward Advisory Services AFGHANISTAN: Remuneration Benchmarking Survey 2007 February 2007 A. F. Ferguson & Co. , A member firm of Chartered Accountants 2 AFGHANISTAN Remuneration Benchmarking Survey 2007 PwC would like to invite your organization to participate in the Remuneration Benchmarking Survey 2007 which will be conducted once every year. This survey will cover all multinational organizations and local companies in AFGHANISTAN, regardless of any particular industry/ sector. This effort is being formulated so as to bring organizations at par with other players in market-resulting by bringing sanity to management and HRM practice in Afghanistan especially during reconstruction era. The survey will comprise of two parts: • Part A – remuneration to personnel in managerial and executive cadres (excluding CEOs/ Country Heads) • Part B – remuneration to CEOs/ Country Heads (international and local nationals separately) • Part C – remuneration to non-management cadre Each report is prepared separately, and participants may choose to take part in either one or all three sections of the survey. Job benchmarking and data collection from the participating organizations will be done through personal visits by our consultants. A structured questionnaire will be used to record detailed information on salaries, allowances, all cash and non-cash benefits and other compensation policies. The collected information will be treated in strict confidence and the findings of the survey will be documented in the form of a report, which will be coded. Each participating organization will be provided a code number with which they can identify their own data and the report will only be available to the participant pool. -

Present Status and Potential of Biomass Energy in Pakistan Based on Existing and Future Renewable Resources

sustainability Review Present Status and Potential of Biomass Energy in Pakistan Based on Existing and Future Renewable Resources Wajahat Ullah Khan Tareen 1,2,3,4,*, Muhammad Tariq Dilbar 1, Muhammad Farhan 1 , Muhammad Ali Nawaz 1, Ali Waqar Durrani 1 , Kamran Ali Memon 5 , Saad Mekhilef 3,6 , Mehdi Seyedmahmoudian 6, Ben Horan 7 , Muhammad Amir 1 and Muhammad Aamir 4 1 Department of Electrical Engineering, International Islamic University, Islamabad 44000, Pakistan; [email protected] (M.T.D.); [email protected] (M.F.); [email protected] (M.A.N.); [email protected] (A.W.D.); [email protected] (M.A.) 2 Department of Electrical and Electronic Engineering, College of Engineering, University of Jeddah, Jeddah 21589, Saudi Arabia 3 Power Electronics and Renewable Energy Research Laboratory (PEARL), Department of Electrical Engineering, University of Malaya, Kuala Lumpur 50603, Malaysia; [email protected] 4 Department of Electrical Engineering, Bahria University, Islamabad 44000, Pakistan; [email protected] 5 School of Electronic Engineering, Beijing University of Posts and Telecommunications (BUPT), Beijing 100876, China; [email protected] 6 School of Software and Electrical Engineering, Swinburne University of Technology, Hawthorn, Melbourne, VIC 3122, Australia; [email protected] 7 School of Engineering, Deakin University, Waurn Ponds, VIC 3216, Australia; [email protected] * Correspondence: [email protected] Received: 10 October 2019; Accepted: 21 November 2019; Published: 27 December 2019 Abstract: Pakistan is a developing country that is experiencing a shortage of electricity generation due to its rapidly growing demand. The existing and upcoming energy requirements for power generation and future transportation can be met by efficient utilisation of homegrown biomass resources. -

MVIS Pakistan Index

FACTSHEET MVIS Pakistan Index The MVIS Pakistan Index (MVPAK) tracks the performance of the largest and most liquid companies in Pakistan. The index is a modified market cap-weighted index, and it also includes non-local companies incorporated outside Pakistan that generate at least 50% of their revenue in Pakistan. MVPAK covers at least 90% of the investable universe. Key Features Size and Liquidity Requirements Full MCap of at least 150 mln USD.Three month average-daily-trading volume of at least 1 mln USD at a review and also at the previous two reviews.At least 250,000 shares traded per month over the last six months at a review and also at the previous two reviews. Pure-Play Index includes non-local companies. Diversification Company weightings are capped at 8%. Review All Time High/Low 52-Week High/Low Quarterly. Total Return Net Index 1,503.92/216.64 472.86/374.45 Index Data INDEX PARAMETERS FUNDAMENTALS* ANNUALISED PERFORMANCE* Launch Date 14 Jul 2010 Components 25.00 Price/Earnings Trailing 5.74 1 Month -9.11% Type Country Volatility (1 year) 15.40 Price/Book 1.06 1 Year -1.22% Currency USD Full MCap bn USD 20.19 Price/Sales 0.61 3 Years -14.94% Base Date 30 Jun 2006 Float MCap bn USD 8.45 Price/Cash Flow 4.08 5 Years -14.52% Base Value 1,000.00 Correlation* (1 year) 0.97 Dividend Yield 7.06 Since Inception -6.16% * as of 30 Sep 2021 * MSCI Pakistan IMI * Total Return Net Index Country and Size Weightings COUNTRY WEIGHTINGS EXCL. -

IV. TRADE POLICIES by SECTOR (1) 1. Since Its Last Review, Pakistan

WT/TPR/S/193 Trade Policy Review Page 80 IV. TRADE POLICIES BY SECTOR (1) OVERVIEW 1. Since its last Review, Pakistan has continued to lower its average level of tariff protection. Nonetheless, border protection and domestic support still varies by sector, thus constituting potential impediments to the efficient allocation of resources and Pakistan's sustainable economic development. Reform in key sectors has been under way but adjustment toward a more diversified and efficient production pattern has not yet occurred. 2. Agriculture remains the economy’s mainstay, despite the decline of its GDP share from 24.1% in 2001/02 to 20.9% in 2006/07; it still accounts for more than four out of ten jobs. The sector’s productivity is low by international and domestic standards, undermined by inefficient resource use; skewed distribution of farm holdings, accentuated by a thin land market that reflects insecure tenure, inefficient non-price allocation of water (involving significant irrigation subsidies), and irrigation systems in a drought-prone country; as well as poor quality inputs and infrastructure. Food security based on self-sufficiency, a potentially costly policy, is a major government priority. Reforms since 2001/02 have been directed at a greater role for the private sector, including in marketing, and supplying farm inputs. Reportedly, domestic support measures (price and non-price) hinder diversification, in some cases they periodically penalize farmers (e.g. recently for wheat and rice), and are biased towards relatively low-value, water-intensive crops e.g. sugar cane; sugar seems to be particularly inefficient, with domestic prices exceeding world levels, by at times up to 50-60%.