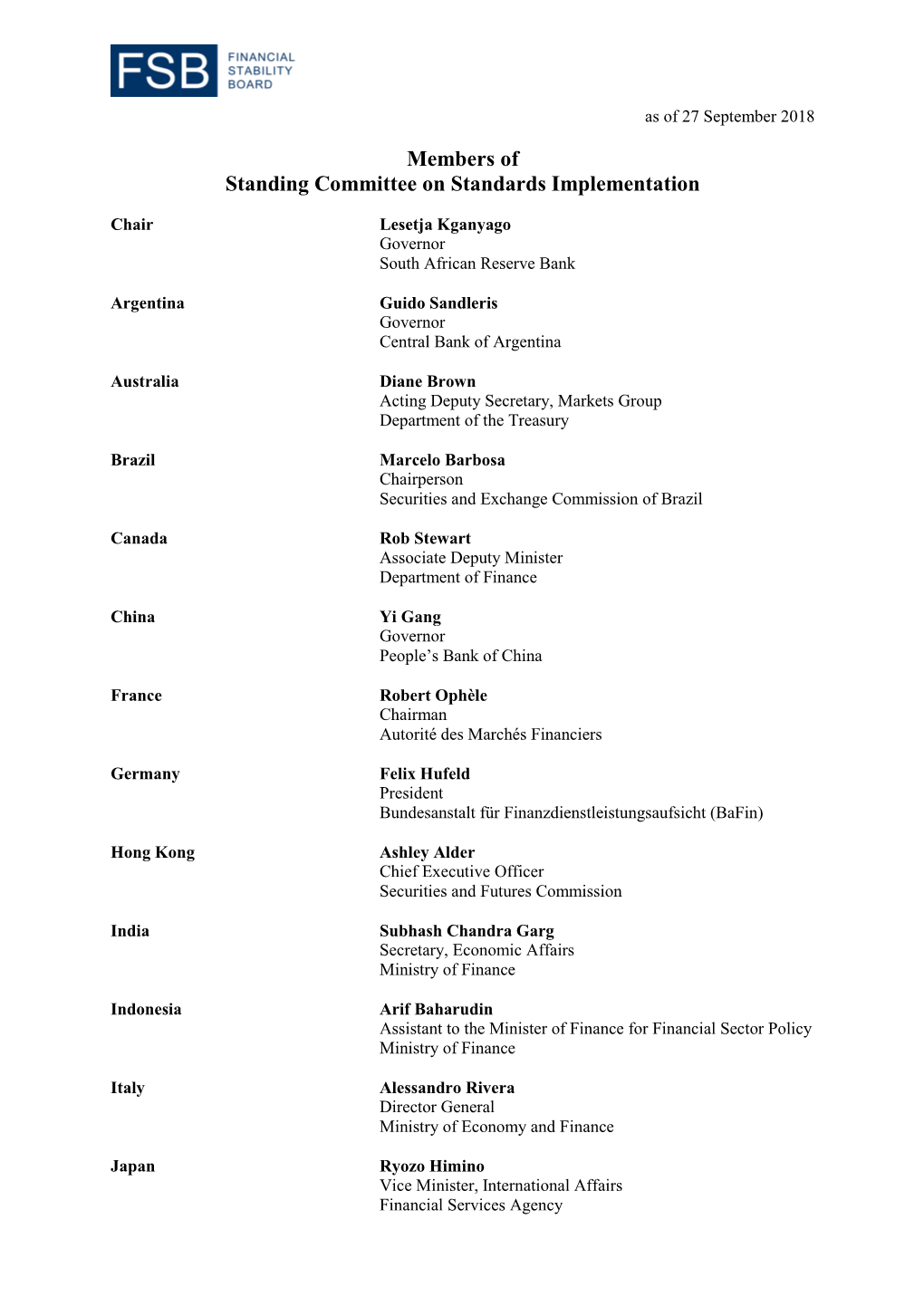

FSB SCSI Members List

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Novelli Working Paper Final

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Novelli, José Marcos Nayme Working Paper Progress and setbacks in the neo-developmentalist agenda of public policy in Brazil Bath Papers in International Development and Wellbeing, No. 47 Provided in Cooperation with: Centre for Development Studies (CDS), University of Bath Suggested Citation: Novelli, José Marcos Nayme (2016) : Progress and setbacks in the neo- developmentalist agenda of public policy in Brazil, Bath Papers in International Development and Wellbeing, No. 47, University of Bath, Centre for Development Studies (CDS), Bath This Version is available at: http://hdl.handle.net/10419/179374 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu Bath Papers in International Development and Wellbeing No: 47/2016 PROGRESS AND SETBACKS IN THE NEO-DEVELOPMENTALIST AGENDA OF PUBLIC POLICY IN BRAZIL José Marcos N. -

Brazil Links Newsletter

2015 May EURAXESS LINKS Issue 25 BRAZIL Dear Colleagues, EURAXESS Links Brazil We have the pleasure to present to you the 25th edition of the EURAXESS Newsletter is a monthly Links Brazil Newsletter for May 2015. electronic newsletter, edited by EURAXESS L partners. This month, our “EU Insight” section focuses on the recently published The information contained in Innovation Union Scoreboard 2015. this publication is intended for We also bring you a feature interview with Professor Carlos H. de Brito Cruz, personal use only. It should Scientific Director of the Foundation for Support to Research of the São Paulo not be taken in any way to State (FAPESP). reflect the views of the European Commission nor of Under EURAXESS Links activities, we report on the Science without Borders the Delegation of the Road Show 2015 and the first event of the “Tour of Brazil 2015”, where we European Union to Brazil. participated together with representatives from EU Member States. Please email to [email protected] with any We have the pleasure to announce that the submission process for the comments on this newsletter, EURAXESS Science Slam Brazil 2015 is now open and will remain open contributions you would like to until 15 September 2015. Researchers (including masters students) of all make, if you think any other nationalities and research fields currently based in Brazil can apply. It is a fun colleagues would be interested in receiving this way to communicate your research project to an audience of non-experts. newsletter, or if you wish to As usual, in our “News and Developments” section, we report on several unsubscribe. -

Resenha De 22 NOV 2014

Continuação da Resenha Diária 22/11/14 2 MINISTÉRIO DA DEFESA 22 NOV 14 EXÉRCITO BRASILEIRO Resenha GABINETE DO COMANDANTE Diária Sábado CCOMSEX Elaborado pelo Centro de Comunicação Social do Exército DESTAQUES O GLOBO - A ‘ruivinha’ que deu prejuízo FOLHA DE S. PAULO - Governo agora prevê superavit primário de R$ 10 bi neste ano - Dilma acena ao mercado e deve anunciar Joaquim Levy para comandar O ESTADO DE S. PAULO Fazenda - Ministro diz que corrupção é ‘cultural’ no Brasil CORREIO BRAZILIENSE - Supersalários de volta à Câmara Continuação da Resenha Diária 22/11/14 3 A ‘ruivinha’ que deu prejuízo Pasadena ganhou apelido após estatal constatar, antes da compra, que ela estava toda enferrujada Eduardo Bresciani BRASÍLIA- A polêmica refinaria de Pasadena já era malvista pela área técnica da Petrobras desde o início do processo de avaliação para a aquisição. O desconforto era tal que a refinaria americana tinha um curioso apelido dados por funcionários antes da realização da compra. O diretor financeiro da Petrobras, Almir Barbassa, que no cargo desde 2003, contou em depoimento à Comissão Interna de Apuração que a refinaria era chamada de “ruivinha”, e explicou o motivo mostrando o desconforto com o negócio: Pasadena estava toda enferrujada. “Pessoas desta sede viajaram para avaliação in loco, e houve reação negativa dessas pessoas, que não gostaram do que viram e apelidaram a refinaria de ruivinha, porque estava tudo enferrujado. Havia sentimento muito negativo, mas também desejo muito forte da área Internacional de que o negócio ocorresse”, disse Barbassa em 13 de maio deste ano. Apontado no relatório da comissão como principal articulador do negócio e responsável em dez das 11 irregularidades levantadas pela investigação interna, o ex-diretor da área Internacional Nestor Cerveró atribuiu o mau estado de conservação à falta de preocupação dos americanos com “aparência”. -

Eleições 2016 E Novos Rumos Políticos

Arthur Grünewald Zarantoneli Bastos ELEIÇÕES 2016 E NOVOS RUMOS POLÍTICOS 2016 ELECTIONS AND NEW POLITICAL ROUTES Arthur Grünewald Zarantoneli Bastos1 RESUMO O presente artigo se propõe a explicar a derrota do Partido dos Trabalhadores (PT) nas últimas eleições municipais no ano de 2016, e a consequente vitoria dos partidos opositores. Como poderíamos rever uma mudança de comportamento dos eleitores na urna eletrônica em comparação com as eleições municipais de 2012, quando o mesmo partido ganhou em importantes cidades do Brasil, por exemplo: São Paulo e em seu tradicional “berço político” o ABC paulista Formado pelas cidades Santo André, São Bernardo do Campo e São Caetano.) e nas eleições seguintes perdeu para partidos opositores, como na cidade de São Paulo capital em primeiro turno para o rival PSDB. A derrota petista ainda pode ser explicada, por conta de uma série de escândalos envolvendo os mais altos líderes da classe política, aonde o Partido dos Trabalhadores foi um dos alvos da maior operação anti-corrupção realizada pela polícia federal chamada de operação “Lava Jato” e também o Impeachment da ex- presidente da república Dilma Vana Rousseff e causando um abalo político na imagem do partido. Ainda tentarei explicar os novos rumos políticos que o Brasil e o mundo podem adotar a partir das próximas eleições. Neste artigo explicarei os temas através de artigos acadêmicos e livros, tentando ser o mais imparcial possível. Palavras-chave: Eleições. Partido do Trabalhadores. Comparação 2012x2016. ABSTRACT This article proposes to explain the defeat of the Workers Party (PT) in the last municipal elections in 2016, and the consequent victory of the opposition parties. -

2016 Annual Meetings of the Boards of Governors

THE WORLD BANK GROUP Public Disclosure Authorized 2016 ANNUAL MEETINGS OF THE BOARDS OF GOVERNORS Public Disclosure Authorized SUMMARY PROCEEDINGS Public Disclosure Authorized Washington, D.C. October 7-9, 2016 Public Disclosure Authorized THE WORLD BANK GROUP Headquarters 1818 H Street, NW Washington, D.C. 20433 U.S.A. Phone: (202) 473-1000 Fax: (202) 477-6391 Internet: www.worldbankgroup.org iii INTRODUCTORY NOTE The 2016 Annual Meetings of the Boards of Governors of the World Bank Group (Bank), which consist of the International Bank for Reconstruction and Development (IBRD), International Development Association (IDA), the International Finance Corporation (IFC), International Centre for the Settlement of Investment Disputes (ICSID), and the Multilateral Investment Guarantee Agency (MIGA), held jointly with the International Monetary Fund (Fund), took place on October 7, 2016 in Washington, D.C. The Honorable Mauricio Cárdenas, Governor of the Bank and Fund for Colombia, served as the Chairman. In Committee Meetings and the Plenary Session, a joint session with the Board of Governors of the International Monetary Fund, the Board considered and took action on reports and recommendations submitted by the Executive Directors, and on matters raised during the Meeting. These proceedings outline the work of the 70th Annual Meeting and the final decisions taken by the Board of Governors. They record, in alphabetical order by member countries, the texts of statements by Governors and the resolutions and reports adopted by the Boards of Governors of the World Bank Group. In addition, the Development Committee discussed the Forward Look – A Vision for the World Bank Group in 2030, and the Dynamic Formula – Report to Governors Annual Meetings 2016. -

Weatherhead Center for International Affairs

WEATHERHEAD CENTER FOR INTERNATIONAL AFFAIRS H A R V A R D U N I V E R S I T Y two2004-2005 thousand four – two thousand five ANNUAL REPORTS two2005-2006 thousand five – two thousand six 1737 Cambridge Street • Cambridge, MA 02138 www.wcfia.harvard.edu TABLE OF CONTENTS INTRODUCTION 2 PEOPLE Visiting Committee 4 Executive Committee 4 Administration 6 RESEARCH ACTIVITIES Small Grants for Faculty Research Projects 8 Medium Grants for Faculty Research Projects 9 Large Grants for Faculty Research Projects 9 Large Grants for Faculty Research Semester Leaves 9 Distinguished Lecture Series 11 Weatherhead Initiative in International Affairs 12 CONFERENCES 13 RESEARCH SEMINARS Challenges of the Twenty-First Century 34 Communist and Postcommunist Countries 35 Comparative Politics Research Workshop 36 Comparative Politics Seminar 39 Director’s Faculty Seminar 39 Economic Growth and Development 40 Harvard-MIT Joint Seminar on Political Development 41 Herbert C. Kelman Seminar on International Conflict Analysis and Resolution 42 International Business 43 International Economics 45 International History 48 Middle East 49 Political Violence and Civil War 51 Science and Society 51 South Asia 52 Transatlantic Relations 53 U.S. Foreign Policy 54 RESEARCH PROGRAMS Canada Program 56 Fellows Program 58 Harvard Academy for International and Area Studies 65 John M. Olin Institute for Strategic Studies 74 Justice, Welfare, and Economics 80 Nonviolent Sanctions and Cultural Survival 82 Religion, Political Economy, and Society 84 Student Programs 85 Transnational Studies Initiative 95 U.S.-Japan Relations 96 PUBLICATIONS 104 ANNUAL REPORTS 2004–2005 / 2005–2006 - 1 - INTRODUCTION In August 2005, the Weatherhead Center moved In another first, the faculty research semester to the new Center for Government and leaves that the Center awarded in spring 2005 International Studies (CGIS) complex. -

Global Finance's Central Banker Report Cards 2021

Global Finance’s Central Banker Report Cards 2021 NEW YORK, September 1, 2021 — Global Finance magazine has released the names of Central Bank Governors who earned “A” or “A-” grades as part of its Central Banker Report Cards 2021. The full Central Banker Report Cards 2021 report and grade list will appear in Global Finance’s October print and digital editions and online at GFMag.com. The Central Banker Report Cards, published annually by Global Finance since 1994, grade the central bank governors of 101 key countries and territories including the European Union, the Eastern Caribbean Central Bank, the Bank of Central African States and the Central Bank of West African States. About Global Finance Grades are based on an “A” to “F” scale for success in areas such as inflation control, economic Global Finance, founded in growth goals, currency stability and interest rate management. (“A” represents an excellent 1987, has a circulation of performance down through “F” for outright failure.) Subjective criteria also apply. 50,000 and readers in 191 countries. Global Finance’s “With the pandemic still surging in many areas, and inflation emerging as a major area of audience includes senior concern once again, the world’s central bankers are confronting multiple challenges from corporate and financial multiple directions,” said Global Finance publisher and editorial director Joseph Giarraputo. officers responsible for making investment and strategic “Global Finance’s annual Central Banker Report Cards show which financial policy leaders are decisions at multinational succeeding in the face of adversity and which are falling behind.” companies and financial The Central Bankers earning an “A” grade in the Global Finance Central Banker Report Card institutions. -

00 Preliminares 12 TBE 2015.Indd

BRAZIL NEWS BRIEFS POLITICS Vetoes on spending bills upheld Brazil’s Congress has upheld President Dilma Rousseff’s vetoes of two bills to raise public spending, a victory for the embattled leader as she tries to close a gaping fiscal deficit and regain investors’ confidence. Opposition lawmakers failed Photo:Wilson Dias/Agencia Brasil. to reach the absolute majority needed to override the president’s vetoes of one bill to raise benefit payments to retirees Brasil. Pozzebom/Agencia Rodrigues Fabio Photo: and another that would have granted steep wage hikes for court employees. The two bills would have cost 47 billion reais (US$12.43 billion) in extra spending Speaker of the House Eduardo Cunha President Dilma Rousseff over four years, the Finance Ministry estimated. (November 19) Congress moves to impeach Workers Party, which Rousseff represents, President Rousseff decided to support proceedings in Eduardo Cunha, speaker of the the House Ethics Council to remove lower house of Brazil’s Congress, has speaker Cunha, who has been accused announced plans to open impeachment of accepting bribes in the Petrobras corruption scandal. Cunha denied the proceedings against President Dilma Photo: José Cruz./Agência Brasil. Rousseff, in response to charges allegations but it has been confirmed that in 2014 she violated the law by that the speaker and family members manipulating government finances to had bank accounts in Switzerland with benefit her re-election campaign. If the deposit dates and amounts that closely committee hearing the charges, -

José Roberto Mendonça De Barros, Partner in MB Associates Consulting Group

Interview: José Roberto Mendonça de Barros, Partner in MB Associates Consulting Group --“The tax code has become as much an obstacle to growth as inflation was in the 1980s.”— Brazil’s government has worked hard since the 2008 global financial crisis to support the country’s often hard-pressed manufacturing sector, with a plethora of incentives, policy initiatives and programs, but the time has come, according to a leading expert in industry and foreign trade, to admit the effort has largely failed. At a recent meeting of investors and reporters in São Paulo, José Roberto Mendonça de Barros, a former Brazilian Foreign Trade Secretary, addressed the issues behind Brazil’s industrial malaise. Excerpts follow: • On efforts to revive Brazilian manufacturing: “Today in Brazil, instead of having an industrial strategy, we have an array of disparate industrial policies, including all kinds of aid and incentive programs, and more trade protectionism than at any time in the last 30 years. We have subsidized credit. We have national-content and government procurement rules. But it’s not working and Brazil’s government doesn’t seem to know why and it doesn’t seem to know what to do to get us out of the hole we’re in.” • On approaches to a new industrial policy: “The first problem is macroeconomic policy. There is no piecemeal approach to industrial policy that will work if macroeconomic policies are out of kilter. Today, they are out of kilter in virtually every area—monetary, fiscal and regulatory. The first order of priority is to fix the economic policy mix.” • On the broader array of problems facing industry: “There is no amount of subsidized BNDES credit that is going to compensate for the problems arising from an overvalued currency. -

Local Currency Bond Markets Conference South African Reserve Bank (SARB) Conference Centre, Pretoria, South Africa

Local Currency Bond Markets Conference South African Reserve Bank (SARB) Conference Centre, Pretoria, South Africa Thursday, 8 March 2018 Venue: SARB Conference Centre Auditorium 11.00 – 12.00 Registration 12.00 – 13.00 Finger lunch Programme Director: Mr Nimrod Lidovho, SARB 13.00 – 13.15 Welcome address by Governor Lesetja Kganyago, SARB 13.15 – 13.45 Opening remarks "Facing up to the original sin - The German experience of establishing a local currency bond market" by Andreas Dombret, Board Member, Deutsche Bundesbank 13.45 – 14.30 Keynote “Local currency markets – the case of a development bank” Joachim Nagel, Member of the Executive Board, KfW 14.30 – 14.45 Coffee break 14.45 – 15.30 “African growth and prosperity: the important role of local currency bond markets” by Stacie Warden, Executive Director, Center for Financial Markets, Milken Institute 15.30 – 16.15 Expert speech “Challenges of development of LCBM in emerging markets” Leon Myburgh, SARB 16.15 – 17.15 Bilateral talk “CWA: Development of financial markets in Africa” moderated by Deputy Governor Daniel Mminele, SARB Dondo Mogajane and Ludger Schuknecht, co-chairs of G-20 Africa Advisory Group, ZAF/GER Venue: SARB Conference Centre Banqueting Room 18.00 – 21.00 Conference dinner 18.00 – 18.20 Dinner remarks by Deputy Governor Daniel Mminele, SARB Friday, 9 March 2018 Venue: SARB Conference Centre Auditorium Programme Director: Mr Martin Dinkelborg, Deutsche Bundesbank 9.00 – 10.30 Panel discussion “The role of central banks in establishing primary markets” moderated by Zafar -

POLITICAL CLIMATE REPORT Prior to the Prior to to Assuage the Uncertainty That Has Been Plaguing the Argentine Economy Since April This Year

CONTACT INFORMATION POLITICAL & REGULATORY RISKS [email protected] Juan Cruz Díaz [email protected] www.cefeidas.com Madeleine Elder +54 (11) 5238 0991 (ARG) [email protected] +1 (646) 233 3204 (USA) Megan Cook Torre Bellini [email protected] Esmeralda 950 Sergio Espinosa Ciudad Autónoma de Buenos Aires [email protected] (C1007ABL) República Argentina Political Climate Report - ARGENTINA September 28, 2018 POLITICAL CLIMATE REPORT IN THIS ISSUE The Macri administration is looking to restore confidence in the markets Page 3 following weeks of economic turmoil. A modified agreement between Government reduces cabinet ministries Argentina and the International Monetary Fund, changes in central bank in effort to show austerity strategy and the ongoing debate to finalize the 2019 budget may prove Page 5 pivotal to stabilize the local economy. With brewing social unrest, Unions hold fourth general strike ongoing corruption investigations into the previous administrations and Page 6 Macri’s announced bid for reelection in 2019, the government will have Carlos Rosenkrantz named new to perform a delicate balancing act between mitigating short-term president of the Supreme Court unrest and achieving longer-term objectives. Page 7 More chapters in the notebooks scandal Tying it all together: the IMF agreement, central bank Page 8 changes, and the 2019 budget G20 watch In late August and early September, the Macri administration scrambled to respond to a fresh plunge in the already-depreciated Argentine peso (relative to the U.S. dollar). The crisis culminated in a series of measures taken by the government to reassure investors and restore confidence in the markets, including renegotiating the USD 50 billion stand-by agreement with the International Monetary Fund (IMF), tightening 2019 budget and cutting the number of ministries. -

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT of NEW YORK in RE BANCO BRADESCO S.A. SECURITIES LITIGATION Civil Case No. 1:16

Case 1:16-cv-04155-GHW Document 45 Filed 10/21/16 Page 1 of 92 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK IN RE BANCO BRADESCO S.A. Civil Case No. 1:16-cv-04155 (GHW) SECURITIES LITIGATION AMENDED CLASS ACTION COMPLAINT JURY TRIAL DEMANDED Case 1:16-cv-04155-GHW Document 45 Filed 10/21/16 Page 2 of 92 TABLE OF CONTENTS Page I. INTRODUCTION ...............................................................................................................2 II. JURISDICTION AND VENUE ..........................................................................................9 III. PARTIES ...........................................................................................................................10 A. Lead Plaintiff .........................................................................................................10 B. Defendants .............................................................................................................10 1. Banco Bradesco S.A. ................................................................................ 10 2. The Individual Defendants ........................................................................ 12 C. Relevant Non-Parties .............................................................................................13 IV. BACKGROUND ...............................................................................................................16 A. Bradesco Accesses the U.S. Capital Markets ........................................................16 B. Operation