康師傅控股有限公司 Tingyi (Cayman

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

3.4.2 Sentiment Analysis

Information School INF6000 Dissertation COVER SHEET (TURNITIN) Registration Number 160128947 Family Name Zhao First Name Pan Use of unfair means. It is the student's responsibility to ensure no aspect of their work is plagiarised or the result of other unfair means. The University’s and Information School’s advice on unfair means can be found in your Student Handbook, available via http://www.sheffield.ac.uk/is/current Assessment Word Count _____10893_____________. If your dissertation has a word count that is outside the range 10,000 – 15,000 words or if you do not state the word count then a deduction of 3 marks will be applied Late submission. A dissertation submitted after 10am on the stated submission date will result in a deduction of 5% of the mark awarded for each working day after the submission date/time up to a maximum of 5 working days, where ‘working day’ includes Monday to Friday (excluding public holidays) and runs from 10am to 10am. A dissertation submitted after the maximum period will receive zero marks. Ethics documentation should be included in the Appendix if your dissertation has been judged to be Low Risk or High Risk. R (Please tick the box if you have included the documentation) A deduction of 3 marks will be applied for a dissertation if the required ethics documentation is not included in the appendix; and the same deduction will be applied if your research data has not been available for inspection when required. The deduction procedures are detailed in the INF6000 Module Outline and Dissertation Handbook. -

Alibaba Pictures , Ruyi Films and Enlight Pictures' Once Upon a Time to Be

IMAX CORPORATION ALIBABA PICTURES , RUYI FILMS AND ENLIGHT PICTURES’ ONCE UPON A TIME TO BE RELEASED IN IMAX® THEATRES ACROSS CHINA SHANGHAI – July 20, 2017 – IMAX Corporation (NYSE:IMAX) and IMAX China Holding Inc. (HKSE: 1970) today announced that Enlight Pictures’, Ruyi Films’ and Alibaba Pictures Group’s much-anticipated fantasy flick, Once Upon a Time, will be digitally re-mastered in the immersive IMAX 3D format and released in approximately 420 IMAX® theatres in China, beginning Aug. 3. Directed by Zhao Xiaoding and Anthony LaMolinara, Once Upon a Time was adapted from the popular fantasy romance novel, illustrating the story of Bai Qian (Liu Yifei) and Ye Hua (Yang Yang). It is produced by well-known filmmaker Zhang Yibai, and stars Liu Yifei, Yang Yang, Luo Jin, Yan Yikuan, Lichun, Gu Xuan and Peng Zisu. Once Upon a Time marks the first Chinese local-language IMAX DMR film in partnership with Alibaba Pictures Group and Ruyi Films, and the second with Enlight Pictures, which released Lost in Hong Kong in 2015. “We are excited to team up with Alibaba Pictures, Ruyi Films and Enlight Pictures, and directors Zhao Xiaoding and Anthony LaMolinara to bring this beloved fantasy novel to life in IMAX,” said Greg Foster, CEO of IMAX Entertainment and Senior Executive Vice President, IMAX Corp. “The film's incredible visual effects showcase The IMAX Experience and create a powerful addition to our summer movie slate.” The IMAX 3D release of Once Upon a Time will be digitally re-mastered into the image and sound quality of The IMAX Experience® with proprietary IMAX DMR® (Digital Re-mastering) technology. -

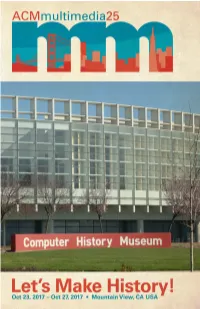

General Chairs' Welcome

General Chairs’ Welcome ACM Multimedia 2017 We warmheartedly welcome you to the 25th ACM Multimedia conference, which is hosted in the heart of Silicon Valley at the wonderful Computer History Museum in Mountain View, CA, USA. As you will notice, the second floor of the Computer History Museum is still nearly empty these days. 25 years later, the second floor will be filled with artifacts people have created today. Hopefully some of these artifacts are created by attendees of this conference. Let us work together and make history. We are celebrating our 25th anniversary with an extensive program consisting of technical sessions covering all aspects of the multimedia field in both form of oral and poster presentations, tutorials, panels, exhibits, demonstrations and workshops, bringing into focus the principal subjects of investigation, competitions of research teams on challenging problems, and an interactive art program stimulating artists and computer scientists to meet and discover together the frontiers of artistic communication. For our 25th ACM Multimedia conference, ACM Multimedia 2017, we unified for the first time the long and short papers into a single submission track and review process. In order to support the traditional short and long papers, the unified track has had a flexible range of paper lengths (6-8 pages plus references), which is not much longer than the previous short paper length (5 pages), while also supporting the traditional long papers with 8 pages plus references. This change was decided at the SIGMM Business Meeting at ACM Multimedia 2016 in Amsterdam. It aims at making the review process more consistent than the former short and long paper track. -

Staff and Students

KIB STAFF AND STUDENTS HAN Min CHEN Shao-Tian WANG Ying JI Yun-Heng Director: XUAN Yu CHEN Wen-Yun LI De-Zhu DUAN Jun-Hong GU Shuang-Hua The Herbarium Deputy Directors: PENG Hua (Curator) SUN Hang Sci. & Tech. Information Center LEI Li-Gong YANG Yong-Ping WANG Li-Song ZHOU Bing (Chief Executive) LIU Ji-Kai LI Xue-Dong LIU Ai-Qin GAN Fan-Yuan WANG Jing-Hua ZHOU Yi-Lan Director Emeritus: ZHANG Yan DU Ning WU Zheng-Yi WANG Ling HE Yan-Biao XIANG Jian-Ying HE Yun-Cheng General Administrative Offi ce LIU En-De YANG Qian GAN Fan-Yuan (Head, concurrent WU Xi-Lin post) ZHOU Hong-Xia QIAN Jie (Deputy Head) Biogeography and Ecology XIONG De-Hua Department Other Members ZHAO JI-Dong Head: ZHOU Zhe-Kun SHUI Yu-Min TIAN Zhi-Duan Deputy Head: PENG Hua YANG Shi-Xiong HUANG Lu-Lu HU Yun-Qian WU Yan CAS Key Laboratory of Biodiversity CHEN Wen-Hong CHEN Xing-Cai (Retired Apr. 2006) and Biogeography YANG Xue ZHANG Yi Director: SUN Hang (concurrent post) SU Yong-Ge (Retired Apr. 2006) Executive Director: ZHOU Zhe-Kun CAI Jie Division of Human Resources, Innovation Base Consultant: WU Master' s Students Zheng-Yi CPC & Education Affairs FANG Wei YANG Yun-Shan (secretary) WU Shu-Guang (Head) REN Zong-Xin LI Ying LI De-Zhu' s Group LIU Jie ZENG Yan-Mei LI De-Zhu ZHANG Yu-Xiao YIN Wen WANG Hong YU Wen-Bin LI Jiang-Wei YANG Jun-Bo AI Hong-Lian WU Shao-Bo XUE Chun-Ying ZHANG Shu PU Ying-Dong GAO Lian-Ming ZHOU Wei HE Hai-Yan LU Jin-Mei DENG Xiao-Juan HUA Hong-Ying TIAN Xiao-Fei LIU Pei-Gui' s Group LIANG Wen-Xing XIAO Yue-Qin LIU Pei-Gui QIAO Qin ZHANG Chang-Qin Division of Science and TIAN Wei WANG Xiang-Hua Development MA Yong-Peng YU Fu-Qiang WANG Yu-Hua (Head) SHEN Min WANG Yun LI Zhi-Jian ZHU Wei-Dong MA Xiao-Qing SUN Hang' s Group NIU Yang YUE Yuan-Zheng SUN Hang YUE Liang-Liang LI Xiao-Xian NIE Ze-Long LI Yan-Chun TIAN Ning YUE Ji-Pei FENG Bang NI Jing-Yun ZHA Hong-Guang XIA Ke HU Guo-Wen (Retired Jun. -

Luxury Goods

LUXURY GOODS China Online Boom: ...yet to come for Ostrich Luxury Brands 21 FEBRUARY 2017 at 05:29* We go back to surveying how western luxury goods brands are faring in the Chinese digital market, following up on our two previous reports: China Online Boom - No Country for Ostrich Brands; Best Luca Solca of: China Online Boom: Ostriches are lifting their heads from the sand. (+44) 203 430 8503 [email protected] China is the most advanced digital market in the world Melania Grippo Digital payment penetration in China is 50 times higher than in the USA, largely still relying on (+39) 02 89 63 1724 [email protected] plastic. FMCG online penetration has reached the mid-teens. Big-box retailing in China makes shopping malls and department stores in the USA look like the garden of Eden. Guido Lucarelli (+39) 02 89 63 1726 [email protected] Western luxury brands in China are still lagging behind Only 21 of the 34 brands we have analysed operate an e-commerce mono-brand website in China. Even more remarkable is that the largest brands, such as LV, Hermès, Gucci, Prada, Ralph Lauren and Swatch, do not have an ecommerce mono-brand site. For comparison, 31 out of 32 brands Specialist sales surveyed operate an e-commerce mono-brand website in the USA, and 30 out of 32 in the UK. David Tovar Digital proficiency in China is 46% – against 55% in our latest digital competitive map (DCM). (+44) 203 430 8677 Burberry, Michael Kors and Cartier are the only exceptions Contactlab Burberry stands out in China as strong leader on the Strategic Reach axis for exploiting all possible Marco Pozzi (+39) 02 28 31 181 ecommerce channels as well as on the Digital Customer Experience Axis, excelling in customer [email protected] service and style advisory. -

Xi Jinping's Inner Circle (Part 2: Friends from Xi's Formative Years)

Xi Jinping’s Inner Circle (Part 2: Friends from Xi’s Formative Years) Cheng Li The dominance of Jiang Zemin’s political allies in the current Politburo Standing Committee has enabled Xi Jinping, who is a protégé of Jiang, to pursue an ambitious reform agenda during his first term. The effectiveness of Xi’s policies and the political legacy of his leadership, however, will depend significantly on the political positioning of Xi’s own protégés, both now and during his second term. The second article in this series examines Xi’s longtime friends—the political confidants Xi met during his formative years, and to whom he has remained close over the past several decades. For Xi, these friends are more trustworthy than political allies whose bonds with Xi were built primarily on shared factional association. Some of these confidants will likely play crucial roles in helping Xi handle the daunting challenges of the future (and may already be helping him now). An analysis of Xi’s most trusted associates will not only identify some of the rising stars in the next round of leadership turnover in China, but will also help characterize the political orientation and worldview of the influential figures in Xi’s most trusted inner circle. “Who are our enemies? Who are our friends?” In the early years of the Chinese Communist movement, Mao Zedong considered this “a question of first importance for the revolution.” 1 This question may be even more consequential today, for Xi Jinping, China’s new top leader, than at any other time in the past three decades. -

<A>INTRODUCTION

Montgomery, L. & E. Priest (2016), “Copyright and China’s Digital Cultural Industries.” In Michael Keane (Ed) Handbook of the Cultural and Creative Industries in China. Cheltenham: Edward Elgar. <a>INTRODUCTION Economic and cultural sector reforms and engagement with international markets initiated by Deng Xiaoping since 1990 led to the rapid development of the PRC’s copyright law. Since China joined the World Trade Organization in December 2001, affluent Chinese consumers have become an important target market for both Chinese and international firms trading in creative and cultural products. While enforcement remains problematic, Chinese creators and businesses are adept at navigating the intellectual property system – developing business strategies that engage with the possibilities of digital technologies and copyright licensing; using copyright to support eXpansion into new markets; and adapting distribution approaches to reflect lessons provided by first-movers in digital spaces. This chapter eXplores how and why copyright’s role is eXpanding and changing in China, focusing on recent developments in digital content markets. It considers the impact of uneven media sector reform processes on the emergence of ‘born digital’ copyright industries in China. There are signs that the commercial benefits of copyright compliance are beginning to outweigh the advantages of operating outside the intellectual property system for many Chinese stakeholders. We argue that these developments – in particular the emergence of widespread exclusive licensing practices – signal a watershed moment for China’s cultural and creative industries, highlighting the potential for digital technology to create new markets for legitimate content and services, as well as the importance of global dynamics in the development of digital era copyright industries. -

The Chinese People's Liberation Army in 2025

The Chinese People’s Liberation Army in 2025 The Chinese People’s The Chinese People’s Liberation Army in 2025 FOR THIS AND OTHER PUBLICATIONS, VISIT US AT http://www.carlisle.army.mil/ U.S. ARMY WAR COLLEGE David Lai Roy Kamphausen Editors: Editors: UNITED STATES Roy Kamphausen ARMY WAR COLLEGE PRESS David Lai This Publication SSI Website USAWC Website Carlisle Barracks, PA and The United States Army War College The United States Army War College educates and develops leaders for service at the strategic level while advancing knowledge in the global application of Landpower. The purpose of the United States Army War College is to produce graduates who are skilled critical thinkers and complex problem solvers. Concurrently, it is our duty to the U.S. Army to also act as a “think factory” for commanders and civilian leaders at the strategic level worldwide and routinely engage in discourse and debate concerning the role of ground forces in achieving national security objectives. The Strategic Studies Institute publishes national security and strategic research and analysis to influence policy debate and bridge the gap between military and academia. The Center for Strategic Leadership and Development CENTER for contributes to the education of world class senior STRATEGIC LEADERSHIP and DEVELOPMENT leaders, develops expert knowledge, and provides U.S. ARMY WAR COLLEGE solutions to strategic Army issues affecting the national security community. The Peacekeeping and Stability Operations Institute provides subject matter expertise, technical review, and writing expertise to agencies that develop stability operations concepts and doctrines. U.S. Army War College The Senior Leader Development and Resiliency program supports the United States Army War College’s lines of SLDR effort to educate strategic leaders and provide well-being Senior Leader Development and Resiliency education and support by developing self-awareness through leader feedback and leader resiliency. -

An Analysis of Mobile Television in the Chinese Market

An Analysis of Mobile Television in the Chinese Market A Thesis Submitted to the Faculty of Drexel University by Yang Yang in partial fulfillment of the requirements for the degree of Master of Science in Television Management September 2015 © Copyright 2015 Yang Yang. All Rights Reserved. ii Table of Contents List of Tables ........................................................................................................ iiv List of Figures .......................................................................................................... v Abstract ................................................................................................................... vi CHAPTER 1: INTRODUCTION ............................................................................ 1 1.1 Introduction ........................................................................................................ 1 1.2 Statement of the Problem ................................................................................... 2 1.3 Background and Need ........................................................................................ 2 1.4 Purpose of the Study .......................................................................................... 5 1.5 Research Questions ............................................................................................ 6 1.6 Definitions.......................................................................................................... 6 CHAPTER 2: LITERATURE REVIEW ................................................................ -

That's Beijing

Follow us on WeChat Now Advertising Hotline 400 820 8428 城市漫步北京 英文版 5 月份 国内统一刊号: CN 11-5232/GO China Intercontinental Press ISSN 1672-8025 EYE ON THE SKY China's Massive Telescope and the Global Quest to Find Extraterrestrial Life MAY 2019 主管单位 : 中华人民共和国国务院新闻办公室 Supervised by the State Council Information Office of the People's Republic of China 主办单位 : 五洲传播出版社 地址 : 北京西城月坛北街 26 号恒华国际商务中心南楼 11 层文化交流中心 邮编 100045 Published by China Intercontinental Press Address: 11th Floor South Building, HengHua linternational Business Center, 26 Yuetan North Street, Xicheng District, Beijing 100045, PRC http://www.cicc.org.cn 社长 President of China Intercontinental Press 陈陆军 Chen Lujun 期刊部负责人 Supervisor of Magazine Department 付平 Fu Ping 编辑 Editor 朱莉莉 Zhu Lili 发行 Circulation 李若琳 Li Ruolin Editor-in-Chief Valerie Osipov Deputy Editor Edoardo Donati Fogliazza National Arts Editor Sarah Forman Designers Ivy Zhang 张怡然 , Joan Dai 戴吉莹 , Nuo Shen 沈丽丽 Contributors Andrew Braun, Cristina Ng, Curtis Dunn, Dominic Ngai, Ellie Dunnigan, Flynn Murphy, Grigor Grigorian, Gwen Kim, Guo Xun, Karen Toast, Matthew Bossons, Mia Li, Mollie Gower, Naomi Lounsbury, Ryan Gandolfo, Wang Kaiqi, Xue Juetao HK FOCUS MEDIA Shanghai (Head office) 上海和舟广告有限公司 上海市静安区江宁路 631 号 6 号楼 407-408 室 邮政编码 : 200041 Room 407-408, Building 6, No. 631 Jiangning Lu, Jing'an District, Shanghai 200041 电话 : 021-6077 0760 传真 : 021-6077 0761 Guangzhou 上海和舟广告有限公司广州分公司 广州市越秀区麓苑路 42 号大院 2 号楼 610 房 邮政编码 : 510095 Room 610, No. 2 Building, Area 42, Lu Yuan Lu, Yuexiu District, Guangzhou, PRC 510095 电话 : 020-8358 -

2013 2Nd International Conference on Measurement, Information and Control

2013 2nd International Conference on Measurement, Information and Control (ICMIC 2013) Harbin, China 16-18 August 2013 Volume 1 Pages 1-766 IEEE Catalog Number: CFP1312R-POD ISBN: 978-1-4799-1391-6 1/2 Table of Contents-Volume 1 Track I: Measurement and Sensor The Design and Implementation of Signal Extraction Circuit for Field Balancing 1-0054 Measurement 1 WU Ning, ZHANG Ren-jie, YIN Xiu-mei, SUN Chun-yu The Reconstruction Research of 3D Temperature Field of Flame of the Optical 1-0065 Fiber Taper Machine Based on the Multispectral Radiation 5 Zhang Zhilin, Sun Weimin, Xing Jian, Cui Shuanglong A Retrieval Algorithm of Fast Aerosol Optical Thickness Based on Hyperion Data 1-0079 9 ZHAO Sheng-bing, LI Yun-Peng Design of Simplified TCP/IP Protocol Stack for Electricity Information Acquisition Test System 1-0087 12 Min XIANG, Ling LUO, Ping WANG, Jianjun HUANG, Xingzhe HOU, Qingling ZUO Fault Detection of Analog Circuits by Using Transient Output Voltage 1-0109 17 Chaojie Zhang, Guo He, Guanghui Chang Soft Sensor of Vertical Mill Material Layer Based on LS-SVM 1-0117 22 Xueyun Cai, Qingjin Meng*, Weilei Luan Effects of Excitation Parameters on the Echo Wave-packet of Magnetostrictive 1-0124 Guided-wave 26 Tao Cheng, XiaoChun Song, Zhengwang Xu An Interactive Oil Well Production Prediction Method for Sucker-Rod Pumps 1-0168 Based on Dynamometer Diagram 31 Xinrong Lyu, Xuhu Ren Modeling of Magnetic Fields for Application in Nuclear Magnetic Resonance 1-0169 Gyroscopes 36 Yingying Li, Jie Yuan, Zhiguo Wang, Jianwen Song, Guangzong Xiao A -

Acta Oceanologica Sinica

Acta Oceanologica Sinica Subject Index to Vol. 36 (2017) CONTENTS No.-P Physical Oceanography, Marine Meteorology and Marine Physics 1-1……………… The regime shift in the 1960s and associated atmospheric change over the southern Indian Ocean WANG Tianyu, DU Yan, LIAO Xiaomei 1-9……………… Characteristics and possible causes of the seasonal sea level anomaly along the South China Sea coast WANG Hui, LIU Kexiu, GAO Zhigang, FAN Wenjing, LIU Shouhua, LI Jing 1-17……………… Definition of water exchange zone between the Bohai Sea and Yellow Sea and the effect of winter gale on it SONG Jun, GUO Junru, LI Jing, MU Lin, LIU Yulong, WANG Guosong, LI Yan, LI Huan 1-26……………… Seasonal variation of the double diffusion processes at the Strait of Hormuz AZIZPOUR Jafar, CHEGINI Vahid, SIADATMOUSAVI Seyed Mostafa 1-35……………… Regime shift of the dominant factor for halocline depth in the Canada Basin during 1990–2008 MU Longjiang, ZHAO Jinping, ZHONG Wenli 1-44……………… Arctic sea ice volume export through the Fram Strait from combined satellite and model data: 1979–2012 ZHANG Zehua, BI Haibo, SUN Ke, HUANG Haijun, LIU Yanxia, YAN Liwen 1-56……………… Winter sea ice albedo variations in the Bohai Sea of China ZHENG Jiajia, KE Changqing, SHAO Zhude 1-64……………… Aerial observations of sea ice and melt ponds near the North Pole during CHINARE2010 LI Lanyu, KE Changqing, XIE Hongjie, LEI Ruibo, TAO Anqi 1-73……………… Characteristics of the sea ice reflectance spectrum polluted by oil spills based on field experiments in the Bohai Sea CHAO Jinlong, LIU Chengyu, LI Ying, LIN Xia, YAN