Recovering the Stolen Sweets of Fraud and Corruption

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

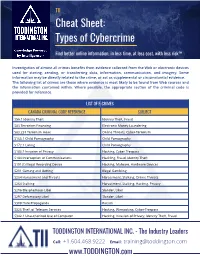

TII Cybercrime Cheat Sheet

TII Cheat Sheet: Types of Cybercrime Find better online information, in less time, at less cost, with less risk™ Investigation of almost all crimes benefits from evidence collected from the Web or electronic devices used for storing, sending, or transferring data, information, communication, and imagery. Some information may be directly related to the crime, or act as supplemental or circumstantial evidence. The following list of crimes are those where evidence is most likely to be found from Web sources and the information contained within. Where possible, the appropriate section of the criminal code is provided for reference. LIST OF E-CRIMES CANADA CRIMINAL CODE REFERENCE SUBJECT S56.1 Identity Theft Identity Theft, Fraud S83 Terrorism Financing Electronic Money Laundering S83.231 Terrorism Hoax Online Threats, Cyber-Terrorism S163.1 Child Pornography Child Pornography S172.1 Luring Child Pornography S183.1 Invasion of Privacy Hacking, Cyber-Trespass S184 Interception of Communications Hackling, Fraud, Identity Theft S191(1) Illegal Recording Device Hacking, Malware, Hardware Devices S201 Gaming and Betting Illegal Gambling S264 Harassment and Threats Harassment, Stalking, Online Threats S264 Stalking Harassment, Stalking, Hacking, Privacy S296 Blasphemous Libel Slander, Libel S297 Defamatory Libel Slander, Libel S308 Hate Propaganda Racism S326 Theft of Telecom Services Hacking, Wirejacking, Cyber-Trespass S342.1 Unauthorized Use of Computer Hacking, Invasion of Privacy, Identity Theft, Fraud TODDINGTON INTERNATIONAL INC. - The Industry -

The Price Riggs Paid

REPUTATION DAMAGE: The Price Riggs Paid A Case Study prepared by World-Check, the market pioneer and industry standard for PEP screening and customer due diligence — serving over 1,600 financial institutions and government agencies in more than 120 countries, including 45 of the world’s 50 largest financial institutions. © 2006 World-Check (Global Objectives Ltd) All Rights Reserved. For permission to re-publish in whole or part please email [email protected] World-Check is a registered trademark. Reputation Damage: ‘ The Price Riggs Paid’ CONTENT: Section Page FOREWORD: By David B. Caruso Former Executive Vice President of Compliance & Security at Riggs Bank INTRODUCTION: RIGGS: ‘Things fall apart’ 1 UNDERSTANDING THE ISSUES AT RIGGS: 2 TWO LEADERS, TOO MANY? 2 • RIGGS & PINOCHET 2 • RIGGS & OBIANG 3 PRIOR TO ITS ‘PRESIDENTIAL PROBLEMS’ 4 THE SAUDI ARABIAN DIPLOMATIC ACCOUNTS 4 THE RESULTS: 5 SHAREHOLDER SUITS AND FINES. 5 RENEGOTIATING THE MERGER. 8 UNDERSTANDING THE EFFECTS: 8 REPUTATION FALLOUT 8 TIMELINE 10 LESSONS TO BE LEARNT 11 WORLD-CHECK: AN OVERVIEW FOREWORD by David B. Caruso Former Executive Vice President of Compliance & Security at Riggs Bank Riggs is a story about the price paid when an Anti-Money Laundering ("AML") compliance program lacks proper oversight by management and the board of directors. As you will read in this paper the outcome of such failure in the case of Riggs was rather dramatic and as in any good drama there were lots of twists and turns in the various plots and sub-plots. Who could have imagined that one, relatively small bank in Washington DC, could have participated in the questionable financial activities of two of the more notorious dictators of the last quarter century? One of the many thing my staff and I learned over the two years we were at Riggs busy trying to build a compliance program and ultimately uncovering almost all of the facts you'll read about in this paper, is how harmless most poor business decisions seem at the time they are made. -

Zerohack Zer0pwn Youranonnews Yevgeniy Anikin Yes Men

Zerohack Zer0Pwn YourAnonNews Yevgeniy Anikin Yes Men YamaTough Xtreme x-Leader xenu xen0nymous www.oem.com.mx www.nytimes.com/pages/world/asia/index.html www.informador.com.mx www.futuregov.asia www.cronica.com.mx www.asiapacificsecuritymagazine.com Worm Wolfy Withdrawal* WillyFoReal Wikileaks IRC 88.80.16.13/9999 IRC Channel WikiLeaks WiiSpellWhy whitekidney Wells Fargo weed WallRoad w0rmware Vulnerability Vladislav Khorokhorin Visa Inc. Virus Virgin Islands "Viewpointe Archive Services, LLC" Versability Verizon Venezuela Vegas Vatican City USB US Trust US Bankcorp Uruguay Uran0n unusedcrayon United Kingdom UnicormCr3w unfittoprint unelected.org UndisclosedAnon Ukraine UGNazi ua_musti_1905 U.S. Bankcorp TYLER Turkey trosec113 Trojan Horse Trojan Trivette TriCk Tribalzer0 Transnistria transaction Traitor traffic court Tradecraft Trade Secrets "Total System Services, Inc." Topiary Top Secret Tom Stracener TibitXimer Thumb Drive Thomson Reuters TheWikiBoat thepeoplescause the_infecti0n The Unknowns The UnderTaker The Syrian electronic army The Jokerhack Thailand ThaCosmo th3j35t3r testeux1 TEST Telecomix TehWongZ Teddy Bigglesworth TeaMp0isoN TeamHav0k Team Ghost Shell Team Digi7al tdl4 taxes TARP tango down Tampa Tammy Shapiro Taiwan Tabu T0x1c t0wN T.A.R.P. Syrian Electronic Army syndiv Symantec Corporation Switzerland Swingers Club SWIFT Sweden Swan SwaggSec Swagg Security "SunGard Data Systems, Inc." Stuxnet Stringer Streamroller Stole* Sterlok SteelAnne st0rm SQLi Spyware Spying Spydevilz Spy Camera Sposed Spook Spoofing Splendide -

Cybercrime Presentation

Cybercrime ‐ Marshall Area Chamber of October 10, 2017 Commerce CYBERCRIME Marshall Area Chamber of Commerce October 10, 2017 ©2017 RSM US LLP. All Rights Reserved. About the Presenter Jeffrey Kline − 27 years of information technology and information security experience − Master of Science in Information Systems from Dakota State University − Technology and Management Consulting with RSM − Located in Sioux Falls, South Dakota • Rapid Assessment® • Data Storage SME • Virtual Desktop Infrastructure • Microsoft Windows Networking • Virtualization Platforms ©2017 RSM US LLP. All Rights Reserved. RSM US LLP 1 Cybercrime ‐ Marshall Area Chamber of October 10, 2017 Commerce Content - Outline • History and introduction to cybercrimes • Common types and examples of cybercrime • Social Engineering • Anatomy of the attack • What can you do to protect yourself • Closing thoughts ©2017 RSM US LLP. All Rights Reserved. INTRODUCTION TO CYBERCRIME ©2017 RSM US LLP. All Rights Reserved. RSM US LLP 2 Cybercrime ‐ Marshall Area Chamber of October 10, 2017 Commerce Cybercrime Cybercrime is any type of criminal activity that involves the use of a computer or other cyber device. − Computers used as the tool − Computers used as the target ©2017 RSM US LLP. All Rights Reserved. Long History of Cybercrime John Draper uses toy whistle from Cap’n Crunch cereal 1971 box to make free phone calls Teller at New York Dime Savings Bank uses computer to 1973 funnel $1.5 million into his personal bank account First convicted felon of a cybercrime – “Captain Zap” 1981 who broke into AT&T computers UCLA student used a PC to break into the Defense 1983 Department’s international communication system Counterfeit Access Device and Computer Fraud and 1984 Abuse Act was passed ©2017 RSM US LLP. -

WRITTEN STATEMENT of RIGGS BANK N.A. to the PERMANENT SUBCOMMITTEE on INVESTIGATIONS of the COMMITTEE on GOVERNMENTAL AFFAIRS Of

WRITTEN STATEMENT OF RIGGS BANK N.A. to the PERMANENT SUBCOMMITTEE ON INVESTIGATIONS of the COMMITTEE ON GOVERNMENTAL AFFAIRS of the UNITED STATES SENATE July 15, 2004 I. Introduction. Riggs Bank has been privileged to serve the banking needs of our nation’s capital for nearly two centuries. During that time, Riggs has served such historical figures as President Abraham Lincoln and American Red Cross founder Clara Barton. Riggs also has assisted in some important historical transactions, such as supplying the gold for the purchase of the State of Alaska. Today, Riggs is the oldest independent bank headquartered in Washington, D.C., serving the District and the surrounding metropolitan area with more than 45 branch locations. Without a doubt, this past year has been among the most challenging in the Bank’s long and storied history. We will address today some of those challenges and how the Bank is moving to address them, and will address questions raised in the letter from Chairman Coleman and Senator Levin. Looking back, it is clear that Riggs did not accomplish all that it needed to. Specifically, with respect to the improvements that were outlined by the Office of the Comptroller of the Currency (“OCC”) in its examinations, Riggs deeply regrets that it did not more swiftly and more thoroughly complete the work necessary to meet fully the expectations of its regulators. For this, the Bank accepts full responsibility. Looking forward, Riggs is acting forcefully to comply with all federal rules and regulations and is cooperating as fully as possible with all appropriate agencies and congressional committees looking into these matters. -

Pinochet US Bank Accounts Under Scrutiny LADB Staff

University of New Mexico UNM Digital Repository NotiSur Latin America Digital Beat (LADB) 7-23-2004 Pinochet US Bank Accounts Under Scrutiny LADB Staff Follow this and additional works at: https://digitalrepository.unm.edu/notisur Recommended Citation LADB Staff. "Pinochet US Bank Accounts Under Scrutiny." (2004). https://digitalrepository.unm.edu/notisur/13279 This Article is brought to you for free and open access by the Latin America Digital Beat (LADB) at UNM Digital Repository. It has been accepted for inclusion in NotiSur by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. LADB Article Id: 52339 ISSN: 1089-1560 Pinochet US Bank Accounts Under Scrutiny by LADB Staff Category/Department: Chile Published: 2004-07-23 Money laundering and involvement in Operation Condor came up as potential points of prosecution against former Chilean dictator Gen. Augusto Pinochet (1973-1990) this month, as a scandal involving US-based Riggs Bank unfolded. Chilean President Ricardo Lagos received assurances from US President George W. Bush that there would be "a full investigation" of how the ex-dictator hid millions with the bank's help. The 88-year-old Pinochet has faced renewed legal fights since a Chilean appeals court stripped him of his immunity in May of this year (see NotiSur, 2004-06-18), though his defenders argue that his advanced age makes him unfit to stand trial. Riggs Banks accused of helping launder A US Senate committee report said the Washington-based Riggs Bank helped Pinochet hide his assets over an eight-year period, even after he was arrested in London in 1998 and a court froze his assets (see NotiSur, 1998-10-23). -

The Washington Post Company 2003Annual Report

The Washington Post Company 2003 Annual Report Contents Financial Highlights 01 To Our Shareholders 02 Corporate Directory 16 Form 10-K FINANCIAL HIGHLIGHTS (in thousands, except per share amounts) 2003 2002 % Change Operating revenue $ 2,838,911 $ 2,584,203 + 10% Income from operations $ 363,820 $ 377,590 – 4% Net income Before cumulative effect of change in accounting principle in 2002 $ 241,088 $ 216,368 + 11% After cumulative effect of change in accounting principle in 2002 $ 241,088 $ 204,268 + 18% Diluted earnings per common share Before cumulative effect of change in accounting principle in 2002 $ 25.12 $ 22.61 + 11% After cumulative effect of change in accounting principle in 2002 $ 25.12 $ 21.34 + 18% Dividends per common share $ 5.80 $ 5.60 + 4% Common shareholders’ equity per share $ 217.46 $ 193.18 + 13% Diluted average number of common shares outstanding 9,555 9,523 – Operating Revenue Income from Operations Net Income ($ in millions) ($ in millions) ($ in millions) 03 2,839 03 364 03 241 02 2,584 02 378 02 204 01 2,411 01 220 01 230 00 2,410 00 340 00 136 99 2,212 99 388 99 226 Diluted Earnings Return on Average Common per Common Share Shareholders’ Equity ($) 03 25.12 03 12.3% 02 21.34 02 11.5% 01 24.06 01 14.4% 00 14.32 00 9.5% 99 22.30 99 15.2% 01 The Washington Post Company The undramatic financial results of 2003—earnings per share a bit higher than last year’s—mask a year in which some important things happened at The Washington Post Company. -

In the Matter of Riggs Bank, NA

UNITED STATES OF AMERICA DEPARTMENT OF THE TREASURY FINANCIAL CRIMES ENFORCEMENT NETWORK IN THE MATTER OF No. 2004-01 RIGGS BANK, N.A. ASSESSMENT OF CIVIL MONEY PENALTY I. INTRODUCTION The Secretary of the United States Department of the Treasury has delegated to the Director of the Financial Crimes Enforcement Network (“FinCEN”) the authority to determine whether a financial institution has violated the Bank Secrecy Act, 31 USC §§5311 et seq. and 31 CFR Part 103 thereunder (“BSA”), and what, if any, sanction is appropriate. In order to resolve this matter, and only for that purpose, Riggs Bank N.A. (“Riggs”) has entered into a CONSENT TO THE ASSESSMENT OF CIVIL MONEY PENALTY (“CONSENT”) dated May 13, 2004, without admitting or denying FinCEN’s determinations described in Sections III and IV below, except as to jurisdiction in Section II below, which is admitted. The CONSENT is incorporated into this ASSESSMENT OF CIVIL MONEY PENALTY (“ASSESSMENT”) by this reference. II. JURISDICTION Riggs is the principal subsidiary of Riggs National Corporation, a publicly traded bank holding company based in Washington, D.C. As of December 31, 2003, Riggs had assets of approximately $6 billion, deposits of $4.29 billion, and stockholders’ equity of $427.2 million. Riggs is a “financial institution” and a “bank” within the meaning of 31 USC §5312(a)(2) and 31 CFR §103.11. The Office of the Comptroller of the Currency (the “OCC”) is Riggs’ primary federal supervisory agency and examines Riggs for BSA compliance. III. FINDINGS A. Summary of Violations FinCEN has determined that Riggs willfully violated the suspicious activity and currency transaction reporting requirements of the BSA and its implementing regulations, and that Riggs has willfully violated the anti-money laundering program (“AML program”) requirement of the BSA and its implementing regulations. -

The Saudi Money Trail Rent Payments for 9-11 Hijackers and Mysterious Checks from a Princess's Account

MSNBC.com Mobile Advertisement The Saudi Money Trail Rent payments for 9-11 hijackers and mysterious checks from a princess's account. Is there a Saudi tie to terror? Inside the probe the Bush administration doesn't want you to know about Dec. 2 issue — When the two Qaeda operatives arrived at Los Angeles International Airport around New Year's 2000, they were warmly welcomed. Nawaf Alhazmi and Khalid Almihdhar would help hijack American Airlines Flight 77 and crash it into the Pentagon a year and a half later, but that January in Los Angeles, they were just a couple of young Saudi men who barely spoke English and needed a place to stay. AT THE AIRPORT, THEY were swept up by a gregarious fellow Saudi, Omar al-Bayoumi, who had been living in the United States for several years. Al-Bayoumi drove the two men to San Diego, threw a welcoming party and arranged for the visitors to get an apartment next to his. He guaranteed the lease, and plunked down $1,550 in cash to cover the first two months' rent. His hospitality did not end there. Al-Bayoumi also aided Alhazmi and Almihdhar as they opened a bank account, and recruited a friend to help them obtain Social Security cards and call flight schools in Florida to arrange flying lessons, according to law-enforcement officials. Two months before 9-11, al-Bayoumi moved to England; several months later, he disappeared. He is believed to be somewhere in Saudi Arabia. MYSTERY MAN Who is al-Bayoumi? At various times, the affable father of four told people that he was getting his doctorate at San Diego State, though the school has no record he ever attended. -

Impostor Scams

University of Michigan Journal of Law Reform Volume 54 2021 Impostor Scams David Adam Friedman Willamette University Follow this and additional works at: https://repository.law.umich.edu/mjlr Part of the Internet Law Commons, and the Torts Commons Recommended Citation David A. Friedman, Impostor Scams, 54 U. MICH. J. L. REFORM 611 (2021). Available at: https://repository.law.umich.edu/mjlr/vol54/iss3/3 https://doi.org/10.36646/mjlr.54.3.imposter This Article is brought to you for free and open access by the University of Michigan Journal of Law Reform at University of Michigan Law School Scholarship Repository. It has been accepted for inclusion in University of Michigan Journal of Law Reform by an authorized editor of University of Michigan Law School Scholarship Repository. For more information, please contact [email protected]. IMPOSTOR SCAMS David Adam Friedman* ABSTRACT Impostor scams have recently become the most common type of consumer scam in America, surpassing identity theft. It has never been easier and more profitable to be an impostor scammer. Though the core of these scams dates back centuries, these fraudsters consistently find novel ways to manipulate human motives and emotions. Nonetheless, the public should not give up hope. Policymakers and private actors can slow down this scourge if they focus on the key chokepoints that impostor scammers rely upon to achieve their ends. This Article provides a roadmap for a solution to impostor scams, offering specific suggestions for mitigating this fraud today, while advocating the adoption of a “least-cost avoider” approach to address the whole of the ongoing problem. -

Undue Diligence: How Banks Do Business with Corrupt Regimes

UNDUE DILIGENCE How banks do business with corrupt regimes A report by Global Witness, March 2009 CONTENTS Summary 03 1 Introduction: 07 Breaking the links between banks, corruption and poverty 2 Who is your customer? 17 3 Riggs and Equatorial Guinea: 26 Doing business with heads of state (Plus: Where did Equatorial Guinea’s oil money go after the demise of Riggs?) 4 Barclays and Equatorial Guinea: 40 Doing business with the sons of heads of state, Part I (Plus: Who banks for President Bongo of Gabon since Citibank closed its doors to him?) 5 Bank of East Asia and Republic of Congo: 50 Doing business with the sons of heads of state, Part II 6 Citibank, Fortis and Liberia’s logs of war: 68 Doing business with natural resources that are fuelling conflict 7 Deutsche Bank and Turkmenistan: 82 Doing business with a human rights abuser 8 Oil-backed loans to Angola: 90 Doing business with an opaque national oil company 9 The problem with the Financial Action Task Force 105 10 Conclusions and recommendations 112 Glossary 124 SUMMARY Economic crisis: banks have damaged the world’s richest economies, but by facilitating corruption they help perpetuate poverty in the world’s poorest countries. What is the problem? which deny these countries the chance to lift The world has learnt during 2008 and 2009 themselves out of poverty and leave them that failures by banks and the governments dependent on aid. that regulate them have been responsible for pitching the global economy into its This is happening despite a raft of anti-money worst crisis in decades. -

Financial Accountability for Torture and Other Human Rights Abuses

FINANCIAL ACCOUNTABILITY FOR TORTURE AND OTHER HUMAN RIGHTS ABUSES A Framework for Developing Case Strategies REDRESS is an international human rights organ- isation that represents victims of torture to obtain justice and reparations. We bring legal cases on be- half of individual survivors, and advocate for better laws to provide effective reparations. Our cases re- spond to torture as an individual crime in domestic and international law, as a civil wrong with individual responsibility, and as a human rights violation with state responsibility. REDRESS wishes to acknowledge the valuable input and feedback we received relating to promoting fi- nancial accountability for perpetrators of torture and other serious human rights abuses, including from the participants of the Roundtable convened in De- cember 2019 to consider financial accountability for perpetrators of torture, as well as participants in the side meeting of NGOs to the EU Genocide Network in June 2020. Particular thanks are made to Stuart Alford QC and Alex Cox of Latham Watkins LLP, Nich- olas Bortman and Louisa Barnett of Raedas/Find, and Kelsey Froehlich and Ekaterina Tomashchuk of Mintz Group, for their extensive pro bono support to this programme of work. REDRESS is grateful to the Knowledge Platform for Security & Rule of Law for their financial support for this project. Design by Marc Rechdane. Cover image: Jeroen Oerlemans/PANOS Pictures. Iraqi, Iranian and American currency depicting Sadd- am Hussein being changed on a street stall in Iraq. First published July 2020, updated March 2021. © REDRESS and Knowledge Platform for Security & Rule of Law. CONTENTS I. EXECUTIVE SUMMARY 5 II.