Increase U.S. Competitiveness in Trade with China Policy Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Outdoor Retailer Summer Market 2019 Colorado Convention Center | Denver, Co Exhibitor List

OUTDOOR RETAILER SUMMER MARKET 2019 COLORADO CONVENTION CENTER | DENVER, CO EXHIBITOR LIST 4OCEAN, LLC ARCTIC COLLECTION AB BIG CITY MOUNTAINEERS 5.11 TACTICAL ARMBURY INC. BIG SKY INTERNATIONAL 7 DIAMONDS CLOTHING CO., INC. ART 4 ALL BY ABBY PAFFRATH BIMINI BAY OUTFITTERS, LTD. 7112751 CANADA, INC. ASANA CLIMBING BIOLITE 8BPLUS ASOLO USA, INC. BIONICA FOOTWEAR A O COOLERS ASSOCIATION OF OUTDOOR RECREATION & EDUCATION BIRKENSTOCK USA A PLUS CHAN CHIA CO., LTD. ASTRAL BUOYANCY CO. BISON DESIGNS, LLC A+ GROUP ATEXTILE FUJIAN CO LTD BITCHSTIX ABACUS HP ATOMICCHILD BLACK DIAMOND EQUIPMENT, LLC ABMT TEXTILES AUSTIN MEIGE TECH LLC BLISS HAMMOCKS, INC. ABSOLUTE OUTDOOR INC AUSTRALIA UNLIMITED INC. BLITZART, INC. ACCESS FUND AVALANCHE BLOQWEAR RETAIL ACHIEVETEX CO., LTD. AVALANCHE IP, LLC BLOWFISH LLC ACOPOWER AVANTI DESIGNS / AVANTI SHIRTS BLUE DINOSAUR ACT LAB, LLC BABY DELIGHT BLUE ICE NORTH AMERICA ADIDAS TERREX BACH BLUE QUENCH LLC ADVENTURE MEDICAL KITS, LLC BACKPACKER MAGAZINE - ADD LIST ONLY BLUE RIDGE CHAIR WORKS AEROE SPORTS LIMITED BACKPACKER MAGAZINE - AIM MEDIA BLUNDSTONE AEROPRESS BACKPACKER’S PANTRY BOARDIES INTERNATIONAL LTD AEROTHOTIC BAFFIN LTD. BOCO GEAR AETHICS BALEGA BODYCHEK WELLNESS AGS BRANDS BALLUCK OUTDOOR GEAR CORP. BODY GLIDE AI CARE LLC BAR MITTS BODY GLOVE IP HOLDINGS, LP AIRHEAD SPORTS GROUP BATES ACCESSORIES, INC. BOGS FOOTWEAR AKASO TECH, LLC BATTERY-BIZ BOKER USA INC. ALCHEMI LABS BC HATS, INC. BOOSTED ALEGRIA SHOES BDA, INC. BORDAN SHOE COMPANY ALIGN TEXTILE CO., LTD. BEAGLE / TOURIT BOTTLEKEEPER ALLIED FEATHER & DOWN BEAR FIBER, INC. BOULDER DENIM ALLIED POWERS LLC BEARDED GOAT APPAREL, LLC. BOUNDLESS NORTH ALOE CARE INTERNATIONAL, LLC BEARPAW BOY SCOUTS OF AMERICA ALOHA COLLECTION, LLC BEAUMONT PRODUCTS INC BOYD SLEEP ALPS MOUNTAINEERING BED STU BRAND 44, LLC ALTERNATIVE APPAREL BEDFORD INDUSTRIES, INC. -

Discovery 2012 ANNUAL REPORT WE Transforming Lives | Conserving Wild Places ARE (THE)

discovery 2012 ANNUAL REPORT WE transforming lives | conserving wild places ARE (THE) The Mountaineers MOUNTAINEERS 2011 Annual Report We love the outdoors We are driven to explore We seek challenge We never stop learning We connect with nature We have heart It’s in our DNA. We are a community built around a shared passion We care about wild places for the outdoors. For over 100 years individuals have IT’S come to The MountaineersWe believe+to learn how to be competent in the outdoors. Each findsWe love people the outdoors.who share goals, passions and dreams. Each becomes part of a community. And the community is better for it, because facing challenges teaches us about ourselves, makes us better people and drives us to make the world a better place. We transform lives We care for wild places IN We give back It’s in our DNA OUR No matter how many times you visit you never really know what you’ll find. Always a chance to discover something new. About where you are or who you are. Creativity and imagination Look up and find your self in the middle of an Table of Contents: 3) MessageEnchanted from the Executive Forest. Director 4) Breaking barriers 6) Caring for wild places DNA 8) Transforming lives 10) Building community 11) Donors 13) Financial Summary 2 14) Message from the Board President FROM THE EXECUTIVE DIRECTOR MARTINIQUE GRIGG What strikes me most in reviewing our achievements from the past year is passion. We are Mountaineers. We are passion-driven. Passion for the outdoors inspires our volunteers to share their knowledge and expertise with members – young and old. -

Eighth Annual Auction for North Beach Elementary

WELCOME TO THE EIGHTH ANNUAL AUCTION FOR NORTH BEACH ELEMENTARY Thank you for joining us for an evening Celebrating Superheroes! Tonight, our community of parents, grandparents, neighbors, teachers, and friends come together to support our school and raise tomorrow’s superheroes. Our children thrive because they are surrounded by people who believe in them and value them as individuals and members of our school community. Your generosity tonight will help every child grow academically and personally – so please bid early, often, and generously! Our North Beach PTA provides many opportunities for our children that aren’t available at every school: • Music Program • Tutors • Counseling • Technology • Playground Equipment • Leveled Libraries in Classrooms • Author Visits • Teacher Mini-Grants • And so much more — all provided by the PTA! These programs – which inspire our children today – help our children explore who they are right now and think about who they want to become tomorrow. We especially thank our North Beach teachers and staff tonight. These amazing superheroes give our children an incredible educational experience every day, using their superpowers to perform an astounding number of feats as they join us in the mission of raising tomorrow’s superheroes. Please enjoy this evening. Laugh with friends, seek out spectacular treasures in the silent auction, and join in the excitement of live bidding. When we come together as a community, anything is possible! 1 From our Principal Dear North Beach Parents and Community, Thank you in advance for coming together this evening to support and celebrate the current and future superheroes who comprise this incredible community. -

2014 Annual Report It’S Not 2005 Plus 10 02

WORKING TOGETHER FOR THIS PLACE 2014 ANNUAL REPORT IT’S NOT 2005 PLUS 10 02 Since launching the Cascade Agenda exactly a decade dynamic approach to the issues. Together, this place is ago, Forterra has worked for a truly sustainable region who we are and together we can make it all it can be. through a focus on land—how we live on it, work on There has never been a time when humans have had so it and play on it. Our expertise is in conducting land much power to determine the outcomes of our natural transactions and real estate projects, conceiving and world. We are the problem. But we are also the solu- advancing policy, contributing to research and educa- tion. By recognizing the interconnectedness of our tion, building community-based stewardship and hab- environments and our people, we can unlock solutions. itat restoration programs and connecting people with A rallying cry is emerging—we are all in this together. the land. We’ve achieved measurable outcomes from Our love for this place makes anything possible. our most urban cities to our most sacred lands. And for all we have done together over the last decade, it’s time GENE DUVERNOY, PRESIDENT to do much, much more. Today is not simply 2005 plus ten. The world is chang- ing faster and with greater intensity than anyone imagined, raising the stakes and compressing our time to act—climate change, mounting social and econom- ic inequities, rapid technological innovation. As such, early in 2014 Forterra set out to reassess the region’s needs and evaluate our progress. -

Governor's Blue Ribbon Task Force on Parks and Outdoor Recreation

GOVERNOR’S BLUE RIBBON PARKS & OUTDOOR RECREATION TASK FORCE | FINAL RECOMMENDATIONS TO GOVERNOR INSLEE September 19, 2014 “We want our children to experience, enjoy, learn about, and become lifetime stewards of Washington’s magnificent natural resources.” - Governor Jay Inslee Acknowledgements On behalf of the Blue Ribbon Task Force on Parks and Outdoor Recreation, the Washington State Recreation and Conservation Office is pleased to submit this final report to Governor Inslee. It represents thoughtful engagement throughout the six-month process and over 3,700 comments gathered from stakeholders and citizens from across the State. The 29 members were supported by the Recreation and Conservation Office and their consultant partners. We wish to thank Governor Inslee, task force members, stakeholders, and the public for their time and commitment to this process. The collective insight and perspective is captured in this report. Task Force Voting Members Barb Chamberlain Task Force co-chair and Executive Director, Washington Bikes Doug Walker Task Force co-chair and Chair, The Wilderness Society Marc Berejka Director Government and Community Affairs, REI Joshua Brandon Military Organizer, Sierra Club Outdoors Russ Cahill Retired WA and CA State Parks Manager Dale Denney Owner, Bearpaw Outfitters Patty Graf-Hoke CEO, Visit Kitsap Peninsula George Harris Executive Director, Northwest Marine Trade Association Connor Inslee COO and Program Director, Outdoors for All John Keates Director, Mason County Facilities, Parks and Trails Department Ben -

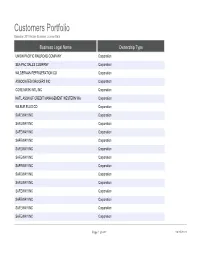

Customers Portfolio Based on 2010 Active Business License Data

Customers Portfolio Based on 2010 Active Business License Data Business Legal Name Ownership Type UNION PACIFIC RAILROAD COMPANY Corporation SEA PAC SALES COMPANY Corporation WILDERMAN REFRIGERATION CO Corporation ASSOCIATED GROCERS INC Corporation CORE MARK INTL INC Corporation NATL ASSN OF CREDIT MANAGEMENT WESTERN WA Corporation WILBUR ELLIS CO Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation SAFEWAY INC Corporation Page 1 of 482 09/25/2021 Customers Portfolio Based on 2010 Active Business License Data Trade Name City, State, Zip UNION PACIFIC RAILROAD COMPANY SEATTLE, WA 98108 SEA-PAC SALES COMPANY KENT, WA 98032 WILDERMAN REFRIGERATION CO SEATTLE, WA 98109 ASSOCIATED GROCERS INC SEATTLE, WA 98118 CORE-MARK INTL INC LAKEWOOD, WA 98499 NACM WESTERN WASHINGTON & ALASKA SEATTLE, WA 98121 WILBUR-ELLIS CO AUBURN, WA 98001 SAFEWAY INC BELLEVUE, WA 98005 SAFEWAY INC #1477 SEATTLE, WA 98107 SAFEWAY STORE #1062 SEATTLE, WA 98116 SAFEWAY STORE #1143 SEATTLE, WA 98117 SAFEWAY STORE #1508 SEATTLE, WA 98118 SAFEWAY STORE #1550 SEATTLE, WA 98115 SAFEWAY STORE #1551 SEATTLE, WA 98112 SAFEWAY STORE #1586 SEATTLE, WA 98125 SAFEWAY STORE #1845 SEATTLE, WA 98103 SAFEWAY STORE #1885 SEATTLE, WA 98119 SAFEWAY STORE #1965 SEATTLE, WA 98118 SAFEWAY STORE #1993 SEATTLE, WA 98112 SAFEWAY STORE #219 SEATTLE, WA -

Outdoor Sports Brands' Strategies for Building

OUTDOOR SPORTS BRANDS’ STRATEGIES FOR BUILDING INSTAGRAM BRAND COMMUNITY BY JENNIFER SHIYUE ZHANG THESIS Submitted in partial fulfillment of the requirements for the degree of Master of Science in Advertising in the Graduate College of the University of Illinois at Urbana-Champaign, 2020 Urbana, Illinois Adviser: Assistant Professor Leona Yi-Fan Su ABSTRACT Over 56% of the world’s population now live with social media (“Digital in 2019,” n.d.). Most direct-to-consumer brands are now using social media as a market tool to communicate with consumers, and the outdoor industry is no exception. Instagram, as the second most popular social networking medium globally, is a popular place to share photos and videos within the online brand community. Most outdoor brands maintain Instagram accounts as a part of their online brand community to interact with followers. This research examines 957 Instagram posts from three leading outdoor sports brands, namely, Arc’teryx, Patagonia, and Salomon via content analysis. The purpose of this study is to investigate post orientations and sports types across the three target brands, and gain insights into their Instagram practices by examining visual elements, textual attributes, and technical factors. Results suggest that outdoor brands with different followers took diverse strategies to build either a transactional or relationship Instagram brand community. Findings from this study offer important implications for researchers as well as practitioners in the domain of social media brand management. ii In loving memory of my father, Junqin. You are my hero. iii ACKNOWLEDGMENTS This thesis would not have been possible without support of many people. -

AGENDA Finance Committee Meeting

AGENDA Finance Committee Meeting 4:30 PM - Monday, November 19, 2018 Council Conference Room, 7th Floor, City Hall – 1055 S. Grady Way 1. Reclassifications a) AB - 2251 Human Resources / Risk Management Department recommends approval of the following reclassification of positions, effective January 1, 2019. Total cost of reclassifications $114,008, which will be included in the 1st Quarter budget adjustment. 2. Vouchers a) Accounts Payable b) Benefits' Deductions c) Payroll (located in Dropbox) 3. Emerging Issues in Finance AGENDA ITEM #1. a) AB - 2251 City Council Regular Meeting - 05 Nov 2018 SUBJECT/TITLE: Reclassifications effective January 1, 2019 RECOMMENDED ACTION: Refer to Finance Committee DEPARTMENT: Human Resources / Risk Management Department STAFF CONTACT: Ellen Bradley-Mak, Administrator EXT.: 7657 FISCAL IMPACT SUMMARY: All reclass/salary adjustments will be effective as of January 1, 2019. See "2019 Budget Impact" attachment for each position's breakdown of costs. Total increases by department for 2019 are as follows: ASD: $42,816 CED: $5,172 HRRM: $37,452 Police: $28,568 In addition, increase Commander and Deputy Chief physical fitness premium to 3% Total cost for reclassifications 2019: $114,008 SUMMARY OF ACTION: See Issue Papers, attached EXHIBITS: A. 2019 Budget Impact (budgeting detail for each position) B. Financial Services Manager Issue paper- ASD Dept C. Service Desk Supervisor Issue paper- ASD Dept D. Tax Auditor Issue paper - ASD Dept E. Systems Analyst Issue paper- ASD Dept F. Business Systems Analyst Issue paper- ASD Dept G. HR Analyst Issue Paper- HRRM Dept H. Property and Technical Services Manager Issue paper - CED Dept I. Police Commander & Deputy Chief Issue paper - Police Dept STAFF RECOMMENDATION: Approve reclassifications of the positions listed below, effective January 1, 2019. -

MASTER STROKE the Legendary 1958 Husky Crew—Powered by Four Foster Grads— Beat the World-Champion Soviets in Moscow Page 10

FOSTER MICHAEL G. FOSTER SCHOOL OF BUSINESS UNIVERSITY OF WASHINGTON FALL 2013 MASTER STROKE The legendary 1958 Husky crew—powered by four Foster grads— beat the world-champion Soviets in Moscow Page 10 ALSO: New Name, Same Great Center Page 14 Are You Experienced? Page 19 Exemplary Accelerator Page 21 NAME: Sora Mizutani DOB: August 4, 2013 Does this look like a UW MBA fellowship recipient? No, Sora hasn’t been awarded a scholarship (at least not yet), but her father, Ryota Mizutani (MBA 2010) benefitted from the Dick and Nora Hinton MBA Fellowship that aided his studies and positioned him for a leadership role with SoftBank Corp in Japan. Today, Ryota is a Foster School ambassador promoting our school overseas, and little Sora is enjoying a better start because of the difference made by the Hintons’ generosity. Whether you, too, would like to build a UW bridge to Tokyo or Tacoma, your scholarship support doesn’t just impact your student. It can make a profound difference in families’ lives for generations to come. For more information on how you can help, contact Foster School Advancement at 206.543.0305. CONTENTS On the cover 10 Master Stroke The legendary 1958 Husky crew—powered by four Foster grads— beat the world-champion Soviets in Moscow 14 New Name, Same Great Center A new name for the Business and Economic Development Center only begins to showcase all the center does 19 Are You Experienced? The MBA Strategic Consulting Program equips Foster students to apply classroom theories to real-world problems 21 Exemplary Accelerator The Buerk Center’s pioneering Jones + Foster Accelerator Program is helping turn entrepreneurial student teams into successful start-up teams FALL 2013 1 CONTENTS Dean James Jiambalvo Associate Dean of Advancement 26 Steven Hatting Managing Director Marketing & Communications Eric Nobis Managing Editor Renate Kroll Contributing Writers Ed Kromer, Andrew Krueger, Sarah Massey, 8 30 Eric Nobis, L.A. -

Annual Report 2012

WASHINGTON ENVIRONMENTAL COUNCIL ANNUAL REPORT 2012 Photo by Brian Walsh1 OUR MISSION To protect, restore, and sustain Washington’s environment OUR WORK Washington Environmental Council has an over forty year history of working to achieve smart environmental protections for our state. We bring people together to advance bold solutions that make Washington a better place to live. We focus on state level environmental policy and have played a significant role in the adoption and enforcement of Washington state’s most successful environmental laws and policies – protecting our land, air, water, and quality of life. Photo by Brian Walsh 2 A MESSAGE FROM OUR EXECUTIVE DIRECTOR 2012 was a year of transitions – some long-planned for and some unexpected. Statewide, Washington welcomed a new governor – Jay Inslee. Governor Inslee brings new energy, deep expertise, and personal commitment to the most pressing issue of our times: climate change. His will be an important voice as we work to make Washington a leader on reducing climate pollution and developing a clean energy economy. This past fall brought another big transition for the environmental community. People For Puget Sound, a long-time partner, transitioned its policy, advocacy, and grassroots work to WEC. While we were surprised and saddened by their passing, we were honored that People For Puget Sound Joan Crooks found us to be the right group to carry on their work. We have picked up the torch and are moving full-steam ahead in our work to protect and restore Puget Sound. This year, we thanked Rod Brown for his service as Board President and welcomed back a familiar face: Jay Manning. -

20000 SF+ Non-Residential Multifamily Buildings

Seattle Energy Benchmarking Ordinance | 20,000 SF+ Non‐Residential Multifamily Buildings ‐ Required to Report Dec 2015 Data IMPORTANT: This list may not indicate all buildings on a parcel and/or all buildings subject to the ordinance. Building types subject to the ordinance as defined in the Director's Rule need to report, regardless of whether or not they are listed below. The Building Name, Building Address and Gross Floor Area were derived from King County Assessor records and may differ from the actual building. Please confirm the building information prior to benchmarking and email corrections to: [email protected]. SEATTLE GROSS FLOOR BUILDING NAME BUILDING ADDRESS BUILDING ID AREA (SF) 1MAYFLOWER PARK HOTEL 405 OLIVE WAY, SEATTLE, WA 98101 88,434 2 PARAMOUNT HOTEL 724 PINE ST, SEATTLE, WA 98101 103,566 3WESTIN HOTEL 1900 5TH AVE, SEATTLE, WA 98101 961,990 5HOTEL MAX 620 STEWART ST, SEATTLE, WA 98101 61,320 8WARWICK SEATTLE HOTEL 401 LENORA ST, SEATTLE, WA 98121 119,890 9WEST PRECINCT (SEATTLE POLICE) 810 VIRGINIA ST, SEATTLE, WA 98101 97,288 10 CAMLIN WORLDMARK HOTEL 1619 9TH AVE, SEATTLE, WA 98101 83,008 11 PARAMOUNT THEATER 901 PINE ST, SEATTLE, WA 98101 102,761 12 COURTYARD BY MARRIOTT ‐ ALASKA 612 2ND AVE, SEATTLE, WA 98104 163,984 13 LYON BUILDING 607 3RD AVE, SEATTLE, WA 98104 63,712 15 HOTEL MONACO 1101 4TH AVE, SEATTLE, WA 98101 153,163 16 W SEATTLE HOTEL 1112 4TH AVE, SEATTLE, WA 98101 333,176 17 EXECUTIVE PACIFIC PLAZA 400 SPRING ST, SEATTLE, WA 98104 65,009 18 CROWNE PLAZA 1113 6TH AVE, SEATTLE, WA 98101 -

Annual Report 2014 by the Numbers:

2014 ANNUAL REPORT 2014 BY THE NUMBERS: ... worked in 201 parks 44 AmeriCorps and and natural areas International participants from around the world... ... led 11,422 volunteers including 6,139 kids ... planted 39,474 native trees and ... put 436 acres shrubs into restoration At EarthCorps, we believe in the power of people to tackle the most pressing challenges facing our world. EarthCorps brings together passionate and hardworking young adults from the US and countries around the world, for a yearlong leadership training and service program in Seattle, Washington. The Puget Sound is our classroom. The AmeriCorps and International participants who join our corps develop leadership skills through working collaboratively, leading community volunteers, and executing technical restoration projects along shorelines, in parks, on trails and in forests. Every day our corps is hard at work, improving the health of our Puget Sound region. After the yearlong program, these emerging leaders leave EarthCorps with tools and skills needed to tackle the pressing issues of our time – including climate change, pollution, and ecological degradation – to create a better world for all of us. We can’t do it alone. EarthCorps depends on the generosity of our committed volunteers and supporters. More than 11,000 youth, business leaders, and community members work alongside our corps and staff annually, to sustain and restore our public parks for future generations to enjoy. 150,000 volunteers work to transform the Puget Sound. Twenty-one years ago EarthCorps started working with volunteers to plant trees in Washington State. In July 2014, the number of community members who volunteered their time and energy with EarthCorps surpassed 150,000! Nearly half of EarthCorps volunteers are kids who build a broad stewardship ethic by digging in the dirt at service learning projects around Puget Sound.