Rebooting Japan's Mobility Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 ENCATC International Study Tour to Tokyo TABLE of CONTENTS

The European network on cultural management and policy 2018 ENCATC International Study Tour to 5-9 November 2018 Tokyo Tokyo, Japan ENCATC Academy on Cultural Policy & Cultural #ENCATCinTokyo Diplomacy and Study Visits The ENCATC International Study Tour The ENCATC Academy is done in Media partners The ENCATC International Study The ENCATC International Study Tour and Academy are an initiative of partnership with Tour is done in the framework of and Academy are supported by www.encatc.org | #ENCATCinTokyo 1 2018 ENCATC International Study Tour to Tokyo TABLE OF CONTENTS Presentation 3 6 reasons to join us in Tokyo 6 Programme 7 Study Visits 12 Open Call for Presentations 13 Meet Distinguished Speakers 14 Bibliography 21 List of Participants 22 Useful Information & Maps 24 About ENCATC and our Partners 33 ENCATC Resources 35 Be involved! 36 @ENCATC #ENCATCinTokyo @ENCATC_official #ENCATCinTokyo @ENCATC #ENCATCinTokyo ENCATC has produced this e-brochure to reduce our carbon footprint! We suggest you download it to your smartphone or tablet before arriving to Tokyo. COVER PHOTOSFROM TOP LEFT CLOCKWISE: “Koinobori now!” at the National Art Center Tokyo www.nact.jp/english/; Mori Building Digital Art Museum teamlab borderless https://borderless.teamlab.art/; Poster of a performance from the Japan Arts Council https://www.ntj.jac.go.jp/english.html; EU Commissioner European Commissioner for Education, Culture, Youth and Sport meeting with Yoshimasa Hayashi, Japan Minister of Education, Culture, Sports, Science and Technology (MEXT) on 6 July -

Quiz―700 Questions About Things Japanese

National Diet Library Newsletter No. 227, December 2019 Selections from NDL collections Quiz―700 Questions About Things Japanese NISHIKAWA Hisashi, Business, Science and Technology Division, Reader Services and Collections Department This article is a translation of the article in Japanese in NDL Monthly Bulletin No. 701/702 (September/October 2019). front cover back cover Quiz―700 answers to questions on things Japanese Published by Japan Travel Bureau in December 1948, 152p; 18cm, NDL Call no. 915.2-N691q In 2018, the number of international inbound visitors to Quiz―700 answers to questions on things Japanese was Japan reached 30 million for the first time in history1, and first published in 1948, shortly after inbound visitors first there are those who predict that this number will exceed began to visit postwar Japan. In addition to the first 35 million during 2019.2 With Japan hosting the Tokyo inbound visitors, who arrived in Yokohama in December Olympic and Paralympic Games in 2020, the number of 1947, there were also some one hundred thousand non- international visitors to Japan is expected to reach Japanese living in Japan, who were not tourists but the unprecedented levels in the near future. But there was a officers and men of the occupation forces. time when Japan was an exotic destination known only to a few. In this article, we will take a look at a book from It was during this period that the Japan Travel Bureau an earlier age that purports to introduce Japanese culture (JTB) played a significant role by serving the needs of the to non-Japanese. -

The Union of National Economic Associations in Japan

No.S Information Bulletin of The Union of National Economic Associations in Japan 日本経済学会連合 1986 INFORMATION BULLETIN OF THE UNION OF NATIONAL ECONOMIC ASSOCIATIONS IN JAPAN This Information Bulletin is designed to serve as an introduction of the academic activities of member associations of the Union to the economic societies throughout the world. The copies will be distributed by the secretariat of the Union to economists and societies in other countries whose names have been given by the member associations of the Union. Managing Editors Yoshio Okuda, Chuo University Akira Takayanagi, University of Tsukuba Shinya Sugiyama, Keio University Masatoshi Hayashi, Yokohama Municipal University Hisanobu Kato, Asia University Mitsuhiro Hirata, Hitotsubashi University Yasuo Kawasima, Meiji Gakuin University Masahiro Sugiyama, Waseda University Koichi Tanouchi, Hitotsubashi Univesity Shoji Nedachi, Nihon University Masatoshi Kawanabe, St. Paul's University Terushi Hara, Waseda University Editional Committee Fumimasa Hamada, Keio University Yoshinori Suzuki, Kanagawa University Shizuya Nishimura, Hosei University Hideo Tamura, Chuo University Shusaku Yamaya, Toyo University Kiyoshi Okamoto, Hitotsubashi University Hisanori Nishiyama, Meiji University Masaru Saito, Chuo University Kazuo Nimura, Hosei University Hiroshi Tsukahara, Nagoya Economic University Junko Nishikawa, Tokyo Metroporitan College of Toshio Watanabe, University of Tsukuba Commerce Yoko Sano, Keio University Directors of the Union President Takashi SHIRAISHI, Kyorin University -

Copyrighted Material

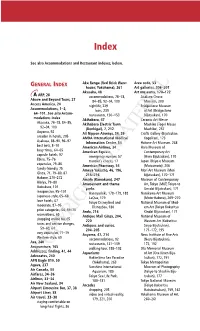

18_543229 bindex.qxd 5/18/04 10:06 AM Page 295 Index See also Accommodations and Restaurant indexes, below. GENERAL INDEX Aka Renga (Red Brick Ware- Area code, 53 house; Yokohama), 261 Art galleries, 206–207 Akasaka, 48 Art museums, 170–172 A ARP, 28 accommodations, 76–78, Asakura Choso Above and Beyond Tours, 27 84–85, 92–94, 100 Museum, 200 Access America, 24 nightlife, 229 Bridgestone Museum Accommodations, 1–2, bars, 239 of Art (Bridgestone 64–101. See also Accom- restaurants, 150–153 Bijutsukan), 170 modations Index Akihabara, 47 Ceramic Art Messe Akasaka, 76–78, 84–85, Akihabara Electric Town Mashiko (Togei Messe 92–94, 100 (Denkigai), 7, 212 Mashiko), 257 Aoyama, 92 All Nippon Airways, 34, 39 Crafts Gallery (Bijutsukan arcades in hotels, 205 AMDA International Medical Kogeikan), 173 Asakusa, 88–90, 96–97 Information Center, 54 Hakone Art Museum, 268 best bets, 8–10 American Airlines, 34 Hara Museum of busy times, 64–65 American Express Contemporary Art capsule hotels, 97 emergency number, 57 (Hara Bijutsukan), 170 Ebisu, 75–76 traveler’s checks, 17 Japan Ukiyo-e Museum expensive, 79–86 American Pharmacy, 54 (Matsumoto), 206 family-friendly, 75 Ameya Yokocho, 46, 196, Mori Art Museum (Mori Ginza, 71, 79–80, 87 215–216 Bijutsukan), 170–171 Hakone, 270–272 Amida (Kamakura), 247 Museum of Contemporary Hibiya, 79–80 Amusement and theme Art, Tokyo (MOT; Tokyo-to Ikebukuro, 101 parks Gendai Bijutsukan), 171 inexpensive, 95–101 Hanayashiki, 178–179, 188 Narukawa Art Museum Japanese-style, 65–68 LaQua, 179 (Moto-Hakone), 269–270 love hotels, -

2010-61 Estimation of Social Costs of Transportation in Japan (Revised

2010-61 Estimation of Social Costs of Transportation in Japan (Revised Version) Fumitoshi Mizutani Yusuke Suzuki Hiroki Sakai Estimation of Social Costs of Transportation in Japan (Revised Version) by Fumitoshi MIZUTANI , Yusuke SUZUKI, Hiroki SAKAI Kobe University, Graduate School of Business Administration 2-1 Rokkodai, Nada-ku, Kobe 657-8501 Japan Correspondent Author: Fumitoshi Mizutani [email protected] [Abstract]: Using a data set of 111 Japanese cities from the year 2005, we aim in this paper to estimate the social costs of car transport and to analyze the structure of the components of and the relationship between social costs and city size. We obtain the following major results. First, the social costs of vehicular transport increase at an accelerated pace as city size becomes larger. Second, while the construction of roads does not work to decrease the social costs of vehicular transport, public transportation has a tendency to decrease such costs, though with minimal effect. Third, the traffic congestion component represents more than 45% of the total social cost of vehicular transport. Cost due to global warming accounts for 5 to 11% of the total. Fourth, the social costs of vehicular transport are about 8.0% of GDP. Fuel tax for car transport in Japan covers only 16.3% of the social costs of regular car use. [JEL Classification] Q51, Q52, R41 [Key Words] Social costs, External costs, Vehicular transport, Environmental protection, Global warming 1 1. Introduction With more people concerned about protecting the environment at both local and global levels, dependence on vehicular transportation in cities has brought about problems. -

What Is the Importance and Role of Food in Modern Japanese Society?

Háskóli Íslands Hugvísindasvið B.A í Japönsku máli og menningu What is the importance and role of food in modern Japanese society? Why is Japanese food classified as world heritag and what makes Japanese food stand apart from the food culture of other countries? Ritgerð til BA / MA-prófs í Japönsku máli og menningu César Vladimir Rodríguez Cedillo Kt: 040892-5089 Leiðbeinandi: Gunnella Þórgeirsdóttir May 20017 1 Abstract. In Japanese society, a meal goes beyond the food and eating it. It is known that Japanese food was influenced by China and Korea due to the geographical proximity. Traditional food is an important aspect of the culture and it is considered a world heritage. Thus, a traditional meal is not only aiming for the taste, but also aiming to protect the nature and transmit knowledge to future generations. The climate in Japan varies considerably, which allowed each city to develop their own traditional dishes representing the area. This has encouraged culinary tourism, where people travel throughout Japan to experience different flavours. Culinary tourism benefited Japanese culture and economy by supporting local villages and smaller communities. A convenient way to experience dishes from different regions, is by buying ekiben (lunch boxes sold at the train stations) while riding the train from one city to another. Seasonal food is important for society, because the diet is based on each season of the year. To stay healthy throughout the year, Japanese children learn important values and skills such as cooperation, teamwork and responsibility in their school lunches during elementary school. Bento boxes (lunch boxes) influenced, to some extent, the personality of Japanese children either by helping them to socialize easier with their classmates or excluded them out of a group. -

FY2019.3 Second Quarter Financial Results Presentation

FY2019.3 Second Quarter Financial Results Presentation October 30, 2018 East Japan Railway Company Contents I. JR East Group Management Vision "Move Up" 2027 Basic Policies① 4 Real Estate & Hotels - Results and Plan 21 Basic Policies② 5 Others - Results and Plan 22 Summary of Non-operating Income / Expenses and Overview 6 23 Extraordinary Gains / Losses (consolidated) Numerical targets (FY2023) 7 Summary of Cash Flows (consolidated) 24 Main "Move Up" 2027 Topics (Safety) 9 Change in Capital Expenditures (consolidated) 25 Main "Move Up" 2027 Topics (ESG management・Technology) 10 Change in Interest-bearing Debt Balance (consolidated) 26 Main "Move Up" 2027 Topics (Making cities more comfortable) 11 Plan for the use of cash in FY2019.3 27 Main "Move Up" 2027 Topics (Making regional areas more affluent 12 / Developing businesses for the world) II. FY2019.3 Second Quarter Financial Results and FY2019.3 Plan III. Reference Materials FY2019.3 Second Quarter Financial Results and > FY2019.3 Traffic Volume and Passenger Revenues - Plan 14 FY2019.3 Plan (non-consolidated) > Breakdown of Shinkansen and Conventional Lines Passenger Revenues FY2018.3 Operating Performance 15 - 1st half Results and Main Positive and Negative Factors > Inbound Tourism > Operation Suspended Lines and Segments Passenger Revenues 16 Damaged by Tsunami during Great East Japan Earthquake - 1st half Results and Full-term Plan > Revision of Elder Employee System Operating Expenses (non-consolidated) > Major Subsidiaries - Results and Plan 17 - FY2019.3 Second Quarter Results > Hotel Operations - Overview FY2019.3 Second Quarter Financial Results and > Shinagawa Development Project 18 > Major Projects Going Forward FY2019.3 Plan (consolidated) > Suica Transportation - Results and Plan 19 > Initiatives in Overseas Businesses > Plan of Station Upgrades Targeting Use before the Tokyo 2020 Begin > Additional Information for bond Investors Retail & Services - Results and Plan 20 > Numerical targets (JR East Group Management Vision "Move Up" 2027) I. -

How Global Can Museums Be? CIMAM 2015 Annual Conference

CIMAM 2015 Annual Conference Proceedings How Global Can Museums Be? CIMAM 2015 Annual Conference Proceedings Tokyo November 7–9 2015 1 CIMAM 2015 Annual Conference Proceedings and Graduate University for Advanced Studies Program (Sokendai), Hayama, Japan. Saturday November 7, 2015 Q&A with Shigemi Inaga The National Art Center, Tokyo Day 1. Is the museum still a place for debate? Perspective 05: Hammad Nasar, Head of Research and Programs, Welcoming remarks Asia Art Archive, Hong Kong. — Mami Kataoka – Chief Curator, Mori Art Museum. Perspective 06: — Bartomeu Marí – President of CIMAM. Slavs and Tatars, Artists, Eurasia. — Hans-Martin Hinz – President of ICOM. — Arimasu Ikiku – Deputy Commissioner, Agency Perspective 07: for Cultural Affairs, Government of Japan. Eugene Tan, Director of Singapore National Gallery, — Tamotsu Aoki – General Director, The National Singapore. Center, Tokyo; Chair of Japanese National Committee for ICOM and Chair of CIMAM Perspective 08: Tokyo 2015 Executive Committee. Mariana Botey, Associate Professor Modern/ Contemporary Latin American Art History, Visual Keynote 1: Patricia Falguières, Professor, School for Arts Department, University of California San Diego Advanced Studies in Social Sciences (EHESS), Chair (UCSD), San Diego, California. of the Centre National des Arts Plastiques (CNAP), Paris. Panel discussion with perspective speakers Q & A with Patricia Falguières Q & A with Perspective speakers Perspective 01: Mika Kuraya, Chief Curator, Department of Fine Arts, The National Museum of Modern Art, Tokyo. Monday November 9, 2015 Roppongi Academyhills, Tokyo Perspective 02: Jack Persekian, Director and Head Day 3. Is there a global audience? Curator of The Palestinian Museum, Palestine. Perspective 9: Perspective 03: Brook Andrew, Artist and Lecturer: Bose Krishnamachari, President and co-founder, MADA (Monash Art, Design and Architecture), Kochi Biennale Foundation, Cochin, Kerala, India. -

Ride-Hailing Apps for LAMAT Services and Their Influences in Asian Developing Cities (アジア途上国都市におけるLAMAT向け配車アプリとその影響)

The 44th Symposium on Japan Transport and Tourism Research Institute: Autumn 2018 November 21, 2018 Tokyo, Japan Ride-hailing Apps for LAMAT Services and Their Influences in Asian Developing Cities (アジア途上国都市におけるLAMAT向け配車アプリとその影響) Research Fellow PHUN Veng Kheang ポン ヴェン キェン 一般財団法人運輸総合研究所 Japan Transport and Tourism Research Institute (C) Dr. PHUN Veng Kheang, Japan Transport and Tourism Research Institute, 2018 1. LAMAT Concept LAMATとは? 2. Ride-hailing Apps 配車アプリ 3. Motivation & Objective 研究の背景と目的 4. Case Study ケーススタディ 5. Policy Discussion 政策議論 (C) Dr. PHUN Veng Kheang, Japan Transport and Tourism Research Institute, 2018 3 アジアの特徴的な交通手段 Indonesia Nepal @Yai Thailand Silorlek Safa Tempo Angkot & Becak, @Yai Tuktuk Songteaw Philippines Tricycle Jeepney Multicap Jeepney Samlor Motorcycle taxi Japan India @Yai Laos Myanmar @Yai Bajaj Jambo Sidecar . (C) Dr. PHUN Veng Kheang, Japan Transport and Tourism Research Institute, 2018 LAMATのコンセプト 4 LAMAT is proposed and used instead of Paratransit because: Different paratransit concepts in developed vs. developing countries. Various terms for paratransit (e.g. informal transport, third world transport). To cover all paratransit services in Asia. Source: Phun & Yai (2016) (C) Dr. PHUN Veng Kheang, Japan Transport and Tourism Research Institute, 2018 LAMATの意味 5 Motorcycle Taxi Taxi Van Angkot Long-tailed Remork Songtaew PinoyRepublic.tv Ride-Hailing Apps (RHAs) Jeepney E-Jeepney Smart card for E-Jeepney Source: Phun & Yai (2016) (C) Dr. PHUN Veng Kheang, Japan Transport and Tourism Research Institute, 2018 1. LAMAT Concept LAMATとは? 2. Ride-hailing Apps (RHAs) 配車アプリ 3. Motivation & Objective 研究の背景と目的 4. Case Study ケーススタディ 5. Policy Discussion 政策議論 (C) Dr. PHUN Veng Kheang, Japan Transport and Tourism Research Institute, 2018 配車サービス 7 Smartphone with GPS, internet, and available digital maps enables technologies for ride-hailing services via ride-hailing apps (RHAs). -

Notice of Convocation of the 151St Annual General Meeting of Shareholders

These documents are partial translations of the Japanese originals for reference purposes only. In the event of any discrepancy between these translated documents and the Japanese originals, the originals shall prevail. The Bank assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translations. (Securities Code: 8383) June 10, 2015 To Shareholders with Voting Rights: Masahiko Miyazaki Representative Director and President THE TOTTORI BANK, LTD. 171, Eirakuonsen-cho, Tottori, Japan NOTICE OF CONVOCATION OF THE 151ST ANNUAL GENERAL MEETING OF SHAREHOLDERS You are cordially invited to attend the 151st Annual General Meeting of Shareholders of THE TOTTORI BANK, LTD. (the “Bank”). The meeting will be held for the purposes as described below. If you are unable to attend the meeting, you can exercise your voting rights in writing. Please review the Reference Documents for the General Meeting of Shareholders described hereinafter, indicate your vote for or against the proposals on the enclosed Voting Rights Exercise Form and return it so that it is received by 5:00 p.m. on Wednesday, June 24, 2015 Japan time. 1. Date and Time: Thursday, June 25, 2015 at 10:00 a.m. Japan time 2. Place: Hall, 3F, Head Office of the Bank, located at 171, Eirakuonsen-cho, Tottori, Japan 3. Meeting Agenda: Matters to be reported: 1. The Business Report, Non-consolidated Financial Statements and Consolidated Financial Statements for the Bank’s 151st Fiscal Year (from April 1, 2014 to March 31, 2015) 2. Results of audits of the Consolidated Financial Statements for the Bank’s 151st Fiscal Year by the Accounting Auditor and the Board of Corporate Auditors Proposals to be resolved: Proposal No. -

CHINATOWN Explore Yokohama’S More Colorful Side

JUNE 2016 Japan’s number one English language magazine Plus Nine Other Top Festival Acts to Watch This Summer CHINATOWN Explore Yokohama’s More Colorful Side “I OPENED FOR THE BEATLES” Remembering That Budokan Show, 50 Years Back ALSO: Where to Go Hang Gliding, How to Plan a Wedding in Tokyo, and Meet “King Kohei” – Japan’s Champion Gymnast 2 | JUNE 2016 | TOKYO WEEKENDER 19 7 28 32 JUNE 2016 radar guide 24 “I OPENED FOR THE BEATLES” THIS MONTH’S HEAD TURNERS CULTURE ROUNDUP Fifty years after the Fab Four’s landmark 7 AREA GUIDE: CHINATOWN Tokyo show, we chat to two of the warm- 41 THE ART WORLD Experience the flavors of Yokohama’s more up acts who were there to see it all Must-see exhibitions including Renoir’s decorative neighborhood masterpieces and Joshua Nathanson’s 28 SO YOU WANT TO GET MARRIED magical depictions of daily life 12 STYLE IN TOKYO? A new Guess store in Shibuya brings floral Here’s everything you need to know about 43 BOOKS prints to the fore, just in time for summer planning the big day in Japan On our bookshelf this month: day walks, tattoos, and a different way to connect 14 TRENDS 30 SECRET JAPANESE INGREDIENTS with Tokyo What to do in the rainy season? Eat cake, From konnyaku to azuki beans, these are drink coffee... your keys to a more beautiful summer 44 AGENDA Dress up for Cosplay Festa TDC 2016, 32 FLY AWAY WITH ME splash your way down the world’s longest in-depth Did you know there’s a thriving hang gliding slide, and switch off your phone for Candle COFFEE-BREAK READS community in Japan? Night at Zozoji 19 WHO TO WATCH THIS SUMMER 34 MONSTER PERFORMER 46 PEOPLE, PARTIES, PLACES Start planning your music festival calendar Meet Kohei Uchimura, possibly the best Celebrating St Patrick’s Day, and remember- now with our guide to the top acts playing gymnast the sport has ever seen ing VIP days spent with Prince TOKYO WEEKENDER | JUNE 2016 | 3 JUNE 2016 Publisher ENGAWA Co., Ltd. -

Consolidated Financial Results for the Three Months of Fiscal Year Ending March 31, 2021 August 5, 2020

Consolidated Financial Results For the Three Months of Fiscal Year Ending March 31, 2021 August 5, 2020 All Rights Reserved, Copyright © Tokyo Century Corporation 1. Financial Highlights Financial Highlights 4 International Business 1 Business Results of CSI Leasing 27 Ordinary Income by Operating Segment & ROA 5 International Business 2 28 Balance of Segment Assets by Operating Segment 6 Initiatives Utilizing Joint Crediting Mechanism (JCM) Change of Global Assets Ratio 7 Business Alliance with NTT in All Four Operating Segments 29 FY2020 Consolidated Results Forecast 8 2. Results by Operating Segment 4. New Fourth Medium-Term Management Plan Results of Equipment Leasing 10 The New Fourth Medium-Term Management Plan 31 Results of Mobility & Fleet Management 11 Highlight 1 - Management Indicator Balance of Segment Assets and Transaction Volume 12 The New Fourth Medium-Term Management Plan 32 in Mobility & Fleet Management Highlight 2 - Shareholder Returns Policy Results of Specialty Financing 13 Continually Evolving “Finance x Service x Business Expertise” 33 Balance of Segment Assets in Specialty Financing 14 Business Model 4 Results of International Business 15 Balance of Segment Assets in International Business 16 5. Appendix 3. Major Topics State of Income 35 Balance Sheet 36 Business Summary by Operating Segment 18 Interest-Bearing Debt 37 Major Topics by Operating Segment 19 Quarterly Changes in Results by Subsidiary 38 Equipment Leasing 1 NTT TC Leasing 20 in Mobility & Fleet Management Mobility & Fleet Management 1 Alliance Strategy: