FY2019.3 Second Quarter Financial Results Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018 ENCATC International Study Tour to Tokyo TABLE of CONTENTS

The European network on cultural management and policy 2018 ENCATC International Study Tour to 5-9 November 2018 Tokyo Tokyo, Japan ENCATC Academy on Cultural Policy & Cultural #ENCATCinTokyo Diplomacy and Study Visits The ENCATC International Study Tour The ENCATC Academy is done in Media partners The ENCATC International Study The ENCATC International Study Tour and Academy are an initiative of partnership with Tour is done in the framework of and Academy are supported by www.encatc.org | #ENCATCinTokyo 1 2018 ENCATC International Study Tour to Tokyo TABLE OF CONTENTS Presentation 3 6 reasons to join us in Tokyo 6 Programme 7 Study Visits 12 Open Call for Presentations 13 Meet Distinguished Speakers 14 Bibliography 21 List of Participants 22 Useful Information & Maps 24 About ENCATC and our Partners 33 ENCATC Resources 35 Be involved! 36 @ENCATC #ENCATCinTokyo @ENCATC_official #ENCATCinTokyo @ENCATC #ENCATCinTokyo ENCATC has produced this e-brochure to reduce our carbon footprint! We suggest you download it to your smartphone or tablet before arriving to Tokyo. COVER PHOTOSFROM TOP LEFT CLOCKWISE: “Koinobori now!” at the National Art Center Tokyo www.nact.jp/english/; Mori Building Digital Art Museum teamlab borderless https://borderless.teamlab.art/; Poster of a performance from the Japan Arts Council https://www.ntj.jac.go.jp/english.html; EU Commissioner European Commissioner for Education, Culture, Youth and Sport meeting with Yoshimasa Hayashi, Japan Minister of Education, Culture, Sports, Science and Technology (MEXT) on 6 July -

Pdf/Rosen Eng.Pdf Rice fields) Connnecting Otsuki to Mt.Fuji and Kawaguchiko

Iizaka Onsen Yonesaka Line Yonesaka Yamagata Shinkansen TOKYO & AROUND TOKYO Ōu Line Iizakaonsen Local area sightseeing recommendations 1 Awashima Port Sado Gold Mine Iyoboya Salmon Fukushima Ryotsu Port Museum Transportation Welcome to Fukushima Niigata Tochigi Akadomari Port Abukuma Express ❶ ❷ ❸ Murakami Takayu Onsen JAPAN Tarai-bune (tub boat) Experience Fukushima Ogi Port Iwafune Port Mt.Azumakofuji Hanamiyama Sakamachi Tuchiyu Onsen Fukushima City Fruit picking Gran Deco Snow Resort Bandai-Azuma TTOOKKYYOO information Niigata Port Skyline Itoigawa UNESCO Global Geopark Oiran Dochu Courtesan Procession Urabandai Teradomari Port Goshiki-numa Ponds Dake Onsen Marine Dream Nou Yahiko Niigata & Kitakata ramen Kasumigajo & Furumachi Geigi Airport Urabandai Highland Ibaraki Gunma ❹ ❺ Airport Limousine Bus Kitakata Park Naoetsu Port Echigo Line Hakushin Line Bandai Bunsui Yoshida Shibata Aizu-Wakamatsu Inawashiro Yahiko Line Niigata Atami Ban-etsu- Onsen Nishi-Wakamatsu West Line Nagaoka Railway Aizu Nō Naoetsu Saigata Kashiwazaki Tsukioka Lake Itoigawa Sanjo Firework Show Uetsu Line Onsen Inawashiro AARROOUUNNDD Shoun Sanso Garden Tsubamesanjō Blacksmith Niitsu Takada Takada Park Nishikigoi no sato Jōetsu Higashiyama Kamou Terraced Rice Paddies Shinkansen Dojo Ashinomaki-Onsen Takashiba Ouchi-juku Onsen Tōhoku Line Myoko Kogen Hokuhoku Line Shin-etsu Line Nagaoka Higashi- Sanjō Ban-etsu-West Line Deko Residence Tsuruga-jo Jōetsumyōkō Onsen Village Shin-etsu Yunokami-Onsen Railway Echigo TOKImeki Line Hokkaid T Kōriyama Funehiki Hokuriku -

THE WESTIN TOKYO Sakura Map

THE WESTIN TOKYO Sakura Map 1 Meguro River 2 Yoyogi Park Take the JR Yamanote Line from Ebisu Station to Take the JR Yamanote Line from Ebisu Station to Meguro Station (3 minutes). 5 minutes' walk from Harajuku Station (5 minutes). 3 minutes' walk from Meguro Station. Harajuku Station. Along both sides of the river banks spanning Atop the vast lawn, you will find cherry trees 4km, you will find 800 Somei Yoshino cherries in full bloom. This is a popular cherry in bloom. At night, they are illuminated. blossom viewing location. Ueno 4 Yamanote Line Sobu Line Kudanshita Hanzomon Line 7 Shinjyuk3ugyoen 3 Shinjyuku Gyoen National Park 4 Ueno Onshi Park Take the JR Yamanote Line from Ebisu Station to Shinjuku Take the JR Yamanote Line from Ebisu Station to Shinjyuku Station. From Shinjuku Station, board the Tokyo Metro Ueno Station (30 minutes). 2 minutes' walk from the Marunouchi Line and take it to Shinjuku-gyoenmae Station (3 Ueno Park exit of Ueno Station. minutes). 5 minutes' walk from Shinjuku-gyoenmae Station. The main road through the park features Enjoy 1,300 cherry trees of 65 varieties 1,200 cherry trees, making it one of the Marunouchi Line 6 outbloom. foremost destinations in Tokyo. Roppongi 5 Tokyo Midtown Harajyuku Shinanomachi 2 Take the Tokyo Metro Hibiya Line from Ebisu Station to Roppongi Station (6 minutes). 6 minutes' walk from Roppongi Station. 5 When in full bloom, sakura street is turned to sakura tunnel. At night, their illuminated blossoms create a bewitching mood. Hibiya Line 8 6 Meiji Jingu Gaien Ebisu Hamamatsucho Take the JR Yamanote Line from Ebisu Station to Yoyogi Station (8 minutes). -

Unifying Rail Transportation and Disaster Resilience in Tokyo

University of Arkansas, Fayetteville ScholarWorks@UARK Architecture Undergraduate Honors Theses Architecture 5-2020 The Yamanote Loop: Unifying Rail Transportation and Disaster Resilience in Tokyo Mackenzie Wade Follow this and additional works at: https://scholarworks.uark.edu/archuht Part of the Urban, Community and Regional Planning Commons Citation Wade, M. (2020). The Yamanote Loop: Unifying Rail Transportation and Disaster Resilience in Tokyo. Architecture Undergraduate Honors Theses Retrieved from https://scholarworks.uark.edu/archuht/41 This Thesis is brought to you for free and open access by the Architecture at ScholarWorks@UARK. It has been accepted for inclusion in Architecture Undergraduate Honors Theses by an authorized administrator of ScholarWorks@UARK. For more information, please contact [email protected]. The Yamanote Loop: Unifying Rail Transportation and Disaster Resilience in Tokyo by Mackenzie T. Wade A capstone submitted to the University of Arkansas in partial fulfillment of the requirements of the Honors Program of the Department of Architecture in the Fay Jones School of Architecture + Design Department of Architecture Fay Jones School of Architecture + Design University of Arkansas May 2020 Capstone Committee: Dr. Noah Billig, Department of Landscape Architecture Dr. Kim Sexton, Department of Architecture Jim Coffman, Department of Landscape Architecture © 2020 by Mackenzie Wade All rights reserved. ACKNOWLEDGEMENTS I would like to acknowledge my honors committee, Dr. Noah Billig, Dr. Kim Sexton, and Professor Jim Coffman for both their interest and incredible guidance throughout this project. This capstone is dedicated to my family, Grammy, Mom, Dad, Kathy, Alyx, and Sam, for their unwavering love and support, and to my beloved grandfather, who is dearly missed. -

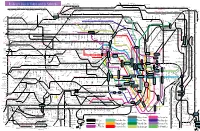

Railway Lines in Tokyo and Its Suburbs

Minami-Sakurai Hasuta Shin-Shiraoka Fujino-Ushijima Shimizu-Koen Railway Lines in Tokyo and its Suburbs Higashi-Omiya Shiraoka Kuki Kasukabe Kawama Nanakodai Yagisaki Obukuro Koshigaya Atago Noda-Shi Umesato Unga Edogawadai Hatsuisi Toyoshiki Fukiage Kita-Konosu JR Takasaki Line Okegawa Ageo Ichinowari Nanasato Iwatsuki Higashi-Iwatsuki Toyoharu Takesato Sengendai Kita-Koshigaya Minami-Koshigaya Owada Tobu-Noda Line Kita-Kogane Kashiwa Abiko Kumagaya Gyoda Konosu Kitamoto Kitaageo Tobu Nota Line Toro Omiya-Koen Tennodai Miyahara Higashi-Urawa Higashi-Kawaguchi JR Musashino Line Misato Minami-Nagareyama Urawa Shin-Koshigaya Minami- Kita- Saitama- JR Tohoku HonsenKita-Omiya Warabi Nishi-Kawaguchi Kawaguchi Kashiwa Kashiwa Hon-Kawagoe Matsudo Shin- Gamo Takenozuka Yoshikawa Shin-Misato Shintoshin Nishi-Arai Umejima Mabashi Minoridai Gotanno Yono Kita-Urawa Minami-Urawa Kita-Akabane Akabane Shinden Yatsuka Shin- Musashiranzan Higashi-Jujo Kita-Matsudo Shinrin-koenHigashi-MatsuyamaTakasaka Omiya Kashiwa Toride Yono Minami- Honmachi Yono- Matsubara-Danchi Shin-Itabashi Minami-FuruyaJR Kawagoe Line Musashishi-Urawa Kita-Toda Toda Toda-Koen Ukima-Funato Kosuge JR Saikyo Line Shimo Matsudo Kita-Sakado Kita- Shimura- Akabane-Iwabuchi Soka Masuo Ogawamachi Naka-Urawa Takashimadaira Shiden Matsudo- Yono Nishi-Takashimadaira Hasune Sanchome Itabashi-Honcho Oji Kita-senju Kami- Myogaku Sashiogi Nisshin Nishi-Urawa Daishimae Tobu Isesaki Line Kita-Ayase Kanamachi Hongo Shimura- Jujo Oji-Kamiya Oku Sakasai Yabashira Kawagoe Shingashi Fujimino Tsuruse -

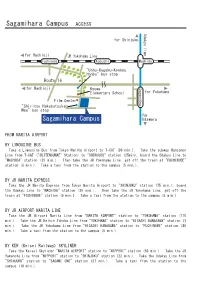

Sagamihara Campus ACCESS Odakyu Line

Sagamihara Campus ACCESS Odakyu line for Shinjuku for Hachioji JR Yokohama Line Fuchinobe Kobuchi Machida "Uchu-Kagaku-Kenkyu Honbu" bus stop Route 16 for Hachioji Kyowa SagamiOno Elementary School for Yokohama Film Center "Shiritsu Hakubutsukan Mae" bus stop for Sagamihara Campus Odawara FROM NARITA AIRPORT BY LIMOUSINE BUS Take a Limousine Bus from Tokyo Narita Airport to T-CAT (90 min.). Take the subway Hanzomon Line from T-CAT ("SUITENGUMAE" Station) to "SHINJUKU" station (25min), board the Odakyu Line to "MACHIDA" station (35 min.). Then take the JR Yokohama Line, get off the train at "FUCHINOBE" station (6 min.). Take a taxi from the station to the campus (5 min.). BY JR NARITA EXPRESS Take the JR Narita Express from Tokyo Narita Airport to "SHINJUKU" station (75 min.), board the Odakyu Line to "MACHIDA" station (35 min.). Then take the JR Yokohama Line, get off the train at "FUCHINOBE" station (6 min.). Take a taxi from the station to the campus (5 min.). BY JR AIRPORT NARITA LINE Take the JR Airport Narita Line from "NARITA AIRPORT" station to "YOKOHAMA" station (110 min.). Take the JR Keihin Tohoku Line from "YOKOHAMA" station to "HIGASHI KANAGAWA" station (3 min.). Take the JR Yokohama Line from "HIGASHI KANAGAWA" station to "FUCHINOBE" station (40 min.). Take a taxi from the station to the campus (5 min.). BY KER (Keisei Railway) SKYLINER Take the Keisei Skyliner "NARITA AIRPORT" station to "NIPPORI" station (50 min.). Take the JR Yamanote Line from "NIPPORI" station to "SHINJUKU" station (22 min.). Take the Odakyu Line from "SHINJUKU" station to "SAGAMI ONO" station (37 min.). -

Tokyo Great Garden Spring Campaign

Enlightenment with Asakura style philosophy 7RN\R Former AsakuraAsakura Fumio Garden (Asakura Museum of Sculpture, Taito) 7-18-10 Yanaka, Taito-ku 103-3821-4549 *UHDW National - designated Place of Scenic Beauty "Former Asakura Fumio Garden" Asakura Sculpture Museum is the building that was a studio and residence of Fumio Asakura (1883 ~1964) a leading sculptor of modern Japan. Asakura designed and supervised the building which was completed in 1935. Asakura died in 1964, but the building was opened to the public as a Asakura Sculpture Museum since 1967 by the family of the deceased (transferred to Taito-ku in 1986), in 2001 the building is registered in the tangible cultural heritage of the country. In 2008 the integration of architecture and gardens were admitted for their value and artistic appreciation and *DUGHQ the entire site has been designated as a national scenic spot as "The former gardens of Fumio Asakura". Since 2009 to 2013 was carried out conservation and restoration works on a large scale and appearance could be restored even when Asakura was alive. Admission General 500 yen (300 yen). Elementary, middle and high school students 250 yen (150 yen) *( ) inside is a group rate of more than 20 people *Persons holding the Handicapped person's passbook or a Certificate Issued for Specific Disease Treatment and their caregivers is free Yearly Passport: 1,000 yen (same price for all visitors) 6SULQJ Open 9:30 - 16:30 (Admission until 16:00) Closed Mondays and Thursdays Open on holidays and Closed on the day following a holidays Year-end and New Year holidays *During changing exhibitions, etc. -

Tokyo Pocket Guide Harajuku Map Attractions Tokyo Pocket Guide Harajuku Map English

TOKYO POCKET GUIDE HARAJUKU MAP ATTRACTIONS Gim Togo AO Hipanda TOGO Tiger A B Nubian C D E F G H I 1 SHRINEShrine HUG Conv Aeropostal Shinjuku Stay Hassayadai Real Mojo 2030 Regatte Bring Toilet Whoop-de-doo Not Conventional Warp RamidusAbstract Takenoko RichardsGorakudo StylelandiaWorld What’s Tokia Happy Hearts Body Line Xing Fu Connection Blue TAKESHITA-DORIBroadway St #00TD Redeye Cosmura Gold’s Blackanny With Box Up 3/4 7/11 AC/DC Innisfree Gym Stormy Marion Romantic 1 Jean’sMate Wego Atmos gettry Standard asics MoMon Brand Tourist My Pouch Claire’s kuro Collect Info Wendy’s TAKESHITA-DORI STREET Murasaki Loyd Daiso Burlesque CalienteNadia Paris Kids WC MAP StrawGFC A.P.C. 2 Ruo Candy-a-gogoCute Cube McD’s Calbee Etudeto Alice Brand Wego Bic Matsumoto TokiaYosukeKokumin Me Santa LotteriaCollect Blowz Monica Etude New DisneyAlta Studious 2 Studious Conv Tutu Anna Balance GoodCalzedonia Day 2nd Takeshita-doriCS T&PSilhouette Street Anap A’gem Street Rinkan Girl Stussy Takeshita TabioDor Panama DNA Royal Yoshinoya Noa Boy Moosh Closet Child Tea SB's Surku studious Sunny B-side exit Champion AC/DC Anap Advan Studious 3 Bazz Bopper Le Rag Shining Attractions Carhartt Fonte Fake Store Diana P-mimi Abettor 2 Farms HUF Noah Viva Extreme X-Large Kamo Acryl Rawdrip Bones Goa Undefeated Aape Junk Yard Supreme flamingo X-girl Skechers Avex Reversal Artists LHP Neighbor 3 Alley Galaxy LaDonna Candy Bubbles Pool Stripper Undefeated Polcadot Tha Terminal Oshman’s Prisila 3 H&M Line Friends Luigi Billy’s U Deeta Leflah Beauty Square Fools Punk Chicago -

Policy of Cultural Affairs in Japan

Policy of Cultural Affairs in Japan Fiscal 2016 Contents I Foundations for Cultural Administration 1 The Organization of the Agency for Cultural Affairs .......................................................................................... 1 2 Fundamental Law for the Promotion of Culture and the Arts and Basic Policy on the Promotion of Culture and the Art ...... 2 3 Council for Cultural Affairs ........................................................................................................................................................ 5 4 Brief Overview of the Budget for the Agency for Cultural Affairs for FY 2016 .......................... 6 5 Commending Artistic and Related Personnel Achievement ...................................................................... 11 6 Cultural Publicity ............................................................................................................................................................................... 12 7 Private-Sector Support for the Arts and Culture .................................................................................................. 13 Policy of Cultural Affairs 8 Cultural Programs for Tokyo 2020 Olympic and Paralympic Games .................................................. 15 9 Efforts for Cultural Programs Taking into Account Changes Surrounding Culture and Arts ... 16 in Japan II Nurturing the Dramatic Arts 1 Effective Support for the Creative Activities of Performing Arts .......................................................... 17 2 -

Tokyo Metoropolitan Area Railway and Subway Route

NikkNikkō Line NikkNikkō Kuroiso Iwaki Tōbu-nikbu-nikkkō Niigata Area Shimo-imaichi ★ ★ Tōbu-utsunomiya Shin-fujiwara Shibata Shin-tochigi Utsunomiya Line Nasushiobara Mito Uetsu Line Network Map Hōshakuji Utsunomiya Line SAITAMA Tōhoku Shinkansen Utsunomiya Tomobe Ban-etsu- Hakushin Line Hakushin Line Niitsu WestW Line ■Areas where Suica・PASMO can be used RAILWAY Tochigi Oyama Shimodate Mito Line Niigata est Line Shinkansen Moriya Tsukuba Jōmō- Jōetsu Minakami Jōetsu Akagi Kuzū Kōgen ★ Shibukawa Line Shim-Maebashi Ryōmō Line Isesaki Sano Ryōmō Line Hokuriku Kurihashi Minami- ban Line Takasaki Kuragano Nagareyama Gosen Shinkansen(via Nagano) Takasaki Line Minami- Musashino Line NagareyamaNagareyama-- ō KukiKuki J Ōta Tōbu- TOBU Koshigaya ōōtakanomoritakanomori Line Echigo Jōetsu ShinkansenShinkansen Shin-etsu Line Line Annakaharuna Shin-etsu Line Nishi-koizumi Tatebayashi dōbutsu-kōen Kasukabe Shin-etsu Line Yokokawa Kumagaya Higashi-kHigashi-koizumioizumi Tsubamesanjō Higashi- Ogawamachi Sakado Shin- Daishimae Nishiarai Sanuki SanjSanjōō Urawa-Misono koshigaya Kashiwa Abiko Yahiko Minumadai- Line Uchijuku Ōmiya Akabane- Nippori-toneri Liner Ryūgasaki Nagaoka Kawagoeshi Hon-Kawagoe Higashi- iwabuchi Kumanomae shinsuikoen Toride Yorii Ogose Kawaguchi Machiya Kita-ayase TSUKUBA Yahiko Yoshida HachikHachikō Line Kawagoe Line Kawagoe ★ ★ NEW SHUTTLE Komagawa Keihin-Tōhoku Line Ōji Minami-Senju EXPRESS Shim- Shinkansen Ayase Kanamachi Matsudo ★ Seibu- Minami- Sendai Area Higashi-HanHigashi-Hannnō Nishi- Musashino Line Musashi-Urawa Akabane -

Quiz―700 Questions About Things Japanese

National Diet Library Newsletter No. 227, December 2019 Selections from NDL collections Quiz―700 Questions About Things Japanese NISHIKAWA Hisashi, Business, Science and Technology Division, Reader Services and Collections Department This article is a translation of the article in Japanese in NDL Monthly Bulletin No. 701/702 (September/October 2019). front cover back cover Quiz―700 answers to questions on things Japanese Published by Japan Travel Bureau in December 1948, 152p; 18cm, NDL Call no. 915.2-N691q In 2018, the number of international inbound visitors to Quiz―700 answers to questions on things Japanese was Japan reached 30 million for the first time in history1, and first published in 1948, shortly after inbound visitors first there are those who predict that this number will exceed began to visit postwar Japan. In addition to the first 35 million during 2019.2 With Japan hosting the Tokyo inbound visitors, who arrived in Yokohama in December Olympic and Paralympic Games in 2020, the number of 1947, there were also some one hundred thousand non- international visitors to Japan is expected to reach Japanese living in Japan, who were not tourists but the unprecedented levels in the near future. But there was a officers and men of the occupation forces. time when Japan was an exotic destination known only to a few. In this article, we will take a look at a book from It was during this period that the Japan Travel Bureau an earlier age that purports to introduce Japanese culture (JTB) played a significant role by serving the needs of the to non-Japanese. -

The Union of National Economic Associations in Japan

No.S Information Bulletin of The Union of National Economic Associations in Japan 日本経済学会連合 1986 INFORMATION BULLETIN OF THE UNION OF NATIONAL ECONOMIC ASSOCIATIONS IN JAPAN This Information Bulletin is designed to serve as an introduction of the academic activities of member associations of the Union to the economic societies throughout the world. The copies will be distributed by the secretariat of the Union to economists and societies in other countries whose names have been given by the member associations of the Union. Managing Editors Yoshio Okuda, Chuo University Akira Takayanagi, University of Tsukuba Shinya Sugiyama, Keio University Masatoshi Hayashi, Yokohama Municipal University Hisanobu Kato, Asia University Mitsuhiro Hirata, Hitotsubashi University Yasuo Kawasima, Meiji Gakuin University Masahiro Sugiyama, Waseda University Koichi Tanouchi, Hitotsubashi Univesity Shoji Nedachi, Nihon University Masatoshi Kawanabe, St. Paul's University Terushi Hara, Waseda University Editional Committee Fumimasa Hamada, Keio University Yoshinori Suzuki, Kanagawa University Shizuya Nishimura, Hosei University Hideo Tamura, Chuo University Shusaku Yamaya, Toyo University Kiyoshi Okamoto, Hitotsubashi University Hisanori Nishiyama, Meiji University Masaru Saito, Chuo University Kazuo Nimura, Hosei University Hiroshi Tsukahara, Nagoya Economic University Junko Nishikawa, Tokyo Metroporitan College of Toshio Watanabe, University of Tsukuba Commerce Yoko Sano, Keio University Directors of the Union President Takashi SHIRAISHI, Kyorin University