Q3 2007 Johnson & Johnson Earnings Webcast and Analyst

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

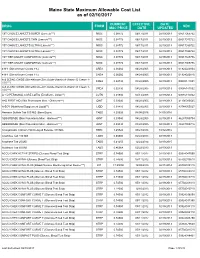

Maine State Maximum Allowable Cost List As of 02/10/2017

Maine State Maximum Allowable Cost List as of 02/10/2017 CURRENT EFFECTIVE DATE DRUG FORM NDC MAC PRICE DATE UPDATED 1ST CHOICE LANCETS SUPER (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517065722 1ST CHOICE LANCETS THIN (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517015722 1ST CHOICE LANCETS ULTRA (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517030722 1ST CHOICE LANCETS ULTRA (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517035722 1ST TIER UNILET COMFORTOU (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517025736 1ST TIER UNILET COMFORTOU (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517065736 4-N-1 (Dimethicone Cream 1%) CREA 0.06060 04/28/2005 02/19/2013 61924020804 4-N-1 (Dimethicone Cream 1%) CREA 0.06060 04/28/2005 02/19/2013 61924020816 A & D ZINC OXIDE (Dimethicone-Zinc Oxide-Vitamin A-Vitamin D Cream 1- CREA 0.02730 04/28/2005 02/19/2013 00085141001 10%***) A & D ZINC OXIDE (Dimethicone-Zinc Oxide-Vitamin A-Vitamin D Cream 1- CREA 0.02730 04/28/2005 02/19/2013 00085141002 10%***) A + D PERSONAL CARE LOTIO (Emollient - Lotion**) LOTN 0.01940 03/13/2008 02/19/2013 00085113002 A+D FIRST AID (Skin Protectants Misc - Ointment***) OINT 0.03040 04/28/2005 02/19/2013 41100080545 A-SOY (Nutritional Supplement Liquid**) LIQD 0.01410 04/28/2005 02/19/2013 83744055027 Abacavir Sulfate Tab 300 MG (Base Equiv) TABS 4.20626 04/08/2016 04/05/2016 ABSORBASE (Skin Protectants Misc - Ointment***) OINT 0.03040 04/28/2005 02/19/2013 46287050704 ABSORBASE (Skin Protectants Misc - Ointment***) OINT 0.03040 04/28/2005 02/19/2013 -

“The Silver Sheet” MEDICAL DEVICE QUALITY CONTROL

F-D-C REPORTS — FOUNDED 1939 $665 A YEAR ® www.TheSilverSheet.com“The Silver Sheet” MEDICAL DEVICE QUALITY CONTROL Vol. 13, No. 2 February 2009 THE NEWS THIS ISSUE • RECALLS SOARED TO THEIR HIGHEST POINT EVER IN 2008, with companies recalling a total of 845 devices. Many of the recalls were related to software problems and tainted heparin. “The goal is to try and decrease those recalls,” says Tim Ulatowski, director of CDRH’s Office of Compliance. “So we’re trying to push that number down through effective enforcement actions and industry training.” There is good news, however: The number of Class I recalls fell from 23 in 2007 to only 17 in 2008 – industry’s best Class I showing since 2003. Also, the recall manager for a Virginia hospital chain tells what companies should do to make their recall letters clearer and easier to comply with. “We get some recall letters and we truly don’t know what to do with them,” Bea Haupt says................................................Below • COMPLETE TABLE OF RECALLS FROM 2008 includes 17 Class I (2%), 726 Class II (86%) and 107 Class III (12%) medical device events ............................................................................................................12 • WARNING LETTERS: I-Flow cited for QS and MDR reg violations in relation to its infusion pumps.........66 • IN BRIEF: New GHTF guidance instructs firms on the control of products and services obtained from suppliers; former OSEL Director Larry Kessler is concerned that CDRH doesn’t always follow scientific principles and practices .......................................................................................................Back page Problems Related To Software, Heparin Help Push Recalls To All-Time High Also, FDA And Industry Experts Give Tips For Composing Recall Letters The number of recalled medical devices counting methods are typically negligible; the skyrocketed last year to its highest point ever, agency counted 831 total recalls in FY 2008 and spurred on by a large volume of Class II recalls 664 in FY 2007. -

SWHPCGV (A6) Scott & White Health Plan Group Value Closed

SWHP Group Value Formulary Federal Employees Health Benefits Program 3rd Quarter 2021 P a g e | 2 Table of Contents What is my prescription drug coverage? ...................................................................... 3 What is the Scott & White Health Plan Group Value Formulary? .................................. 3 How was the formulary created and how are new medications reviewed? .................. 3 Does the formulary ever change? ................................................................................ 3 How am I notified of changes to the formulary? .......................................................... 4 What are brand-name and generic drugs? ................................................................... 4 What is generic substitution? ...................................................................................... 4 What are specialty drugs? ........................................................................................... 4 What are pharmaceutical management procedures?................................................... 5 Are there any restrictions on my coverage? ................................................................. 5 How do I request an exception to the SWHP formulary?.............................................. 5 What drugs are not covered by my prescription drug benefit? ..................................... 5 How much medication does my copayment cover and does my plan cover maintenance medications? ........................................................................................ -

2021 Bright Formulary (List of Covered Drugs)

2021 Bright Formulary (List of Covered Drugs) Bright Health Individual and Family Plans Colorado PLEASE READ: This document contains information about the drugs Bright Health covers in their Individual and Family plans. This formulary was updated on 09/01/2021. For more recent information or other questions, please contact us at 833-661-1988 or visit www.brighthealthplan.com. PA - Prior Authorization QL - Quantity Limits ST - Step Therapy OTC - Over the i counter Welcome to Bright Enclosed you will find a list of the drugs included in our Bright Health Individual and Family plans from January 1, 2021 - December 31, 2021. As you review, be sure to have your medications on hand so you can confirm your prescriptions are covered and compare dosage and pricing of the drugs you take. Keep in mind, this document includes a comprehensive list of drugs (formulary) included in our Individual and Family plans. For an updated formulary, please contact us. Our contact information, along with the date we last updated the formulary, appears on the front and back cover pages. As a Bright Health member, you must generally use in-network pharmacies to fill your prescriptions. Benefits, formulary, pharmacy network, and/or copayments/coinsurance may change on January 1, 2022, and from time to time during the 2021 calendar year. Sincerely, Your Bright Health team PA - Prior Authorization QL - Quantity Limits ST - Step Therapy OTC - Over the ii counter Frequently Asked Questions: What is a Formulary (drug list)? A formulary is a list of covered drugs selected by Bright Health in consultation with a team of health care providers, which represents the prescription therapies believed to be a necessary part of a quality treatment program. -

Wellcare of South Carolina Medicaid Preferred Drug List

2021 South Carolina Medicaid Comprehensive Preferred Drug List (List of Covered Drugs) Lista integral de medicamentos preferidos de South Carolina Medicaid (Lista de medicamentos cubiertos) WellCare of South Carolina 00 Please read: This document contains information about the drugs we cover in this plan. Please note: The South Carolina Medicaid Preferred Drug List is updated quarterly. Providers, please visit our website at https://www.wellcare.com/South- Carolina/Providers/Medicaid/Pharmacy to view updates to the preferred drug list. Members, please visit our website at https://www.wellcare.com/South-Carolina/Members/Medicaid-Plans/WellCare-of-South-Carolina/Pharmacy- Services to view updates to the preferred drug list. Importante: Este documento contiene información acerca de los medicamentos que tienen cobertura con este plan. Tenga en cuenta lo siguiente: La lista de medicamentos preferidos de South Carolina Medicaid se actualiza cada trimestre. Proveedores: visite nuestro sitio web en https://www.wellcare.com/South- Carolina/Providers/Medicaid/Pharmacy para ver las actualizaciones de la lista de medicamentos preferidos. Miembros: visite nuestro sitio web en https://www.wellcare.com/South-Carolina/Members/Medicaid-Plans/WellCare-of-South-Carolina/Pharmacy- Services para ver las actualizaciones de la lista de medicamentos preferidos. Last updated (4/1/2021) Última actualización (4/1/2021) CAD_67295M State Approved 01282021 ©WellCare 2021 SC1SMDCVR68980M_2021 Drug Name Preference Details Coverage Details *Adhd/Anti-Narcolepsy/Anti- -

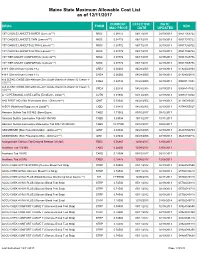

Mainecare MAC List Effective 12.11.2017

Maine State Maximum Allowable Cost List as of 12/11/2017 CURRENT EFFECTIVE DATE DRUG FORM NDC MAC PRICE DATE UPDATED 1ST CHOICE LANCETS SUPER (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517065722 1ST CHOICE LANCETS THIN (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517015722 1ST CHOICE LANCETS ULTRA (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517030722 1ST CHOICE LANCETS ULTRA (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517035722 1ST TIER UNILET COMFORTOU (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517025736 1ST TIER UNILET COMFORTOU (Lancets***) MISC 0.08772 06/17/2011 02/19/2013 08517065736 4-N-1 (Dimethicone Cream 1%) CREA 0.06060 04/28/2005 02/19/2013 61924020804 4-N-1 (Dimethicone Cream 1%) CREA 0.06060 04/28/2005 02/19/2013 61924020816 A & D ZINC OXIDE (Dimethicone-Zinc Oxide-Vitamin A-Vitamin D Cream 1- CREA 0.02730 04/28/2005 02/19/2013 00085141001 10%***) A & D ZINC OXIDE (Dimethicone-Zinc Oxide-Vitamin A-Vitamin D Cream 1- CREA 0.02730 04/28/2005 02/19/2013 00085141002 10%***) A + D PERSONAL CARE LOTIO (Emollient - Lotion**) LOTN 0.01940 03/13/2008 02/19/2013 00085113002 A+D FIRST AID (Skin Protectants Misc - Ointment***) OINT 0.03040 04/28/2005 02/19/2013 41100080545 A-SOY (Nutritional Supplement Liquid**) LIQD 0.01410 04/28/2005 02/19/2013 83744055027 Abacavir Sulfate Tab 300 MG (Base Equiv) TABS 1.71062 09/15/2017 09/12/2017 Abacavir Sulfate-Lamivudine Tab 600-300 MG TABS 5.09004 10/13/2017 10/11/2017 Abacavir Sulfate-Lamivudine-Zidovudine Tab 300-150-300 MG TABS 19.77500 03/10/2017 03/08/2017 -

The Top 30 Global Medical Device Companies

The Top 30 Global Medical Device Companies Gains Top Declines The success of the medical device industry is never more apparent than when you examine the numbers being produced by manufacturers in this market. Year by year, today’s top companies show that dedication to the bottom line can help amass steady growth, with most of the top 30 companies posting healthy double- digit gains over the prior fiscal year. Of course, with all the competition and consolidation occurring in daily business, some companies showed signs of weakness with flat or, even worse, declining sales and profits—however, they are in the minority. While US companies tend to dominate the top 30, the proliferation of international giants shows that the industry is generating more and more profits from global outreach efforts, particularly in China, Japan and Europe. The dollar’s fluctuating worth will surely continue to impact sales over time, though. As the following in-depth company examinations show, new product innovation usually plays the most prominent role in determining success and sustainability year after year. At least one of the companies on this list will disappear in 2006. Guidant will probably go down in history as one of the top newsmakers of 2005 due to Boston Scientific’s aggressive acquisition of the cardiovascular product maker—not to mention Guidant’s mounting legal troubles stemming from a slew of product recalls and reports of improper handling of related problems with its ICDs and pacemakers. Parent company Kodak has also been weighing the merits of selling its longtime healthcare division and, by this time next year, that segment could be operating under another owner. -

The Leading Source of Diabetes Business News the Long View Fall

The Leading Source of Diabetes Business News The Long View Fall 2011 • No. 108 Although change isn’t literally in the air for me – here in San Francisco, we still get a few more weeks of summer – autumn brings some notable shifts in the world of diabetes, and I’m looking forward to hearing all about them in companies’ third-quarter financial updates. Perhaps most importantly, Amylin/Lilly/Alkermes’ Bydureon, the first once-weekly diabetes therapy, has now made its debut in several European countries. That means this earnings’ season will be the first chance to hear how the launch has gone, and we’ll get our first real indicator of what to expect in the quarters to come. Will patients flock to the every-seven-days dosage schedule, forcing rival GLP-1 companies to accelerate development of their own once-weekly products (and encouraging Amylin/Lilly/Alkermes to stay on course with their phase 2 once-monthly exenatide)? Or will factors like needle size, injection simplicity – and even the regularity of daily dosing, considered an advantage by some – give the edge to Victoza? (Novo Nordisk certainly isn’t resting on the success of this soon-to- be-blockbuster, having most recently launched Victoza in the swiftly growing Chinese market – a topic we explore in this issue’s interview with Novo Nordisk’s head of China, Ron Christie.) The global GLP-1 contest was already intensely competitive and has become more so, even before Bydureon’s entry to the US or the arrival of new players (e.g., Sanofi’s Lyxumia). -

Catalog of Medical Veterinary Customers

Save On Quality Pharmaceuticals from First Veterinary Supply As a national distributor of quality, FDA-approved veterinary pharmaceuticals for licensed companion animal and specialty veterinary practices, First Veterinary Supply offers over 8,000 branded and generic products. We also have a wide array of biological, diagnostic, and medical supplies— everything you need to better serve your clients and to grow your practice. The Pharmaceutical, Surgical and Value-Added Medical Supplies You Need—Fast Support With competitive pricing, timely deliveries, an extensive Our in-house sales professionals have extensive industry selection of products and no long-term commitments, experience – most are licensed veterinary technicians. Our we deliver savings you expect from your veterinary team of dedicated associates has cultivated long-standing distributor: relationships with key pharmaceutical manufacturers, allowing us to be the supplier of choice to over 9,000 • A comprehensive product catalog of medical veterinary customers. We understand your needs, and instruments, devices & supplies offer value-added support services that help you grow • Consistent, competitive pricing with monthly your practice: manufacturer specials • Extended office hours from 8am to 8pm EST • Referral Program which pays you cash to serve customers • Online access to MSDS sheets & Veterinary • Rapid delivery—next day & Saturday Compendium product label data • Online orders late in the evening still receive • Vaccine program that manages your inventory next-day delivery & lowers costs • Compliant with all drug pedigree laws • Special programs for Board Certified specialists • Easy, online Controlled Substance Ordering System Broad (CSOS) for DEA-licensed users Product Selection We offer a wide range of products from over 30 veterinary manufacturers, including Vetoquinol, Dechra and Virbac. -

Medical, Surgical & Pharmaceutical Purchasing Program

13MS6992 AAO Formulary FC_BC_Layout 1 5/14/13 12:04 PM Page 1 13MS6992 Medical, Surgical & Pharmaceutical Purchasing Program Over 90,000 items in stock No purchase commitments No enrollment fee Over 300 NEW PRODUCTS To Order: 1-800-P-SCHEIN (1-800-772-4346) 8am–9pm (et) To Fax: 1-800-329-9109 24 Hours JOIN OUR COMMUNITY www.henryschein.com/aao 13MS6992 AAO Formulary Ads_Formulary 5/15/13 2:54 PM Page 2 With , access a comprehensive portfolio of products and services to help your ophthalmology practice thrive. Purchasing Program Formulary Assembled precisely with your needs in mind, this Purchasing Program includes popular and essential products for a successful Eye MD practice. Leveraging the combined purchasing volume of Program members, the formulary delivers savings on a variety of products. If you are currently ordering online, you can receive additional benefits through our loyalty program exclusively for Academy members. www.henryschein.com/aao Ordering, Tracking, and Spend Management Tools Henry Schein’s Web site is tailored to the needs of your practice and the conditions you treat. The enhanced search capabilities and functionality make finding, ordering, and tracking products quick and efficient. Spend reporting tools allow you to analyze and optimize your budget. www.henryschein.com/medical Consultation Services Looking for solutions that improve patient safety and practice performance? Consider our OSHA compliance checklist. Are you looking to upgrade, move, or add services to your current practice? Henry Schein Sales Consultants can help you navigate complex challenges and select the solutions that are right for you at no additional charge. -

1-DAY ACUVUE, Contact Lenses ACIPHEX/PARIET

1-DAY ACUVUE, contact lenses ACIPHEX/PARIET (rabeprazole sodium), for gastrointestinal conditions (non-J&J trademark) ACT, rinse ACTIVE NATURALS, ingredients derived from nature ACUVUE, contact lenses ACUVUE 2 COLOURS, contact lenses ACUVUE ADVANCE, contact lenses ACUVUE OASYS, contact lenses ADVANCED SOLUTIONS, cosmetic dermatology products ALAMAST, penmirotast potassium ophthalmic solution (non-J&J trademark) AMBI, skin care for women of color ANTIVIROGRAM, HIV drug resistance testing ARESTIN (rninoeycline HCl 1 mg), for periodontal. disease AVEENO, skin care products AXERT, (almotriptan malate tablets) for acute migraine treatment BABYCENTER, resources for new and expectant parents BAND-AID, adhesive bandages BENECOL, food spread (non-J&J trademark) BETIMOL, timolol ophthalmic solution (non-J&J trademark) BIAFINE, skin healing brand on the French market BX VELOCITY, stent CAREFREE, Pantiliners CARTO, cardiac navigation system CARTOMERGE, image integration software module CELLSEARCH, assays for circulating tumor cells CELSIUS, diagnostic ablation steerable tip catheter CHARITE, artificial spinal disc CIDEX, instrument sterilization, disinfection, and cleaning technologies CLEAN & CLEAR, teen skin care products COMFORT-FLEX, adhesive CONCERTA (methylphenidate HC1), treatment of attention deficit hyperactivity disorder CONCORDE, implant and instrument system for spinal surgery CONTOUR, curved cutter stapler CYPHER, Sirolimus-eluting Stent DEPUY ASR, bearings for joint stability DEPUY PROXIMA, hip implant DERMABOND, topical skin adhesive -

Medical, Surgical & Pharmaceutical Purchasing Program

10MS3123 Medical, Surgical & Pharmaceutical Purchasing Program • Over 90,000 items in stock • No purchase commitments • No enrollment fee • Over 150 price reductions • Contract pricing for over 140 items www.henryschein.com/AAO Privileges Rewards Buy what you need, get what you want Earn reward points with PRIVILEGES while saving money with Henry Schein Brand Products. With our PRIVILEGES PROGRAM, we believe in rewarding our loyal customers with products and services that will help their practices stay competitive and profitable, now more than ever. Henry Schein Brand Products provide brand quality and performance without brand cost. As a PRIVILEGES member, you’ll receive: Visit your account often to check your points, browse the gift • PRIVILEGES Rewards points for all electronic purchases catalog and redeem for thousands of brand-name gift items – including FREE travel and event tickets! You can reward an • Value Certificates to reduce your expenses and offer employee or redecorate your office with PRIVILEGES points! you the opportunity to earn Bonus Points Sign up now to start enjoying all the special attention and • PRIVILEGES Monthly E-Promotions exclusive benefits that you deserve. Membership is FREE! • Exclusive Quarterly E-Newsletters To enroll or learn more, speak with your Sales Consultant • Access to Practice Marketing Services or visit www.henryschein.com/privilegesmd • Double points program for Privileges I Allscripts I Henry Schein Brand I Rx Samples Service I Henry Schein Financial Services 1.866.MED.VIPS 1.800.PSCHEIN www.henryschein.com/privilegesmd www.henryschein.com/medical [email protected] ©2010 Henry Schein, Inc. No copying without permission. Not responsible for typographical errors.