Announcement of Interim Results for the Six Months Ended 30 June 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Returning to China I Am Unsure About CLICK HERE Leaving the UK

Praxis NOMS Electrronic Toolkit A resource for the rresettlement ofof Foreign National PrisonersPrisoners (FNP(FNPss)) www.tracks.uk.net Passport I want to leave CLICK HERE the UK Copyright © Free Vector Maps.com I do not want to CLICK HERE leave the UK Returning to China I am unsure about CLICK HERE leaving the UK I will be released CLICK HERE into the UK Returning to China This document provides information and details of organisations which may be useful if you are facing removal or deportation to China. While every care is taken to ensure that the information is correct this does not constitute a guarantee that the organisations will provide the services listed. Your Embassy in the UK Embassy of the People’s Republic of China Consular Section 31 Portland Place W1B 1QD Tel: 020 7631 1430 Email: [email protected] www.chinese-embassy.org.uk Consular Section, Chinese Consulate-General Manchester 49 Denison Road, Rusholme, Manchester M14 5RX Tel: 0161- 2248672 Fax: 0161-2572672 Consular Section, Chinese Consulate-General Edinburgh 55 Corstorphine Road, Edinburgh EH12 5QJ Tel: 0131-3373220 (3:30pm-4:30pm) Fax: 0131-3371790 Travel documents A valid Chinese passport can be used for travel between the UK and China. If your passport has expired then you can apply at the Chinese Embassy for a new passport. If a passport is not available an application will be submitted for an emergency travel certificate consisting of the following: • one passport photograph • registration form for the verification of identity (completed in English and with scanned -

RAPD Fingerprint Construction and Genetic Similarity of Mesona Chinensis (Lamiaceae) in China

RAPD fingerprint construction and genetic similarity of Mesona chinensis (Lamiaceae) in China G.F. Zhang, J.M. Guan, X.P. Lai, J. Lin, J.M. Liu and H.H. Xu College of Chinese Medicine, Guangzhou University of Chinese Medicine, Guangzhou, Guangdong, China Corresponding author: X.P. Lai E-mail: [email protected] Genet. Mol. Res. 11 (4): 3649-3657 (2012) Received April 23, 2012 Accepted July 20, 2012 Published October 4, 2012 DOI http://dx.doi.org/10.4238/2012.October.4.12 ABSTRACT. Mesona chinensis is an economically important agricultural crop, primarily cultivated for making grass jelly. It was originally discovered in South China. We examined 18 cultivars, including cultivars from Guangdong, Fujian, and Guangxi, China, Taiwan, and Indonesia, and a hybrid (a cross between cultivars from Indonesia and Guangdong), based on RAPD markers. The genetic similarity coefficient was calculated by NTSYS 2.10 and the clustering analysis was made by UPGMA. PCR amplification with 10 primers produced 163 bands; 94% of the amplified loci were polymorphic. The primers S208, S206, and S253 could completely distinguish all 19 samples by constructing a DNA fingerprint. Cluster analysis divided the 19 cultivars into five groups, with an overall genetic similarity coefficient of 0.68. Correlations were found among regional distributions, parental sources, and RAPD markers, demonstrating the rich genetic diversity of these 19 cultivars of M. chinensis. This study provides useful information for the classification, identification, and breeding of M. chinensis. Key words: Mesona chinensis; RAPD fingerprint; Genetic similarity Genetics and Molecular Research 11 (4): 3649-3657 (2012) ©FUNPEC-RP www.funpecrp.com.br G.F. -

Official Record of Proceedings

LEGISLATIVE COUNCIL ─ 3 November 2010 1399 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 3 November 2010 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN IR DR THE HONOURABLE RAYMOND HO CHUNG-TAI, S.B.S., S.B.ST.J., J.P. THE HONOURABLE LEE CHEUK-YAN DR THE HONOURABLE DAVID LI KWOK-PO, G.B.M., G.B.S., J.P. THE HONOURABLE FRED LI WAH-MING, S.B.S., J.P. DR THE HONOURABLE MARGARET NG THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHEUNG MAN-KWONG THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE MRS SOPHIE LEUNG LAU YAU-FUN, G.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG DR THE HONOURABLE PHILIP WONG YU-HONG, G.B.S. 1400 LEGISLATIVE COUNCIL ─ 3 November 2010 THE HONOURABLE WONG YUNG-KAN, S.B.S., J.P. THE HONOURABLE LAU KONG-WAH, J.P. THE HONOURABLE LAU WONG-FAT, G.B.M., G.B.S., J.P. THE HONOURABLE MIRIAM LAU KIN-YEE, G.B.S., J.P. THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE ANDREW CHENG KAR-FOO THE HONOURABLE TIMOTHY FOK TSUN-TING, G.B.S., J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, S.B.S., J.P. THE HONOURABLE LI FUNG-YING, S.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. -

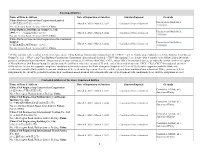

Sanctioned Entities Name of Firm & Address Date

Sanctioned Entities Name of Firm & Address Date of Imposition of Sanction Sanction Imposed Grounds China Railway Construction Corporation Limited Procurement Guidelines, (中国铁建股份有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway 23rd Bureau Group Co., Ltd. Procurement Guidelines, (中铁二十三局集团有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway Construction Corporation (International) Limited Procurement Guidelines, March 4, 2020 - March 3, 2022 Conditional Non-debarment (中国铁建国际集团有限公司)*38 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China *38 This sanction is the result of a Settlement Agreement. China Railway Construction Corporation Ltd. (“CRCC”) and its wholly-owned subsidiaries, China Railway 23rd Bureau Group Co., Ltd. (“CR23”) and China Railway Construction Corporation (International) Limited (“CRCC International”), are debarred for 9 months, to be followed by a 24- month period of conditional non-debarment. This period of sanction extends to all affiliates that CRCC, CR23, and/or CRCC International directly or indirectly control, with the exception of China Railway 20th Bureau Group Co. and its controlled affiliates, which are exempted. If, at the end of the period of sanction, CRCC, CR23, CRCC International, and their affiliates have (a) met the corporate compliance conditions to the satisfaction of the Bank’s Integrity Compliance Officer (ICO); (b) fully cooperated with the Bank; and (c) otherwise complied fully with the terms and conditions of the Settlement Agreement, then they will be released from conditional non-debarment. If they do not meet these obligations by the end of the period of sanction, their conditional non-debarment will automatically convert to debarment with conditional release until the obligations are met. -

Xiamen International Bank Co., Ltd. 2018 Annual Report

Xiamen International Bank Co., Ltd. 2018 Annual Report 厦门国际银行股份有限公司 2018 年年度报告 Important Notice The Bank's Board of Directors, Board of Supervisors, directors, supervisors, and senior management hereby declare that this report does not contain any false records, misleading statements or material omissions, and they assume joint and individual responsibilities on the authenticity, accuracy and completeness of the information herein. The financial figures and indicators contained in this annual report compiled in accordance with China Accounting Standards, unless otherwise specified, are consolidated figures calculated based on domestic and overseas data in terms of RMB. Official auditor of the Bank, KPMG Hua Zhen LLP (special general partnership), conducted an audit on the 2018 Financial Statements of XIB compiled in accordance with China Accounting Standards, and issued a standard unqualified audit report. The Bank’s Chairman Mr. Weng Ruotong, Head of Accounting Affairs Ms. Tsoi Lai Ha, and Head of Accounting Department Mr. Zheng Bingzhang, hereby ensure the authenticity, accuracy and completeness of the financial report contained in this annual report. Notes on Major Risks: No major risks that can be predicted have been found by the Bank. During its operation, the key risks faced by the Bank include credit risks, market risks, operation risks, liquidity risks, compliance risks, country risks, information technology risks, and reputation risks, etc. The Bank has taken measures to effectively manage and control the various kinds of operational risks. For relevant information, please refer to Chapter 2, Discussion and Analysis of Business Conditions. Forward-looking Risk Statement: This Report involves several forward-looking statements about the financial position, operation performance and business development of the Bank, such as “will”, “may”, “strive”, “endeavor”, “plan to”, “goal” and other similar words used herein. -

Land Acquisition ◆ in April 2020, the Group Completed the Following Land Acquisitions

2020 Corporate Monthly Newsletter APRIL CIFI’s Contracted Sales of RMB13.00B in April 2020 and RMB35.40B in First Four Months ◆ In April 2020, the Group achieved the contracted sales of RMB13.00 billion. Contracted GFA amounted to approximately 815,900 sq.m. Contracted ASP was approximately RMB15,900/sq.m. in April 2020. ◆ From January to April 2020, the Group achieved contracted sales of RMB35.40 billion. Contracted GFA amounted to approximately 2,204,800 sq.m. Contracted ASP was approximately RMB16,100/sq.m. from January to April 2020. Land Acquisition ◆ In April 2020, the Group completed the following land acquisitions: Average Group’s Total Planned Group’s Land Cost Current Intended Site GFA Attributable (Excluding City Project Equity Primary Area (Excluding Consideration Carpark) Interest Use (sq.m.) Carpark) (RMB) (RMB/ (sq.m.) sq.m.) Miyun District, Beijing Tanying Town, 6023 22.5% Residential 60,600 124,400 336,600,000 12,027 Project Jimo District, Qingdao Zaohang 100% Residential 59,500 141,800 252,570,000 1,781 Resettlement Project Jimo District, Qingdao Zaohang 100% Residential 111,900 241,700 654,390,000 2,708 Development Project Economic Development Zone, Residential, Nanchang 100% 415,700 498,800 2,020,090,000 4,050 No. DAGJ2020004 Commercial Project Page 1 of 4 2020 Corporate Monthly Newsletter APRIL (Cont’d) Average Group’s Total Planned Group’s Land Cost Current Intended Site GFA Attributable (Excluding City Project Equity Primary Area (Excluding Consideration Carpark) Interest Use (sq.m.) Carpar) (RMB) (RMB/ (sq.m.) sq.m.) Banan District, Yudong Yunzhuan Chongqing 51% Residential 37,500 82,500 141,430,000 3,362 Mountain, P07-03-01 Project Jiangyin City, Yunting Street, Experimental Wuxi 33% Residential 46,000 81,800 256,460,000 9,498 Primary School North Project Company News ◆ In April 2020, Moody’s reaffirmed CIFI’s “Ba3” issuer rating with outlook positive. -

Annual Report, and They Severally and Jointly Accept Legal Responsibility for the Truthfulness, Accuracy and Completeness of Its Contents

(A joint stock limited company incorporated in the People's Republic of China with limited liability) Stock Code: 1618 * For identification purpose only IMPORTANT NOTICE I. The Board and the Supervisory Committee of the Company and its Directors, Supervisors and senior management warrant that there are no false representations, misleading statements contained in or material omissions from the information set out in this annual report, and they severally and jointly accept legal responsibility for the truthfulness, accuracy and completeness of its contents. II. The Company convened the 14th meeting of the third session of the Board on 31 March 2020. All Directors of the Company attended the meeting. III. Deloitte Touche Tohmatsu CPA LLP issued an unqualified audit report to the Company. IV. Guo Wenqing, the Chairman and legal representative of the Company, Zou Hongying, the Vice President and the Chief Accountant of the Company, and Fan Wanzhu, the Deputy Chief Accountant and the Head of the Financial Planning Department, have declared that they warrant the truthfulness, accuracy and completeness of the financial report contained in this annual report. V. The proposal for profit distribution or transfer of capital reserve to share capital for the Reporting Period was considered by the Board The net profit attributable to Shareholders of the Company in the audited consolidated statement of MCC in 2019 amounted to RMB6,599,712 thousand and the undistributed profit of MCC headquarters amounted to RMB1,920,906 thousand. Based on the total share capital of 20,723.62 million shares, the Company proposed to distribute to all Shareholders a cash dividend of RMB0.72 (tax inclusive) for every 10 shares and the total cash dividend is RMB1,492,101 thousand, the remaining undistributed profit of RMB428,805 thousand will be used for the operation and development of the Company and rolled over to the coming year for distribution. -

High People's Court of Fujian Province Civil Judgement

High People's Court of Fujian Province Civil Judgement (2015) Min Min Zhong Zi No.2060 Appellant (defendant of the first instance): Xie Zhijin, Male, DOB: 10/27/1963, Han Chinese, Self-employed, residing in Cangshan District, Fuzhou, Fujian Appellant (defendant of the first instance): Ni Mingxiang, Male, DOB: 03/28/1965, Han Chinese, Farmer, residing in Fuqing, Fujian Appellant (defendant of the first instance): Zheng Shijiang, Male, DOB: 04/04/1966, Han Chinese, Farmer, residing in Fuqing, Fujian Attorney of the three appellants above: Xie Changling, Zhong Yin (Fuzhou) Law Firm. Appellee (plaintiff of the first instance): Friends of Nature Domicile: Room A201, Building 2, No. 12 Yumin Road, Chaoyang District, Beijing Legal Representative: Zhang Hehe, Deputy Director-General Entrusted Agent: Ge Feng, Female, Director of Legal and Policy Affairs, residing in Wuchang District, Wuhan Attorney: Liu Xiang, Golden Diamond Law Firm Appellee (plaintiff of the first instance): Fujian Green Home Environment-friendly Center Domicile: 3H, Buidling B, Hot Spring Park, Yingji Road No. 38, Gulou District, Fuzhou, Fujian Legal Representative: Lin Meiying, Director Attorney: Wu Anxin, Hubei Longzhong Law Firm Defendant of the First Instance: Li Mingshuo, Male, DOB: 12/16/1968, Han Chinese, Farmer, residing in Taishun County, Zhejiang Attorney: Qiu Shuhua, Fujian Quanxin Law Firm Third Party of the First Instance: Yanping District Land Resources Bureau of Nanping Municipal Land Resources Bureau Domicile: Shengli Street No. 182, Yanping District, Nanping, Fujian Legal Representative: Huang Ge, Director-General Attorney: He Jianhua, Fujian Shunning Law Firm Third Party of the First Instance: Yanping District Forestry Bureau of Nanping Municipal Forestry Bureau Domicile: Chaoyang Street No. -

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation

ATTACHMENT 1 Barcode:3800584-02 C-570-107 INV - Investigation - Chinese Producers of Wooden Cabinets and Vanities Company Name Company Information Company Name: A Shipping A Shipping Street Address: Room 1102, No. 288 Building No 4., Wuhua Road, Hongkou City: Shanghai Company Name: AA Cabinetry AA Cabinetry Street Address: Fanzhong Road Minzhong Town City: Zhongshan Company Name: Achiever Import and Export Co., Ltd. Street Address: No. 103 Taihe Road Gaoming Achiever Import And Export Co., City: Foshan Ltd. Country: PRC Phone: 0757-88828138 Company Name: Adornus Cabinetry Street Address: No.1 Man Xing Road Adornus Cabinetry City: Manshan Town, Lingang District Country: PRC Company Name: Aershin Cabinet Street Address: No.88 Xingyuan Avenue City: Rugao Aershin Cabinet Province/State: Jiangsu Country: PRC Phone: 13801858741 Website: http://www.aershin.com/i14470-m28456.htmIS Company Name: Air Sea Transport Street Address: 10F No. 71, Sung Chiang Road Air Sea Transport City: Taipei Country: Taiwan Company Name: All Ways Forwarding (PRe) Co., Ltd. Street Address: No. 268 South Zhongshan Rd. All Ways Forwarding (China) Co., City: Huangpu Ltd. Zip Code: 200010 Country: PRC Company Name: All Ways Logistics International (Asia Pacific) LLC. Street Address: Room 1106, No. 969 South, Zhongshan Road All Ways Logisitcs Asia City: Shanghai Country: PRC Company Name: Allan Street Address: No.188, Fengtai Road City: Hefei Allan Province/State: Anhui Zip Code: 23041 Country: PRC Company Name: Alliance Asia Co Lim Street Address: 2176 Rm100710 F Ho King Ctr No 2 6 Fa Yuen Street Alliance Asia Co Li City: Mongkok Country: PRC Company Name: ALMI Shipping and Logistics Street Address: Room 601 No. -

Shop Direct Factory List Dec 18

Factory Factory Address Country Sector FTE No. workers % Male % Female ESSENTIAL CLOTHING LTD Akulichala, Sakashhor, Maddha Para, Kaliakor, Gazipur, Bangladesh BANGLADESH Garments 669 55% 45% NANTONG AIKE GARMENTS COMPANY LTD Group 14, Huanchi Village, Jiangan Town, Rugao City, Jaingsu Province, China CHINA Garments 159 22% 78% DEEKAY KNITWEARS LTD SF No. 229, Karaipudhur, Arulpuram, Palladam Road, Tirupur, 641605, Tamil Nadu, India INDIA Garments 129 57% 43% HD4U No. 8, Yijiang Road, Lianhang Economic Development Zone, Haining CHINA Home Textiles 98 45% 55% AIRSPRUNG BEDS LTD Canal Road, Canal Road Industrial Estate, Trowbridge, Wiltshire, BA14 8RQ, United Kingdom UK Furniture 398 83% 17% ASIAN LEATHERS LIMITED Asian House, E. M. Bypass, Kasba, Kolkata, 700017, India INDIA Accessories 978 77% 23% AMAN KNITTINGS LIMITED Nazimnagar, Hemayetpur, Savar, Dhaka, Bangladesh BANGLADESH Garments 1708 60% 30% V K FASHION LTD formerly STYLEWISE LTD Unit 5, 99 Bridge Road, Leicester, LE5 3LD, United Kingdom UK Garments 51 43% 57% AMAN GRAPHIC & DESIGN LTD. Najim Nagar, Hemayetpur, Savar, Dhaka, Bangladesh BANGLADESH Garments 3260 40% 60% WENZHOU SUNRISE INDUSTRIAL CO., LTD. Floor 2, 1 Building Qiangqiang Group, Shanghui Industrial Zone, Louqiao Street, Ouhai, Wenzhou, Zhejiang Province, China CHINA Accessories 716 58% 42% AMAZING EXPORTS CORPORATION - UNIT I Sf No. 105, Valayankadu, P. Vadugapal Ayam Post, Dharapuram Road, Palladam, 541664, India INDIA Garments 490 53% 47% ANDRA JEWELS LTD 7 Clive Avenue, Hastings, East Sussex, TN35 5LD, United Kingdom UK Accessories 68 CAVENDISH UPHOLSTERY LIMITED Mayfield Mill, Briercliffe Road, Chorley Lancashire PR6 0DA, United Kingdom UK Furniture 33 66% 34% FUZHOU BEST ART & CRAFTS CO., LTD No. 3 Building, Lifu Plastic, Nanshanyang Industrial Zone, Baisha Town, Minhou, Fuzhou, China CHINA Homewares 44 41% 59% HUAHONG HOLDING GROUP No. -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

Annual Report 2019

HAITONG SECURITIES CO., LTD. 海通證券股份有限公司 Annual Report 2019 2019 年度報告 2019 年度報告 Annual Report CONTENTS Section I DEFINITIONS AND MATERIAL RISK WARNINGS 4 Section II COMPANY PROFILE AND KEY FINANCIAL INDICATORS 8 Section III SUMMARY OF THE COMPANY’S BUSINESS 25 Section IV REPORT OF THE BOARD OF DIRECTORS 33 Section V SIGNIFICANT EVENTS 85 Section VI CHANGES IN ORDINARY SHARES AND PARTICULARS ABOUT SHAREHOLDERS 123 Section VII PREFERENCE SHARES 134 Section VIII DIRECTORS, SUPERVISORS, SENIOR MANAGEMENT AND EMPLOYEES 135 Section IX CORPORATE GOVERNANCE 191 Section X CORPORATE BONDS 233 Section XI FINANCIAL REPORT 242 Section XII DOCUMENTS AVAILABLE FOR INSPECTION 243 Section XIII INFORMATION DISCLOSURES OF SECURITIES COMPANY 244 IMPORTANT NOTICE The Board, the Supervisory Committee, Directors, Supervisors and senior management of the Company warrant the truthfulness, accuracy and completeness of contents of this annual report (the “Report”) and that there is no false representation, misleading statement contained herein or material omission from this Report, for which they will assume joint and several liabilities. This Report was considered and approved at the seventh meeting of the seventh session of the Board. All the Directors of the Company attended the Board meeting. None of the Directors or Supervisors has made any objection to this Report. Deloitte Touche Tohmatsu (Deloitte Touche Tohmatsu and Deloitte Touche Tohmatsu Certified Public Accountants LLP (Special General Partnership)) have audited the annual financial reports of the Company prepared in accordance with PRC GAAP and IFRS respectively, and issued a standard and unqualified audit report of the Company. All financial data in this Report are denominated in RMB unless otherwise indicated.