Off-Grid Solar Market Assessment Ethiopia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

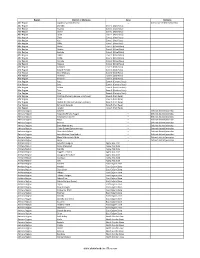

Districts of Ethiopia

Region District or Woredas Zone Remarks Afar Region Argobba Special Woreda -- Independent district/woredas Afar Region Afambo Zone 1 (Awsi Rasu) Afar Region Asayita Zone 1 (Awsi Rasu) Afar Region Chifra Zone 1 (Awsi Rasu) Afar Region Dubti Zone 1 (Awsi Rasu) Afar Region Elidar Zone 1 (Awsi Rasu) Afar Region Kori Zone 1 (Awsi Rasu) Afar Region Mille Zone 1 (Awsi Rasu) Afar Region Abala Zone 2 (Kilbet Rasu) Afar Region Afdera Zone 2 (Kilbet Rasu) Afar Region Berhale Zone 2 (Kilbet Rasu) Afar Region Dallol Zone 2 (Kilbet Rasu) Afar Region Erebti Zone 2 (Kilbet Rasu) Afar Region Koneba Zone 2 (Kilbet Rasu) Afar Region Megale Zone 2 (Kilbet Rasu) Afar Region Amibara Zone 3 (Gabi Rasu) Afar Region Awash Fentale Zone 3 (Gabi Rasu) Afar Region Bure Mudaytu Zone 3 (Gabi Rasu) Afar Region Dulecha Zone 3 (Gabi Rasu) Afar Region Gewane Zone 3 (Gabi Rasu) Afar Region Aura Zone 4 (Fantena Rasu) Afar Region Ewa Zone 4 (Fantena Rasu) Afar Region Gulina Zone 4 (Fantena Rasu) Afar Region Teru Zone 4 (Fantena Rasu) Afar Region Yalo Zone 4 (Fantena Rasu) Afar Region Dalifage (formerly known as Artuma) Zone 5 (Hari Rasu) Afar Region Dewe Zone 5 (Hari Rasu) Afar Region Hadele Ele (formerly known as Fursi) Zone 5 (Hari Rasu) Afar Region Simurobi Gele'alo Zone 5 (Hari Rasu) Afar Region Telalak Zone 5 (Hari Rasu) Amhara Region Achefer -- Defunct district/woredas Amhara Region Angolalla Terana Asagirt -- Defunct district/woredas Amhara Region Artuma Fursina Jile -- Defunct district/woredas Amhara Region Banja -- Defunct district/woredas Amhara Region Belessa -- -

Ethiopia: 2015 HRF Projects Map (As of 31 December 2015)

Ethiopia: 2015 HRF projects map (as of 31 December 2015) Countrywide intervention ERITREA Legend UNICEF - Nutrition - $999,753 Concern☃ - VSF-G ☈ ! Refugee camp WFP - Nutrition (CSB) - $1.5m National capital Shimelba Red Sea SUDAN Regional intervention International boundary Hitsa!ts Dalul UNICEF - Health - $1.0m ! !Hitsats ! ! Undetermined boundary ! ! SCI Tigray, Afar, Amhara, Oromia, Kelete Berahile ☃☉ May-Ayni Kola ! Somali, Gambella, SNPR & NRC - ☉ Ts!elemti Temben Awelallo Lake IRC - ★ ! ☄ ! ♫ Tanqua ! SUDAN ! ! ! Dire Dawa Adi Harush ! Enderta Abergele ! Ab Ala Afdera Project woredas Tselemt ! NRC - Debark GAA - ☇ ! WFP (UNHAS) - Coordination ☈ Abergele! Erebti ☋☉ Plan Int. - ACF - ☃ Dabat Sahla ☃Megale Bidu and Support Service - $740,703 Janamora Wegera! Clusters/Activities ! Ziquala Somali region Sekota ! ! Concern - SCI Teru ! Agriculture CRS - Agriculture/Seed - $2,5m ☃ ☃ Kurri ! Dehana ! ☋ ! Gaz Alamata ! Elidar GAA - ☋ Amhara,Ormia and SNNP regions ! ☃☉ Gonder Zuria Gibla ! Gulf of ! Education Plan Int. - Ebenat Kobo SCI☃☉ ☃ ! Gidan ☄ Lasta ! Aden CARE - Lay Guba ! Ewa ! ☃ ! Meket Lafto Gayint ! Food security & livelihood WV - ☃ Dubti ☈ ☉ ! Tach Habru Chifra SCI - ☃ Delanta ! ! - Tigray Region, Eastern Zone, Kelete Awelall, ! Gayint IMC - ☃ Health ☉ Simada Southern Zone, Alamata and Enderta woredas ! ! Mile DJIBOUTI ☊ Mekdela ! Bati Enbise SCI- Nutrition ! Argoba ☃☉ WV - ☃ Sar Midir Legambo ☃ ! Oxfam GB - Enarj ! ☉ ! ! Ayisha Non Food Items - Amhara region, North Gonder (Gonder Zuria), Enawga ! Antsokiya Dalfagi ! ! ! Concern -

ETHIOPIA - National Hot Spot Map 31 May 2010

ETHIOPIA - National Hot Spot Map 31 May 2010 R Legend Eritrea E Tigray R egion !ª D 450 ho uses burned do wn d ue to th e re ce nt International Boundary !ª !ª Ahferom Sudan Tahtay Erob fire incid ent in Keft a hum era woreda. I nhabitan ts Laelay Ahferom !ª Regional Boundary > Mereb Leke " !ª S are repo rted to be lef t out o f sh elter; UNI CEF !ª Adiyabo Adiyabo Gulomekeda W W W 7 Dalul E !Ò Laelay togethe r w ith the regiona l g ove rnm ent is Zonal Boundary North Western A Kafta Humera Maychew Eastern !ª sup portin g the victim s with provision o f wate r Measle Cas es Woreda Boundary Central and oth er imm ediate n eeds Measles co ntinues to b e re ported > Western Berahle with new four cases in Arada Zone 2 Lakes WBN BN Tsel emt !A !ª A! Sub-city,Ad dis Ababa ; and one Addi Arekay> W b Afa r Region N b Afdera Military Operation BeyedaB Ab Ala ! case in Ahfe rom woreda, Tig ray > > bb The re a re d isplaced pe ople from fo ur A Debark > > b o N W b B N Abergele Erebtoi B N W Southern keb eles of Mille and also five kebeles B N Janam ora Moegale Bidu Dabat Wag HiomraW B of Da llol woreda s (400 0 persons) a ff ected Hot Spot Areas AWD C ases N N N > N > B B W Sahl a B W > B N W Raya A zebo due to flo oding from Awash rive r an d ru n Since t he beg in nin g of th e year, Wegera B N No Data/No Humanitarian Concern > Ziquala Sekota B a total of 967 cases of AWD w ith East bb BN > Teru > off fro m Tigray highlands, respective ly. -

OCHA East Hub Easthararghe Zone of Oromia: Flash Floods 290K 13

OCHA East Hub East Hararghe Zone of Oromia: Flash floods Flash Update No. 1 As of 26 August 2020 HIGHLIGHTS Districts affected by flash floods as of 20 August 2020 • 290,185 people (58,073HHs) were affected due to the recent flood and landslide • 169 PAs in 13 districts (Haromaya, Goro Muxi, Kersa Melka Belo, Bedeno, Meta, Deder, Kumbi, Giraw, Kurfa Calle, Kombolcha, Jarso and Goro Gutu) were affected. • Over 42,000IDPs in those affected woredas were also affected including secondary displacement in some areas like the 56HH IDPs in Calanqo city of Metta woreda • 970 houses were damaged out of which 330 were totally damaged resulting to the displacement for 1090 people. Moreover,22,080 hectares of meher plantations were damaged impacting 18885 people in 4 districts and landslides on 2061 hectares affected 18785 people. A total of 18 human deaths as well as 135 livestock deaths reported. • 4 roads with total length of 414kms were partially damaged which might cause physical access constraints to 4-5 woredas of the zone. 290K 13 affected Districts affected people SITUATION OVERVIEW East Hararghe zone is recurrently affected by flood impact. Chronically,9 woredas of the zone, namely, Kersa, Melak Belo, Midhega Tola, Bedeno, Gursum, Deder, Babile, Haromaya ad Metta were prone to flooding. The previous flood in May affected 8 of the these woredas were 10,067 HHs (over 60,000 people) in 62 kebeles were affected. During this time, over 2000 hectares of Belg plantations were damaged. Only Babile woreda was reached with few assistances from some partners. The NMA predicted that above normal rainfall will likely to happen in the Eastern part after June. -

Local History of Ethiopia Ma - Mezzo © Bernhard Lindahl (2008)

Local History of Ethiopia Ma - Mezzo © Bernhard Lindahl (2008) ma, maa (O) why? HES37 Ma 1258'/3813' 2093 m, near Deresge 12/38 [Gz] HES37 Ma Abo (church) 1259'/3812' 2549 m 12/38 [Gz] JEH61 Maabai (plain) 12/40 [WO] HEM61 Maaga (Maago), see Mahago HEU35 Maago 2354 m 12/39 [LM WO] HEU71 Maajeraro (Ma'ajeraro) 1320'/3931' 2345 m, 13/39 [Gz] south of Mekele -- Maale language, an Omotic language spoken in the Bako-Gazer district -- Maale people, living at some distance to the north-west of the Konso HCC.. Maale (area), east of Jinka 05/36 [x] ?? Maana, east of Ankar in the north-west 12/37? [n] JEJ40 Maandita (area) 12/41 [WO] HFF31 Maaquddi, see Meakudi maar (T) honey HFC45 Maar (Amba Maar) 1401'/3706' 1151 m 14/37 [Gz] HEU62 Maara 1314'/3935' 1940 m 13/39 [Gu Gz] JEJ42 Maaru (area) 12/41 [WO] maass..: masara (O) castle, temple JEJ52 Maassarra (area) 12/41 [WO] Ma.., see also Me.. -- Mabaan (Burun), name of a small ethnic group, numbering 3,026 at one census, but about 23 only according to the 1994 census maber (Gurage) monthly Christian gathering where there is an orthodox church HET52 Maber 1312'/3838' 1996 m 13/38 [WO Gz] mabera: mabara (O) religious organization of a group of men or women JEC50 Mabera (area), cf Mebera 11/41 [WO] mabil: mebil (mäbil) (A) food, eatables -- Mabil, Mavil, name of a Mecha Oromo tribe HDR42 Mabil, see Koli, cf Mebel JEP96 Mabra 1330'/4116' 126 m, 13/41 [WO Gz] near the border of Eritrea, cf Mebera HEU91 Macalle, see Mekele JDK54 Macanis, see Makanissa HDM12 Macaniso, see Makaniso HES69 Macanna, see Makanna, and also Mekane Birhan HFF64 Macargot, see Makargot JER02 Macarra, see Makarra HES50 Macatat, see Makatat HDH78 Maccanissa, see Makanisa HDE04 Macchi, se Meki HFF02 Macden, see May Mekden (with sub-post office) macha (O) 1. -

Total Affected Population, January-June 2012

Total Affected Population, January-June 2012 Erob Tahtay Adiyabo Mereb LekeAhferom Laelay Adiyabo Gulomekeda Dalul Legend · Adwa Saesie Tsaedaemba Werei Leke Tigray HawzenKoneba Lakes Asgede Tsimbila Naeder Adet Atsbi Wenberta Berahle Kola Temben Tselemti Tselemt Administrative boundary Tanqua Abergele Enderta Addi Arekay Ab Ala Afdera Beyeda Saharti Samre Hintalo Wejirat Erebti Abergele Region Janamora Megale Bidu Sahla Alaje Ziquala Endamehoni Sekota Raya Azebo Teru Zone West Belesa Ofla Yalo Gonder Zuria Dehana Kurri Gaz Gibla Alamata Elidar Bugna Gulina Awra Woreda Lasta (Ayna)Gidan Kobo Ewa Afar Lay GayintMeket Wadla Guba Lafto Dubti Total affected Population Delanta Habru Chifra Guba Amhara Worebabu Simada Adaa'r Mile 0(no requirment) MekdelaTenta Afambo Bati z Sayint u Telalak m Mehal Sayint u Legambo Dewa HarewaDewe 14-8108 G Antsokiya Ayisha Sherkole l Kurmuk u Gishe Rabel Sirba Abay g Artuma Fursi Gewane n Menz Gera Midir 8109-13746 Bure Mudaytu a DeraMimo Weremo Jille Timuga Erer Shinile h Afdem is Ibantu Menz Mama Midir Assosa n Wara JarsoHidabu Abote Kewet e Simurobi Gele'alo Dembel 13747-21231 Degem Tarema Ber B Abuna G/BeretKuyu Dire Dawa Ginde Beret Gerar Jarso Miesso Dire DawaJarsoChinaksen Meta Robi DulechaAmibara Goro Gutu Jida Argoba Special KersaHarar Jijiga 21232-33163 JelduAdda Berga Doba Meta Gursum Aleltu Gursum Sasiga Ifata Mieso TuloDeder Babile Hareshen Chiro Zuria Bedeno Diga Mesela Hareri Kebribeyah Addis Ababa Goba KorichaGemechisMalka Balo GirawaFedis 33164-59937 AncharHabro Midega TolaBabile Daro Lebu -

Prioritization of Shelter/NFI Needs

Prioritization of Shelter/NFI needs Date: 31st May 2018 Shelter and NFI Needs As of 18 May 2018, the overall number of displaced people is 345,000 households. This figure is based on DTM round 10, partner’s assessments, government requests, as well as the total of HH supported since July 2017. The S/NFI updated its prioritisation in early May and SNFI Cluster partners agreed on several criteria to guide prioritisation which include: - 1) type of emergency, 2) duration of displacement, and 3) sub-standard shelter conditions including IDPS hosted in collective centres and open-air sites and 4) % of vulnerable HH at IDP sites. Thresholds for the criteria were also agreed and in the subsequent analysis the cluster identified 193 IDP hosting woredas mostly in Oromia and Somali regions, as well as Tigray, Gambella and Addis Ababa municipality. A total of 261,830 HH are in need of urgent shelter and NFI assistance. At present the Cluster has a total of 57,000 kits in stocks and pipeline. The Cluster requires urgent funding to address the needs of 204,830 HHs that are living in desperate displacement conditions across the country. This caseload is predicted to increase as the flooding continues in the coming months. Shelter and NFI Priority Activities In terms of priority activities, the SNFI Cluster is in need of ES/NFI support for 140,259 HH displaced mainly due to flood and conflict under Pillar 2, primarily in Oromia and Somali Regions. In addition, the Shelter and NFI Cluster requires immediate funding for recovery activities to support 14,000 HH (8,000 rebuild and 6,000 repair) with transitional shelter support and shelter repair activities under Pillar 3. -

Dire Dawa Millennium Park

IOM SITE MANAGEMENT SITE PROFILE - ETHIOPIA, DIRE DAWA SUPPORT Dire Dawa Millennium Park (January 2020) Publication: 01 February 2020 ETHIOPIA IOM OIM Context The residents of Millennium Park IDP site are Somali IDPs who fled their areas of origin in Oromia. The site, which is located on Current Priority Needs land slated for development by the Dire Dawa Municipality, with World Bank funding, is included in the Somali Regional Govern- Site Overview Site Population ment's durable solutions planning, though the timeframe for potential relocations to Somali Region is not yet known. In the interim, many basic humanitarian needs of the site residents are unmet, including safe water provision and sufficient latrine coverage. Fo- 1 WASH Site Location 1,638 individuals od distribution was very irregular in the second half of 2019, but distribution did take place in Jan 2020 2 Livelihood Latitude: 9.6056860 306 households Longitude:41.859980 2 3 Health Site Area: 30,000m Data source: DTM Data, SA 20 of November 2019 Methodology Established in: Sep. 18 2017 * Priority needs as reported by residents through SMS-run Complaint The information for this site profile was collected through key informant interviews and group discussions with the Site Management and Feedback Mechanism Committees and beneficiaries by the Site Management Support (SMS) team in the area. Population figures are collected and aligned through SMS and DTM and allow for the most accurate analysis possible. Sector Overview Demographics Vulnerabilities 0 Unaccompanied children Implementing -

Oromia Region Administrative Map(As of 27 March 2013)

ETHIOPIA: Oromia Region Administrative Map (as of 27 March 2013) Amhara Gundo Meskel ! Amuru Dera Kelo ! Agemsa BENISHANGUL ! Jangir Ibantu ! ! Filikilik Hidabu GUMUZ Kiremu ! ! Wara AMHARA Haro ! Obera Jarte Gosha Dire ! ! Abote ! Tsiyon Jars!o ! Ejere Limu Ayana ! Kiremu Alibo ! Jardega Hose Tulu Miki Haro ! ! Kokofe Ababo Mana Mendi ! Gebre ! Gida ! Guracha ! ! Degem AFAR ! Gelila SomHbo oro Abay ! ! Sibu Kiltu Kewo Kere ! Biriti Degem DIRE DAWA Ayana ! ! Fiche Benguwa Chomen Dobi Abuna Ali ! K! ara ! Kuyu Debre Tsige ! Toba Guduru Dedu ! Doro ! ! Achane G/Be!ret Minare Debre ! Mendida Shambu Daleti ! Libanos Weberi Abe Chulute! Jemo ! Abichuna Kombolcha West Limu Hor!o ! Meta Yaya Gota Dongoro Kombolcha Ginde Kachisi Lefo ! Muke Turi Melka Chinaksen ! Gne'a ! N!ejo Fincha!-a Kembolcha R!obi ! Adda Gulele Rafu Jarso ! ! ! Wuchale ! Nopa ! Beret Mekoda Muger ! ! Wellega Nejo ! Goro Kulubi ! ! Funyan Debeka Boji Shikute Berga Jida ! Kombolcha Kober Guto Guduru ! !Duber Water Kersa Haro Jarso ! ! Debra ! ! Bira Gudetu ! Bila Seyo Chobi Kembibit Gutu Che!lenko ! ! Welenkombi Gorfo ! ! Begi Jarso Dirmeji Gida Bila Jimma ! Ketket Mulo ! Kersa Maya Bila Gola ! ! ! Sheno ! Kobo Alem Kondole ! ! Bicho ! Deder Gursum Muklemi Hena Sibu ! Chancho Wenoda ! Mieso Doba Kurfa Maya Beg!i Deboko ! Rare Mida ! Goja Shino Inchini Sululta Aleltu Babile Jimma Mulo ! Meta Guliso Golo Sire Hunde! Deder Chele ! Tobi Lalo ! Mekenejo Bitile ! Kegn Aleltu ! Tulo ! Harawacha ! ! ! ! Rob G! obu Genete ! Ifata Jeldu Lafto Girawa ! Gawo Inango ! Sendafa Mieso Hirna -

Somali Region

Food Supply Prospects FOR THE SECOND HALF OF YEAR 2013 ______________________________________________________________________________ Disaster Risk Management and Food Security Sector (DRMFSS) Ministry of Agriculture (MoA) September, 2013 Addis Ababa, Ethiopia TABLE OF CONTENTS GLOSSARY OF LOCAL NAMES .................................................................. 1 ACRONYMS ............................................................................................. 2 EXCUTIVE SUMMARY .............................................................................. 3 INTRODUCTION ....................................................................................... 7 REGIONAL SUMMARY OF FOOD SUPPLY PROSPECT ............................. 11 SOMALI .............................................................................................. 11 OROMIA ............................................................................................. 16 TIGRAY ............................................................................................... 22 AMHARA ............................................................................................ 25 AFAR .................................................................................................. 28 SNNP .................................................................................................. 32 Annex – 1: NEEDY POPULATION AND FOOD REQUIREMENT BY WOREDA (Second half of 2013) ............................................................................ 35 0 | P a g e GLOSSARY -

Administrative Region, Zone and Woreda Map of Oromia a M Tigray a Afar M H U Amhara a Uz N M

35°0'0"E 40°0'0"E Administrative Region, Zone and Woreda Map of Oromia A m Tigray A Afar m h u Amhara a uz N m Dera u N u u G " / m r B u l t Dire Dawa " r a e 0 g G n Hareri 0 ' r u u Addis Ababa ' n i H a 0 Gambela m s Somali 0 ° b a K Oromia Ü a I ° o A Hidabu 0 u Wara o r a n SNNPR 0 h a b s o a 1 u r Abote r z 1 d Jarte a Jarso a b s a b i m J i i L i b K Jardega e r L S u G i g n o G A a e m e r b r a u / K e t m uyu D b e n i u l u o Abay B M G i Ginde e a r n L e o e D l o Chomen e M K Beret a a Abe r s Chinaksen B H e t h Yaya Abichuna Gne'a r a c Nejo Dongoro t u Kombolcha a o Gulele R W Gudetu Kondole b Jimma Genete ru J u Adda a a Boji Dirmeji a d o Jida Goro Gutu i Jarso t Gu J o Kembibit b a g B d e Berga l Kersa Bila Seyo e i l t S d D e a i l u u r b Gursum G i e M Haro Maya B b u B o Boji Chekorsa a l d Lalo Asabi g Jimma Rare Mida M Aleltu a D G e e i o u e u Kurfa Chele t r i r Mieso m s Kegn r Gobu Seyo Ifata A f o F a S Ayira Guliso e Tulo b u S e G j a e i S n Gawo Kebe h i a r a Bako F o d G a l e i r y E l i Ambo i Chiro Zuria r Wayu e e e i l d Gaji Tibe d lm a a s Diga e Toke n Jimma Horo Zuria s e Dale Wabera n a w Tuka B Haru h e N Gimbichu t Kutaye e Yubdo W B Chwaka C a Goba Koricha a Leka a Gidami Boneya Boshe D M A Dale Sadi l Gemechis J I e Sayo Nole Dulecha lu k Nole Kaba i Tikur Alem o l D Lalo Kile Wama Hagalo o b r Yama Logi Welel Akaki a a a Enchini i Dawo ' b Meko n Gena e U Anchar a Midega Tola h a G Dabo a t t M Babile o Jimma Nunu c W e H l d m i K S i s a Kersana o f Hana Arjo D n Becho A o t -

Report of a Home Office Fact-Finding Mission Ethiopia: the Political Situation

Report of a Home Office Fact-Finding Mission Ethiopia: The political situation Conducted 16 September 2019 to 20 September 2019 Published 10 February 2020 This project is partly funded by the EU Asylum, Migration Contentsand Integration Fund. Making management of migration flows more efficient across the European Union. Contents Introduction .............................................................................................................. 5 Background ............................................................................................................ 5 Purpose of the mission ........................................................................................... 5 Report’s structure ................................................................................................... 5 Methodology ............................................................................................................. 6 Identification of sources .......................................................................................... 6 Arranging and conducting interviews ...................................................................... 6 Notes of interviews/meetings .................................................................................. 7 List of abbreviations ................................................................................................ 8 Executive summary .................................................................................................. 9 Synthesis of notes ................................................................................................