How to Contact Brent Customer Services How to Pay Your Council

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Getting to Brent Civic Centre Step by Step Directions

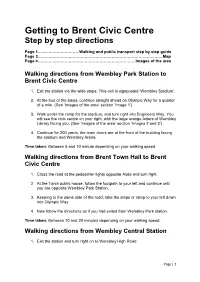

Getting to Brent Civic Centre Step by step directions Page 1………………………….Walking and public transport step by step guide Page 3…………………………………………………………………………………Map Page 4………………………………………………………….……Images of the area Walking directions from Wembley Park Station to Brent Civic Centre 1. Exit the station via the wide steps. This exit is signposted ‘Wembley Stadium’. 2. At the foot of the steps, continue straight ahead on Olympic Way for a quarter of a mile. (See ‘Images of the area’ section ‘Image 1’) 3. Walk under the ramp for the stadium, and turn right into Engineers Way. You will see the civic centre on your right, with the large orange letters of Wembley Library facing you. (See ‘Images of the area’ section ‘Images 2 and 3’) 4. Continue for 200 yards, the main doors are at the front of the building facing the stadium and Wembley Arena. Time taken: Between 5 and 10 minute depending on your walking speed. Walking directions from Brent Town Hall to Brent Civic Centre 1. Cross the road at the pedestrian lights opposite Asda and turn right. 2. At the Torch public house, follow the footpath to your left and continue until you are opposite Wembley Park Station. 3. Keeping to the same side of the road, take the steps or ramp to your left down into Olympic Way. 4. Now follow the directions as if you had exited from Wembley Park station. Time taken: Between 10 and 20 minutes depending on your walking speed. Walking directions from Wembley Central Station 1. Exit the station and turn right on to Wembley High Road. -

Open for Business Brent Business Guide

Brent is Open for Business Brent Business Guide Business Development Services What we offer • Apprenticeships & work- based training • Bespoke staff development • Industry-oriented English language • Professional short courses • Facilities hire We have a dedicated Business Development Team who deal solely with the training needs of businesses. Our role is to provide bespoke training or adapt existing qualifications and training to fit the needs of individual organisations. Training can be provided to groups on company premises or at the College, depending on the type of specialist equipment required. If you are self-employed we have short specialist courses open to individuals. “The service and delivery provided by the College of North West London... is excellent. The tutor is inspirational. John Holland, United Biscuits ” “We have been really pleased with the service provided to us by CNWL. They provide us with up to date and timely information...the dedicated support we receive has been invaluable. Victoria Whyte, Hyder” Consulting Apprenticeships Every year, hundreds of employers across London and the south east region choose us to train their apprentices. We have apprentices in a range of sectors and provide specialist support that ensures high success rates and employer satisfaction. If you are considering taking on an Apprentice or are looking for an Apprentice to fill a job vacancy, we support the following sectors: • Accounting • Construction & Engineering including: • Please ask us if you have another Building Services Engineering; job role where an apprentice could Civil Engineering; Construction benefit your business! Operations; Building Crafts; Electrical; Plumbing; Refrigeration & Air Conditioning; Funded training Automotive Engineering We know that financing staff training • Health and Social Care can be challenging, particularly for • Childcare smaller companies. -

Brent Children & Families Information Service Brent Civic Centre

Brent Children & Families Information Service Brent Civic Centre, Engineers Way, Wembley, HA9 0FJ Tel: 0208 937 3001 Special Needs Services 0 to 25 This list is updated regularly Call Brent CFIS on 020 8937 3001 for up to date information Open 9am to 5pm Monday to Friday I am worried about my child’s development – what can I do? Many children will have special educational needs at some time during their education. For most of them this will be a short-term need that can be met through the expertise and resources of their nursery, school or college, or with advice and support from outside professionals. Very few children will have needs that are long-term or a disability or medical condition that significantly affects their learning. In these cases an education, health and care plan may be required. What are special educational needs and disabilities (SEND)? Children and young people with SEND have learning difficulties or disabilities that make it harder for them to learn than most other children and young people of the same age. Children may have additional needs if they have difficulties with: reading, writing, number work or understanding information expressing themselves or understanding what others are saying making friends or relating to adults understanding and following rules and routines organising themselves a medical condition which impedes learning a sensory or physical need which may affect them in school. Who can I talk to about my concerns? It is very important that children with SEND are identified as early as possible to ensure they start to get the support they need. -

New Office Accommodation for OPDC at Brent Civic Centre, Wembley

CEO DECISION – CD159 Title: New Office Accommodation for OPDC at Brent Civic Centre, Wembley Executive summary This decision seeks approval for OPDC to secure alternative office accommodation within Brent Civic Centre, Wembley. The need to relocate, away from OPDC’s current base a 169 Union Street, has arisen as a result of the GLA’s relocation from City Hall to the Crystal, Royal Docks; no fixed office or ‘anchor’ provision will be available to OPDC beyond July 2021. Officers have therefore been engaged in an exercise to identify and assess potential options for a new base. This exercise has now concluded, and the preferred option is a relocation to Brent Civic Centre, Wembley. This decision follows on from the Chief Executive Officer’s report to Board in March 2021. Section 10 of that report set out the broad requirements for any new space and the emerging options. It also provided for a delegation to the CEO, to be exercised in consultation with the Chair, to secure new office space. Decision That the Chief Executive, having consulted with OPDC’s Chair: i. approves Brent Civic Centre as OPDC’s preferred relocation option and authorises Officers to enter into a 24-month licence agreement (with a break option at month 12) along with any other commitments necessary to secure the accommodation ii. approves expenditure of up to £125,000 p.a. for rent, service charge and Business Rates, noting that future annual approvals will be granted through the Corporation’s budget setting process iii. approves one-off expenditure of up to £30,000 for anticipated IT infrastructure and/or office set up costs iv. -

Brent Year 4 Reshaping Tomorrow Project Impact Review

BRENT YEAR 4 RESHAPING TOMORROW PROJECT IMPACT REVIEW Above all, it’s about people wates.co.uk Reshaping Tomorrow Project Impact Review 1 Wates Living Space is a company with a single minded commitment to delivering the highest “quality for our customers while making a lasting difference to the communities in which we work. When we started this project, we promised to make a lasting difference in Brent. This report demonstrates“ how we are working to meet this challenge and deliver on our promises. I hope you enjoy reading what we have done and how the team enjoyed being part of creating something special. Have you read Communities Count: A practical guide to David Morgan embedding social value or Communities Count: Four steps Managing Director, Wates Living Space to unlocking social value? Visit www.wates.co.uk Above all, it’s about people wates.co.uk 2 Wates Living Space Reshaping Tomorrow Project Impact Review Reshaping Tomorrow Project Impact Review 3 Client: Communities Count Brent Council It is critical that every penny of the money invested in housing is spent effectively and in Value: a way that delivers the most benefit to people, their communities and society as a whole. Circa £15m (Year 4) In 2017, Wates Living Space together with Social Enterprise UK, PWC, Orbit Group and the Chartered Institute of Housing conducted the most comprehensive piece of research Duration: into the Public Services (Social Value) Act and how housing associations and local authorities This 10 year contract was launched in July 2014. This report includes are seeking to create social value. -

Wembley Area Action Plan

Wembley Area Action Plan Contents . FOREWORD 8 1. INTRODUCTION 10 2. STRATEGIC PLANNING CONTEXT 12 3. VISION AND OBJECTIVES FOR WEMBLEY 17 4. URBAN DESIGN & PLACE MAKING 19 5. BUSINESS, INDUSTRY AND WASTE 46 6. TRANSPORT 51 7. HOUSING 67 Wembley Area Action Plan Contents 8. TOWN CENTRES, SHOPPING, LEISURE AND 75 TOURISM 9. SOCIAL INFRASTRUCTURE 82 10. RESPONSE TO CLIMATE CHANGE 85 11. OPEN SPACE, SPORTS AND WILDLIFE 91 12. WEMBLEY HIGH ROAD 100 13. COMPREHENSIVE DEVELOPMENT AREA 106 14. WEMBLEY PARK/EMPIRE WAY CORRIDOR 119 15. WEMBLEY EASTERN LANDS 123 Wembley Area Action Plan Contents 16. WEMBLEY INDUSTRIAL ESTATES 128 17. DELIVERY AND MONITORING 131 18. APPENDIX A: SUPERSEDED POLICIES 139 19. APPENDIX B: GLOSSARY 140 20. APPENDIX C: LAND TAKE MAPS 144 21. CHANGES TO POLICIES MAP 155 LIST OF POLICIES WEM 1 Urban Form 31 WEM 2 Gateways to Wembley 34 WEM 3 Public Realm 36 WEM 4 Public Art 37 WEM 5 Tall Buildings 38 Wembley Area Action Plan Contents WEM 6 Protection of Stadium Views 40 WEM 7 Character of Olympic Way 43 WEM 8 Securing Design Quality 44 WEM 9 Offices 49 WEM 10 Low-cost Business Start-up Space 50 WEM 11 Protected Rail Sidings 50 WEM 12 Road and Junction Improvements to Stadium Access Corridor 55 and Western Access Corridor WEM 13 Western Highway Corridor 56 WEM 14 Car Parking Strategy 57 WEM 15 Car parking standards 58 WEM 16 Walking and Cycling 63 WEM 17 Event Related Transport 64 WEM 18 Housing Mix 69 WEM 19 Family Housing 70 WEM 20 Extra Care Housing 71 WEM 21 Wheelchair Housing and Supported Housing 71 WEM 22 Private Rented -

Tokyngton Wards Are Major Destinations in Themselves in Addition to Being Residential Areas

ELECTORAL REVIEW OF THE LONDON BOROUGH OF BRENT WARDING PATTERN SUBMISSION BY THE BRENT CONSERVATIVE GROUP RESPONSE TO THE LGBCE CONSULTATION NOVEMBER 2018 1 | P a g e Introduction Why Brent? During the current London Government Boundary Commission Executive (LGBCE) review process, it has become clear to us that since the previous review in 2000, warding levels have developed out of balance. Brent Council meets the Commission’s criteria for electoral inequality with 7 wards having a variance outside 10%. The outliers are Brondesbury Park at -16% and Tokyngton at 28%. Electoral review process The electoral review will have two distinct parts: Council size – The Brent conservative group welcomes to reduce the number of councillors to 57 from current 63. We appreciate that this will require some existing wards to be redrawn, and recognise that this will represent an opportunity to examine whether the existing boundaries are an appropriate reflection of how Brent has developed since 2000. In addition, the establishment of new developments such as South Kilburn Regeneration, Wembley Regeneration, Alperton and Burnt Oak and Colindale area. Ward boundaries – The Commission will re-draw ward boundaries so that they meet their statutory criteria. Should the Commission require any further detail on our scheme we would be very happy to pass on additional information or to arrange a meeting with Commission members or officers to run through the proposals. 2 | P a g e Interests & identities of local communities The Commission will be looking for evidence on a range of issues to support our reasoning. The best evidence for community identity is normally a combination of factual information such as the existence of communication links, facilities and organisations along with an explanation of how local people use those facilities. -

Brent Civic Centre

Client Brent Council Location London, UK Brent Civic Centre Size / Cost 40,000 sqm NIA / £90 Million Team Architecture - Hopkins PROJECT PROFILE Structures - URS Corporation MEP - URS Corporation Cost - Turner & Townsend PM - Turner & Townsend Contractor - Skanska Awards BCO Corporate Workplace Award, London & South east RIBA Regional Award RIBA National Award SCALA Civic Building of the Year RICS London Award Design through innovation Civic Trust Award London Building Excellence Best Public Service Building onsarc were appointed as joint lead developed from an awareness of and Client and Architectural Advisors response to the sensitivity of customer Cto the London Borough of Brent on interfaces and the diversity of people the development of their new Civic Centre, and issues that come under the remit of catalyst of the regenerated Wembley customer care in the public sector. Masterplan. The new building needed to accommodate up to 3,000 employees from across the Borough into a single fully “All Consarc’s work led to accessible Civic Hub. We were involved our affordability argument, on the project from the strategic definition without which the project phase, continuing to work client side up would have been impossible” until the early construction stages. Initially Anna Woda, Project Director, Brent Council appointed to produce a comprehensive brief for their new Civic Centre and a feasibility study for the Brent Town Hall The concepts of a hierarchical zoning site, the role evolved to key advisor to for primary, secondary and tertiary the project board and leaders of the service enquiries were explored with Council. This included strategic advice adjacency diagrams and sketch plans. -

West London Waste Plan Notice of Adoption of Local

West London Waste Plan Regulation 26 Adoption of a Local Plan Town and Country Planning (Local Planning) (England) Regulations 2012 Notice of Adoption of Local Plan and Adoption Statement In accordance with the above Regulations, this Adoption Statement, dated 30 July 2015, gives notice that the six West London Boroughs of Brent, Ealing, Harrow, Hillingdon, Hounslow and Richmond upon Thames and the Old Oak and Park Royal Development Corporation (the Authorities) have formally adopted the West London Waste Plan (the Plan). The Plan sets out planning policies for the management of waste across the area of west London administered by the Boroughs of Brent, Ealing, Harrow, Hillingdon, Hounslow and Richmond upon Thames and those areas within Brent and Ealing administered, for planning purposes, by the Old Oak and Park Royal Development Corporation, to 2031. The Plan was examined by an independent Inspector and the Authorities consulted on a Main Modifications to the Plan between 7 November and 19 December 2014. The Inspector’s Report, including details of the Main Modifications, was issued on 16 March 2015 and can be viewed at the locations set out below and on the following website: www.wlwp.net. The adopted Plan incorporates the Main Modifications as well as a series of minor modifications. Copies of the Plan, the Sustainability Appraisal, SEA Adoption Statement and this Adoption Statement are available for inspection at Council Offices and Borough Libraries detailed below. A person aggrieved by the Plan may make an application to the High Court under section 113 of the Planning and Compulsory Purchase Act 2004 on the ground that– (a) the Plan is not within the appropriate power; (b) a procedural requirement has not been complied with. -

GLA Letter Template

Development, Enterprise and Environment June Taylor Principal Planning Officer (North Area Team) Department: Planning Planning & Regeneration Our ref: GLA/4346 Brent Council Your ref: 18/4199 Brent Civic Centre, Engineers Way Date: 18 February 2019 Wembley HA9 0FJ Dear Ms. Taylor Town & Country Planning Act 1990 (as amended); Greater London Authority Act 1999 & 2007; Town & Country Planning (Mayor of London) Order 2008. Alperton House and Units 9 & 10 Abercorn Commercial Centre, Wembley, London Borough of Brent Local planning authority reference: 18/4199 I refer to the copy of the above planning application, which was received from you on 8 November 2018. On 18 February 2019, the Mayor considered a report on this proposal reference GLA/4346/01. A copy of the report is attached, in full. This letter comprises the statement that the Mayor is required to provide under Article 4(2) of the Order. The Mayor considers that the application does not comply with the London Plan and draft London Plan, for the reasons set out in paragraph 58 of the above-mentioned report; but that the possible remedies set out in that paragraph of this report could address these deficiencies. If your Council subsequently resolves to make a draft decision on the application, it must consult the Mayor again under Article 5 of the Order and allow him fourteen days to decide whether to allow the draft decision to proceed unchanged, or direct the Council under Article 6 to refuse the application, or issue a direction under Article 7 that he is to act as the local planning authority for the purpose of determining the application. -

Anthology Wembley Parade Brochure

A guide to your new Home and Neighbourhood 2 ANTHOLOGY WEMBLEY PARADE CONTENTS 3 CONTENTS Welcome to Wembley Parade 04 Built from London 06 Welcome to London 08 At a glance 10 Welcome to Wembley 12 Eating & drinking 14 Schools & education 16 Sports & activites 18 Entertainment & culture 20 Out & about 22 Getting around 24 Transport 26 Wembley’s finest 28 The history of the Parade 30 Wembley Regeneration Masterplan 32 Anthology Wembley Parade 34 The gardens 38 The homes 40 Lounge & balcony 42 Kitchen 44 Master bedroom & en-suite 46 Entrance & hallway 48 Bathroom 50 Specification 52 Did you know? 54 Our promise 55 Contact 56 Credit: Brag Media WELCOME 5 Welcome to Wembley Parade A note from Anthology’s David Newey Welcome to the next chapter from This rich heritage of celebration and Anthology. We have now ventured into peaceful gatherings has influenced both North West London. Here, we focus on the name and architecture of our homes, Wembley and an exciting development inspiring us to write a new chapter in the of new homes that will form a key part of lives for those who come here to join this the wider regeneration of this area. thriving, famous neighbourhood. Wembley of course is famous for its Stadium, scene to many memorable events and occasions. But more than that, this area is a place where historically people of all nations, ages and beliefs have come together, to congregate and to celebrate. David Newey Project Director 6 TOTTENHAM 7 MARSHES BUILT FROM LONDON Our residential developments span across Zones 2-5, from North to South, East to West. -

All Notices Gazette

ALL NOTICES GAZETTE CONTAINING ALL NOTICES PUBLISHED ONLINE BETWEEN 13 AND 17 APRIL 2017 PRINTED ON 18 APRIL 2017 PUBLISHED BY AUTHORITY | ESTABLISHED 1665 WWW.THEGAZETTE.CO.UK Contents State/2* Royal family/ Parliament & Assemblies/ Honours & Awards/ Church/ Environment & infrastructure/5* Health & medicine/ Other Notices/22* Money/25* Companies/27* People/77* Terms & Conditions/109* * Containing all notices published online between 13 and 17 April 2017 STATE 3. This Proclamation shall come into force on the thirteenth day of April Two thousand and seventeen. STATE Given at Our Court at Windsor Castle, this twelfth day of April in the year of Our Lord Two thousand and seventeen and in the sixty-sixth year of Our Reign. PROCLAMATIONS GOD SAVE THE QUEEN (2752876) 2752876BY THE QUEEN A PROCLAMATION DETERMINING THE SPECIFICATIONS AND DESIGNS FOR A NEW SERIES OF TEN 2752875BY THE QUEEN A PROCLAMATION DETERMINING THE POUND COINS IN GOLD AND IN SILVER COMMEMORATING THE SPECIFICATIONS AND DESIGNS FOR A NEW EIGHT HUNDRED HUNDREDTH ANNIVERSARY OF THE FIRST WORLD WAR POUND GOLD COIN AND A NEW TWO HUNDRED AND FIFTY ELIZABETH R. POUND SILVER COIN ELIZABETH R. Whereas under section 3(1)(a), (b), (c), (cc), (cd) and (d) of the Coinage Whereas under section 3(1)(a), (b), (c), (cc), (cd) and (d) of the Coinage Act 1971 We have power, with the advice of Our Privy Council, by Act 1971 We have power, with the advice of Our Privy Council, by Proclamation to determine the denomination, the design and Proclamation to determine the denomination, the design and