Committee for Brisbane 2019 Vitality Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Oxford Street

Oxford Street The Bulimba District, Brisbane, Australia Project Type: Mixed-Use/Multi-Use Case No: C033007 Year: 2003 SUMMARY A public/private partnership to transform a defunct shopping strip located in the Bulimba District of Brisbane, Australia, into a vibrant, mixed-use district. The catalyst for this transformation is a city-sponsored program to renovate and improve the street and sidewalks along the 0.6-mile (one-kilometer) retail strip of Oxford Street. FEATURES Public/private partnership City-sponsored improvements program Streetscape redevelopment Oxford Street The Bulimba District, Brisbane, Australia Project Type: Mixed-Use/Multi-Use Volume 33 Number 07 April–June 2003 Case Number: C033007 PROJECT TYPE A public/private partnership to transform a defunct shopping strip located in the Bulimba District of Brisbane, Australia, into a vibrant, mixed-use district. The catalyst for this transformation is a city-sponsored program to renovate and improve the street and sidewalks along the 0.6-mile (one-kilometer) retail strip of Oxford Street. SPECIAL FEATURES Public/private partnership City-sponsored improvements program Streetscape redevelopment PROGRAM MANAGER Brisbane City Council Brisbane Administration Center 69 Ann Street Brisbane 4000 Queensland Australia Postal Address GPO Box 1434 Brisbane 4001 Queensland Australia (07) 3403 8888 Fax: (07) 3403 9944 www.brisbane.qld.gov.au/ council_at_work/improving_city/ creating_living_villages/ suburban_centre/index.shtml GENERAL DESCRIPTION Over the past ten years, Oxford Street, located in the Bulimba District of Brisbane, Australia, has been transformed from a defunct shopping strip into a vibrant, mixed-use district. The catalyst for this turnaround is a public/private partnership between Brisbane’s city council and Oxford Street’s local business owners. -

Property Report

PROPERTY REPORT Queensland Softer residential National overview property prices around the country are presenting In this edition of the Westpac Herron Todd White Residential opportunities for Property Report, we are putting the spotlight on the aspiring landlords opportunities for cashed-up investors and self-managed super and DIY superfunds, funds (SMSFs). and we’ll take a look Softer residential property prices around the country are at some of the stand- presenting opportunities for aspiring landlords and DIY out investment real superfunds, and we’ll take a look at some of the stand-out estate markets. investment real estate markets. A buyer’s market With lending still tight and confidence relatively low, competition for quality homes is comparatively thin on the ground, particularly in the entry level markets that are typically popular with investors. While prices are yet to hit bargain basement levels, it’s fair to say they have flattened out. This is good news for cashed-up investors and SMSFs looking for long-term capital gains. Leading the way is the Western Australian market, which has stabilised after a booming period of growth. Similarly, there has been a slight drop in Tasmanian real estate values after 10 years of strong returns. Indeed some markets in and around Hobart, such as Sandy Bay, South Hobart and West Hobart, recorded growth of more than 200% over the last decade. Property a long term investment While buyers, particularly first timers, might be taking a wait-and-see approach, rental markets around Australia are still relatively strong. As a result, vacancy rates are low and this is keeping rents steady, which is good news for investor cash flow. -

Safer School Travel for Runcorn Discover the Urban Stories of Artist Robert Brownhall WHAT's ON

Safer school travel for Runcorn Students at Runcorn Heights State Primary School have received a school travel safety boost after Council completed works as part of the Safe School Travel program. The school has a high percentage of students who walk, cycle, carpool and catch public transport to school. Council recently installed pedestrian safety islands at the school crossing on Nemies Road to improve safety for students and their parents and guardians.The final design of the improvement was decided after consultation with both the school and residents in the area and was delivered with the Queensland Government’s Department of Transport and Main Roads. Council’s Safe School Travel program has operated since 1991 to improve safety across Brisbane’s road network, including children’s daily commute to and from school. The Safe School Travel program delivers about 12 improvement projects each year. Robert Brownhall Story Bridge at Dusk (detail) 2010, City of Brisbane Collection, Museum of Brisbane. WHAT’S ON 7-12 April: Festival of German Films, Palace Centro, Fortitude Valley. 11 & 13 April: Jazzercise (Growing Older and Living Dangerously), 6.30-7.30pm, Calamvale Community College, Calamvale. 15-17 April: Gardening Discover the urban stories of Australia Expo 2011, Brisbane Convention and Exhibition artist Robert Brownhall Centre, www.abcgardening expo.com.au. Get along to Museum of Brisbane from 15 April to experience Brisbane through the eyes of Robert Brownhall. 16-26 April: 21st Century Kids Festival, Gallery of Modern Art, Somewhere in the City: Urban narratives by Robert Brownhall will showcase South Bank, FREE. Brownhall’s quirky style and birds-eye view of Brisbane. -

Hotel Fact Sheet

HYATT REGENCY BRISBANE 72 Queen Street Brisbane, QLD 4000, Australia T +61 7 5647 1234 F +61 7 3221 9389 hyattregencybrisbane.com @hyattregencybrisbane ACCOMMODATIONS AMENITIES MEETINGS & EVENTS • Modern accommodation with 292 All Accommodations Offer • Complimentary Internet access • Flexible meeting facilities with total well-appointed guestrooms offering • City views or Brisbane River views • On-site valet parking space of 100 sqm / 1,076 sqft. views of Brisbane city. Higher floor • Pharmacopia amenities • Tesla charging facility • Executive Studios located on the guestrooms offer views of the • Comfortable work station • Room Service lobby level, offer three individual Brisbane River. • 48-inch Flat-screen TV • Business services meeting rooms that can be • 190 Guestrooms (Queen, Twin, King) • Individually controlled heat combined to form a larger event • 12 Accessible Guestrooms (Queen) and air-conditioning RECREATIONAL FACILITIES space. The Event space features • 78 Brisbane River View Rooms • Robes and slippers • Outdoor 20 metre infinity-edge pool retractable walls and floor to ceiling (Queen, Twin, King) • Hair dryer located on the fourth floor windows overlooking Burnett Lane. • 4 Deluxe room (King) • Coffeemaker and tea setup • 24-hour fitness centre equipped • 8 Regency Suites • Minibar with refrigerator with cardio machines and • Iron and ironing board strength-training equipment • Large in-room safe, can • Queen Street Mall shopping precinct accommodate laptop with charging facility RESTAURANTS & BARS • Walk-in shower • The Pool Terrace & Bar offers a • 12 Accessible rooms – Queen bed casual al fresco venue for beverages with wheelchair accessibility space and light snacks overlooking the around, wardrobe with lowered rails hotel’s infinity pool. and draws, bathroom with handrails, • Lennons Restaurant & Bar roll-in shower and roll-up basin. -

Quick Reference Guide M Brisbane a D E B Y Equipping You with the Visitor Information and Wayfinding R N I a Knowledge to Be a Great Destination Host! S BA N E

W G elcome I V to E Y Quick reference guide M Brisbane A D E B Y Equipping you with the visitor information and wayfinding R N I A knowledge to be a great destination host! S BA N E Destination Information Service Tell me more? Where can I find this? Brisbane The Brisbane Airport Ambassadors provide Visit: Visitor Information - Airport assistance to passengers and visitors in both International Terminal, Level 2 Ambassadors the international and domestic terminals of (07) 3406 3190 & Visitor Brisbane Airport. Airport Visitor Information Centre Information - Domestic Terminal, Level 1 W: bne.com.au/corporate/about-us/community/ (07) 3305 9233 our-airport-ambassadors Brisbane Meet one of our friendly and knowledgeable To book a FREE greet: Greeters locals and go behind the scenes of our city to W: brisbanegreeters.com.au Orientation really connect with Brisbane. P: (07) 3156 6364 experience - up E: brisbanegreeters@ to 4 hours. brisbanemarketing.com.au Visitor There are two Visitor Information Centres Brisbane Visitor Information and Information located in the city and up to 20 across greater Booking Centre Centres Brisbane region. Queen Street Mall, Queen Street, Brisbane Ask a local for tour and accommodation P: (07) 3006 6290 bookings, events and entertainment E: [email protected] information, brochures and maps and general tourist advice. South Bank Visitor Centre Stanley Street Plaza, South Bank For more all Visitor Information Centres Parklands information: P: (07) 3156 6366 W: visitbrisbane.com.au/information/visitor- E: vicsouthbank@ essentials/visitor-information-centres brisbanemarketing.com.au Brisbane See some of the best of Brisbane in 90 minutes! Bookings can be made through Explorer Explore the City with a 24 or 48 hour ticket the Visitor Information Centre in on-board the Brisbane Explorer’s open-top Queen Street Mall or the Brisbane double decker buses. -

South Brisbane’ S Heart’S Desire

SOUTH BRISBANE’ S HEART’S DESIRE EVE REPRESENTS THE SUB-TROPICAL ENERGY AND EXCITEMENT OF BRISBANE WITH STYLISH ELEGANCE. WHERE CONTEMPORARY INNER CITY LIVING COMES INTO IT’S OWN. QUEEN STREET MALL BRISBANE CBD PROPOSED NEW CASINO GOMA SOUTH BANK THE WHEEL OF BRISBANE SOUTH BRISBANE STATION BRISBANE CONVENTION CENTRE BRISBANE STATE HIGH SCHOOL QUEEN STREET MALL CITY VIBE Brisbane’s character sets it apart from anywhere. A refreshing blend of city style and easy-going ambience. A unique combination of cutting edge architecture and heritage reflection. Brisbane is focused on success but EAGLE STREET PIER BR ISBANE knows how to have fun at the end of every day. Eve enhances this atmosphere. Ideally located in South Brisbane, Eve offers direct access to the city, to South Bank’s many cultural and recreational amenities and to the cosmopolitan energy of the West End. The epitome of style and convenience, Eve’s one and two-bedroom UP CLOSE apartments, and private resort facilities align with the excitement that is Brisbane. The building is as abundant as the city itself. Sub-tropical LIVE IN THE HEART OF A WORLD-CLASS plants will flourish above its undulating awning, on its balconies and down its facades. And as a signature of CITY, WHERE EVERY ATTRACTION Eve’s emphasis on luxury, you and your guests will enjoy a resort-style recreation deck overlooking the city. IS WITHIN AN EASY REACH THE WHEEL OF BRISBANE CENTR AL CITY STYLE BRISBANE IS A CITY ON SHOW, WHERE TAKING YOUR PICK MEANS ENJOYING THE BEST OF EVERYTHING FROM FOOD TO FASHION. -

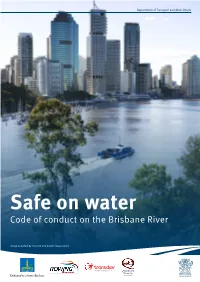

Code of Conduct on the Brisbane River

Safe on water Code of conduct on the Brisbane River Image supplied by Tourism and Events Queensland 2 Content Content 2 4.8.1 Town Reach and South Brisbane Reach (between the Story Bridge and the Introduction 3 William Jolly Bridge) 16 4.8.2 Mowbray Park to Bretts Wharf 17 Application 3 5 Commercial vessels Definitions 4 and recreational power craft 19 1 General guidelines for 5.1 Docking and departing passive craft 5 pontoon procedures 19 5.1.1 Docking 19 2 General guidelines for 5.1.2 Departing pontoon 20 all commercial vessels and recreational 5.1.3 Exclusion zone markers power craft 6 deployed 20 3 Guidelines for 6 Incident reporting 21 the operation of passive craft 8 7 Endorsement of the 3.1 Guidelines for the operation code of conduct 22 of paddle sport craft 9 Annex A 23 4 Environmental considerations 10 4.1 Lighting 10 4.2 Restricted visibility 10 4.3 Noise 11 4.4 Tides 11 4.5 Hazards 12 4.6 River construction works 14 4.7 Bridges 16 4.8 Reaches of the Brisbane River 16 Brisbane River Code of Conduct, Transport and Main Roads, 2015 3 Introduction The safe operation of passive craft on Queensland’s waterways is a priority for state and local government authorities, commercial operators and sport and recreational organisations. This code of conduct has been created to provide guidance on several aspects of safe on-water conduct of passive craft including general rules of the river, interacting with other vessels, adapting to environmental factors, participant safety and incident reporting. -

Department of Government and Political Science Submitted for the Degree of Master of Arts 12 December 1968

A STUDY OF THE PORIIATION OF THE BRISBANE T01\rN PLAN David N, Cox, B.A. Department of Government and Political Science Submitted for the degree of Master of Arts 12 December 1968 CHAPTER I TOWN PLANNING IN BRISBANE TO 1953 The first orderly plans for the City of Brisbane were in the form of an 1840 suirvey preceding the sale of allotments to the public. The original surveyor was Robert Dixon, but he was replaced by Henry Wade in 1843• Wade proposed principal streets ihO links (92,4 ft.) in width, allotments of ^ acre to allow for air space and gardens, public squares, and reserves and roads along 2 the river banks. A visit to the proposed village by the New South Wales Colonial Governor, Sir George Gipps, had infelicitous results. To Gipps, "It was utterly absurd, to lay out a design for a great city in a place which in the very 3 nature of things could never be more than a village." 1 Robinson, R.H., For My Country, Brisbane: W, R. Smith and Paterson Pty. Ltd., 1957, pp. 23-28. 2 Mellor, E.D., "The Changing Face of Brisbane", Journal of the Royal Historical Society. Vol. VI., No. 2, 1959- 1960, pp. 35^-355. 3 Adelaide Town Planning Conference and Exliibition, Official Volume of Proceedings, Adelaide: Vardon and Sons, Ltd., I9I8, p. 119. He went further to say that "open spaces shown on the pleua were highly undesirable, since they might prove an inducement to disaffected persons to assemble k tumultuously to the detriment of His Majesty's peace." The Governor thus eliminated the reserves and river 5 front plans and reduced allotments to 5 to the acre. -

Pdf, 522.77 KB

Heritage Citation Tram Shelter Key details Addresses Outside 81 Chatsworth Road, Greenslopes, Queensland 4120 Type of place Tram / bus shelter Period Interwar 1919-1939 Geolocation -27.505819 153.054955 Key dates Local Heritage Place Since — 1 January 2003 Date of Citation — September 2008 Construction Roof: Corrugated iron; Structure: Timber People/associations Brisbane City Council Department of Works (Architect) Date of Citation — September 2008 Page 1 Criterion for listing (A) Historical; (B) Rarity This two-posted double-sided timber tram shelter was constructed by the Brisbane City Council around the 1930s and was originally the terminus of the electric tram route along Chatsworth Road. The shelter is significant for the evidence it provides of Brisbane’s tramway system and for its contribution to the streetscape of Chatsworth Road. History This timber tram shelter is typical of those constructed by the Brisbane City Council on the city’s tram routes during the 1930s. Although it is situated on a tramline constructed in 1914, tram shelters were not generally built during this period, but appeared later as part of the Brisbane City Council’s efforts to improve the tramway system. Brisbane’s association with trams began in August 1885 with the horse tram, owned by the Metropolitan Tramway & Investment Co. In 1895, a contract was let to the Tramways Construction Co. Ltd. of London to electrify the system. The new electric tramway system officially opened on 21 June 1897 when a tram ran from Logan Road to the Victoria Bridge. Other lines opened in that year included the George Street, Red Hill and Paddington lines. -

Pdf, 504.76 KB

Heritage Information Please contact us for more information about this place: [email protected] -OR- phone 07 3403 8888 Hooper's shop (former) Date of Information — August 2006 Page 1 Key details Addresses At 138 Wickham Street, Fortitude Valley, Queensland 4006 Type of place Shop/s Period Interwar 1919-1939 Style Anglo-Dutch Lot plan L3_RP9471 Key dates Local Heritage Place Since — 30 October 2000 Date of Information — August 2006 Construction Walls: Masonry - Render People/associations Chambers and Ford (Architect) Criterion for listing (A) Historical; (E) Aesthetic; (H) Historical association This single storey rendered brick building, designed by notable architects Chambers and Ford, is influenced by the Federation Anglo-Dutch style. It was built in 1922 for jeweller and optometrist George Hooper, who opened a jewellery store that operated until around 1950. It is one of a row of buildings in Wickham Street that form a harmonious streetscape and demonstrate the renewal and growth that occurred in Fortitude Valley in the 1920s. History The Paddy Pallin building is a single storey commercial building designed by Brisbane architects, Chambers and Ford, for owner George Hooper, jeweller and optometrist, who purchased the 6 and 21/100 perch site in July 1922 after subdivision of a larger pre-existing block. This building and others in the block were constructed in the 1920s, replacing earlier buildings, some of which were timber and iron. The 1920s was a decade of economic growth throughout Brisbane. The Valley in particular, with its success as a commercial and industrial hub, expanded even further. Electric trams, which passed the busy corner of Brunswick and Wickham Streets, brought thousands of shoppers to the Valley. -

The Death and Life of Great Australian Music: Planning for Live Music Venues in Australian Cities

The Death and Life of Great Australian Music: planning for live music venues in Australian Cities The Death and Life of Great Australian Music: planning for live music venues in Australian Cities Dr Matthew Burke1 Amy Schmidt2 1Urban Research Program Griffith University 170 Kessels Road Nathan Qld 4111 Australia [email protected] 2Craven Ovenden Town Planning Brisbane, Australia [email protected] Word count: 4,854 words excluding abstract and references Running header: The Death and Life of Great Australian Music Key words: live music, noise, urban planning, entertainment precincts Abstract In recent decades outdated noise, planning and liquor laws, encroaching residential development, and the rise of more lucrative forms of entertainment for venue operators, such as poker machines, have acted singly or in combination to close many live music venues in Australia. A set of diverse and quite unique policy and planning initiatives have emerged across Australia’s cities responding to these threats. This paper provides the results of a systematic research effort conducted in 2008 into the success or otherwise of these approaches in Brisbane, Sydney and Melbourne. Archival and legislative reviews and field visits were supplemented by interviews with key authorities, venue operators, live music campaigners and others in each city. The research sought to categorise and evaluate the diverse approaches being used and to attempt to understand best ways forward to maintain opportunities for live music performance. In Brisbane a place-based approach designating ‘Entertainment Precincts’ has been used, re-writing separate pieces of legislation (across planning, noise and liquor law). Resulting in monopolies for the few venue operators within the precincts, outside the threats remain and venues continue to be lost. -

MAP LEGEND Gould Rd Mcconnell St 1 Allom St Village Not Far from the City

Bess St Ada St Frederick St Maygar St Jean St Robe St Carberry St Days Rd Gilbert Rd Crombie St Bridge St Riverton St Oriel Rd Daisy St Annie St Grove St Antill St McLennan St Yarradale St Daisy St Camden St Cumberland St Reeve St Oriel Rd Gracemere St Wakefield St Flower St Salt St Sandgate Rd Mina Parade Bale St Primrose St Inglis St Palmer St Barlow St Constitution Rd Drury St Albion Rd Dalrymple St Albion Butler St Ormond St Ascot Ascot St Hudson Rd Upper Lancaster Rd Montpelier St Lovedale St Dibley Ave Mackay St Yabba St Brent St Kate St Blackmore St Alderon St Wilston Rd Angliss St Harris St Towers St ASCOT Farm St Melvin St Main Ave Lapraik St Henry St Lancaster Rd Bonython St Garden Tce Gaunt St Kedron Brook Rd Dover St Lansdowne St Burdett St Watson St Constitution Rd Airport Link Tunnel (Toll road) McDonald Rd Rupert Tce Erneton St Fifth Ave Joseph St Grafton St Pringle St Londsale St Dover St Crosby Rd Barwood St Vine St Newmarket Napier St Crosby Rd Abbott St North St Kichener Rd Duke St Vale St Beatrice Tce Norman St Bowen St Mayfield St Charlston St Fox St Anthony St Lamont Rd Sixth Ave Pine St Precincts Give me Brisbane Any Day Burrows St e c Tenth Ave T Brown St Silvester St l a Ascot & Hamilton T1 Somerset St y Dobson St Abuklea St Macgregor St o Willmingston St R Greene St Hewitt St Joynt St From colourful bohemian markets, fabulous boutique-lined streets, beautiful Sparkes Ave Windermere Rd Windsor Le Geyt St Hugging the banks of the Brisbane River Hipwood Rd Stevenson St parks and fascinating galleries to quirky cafes, eclectic barsClowes andLn award-winning and replete with stately architecture, the Queens Rd restaurants, Brisbane is criss-crossed by distinctive precincts that radiate an Grantson St Ascot and Hamilton precinct is Kenta safe St Quandong St Wilston d R harbour for seekers of refined leisure.