Abschlussbericht Games Studie

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Embracer Group Förvärvar Flying Wild Hog

EJ FÖR OFFENTLIGGÖRANDE, PUBLICERING ELLER DISTRIBUTION, HELT ELLER DELVIS, DIREKT ELLER INDIREKT, INOM ELLER TILL USA, AUSTRALIEN, KANADA, NYA ZEELAND, HONGKONG, JAPAN, SYDAFRIKA ELLER I NÅGON ANNAN JURISDIKTION DÄR SÅDANT OFFENTLIGGÖRANDE, PUBLICERING ELLER DISTRIBUTION SKULLE VARA I STRID MED GÄLLANDE REGLER ELLER KRÄVA YTTERLIGARE REGISTRERING ELLER ANDRA ÅTGÄRDER. Pressmeddelande Karlstad, 18 november 2020 Embracer Group förvärvar Flying Wild Hog Embracer Group AB ("Embracer"), genom sitt helägda dotterbolag Koch Media GmbH, har idag ingått avtal om förvärv av 100 procent av aktierna i det Polen- baserade Flying Wild Hog ("FWH") från Supernova Capital LLP. Flying Wild Hog är en välrenommerad och växande oberoende polsk utvecklare av AA+ spel för PC och konsol, såsom den kritikerrosade Shadow Warrior-serien. FWH arbetar för närvarande på fyra projekt tillsammans med andra välrenommerade externa förläggare. Genom förvärvet välkomnar Embracer ett ansett team om över 260 anställda i tre studios i Polen som bidrar med en solid plattform i en viktig och växande hubb för spelutveckling i Europa. Den initiala köpeskillingen uppgår till 135,2 och motsvarar 137,2 MUSD på en kassa och skuldfri basis och betalas kontant till Supernova Capital, som är en välkänd private equity-firma i spelbranschen. Därutöver har ett incitamentsprogram för ledningspersoner etablerats för att förena intressena framgent. Incitamentsprogrammet uppgår till totalt 7,1 MUSD i B-aktier i Embracer och är föremål för uppfyllande av överenskomna milstolpar och åtaganden att kvarstå i FWH under de kommande fem åren. “Flying Wild Hog har varit på vår radar under många år på grund av deras talang men också på grund av deras förmåga att skala upp med fortsatt hög kvalitet. -

Weekly News Digest #47

INVESTGAME Nov 16 — Nov 22, 2020 Weekly News Digest #47 Hi everyone, Last week we decided to create the archive of the weekly newsletter for your convenience — click here to access it. Roblox to go public on the New York Stock Exchange CAbased video game platform Roblox has filed its S1 registration documents targeting an IPO on NYSE before the end of this year. Roblox has neither disclosed the sum it’s planning to raise, nor the valuation of the company. Founded in 2004, Roblox Corporation has raised $335.9m investments over the course of 8 rounds with the most recent Series G round closed in Feb 2020 — raising $150m at a $4B postmoney valuation. Just eight months later in Oct 2020, Roblox’s rumored potential IPO valuation was said to be $8B. Such an impressive valuation enhancement could be explained by the strong demand for entertainment content due to COVID19 and shelterinplace orders (Roblox’s DAUs increased by 90% from 19.1m in Q4’19 to 36.2m DAU in Q3’20). The company’s financial results over the last twelve months ending 30 Sep 2020 are: > $1,477m Bookings vs. $727m Revenue — Roblox gradually recognizes revenue over the average lifetime of a paying user; > ($245m) Loss from operations vs. +$301m Free cash flow. Roblox is an operationally profitable business (taking into account bookings numbers), and we consider the rumored $8B as a probable valuation at IPO. The valuation multiples in such case would be 5.4x Bookings, 11.0x Revenue, and 27x Free cash flow. -

006NAG June 2013

SOUTH AFRICA’S LEADING GAMING, COMPUTER & TECHNOLOGY MAGAZINE Vol. 16 Issue THREE CALL OF DUTY: GHOSTS PC / PLAYSTATION / XBOX / NINTENDO We go to Los Angeles to stroke some beards and fi ddle PLEASE TRY TO with man stuff UNDERSTAND Intel IDF 2013 Beijing: 4th generation core technology We insert our probes deep into the soft meaty insides of 2K’s latest alien mystery Editor Michael “RedTide“ James [email protected] Contents Assistant editor Geoff “GeometriX“ Burrows Staff writer Dane “Barkskin “ Remendes Features Contributing editor Lauren “Guardi3n “ Das Neves 30 CALL OF DUTY:DU GHOSTS ComeCome on, you had to knowkno this was bound to happen. Technical writer 2013’s2013’s Call of Dutyy wantswant you to pay close attention Neo “ShockG“ Sibeko RegularsRegulars to its new enengine,gine, new sstoryline,t new player-triggered events andand new dogdog companion,com all so that when the International correspondent 1010 Ed’sEd’s NoteNote gamegame releases you’reyou’re readyrea for a bit of expectedly Miktar “Miktar” Dracon 12 InboxInbox familiar,familiar, ggoodood ol’ COD. 16 BytesBytes Contributors 53 home_codedhome_coded Rodain “Nandrew” Joubert Walt “Shryke” Pretorius 62 EverythingEverything elseelse 44 THE BUREAU:BUREA Miklós “Mikit0707 “ Szecsei XCOMXCOM DECLASSIFIEDDECLASS Pippa “UnexpectedGirl” Tshabalala It’sIt’s baaaaack! 2K2K Marin’sMarin’s XCOM has fl ipped itself on its Tarryn “Azimuth “ Van Der Byl head, adopting a diff erenteren approach in turning XCOM Adam “Madman” Liebman OpinionOpinion intointo a more hands-on, acaction-oriented alien-bashing Wesley “Cataclysm” Fick 16 I, GamGamerer experience with enoughenough tactical depth to satisfy anyoneanyone lookinlookingg for a bit more intelligence in their 1188 ThThee GaGameme SStalkertalker Art director shooters. -

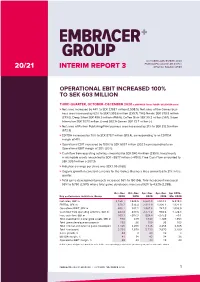

20/21 Interim Report 3 Reg No

OCTOBER–DECEMBER 2020 EMBRACER GROUP AB (PUBL) 20/21 INTERIM REPORT 3 REG NO. 556582-6558 OPERATIONAL EBIT INCREASED 100% TO SEK 603 MILLION THIRD QUARTER, OCTOBER–DECEMBER 2020 (COMPARED TO OCTOBER–DECEMBER 2019) > Net sales increased by 44% to SEK 2,168.1 million (1,508.5). Net sales of the Games busi- ness area increased by 62% to SEK 1,355.6 million (835.7). THQ Nordic SEK 379.8 million (333.0), Deep Silver SEK 496.9 million (466.6), Coffee Stain SEK 99.2 million (36.1), Saber Interactive SEK 307.0 million (-) and DECA Games SEK 72.7 million (-). > Net sales of Partner Publishing/Film business area increased by 21% to SEK 812.5 million (672.9). > EBITDA increased by 70% to SEK 878.7 million (518.4), corresponding to an EBITDA margin of 41%. > Operational EBIT increased by 100% to SEK 603.1 million (302.1) corresponding to an Operational EBIT margin of 28% (20%). > Cash flow from operating activities amounted to SEK 840.4 million (239.5). Investments in intangible assets amounted to SEK –557.7 million (–419.0). Free Cash Flow amounted to SEK 309.1 million (–207.3). > Adjusted earnings per share was SEK 1.06 (0.68). > Organic growth in constant currency for the Games Business Area amounted to 21% in the quarter. > Total game development projects increased 56% to 150 (96). Total headcount increased 93% to 5,730 (2,970) where total game developers increased 92% to 4,325 (2,258). Oct–Dec Oct–Dec Apr–Dec Apr–Dec Apr 2019– Key performance indicators, Group 2020 2019 2020 2019 Mar 2020 Net sales, SEK m 2,168.1 1,508.5 6,620.0 3,910.3 5,249.4 -

Die Computer- Und Videospielindustrie in Deutschland

Abschlussbericht zur Studie Die Computer- und Videospielindustrie in Deutschland Daten – Fakten – Analysen Oliver Castendyk & Jörg Müller-Lietzkow Die Studie Die Computer- und Videospielindustrie in Deutschland wurde durchgeführt vom Forschungs- und Kompetenzzentrum Audiovisuelle Produktion der Hamburg Media School unter der Leitung von Oliver Castendyk, in Kooperation mit Jörg Müller-Lietzkow von der Universität Paderborn, im Auftrag der beiden nationalen Branchenverbände der deutschen Games-Industrie, BIU – Bundesverband Interaktive Unterhaltungssoftware e.V. und GAME – Bundesverband der deutschen Games-Branche e.V. sowie mit Förderung der Beauftragten der Bundesregierung für Kultur und Medien (BKM) im Rahmen der Initiative Kultur- und Kreativwirtschaft des Bundes, der Senatskanzlei Berlin und dem Hessischen Ministerium für Wirtschaft, Energie, Verkehr und Landesentwicklung. © 2017 Forschungs- und Kompetenzzentrum Audiovisuelle Produktion der Hamburg Media School Autoren & Mitarbeiter Hamburg Media School: Prof. Dr. Oliver Castendyk, Juliane Müller, Clemens Poser, Christoph Witte Universität Paderborn: Prof. Dr. Jörg Müller-Lietzkow Infografiken Natalja Knauer www.nakn.de Inhalt A. Einleitung: Von Kennzahlen und Erkenntnissen ....................................................... 1 B. Geschichte der deutschen Games-Industrie ............................................................ 3 B.I. Internationale Entwicklungslinien .................................................................... 3 B.I.1. Vor 1972 ............................................................................................... -

Polish Game Industry

THE GAME INDUSTRY REPORT 2020 OF POLAND W ASD Enter Shift Alt Ctrl W A S D The game industry of Poland — Report 2020 Authors: Eryk Rutkowski Polish Agency for Enterprise Development Jakub Marszałkowski Indie Games Poland, Poznan University of Technology Sławomir Biedermann Polish Agency for Enterprise Development Edited by Sławomir Biedermann, Jakub Marszałkowski Cooperation: Ministry of Development Ministry of Culture and National Heritage Expert support: Game Industry Conference Published by the Polish Agency for Enterprise Development Pańska 81/83, 00-834 Warsaw, Poland www.parp.gov.pl © Polish Agency for Enterprise Development 2020 ISBN 978-83-7633-434-9 The views expressed in this publication are those of the authors and do not necessarily coincide with activities of the Polish Agency for Enterprise Development. All product names, logos and brands mentioned in this publication are the property of their respective owners. Printing of this publication has been co-financed from the European Regional Development Fund in the framework of the Smart Growth Operational Programme. 4 Table of contents Overview of the gaming sector .............................................................................................................. 7 A game has to stir up emotions Success story of 11 bit studios ............................................................................................................... 11 Global game market growth estimates and drivers ................................................................... 13 To diversify -

Koch Media Group

KOCH MEDIA GROUP THREE YEARS WITHIN EMBRACER GROUP WE ARE THE KOCH MEDIA GROUP Our motivation to join the Embracer Group WHY WE JOINED BUILDING PRINCIPLES PROMISE COMMITMENT Entrepreneurship Trust Unlock Potential Leadership Global Vision Empowerment Grow Faster Right Time & Right Place Corp Architecture Corp Family Seize Opportunities Go Beyond Our M&A process and subsequent onboarding M&A PHASE BUILDING PRINCIPLES PROMISE COMMITMENT Due Diligence Personal ..was kept Long-term Key Areas Parent Company .. continued as before Respect Professional Sister Companies Ambitious Swift What happened since we joined the Embracer Group STUDIOS PUBLISHING OUR FIRST 3 YEARS FILM / MERCH Founded Koch Media Acquired Warhorse Acquired Voxler Studio Acquired Vertigo Joined Embracer Poland Studios Games Group (THQ Nordic) Acquired KSM Films Acquired GAYA Acquired Sola Media Founded Koch Media Entertainment Japan Feb 2018 Feb 2019 Jun 2019 Jul 2019 Aug 2019 Oct 2019 Feb 2020 Jul 2020 Aug 2020 Sep 2020 Oct 2020 Nov 2020 Acquired 18Point2 Converted Deep Silver, (Koch Media Founded Koch Media Acquired Flying Wild Acquired Milestone Inc. to Koch Media Australia) Czech QA Studio America Hog (3 Studios) Launched Metro Founded Koch Media Launched Exodus Launched Oscar- Hong Kong Kingdom Come: Winner PARASITE Deliverance What happened since we joined the Embracer Group OUR TALENTS FEB 2021 incl. organic growth FEB 2021 plus M&A incl. organic 1250 FEB 2018 growth 500 1900 328 80 +147% 60 1070 38 770 +39% 570 404 510 STUDIOS 3 4 10 PUBLISHING 10 13 14 FILM / MERCH -

|||GRATIS||| Het Moederbedrijf Ebook

HET MOEDERBEDRIJF GRATIS EBOOK Auteur: W. Van Hoeflaken Aantal pagina's: 142 pagina's Verschijningsdatum: 2002-04-13 Uitgever: Uitgeverij Nieuwezijds EAN: 9789057120893 Taal: nl Link: Download hier Microsoft koopt Zenimax het moederbedrijf van Bethesda – That's Gaming Het is belangrijk dat u goed begrijpt hoe CFD's werken en dat u nagaat of u zich het hoge risico op verlies kunt permitteren. Opties en turbocertificaten zijn complexe financiële instrumenten. Uw vermogen loopt risico. Wij gebruiken een aantal cookies om u de best mogelijke browserervaring te bieden. Door deze website te blijven gebruiken, gaat u akkoord met ons gebruik van cookies. U kunt hier meer lezen over ons cookiebeleid of op de link klikken onderaan iedere pagina van onze website. Ik ga akkoord. Meer zoekresultaten bekijken. Het Moederbedrijf moederbedrijf heeft een controlerend belang meerderheidsbelang in een ander bedrijf, waarmee het Het Moederbedrijf recht heeft om controle te houden over de bedrijfsactiviteiten van de dochtermaatschappij. Het wordt ook wel een moedermaatschappij of moederonderneming genoemd. Sommige moederbedrijven zijn rechtstreeks betrokken bij het bestuur van hun dochterondernemingen, terwijl andere zich er wat minder mee bemoeien. Hier komt Het Moederbedrijf meer te weten over aandelenhandel, zoals het opstellen van een handelsplan en het openen van een positie. Meer weten. Een moederbedrijf heeft vaak directe zeggenschap over Het Moederbedrijf verrichtingen van zijn dochtermaatschappij. Dit geldt Het Moederbedrijf voor holdings. Een holding wordt gewoonlijk opgezet om meerdere maatschappijen in één groep onder te brengen, meestal voor belastingdoeleinden. Een moedermaatschappij daarentegen kan een conglomeraat zijn: een bedrijf dat eigenaar is van een aantal bedrijven in verschillende sectoren en hier controle op uitoefent. -

Focus Home Interactive and Flying Wild Hog Announce New Partnership for Upcoming Title

PRESS RELEASE 29.09.2020 Focus Home Interactive and Flying Wild Hog announce new partnership for upcoming title PARIS, FRANCE – 29th September 2020 – FOCUS HOME INTERACTIVE (FR0012419307 ALFOC), a leading French video game publisher, is pleased to welcome Flying Wild Hog among its partner studios. Based across three studios in Poland, the studio is best known for their smash hit Shadow Warrior series. Bringing over ten years of expertise in creating some of the most high-octane titles on the market, this collaboration sees the studio developing their most ambitious game to date. “Focus Home Interactive is the perfect partner for Flying Wild Hog,” declared Michal Szustak, CEO at Flying Wild Hog. “We both share a love for creating unique, exciting worlds filled with crazy gameplay. We also deeply care for quality and creativity. FHI’s teams support us not only with great trust for our vision, but also help us to forge that vision into an outstanding game. We are sure that our partnership will bloom into an amazing experience for players around the world. Fans of original action games can expect quite a surprise!” “At Focus Home Interactive, we have a directive to bring exciting and innovative games to the market, and with their upcoming title we know that Flying Wild Hog will reach the objectives we have on all of our projects, in terms of both quality and originality,” announced John Bert, COO at Focus Home Interactive. “We are enthusiastic to be working with this professional team, who are masters in the art of creating spectacular, action-packed games.” 1 PRESS RELEASE About Flying Wild Hog Founded in 2009 in Warsaw, Poland, independent game studio Flying Wild Hog’s name evokes the same core feeling as its acclaimed catalog of titles — action-packed, fast-paced, and wholeheartedly unique. -

20/21 Bokslutskommuniké Org Nr

APRIL 2020 – MARS 2021 EMBRACER GROUP AB (PUBL) 20/21 BOKSLUTSKOMMUNIKÉ ORG NR. 556582-6558 OPERATIVT EBIT ÖKADE MED 216% TILL 903 MSEK FJÄRDE KVARTALET, JANUARI–MARS 2021 (JÄMFÖRT MED OKTOBER–DECEMBER 2020) > Nettoomsättningen ökade med 80% till 2 404,2 MSEK (1 339,1). > Nettoomsättningen för affärsområdet Games ökade med 119% till 1 975,2 MSEK (903,5). THQ Nordic 354,6 MSEK (306,7), Deep Silver 464,9 MSEK (514,7), Coffee Stain 780,9 MSEK (82,1), Saber Interactive 270,7 MSEK (-) och DECA Games 104,2 MSEK (-). > Nettoomsättningen för affärsområdet Partner Publishing/Film uppgick till 429,0 MSEK (435,6). > EBITDA ökade med 137% till 1 172,5 MSEK (495,2), vilket motsvarar en EBITDA-marginal på 49% (37%). > Operativt EBIT ökade med 216% till 903,2 MSEK (286,0) motsvarande en operativ EBIT-marginal på 38% (21%). > Kassaflödet från den löpande verksamheten uppgick till 1 521,8 MSEK (765,7). Investeringar i immateriella tillgångar uppgick till 598,9 MSEK (464,4). Fritt kassaflöde uppgick till 860,5 MSEK (275,7). > Justerat resultat per aktie uppgick till 2,07 SEK (0,97). > Organisk tillväxt i konstant valuta för affärsområdet Games uppgick till 85% under kvartalet. > Totalt antal pågående spelutvecklingsprojekt ökade 55% till 160 (103). Totalt antal sysselsatta ökade 103% till 6 325 (3 109) och antalet spelutvecklare ökade 116% till 5 115 (2 365). HELÅRET, APRIL 2020–MARS 2021 (JÄMFÖRT MED APRIL 2019–MARS 2020) > Nettoomsättningen ökade med 72% till 9 024,2 MSEK (5 249,4). > Nettoomsättningen för affärsområdet Games ökade med 102% till 6 448,3 MSEK (3 196,5). -

Game Developer Index 2020

Game Developer Index 2020 Second edition December 2020 Published by the Swedish Games Industry Research: Nayomi Arvell, Alexander Milton, Christian Kähkönen Layout: Kim Persson Illustration, cover: Louise Meijer Text & analys: Kajsa Grafström The Swedish Games Industry is a collaboration between trade organizations ANGI and Spelplan-ASGD. ANGI represents publishers and distributors and Spelplan- ASGD represents developers and producers. Dataspelsbranschen | Swedish Games Industry Magnus Ladulåsgatan 3, SE-116 35 Stockholm www.dataspelsbranschen.se Contact: [email protected] Key figures Key Figures 2019 2018 2017 2016 2015 2014 Number of companies 435 (13%) 382 (+11%) 343 (+22%) 282 (+19%) 236 (+11%) 213 (+25%) Revenue MEUR 2 318 (+24%) 1 872 (+33%) 1 403 (+6%) 1 325 (+6%) 1 248 (+21%) 1 028 (+36%) Income in addition to net 1 592 - - - - - revenue MEUR Revenue per employee 261 (+10%) 236 (-10%) 263 (-15%) 309 (-8%) 337 (+8%) 312 (+4%) Result, MEUR 493 (+47%) 335 (-25%) 446 (-49%) 872 (+65%) 527 (+43%) 369 (+29%) Result including income in 2 149 - - - - - addition to net revenue MEUR Number of employees 9178 ( +16%) 7921 (+48%) 5338 (+24%) 4291 (+16%) 3709 (+19%) 3117 (+23%) Number of employees 5925 ( +11%) 5317 (+14%) 4670 (+25%) 3750 - - (Sweden) Men 7099 (77%) 6221 (79%) 4297 (80%) 3491 (81%) 3060 (82%) 2601 (83%) Women 2079 (23%) 1699 (21%) 1041 (20%) 800 (19%) 651 (18%) 516 (17%) Index Preface Can games save the Earth? 1 Preface Game Development Index 2020 presents new record numbers, with revenue increasing for the eleventh 3 Summary consecutive year. Back in 2009, the sum total of 5 Revenues company revenue was 91 million EUR. -

Read Full Report (PDF)

Equity Research - 23 November 2020 20:46 CET Embracer Group Reason: Post-results comment Long-term strengthened, Q3 downside risk Company sponsored research Q2 adj. EBIT SEK 653m, +18% vs. ABG, +21% vs. cons Not rated Long-term outlook enhanced, downside risk in Q3 SOTP fair value SEK 157-228 (156-212) per share Estimate changes (%) 2020e 2021e 2022e Estimate beat and 13 acquisitions in Q2’20/21 Sales 1.4% 9.2% 11.8% Embracer delivered a very strong Q2 report, with adj. EBIT of SEK EBIT (rep) -25.7% 24.8% 25.5% 653m, +18.1% vs. ABGSCe and +20.9% vs. consensus. Revenues were EPS (rep) -2.6% 24.7% 25.1% SEK 2,383m +11.1% vs. ABGSCe and +15.5% vs. consensus. The Source: ABG Sundal Collier Games segment comprised 62.7% of revenues, driven by both strong 23/11/2020 new releases like Destroy All Humans and strong back-catalogue sales Share price (SEK) 164.0 from, for instance, SpongeBob remastered and Metro Exodus. As such, Fair value range (per share) 157-228 the Games segment grew organically by 61% y-o-y according to management. In total, 13 acquisitions were announced (see page 6). IT, Sweden EMBRACB.ST /EMBRACB ST ABGSC Q3e adj. EBIT SEK 455m, -17% vs. cons Looking at Q3’20/21e, we think that the market should be prepared for a MCap (SEKm) 69,586 slightly slower quarter for the Games segments. The new game pipeline MCap (EURm) 6,817 in Q3 is thinner than the last two quarters, with a game development cost Net debt (EURm) -580 of SEK 150-175m (see page 5).