20/21 Interim Report 3 Reg No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Redeye-Gaming-Guide-2020.Pdf

REDEYE GAMING GUIDE 2020 GAMING GUIDE 2020 Senior REDEYE Redeye is the next generation equity research and investment banking company, specialized in life science and technology. We are the leading providers of corporate broking and corporate finance in these sectors. Our clients are innovative growth companies in the nordics and we use a unique rating model built on a value based investment philosophy. Redeye was founded 1999 in Stockholm and is regulated by the swedish financial authority (finansinspektionen). THE GAMING TEAM Johan Ekström Tomas Otterbeck Kristoffer Lindström Jonas Amnesten Head of Digital Senior Analyst Senior Analyst Analyst Entertainment Johan has a MSc in finance Tomas Otterbeck gained a Kristoffer Lindström has both Jonas Amnesten is an equity from Stockholm School of Master’s degree in Business a BSc and an MSc in Finance. analyst within Redeye’s tech- Economic and has studied and Economics at Stockholm He has previously worked as a nology team, with focus on e-commerce and marketing University. He also studied financial advisor, stockbroker the online gambling industry. at MBA Haas School of Busi- Computing and Systems and equity analyst at Swed- He holds a Master’s degree ness, University of California, Science at the KTH Royal bank. Kristoffer started to in Finance from Stockholm Berkeley. Johan has worked Institute of Technology. work for Redeye in early 2014, University, School of Business. as analyst and portfolio Tomas was previously respon- and today works as an equity He has more than 6 years’ manager at Swedbank Robur, sible for Redeye’s website for analyst covering companies experience from the online equity PM at Alfa Bank and six years, during which time in the tech sector with a focus gambling industry, working Gazprombank in Moscow he developed its blog and on the Gaming and Gambling in both Sweden and Malta as and as hedge fund PM at community and was editor industry. -

Cheers to Oktoberfest Ames Celebrates with Drinks, Fun

Iowa State Daily, October 2019 Iowa State Daily, 2019 10-14-2019 Iowa State Daily (October 14, 2019) Iowa State Daily Follow this and additional works at: https://lib.dr.iastate.edu/iowastatedaily_2019-10 Recommended Citation Iowa State Daily, "Iowa State Daily (October 14, 2019)" (2019). Iowa State Daily, October 2019. 16. https://lib.dr.iastate.edu/iowastatedaily_2019-10/16 This Book is brought to you for free and open access by the Iowa State Daily, 2019 at Iowa State University Digital Repository. It has been accepted for inclusion in Iowa State Daily, October 2019 by an authorized administrator of Iowa State University Digital Repository. For more information, please contact [email protected]. An independent student newspaper serving Iowa State since 1890 59 45 10.14.2019 Vol. 220 No. 035 MONDAY Cheers to Oktoberfest Ames celebrates with drinks, fun BY JAKE.WEBSTER @iowastatedaily.com The 2019 Ames Oktoberfest featured music, a variety of beers and wines, the Iowa State vs. West Virginia football game and SYDNEY NOVAK/ IOWA STATE DAILY several yard games for entertainment. Nicholas Ryan, freshman in open option, went to various activities with Oktoberfests are held across the world to his family during Family Weekend. Ryan’s parents said they were most celebrate German culture — including its excited to learn more about a typical day for him at Iowa State. music, food and beverages. The first 1,000 people who entered the venue for the eighth annual Ames Family Weekend Oktoberfest, held in the parking lot of Main Street Station, received a free beer mug. offers new activities as Iowa Brewing Company’s “Bohemian Rapids” beer was skillfully poured by one of the individuals running the taps at attendance increases Oktoberfest. -

25 Jahre Koch Media – Ein Jubiläum (PDF Download)

25 JAHRE KOCH MEDIA - EIN JUBILÄUM Während Unternehmen in manch anderen Branchen mit 25 Und so ist die Entwicklung von Koch Media in den vergange- Jahren noch zu den Newcomern zählen würden, ist diese nen 25 Jahren auch ein Mutmacher: Sie zeigt, dass man mit Zeitspanne in der Entertainment-Branche kaum zu überbli- der Entwicklung und dem Vertrieb von Games auch in und cken. Zu schnell kommen und gehen Trends und mit ihnen aus Deutschland heraus enorm erfolgreich sein kann. häufig auch ganze Unternehmen. Das gilt ganz besonders für die Games-Branche, die zwar seit vielen Jahren stark Koch Media hat sich in den vergangenen 25 Jahren zu einem wächst, deren dynamische Entwicklung aber selbst Bran- integralen Bestandteil der deutschen Games-Branche ent- chen-Urgesteine von Zeit zu Zeit überfordert. Das 25-jähri- wickelt. Als Gründungsmitglied des BIU – Bundesverband ge Jubiläum von Koch Media ist daher ein Meilenstein, der Interaktive Unterhaltungssoftware und mit Dr. Klemens Kun- gar nicht hoch genug geschätzt werden kann. dratitz als aktivem Vorstand des Verbandes hat sich Koch Media immer für die Themen der Branche und die Weiter- Die Erfolgsgeschichte von Koch Media ist auch mit dem entwicklung der gamescom engagiert. Seit vielen Jahren ist Blick auf ihren Entstehungsort einmalig. Die Geschichte der Koch Media Partner von Spiele-Entwicklern in Deutschland deutschen Games-Branche ist sehr wechselhaft, nur wenige wie aktuell von King Art oder hat eigene Studios wie Deep Unternehmen schaffen es über viele Jahre, hier Games zu Silver Fishlabs. Doch darf man das Unternehmen nicht nur entwickeln und zu verlegen. Das Image von Games hat sich auf seine Rolle in Deutschland beschränken: Mit Niederlas- erst in den vergangenen Jahren verbessert und war zuvor sungen in allen europäischen Kernmärkten, in Nordamerika allzu lange von Klischees bestimmt. -

Embracer Group Acquires Easy Trigger

Press release Karlstad, Sweden, 5 August 2021 Embracer Group acquires Easy Trigger Embracer Group AB (“Embracer”) through its wholly owned subsidiary Coffee Stain Studios AB ("Coffee Stain"), have entered into an agreement to acquire 100 percent of the shares in Easy Trigger AB ("Easy Trigger"), the studio behind the critically acclaimed title Huntdown. “We have worked with Easy Trigger for a couple of years already on the Huntdown game and are impressed with talent within the studio. We will continue to work closely with the team and are excited welcome them into the Embracer family”, says Anton Westbergh, Co-founder and CEO Coffee Stain. Background and rationale Easy Trigger is a development studio founded in 2016, with headquarters located in Trollhättan, Sweden. The studio consists of 5 employees that have collaborated with Coffee Stain on the development and release of the critically acclaimed indie title Huntdown. Easy Trigger is led by co-founder and CEO Tommy Gustafsson, and co- founder and lead programmer Andreas Renberg. The company was wholly owned by the two co-founders who will remain in their current roles post-transaction. Through the acquisition, Coffee Stain onboards a talented team that will boost the development of 1st party IP within the group. Going forward, Easy Trigger will collaborate with Coffee Stain to continue working on the Huntdown IP as well as creating new original indie titles. “We look forward to continuing our partnership with Coffee Stain and further leverage the knowledge and experience within the entire Embracer Group, to accelerate growth within Easy Trigger and continue to make great games” says Tommy Gustafsson, Co-founder and CEO Easy Trigger. -

OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION

THQ NORDIC AB (PUBL) REG NO.: 556582-6558 EXTENDED FINANCIAL YEAR REPORT • 1 JAN 2018 – 31 MAR 2019 OPERATIONAL EBIT INCREASED 217% to SEK 396 MILLION JANUARY–MARCH 2019 JANUARY 2018–MARCH 2019, 15 MONTHS (Compared to January–March 2018) (Compared to full year 2017) > Net sales increased 158% to SEK 1,630.5 m > Net sales increased to SEK 5,754.1 m (507.5). (632.9). > EBITDA increased to SEK 1,592.6 m (272.6), > EBITDA increased 174% to SEK 618.6 m (225.9), corresponding to an EBITDA margin of 28%. corresponding to an EBITDA margin of 38%. > Operational EBIT increased to SEK 897.1 m > Operational EBIT increased 217% to SEK 395.9 m (202.3) corresponding to an Operational EBIT (124.9) corresponding to an Operational EBIT margin of 16%. margin of 24%. > Cash flow from operating activities amounted > Cash flow from operating activities amounted to SEK 1,356.4 m (179.1). to SEK 777.2 m (699.8). > Earnings per share was SEK 4.68 (1.88). > Earnings per share was SEK 1.10 (1.02). > As of 31 March 2019, cash and cash equivalents were SEK 2,929.1 m. Available cash including credit facilities was SEK 4,521.1 m. KEY PERFORMANCE INDICATORS, Jan-Mar Jan-Mar Jan 2018- Jan-Dec GROUP 2019 2018 Mar 2019 2017 Net sales, SEK m 1,630.5 632.9 5,754.1 507.5 EBITDA, SEK m 618.6 225.9 1,592.6 272.6 Operational EBIT, SEK m 395.9 124.9 897.1 202.3 EBIT, SEK m 172.0 107.3 574.6 188.2 Profit after tax , SEK m 103.0 81.1 396.8 139.2 Cash flow from operating activities, SEK m 777.2 699.8 1,356.4 179.1 Sales growth, % 158 673 1,034 68 EBITDA margin, % 38 36 28 54 Operational EBIT margin, % 24 20 16 40 Throughout this report, the extended financial year 1 January 2018 – 31 March 2019 is compared with the financial year 1 January – 31 December 2017. -

Links to the Past User Research Rage 2

ALL FORMATS LIFTING THE LID ON VIDEO GAMES User Research Links to Game design’s the past best-kept secret? The art of making great Zelda-likes Issue 9 £3 wfmag.cc 09 Rage 2 72000 Playtesting the 16 neon apocalypse 7263 97 Sea Change Rhianna Pratchett rewrites the adventure game in Lost Words Subscribe today 12 weeks for £12* Visit: wfmag.cc/12weeks to order UK Price. 6 issue introductory offer The future of games: subscription-based? ow many subscription services are you upfront, would be devastating for video games. Triple-A shelling out for each month? Spotify and titles still dominate the market in terms of raw sales and Apple Music provide the tunes while we player numbers, so while the largest publishers may H work; perhaps a bit of TV drama on the prosper in a Spotify world, all your favourite indie and lunch break via Now TV or ITV Player; then back home mid-tier developers would no doubt ounder. to watch a movie in the evening, courtesy of etix, MIKE ROSE Put it this way: if Spotify is currently paying artists 1 Amazon Video, Hulu… per 20,000 listens, what sort of terrible deal are game Mike Rose is the The way we consume entertainment has shifted developers working from their bedroom going to get? founder of No More dramatically in the last several years, and it’s becoming Robots, the publishing And before you think to yourself, “This would never increasingly the case that the average person doesn’t label behind titles happen – it already is. -

THQ Nordic AB (Publ) Acquires Koch Media

THQ Nordic AB (publ) acquires Koch Media Investor Presentation February 14, 2018 Acquisition rationale AAA intellectual property rights Saints Row and Dead Island Long-term exclusive licence within Games for “Metro” based on books by Dmitry Glukhovsky 4 AAA titles in production including announced Metro Exodus and Dead Island 2 2 AAA studios Deep Silver Volition (Champaign, IL) and Deep Silver Dambuster Studios (Nottingham, UK) #1 Publishing partner in Europe for 50+ companies Complementary business models and entrepreneurial cultural fit Potential revenue synergy and strong platform for further acquisitions EPS accretive acquisition to THQ Nordic shareholders 2 Creating a European player of great scale Internal development studios1 7 3 10 External development studios1 18 8 26 Number of IPs1 91 15 106 Announced 12 5 17 Development projects1 Unannounced 24 9 33 Headcount (internal and external)1 462 1,181 1,643 Net sales 2017 9m, Apr-Dec SEK 426m SEK 2,548m SEK 2,933m2 Adj. EBIT 2017 9m, Apr-Dec SEK 156m SEK 296m3 SEK 505m2,3 1) December 31, 2017. 2) Pro forma. 3) Adjusted for write-downs of SEK 552m. Source: Koch Media, THQ Nordic 3 High level transaction structure THQ Nordic AB (publ) Koch Media Holding GmbH, seller (Sweden) (Germany) Purchase price EUR 91.5m 100% 100% SALEM einhundertste Koch Media GmbH, Operations Holding GmbH operative company (Austria) 100% (Austria) Pre-transaction Transaction Transaction information . Purchase price of EUR 91.5m – EUR 66m in cash paid at closing – EUR 16m in cash paid no later than August 14, 2018 – EUR 9.5m in shares paid no later than June 15, 2018 . -

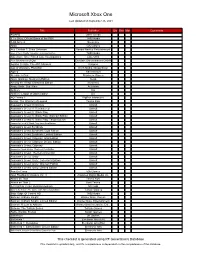

Microsoft Xbox One

Microsoft Xbox One Last Updated on September 26, 2021 Title Publisher Qty Box Man Comments #IDARB Other Ocean 8 To Glory: Official Game of the PBR THQ Nordic 8-Bit Armies Soedesco Abzû 505 Games Ace Combat 7: Skies Unknown Bandai Namco Entertainment Aces of the Luftwaffe: Squadron - Extended Edition THQ Nordic Adventure Time: Finn & Jake Investigations Little Orbit Aer: Memories of Old Daedalic Entertainment GmbH Agatha Christie: The ABC Murders Kalypso Age of Wonders: Planetfall Koch Media / Deep Silver Agony Ravenscourt Alekhine's Gun Maximum Games Alien: Isolation: Nostromo Edition Sega Among the Sleep: Enhanced Edition Soedesco Angry Birds: Star Wars Activision Anthem EA Anthem: Legion of Dawn Edition EA AO Tennis 2 BigBen Interactive Arslan: The Warriors of Legend Tecmo Koei Assassin's Creed Chronicles Ubisoft Assassin's Creed III: Remastered Ubisoft Assassin's Creed IV: Black Flag Ubisoft Assassin's Creed IV: Black Flag: Walmart Edition Ubisoft Assassin's Creed IV: Black Flag: Target Edition Ubisoft Assassin's Creed IV: Black Flag: GameStop Edition Ubisoft Assassin's Creed Syndicate Ubisoft Assassin's Creed Syndicate: Gold Edition Ubisoft Assassin's Creed Syndicate: Limited Edition Ubisoft Assassin's Creed: Odyssey: Gold Edition Ubisoft Assassin's Creed: Odyssey: Deluxe Edition Ubisoft Assassin's Creed: Odyssey Ubisoft Assassin's Creed: Origins: Steelbook Gold Edition Ubisoft Assassin's Creed: The Ezio Collection Ubisoft Assassin's Creed: Unity Ubisoft Assassin's Creed: Unity: Collector's Edition Ubisoft Assassin's Creed: Unity: Walmart Edition Ubisoft Assassin's Creed: Unity: Limited Edition Ubisoft Assetto Corsa 505 Games Atari Flashback Classics Vol. 3 AtGames Digital Media Inc. -

“List of Companies/Llps Registered During the Year 1995”

“List of Companies/LLPs registered during the year 1995” Note: The list include all companies/LLPs registered during this period irrespective of the current status of the company. In case you wish to know the current status of any company please access the master detail of the company at the MCA site http://mca.gov.in Sr. No. CIN/FCRN/LLPIN/FLLPIN Name of the entity Date of Registration 1 U99999MH1995PTC007996 KESAR ENTERPRISES LTD. 1/1/1995 2 U74899DL1995PTC046965 EXPEDIENT INVESTMENTS PRIVATE LIMITED 1/1/1995 3 U55102KL1995PTC008549 RIVERSIDE RETREAT PVT LTD 1/1/1995 4 U99999MH1995PLC007996 KESAR ENTERPRISES LTD. 1/1/1995 5 L32301PN1995PLC015978 TOP TELEMEDIA LIMITED 1/1/1995 6 U29190MH1995PTC084202 AUTONUM CONTROLS PRIVATE LIMITED 1/2/1995 7 U27107MH1995PTC084215 APCON COMMERCIAL PRIVATE LIMITED 1/2/1995 8 U99999MH1995PLC084224 CHAITANYA CAPITAL MANAGEMENT LIMITED 1/2/1995 9 U21093MH1995PTC084227 DARSHAK PAPER TRADING PRIVATE LIMITED 1/2/1995 10 U22120MH1995PLC084231 BRIJBASI PRESS LIMITED 1/2/1995 11 U52334WB1995PTC067038 DIAMOND LAUNDRY PVT. LTD. 1/2/1995 12 U70109WB1995PTC067039 B. D. RESOURCES PVT. LTD. 1/2/1995 13 U45201WB1995PTC067043 CHANDRIKA CONSTRUCTIONS PVT. LTD. 1/2/1995 14 U01222WB1995PTC067044 BOSE AGROTECH PVT. LTD. 1/2/1995 15 U24232WB1995PTC067046 BILBUB PHARMA PVT. LTD. 1/2/1995 16 U51909WB1995PTC067051 DISTANT VINIMAY PVT.LTD. 1/2/1995 17 U17232WB1995PTC067056 ADITYA TRANSLINK PVT LTD 1/2/1995 18 U74899DL1995PLC063976 AVS HOLDINGS LIMITED 1/2/1995 19 U74899DL1995PTC063945 CLOCKNER METALS PRIVATE LIMITED 1/2/1995 20 U74899DL1995PTC063947 CHOICE CLOTHING COMPANY PRIVATE LIMITED 1/2/1995 21 U74899DL1995PTC063950 ALFA DEVELOPERS PRIVATE LIMITED 1/2/1995 22 U74899DL1995PTC063954 BHILWARA TELENET SERVICES PRIVATE LIMITED 1/2/1995 23 U74899DL1995PTC063955 A.R. -

Family Friendly Magazine 129 in PDF Format

Family Friendly Gaming The VOICE of TM the FAMILY in GAMING Kingdom Hearts III, Ooblets, Monster Hunter World and more in this fabu- lous issue!! ISSUE #129 NI NO KUNI II REVENANT KING- DOM wants you to April 2018 role play. CONTENTS ISSUE #129 April 2018 CONTENTS Links: Home Page Section Page(s) Editor’s Desk 4 Female Side 5 Comics 7 Sound Off 8 - 10 Look Back 12 Quiz 13 Devotional 14 Helpful Thoughts 15 In The News 16 - 23 We Would Play That! 24 Reviews 25 - 37 Sports 38 - 41 Developing Games 42 - 67 Now Playing 68 - 83 Last Minute Tidbits 84 - 106 “Family Friendly Gaming” is trademarked. Contents of Family Friendly Gaming is the copyright of Paul Bury, and Yolanda Bury with the exception of trademarks and related indicia (example Digital Praise); which are prop- erty of their individual owners. Use of anything in Family Friendly Gaming that Paul and Yolanda Bury claims copyright to is a violation of federal copyright law. Contact the editor at the business address of: Family Friendly Gaming 7910 Autumn Creek Drive Cordova, TN 38018 [email protected] Trademark Notice Nintendo, Sony, Microsoft all have trademarks on their respective machines, and games. The current seal of approval, and boy/girl pics were drawn by Elijah Hughes thanks to a wonderful donation from Tim Emmerich. Peter and Noah are inspiration to their parents. Family Friendly Gaming Page 2 Page 3 Family Friendly Gaming Editor’s Desk FEMALE SIDE this instance I feel wonderful. God has given God is my prize and my goal. -

Inside the Video Game Industry

Inside the Video Game Industry GameDevelopersTalkAbout theBusinessofPlay Judd Ethan Ruggill, Ken S. McAllister, Randy Nichols, and Ryan Kaufman Downloaded by [Pennsylvania State University] at 11:09 14 September 2017 First published by Routledge Th ird Avenue, New York, NY and by Routledge Park Square, Milton Park, Abingdon, Oxon OX RN Routledge is an imprint of the Taylor & Francis Group, an Informa business © Taylor & Francis Th e right of Judd Ethan Ruggill, Ken S. McAllister, Randy Nichols, and Ryan Kaufman to be identifi ed as authors of this work has been asserted by them in accordance with sections and of the Copyright, Designs and Patents Act . All rights reserved. No part of this book may be reprinted or reproduced or utilised in any form or by any electronic, mechanical, or other means, now known or hereafter invented, including photocopying and recording, or in any information storage or retrieval system, without permission in writing from the publishers. Trademark notice : Product or corporate names may be trademarks or registered trademarks, and are used only for identifi cation and explanation without intent to infringe. Library of Congress Cataloging in Publication Data Names: Ruggill, Judd Ethan, editor. | McAllister, Ken S., – editor. | Nichols, Randall K., editor. | Kaufman, Ryan, editor. Title: Inside the video game industry : game developers talk about the business of play / edited by Judd Ethan Ruggill, Ken S. McAllister, Randy Nichols, and Ryan Kaufman. Description: New York : Routledge is an imprint of the Taylor & Francis Group, an Informa Business, [] | Includes index. Identifi ers: LCCN | ISBN (hardback) | ISBN (pbk.) | ISBN (ebk) Subjects: LCSH: Video games industry. -

THQ Nordic (THQNO.ST)

COMPANY ANALYSIS 1 March 2018 Summary THQ Nordic (THQNO.ST) List: Power-up! Market Cap: 11,190 MSEK The company had an immense release schedule with loads of Industry: Gaming new content during the quarter. The reported numbers beat CEO: Lars Wingefors Chairman: Kicki Wallje-Lund our estimates. Even though that THQ Nordic produced a record quarter, the thing stole the spotlight was the announcement of the acquisition of Koch Media; we get into OMXS 30 THQ Nordic detail about the acquired company in this research update. 160 The acquisition is a prime example of THQ Nordic’s 140 acquisition strategy. We believe that the market is yet to fully 120 100 grasp the underlying value and cash flow generating 80 capabilities of THQ Nordic’s growing IP portfolio, which was 60 enhanced significantly by the acquirement. 40 20 We raised our Base-case valuation to 140 SEK per share 0 28-Feb 29-May 27-Aug 25-Nov 23-Feb based on a Back-Of-The-Envelope assessment on the same day as the acquisition. Following a more in-depth analysis, we increase our fair value estimate further to 168 SEK per share. We argue that the new addition to the Group was acquired at a low price and that the long-term possibilities following the purchase are vast. Redeye Rating (0 – 10 points) Management Ownership Profit outlook Profitability Financial strength 8.0 points 9.0 points 7.0 points 6.0 points 8.0 points Key Financials 2016 2017 2018E 2019E 2020E Share information Revenue, MSEK 302 508 3,666 3,909 4,300 Share price (SEK) 141.0 Growth 42% 68% 622% 7% 10% Number of shares (m) 79.4 EBITDA 132 273 929 1,009 1,212 Market Cap (MSEK) 11,190 EBITDA margin 44% 54% 25% 26% 28% Net cash (MSEK) 255 EBIT 95 188 616 696 849 Free float (%) 50 % EBIT margin 31% 37% 17% 18% 20% Daily turnover (’000) 60 Pre-tax earnings 93 182 616 696 849 Net earnings 72 139 480 543 662 Net margin 24% 27% 13% 14% 15% Analysts: Kristoffer Lindstrom 2016 2017 2018E 2019E 2020E [email protected] Dividend/Share 0.00 0.00 0.00 0.00 2.50 2016 2017 2018E 2019E 2020E EPS adj.