The Market Continued with Its Previous Day's Negative Momentum Across

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Major Projects Completed in the Past Major Projects Completed in 2017

List of Major projects completed in the past Major Projects Completed in 2017 Project Client 1 Western Provincial Council Sanken Constructions 2 Labour Department Thudawe Brothers 3 National Environmental Secretariat Building CECB 4 IOC petrol station lighting IOC 5 Unidil Packaging Factory Fentons 6 Angunukolapalessa Prison Venora 7 Hayleys Fabric new factory Hayleys Fabric 8 Swisstek Aluminium Factory Fentons LED street lighting from Ingurukade Junction 9 CMC to Armour street 10 Galle Face Hotel Richardson Projects 11 HSBC Branches LED lighting HSBC 12 Brandix Batticlioa DIMO PLC 13 Vakkaru Island Resort Development Project Venora 14 John Keels Automation office LED Lighting John Keels Automation LED street Lighting in Bandaranaike 15 AASL International Airport 16 Sirimavo College Indoor Gym Sri Lanka Army 17 Clearpoint Residencies MAGA 18 New Anthonies Farm New Anthonies 19 Hemas Consumer Brands factory lighting Hemas 20 Hayleys Agro Fertilizers Office Hayleys Agro Fertilizers 21 HNB Nugegogda Sripali Construction 22 BOC Nugegoda Sripali Construction 23 Sojitz Powerplant-Area lighting Sojitz (Pvt) Ltd 24 Vidyalankara Buddhist Conference Hall CECB 25 KIA Motors Workshop KIA Motors 26 NAITA Automobile Training Centre Thudawe Brothers 27 NAVESTA Pharmaceuticals Factory Navesta Pharmaceuticals 28 Hayleys Main Board Room Hayleys PLC Major Projects Completed in 2016 Project Client 1 Dialog Old Corporate Building Dialog Axiata- Fentons 2 Greater Colombo Project Pubudu Engineering Colombo Municipal Council - Street Lighting 3 Colombo Municipal -

Expolanka Holdings Plc Integrated Annual Report

EXPOLANKA HOLDINGS PLC INTEGRATED ANNUAL REPORT 2020/21 EXPOLANKA HOLDINGS PLC | INTEGRATED REPORT 2020/21 2 fruitionEXPOLANKA HOLDINGS PLC | INTEGRATED ANNUAL REPORT 2020/21 At Expolanka, we remain fully committed to our promise made several years ago, to drive long term sustainable value, by adapting a focused, constant and consistent strategy. Even though the year under review post several challenges, we were able to pursue our said strategies and bring to fruition our plans for progress which was fueled by our innate resilience and strength. The seeds we planted have taken root and we keep our focus upward, expanding in our focused direction in order to adapt to the current environment. We remain fruitful in our optimism, our can-do attitude and endurance, a recipe for success that will carry us through to more opportunity. Overview EXPOLANKA HOLDINGS PLC | INTEGRATED ANNUAL REPORT 2020/21 2 CONTENTS Chairman’s Overview Compliance Reports 12 About Us 3 Corporate Governance 71 Message About this Report 4 Risk Management Report 93 Group Milestones 5 Related Party Transactions Financial Highlights 6 Review Committee Report 101 15 Group CEO’s Highlights of the Year 7 Remuneration Committee Report 103 Review Chairman’s Message 12 Group CEO’s Review 15 Financial Reports Board of Directors 18 Annual Report of the Board of Directors Group Senior Management Team 20 on the Affairs of the Company 108 23 Financial Indicators 22 The Statement of Directors’ Responsibility 112 Performance Group Performance 23 Audit Committee Report 113 Overcoming -

Annual Report 2012/2013

THE PURSUIT OF EXCELLENCE One hundred years of passion, hard work and perseverance have brought to where we are today: a highly respected, fast growing blue chip conglomerate with interests in several key growth industry sectors: beverages, telecommunications, plantations, hotels, textiles, finance, insurance, power genaration, media and logistics. And yet, we will not rest. Our story is far from over. Indeed, it has only just begun. Look to us for even greater achievements as we step into the next century of our lifetime, to build further upon our current successes. DCSL. 100 years in the passionate pursuit of excellence. Distilleries Company of Sri Lanka PLC | Annual Report 2012/13 1 Financial Highlights 2013 2012 2013 2012 Group Group Company Company Summary of Results Gross Turnover Rs Mn 65,790 63,125 51,549 49,136 Excise Duty Rs Mn 37,024 36,150 34,088 33,860 Net Turnover Rs Mn 28,766 26,975 17,461 15,276 Profit After Tax Rs Mn 5,258 6,052 6,873 4,297 Shareholders Funds Rs Mn 47,978 41,576 39,155 32,597 Working Capital Rs Mn (1,298) (3,234) (6,139) (21,374) Total Assets Rs Mn 78,245 73,355 55,942 62,563 Staff Cost Rs Mn 3,194 3,155 1,039 1,080 No. of Employees 18,674 18,158 1,343 1,389 Per Share Basic Earnings* Rs. 17.13 18.45 10.68 11.85 Net Assets Rs. 159.93 138.59 130.52 108.66 Dividends Rs. 3.00 3.00 3.00 3.00 Market Price - High Rs. -

5G Ecosystem the Digital Haven of Opportunities September 2019 5G Ecosystem | the Digital Haven of Opportunities

5G Ecosystem The digital haven of opportunities September 2019 5G Ecosystem | The digital haven of opportunities ii 5G Ecosystem | The digital haven of opportunities Contents Foreword 03 Message from CII 04 5G commercial launch in India: Are we ready? 05 • National Digital Communications Policy (NDCP) lays the foundation for next generation 05 • Movement/transition of data traffic to 4G 06 • Regulatory endeavour for 5G spectrum allocation 06 • Progress made on policy front to prepare for a 5G future 08 • Efforts to have an indigenous 5G technology 09 • Mega cloud push will accelerate change in India’s infrastructure 09 Encircling the seamless – what is the 5G ecosystem? 10 • Handset manufacturers geared up for 5G 10 • Equipment manufacturers - Key for new business opportunities 12 • Infrastructure providers - Expanding the network footprint 13 • Mobile network operators - Supporting the 5G ecosystem 14 • Rise of application/software providers 22 Digital transformation across industry verticals – no one wants to be left behind 24 • Manufacturing 25 • Media and entertainment 26 • Automotive 27 • Government 28 Current 5G ecosystem in India 29 Conclusion 31 Glossary of terms 32 About Confederation of India Industry 33 Acknowledgements 34 Contacts 34 References 35 01 5G Ecosystem | The digital haven of opportunities 02 5G Ecosystem | The digital haven of opportunities Foreword 5G will be a game changer for India with the potential to create significant social and economic impact. As the 5G ecosystem develops in the country, telcos are expected to focus beyond connectivity towards collaboration across the telecom value chain and cross-sector, leading to the creation of new business models and innovation. -

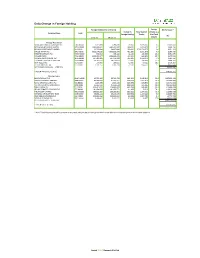

Daily Change in Foreign Holding

Daily Change in Foreign Holding Foreign Holding (No. of Shares) Foreign Net Turnover * Change in Total Volume Volume as a Company Name Code Foreign Holding Traded % of Total Rs. Volume 1-Feb-21 29-Jan-21 Foreign Purchases LANKA ORIX LEASING COMPANY PLC LOLC.N0000 2,313,835 2,286,635 27,200 2,699,110 1.0 13,702,000 EXPOLANKA HOLDINGS LIMITED EXPO.N0000 1,483,800,622 1,483,612,587 188,035 9,893,475 1.9 9,646,196 BROWNS INVESTMENTS LIMITED BIL.N0000 39,790,648 38,857,648 933,000 2,710,774,277 0.0 6,251,100 DIALOG AXIATA PLC DIAL.N0000 7,503,174,020 7,502,692,370 481,650 5,891,576 8.2 6,068,790 SWISSTEK (CEYLON) PLC PARQ.N0000 536,541 495,422 41,119 183,663 22.4 5,951,975 RICHARD PIERIS RICH.N0000 1,535,157,477 1,534,940,476 217,001 643,305 33.7 3,472,016 PIRAMAL GLASS CEYLON PLC GLAS.N0000 567,423,605 567,159,200 264,405 3,624,074 7.3 2,591,169 CHEVRON LUBRICANTS LANKA PLC LLUB.N0000 39,685,643 39,669,043 16,600 108,104 15.4 1,809,400 JOHN KEELLS PLC JKL.N0000 234,960 218,015 16,945 59,322 28.6 1,418,297 CIC HOLDINGS PLC (X) CIC.X0000 3,511,252 3,483,738 27,514 858,562 3.2 1,317,921 NET FOREIGN PURCHASE (TOP TEN) 52,228,863 FOREIGN PURCHASE (TOTAL) 149,626,332 Foreign Sales SAMPATH BANK PLC SAMP.N0000 49,752,499 50,713,780 (961,281) 2,948,613 32.6 (187,690,115) HATTON NATIONAL BANK PLC HNB.N0000 90,479,629 91,019,351 (539,722) 1,012,713 53.3 (81,363,092) ROYAL CERAMICS LANKA PLC RCL.N0000 1,825,896 1,946,188 (120,292) 826,955 14.5 (46,071,836) HATTON NATIONAL BANK PLC (X) HNB.X0000 25,447,044 25,629,644 (182,600) 625,195 29.2 (21,546,800) -

Downloadannual Report

Return to Contents Annual Report 2019 Sri Lanka Telecom PLC 02 Sri Lanka Telecom PLC Annual Report 2019 Every Step of the Way... With every Fibre of our Being. At the end of the day...it’s always the Big Picture that’s important. Yes – Sri Lanka Telecom is Sri Lanka’s premier “legacy” communications provider over decades; yes – we are today Sri Lanka’s leading proponent and provider of cutting-edge technology inspired solutions in the ICT realm that has transformed Sri Lanka. But...what really is the Big Picture? All of this we have accomplished for a single purpose only...to walk in step with every citizen of this country, providing the products and services they need, anticipating what they will need and value adding...at every turn. CONTENTS 03 23-33 107 About the Report Business Model Financial Reporting 23 - Operating Environment 108 - Annual Report of the Board of 26 - Strategy Directors on the Affairs of the 28 - Value Creation Model Company 30 - Stakeholders 113 - Statement of Directors in relation to 04-09 their responsibility for the preparation of Financial Statements 114 - Independent Auditors’ Report About SLT 118 - Statement of Profit or Loss and 34-75 other Comprehensive Income 119 - Statement of Financial Position Management Discussion 120 - Statement of Changes in Equity – Group and Analysis 121 - Statement of Changes 10-11 in Equity – Company 34 - Financial Capital 122 - Cash Flow Statement 40 - Institutional Capital 123 - Notes to the Financial Statements Highlights of the Year 46 - Investor Capital 49 - Customer Capital -

How COVID-19 Will Change Telco Investments and Activities

Webinar Q&A – How COVID-19 will change telco investments and activities The responses below are colour coded: • Dr Rainer Deutschmann (Dialog Axiata PLC) responses in black • Dr Sukant Mohapatra (Verizon Wireless) responses in blue • Dean Bubley (STL Partners, Disruptive Analysis) in red Impact on 5G, fibre and broadband networks • How do you see the impact of traffic change on network aggregation and broadband delivery if working from home is the new normal? − Substantial traffic changes – from commercial to residential geography, from evening peak to more evened out also during daytime, fixed/fixed wireless increase even more than mobile, consumer increase even more than enterprise. Overall network utilisations improved. Capacity is the new currency. Need deeper drive of fibre (vs. MW) – both RAN as well as closer to home/office – capacity and low latency. Last mile (fibre vs fixed wireless) depends on business case and time to market ambition. It is also possible to do both – first fixed- wireless to capture the market, then migrate to fibre. − Working from home (in the new normal) may need additional capacity in the last mile access network. Architecturally, aggregation and core network would be the same with capacity augmentation at specific locations as required. Last mile could leverage fibre (FTTH/FTTB) and/or 5G/FWA (Fixed Wireless Access). Specifically with fibre, where home connecting costs are higher (e.g. due to spread of household as in rural America), FWA could be a more economical option than fibre for last mile. Last mile deployment/augmentation strategy will be driven by economics/RoI on a case by case basis. -

DFCC Bank PLC Annual Report 2016.Pdf

Going beyond conventional reporting, we have implemented a About this Report more current format for reporting and have upgraded our corporate website with a focus on investor relations, supplemented by an investor relations app for smart phones and other devices. This is an integrated annual report and is a compact Reporting Period disclosure on how our strategy, governance, performance and prospects have resulted in the The DFCC Bank Annual Report for 2016 covers the 12 month period from 01 January 2016 to 31 December 2016 and is reflective of the creation of sustainable value within our operating change in the financial year-end implemented in 2015. The previous environment. annual report covered the nine month period from 01 April 2015 to 31 December 2015 and is available on the company website Value Creation and Capital Formation (www.dfcc.lk). Some of the Group entities have a 31 March financial year-end and they are consolidated with DFCC Bank’s reporting The ability of an organisation to create sustainable value for itself period with a three month time lag. A summary of the accounting depends on the value it creates for its stakeholders, making value periods covered by the Statement of Profit and Loss and Other creation essentially a two-way process. In fact, the more value an Comprehensive Income in the Bank and the Group columns is given organisation creates, the more value it is able to create for itself. in the Financial Report (page 136). Therefore firms spend substantial resources on creating and maintaining relationships with their stakeholders. Value creation leads to capital formation. -

Asia Pacific Set for 417 Million SVOD Subs

Asia Pacific set for 417 million SVOD subs Despite the negative impact from the coronavirus and the Chinese economic downturn, Asia Pacific will have 417 million SVOD subscriptions by 2025, up from 269 million in 2019. China will have 269 million SVOD subscriptions in 2025 – or 65% of the region’s total. India will supply a further 45 million – more than double its 2019 total. SVOD subscribers by platform in 2025 (000) Others, 47,340 Other China, 33,916 Disney+, 15,469 Apple TV+, 2,140 Amazon, 23,644 iQiyi, 100,672 Netflix, 34,286 India*, 24,737 Tencent, 99,595 Youku Tudou, 34,993 Source: Digital TV Research. * excluding US-based platforms Three Chinese companies will top the Asia Pacific SVOD subscriber rankings in 2025 – with two recording 100 million subscribers. Never expected to operate as standalone platforms in China, Netflix and Amazon Prime Video will take fourth and fifth places respectively. Simon Murray, Principal Analyst at Digital TV Research, said: “China will also dominate the SVOD revenue rankings. The top five platforms [Tencent Video, Iqiyi, Netflix, Disney+ and Youku Tudou] will account for two-thirds of the region’s SVOD revenues by 2025.” Netflix’s revenues will more than double between 2019 and 2025 to $3.19 billion. Disney+ will generate $1 billion in 2025, despite starting only recently. Murray continued: “Asia Pacific SVOD revenues will reach $18.25 billion in 2025; up by $8 billion on 2019. These forecasts are lower than our previous edition.” Asia Pacific OTT TV & Video Forecasts Table of Contents Published in March 2020, this 212-page PDF, PowerPoint and excel report provides extensive research for 22 territories. -

Annual Report 2014

BLENDING WITH THE NATION'S GROWTH Chevron Lubricants Lanka PLC Annual Report 2014 CONTENTS Chevron Lubricants Lanka PLC Our Vision / 02 Chevron House, 490, Galle Road, Financial Highlights / 03 Colombo, Sri Lanka Status: Listed Chairman’s Review / 06 Legal Form: Public Limited Company Managing Director’s Review of Operations / 08 Financial Auditors: PricewaterhouseCoopers Board of Directors / 12 www.chevron.com Management Team / 14 Management Discussion & Analysis / 18 Chevron Lubricants Lanka PLC engages Financial Review / 24 in blending, manufacturing, importing, Corporate Social Responsibility Report / 26 distributing, and marketing lubricants oils, Corporate Governance / 30 greases, brake fluids, and specialty products Risk Management / 35 in Sri Lanka. The Company offers its products for industrial, commercial, and consumer applications. Chevron Lubricants Lanka Financial Calender / 37 PLC markets its products under Chevron, Annual Report of the Directors / 38 Caltex, and Texaco brands. The Company was Statement of Directors’ Responsibilities / 40 incorporated in 1992 and is based in Colombo, Audit Committee Report / 41 Sri Lanka. Remuneration Committee Report / 42 Independent Auditor’s Report / 43 Income Statement / 44 Statement of Comprehensive Income / 45 Chevron Lubricants Statement of Financial Position / 46 Lanka PLC Statement of Changes in Equity / 47 Annual Report 2014 Cash Flow Statement / 48 Notes to the Financial Statements / 49 Statement of Value Added / 73 Ten Year Summary / 74 Shareholder Information / 75 Notice of Annual General Meeting / 77 Form of Proxy / 79 Scan this QR code with your smart device to view this version of the Annual report online www.chevron.lk/reports GROWTHBLENDING WITH THE NATION'S Chevron Lanka has always been a benchmark of business excellence in Sri Lanka, with a strong focus on value creation at every level of our business and production process. -

John Keells Holdings Plc | Annual Report 2018/19

GOING FORW RD JOHN KEELLS HOLDINGS PLC | ANNUAL REPORT 2018/19 GOING FORW RD For over 149 years, John Keells has built and managed a diverse industry portfolio including several industry sectors strategically selected to represent key growth areas of the economy. We are known as an entrepreneurial company constantly seeking new business opportunities to explore, innovate and make our own. That is how we have maintained an even trajectory of expansion and growth throughout every decade of our long history. Over the past few years, we have been investing in several enterprises that we identified as potentially value enhancing, such as the "Cinnamon Life" project, which will be an iconic landmark transforming the city of Colombo. Today, the Group moves into the next phase as our major investments begin to yield results. Yet the road has not always been an easy one and there were times when we had to dig deep, leveraging on our financial strength, operational expertise, business leadership and corporate resilience to withstand the challenges we have had to face. The Easter Sunday attacks of April 2019 will be long remembered for the tragedy and turmoil we all experienced. Yet, we have every confidence in our nation’s proven resilience and capacity to move ahead and prosper, united as one. Going forward, we will continue to harness the value created by our investment strategies; evolving our standards of governance while ensuring that our digital capabilities and innovative approach will drive your Company’s progress to the next level. JOHN -

Annual Report 2016 Www

Chevron Lubricants Lanka PLC Annual Report 2016 www. chevron.lk Keeping our Chevron Lubricants Lanka PLC Annual Report 2016 1 Chevron Lubricants Lanka PLC Annual Report 2016 www. chevron.lk 2 Annual Report 2016 Keeping our FOCUS Chevron Lanka has delivered yet another year of outstanding results. Your company stood strong, engaging with the issues, working on intelligent solutions and increasing our focus on stakeholder value creation. We have always counted on our strong local and global synergies and the unmatched expertise in technology and industry innovation we own. Over the years we have shared this knowledge, continuing our vision to bring a positive impact to the people and communities we serve, while significantly contributing to the economy of Sri Lanka. Contents 4 Our Vision 5 Financial Highlights 6 Chairman’s Review 8 Managing Director’s Review 12 Board of Directors 16 Management Team 18 Management Discussion & Analysis 27 Financial Review 31 Corporate Social Responsibility 33 Corporate Governance 39 Risk Management 42 Financial Calender 43 Annual Report of the Directors 46 Statement of Directors’ Responsibilities 47 Audit Committee Report 48 Related Party Transactions Review Committee Report 49 Certificate of the Director on Transfer Pricing 50 Remuneration Committee Report 51 Independent Auditor’s Report 52 Income Statement 53 Statement of Comprehensive Income 54 Statement of Financial Position 55 Statement of Changes in Equity 56 Cash Flow Statement 57 Notes to the Financial Statements 84 Ten Year Financial Summary 85 Statement of Value Added 86 Shareholder Information 89 Notice of Annual General Meeting 90 Corporate Information 91 Form of Proxy Annual Report Online www.chevron.lk/reports 2 Our Family of Brands Chevron Lubricants Lanka PLC engages in blending, manufacturing, importing, distributing and marketing lubricants oils, greases, brake fluids and specialty products in Sri Lanka.