Demand and Supply of Power Price of Crude Oil Private Power Projects

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

L-33 NPA Life.Xlsx

FORM - 7A COMPANY NAME: LIFE INSURANCE CORPORATION OF INDIA STATEMENT AS ON : 30.06.2020 (Audited) NAME OF THE FUND : Life Rs. IN CRORES CONFIRMATION OF INVESTMENT PORTFOLIO DETAILS PERIODICITY OF SUBMISSION: QUARTERLY Has there been any Interest Rate Principal waiver? Total O/s (Book Default Principal Default Interest Principal due Interest Due COI Company Name Instrument Type Has there Value) (Book Value) (Book Value) from From been a Board % revision? Deferred Principal Deferred Interest Rolled Over Amount Approval Ref Classification Provision(%) Provision (Rs) ILWC KARIMNAGAR MUNICIPAL COUNCIL SOS Loan- Planned 13.00 0.00 0.08 0.04 0.01 1/1/2020 1/1/2020 0.00 0 0 0 SUBSTANDARD 25 0.02 ILWC NARASARAOPET MUNICIPAL COUNCIL SOS Loan- Planned 13.00 0.00 0.26 0.26 0.09 1/1/2014 7/1/2013 0.00 0 0 0 LOSS 100 0.26 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 8.00 0.00 0.01 0.01 0.00 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.01 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 8.00 0.00 0.10 0.10 0.01 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.10 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 8.50 0.00 0.01 0.01 0.00 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.01 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 10.50 0.00 0.03 0.03 0.01 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.03 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 8.50 0.00 0.02 0.02 0.01 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.02 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 10.50 0.00 0.03 0.03 0.01 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.03 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 10.50 0.00 0.08 0.08 0.04 5/15/2005 5/15/2005 -

Action Plan for Industrial Cluster: Chandrapur

ACTION PLAN FOR INDUSTRIAL CLUSTER: CHANDRAPUR MAHARASHTRA POLLUTION CONTROL BOARD KALPATARU POINT, SION (E),MUMBAI 400 022 www.mpcb.gov.in Maharashtra Pollution Control Board CEPI Report Nov‐2010 ‐ 1 ‐ 1) INTRODUCTION 1.1. Area details including brief history (Background Information) Chandrapur, the easternmost district is located in the eastern edge of Maharashtra in Nagpur division and forms the eastern part of 'Vidharbha' region. It is located between 19.30’ N to 20.45’N Latitude and 78.46’E longitude. The district is bounded by Nagpur, Bhandara and Wardha on the northern side. Yavatmal on the western side. Gadchiroli on the eastern side and Adilibad district of the Andhra Pradesh on the southern side. Physiographically, the district is situated within the Wainganga and Wardha river basins, respectively, on the eastern and western boundaries of the district which are the tributaries of Godavari River. Chandrapur district of Maharashtra is abundantly endowed with rich flora and fauna, water resources and mineral wealth. Chandrapur has been famous from ancient times as the capital of Gond dynasty. Anandavan at Warora is famous the world over due to work being done by the social worker Shri. Baba Amte on the rehabilitation of the leprosy patients. Incidentally he is also an environmental crusader. India’s largest thermal power plant, many coal mines, cement and paper factories, huge lime stone deposits, bauxite, iron, and chromite mines are the sources of wealth for the district. Tadoba‐AndhariTiger Project is a major tourist attraction. Different tribes are the original inhabitants of this district for Millennia. Chandrapur district occupies 11443 square km. -

DISTRICT SURVEY REPORT for SAND MINING INCLUDING OTHER MINOR MINERAL CHANDRAPUR DISTRICT, MAHARASHTRA

DISTRICT SURVEY REPORT For SAND MINING INCLUDING OTHER MINOR MINERAL CHANDRAPUR DISTRICT, MAHARASHTRA As per Notification No. S.O. 3611 (E) New Delhi, the 25th July, 2018 of Ministry of Environment Forest and Climate change, Government of India Prepared by: District Mining Officer Collector Office, Chandrapur 2019 - 2020 .. ;:- CERTIFICATE The District Survey Report preparation has been undertaken in compliance as per Notification No. S.O. 3611 (E) New Delhi, the 25th July, 2018 of Ministry of Environment Forests and Climate Change, Government of India. Every effort have been made to cover sand mining location, area and overview of mining activity in the district with all its relevant features pertaining to geology and mineral wealth in replenishable and non-replenishable areas of rivers, stream and other sand sources. This report will be a model and guiding document which is a compendium of available mineral resources, geographical set up, environmental and ecological set up of the district and is based on data of various departments, published reports, and websites. The District Survey Report will form the basis for application for environmental clearance, preparation of reports and appraisal of projects. Prepared by: Approved by: ~ District Collector, Chandrapur PREFACE The Ministry of Environment, Forests & Climate Change (MoEF&CC), Government of India, made Environmental Clearance (EC) for mining of minerals mandatory through its Notification of 27th January, 1994 under the provisions of Environment Protection Act, 1986. Keeping in view the experience gained in environmental clearance process over a period of one decade, the MoEF&CC came out with Environmental Impact Notification, SO 1533 (E), dated 14th September 2006. -

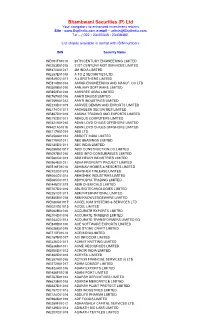

Bhambwani Securities (P) Ltd Your Navigators to Enhanced Investment Returns Site - E-Mail – [email protected] Tel – ( 022 ) 23400345 / 23438482

Bhambwani Securities (P) Ltd Your navigators to enhanced investment returns Site - www.Bsplindia.com e-mail – [email protected] Tel – ( 022 ) 23400345 / 23438482. List shares available in demat with ISIN numbers ISIN Security Name INE091F01010 20TH CENTURY ENGINEERING LIMITED INE253B01015 21ST CENTURY MGT SERVICES LIMITED INE470A01017 3M INDIA LIMITED INE357E01018 A TO Z SECURITIES LTD. INE939C01017 A.J.BROTHERS LIMITED INE814B01014 AAKAR ENGINEERING AND MANUF. CO LTD INE509B01010 AANJAAY SOFTWARE LIMITED INE852E01018 AARSREE AGRA LIMITED INE767A01016 AARTI DRUGS LIMITED INE769A01012 AARTI INDUSTRIES LIMITED INE273D01019 AARVEE DENIMS AND EXPORTS LIMITED INE174C01011 AASHEESH SECURITIES LIMITED INE887D01016 AASWA TRADING AND EXPORTS LIMITED INE192D01011 ABACUS COMPUTERS LIMITED INE421A01010 ABAN LOYD CHILES OFFSHORE LIMITED IN9421A01018 ABAN LOYD CHILES OFFSHORE LIMITED INE117A01014 ABB LTD. INE358A01014 ABBOTT INDIA LIMITED INE779A01011 ABC BEARINGS LIMITED INE125D01011 ABC INDIA LIMITED INE058G01017 ABCI CONSTRUCTION CO LIMITED INE097B01016 ABEE INFO-CONSUMABLES LIMITED INE580C01019 ABG HEAVY INDUSTRIES LIMITED INE964E01011 ABHA PROPERTY PROJECT LIMITED INE516F01016 ABHINAV HOMES & RESORTS LIMITED INE723C01015 ABHISHEK FINLEASE LIMITED INE064C01014 ABHISHEK INDUSTRIES LIMITED INE065C01011 ABHYUDYA TRADING LIMITED INE448C01019 ABIR CHEMICALS LIMITED INE707D01016 ABL BIOTECHNOLOGIES LIMITED INE251C01017 ABM INTERNATIONAL LIMITED INE850B01018 ABM KNOWLEDGEWARE LIMITED INE020G01017 ACCEL ICIM SYSTEMS & SERVICES LTD INE021G01015 ACCEL -

Identifying Market for Dry Waste -A Case of Maharashtra

Identifying Market for Dry Waste A Case of Maharashtra Regional Centre for Urban & Environmental Studies All India Insititute of Local Self-Government, Mumbai Supported by Ministry of Housing and Urban Affairs, Government of India MARCH 2018 Identifying Market for Dry Waste A Case of Maharashtra Regional Centre for Urban & Environmental Studies All India Insititute of Local Self-Government, Mumbai Supported by Ministry of Housing and Urban Affairs, Government of India MARCH 2018 Identifying Market Potential for Recyclable Solid Waste in Maharashtra The Regional Centre for Urban and Environmental Studies (RCUES), All India Institute of Local Self-Government (AIILSG), Mumbai The Regional Centre for Urban & Environmental Studies (RCUES) at AIILSG, Mumbai was established by the Ministry of Housing and Urban Affairs (MoHUA), Government of India (GoI) to undertake urban policy research, technical advisory services and strengthening work capabilities of municipal officials and elected members from the States of Goa, Gujarat, Maharashtra, Rajasthan and UT's of Diu, Daman, Dadra & Nagar Haveli and Lakshadweep in the Western Region and States of Assam and Tripura in the North East Region. RCUES, Mumbai is recognized as a National Training Institute (NTI) and is fully supported by the MoHUA, GoI. The Principal Secretary, Urban Development Department of Government of Maharashtra (GoM) is the ex- officio Chairperson of the Advisory Committee of the RCUES, Mumbai, which is constituted by the MoHUA, GoI. AIILSG, Mumbai houses the Solid Waste Management (SWM) Cell backed by the GoM for capacity building of municipal bodies and provide technical advisory services to ULBs in the State. Ministry of Urban Employment and Poverty Alleviation (MoUE&PA), GoI and UNDP have set up the `National Resource Centre on Urban Poverty' (NRCUP), which is anchored by RCUES at AIILSG, Mumbai. -

List of Appeals Pending in the Office of Commissioner (Appeals), Nagpur As on 30.06.2016

LIST OF APPEALS PENDING IN THE OFFICE OF COMMISSIONER (APPEALS), NAGPUR AS ON 30.06.2016 NAGPUR-I/NAGPUR-II/WARDHA Date of S.No. Appeal No. Receipt Name of the Appellant 1 204/2006 07-06-2006 DC, CE Div. II, Nagpur (Ispat Inds Ltd, Kalmeshwar) 2 205/2007 15-10-2007 Indo Rama Synthetics (I) Ltd 3 223/2007 15-11-2007 Indo Rama Synthetics (I) Ltd 4 249/2007 03-12-2007 Indo Rama Synthetics (I) Ltd 5 250/2007 03-12-2007 Indo Rama Synthetics (I) Ltd 6 004/2008 02-01-2008 Ballarpur Industries Ltd, Ballarpur 7 003/2008 02-01-2008 Ballarpur Industries Ltd, Ballarpur 8 007/2008 04-01-2008 Solar Explosives Ltd, Chakdoh 9 008/2008 07-01-2008 Timothy Travels P Ltd 10 16/2008 21-01-2008 Indo Rama Synthetics (I) Ltd 11 19/2008 24-01-2008 Indo Rama Synthetics (I) Ltd 12 20/2008 24-01-2008 Indo Rama Synthetics (I) Ltd 13 23/2008 04-02-2008 Morarjee Brembara Ltd (Morarjee textiles) 14 32/2008 12-02-2008 Seth Bankatlal Malu Inds P Ltd 15 40/2008 15-02-2008 DC, CE Div. II, Nagpur ( Solar Explosives Ltd) 16 39/2008 15-02-2008 DC, CE Div. II, Nagpur ( Solar Explosives Ltd) 17 97/2008 15-04-2008 Spentex Industries Ltd 18 119/2008 06-05-2008 Rishi Enterprises 19 153/2008 02-06-2008 Sai Travels 20 148/2008 02-06-2008 Ballarpur Industries Ltd, Ghadchiroli 21 154/2008 05-06-2008 Morarjee Brembara Ltd (Morarjee textiles) 22 160/2008 16-06-2008 Heera Laxmi Amusement Pvt Ltd 23 181/2008 12-07-2008 DCCE, Nagpur-I (Sharda Ispat Ltd) 24 182/2008 14-07-2008 Institute of chartered Financial Analysts of India 25 186/2008 17-07-2008 Kaprecon Sleepers Works Pvt Ltd 26 189/2008 -

Challenges Ahead of Ailing Indian Agriculture

Munich Personal RePEc Archive Challenges Ahead of Ailing Indian Agriculture Motkuri, Venkatanarayana Centre for Economics and Social Studies, Hyderabad September 2012 Online at https://mpra.ub.uni-muenchen.de/48570/ MPRA Paper No. 48570, posted 24 Jul 2013 07:42 UTC Challenges Ahead of Ailing Indian Agriculture∗∗∗ Motkuri Venkatanarayana### I Introduction Agriculture has been at the centre stage of rural life for centuries. The rural economy was almost exclusively determined by agricultural activities at the time of India’s independence. As the country moved on an economic growth process in the post-independence era and the rural economy diversifies, the dominance of the agricultural sector in the overall economy has slowly declined over the years. Yet, a characteristic feature that still holds for the Indian economy is that a majority of its population is agriculture dependent for its livelihood. Also, agricultural dependent households form a major chunk of India’s poor population. The growth and development of agriculture plays critical role in reducing rural poverty. The primary role of agriculture for livelihood of the rural population dependent on these activities as well as provision of food security to the nation as a whole will continue in future. The world-wide development experience indicates that the structural changes of an economy in terms of income and employment moving away from agriculture to non-agriculture are inevitable in the economic growth process. Based on such historical experience, a long-run strategy for the developing world has been advocated in these lines of diversification of economy from agriculture to non-agriculture. This diversification strategy emphasises on the strong inter-sectoral linkages between agriculture and the rest of the economy. -

MALU PAPER MILLS LIMITED (Incorporated in India on January 11,1994 As Malu Solvex Limited Under the Companies Act, 1956 with Registration No

C M Y K PROSPECTUS Date: 16th February, 2006 MALU PAPER MILLS LIMITED (Incorporated in India on January 11,1994 as Malu Solvex Limited under the Companies Act, 1956 with Registration No. 11-76009 with Registrar of Companies, Maharashtra. The name of the Company was changed to Malu Paper Mills Limited on April 24, 1998) Registered Office: “ Heera Plaza”’ 4th Floor, Near Telephone Exchange, Central Avenue, Nagpur – 440 008. (Maharashtra) Tel.: +91 712 2760308, 2778506, 2733100, Fax: +91 712 2760310 E-mail: [email protected] Website: www.malupaper.com Contact Person: Mr. Girish Malpani, CFO & Compliance Officer PUBLIC ISSUE OF 66,67,000 EQUITY SHARES OF RS 10- EACH FOR CASH AT A PREMIUM OF RS 20/- PER SHARE (i.e. AT A PRICE OF RS.30/-PER SHARE) AGGREGATING RS 2000.10 LACS. The Issue price of Rs 30/- per share is three (3) times the face value. RISK IN RELATION TO THE FIRST ISSUE This being the first issue of the Equity Shares of Malu Paper Mills Limited, there has been no formal market for the Equity shares of the Company. The face value of the shares is Rs.10/- and the issue price is three times of the face value. The issue price (has been determined and justified by the Lead Merchant Banker and the Issuer Company as stated under Justification of Premium paragraph on page 35) should not be taken to be indicative of the market price of the equity shares after the equity shares are listed. No assurance can be given regarding an active and/or sustained trading in the equity shares of the Company or regarding the price at which the equity shares will be traded after listing. -

(BILT) Chandrapur District, Maharashtra

Ph.D. SYNOPSIS Assessment of Hydrochemical Quality of Groundwater around Ballarpur Industries Limited (BILT) Chandrapur District, Maharashtra. ABSTRACT The groundwater is one of the most important criteria to ascertain its suitability for human beings and irrigation. As Ballarpur is an industrial area the present study focus on the effects of industrial waste water effluent on groundwater as well as on surface water occurring in Ballarpur area within the Chandrapur District of Maharashtra. The obtained results will be compared with World Health Organization (WHO) and Bureau of Indian Standards (BIS) limits. Keywords: Groundwater, Physico-chemical Parameters, Seasonal variation, Hydrogeochemistry. INTRODUCTION As far as we know, earth is the only place in the entire universe where liquid water is found in considerable quantities. In general, it is believed that most of the earth’s water has been formed from oxygen and hydrogen released from rocks through volcanic activity. Earth is unique in having an atmosphere that traps the water vapour and a temperature range that keeps most of it in the Liquid form. Water is therefore a characteristic feature of earth. The sustainability of groundwater for drinking purpose is judged on the basis of pH, - +2 +2 -2 TDS, Total Hardness, Cl , Ca , Mg , Total alkalinity, Sulphate (SO4 ), Sodium, Potassium, etc. and sustainability of groundwater for irrigation purpose is judged on the basis of Sodium contents and Electrical Conductivity. STUDY AREA Chandrapur district is one of the eleven district of Vidarbha region of Maharashtra. It is bounded on south by Telangana state and east by Gadchiroli district on north by Bhandara, Gondia, Nagpur and Wardha district on by west by Yavatmal district. -

List of Appeals Pending with Commissioner (Appeals) As on 31.05.2016

LIST OF APPEALS PENDING WITH COMMISSIONER (APPEALS) AS ON 31.05.2016 S.No. Appeal No. Date of Receipt Name of the Appellant NAGPUR-I/NAGPUR-II/WARDHA COMMISSIONERATES 1 204/2006 07.06.2006 DC, CE Div. II, Nagpur (Ispat Inds Ltd, Kalmeshwar) 2 205/2007 15.10.2007 Indo Rama Synthetics (I) Ltd 3 223/2007 15.11.2007 Indo Rama Synthetics (I) Ltd 4 249/2007 03.12.2007 Indo Rama Synthetics (I) Ltd 5 250/2007 03.12.2007 Indo Rama Synthetics (I) Ltd 6 004/2008 02.01.2008 Ballarpur Industries Ltd, Ballarpur 7 003/2008 02.01.2008 Ballarpur Industries Ltd, Ballarpur 8 007/2008 04.01.2008 Solar Explosives Ltd, Chakdoh 9 008/2008 07.01.2008 Timothy Travels P Ltd 10 16/2008 21.01.2008 Indo Rama Synthetics (I) Ltd 11 19/2008 24.01.2008 Indo Rama Synthetics (I) Ltd 12 20/2008 24.01.2008 Indo Rama Synthetics (I) Ltd 13 23/2008 04.02.2008 Morarjee Brembara Ltd (Morarjee textiles) 14 32/2008 12.02.2008 Seth Bankatlal Malu Inds P Ltd 15 40/2008 15.02.2008 DC, CE Div. II, Nagpur ( Solar Explosives Ltd) 16 39/2008 15.02.2008 DC, CE Div. II, Nagpur ( Solar Explosives Ltd) 17 97/2008 15.04.2008 Spentex Industries Ltd 18 119/2008 06.05.2008 Rishi Enterprises 19 153/2008 02.06.2008 Sai Travels 20 148/2008 02.06.2008 Ballarpur Industries Ltd, Ghadchiroli 21 154/2008 05.06.2008 Morarjee Brembara Ltd (Morarjee textiles) 22 160/2008 16.06.2008 Heera Laxmi Amusement Pvt Ltd 23 181/2008 12.07.2008 DCCE, Nagpur-I (Sharda Ispat Ltd) 24 182/2008 14.07.2008 Institute of chartered Financial Analysts of India 25 186/2008 17.07.2008 Kaprecon Sleepers Works Pvt Ltd 26 189/2008 -

INTERNATIONAL JOURNAL of ENVIRONMENT Volume-4, Issue-3, June-August 2015 ISSN 2091-2854 Received:16 July Revised:31 July Accepted:8 August

INTERNATIONAL JOURNAL OF ENVIRONMENT Volume-4, Issue-3, June-August 2015 ISSN 2091-2854 Received:16 July Revised:31 July Accepted:8 August DUST FALL RATE AND ITS COMPOSITION IN CHANDRAPUR INDUSTRIAL CLUSTER, CENTRAL INDIA R. K. Kamble Centre for Higher Learning and Research in Environmental Science, Department of Environmental Science, Sardar Patel College, Chandrapur 442 402, India Corresponding author: [email protected] Abstract Dust is one of the significant air pollutants in ambient air of Chandrapur industrial cluster. A study was carried out to ascertain the dust fall rate in four sampling locations in the Chandrapur industrial cluster of Chandrapur district, central India. The sampling was carried out by dust fall jar method in winter season (2014-2015) and dust fall rate was estimated gravimetrically. Maximum dust fall rate was recorded in Nakoda 246.67 MT sq km-1 month-1 (industrial area, downwind direction), followed by CSTPS colony 171.77 MT sq km-1 month-1 (industrial area, downwind direction) whereas minimum concentration was found in Babupeath 55.54 MT sq km-1 month-1 (residential area, downwind direction) for December- January. Whereas, during sampling period of February-March maximum dust fall rate was observed to be 278.14 MT sq km-1 month-1 at Babupeath (residential area, upwind direction) and minimum dust fall rate was observed at Ballarpur 173.74 MT sq km-1 month-1 (industrial, upwind direction). The results indicated that dust fall rate for the sampling period of December-January in industrial cluster region was higher as compared with residential region. It has been also observed that upwind direction sampling locations had lesser dust fall rate as compared with downwind direction. -

May 2004 (Updates in the Period: January 2004 to May 2004)

India Power Reforms Update ,QGLD3RZHU5HIRUPV8SGDWH Issue VIII – May 2004 (Updates in the period: January 2004 to May 2004) INTRODUCTION 1 I INDIA 3 Sector Overview Reform Update II ORISSA 9 Sector Overview Reform Update III ANDHRA PRADESH 15 Sector Overview Reform Update IV UTTAR PRADESH 24 Sector Overview Reform Update V MAHARASHTRA 32 Sector Overview Reform Update INTRODUCTION This edition of India Power Reforms Update is a Prayas initiative under the TNI-Energy project. Prayas (www.prayaspune.org) is an Indian NGO working in the area of Power sector policy research and advocacy for the past 12 years. Founded in 1974, the Transnational Institute (TNI, www.tni.org) is an international network of activist-scholars, based in the Netherlands. The TNI Energy Project is a network of NGOs from Africa, Asia, Central and Eastern Europe and Latin America. The project focuses on sustainable development, changing the energy sector policies of Multilateral Development Banks (MDBs), and on alternatives to fossil fuel based energy projects. India Power Reforms Update (IPRU) is an idea initiated by Prayas along with Public Services Research Unit (PSIRU, www.psiru.org) in 2001. As part of the one year collaborative work between Prayas and PSIRU, four issues of IPRU were prepared in October 2001, January 2002, May 2002 and September 2002. These issues reported key reform updates on an all India basis and covered three focus states (namely Orissa, Andhra Pradesh and Uttar Pradesh) in detail. Though the formal collaboration ended after one year, Prayas continued to bring out IPRU issues and three more issues were brought out in February 2003, September 2003 and December 2003.