Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

District Taluka Center Name Contact Person Address Phone No Mobile No

District Taluka Center Name Contact Person Address Phone No Mobile No Mhosba Gate , Karjat Tal Karjat Dist AHMEDNAGAR KARJAT Vijay Computer Education Satish Sapkal 9421557122 9421557122 Ahmednagar 7285, URBAN BANK ROAD, AHMEDNAGAR NAGAR Anukul Computers Sunita Londhe 0241-2341070 9970415929 AHMEDNAGAR 414 001. Satyam Computer Behind Idea Offcie Miri AHMEDNAGAR SHEVGAON Satyam Computers Sandeep Jadhav 9881081075 9270967055 Road (College Road) Shevgaon Behind Khedkar Hospital, Pathardi AHMEDNAGAR PATHARDI Dot com computers Kishor Karad 02428-221101 9850351356 Pincode 414102 Gayatri computer OPP.SBI ,PARNER-SUPA ROAD,AT/POST- 02488-221177 AHMEDNAGAR PARNER Indrajit Deshmukh 9404042045 institute PARNER,TAL-PARNER, DIST-AHMEDNAGR /221277/9922007702 Shop no.8, Orange corner, college road AHMEDNAGAR SANGAMNER Dhananjay computer Swapnil Waghchaure Sangamner, Dist- 02425-220704 9850528920 Ahmednagar. Pin- 422605 Near S.T. Stand,4,First Floor Nagarpalika Shopping Center,New Nagar Road, 02425-226981/82 AHMEDNAGAR SANGAMNER Shubham Computers Yogesh Bhagwat 9822069547 Sangamner, Tal. Sangamner, Dist /7588025925 Ahmednagar Opposite OLD Nagarpalika AHMEDNAGAR KOPARGAON Cybernet Systems Shrikant Joshi 02423-222366 / 223566 9763715766 Building,Kopargaon – 423601 Near Bus Stand, Behind Hotel Prashant, AHMEDNAGAR AKOLE Media Infotech Sudhir Fargade 02424-222200 7387112323 Akole, Tal Akole Dist Ahmadnagar K V Road ,Near Anupam photo studio W 02422-226933 / AHMEDNAGAR SHRIRAMPUR Manik Computers Sachin SONI 9763715750 NO 6 ,Shrirampur 9850031828 HI-TECH Computer -

Village Map Taluka: Mul Sindewahi District: Chandrapur

Bhadravati Bendewahi Rith Village Map Taluka: Mul Sindewahi District: Chandrapur Rajoli Shivapur Gaonganna Kombadwahi Rith Shivapur Tukum Alewahi Alias Nawegaon Golabhuj Ratnapur Dongargaon Shiwapur Ryt.(Chak) Gangalwadi Murmadi Chikhali Mal Tadbhuj µ Bhadurni 2.5 1.25 0 2.5 5 7.5 Padzari Chak Chikhli No.2 Padzari Chak Kanhalgaon km Chak Chikhli No.1 Ushrada Chak Belgata Mal Belgata Chak No.1 Somnath Prakalp Belgata Chak No.2 Location Index Morwahi Chak Sawali Morwahi Mal Maroda District Index Chitegaon Tekadi Nandurbar Bhandara Dhule Amravati Nagpur Gondiya Kosambi Jalgaon Karwan Kosambi Ry. !( Akola Wardha Buldana Marhegaon Nashik Washim Chandrapur Chak Katwan Chicholi Yavatmal Chimadha Palghar Aurangabad MUL Jalna Hingoli Gadchiroli Katwan Akapur !( Thane Ahmednagar Parbhani Mumbai Suburban Nanded Mumbai Bid Mul (M Cl) Raigarh Pune Latur Bidar Osmanabad Janala Ryt. Satara Solapur Ratnagiri Rajgad Sangli Mhasbodan Chak Chandrapur Tadala Tukum Borchandli Bhawarala Maharashtra State Chak Dagadtala Kolhapur Agdi Tadala Sindhudurg Kantapeth Ryt. Dharwad BhagwanpurKawadpeth Raiyyatwari Chichala (Mo) Fiskuti Chandapur Gothangaon Rith Kawadpeth Mal Haldi Tukum Tolewahi Taluka Index Haldi Gaonganna Virai Manda Tukum Wedi Rith Nagbhir Chiroli Junasurla Chimur Brahmapuri Chak Chiroli Bhejgaon Gadisurla Chak Sarajkheda Warora Sandala Sarajkheda Mal Dahegaon Mal Sindewahi Kelzar Khalwaspeth Yejgaon Bhadravati Uthal Peth Dahegaon Chak Churul Tukum Sawali Sintala Dugala Mul Sukadi Rith Chandrapur Sushi Dabgaon Yergaon Alias Belgaon Nawegaon Bhujala Dugala Raiyyatwari Pombhurna Naleshwar Babrala Ballarpur Akapur Raiyyatwari Pipari Dixit Korambi Korpana Dabgaon Makta Chamorshi Dabgaon Tukum Chak Naleshwar Rajura Gondpipri Kanhalgaon Raiyyatwari Khandala Ryt. Legend Jiwati Chak Bembal Bembal !( Taluka Head Quarter Borghat Raiyyatwari District: Chandrapur Railway Chak Ghosari Bondala Kh. -

Chandrapur District Swachhata Plan

0 Chandrapur District Swachhata Plan Strategy and plan to make Chandrapur district ODF by June 2017 Chandrapur District Swachhata Plan 1 CONTENTS 1. Introduction ................................................................................................................ 2 2. Enabling Factors and Bottlenecks ................................................................................ 5 3. The Strategy ................................................................................................................ 6 4. Strategic actions and activity plan ............................................................................... 7 4.1 Demand Management .................................................................................................. 7 4.2 Demand Response Mechanism ................................................................................... 14 4.3 Oversight and Monitoring ........................................................................................... 21 4.4 Sustainability Plan ....................................................................................................... 23 Institutional arrangements for implementation of the strategy ...................................... 24 Non-negotiables for the strategy ...................................................................................... 25 Activity Plan ....................................................................................................................... 27 Financial Plan .................................................................................................................... -

L-33 NPA Life.Xlsx

FORM - 7A COMPANY NAME: LIFE INSURANCE CORPORATION OF INDIA STATEMENT AS ON : 30.06.2020 (Audited) NAME OF THE FUND : Life Rs. IN CRORES CONFIRMATION OF INVESTMENT PORTFOLIO DETAILS PERIODICITY OF SUBMISSION: QUARTERLY Has there been any Interest Rate Principal waiver? Total O/s (Book Default Principal Default Interest Principal due Interest Due COI Company Name Instrument Type Has there Value) (Book Value) (Book Value) from From been a Board % revision? Deferred Principal Deferred Interest Rolled Over Amount Approval Ref Classification Provision(%) Provision (Rs) ILWC KARIMNAGAR MUNICIPAL COUNCIL SOS Loan- Planned 13.00 0.00 0.08 0.04 0.01 1/1/2020 1/1/2020 0.00 0 0 0 SUBSTANDARD 25 0.02 ILWC NARASARAOPET MUNICIPAL COUNCIL SOS Loan- Planned 13.00 0.00 0.26 0.26 0.09 1/1/2014 7/1/2013 0.00 0 0 0 LOSS 100 0.26 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 8.00 0.00 0.01 0.01 0.00 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.01 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 8.00 0.00 0.10 0.10 0.01 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.10 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 8.50 0.00 0.01 0.01 0.00 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.01 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 10.50 0.00 0.03 0.03 0.01 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.03 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 8.50 0.00 0.02 0.02 0.01 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.02 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 10.50 0.00 0.03 0.03 0.01 5/15/2005 5/15/2005 0.00 0 0 0 LOSS 100 0.03 HLSH ASSAM GOVT (HSG) SOS Loan- Planned 10.50 0.00 0.08 0.08 0.04 5/15/2005 5/15/2005 -

Reg. No Name in Full Residential Address Gender Contact No. Email Id Remarks 9421864344 022 25401313 / 9869262391 Bhaveshwarikar

Reg. No Name in Full Residential Address Gender Contact No. Email id Remarks 10001 SALPHALE VITTHAL AT POST UMARI (MOTHI) TAL.DIST- Male DEFAULTER SHANKARRAO AKOLA NAME REMOVED 444302 AKOLA MAHARASHTRA 10002 JAGGI RAMANJIT KAUR J.S.JAGGI, GOVIND NAGAR, Male DEFAULTER JASWANT SINGH RAJAPETH, NAME REMOVED AMRAVATI MAHARASHTRA 10003 BAVISKAR DILIP VITHALRAO PLOT NO.2-B, SHIVNAGAR, Male DEFAULTER NR.SHARDA CHOWK, BVS STOP, NAME REMOVED SANGAM TALKIES, NAGPUR MAHARASHTRA 10004 SOMANI VINODKUMAR MAIN ROAD, MANWATH Male 9421864344 RENEWAL UP TO 2018 GOPIKISHAN 431505 PARBHANI Maharashtra 10005 KARMALKAR BHAVESHVARI 11, BHARAT SADAN, 2 ND FLOOR, Female 022 25401313 / bhaveshwarikarmalka@gma NOT RENEW RAVINDRA S.V.ROAD, NAUPADA, THANE 9869262391 il.com (WEST) 400602 THANE Maharashtra 10006 NIRMALKAR DEVENDRA AT- MAREGAON, PO / TA- Male 9423652964 RENEWAL UP TO 2018 VIRUPAKSH MAREGAON, 445303 YAVATMAL Maharashtra 10007 PATIL PREMCHANDRA PATIPURA, WARD NO.18, Male DEFAULTER BHALCHANDRA NAME REMOVED 445001 YAVATMAL MAHARASHTRA 10008 KHAN ALIMKHAN SUJATKHAN AT-PO- LADKHED TA- DARWHA Male 9763175228 NOT RENEW 445208 YAVATMAL Maharashtra 10009 DHANGAWHAL PLINTH HOUSE, 4/A, DHARTI Male 9422288171 RENEWAL UP TO 05/06/2018 SUBHASHKUMAR KHANDU COLONY, NR.G.T.P.STOP, DEOPUR AGRA RD. 424005 DHULE Maharashtra 10010 PATIL SURENDRANATH A/P - PALE KHO. TAL - KALWAN Male 02592 248013 / NOT RENEW DHARMARAJ 9423481207 NASIK Maharashtra 10011 DHANGE PARVEZ ABBAS GREEN ACE RESIDENCY, FLT NO Male 9890207717 RENEWAL UP TO 05/06/2018 402, PLOT NO 73/3, 74/3 SEC- 27, SEAWOODS, -

Action Plan for Industrial Cluster: Chandrapur

ACTION PLAN FOR INDUSTRIAL CLUSTER: CHANDRAPUR MAHARASHTRA POLLUTION CONTROL BOARD KALPATARU POINT, SION (E),MUMBAI 400 022 www.mpcb.gov.in Maharashtra Pollution Control Board CEPI Report Nov‐2010 ‐ 1 ‐ 1) INTRODUCTION 1.1. Area details including brief history (Background Information) Chandrapur, the easternmost district is located in the eastern edge of Maharashtra in Nagpur division and forms the eastern part of 'Vidharbha' region. It is located between 19.30’ N to 20.45’N Latitude and 78.46’E longitude. The district is bounded by Nagpur, Bhandara and Wardha on the northern side. Yavatmal on the western side. Gadchiroli on the eastern side and Adilibad district of the Andhra Pradesh on the southern side. Physiographically, the district is situated within the Wainganga and Wardha river basins, respectively, on the eastern and western boundaries of the district which are the tributaries of Godavari River. Chandrapur district of Maharashtra is abundantly endowed with rich flora and fauna, water resources and mineral wealth. Chandrapur has been famous from ancient times as the capital of Gond dynasty. Anandavan at Warora is famous the world over due to work being done by the social worker Shri. Baba Amte on the rehabilitation of the leprosy patients. Incidentally he is also an environmental crusader. India’s largest thermal power plant, many coal mines, cement and paper factories, huge lime stone deposits, bauxite, iron, and chromite mines are the sources of wealth for the district. Tadoba‐AndhariTiger Project is a major tourist attraction. Different tribes are the original inhabitants of this district for Millennia. Chandrapur district occupies 11443 square km. -

Assessment of Ambient Air Quality and It's Probable Health Impact On

RESEARCH PAPER engineering Volume : 5 | Issue : 5 | May 2015 | ISSN - 2249-555X Assessment of Ambient Air Quality And It’s Probable Health Impact on Human Being Around Chandrapur City KEYWORDS Air quality index, Health Impact, RSPM, Chandrapur. Nilesh P. Nandanwar Arty K.Dixit Mahendra D. Choudhary Department of Applied Department of Applied Chemistry, Department of Chemistry, Bapurao Chemistry, Rajiv Gandhi College Ramdeobaba Kamala Nehru Deshmukh College of Engineering, of Engineering, Research and College of Engineering, Nagpur. Sewagram (Wardha). Technology, Chandrapur-442402. Kirtiwardhan R.Dixit Sachin S.Wazalwar Department of Applied Chemistry, Rajiv Gandhi Department of Applied Chemistry, Rajiv Gandhi College of Engineering, Research and Technology, College of Engineering, Research and Technology, Chandrapur-442402. Chandrapur-442402. ABSTRACT This present study is the ambient air qualities and its impact on human being of Chandrapur district dur- ing July 2009 to June 2011 at six different stations. The sample was collected for Respirable suspended particulate matter (RSPM), sulfur dioxide (SO2) and oxides of Nitrogen (NOx). It has been observed that air quality during monsoon period is fairly clean and moderately polluted level and during winter and summer season it is moder- ately polluted to severely pollute particularly in Ghughus area samples were significantly higher than that of other sta- tions. The average ambient air concentration of SO2 and NOx were found below permissible limits at all sites. It was also observed that RSPM level in almost all samples were higher and the effect cause asthma and various allergy over human being. Introduction: At elevated concentrations all the metals are harmful to Air pollution is described as the presences of air pollut- living beings including humans (Yasutake and Hirayama, ants in the atmosphere to such an extent that they cause 1997) 18. -

Samadhan Purti Super Bazar

+91-7172274843 Samadhan Purti Super Bazar https://www.indiamart.com/samadhan-purti-super-bazar/ It is pioneer name for retail departmental stores in Chandrapur. Inaugurated in the year 2002 it started a journey of success with the flagship store near Jatpura gate, Chandrapur. With a vision of being the most compelling places . About Us It is pioneer name for retail departmental stores in Chandrapur. Inaugurated in the year 2002 it started a journey of success with the flagship store near Jatpura gate, Chandrapur. With a vision of being the most compelling places to shop work and invest Samadhan purti super bazaar is stepping ahead with an expansion plan. The company intends to start ten new stores in a due course of time namely in the ‘Taluka’ regions of Vidarbha, Maharashtra. Prospective places like Bhandara, Gondia, Warora, Ballarpur, Chimur, Yavatmal, Pusad, Ghughus, Gadchiroli and Wadsa which are understood to be the potential towns for departmental stores. With a mission of getting the best possible deals for our consumers, the team of Samadhan is developing on its strengths. One of the vigor is being able to reach the consumers easily by having multiple stores across Vidarbha and gradually concurring Maharashtra. New stores to Samadhan family are Wani & Gadchandur, which have become the talk of town at both towns. Today Samadhan is one of the leading departmental stores in Chandrapur with an average consumer footfall of 1100 plus per day. The success of our store can be directly measured by the number of consumers related with the Bachat card. It’s a loyalty program run by the management to ensure hassle free access to our exclusive services during the mass purchase. -

Panchayat Samiti Elections in Maharashtra: a Data Analysis (1994-2013)

PANCHAYAT SAMITI ELECTIONS IN MAHARASHTRA: A DATA ANALYSIS (1994-2013) Rajas K. Parchure ManasiV. Phadke Dnyandev C. Talule GOKHALE INSTITUTE OF POLITICS AND ECONOMICS (Deemed to be a University)` Pune (India), 411 001 STUDY TEAM Rajas K. Parchure : Team Leader Manasi V. Phadke : Project Co-ordinator Dnyandev C. Talule Project Co-ordinator Rajesh R. Bhatikar : Editorial Desk Anjali Phadke : Statistical Assistant Ashwini Velankar : Research Assistant Vaishnavi Dande Research Assistant Vilas M. Mankar : Technical Assistance PANCHAYAT SAMITI ELECTIONS IN MAHARASHTRA : A DATA ANALYSIS (1994-2013) 2016 TABLE OF CONTENTS CHAPTER CONTENT PAGE NO. NO. Foreword v Acknowledgements vi 1 A Historical Perspective on Local Governance 1 2 Defining Variables and Research Questions 18 3 Data Analysis: Behaviour of Main Variables 25 Across Different Rounds of Elections 4 Data Analysis: Correlations Between Key 85 Variables 5 Conclusion 86 References Appendix – A Data on VT, POL, SCST and REVERSE COMP 89 Across Rounds of Elections Appendix – B Average Values of VT, POL, RESERVE COMP 105 and IND Appendix – C Cluster Analysis of VT, POL, REVERSE COMP, 124 IND and RES Appendix – D Councils Relevant for Immediate Launch of Voter 144 Awareness Programs Appendix – E Councils Relevant for MCC Implementation 146 Gokhale Institute of Politics and Economics, Pune i PANCHAYAT SAMITI ELECTIONS IN MAHARASHTRA : A DATA ANALYSIS (1994-2013) 2016 LIST OF TABLES Tables Content Page No. No. 3.1 Trends in VT across Successive Rounds of Elections 25 3.2 Panchayat Samitis belonging -

DISTRICT SURVEY REPORT for SAND MINING INCLUDING OTHER MINOR MINERAL CHANDRAPUR DISTRICT, MAHARASHTRA

DISTRICT SURVEY REPORT For SAND MINING INCLUDING OTHER MINOR MINERAL CHANDRAPUR DISTRICT, MAHARASHTRA As per Notification No. S.O. 3611 (E) New Delhi, the 25th July, 2018 of Ministry of Environment Forest and Climate change, Government of India Prepared by: District Mining Officer Collector Office, Chandrapur 2019 - 2020 .. ;:- CERTIFICATE The District Survey Report preparation has been undertaken in compliance as per Notification No. S.O. 3611 (E) New Delhi, the 25th July, 2018 of Ministry of Environment Forests and Climate Change, Government of India. Every effort have been made to cover sand mining location, area and overview of mining activity in the district with all its relevant features pertaining to geology and mineral wealth in replenishable and non-replenishable areas of rivers, stream and other sand sources. This report will be a model and guiding document which is a compendium of available mineral resources, geographical set up, environmental and ecological set up of the district and is based on data of various departments, published reports, and websites. The District Survey Report will form the basis for application for environmental clearance, preparation of reports and appraisal of projects. Prepared by: Approved by: ~ District Collector, Chandrapur PREFACE The Ministry of Environment, Forests & Climate Change (MoEF&CC), Government of India, made Environmental Clearance (EC) for mining of minerals mandatory through its Notification of 27th January, 1994 under the provisions of Environment Protection Act, 1986. Keeping in view the experience gained in environmental clearance process over a period of one decade, the MoEF&CC came out with Environmental Impact Notification, SO 1533 (E), dated 14th September 2006. -

Maharashtra State Boatd of Sec & H.Sec Education Pune

MAHARASHTRA STATE BOATD OF SEC & H.SEC EDUCATION PUNE - 4 Page : 1 schoolwise performance of Fresh Regular candidates MARCH-2019 Division : NAGPUR Candidates passed School No. Name of the School Candidates Candidates Total Pass Registerd Appeared Pass UDISE No. Distin- Grade Grade Pass Percent ction I II Grade 03.01.001 JAKATDAR GIRL'S SCHOOL, BHANDARA-441904 96 96 7 24 33 2 66 68.75 27100100141 03.01.002 NAGAR PARISHAD GANDHI SCHOOL, BHANDARA-441904 32 32 0 4 7 7 18 56.25 27100100142 03.01.003 SHREE GANESH HIGH SCHOOL, BHANDARA-441904 16 15 1 2 3 2 8 53.33 27100100153 03.01.004 S.B.LAHOTI NUTAN MAHARASHTRA VID, BHANDARA-441904 191 183 21 32 43 22 118 64.48 27100100150 03.01.005 PRAKASH HIGH SCHOOL, BHANDARA-441904. 18 18 0 1 3 1 5 27.77 27100100147 03.01.006 NAVPRABHAT HIGH SCHOOL, AMGAON (DIGHORI) 28 28 1 10 7 1 19 67.85 27100105902 03.01.007 ADARSH HIGH SCHOOL, DAVDIPAR (ROAD), 72 71 1 19 25 3 48 67.60 27100102302 03.01.008 NANAJI JOSHI VIDYALAYA, SHAHAPUR, 297 297 41 98 87 33 259 87.20 27100111903 TQ.DIST.BHANDARA 03.01.009 MISSION HIGH SCHOOL, SHANICHARI BHANDARA-441904 24 23 1 5 5 0 11 47.82 27100110803 03.01.010 BUTI VIDYALAYA, KHAMARI, POST MATORA 49 48 0 19 10 0 29 60.41 27100105802 03.01.011 GANDHI VIDYALAYA, PAHELA, POST PAHELA, BHANDARA 213 213 22 75 50 3 150 70.42 27100100202 03.01.012 PRAKASH VIDYALAYA, KARDHA-441924 182 181 17 60 63 1 141 77.90 27100105202 03.01.013 CHAITANYA VIDYALAYA, MANEGAON (BAZAR) 94 92 12 36 23 1 72 78.26 27100103702 03.01.014 Z.P.HIGH SCHOOL, DHARGAON TAL . -

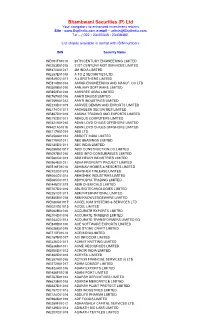

Bhambwani Securities (P) Ltd Your Navigators to Enhanced Investment Returns Site - E-Mail – [email protected] Tel – ( 022 ) 23400345 / 23438482

Bhambwani Securities (P) Ltd Your navigators to enhanced investment returns Site - www.Bsplindia.com e-mail – [email protected] Tel – ( 022 ) 23400345 / 23438482. List shares available in demat with ISIN numbers ISIN Security Name INE091F01010 20TH CENTURY ENGINEERING LIMITED INE253B01015 21ST CENTURY MGT SERVICES LIMITED INE470A01017 3M INDIA LIMITED INE357E01018 A TO Z SECURITIES LTD. INE939C01017 A.J.BROTHERS LIMITED INE814B01014 AAKAR ENGINEERING AND MANUF. CO LTD INE509B01010 AANJAAY SOFTWARE LIMITED INE852E01018 AARSREE AGRA LIMITED INE767A01016 AARTI DRUGS LIMITED INE769A01012 AARTI INDUSTRIES LIMITED INE273D01019 AARVEE DENIMS AND EXPORTS LIMITED INE174C01011 AASHEESH SECURITIES LIMITED INE887D01016 AASWA TRADING AND EXPORTS LIMITED INE192D01011 ABACUS COMPUTERS LIMITED INE421A01010 ABAN LOYD CHILES OFFSHORE LIMITED IN9421A01018 ABAN LOYD CHILES OFFSHORE LIMITED INE117A01014 ABB LTD. INE358A01014 ABBOTT INDIA LIMITED INE779A01011 ABC BEARINGS LIMITED INE125D01011 ABC INDIA LIMITED INE058G01017 ABCI CONSTRUCTION CO LIMITED INE097B01016 ABEE INFO-CONSUMABLES LIMITED INE580C01019 ABG HEAVY INDUSTRIES LIMITED INE964E01011 ABHA PROPERTY PROJECT LIMITED INE516F01016 ABHINAV HOMES & RESORTS LIMITED INE723C01015 ABHISHEK FINLEASE LIMITED INE064C01014 ABHISHEK INDUSTRIES LIMITED INE065C01011 ABHYUDYA TRADING LIMITED INE448C01019 ABIR CHEMICALS LIMITED INE707D01016 ABL BIOTECHNOLOGIES LIMITED INE251C01017 ABM INTERNATIONAL LIMITED INE850B01018 ABM KNOWLEDGEWARE LIMITED INE020G01017 ACCEL ICIM SYSTEMS & SERVICES LTD INE021G01015 ACCEL