Our Finances

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

T:Tm<NEW ZEALAND GAZETTE

T:tm<NEW ZEALAND GAZETTE Reg.No; I operator. Postal Addresss. CANTl!!BBUBY CONSlIIBVANOy-cooonuea 11 Pearson, G. IV., and Sons P.O. Box'14, Rangiora Southbrook. 104 Peninsular Sawmilling Co. Duvauchelle Bay. Banks Peninsula Duvauchelle Bay. 64 Petrie, R. Waiknku Waikuku. 21 Pinus Lumber Sawmilling Co., Ltd. 325 Blenheim Road, Christchurch Christchurch. 106 Plunkett, E. R. 29 ARens Road, Ashburton Ashburton. 66 Pullar Bros. 23 Smith Street, Waimate .. Waimate. 100 Reid, R. J. Cooper's Creek, Oxford Cooper's Creek. 84 Rose, De Lore, and Egerton , 95 Matipo Street, Riocarton Burnham. 16 Roud, G. J., and Son, Ltd. 242 Ferry Road, Christchurch Christchurch. 22 Scott, A. W ... Tancred Street, Rakaia Rakaia. 60 Scott, E. E. .. Geraldine Mayfield. 56 Selwyn Casewoods, Ltd. P.O. Box 1070, Christchurch Papanui. 14 Selwyn Sawmills, Ltd. 86 Manchester Street, Cliristchurch Hororata. 105 Simpson, R. G. 53. Creek Road, Ashburton ... Tinwald. 61 Smith, V. L ... Torqnay Street, Kaikoura Kaikoura. 92 Stonyhurst Sawmilling Co. Private Bag, Cheviot St?nyhurS~. 96 Sutherland and Co., Ltd. Mina. ,Mina. 77 Valetta Timber Co. Valetta R.D., Ashburton Valetta. 63 Waimate Timber Co •.. Queen Street, Waimate Waimate. 55 Wakelin, T., and Sons .. 78 Allen's Road, Ashburton Ashburton. 68 Webster Sawmills Tinwald, Ashburton Hinds. 89 West and Evers, Ltd... Leeliton .. Leeston. 95. Whiting, A. O. 68 Oxford :;!treet, Ashburton Ashburton. 34 Woodbury SawmillingCo. P.O; Box 53, Geraldine Woodbury. SOUTBL~D CONSERVANOY 166 Ashley Cooper, Ltd. P ..O. Box 227, Dunedin C. 1. Green Island. 157 Aubrey, D. C. Cattle Fla.t, Wanaka Cattle Flat. 68 Barrow Box Co. P.O ..Box 27, Invercargill Tapanui. -

No 69, 13 October 1949, 2427

1ltunb. 69 2'631 NEW ZEALAND THE NEW ZEALAND GAZETTE WELLINGTON, THURSDAY, NOVEMBER 10, 1949 Deelaring Certain Craw'll Land to be Subject to Part I of the Maori Allocating Land Taken for a Railway to the PurpoBu 01" Road 4t . La.nd Anumdment Act, 1936 Lilae River [L.S.} B. C. FREYBERG, Governor-General A PROCLAMATION [L.S.] B. C. FREYBERG, Governor-General URSUANT to sectiQIl five of the Maori Purposes Act, 1939, I, A PROCLAMATION P Lieutenant-Gene .... l Sir Bernard Cyril Freyberg, the Governor HEREAS the mnd described in the Schedule hereto :forms General of the Dominion of New Zealand, do hereby declare the W part of land taken for the purposes of the Htmm'Oi Crown land described in the Schedule hereto to be subject to Part I WaitaJd Railway (Little River Branch), and it is considered desirable of the Maori Land Amendment Act, 1936. to allocare such land to the purposes of a road ~ Now, therefore, I, Lieutenant-Geneml Sir Bematd Cyril SCHEDULE Freyberg, the Governor-General of the Dominion of New Zealand, in pursuance and exercise of the powers and authorities vested in AUCKLAND LAND DISTRICT me by section two hundred and twenty-six of the Public Works Act, ALL those areas in the County of Whakatane situated in Blook IV, 1928, and of every other power and authority in anywise _bling Waimana Snrvey District, containing by admeasnrement a tota! of me in this behalf, do hereby proclaim and declare that the l&1ld 1 rood and 18·6 perches, more or less, being portions of road closed described in the Schedule hereto shall, upon the publication hereof adjoining Section 21, Waimana Settlement, by Proclamation in the New Zealand Gazette, become a road, and that the said rOMl published in New Zealand Gazette No. -

New Zealand's 3Rd-Warmest May on Record

New Zealand Climate Summary: May 2019 Issued: 5 June 2019 New New Zealand’s 3rd-warmest May on record Temperature Temperatures were above average (0.51°C to 1.2°C above average) or well above average (>1.2°C above average) across the entire country, with the most unusually warm temperatures in the South Island. Many locations observed record or near- record warm mean, mean maximum, and mean minimum May temperatures. Rainfall Rainfall was below normal (50% to 79% of normal) or well below normal (<50% of normal) for the majority of the North Island, with the exception being parts of Waikato, Taranaki, and coastal Manawatu-Whanganui where rainfall was near normal (80% to 119% of normal). Rainfall was above (120% to 149% of normal) or well above (>149% of normal) normal for much of western and lower South Island. Near or below normal rainfall occurred in parts of Marlborough, Canterbury, coastal Otago, and southern Southland. Soil Moisture As of 31 May, soils were drier than normal for much of the North Island with small areas of wetter than normal soils about western Waitomo and the Kapiti Coast. South Island soil moisture was generally near normal with pockets of below normal soil moisture about Waimate and Waitaki as well as the interior Marlborough region. Click on the link to jump to the information you require: Overview Temperature Rainfall May 2019 climate in the six main centres Highlights and extreme events Overview May 2019 was characterised by higher than normal sea level pressure over and to the east of the North Island and lower than normal pressure to the south of the South Island. -

Regional Services Committee (Ropu Tiaki Waka-A-Rohe)

Committee Members Cr Jeremy McPhail (Chair) Cr Peter McDonald Cr Lloyd Esler Cr Eric Roy Cr Lyndal Ludlow Cr David Stevens Cr Lloyd McCallum Chairman Nicol Horrell (ex officio) Regional Services Committee (Ropu Tiaki Waka-a-Rohe) Environment Southland Council Chambers and via Zoom digital link 1.00 pm 03 September 2020 A G E N D A (Rarangi Take) 1. Welcome (Haere mai) 2. Apologies (Nga pa pouri) 3. Declarations of Interest 4. Public Forum, Petitions and Deputations (He Huinga tuku korero) 5. Confirmation of Minutes (Whakau korero) – 11 June 2020 6. Notification of Extraordinary and Urgent Business (He Panui Autaia hei Totoia Pakihi) 6.1 Supplementary Reports 6.2 Other 7. Questions (Patai) 8. Chairman and Councillors’ Reports (Nga Purongo-a-Tumuaki me nga Kaunihera) 9. Acting General Manager, Operations Report – 20/RS/71 Item 1 – Annual Report of the Land and Water Services Division ..................................12 Item 2 – Biosecurity & Biodiversity Operations Annual Report ......................................32 Item 3 – 2019/20 Rating District Works Programme – Annual Report ...........................60 Item 4 – Catchment Management Work Programmes ...................................................97 Item 5 – Contracts and Progress on Works .....................................................................98 Item 6 – Lease Inspection Reports – March and June 2020 Quarters ............................105 1 Regional Services Committee – 03 September 2020 10. Department of Conservation Verbal Update 11. Extraordinary and -

No 6, 3 February 1955

No. 6 101 NEW ZEALAND THE New Zealand Gazette Published by Authori~ WELLINGTON: THURSDAY, 3 FEBRUARY 1955 Land Held for Housing Purposes Set A.part for Purposes Land Held f01· a Public School Set A.part for Road. in Green Incidental to Coal-mining Operations in Block III, Wairio Island Bush Survey District Survey District [L.S.] C. W. M. NORRIE~ Governor-General [L.S.] C. W. M. NORRIE, Governor-General A PROCLAMATION A PROCLAMATION URSUANT to the Public Works Act 1928, I, Lieutenant P General Sir Charles Willoughby Moke Norrie, the URSUANT to the Public Works Act 1928 and section 170 Governor-General of New Zealand, hereby proclaim and declare P of the Coal Mines Act 1925, I, Lieutenant-General Sir that the land described in the Schedule hereto now held for a Charles Willoughby Moke Norrie, the Governor-General of public school is hereby set apart for road; and I also declare New ZeaJand, hereby proclaim and declare that the surface that this Proclamation shall take effect on and after the of the land described in the Schedule hereto, together with 7th day of February 1955. the subsoil above a plane 100 ft. below and approximately parallel to the surface of the said land now held for housing purposes, is hereby set apart for purposes incidental to coal SCHEDULE mining operations; and I also declare that this Proclamation shall take effect on and after the 7th day of February 1955. APPROXIMATE areas of the pieces of land set apart: A. R. P. Being 0 0 3 · 2 Part Section 37. -

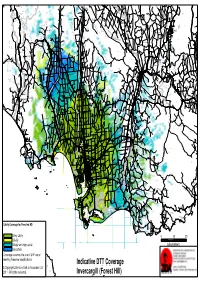

Indicative DTT Coverage Invercargill (Forest Hill)

Blackmount Caroline Balfour Waipounamu Kingston Crossing Greenvale Avondale Wendon Caroline Valley Glenure Kelso Riversdale Crossans Corner Dipton Waikaka Chatton North Beaumont Pyramid Tapanui Merino Downs Kaweku Koni Glenkenich Fleming Otama Mt Linton Rongahere Ohai Chatton East Birchwood Opio Chatton Maitland Waikoikoi Motumote Tua Mandeville Nightcaps Benmore Pomahaka Otahu Otamita Knapdale Rankleburn Eastern Bush Pukemutu Waikaka Valley Wharetoa Wairio Kauana Wreys Bush Dunearn Lill Burn Valley Feldwick Croydon Conical Hill Howe Benio Otapiri Gorge Woodlaw Centre Bush Otapiri Whiterigg South Hillend McNab Clifden Limehills Lora Gorge Croydon Bush Popotunoa Scotts Gap Gordon Otikerama Heenans Corner Pukerau Orawia Aparima Waipahi Upper Charlton Gore Merrivale Arthurton Heddon Bush South Gore Lady Barkly Alton Valley Pukemaori Bayswater Gore Saleyards Taumata Waikouro Waimumu Wairuna Raymonds Gap Hokonui Ashley Charlton Oreti Plains Kaiwera Gladfield Pikopiko Winton Browns Drummond Happy Valley Five Roads Otautau Ferndale Tuatapere Gap Road Waitane Clinton Te Tipua Otaraia Kuriwao Waiwera Papatotara Forest Hill Springhills Mataura Ringway Thomsons Crossing Glencoe Hedgehope Pebbly Hills Te Tua Lochiel Isla Bank Waikana Northope Forest Hill Te Waewae Fairfax Pourakino Valley Tuturau Otahuti Gropers Bush Tussock Creek Waiarikiki Wilsons Crossing Brydone Spar Bush Ermedale Ryal Bush Ota Creek Waihoaka Hazletts Taramoa Mabel Bush Flints Bush Grove Bush Mimihau Thornbury Oporo Branxholme Edendale Dacre Oware Orepuki Waimatuku Gummies Bush -

NEW ZEALAND GAZETTE 1237 Measured South-Easterly, Generally, Along the Said State 2

30 APRIL NEW ZEALAND GAZETTE 1237 measured south-easterly, generally, along the said State 2. New Zealand Gazette, No. 35, dated 1 June 1967, page highway from Maria Street. 968. Situated within Southland District at Manapouri: 3. New Zealand Gazette, No. 26, dated 3 March 1983, page Manapouri-Hillside Road: from Waiau Street to a point 571. 500 metres measured easterly, generally, along the said road 4. New Zealand Gazette, No. 22, dated 25 February 1982, from Waiau Street. page 599. Manapouri-Te Anau Road: from Manapouri-Hillside Road to a 5. New Zealand Gazette, No. 94, dated 7 June 1984, page point 900 metres measured north-easterly, generally, along 1871. Manapouri-Te Anau Road from Manapouri-Hillside Road. 6. New Zealand Gazette, No. 20, dated 29 March 1962, page Situated within Southland District at Ohai: 519. No. 96 State Highway (Mataura-Tuatapere): from a point 7. New Zealand Gazette, No. 8, dated 19 February 1959, 250 metres measured south-westerly, generally, along the said page 174. State highway from Cottage Road to Duchess Street. 8. New Zealand Gazette, No. 40, dated 22 June 1961, page Situated within Southland District at Orawia: 887. No. 96 State Highway (Mataura-Tuatapere): from the south 9. New Zealand Gazette, No. 83, dated 23 October 1941, western end of the bridge over the Orauea River to a point 550 page 3288. metres measured south-westerly, generally, along the said 10. New Zealand Gazette, No.107, dated 21 June 1984, page State highway from the said end of the bridge over the Orauea 2277. River. -

The New Zealand Gazette. 883

MAR. 25.] THE NEW ZEALAND GAZETTE. 883 MILITARY AREA No. 12 (INVERCARGILL)-continued. MILITARY AREA No. 12 (INVERCARGILL)-continued. 533250 Daumann, Frederick Charles, farm labourer, care of post- 279563 Field, Sydney James, machinist, care of Post-office, Mac office, Lovells Flat. lennan, Catlins. 576554 Davis, Arthur Charles, farm labourer, Dipton. 495725 Field, William Henry, fitter and turner, 36 Princes St. 499495 Davis, Kenneth Henry, freezing worker, Dipton St. 551404 Findlay, Donald Malcolm, cheesemaker, care of Seaward 575914 Davis, Verdun John Lorraine, second-hand dealer, 32 Eye St. Downs Dairy Co., Seaward Downs, Southland. 578471 Dawson, Alan Henry, salesman, 83 Robertson St. 498399 Finn, Arthur Henry, farmer, Wallacetown. 590521 Dawson, John Alfred, rabbiter, care of Len Stewart, Esq., 498400 Finn, Henry George, mill worker, Stewart St., Balclutha. West Plains Rural Delivery. 622455 Fitzpatrick, Matthew Joseph, messenger, Merioneth St., 611279 Dawson, Lewis Alfred, oysterman, 199 Barrow St., Bluff. Arrowtown. 573736 Dawson, Morell Tasman, Jorry-driver, 12 Camden St. 553428 Flack, Charles Albert, labourer, Albion St., Mataura. 591145 Dawson, William Peters, carrier, Pa1merston St., Riverton. 562423 Fleet, Trevor, omnibus-driver, 305 Tweed St. 622362 De La Mare, William Lewis, factory worker, 106 Windsor St. 404475 Flowers, Gord<;m Sydney, labourer, 270 Tweed St. 623417 De Lautour, Peter Arnaud, bank officer, care of Bank of 536899 Forbes, William, farmer, Lochiel Rural Delivery. N.Z., Roxburgh. 492676 Ford, Leo Peter, fibrous-plasterer, 82 Islington St. 490649 Dempster, George Campbell, porter, 24 Oxford St., Gore. 492680 Forde, John Edmond, surfaceman, Maclennan, Catlins. 526266 Dempster, Victor Trumper, grocer, 20 Fulton St. 492681 Forde, John Francis, transport-driver, North Rd., Colling- 493201 Denham, Stuart Clarence, linesman, 81 Pomona St. -

Section 6 Schedules 27 June 2001 Page 197

SECTION 6 SCHEDULES Southland District Plan Section 6 Schedules 27 June 2001 Page 197 SECTION 6: SCHEDULES SCHEDULE SUBJECT MATTER RELEVANT SECTION PAGE 6.1 Designations and Requirements 3.13 Public Works 199 6.2 Reserves 208 6.3 Rivers and Streams requiring Esplanade Mechanisms 3.7 Financial and Reserve 215 Requirements 6.4 Roading Hierarchy 3.2 Transportation 217 6.5 Design Vehicles 3.2 Transportation 221 6.6 Parking and Access Layouts 3.2 Transportation 213 6.7 Vehicle Parking Requirements 3.2 Transportation 227 6.8 Archaeological Sites 3.4 Heritage 228 6.9 Registered Historic Buildings, Places and Sites 3.4 Heritage 251 6.10 Local Historic Significance (Unregistered) 3.4 Heritage 253 6.11 Sites of Natural or Unique Significance 3.4 Heritage 254 6.12 Significant Tree and Bush Stands 3.4 Heritage 255 6.13 Significant Geological Sites and Landforms 3.4 Heritage 258 6.14 Significant Wetland and Wildlife Habitats 3.4 Heritage 274 6.15 Amalgamated with Schedule 6.14 277 6.16 Information Requirements for Resource Consent 2.2 The Planning Process 278 Applications 6.17 Guidelines for Signs 4.5 Urban Resource Area 281 6.18 Airport Approach Vectors 3.2 Transportation 283 6.19 Waterbody Speed Limits and Reserved Areas 3.5 Water 284 6.20 Reserve Development Programme 3.7 Financial and Reserve 286 Requirements 6.21 Railway Sight Lines 3.2 Transportation 287 6.22 Edendale Dairy Plant Development Concept Plan 288 6.23 Stewart Island Industrial Area Concept Plan 293 6.24 Wilding Trees Maps 295 6.25 Te Anau Residential Zone B 298 6.26 Eweburn Resource Area 301 Southland District Plan Section 6 Schedules 27 June 2001 Page 198 6.1 DESIGNATIONS AND REQUIREMENTS This Schedule cross references with Section 3.13 at Page 124 Desig. -

LINZ ID Region Client Agency Address LINZ Disposal Provider

Properties currently in the LINZ disposals programme - Updated 2 September 2014 LINZ ID Region Client Agency Address LINZ Disposal Provider Contact Details Disposal Status 2707213 Northland LINZ Otohui Road, Whangarei APL Property Limited [email protected] Other Public Work 2707294 Northland LINZ Carey Road, Kaikohe The Property Group Limited [email protected] Obtain Clearance 2707150 Northland LINZ Lake Road, Okaihau, Okaihau The Property Group Limited [email protected] Obtain Clearance 2817025 Northland LINZ The Landing Paparoa SH12 Darroch Limited Christchurch [email protected] Sale to Crown Agency 2715911 Northland LINZ The Landing Paparoa SH12 Darroch Limited Christchurch [email protected] Sale to Crown Agency 2910661 Northland Ministry of Education 35 Purdy Street, Kaikohe Darroch Limited Christchurch [email protected] OTS Clearance 2910668 Northland Ministry of Education Gorge Road, Pakanae Darroch Limited Christchurch [email protected] Offerback Investigation 2910685 Northland Ministry of Education 4 Mary Ann Place, Kaitaia Darroch Limited Christchurch [email protected] Open Market 2910697 Northland Ministry of Education 31 Purdy Street, Kaikohe Darroch Limited Christchurch [email protected] OTS Clearance 2910698 Northland Ministry of Education 33 Purdy Street, Kaikohe Darroch Limited Christchurch [email protected] OTS Clearance 2910711 Northland Ministry of Education 15 Ormonde Place, Kaikohe Darroch Limited Christchurch -

The Soils of Southland and Their Potential Uses E

THE SOILS OF SOUTHLAND AND THEIR POTENTIAL USES E. J. B. CUTLER, Pedologist, Soil Bureau, Department of Scientific and Industrial Research, Dunedin The pedologist should concern himself not only with mapping and classification of soils; he should examine the use to which soils are put and the changes that take place under varying kinds of use or misuse. The soil survey is only the starting point; it shows the physical, chemical and genetic characteristics of soils, their distribution and relationship to environment. First of all we are interested in the nature of our soils in their undisturbed native state. We can then~ follow the changes that have taken place with changing farming techniques and try to predict desirable changes or modifications; changes which will not only improve the short term production from the soils, but enable us to maintain long-term, sustained-yield production. These prin- ciples apply equally in the mountains and on the plains. Secondly we are interested in seeing that our soil resources arc used most efficiently; that usage of soils takes place in a logical way and that those concerned .with economics are aware of the limitations of the soil as well as of its potentialities. Thirdly there is the aesthetic viewpoint, perhaps not capable of strict scientific treatment but nonetheless a very important one to all of us as civilised people. There is no reason why our landscape should not be planned for pleasure as well as for profit. THE SOILS OF SOUTHLAND The basic soil pattern of Southland is fairly simple; there are three groups of soils delineated primarily by climatic factors. -

Bullinggillianm1991bahons.Pdf (4.414Mb)

THE UNIVERSITY LIBRARY PROTECTION OF AUTHOR ’S COPYRIGHT This copy has been supplied by the Library of the University of Otago on the understanding that the following conditions will be observed: 1. To comply with s56 of the Copyright Act 1994 [NZ], this thesis copy must only be used for the purposes of research or private study. 2. The author's permission must be obtained before any material in the thesis is reproduced, unless such reproduction falls within the fair dealing guidelines of the Copyright Act 1994. Due acknowledgement must be made to the author in any citation. 3. No further copies may be made without the permission of the Librarian of the University of Otago. August 2010 Preventable deaths? : the 1918 influenza pandemic in Nightcaps Gillian M Bulling A study submitted for the degree of Bachelor of Arts with Honours at the University of Otago, Dunedin, New Zealand. 1991 Created 7/12/2011 GILLIAN BULLING THE 1918 INFLUENZA PANDEMIC IN NIGHTCAPS PREFACE There are several people I would like to thank: for their considerable help and encouragement of this project. Mr MacKay of Wairio and Mrs McDougall of the Otautau Public Library for their help with the research. The staff of the Invercargill Register ofBirths, Deaths and Marriages. David Hartley and Judi Eathorne-Gould for their computing skills. Mrs Dorothy Bulling and Mrs Diane Elder 3 TABLE OF CONTENTS List of Tables and Figures 4 List of illustrations 4 Introduction , 6 Chapter one - Setting the Scene 9 Chapter two - Otautau and Nightcaps - Typical Country Towns? 35 Chapter three - The Victims 53 Conclusion 64 Appendix 66 Bibliography 71 4 TABLE OF ILLUSTRATIONS Health Department Notices .J q -20 Source - Southland Times November 1918 Influenza Remedies.