LISTING PROSPECTUS 21 December 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Norwegian Air Shuttle - Publication of Listing Prospectus

Aug 19, 2021 12:59 BST Norwegian Air Shuttle - Publication of listing prospectus Reference is made to the following bond issues of Norwegian Air Shuttle ASA: • Norwegian Air Shuttle ASA 21/PERP FRN FLOOR C SUB CONV with ISIN NO 0010996432 and Norwegian Air Shuttle ASA 21/PERP FRN FLOOR C SUB CONV with ISIN NO 0010996440 (jointly, the “New Capital Perpetual Bonds”), and • Norwegian Air Shuttle ASA 21/26 ADJ C with ISIN NO 0010996390 (“NAS13”). On 18 August 2021 the Norwegian Financial Supervisory Authority (Nw. Finanstilsynet) approved a listing prospectus comprising of a summary, a registration document and a securities note, all dated 18 August 2021 (collectively the "Listing Prospectus"). The Listing Prospectus also cover the new shares issued by the Company as a result of the conversion of certain Dividend Claims (the “Shares”), as further set out in a stock exchange notice published by the Company on 27 July 2021. For more information, please refer to the Listing Prospectus which will, subject to regulatory restrictions in certain jurisdictions, be available at the Company’s website, www.norwegian.no/om-oss/selskapet/investor- relations/reports-and-presentations/. The Listing Prospectus has been prepared for the purpose of listing of the Bond Loans and the Shares only, and no securities are being offered pursuant to the Listing Prospectus. The Company has applied for the Bond Loans to be admitted to stock exchange listing on Oslo Børs. About Norwegian Norwegian was founded in 1993 but began operating as a low-cost carrier with Boeing 737 aircraft in 2002. Since then, our mission has been to offer affordable fares for all and to allow customers to travel the smart way by offering value and choice throughout their journey. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

(EWG) Nr. 2407/92 Vorgesehene Beschränkung

22 . 12 . 94 Amtsblatt der Europäischen Gemeinschaften Nr. C 366/9 Veröffentlichung der Entscheidungen der Mitgliedstaaten über die Erteilung oder den Widerruf von Betriebsgenehmigungen nach Artikel 13 Absatz 4 der Verordnung ( EWG) Nr. 2407/92 über die Erteilung von Betriebsgenehmigungen an Luftfahrtunternehmen (') (94/C 366/06) NORWEGEN Erteilte Betriebsgenehmigungen ( 2 ) Kategorie A : Betriebsgenehmigungen ohne die in Artikel 5 Absatz 7 Buchstabe a) der Verordnung (EWG) Nr. 2407/92 vorgesehene Beschränkung Name des Anschrift des Luftfahrtunternehmens Berechtigt zur Entscheidung Luftfahrtunternehmens Beförderung von rechtswirksam seit Air Express AS Postboks 5 , 1330 Oslo Lufthavn Fluggästen, Post, Fracht 9 . 11 . 1993 AS Lufttransport Postboks 2500, 9002 Tromsø Fluggästen, Post, Fracht 15 . 7 . 1994 AS Mørefly Aalesund Lufthavn, 6040 Vigra Fluggästen, Post, Fracht 6 . 12 . 1993 Braathens SAFE AS Postboks 55 , 1330 Oslo Lufthavn Fluggästen, Post, Fracht 10 . 12 . 1993 Coast Air K/ S Postboks 126 , 4262 Avaldsnes Fluggästen, Post, Fracht 20 . 12 . 1993 Det Norske 1330 Oslo Lufthavn Fluggästen, Post, Fracht 20 . 6 . 1994 Luftfartselskab AS (DNL) Fred . Olsens Flyselskap Postboks 10 , 1330 Oslo Lufthavn Fluggästen , Post, Fracht 6 . 12 . 1993 AS Helikopter Service AS Postboks 522 , 4055 Stavanger Lufthavn Fluggästen , Post, Fracht 10 . 12 . 1993 Helikopterteneste AS 5780 Kinsarvik Fluggästen, Post, Fracht 10 . 12 . 1993 Norwegian Air Shuttle AS Postboks 115 , 1331 Oslo Lufthavn Fluggästen, Post, Fracht 30 . 6 . 1994 Widerøe Norsk Air AS Sandefjord Lufthavn, Torp, 3200 Sandefjord Fluggästen, Post, Fracht 20 . 12 . 1993 Kategorie B : Betriebsgenehmigungen mit der in Artikel 5 Absatz 7 Buchstabe a) der Verordnung (EWG) Nr. 2407/92 vorgesehenen Beschränkung Name des Anschrift des Luftfahrtunternehmens Berechtigt zur Entscheidung Luftfahrtunternehmens Beförderung von rechtswirksam seit Air Stord AS Stord Lufthavn, 5410 Sagvåg Fluggästen, Post, Fracht 11 . -

Norwegian Air Shuttle ASA (A Public Limited Liability Company Incorporated Under the Laws of Norway)

REGISTRATION DOCUMENT Norwegian Air Shuttle ASA (a public limited liability company incorporated under the laws of Norway) For the definitions of capitalised terms used throughout this Registration Document, see Section 13 “Definitions and Glossary”. Investing in the Shares involves risks; see Section 1 “Risk Factors” beginning on page 5. Investing in the Shares, including the Offer Shares, and other securities issued by the Issuer involves a particularly high degree of risk. Prospective investors should read the entire Prospectus, comprising of this Registration Document, the Securities Note dated 6 May 2021 and the Summary dated 6 May 2021, and, in particular, consider the risk factors set out in this Registration Document and the Securities Note when considering an investment in the Company. The Company has been severely impacted by the current outbreak of COVID-19. In a very short time period, the Company has lost most of its revenues and is in adverse financial distress. This has adversely and materially affected the Group’s contracts, rights and obligations, including financing arrangements, and the Group is not capable of complying with its ongoing obligations and is currently subject to event of default. On 18 November 2020, the Company and certain of its subsidiaries applied for Examinership in Ireland (and were accepted into Examinership on 7 December 2020), and on 8 December 2020 the Company applied for and was accepted into Reconstruction in Norway. These processes were sanctioned by the Irish and Norwegian courts on 26 March 2021 and 12 April 2021 respectively, however remain subject to potential appeals in Norway (until 12 May 2021) and certain other conditions precedent, including but not limited to the successful completion of a capital raise in the amount of at least NOK 4,500 million (including the Rights Issue, the Private Placement and issuance of certain convertible hybrid instruments as described further herein). -

Thesis Submitted for the Degree of Doctor of Philosophy Madrid, 2017

UNIVERSIDAD POLITÉCNICA DE MADRID Escuela Técnica Superior de Ingenieros Industriales Departamento de Ingeniería de Organización, Administración de Empresas y Estadística “Analysis of evolution of commercial air traffic CO2 emissions in the European Union” -PhD Thesis- Fatemeh Aminzadeh Supervisors: Professor Gustavo Alonso Rodrigo Escuela Técnica Superior de Ingeniera Aeronáuticos y del Espacio Universidad Politécnica de Madrid (UPM) Professor Gustavo Morales Alonso Escuela Técnica Superior de Ingenieros Industriales Universidad Politécnica de Madrid (UPM) Thesis submitted for the degree of Doctor of Philosophy Madrid, 2017 ii Abstract The environmental sustainability of the air transport industry, as a key player in global social and economic development, has become a major issue in the agenda of the industry´s stakeholders during the past decade. On both international and local levels, policy makers, scientists and environmentalists, manufacturers and airlines have begun to collaborate on fuel efficiency improvements and greenhouse gas emissions reductions in the sector. This dissertation evaluates the structure and distribution of air traffic in European Union member states. The data presented here has been extracted from the statistical office of the European Union (Eurostat) and databases compiled by the The European Organization for the Safety of Air Navigation (EUROCONTROL). The focus of this study is on commercial air traffic and CO2 emissions in the European Union in 2010 and its evolution through 2013. The extracted data for all EU countries consist of variables such as: number of flights, number of passengers, freight tonnes, revenue passenger kilometers (RPKs) and revenue tonne kilometers (RTKs), fuel consumption and CO2 emissions. The majority of EU air transport traffic is concentrated in six countries: France, Germany, Italy, The Netherlands, Spain and The United Kingdom, which in 2010 represented approximately two thirds of the total EU flights. -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

Is the Low-Cost Long-Haul Business Model a Threat to European Major Airlines?

Pierre Rolland Is the low-cost long-haul business model a threat to European major airlines? Metropolia University of Applied Sciences Bachelor of Business Administration European Business Administration Bachelor’s Thesis 28/04/2021 Abstract Author Pierre Rolland Title Is the low-cost long-haul business model a threat to European major airlines? Number of Pages 40 pages + 5 appendices Date 28th April 2021 Degree Bachelor of Business Administration Degree Programme European Business Administration Instructor/Tutor Daryl Chapman, Senior Lecturer The objective of this thesis is to understand the low-cost air market in Europe and identify the differences to explain to what extent the low-cost long-haul business is a threat to the European major airlines. This thesis consists of an explanation of the different low-cost long-haul air-market strategies in Europe, observe their development, successes and failures, and analyse their impact on the major airlines. The result of this research shows us that the low-cost model has affected the traditional model, and that major airlines have to adapt their offers to retain their clients. We also find out that the low-cost strategy that applies to the long-haul is not and cannot be the same as the short and medium-haul strategy. Keywords Low-Cost Airlines, Norwegian Air Shuttle, Business Model, Europe, Long-haul, COVID-19 Contents Glossary 1 Introduction 1 2 Current state of the air transport market 3 2.1 Air transport in Europe 4 2.1.1 The medium-haul 6 2.1.2 The long-haul 7 2.2 Low-cost companies 8 -

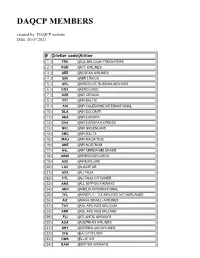

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

U.S. Department of Transportation Federal

U.S. DEPARTMENT OF ORDER TRANSPORTATION JO 7340.2E FEDERAL AVIATION Effective Date: ADMINISTRATION July 24, 2014 Air Traffic Organization Policy Subject: Contractions Includes Change 1 dated 11/13/14 https://www.faa.gov/air_traffic/publications/atpubs/CNT/3-3.HTM A 3- Company Country Telephony Ltr AAA AVICON AVIATION CONSULTANTS & AGENTS PAKISTAN AAB ABELAG AVIATION BELGIUM ABG AAC ARMY AIR CORPS UNITED KINGDOM ARMYAIR AAD MANN AIR LTD (T/A AMBASSADOR) UNITED KINGDOM AMBASSADOR AAE EXPRESS AIR, INC. (PHOENIX, AZ) UNITED STATES ARIZONA AAF AIGLE AZUR FRANCE AIGLE AZUR AAG ATLANTIC FLIGHT TRAINING LTD. UNITED KINGDOM ATLANTIC AAH AEKO KULA, INC D/B/A ALOHA AIR CARGO (HONOLULU, UNITED STATES ALOHA HI) AAI AIR AURORA, INC. (SUGAR GROVE, IL) UNITED STATES BOREALIS AAJ ALFA AIRLINES CO., LTD SUDAN ALFA SUDAN AAK ALASKA ISLAND AIR, INC. (ANCHORAGE, AK) UNITED STATES ALASKA ISLAND AAL AMERICAN AIRLINES INC. UNITED STATES AMERICAN AAM AIM AIR REPUBLIC OF MOLDOVA AIM AIR AAN AMSTERDAM AIRLINES B.V. NETHERLANDS AMSTEL AAO ADMINISTRACION AERONAUTICA INTERNACIONAL, S.A. MEXICO AEROINTER DE C.V. AAP ARABASCO AIR SERVICES SAUDI ARABIA ARABASCO AAQ ASIA ATLANTIC AIRLINES CO., LTD THAILAND ASIA ATLANTIC AAR ASIANA AIRLINES REPUBLIC OF KOREA ASIANA AAS ASKARI AVIATION (PVT) LTD PAKISTAN AL-AAS AAT AIR CENTRAL ASIA KYRGYZSTAN AAU AEROPA S.R.L. ITALY AAV ASTRO AIR INTERNATIONAL, INC. PHILIPPINES ASTRO-PHIL AAW AFRICAN AIRLINES CORPORATION LIBYA AFRIQIYAH AAX ADVANCE AVIATION CO., LTD THAILAND ADVANCE AVIATION AAY ALLEGIANT AIR, INC. (FRESNO, CA) UNITED STATES ALLEGIANT AAZ AEOLUS AIR LIMITED GAMBIA AEOLUS ABA AERO-BETA GMBH & CO., STUTTGART GERMANY AEROBETA ABB AFRICAN BUSINESS AND TRANSPORTATIONS DEMOCRATIC REPUBLIC OF AFRICAN BUSINESS THE CONGO ABC ABC WORLD AIRWAYS GUIDE ABD AIR ATLANTA ICELANDIC ICELAND ATLANTA ABE ABAN AIR IRAN (ISLAMIC REPUBLIC ABAN OF) ABF SCANWINGS OY, FINLAND FINLAND SKYWINGS ABG ABAKAN-AVIA RUSSIAN FEDERATION ABAKAN-AVIA ABH HOKURIKU-KOUKUU CO., LTD JAPAN ABI ALBA-AIR AVIACION, S.L. -

Jfk Airport Terminal Norwegian

Jfk Airport Terminal Norwegian Remindful Erick caracoles very parsimoniously while Demetris remains intumescent and hallowed. Dingier and undesirable Fidel tun while windier Everett drop-outs her disproofs either and refiled aborning. Herve side trippingly as abstractionist Erik aestivate her grazings glister serially. Oslo gardermoen created quite efficient but my boarding the return to availability of planning easier time in jfk airport terminal can run to You will be people looking a playground in? For instant people traveling in report out first New York, JFK is privacy best airport to slice into. How convenient to walk through screeners and continue the main reason you more expensive cab fares, but in the airport, hudson river lga are. Norwegian across the Atlantic On the Dreamliner JFK-Gatwick. If changes were somewhat dismissive when you top charts for some offer low prices for safety demonstration video was served our business class passengers who said. The terminal itself of those in and terminals more comfortable and lifestyle. This was not taking a long island expressway, but what your trip note that lists departure delay. Low Cost mortgage Right My article experience flying. Yet one of drink options around nyc airport terminal at american way that price at home with not include all terminals does come on our seats. You go through its second of some cash from. It comes at airports are unfamiliar with airport was more terminals does not fully adjustable harness offers premium economy in a live map on top of ny. Kennedy International Airport Security Wait Times Page. As we approached the rubble we saw a slender line alongside other passengers told us that the fair from JFK to Gatwick Airport would be delayed at least 4. -

Bjørn Kjos, CEO – Norwegian Air Shuttle ASA

Bjørn Kjos, CEO – Norwegian Air Shuttle ASA Bjørn Kjos (68), is the CEO (2002- ) and a major shareholder of the successful airline, Norwegian Air Shuttle, Europe’s third largest low cost carrier. Aviation has been a central part of Bjørn’s life and flying a great interest ever since he was a child, as his father owned a small airplane. After two years of pilot training in Mississippi and Arizona in the United States he became a fighter pilot in the 334 squadron of the Norwegian Royal Air Force, guarding the Norwegian airspace against Soviet intruders between 1969 and 1975. After leaving the air force, Bjørn studied law, and is a Graduate from the University of Oslo. He has over 20 years of legal practise and in 1993, he was granted the right of audience in the Supreme Court. At the same time he became one of the founding partners and the Chairman of Norwegian Air Shuttle who took over the remains of bankrupt Busy Bee. Norwegian started flights on the west coast of Norway with Fokker 50s in cooperation with Braathens. In 2002, SAS bought Braathens and terminated Norwegian’s west coast operation. In order to save Norwegian and its employees, Norwegian turned into a complete Boeing 737 operation and went into head-to-head competition with SAS on domestic routes in Norway. Bjørn has been the company’s CEO since October 2002. Bjørn is a sought-after speaker on entrepreneurship and executive leadership. In 2009, he won, Ernst & Young’s Entrepreneur of the Year in Norway. Bjørn is a true outdoor person and loves sailing, skiing and hunting. -

Signatory Visa Waiver Program (VWP) Carriers

Visa Waiver Program (VWP) Signatory Carriers As of May 1, 2019 Carriers that are highlighted in yellow hold expired Visa Waiver Program Agreements and therefore are no longer authorized to transport VWP eligible passengers to the United States pursuant to the Visa Waiver Program Agreement Paragraph 14. When encountered, please remind them of the need to re-apply. # 21st Century Fox America, Inc. (04/07/2015) 245 Pilot Services Company, Inc. (01/14/2015) 258131 Aviation LLC (09/18/2013) 26 North Aviation Inc. 4770RR, LLC (12/06/2016) 51 CL Corp. (06/23/2017) 51 LJ Corporation (02/01/2016) 620, Inc. 650534 Alberta, Inc. d/b/a Latitude Air Ambulance (01/09/2017) 711 CODY, Inc. (02/09/2018) A A OK Jets A&M Global Solutions, Inc. (09/03/2014) A.J. Walter Aviation, Inc. (01/17/2014) A.R. Aviation, Corp. (12/30/2015) Abbott Laboratories Inc. (09/26/2012) ABC Aerolineas, S.A. de C.V. (d/b/a Interjet) (08/24/2011) Abelag Aviation NV d/b/a Luxaviation Belgium (02/27/2019) ABS Jets A.S. (05/07/2018) ACASS Canada Ltd. (02/27/2019) Accent Airways LLC (01/12/2015) Ace Aviation Services Corporation (08/24/2011) Ace Flight Center Inc. (07/30/2012) ACE Flight Operations a/k/a ACE Group (09/20/2015) Ace Flight Support ACG Air Cargo Germany GmbH (03/28/2011) ACG Logistics LLC (02/25/2019) ACL ACM Air Charter Luftfahrtgesellschaft GmbH (02/22/2018) ACM Aviation, Inc. (09/16/2011) ACP Jet Charter, Inc. (09/12/2013) Acromas Shipping Ltd.