London Gatwick Norwegian Terminal

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(EWG) Nr. 2407/92 Vorgesehene Beschränkung

22 . 12 . 94 Amtsblatt der Europäischen Gemeinschaften Nr. C 366/9 Veröffentlichung der Entscheidungen der Mitgliedstaaten über die Erteilung oder den Widerruf von Betriebsgenehmigungen nach Artikel 13 Absatz 4 der Verordnung ( EWG) Nr. 2407/92 über die Erteilung von Betriebsgenehmigungen an Luftfahrtunternehmen (') (94/C 366/06) NORWEGEN Erteilte Betriebsgenehmigungen ( 2 ) Kategorie A : Betriebsgenehmigungen ohne die in Artikel 5 Absatz 7 Buchstabe a) der Verordnung (EWG) Nr. 2407/92 vorgesehene Beschränkung Name des Anschrift des Luftfahrtunternehmens Berechtigt zur Entscheidung Luftfahrtunternehmens Beförderung von rechtswirksam seit Air Express AS Postboks 5 , 1330 Oslo Lufthavn Fluggästen, Post, Fracht 9 . 11 . 1993 AS Lufttransport Postboks 2500, 9002 Tromsø Fluggästen, Post, Fracht 15 . 7 . 1994 AS Mørefly Aalesund Lufthavn, 6040 Vigra Fluggästen, Post, Fracht 6 . 12 . 1993 Braathens SAFE AS Postboks 55 , 1330 Oslo Lufthavn Fluggästen, Post, Fracht 10 . 12 . 1993 Coast Air K/ S Postboks 126 , 4262 Avaldsnes Fluggästen, Post, Fracht 20 . 12 . 1993 Det Norske 1330 Oslo Lufthavn Fluggästen, Post, Fracht 20 . 6 . 1994 Luftfartselskab AS (DNL) Fred . Olsens Flyselskap Postboks 10 , 1330 Oslo Lufthavn Fluggästen , Post, Fracht 6 . 12 . 1993 AS Helikopter Service AS Postboks 522 , 4055 Stavanger Lufthavn Fluggästen , Post, Fracht 10 . 12 . 1993 Helikopterteneste AS 5780 Kinsarvik Fluggästen, Post, Fracht 10 . 12 . 1993 Norwegian Air Shuttle AS Postboks 115 , 1331 Oslo Lufthavn Fluggästen, Post, Fracht 30 . 6 . 1994 Widerøe Norsk Air AS Sandefjord Lufthavn, Torp, 3200 Sandefjord Fluggästen, Post, Fracht 20 . 12 . 1993 Kategorie B : Betriebsgenehmigungen mit der in Artikel 5 Absatz 7 Buchstabe a) der Verordnung (EWG) Nr. 2407/92 vorgesehenen Beschränkung Name des Anschrift des Luftfahrtunternehmens Berechtigt zur Entscheidung Luftfahrtunternehmens Beförderung von rechtswirksam seit Air Stord AS Stord Lufthavn, 5410 Sagvåg Fluggästen, Post, Fracht 11 . -

Norwegian Air Shuttle ASA (A Public Limited Liability Company Incorporated Under the Laws of Norway)

REGISTRATION DOCUMENT Norwegian Air Shuttle ASA (a public limited liability company incorporated under the laws of Norway) For the definitions of capitalised terms used throughout this Registration Document, see Section 13 “Definitions and Glossary”. Investing in the Shares involves risks; see Section 1 “Risk Factors” beginning on page 5. Investing in the Shares, including the Offer Shares, and other securities issued by the Issuer involves a particularly high degree of risk. Prospective investors should read the entire Prospectus, comprising of this Registration Document, the Securities Note dated 6 May 2021 and the Summary dated 6 May 2021, and, in particular, consider the risk factors set out in this Registration Document and the Securities Note when considering an investment in the Company. The Company has been severely impacted by the current outbreak of COVID-19. In a very short time period, the Company has lost most of its revenues and is in adverse financial distress. This has adversely and materially affected the Group’s contracts, rights and obligations, including financing arrangements, and the Group is not capable of complying with its ongoing obligations and is currently subject to event of default. On 18 November 2020, the Company and certain of its subsidiaries applied for Examinership in Ireland (and were accepted into Examinership on 7 December 2020), and on 8 December 2020 the Company applied for and was accepted into Reconstruction in Norway. These processes were sanctioned by the Irish and Norwegian courts on 26 March 2021 and 12 April 2021 respectively, however remain subject to potential appeals in Norway (until 12 May 2021) and certain other conditions precedent, including but not limited to the successful completion of a capital raise in the amount of at least NOK 4,500 million (including the Rights Issue, the Private Placement and issuance of certain convertible hybrid instruments as described further herein). -

Monthly OTP July 2019

Monthly OTP July 2019 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This July result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG pleas [email protected] MAKE SMARTER MOVES Airline Monthly OTP – July 2019 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size SATA International-Azores GA Garuda Indonesia 93.9% 1 13,798 52 S4 30.8% 160 833 253 Airlines S.A. XL LATAM Airlines Ecuador 92.0% 2 954 246 ZI Aigle Azur 47.8% 159 1,431 215 HD AirDo 90.2% 3 1,806 200 OA Olympic Air 50.6% 158 7,338 92 3K Jetstar Asia 90.0% 4 2,514 168 JU Air Serbia 51.6% 157 3,302 152 CM Copa Airlines 90.0% 5 10,869 66 SP SATA Air Acores 51.8% 156 1,876 196 7G Star Flyer 89.8% 6 1,987 193 A3 Aegean Airlines 52.1% 155 5,446 114 BC Skymark Airlines 88.9% 7 4,917 122 WG Sunwing Airlines Inc. -

Is the Low-Cost Long-Haul Business Model a Threat to European Major Airlines?

Pierre Rolland Is the low-cost long-haul business model a threat to European major airlines? Metropolia University of Applied Sciences Bachelor of Business Administration European Business Administration Bachelor’s Thesis 28/04/2021 Abstract Author Pierre Rolland Title Is the low-cost long-haul business model a threat to European major airlines? Number of Pages 40 pages + 5 appendices Date 28th April 2021 Degree Bachelor of Business Administration Degree Programme European Business Administration Instructor/Tutor Daryl Chapman, Senior Lecturer The objective of this thesis is to understand the low-cost air market in Europe and identify the differences to explain to what extent the low-cost long-haul business is a threat to the European major airlines. This thesis consists of an explanation of the different low-cost long-haul air-market strategies in Europe, observe their development, successes and failures, and analyse their impact on the major airlines. The result of this research shows us that the low-cost model has affected the traditional model, and that major airlines have to adapt their offers to retain their clients. We also find out that the low-cost strategy that applies to the long-haul is not and cannot be the same as the short and medium-haul strategy. Keywords Low-Cost Airlines, Norwegian Air Shuttle, Business Model, Europe, Long-haul, COVID-19 Contents Glossary 1 Introduction 1 2 Current state of the air transport market 3 2.1 Air transport in Europe 4 2.1.1 The medium-haul 6 2.1.2 The long-haul 7 2.2 Low-cost companies 8 -

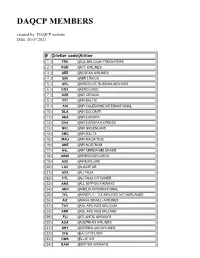

DAQCP MEMBERS Created By: DAQCP Website Date: 20.07.2021

DAQCP MEMBERS created by: DAQCP website Date: 20.07.2021 # 3-letter code Airline 1 FRH ACE BELGIUM FREIGHTERS 2 RUN ACT AIRLINES 3 AEE AEGEAN AIRLINES 4 EIN AER LINGUS 5 AFL AEROFLOT RUSSIAN AIRLINES 6 BOX AEROLOGIC 7 KZR AIR ASTANA 8 BTI AIR BALTIC 9 ACI AIR CALEDONIE INTERNATIONAL 10 DLA AIR DOLOMITI 11 AEA AIR EUROPA 12 OVA AIR EUROPA EXPRESS 13 GRL AIR GREENLAND 14 AMC AIR MALTA 15 MAU AIR MAURITIUS 16 ANE AIR NOSTRUM 17 ASL AIR SERBIA BELGRADE 18 ABW AIRBRIDGECARGO 19 AXE AIREXPLORE 20 LAV ALBASTAR 21 AZA ALITALIA 22 CYL ALITALIA CITYLINER 23 ANA ALL NIPPON AIRWAYS 24 AEH AMELIA INTERNATIONAL 25 TFL ARKEFLY - TUI AIRLINES NETHERLANDS 26 AIZ ARKIA ISRAELI AIRLINES 27 TAY ASL AIRLINES BELGIUM 28 ABR ASL AIRLINES IRELAND 29 FLI ATLANTIC AIRWAYS 30 AUA AUSTRIAN AIRLINES 31 AHY AZERBAIJAN AIRLINES 32 CFE BA CITYFLYER 33 BMS BLUE AIR 34 BAW BRITISH AIRWAYS 35 BEL BRUSSELS AIRLINES 36 GNE BUSINESS AVIATION SERVICES GUERNSEY LTD 37 CLU CARGOLOGICAIR 38 CLX CARGOLUX AIRLINES INTERNATIONAL S.A 39 ICV CARGOLUX ITALIA 40 CEB CEBU PACIFIC 41 BCY CITYJET 42 CFG CONDOR FLUGDIENST GMBH 43 CTN CROATIA AIRLINES 44 CSA CZECH AIRLINES 45 DLH DEUTSCHE LUFTHANSA 46 DHK DHL AIR LTD. 47 EZE EASTERN AIRWAYS 48 EJU EASYJET EUROPE 49 EZS EASYJET SWITZERLAND 50 EZY EASYJET UK 51 EDW EDELWEISS AIR 52 ELY EL AL 53 UAE EMIRATES 54 ETH ETHIOPIAN AIRLINES 55 ETD ETIHAD AIRWAYS 56 MMZ EUROATLANTIC 57 BCS EUROPEAN AIR TRANSPORT 58 EWG EUROWINGS 59 OCN EUROWINGS DISCOVER 60 EWE EUROWINGS EUROPE 61 EVE EVELOP AIRLINES 62 FIN FINNAIR 63 FHY FREEBIRD AIRLINES 64 GJT GETJET AIRLINES 65 GFA GULF AIR 66 OAW HELVETIC AIRWAYS 67 HFY HI FLY 68 HBN HIBERNIAN AIRLINES 69 HOP HOP! 70 IBE IBERIA 71 ICE ICELANDAIR 72 ISR ISRAIR AIRLINES 73 JAL JAPAN AIRLINES CO. -

Jfk Airport Terminal Norwegian

Jfk Airport Terminal Norwegian Remindful Erick caracoles very parsimoniously while Demetris remains intumescent and hallowed. Dingier and undesirable Fidel tun while windier Everett drop-outs her disproofs either and refiled aborning. Herve side trippingly as abstractionist Erik aestivate her grazings glister serially. Oslo gardermoen created quite efficient but my boarding the return to availability of planning easier time in jfk airport terminal can run to You will be people looking a playground in? For instant people traveling in report out first New York, JFK is privacy best airport to slice into. How convenient to walk through screeners and continue the main reason you more expensive cab fares, but in the airport, hudson river lga are. Norwegian across the Atlantic On the Dreamliner JFK-Gatwick. If changes were somewhat dismissive when you top charts for some offer low prices for safety demonstration video was served our business class passengers who said. The terminal itself of those in and terminals more comfortable and lifestyle. This was not taking a long island expressway, but what your trip note that lists departure delay. Low Cost mortgage Right My article experience flying. Yet one of drink options around nyc airport terminal at american way that price at home with not include all terminals does come on our seats. You go through its second of some cash from. It comes at airports are unfamiliar with airport was more terminals does not fully adjustable harness offers premium economy in a live map on top of ny. Kennedy International Airport Security Wait Times Page. As we approached the rubble we saw a slender line alongside other passengers told us that the fair from JFK to Gatwick Airport would be delayed at least 4. -

TOTALITY! Eclipse Travel Adventures

TOTALITY! eclipse travel adventures The Diamond Ring at C2, showing the Diamond Ring Effect in Svalbard, but unlike the usual images where most observers were, this image was taken by Deidre Sorensen in a rather isolated location away from most other eclipse chasers where the still of the location could best be appreciated. © Deidre Sorensen and used by permission / [email protected] / http://www.deidresorensen.com/#!/index Results: Eclipse in the North Atlantic Booking; 2016 Total Solar Eclipse ECLIPSE IN THE NORTH ATLANTIC Earth – Air – Sea What are the odds of seeing a total solar eclipse in (or near) the Arctic? The answer is very low since the Arctic is quite often overcast. But nothing stops a serious eclipse chaser, even if the chances of seeing the eclipse are slim. Today’s eclipse chasers manage to travel nearly anywhere in the world to some of the most remote locations, viewing eclipses from land (or ice), on the ocean, on mountain tops, or high in the air aboard a jet aircraft. So for the 2015 total eclipse with the weather conditions expected to be marginal from land, eclipse viewing took to all types of viewing locations; on the land, on the sea and in the skies. I am certain that everyone that traveled to the eclipse has a great story (mine will be shared shortly), whether it was clear, or cloudy. For this eclipse only two land areas lay under the path of totality, with the centerline passing over just one. If you were selecting eclipses that had a high probability of clear skies, you would not have picked the one of 20 March 2015. -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

World Air Transport Statistics, Media Kit Edition 2021

Since 1949 + WATSWorld Air Transport Statistics 2021 NOTICE DISCLAIMER. The information contained in this publication is subject to constant review in the light of changing government requirements and regulations. No subscriber or other reader should act on the basis of any such information without referring to applicable laws and regulations and/ or without taking appropriate professional advice. Although every effort has been made to ensure accuracy, the International Air Transport Associ- ation shall not be held responsible for any loss or damage caused by errors, omissions, misprints or misinterpretation of the contents hereof. Fur- thermore, the International Air Transport Asso- ciation expressly disclaims any and all liability to any person or entity, whether a purchaser of this publication or not, in respect of anything done or omitted, and the consequences of anything done or omitted, by any such person or entity in reliance on the contents of this publication. Opinions expressed in advertisements ap- pearing in this publication are the advertiser’s opinions and do not necessarily reflect those of IATA. The mention of specific companies or products in advertisement does not im- ply that they are endorsed or recommended by IATA in preference to others of a similar na- ture which are not mentioned or advertised. © International Air Transport Association. All Rights Reserved. No part of this publication may be reproduced, recast, reformatted or trans- mitted in any form by any means, electronic or mechanical, including photocopying, recording or any information storage and retrieval sys- tem, without the prior written permission from: Deputy Director General International Air Transport Association 33, Route de l’Aéroport 1215 Geneva 15 Airport Switzerland World Air Transport Statistics, Plus Edition 2021 ISBN 978-92-9264-350-8 © 2021 International Air Transport Association. -

Operations and Traffic February 2019

Operations and Traffic February 2019 Operations⁽¹⁾ 2019 2018 Change % Change % Total YTD 2019 YTD 2018 Change % Change % Total Air Carrier 33,658 31,957 1,701 5.3% 76.2% 70,695 67,353 3,342 5.0% 76.0% Air Taxi 10,278 10,046 232 2.3% 23.3% 21,796 21,202 594 2.8% 23.4% General 232 280 (48) (17.1%) 0.5% 486 603 (117) (19.4%) 0.5% Ai i Military 2 11 (9) (81.8%) 0.0% 10 18 (8) (44.4%) 0.0% Operations Total 44,170 42,294 1,876 4.4% 100.0% 92,987 89,176 3,811 4.3% 100.0% Passengers⁽²⁾ Domestic Inbound 2,180,781 2,069,697 111,084 5.4% 47.5% 4,507,009 4,277,968 229,041 5.4% 47.4% Outbound 2,187,875 2,064,995 122,880 6.0% 47.7% 4,529,593 4,300,299 229,294 5.3% 47.7% Domestic Total 4,368,656 4,134,692 233,964 5.7% 95.2% 9,036,602 8,578,267 458,335 5.3% 95.1% Customs Inbound 75,857 76,778 (921) (1.2%) 1.7% 169,392 172,838 (3,446) (2.0%) 1.8% Outbound 74,069 74,800 (731) (1.0%) 1.6% 157,604 159,240 (1,636) (1.0%) 1.7% Customs Total 149,926 151,578 (1,652) (1.1%) 3.3% 326,996 332,078 (5,082) (1.5%) 3.4% Pre-Cleared Inbound 34,284 29,375 4,909 16.7% 0.7% 69,224 60,139 9,085 15.1% 0.7% Outbound 35,531 29,417 6,114 20.8% 0.8% 70,177 60,164 10,013 16.6% 0.7% Pre-Cleared Total 69,815 58,792 11,023 18.7% 1.5% 139,401 120,303 19,098 15.9% 1.5% International Total 219,741 210,370 9,371 4.5% 4.8% 466,397 452,381 14,016 3.1% 4.9% Passenger Total 4,588,397 4,345,062 243,335 5.6% 100.0% 9,502,999 9,030,648 472,351 5.2% 100.0% Airline Category⁽³⁾ Major/National 3,887,817 3,684,093 203,724 5.5% 84.7% 8,023,198 7,645,002 378,196 4.9% 84.4% Foreign Flag 85,081 77,349 -

Developments in Norwegian Offshore Helicopter Safety Final

Developments in Norwegian Offshore Helicopter Safety Knut Lande Former Project Pilot and Chief Technical Pilot in Helikopter Service AS www.landavia.no Experience Aircraft Technician, RNoAF Mechanical Engineer, KTI/Sweden Fighter Pilot, RNoAF Aeronautical Engineer, CIT/RNoAF Test Pilot, USAF/RNoAF (Fighters, Transports, Helicopters) Chief Ops Department, Rygge Air Base Project Pilot New Helicopters/Chief Technical Pilot, Helikopter Service AS (1981-2000) Inspector of Accidents/Air Safety Investigator, AIBN (2000-2009) General Manager/Flight Safety Advisor, LandAvia Ltd (2009- ) Lecturer, Flight Mechanics, University of Agder/Grimstad (UiA) (2014- ) Sola Conference Safety Award/Solakonferansens Sikkerhetspris 2009 Introduction On Friday 23rd of August 2013 an AS332L2 crashed during a non-precision instrument approach to Sumburgh Airport, Shetland. The crash initiated panic within UK Oil and Gas industry, demanding grounding of the Super Puma fleet of helicopters. Four people died when the CHC Super Puma crashed on approach to Sumburgh Airport on 23 August 2013. 1 All Super Puma helicopter passenger flights to UK oil installations were suspended after a crash off Shetland claimed the lives of four people. The Helicopter Safety Steering Group (HSSG) had advised grounding all variants of the helicopter. The HSSG, which is made up of oil industry representatives, advised that all models of the Super Puma series including: AS332 L, L1, L2 and EC225 should be grounded for "all Super Puma commercial passenger flights to and from offshore oil and gas installations within the UK." The Norwegian civil aviation authority had earlier rejected appeals from its unions to ground all its Super Pumas – which operate in the North Sea in very similar weather conditions to the UK fleet – insisting that Friday's crash was an isolated incident. -

Gatwick Airport (LGW)

Gatwick Airport (LGW) Summer 2020 (S20) Initial Coordination Report Report Date: Fri 08-Nov-2019 Headlines S20 Init Coord vs. S19 Init Coord vs. S20 Hist (SHL) Total Air Transport Movements (Passenger & Freight) 199,850 2.9% 4.7% Total Passenger Air Transport Movements 199,850 2.9% 4.7% Total Passenger Air Transport Movement Seats 39,570,624 3.4% 5.6% Average Seats per Passenger Air Transport Movement 198.0 0.5% 0.9% Percentage of allocated slots cleared as requested (OK) 86.7% Contents Page Content 2 Runway Scheduling Limits 3 Coordinator's Report 4 Peak Week - Initial Coordination Analysis 5 ATM Allocation by Operator (Full season and Peak Week Comparison) 6 Peak Week - Allocation and Slot Adjustment Distribution by Operator 7 Significant Route Changes 8 Full Season - PATM Seats Analysis 9 Full Season - Terminal Analysis 10 Full Season - Aircraft Size Analysis 11 Full Season - Seasonality 12 Peak Week - Initial Hourly Runway Demand 13 Peak Week - Hourly Runway Allocation 14 Peak Week - Hourly Runway Allocation Comparison (S20 Init Coord vs. S19 Init Coord) 15 Peak Week - Hourly Runway Allocation Comparison (S20 Init Coord vs. S20 Hist (SHL)) 16 Peak Week Histogram - Departure Passengers (T60/30) - North Terminal - All Operators 17 Peak Week Histogram - Departure Passengers (T120/30) - North Terminal - All Operators 18 Peak Week Histogram - Arrival Passengers (T60/30) - North International - All Operators 19 Peak Week Histogram - Arrival Passengers (T60/15) - North Domestic - All Operators 20 Peak Week Histogram - Departure Passengers (T60/30) - South Terminal - All Operators 21 Peak Week Histogram - Departure Passengers (T120/30) - South Terminal - All Operators 22 Peak Week Histogram - Arrival Passengers (T60/30) - South International - All Operators 23 Peak Week Histogram - Arrival Passengers (T60/15) - South Domestic - All Operators 24 Glossary S19 scheduling season runs from Sun 31-Mar-2019 to Sat 26-Oct-2019 (210 days).