Balkrishna Industries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nominee List

NOMINEE LIST Best financial reporting (large cap) Cipla Hindalco Industries Hindustan Unilever Infosys Kotak Mahindra Bank Mahindra & Mahindra Piramal Enterprises Tata Steel Vedanta Best financial reporting (small to mid-cap) CEAT Everest Industries Hikal Hindustan Foods IIFL Holdings KEC International Minda Industries Raymond The Phoenix Mills Zensar Technologies Best investor meetings (large cap) Bharti Airtel Hindustan Unilever Infosys Lupin Mahindra & Mahindra Piramal Enterprises Best investor meetings (mid-cap) Balkrishna Industries IIFL Holdings Mindtree RPG Group Sterlite Technologies The Phoenix Mills NOMINEE LIST Best investor meetings (small cap) Amber Enterprises India Equitas Holdings Greenlam Industries Music Broadcast Navin Fluorine International NOCIL Raymond Zensar Technologies Best investor relations officer (large cap) Bharti Airtel Komal Sharan Bharti Airtel Aparna Vyas Garg Bharti Infratel Surabhi Chandna Cipla Naveen Bansal HDFC Conrad D'Souza Hindustan Unilever Suman Hegde Infosys Sandeep Mahindroo Kotak Mahindra Bank Nimesh Kampani Lupin Arvind Bothra Best investor relations officer (small to mid-cap) CEAT Pulkit Bhandari Jindal Steel & Power Nishant Baranwal Motilal Oswal Financial Services Rakesh Shinde PNB Housing Finance Deepika Gupta Padhi Raymond J Mukund RPG Group Pulkit Bhandari Schneider Electric Infrastructure Vineet Jain The Phoenix Mills Varun Parwal NOMINEE LIST Best investor relations team (large cap) Bharti Airtel Cipla Hindustan Unilever Infosys Kotak Mahindra Bank Larsen & Toubro Infotech Power -

Marketgrader India All-Cap Growth Leaders Index

Fact Sheet MarketGrader MarketGrader India All-Cap Growth Leaders Index RESEARCH & INDEXES The MarketGrader India All-Cap Growth Leaders Index consists of the 80 most fundamentally sound companies with the best growth prospects in India, whose shares are listed in the country’s national exchanges or in the United States. Its objective is to give investors access to the best companies in the world’s fastest growing large economy without overpaying for their shares. Constituents are selected across all market cap segments and all economic sectors after they have passed rigorous size and liquidity filters. Index Rules Performance Investable Universe CumulativeIndia Growth Leaders Total Return, Jan. 2008 - Jul. 2021 All data as of July 30, 2021 All companies domiciled in India that have 175% received a MarketGrader Score consistently for at least six months, whose shares are 150% listed on the National Stock Exchange, the 125% Bombay Stock Exchange or on U.S. national 100% exchanges. 75% Regulatory Requirements 50% Stocks are ineligible for Index selection if 25% they are included in the ‘Red Flag List,’ 0% maintained and published by the National Securities Depository Limited (NDSL) of India, -25% or on the ‘Breach List,’ maintained by the -50% Central Depository Services (India) Limited 07/30/21 -75% (CDSL), both of which govern foreign own- 12/31/07 12/31/08 12/31/09 12/31/10 12/30/11 12/31/12 12/31/13 12/31/14 12/31/15 12/30/16 12/29/17 12/31/18 12/31/19 12/31/20 ership limits of Indian securities. -

Company Reliance Industries Limited Tata Consultancy Services

Top 1000 Private Sector Companies (Rank-wise List) Company Reliance Industries Limited Tata Consultancy Services (TCS) Infosys Technologies Ltd Wipro Limited Bharti Tele-Ventures Limited ITC Limited Hindustan Lever Limited ICICI Bank Limited Housing Development Finance Corp. Ltd. TATA Steel Limited Ranbaxy Laboratories Limited HDFC Bank Ltd Tata Motors Limited Larsen & Toubro Limited (L&T) Satyam Computer Services Ltd. Maruti Udyog Limited Bajaj Auto Ltd. HCL Technologies Ltd. Hero Honda Motors Limited Hindalco Industries Ltd Reliance Energy Limited Grasim Industries Limited Jet Airways (India) Ltd. Sun Pharmaceuticals Industries Ltd Cipla Ltd. Gujarat Ambuja Cements Ltd. Videsh Sanchar Nigam Limited The Tata Power Company Limited Sterlite Industries (India) Ltd. Associated Cement Companies Ltd. Nestlé India Ltd. Hindustan Zinc Limited GlaxoSmithKline Pharmaceuticals Limited Siemens India Ltd. Motor Industries Company Limited Mahindra & Mahindra Limited UTI Bank Ltd. Zee Telefilms Limited Bharat Forge Limited ABB Limited i-Flex Solutions Ltd. Dr. Reddy's Laboratories Ltd. Nicholas Piramal India Limited Kotak Mahindra Bank Limited Reliance Capital Ltd. Ultra Tech Cement Ltd. Patni Computer Systems Ltd. Wockhardt Limited Indian Petrochemicals Corporation Limited Biocon India Limited Essar Oil Limited. Asian Paints Ltd. Dabur India Limited Jaiprakash Associates Limited JSW Steel Limited Tata Chemicals Limited Tata Tea Limited Tata Teleservices (Maharashtra) Limited The Indian Hotels Co. Ltd. Glenmark Pharmaceuticals Limited NIRMA Limited Jindal Steel & Power Ltd HCL Infosystems Ltd. Cadila Healthcare Limited Colgate-Palmolive (India) Limited The Great Eastern Shipping Company Limited Aventis Pharma India Ltd Ashok Leyland Limited Pantaloon Retail (India) Limited Indian Rayon And Industries Limited Financial Technologies (India) Ltd United Phosphorus Limited Matrix Laboratories Limited Sesa Goa Limited Lupin Ltd Cummins India Limited Crompton Greaves Limited. -

Balkrishna Industries (BALIND)

Balkrishna Industries (BALIND) CMP: | 1,450 Target: | 1,700 (17%) Target Period: 12 months BUY November 8, 2020 Robust performance, firm growth prospects lie ahead Balkrishna Industries (BIL) reported stellar Q2FY21 results. Standalone revenue was at | 1,579 crore (up 47% YoY), amid ~36% rise in volumes to 61,224 MT. Margins rose 903 bps YoY to a near five-year high of 34% amid Particulars 494 bps gross margin expansion and savings in employee costs and other P articular ₹ crore expenses. Consequent PAT came in at | 340 crore (up 16.7% YoY). BIL Market Capitalization 28,031 Update declared second interim dividend of | 4/share (record date: November 14). Total Debt (FY20) 861.2 Healthy demand, market share gains keep outlook constructive C ash & Inv (F Y 20) 1,108.6 E V (₹ C rore) 27,783.6 Result BIL is the market leader in the niche export-oriented off-highway tyre (OHT) 52 week H/L (₹) 1515 / 678 segment. As of H1FY21, agri, OTR demand formed 64%, 33%, respectively, E quity capital (₹ crore) 38.7 Face value (₹) 2.0 of end user applications, while in term of geographies Europe (51%), India (23%), North America (14%) constituted its major markets. Replacement demand formed 71% of overall pie. Demand prospects for its products Price Chart remain healthy, particularly on the Europe agri side, where it has gained 1500 14,000 market share in aftermarket amid overall positivity for the industry. The 12,000 company continues to introduce new SKUs (average of ~100 every year) 1000 10,000 8,000 and engage in brand building (via ad spends) in order to gain incremental 6,000 500 4,000 market share. -

Balkrishna Industries (BALIND)

Balkrishna Industries (BALIND) CMP: | 1,896 Target: | 2,250 (19%) Target Period: 12 months BUY May 16, 2021 Superlative growth justifies premium valuations… Balkrishna Industries (BIL) reported robust Q4FY21 numbers. Standalone revenue came in at | 1,746 crore (up 28.6% YoY) tracking 17.3% YoY growth Particulars in tonnage to best ever level of 68,002 MT. EBITDA margins at 31.0% were down a mere 63 bps QoQ amid 120 bps lower gross margins amid Particular ₹ crore Market Capitalization 36,653 sequential savings in employee costs and other expenses (as percentage of Total Debt (FY21P) 893 Update sales). Consequent PAT in Q4FY21 came in at | 372 crore, up 44.6% YoY, Cash & Inv (FY21P) 1,475 aided partly by higher other income (includes forex gains of | 38 crore). The EV (₹ Crore) 36,071 company declared a final dividend of | 5/share for FY21, with total dividend 52 week H/L (₹) 1966 / 915 Result declared for FY21 including interim dividend standing at | 17/share. Equity capital (₹ crore) 38.7 Face value (₹) 2.0 Conducive macroeconomics, double-digit growth on the anvil Price Chart In FY21, BIL posted record performance in volumes (up 12.6% YoY to 2.27 2200 20,000 lakh MT), net sales (up 20.4% YoY to 5,758 crore), EBITDA (up 42.9% YoY 1800 15,000 to | 1,786 crore) and PAT (up 22.3% YoY to | 1,155 crore) despite the impact 1400 10,000 of Covid in key geographies such as India and the US. The market leader in 1000 5,000 the niche off-highway tyre (OHT) exports enjoyed good traction, particularly 600 0 in the agri segment. -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

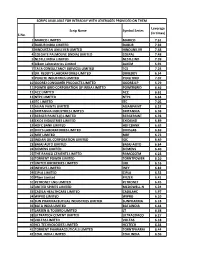

S.No. Scrip Name Symbol Series Leverage (In Times) 1 MARICO

SCRIPS AVAILABLE FOR INTRADAY WITH LEVERAGES PROVIDED ON THEM Leverage Scrip Name Symbol Series (in times) S.No. 1 MARICO LIMITED MARICO 7.61 2 DABUR INDIA LIMITED DABUR 7.92 3 HINDUSTAN UNILEVER LIMITED HINDUNILVR 7.48 4 COLGATE PALMOLIVE (INDIA) LIMITED COLPAL 7.48 5 NESTLE INDIA LIMITED NESTLEIND 7.39 6 Alkem Laboratories Limited ALKEM 6.91 7 TATA CONSULTANCY SERVICES LIMITED TCS 7.24 8 DR. REDDY'S LABORATORIES LIMITED DRREDDY 6.54 9 PIDILITE INDUSTRIES LIMITED PIDILITIND 7.07 10 GODREJ CONSUMER PRODUCTS LIMITED GODREJCP 5.79 11 POWER GRID CORPORATION OF INDIA LIMITED POWERGRID 6.46 12 ACC LIMITED ACC 6.61 13 NTPC LIMITED NTPC 6.64 14 ITC LIMITED ITC 7.05 15 ASIAN PAINTS LIMITED ASIANPAINT 6.52 16 BRITANNIA INDUSTRIES LIMITED BRITANNIA 6.98 17 BERGER PAINTS (I) LIMITED BERGEPAINT 6.78 18 EXIDE INDUSTRIES LIMITED EXIDEIND 6.89 19 HDFC BANK LIMITED HDFCBANK 6.63 20 DIVI'S LABORATORIES LIMITED DIVISLAB 6.69 21 MRF LIMITED MRF 6.73 22 INDIAN OIL CORPORATION LIMITED IOC 6.49 23 BAJAJ AUTO LIMITED BAJAJ-AUTO 6.64 24 SIEMENS LIMITED SIEMENS 6.40 25 THE RAMCO CEMENTS LIMITED RAMCOCEM 6.23 26 TORRENT POWER LIMITED TORNTPOWER 6.10 27 UNITED BREWERIES LIMITED UBL 6.16 28 INFOSYS LIMITED INFY 6.82 29 CIPLA LIMITED CIPLA 6.52 30 Pfizer Limited PFIZER 6.41 31 PETRONET LNG LIMITED PETRONET 6.45 32 UNITED SPIRITS LIMITED MCDOWELL-N 6.24 33 CADILA HEALTHCARE LIMITED CADILAHC 5.97 34 WIPRO LIMITED WIPRO 6.10 35 SUN PHARMACEUTICAL INDUSTRIES LIMITED SUNPHARMA 6.18 36 BATA INDIA LIMITED BATAINDIA 6.44 37 LARSEN & TOUBRO LIMITED LT 6.38 38 ULTRATECH CEMENT -

NSE Symbol NSE 6 Month Avg Total Market

Average Market Cap of 200 listed companies on BSE & NSE for the six months ended 30 June 2021 BSE 6 month Avg NSE 6 month Avg Average of BSE and NSE 6 Total Market Cap Total Market Cap month Avg Total Market Cap S.No. Company Name ISIN BSE SYMBOL (Rs. In Crs.) NSE Symbol (Rs. In Crs.) (Rs. in Crs.) 1 Reliance Industries Ltd INE002A01018 RELIANCE 1338017.01 RELIANCE 1355067.509 1346542.26 Tata Consultancy Services 2 Ltd. INE467B01029 TCS 1169783.56 TCS 1173068.166 1171425.86 3 HDFC Bank Ltd. INE040A01034 HDFCBANK 819037.95 HDFCBANK 818713.671 818875.81 4 Infosys Ltd INE009A01021 INFY 579784.19 INFY 579697.3885 579740.79 5 Hindustan Unilever Ltd., INE030A01027 HINDUNILVR 549336.78 HINDUNILVR 549358.908 549347.84 Housing Development 6 Finance Corp.Lt INE001A01036 HDFC 462288.58 HDFC 461373.1089 461830.84 7 ICICI Bank Ltd. INE090A01021 ICICIBANK 416645.51 ICICIBANK 416389.0234 416517.27 8 Kotak Mahindra Bank Ltd. INE237A01028 KOTAKBANK 361640.52 KOTAKBANK 361438.6361 361539.58 9 State Bank Of India, INE062A01020 SBIN 329767.32 SBIN 329789.268 329778.29 10 Bajaj Finance Limited INE296A01024 BAJFINANCE 324996.53 BAJFINANCE 324843.5005 324920.02 11 Bharti Airtel Ltd. INE397D01024 BHARTIARTL 299981.36 BHARTIARTL 299955.7729 299968.57 12 HCL Technologies Ltd INE860A01027 HCLTECH 261400.46 HCLTECH 261392.0109 261396.24 13 Wipro Ltd., INE075A01022 WIPRO 258617.45 WIPRO 261102.3994 259859.92 14 ITC Ltd INE154A01025 ITC 259423.16 ITC 259396.0648 259409.61 15 Asian Paints Ltd. INE021A01026 ASIANPAINT 253487.28 ASIANPAINT 253454.4536 253470.87 16 AXIS Bank Ltd. -

523395 3MINDIA INE470A01017 3M India Ltd 524348 AARTIDRUGS

NSE BSE BSE NSE Code ISIN Scrip Name Intraday Intraday Code Margin % Margin % 523395 3MINDIA INE470A01017 3M India Ltd 20 20 524348 AARTIDRUGS INE767A01016 Aarti Drugs Ltd 25.45 25.44 524208 AARTIIND INE769A01020 Aarti Industries Ltd 20 20 541988 AAVAS INE216P01012 Aavas Financiers Ltd 20.75 20.72 500002 ABB INE117A01022 ABB India Ltd 20 20 500488 ABBOTINDIA INE358A01014 Abbott India Ltd 20 20 500410 ACC INE012A01025 ACC Ltd 20 20 540691 ABCAPITAL INE674K01013 Aditya Birla Capital Ltd 24.66 24.61 535755 ABFRL INE647O01011 Aditya Birla Fashion and Retail Ltd 20.62 20.79 540025 ADVENZYMES INE837H01020 Advanced Enzyme Technologies Ltd 24.34 24.3 500003 AEGISCHEM INE208C01025 Aegis Logistics Ltd 22.79 22.74 500215 ATFL INE209A01019 Agro Tech Foods Ltd 21.63 21.61 532683 AIAENG INE212H01026 AIA Engineering Ltd 20 20 532331 AJANTPHARM INE031B01049 Ajanta Pharma Ltd 20 20 500710 AKZOINDIA INE133A01011 Akzo Nobel India Ltd 20 20 506235 ALEMBICLTD INE426A01027 Alembic Ltd 25.79 25.75 533573 APLLTD INE901L01018 Alembic Pharmaceuticals Ltd 20 20 539523 ALKEM INE540L01014 Alkem Laboratories Ltd 20 20 532749 ALLCARGO INE418H01029 Allcargo Logistics Ltd 20 20 500008 AMARAJABAT INE885A01032 Amara Raja Batteries Ltd 20 20 500425 AMBUJACEM INE079A01024 Ambuja Cements Ltd 20 20 590006 AMRUTANJAN INE098F01031 Amrutanjan Health Care Ltd 21.81 21.81 532259 APARINDS INE372A01015 Apar Industries Ltd 21.01 20.99 500877 APOLLOTYRE INE438A01022 Apollo Tyres Limited 23.12 23.02 532475 APTECHT INE266F01018 Aptech Ltd 27.65 27.62 542484 ARVINDFASN INE955V01021 Arvind -

India Daily, September 28, 2018

INDIA DAILY September 28, 2018 India 27-Sep 1-day 1-mo 3-mo Sensex 36,324 (0.6) (6.6) 3.7 Nifty 10,978 (0.7) (6.5) 3.7 Contents Global/Regional indices Dow Jones 26,440 0.2 1.4 9.2 Daily Alerts Nasdaq Composite 8,042 0.6 0.1 7.2 Company alerts FTSE 7,545 0.5 (0.9) (0.9) GAIL (India): Setting the stage Nikkei 24,093 1.2 5.6 8.2 Hang Seng 27,879 0.6 (1.7) (2.2) 54% hike in DUPL/DPPL tariffs and 2.5-7X jump in tariffs of smaller KOSPI 2,347 (0.4) 1.9 1.4 networks by PNGRB Value traded – India Expect further increase in tariffs for key pipeline network and gains from Cash (NSE+BSE) 383 407 366 12,64 unification Derivatives (NSE) 18,949 7,831 8 Raise EPS estimates by 6-11% and SoTP-based TP to Rs455 Deri. open interest 4,449 4,390 4,281 InterGlobe Aviation: No let-up in cost pressures Airfares: yields continue to be under pressure Forex/money market Change, basis points No let-up in input cost pressures yet 27-Sep 1-day 1-mo 3-mo Passenger growth remains strong, partly aided by cheap fares Rs/US$ 72.7 5 241 387 10yr govt bond, % 8.3 (2) 14 14 Crude price trajectory may weigh in on stock momentum in the near term Net investment (US$ mn) GSPL: It's almost a bond now and with volatility 26-Sep MTD CYTD (1,166 FIIs (96) (1,857) ) PNGRB approved final tariffs for GSPL’s Gujarat network, 4% higher than MFs 212 1,075 12,949 our expectations Top movers Raise FY2020-21 standalone EPS estimates by 6% and SoTP-based fair Change, % value to Rs185 Best performers 27-Sep 1-day 1-mo 3-mo DIVI IN Equity 1,366 (1.4) 6.6 36.6 Regulated steady-state -

Research Scorecard

MOMENTUMPICK Research Scorecard August 2021 Retail Equity Equity RetailResearch – ICICI ICICI Securities Key pillars of our equity proposition Intensive Research Innovative & flexible products . Dedicated team for fundamental, derivative . Offer innovative and unique products to and technical research cater to every client’s need . Total 33 fundamental research analysts . Provide flexibility in product and covering 360 companies across sectors service features MOMENTUMPICK . Customised research solutions – for . Execution investing or trading using cash, equities or . Margins derivatives . Liquidity Strong service platform Institutional & Corporate Services . Dedicated equity advisors to guide you on . Institutional services offered to our HNI the markets clients . Online and mobile platforms for trading . Block deals and account tracking Equity RetailResearch . VWAP trading – . Online reporting systems for tracking . Compliance reporting and monitoring transactions, profitability, securities services for employee accounts position and cash movement ICICI ICICI Securities Research Coverage Universe 2 Research PhilosophyResearch 3 ICICI Securities – Retail Equity Research MOMENTUM PICK Stock selection basis Fundamentals Derivatives • Financials of the company . Open interest accumulation pattern • Growth prospects of the industry and vis-à-vis price behaviour. company . Analysis of stock discount/premium MOMENTUMPICK • Quality of management and rollover analysis along with delivery activity • Competitive landscape Valuations Technicals -

Nominee List

NOMINEE LIST Best financial reporting (large cap) Cipla Hindalco Industries Hindustan Unilever Infosys Kotak Mahindra Bank Mahindra & Mahindra Piramal Enterprises Tata Steel Vedanta Best financial reporting (small to mid-cap) CEAT Everest Industries Hikal Hindustan Foods IIFL Finance KEC International Minda Industries Raymond The Phoenix Mills Zensar Technologies Best investor meetings (large cap) Bharti Airtel Hindustan Unilever Infosys Lupin Mahindra & Mahindra Piramal Enterprises Best investor meetings (mid-cap) Balkrishna Industries IIFL Finance Mindtree RPG Group Sterlite Technologies The Phoenix Mills NOMINEE LIST Best investor meetings (small cap) Amber Enterprises India Equitas Holdings Greenlam Industries Music Broadcast Navin Fluorine International NOCIL Raymond Zensar Technologies Best investor relations officer (large cap) Bharti Airtel Komal Sharan Bharti Airtel Aparna Vyas Garg Bharti Infratel Surabhi Chandna Cipla Naveen Bansal HDFC Conrad D'Souza Hindustan Unilever Suman Hegde Infosys Sandeep Mahindroo Kotak Mahindra Bank Nimesh Kampani Lupin Arvind Bothra Best investor relations officer (small to mid-cap) CEAT Pulkit Bhandari Jindal Steel & Power Nishant Baranwal Motilal Oswal Financial Services Rakesh Shinde PNB Housing Finance Deepika Gupta Padhi Raymond J Mukund RPG Group Pulkit Bhandari Schneider Electric Infrastructure Vineet Jain The Phoenix Mills Varun Parwal NOMINEE LIST Best investor relations team (large cap) Bharti Airtel Cipla Hindustan Unilever Infosys Kotak Mahindra Bank Larsen & Toubro Infotech Power Finance