Unemployment Insurance Handbook

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SEA Fact Sheet

WHAT IS THE SEA PROGRAM? The Self-Employment Assistance (SEA) program offers qualifying dislocated workers the opportunity for early re-employment through self-employment. The program is designed to encourage and enable unemployed workers to create their own jobs by starting their own small businesses. States operating an SEA program can pay an SEA allowance, instead of regular unemployment insurance benefits, to help unemployed workers while they are establishing businesses and becoming self-employed. Participants receive weekly allowances while they are getting their businesses off the ground. ELIGIBILTY REQUIREMENTS To receive these benefits, an individual must first be eligible to receive regular unemployment insurance under State law. Indiviuals who have been permanently separated from their previous employment and are identified as likely to exhaust regular unemployment benefits are eligible to apply for the program along with other program requirements as designated by the state. Individuals who are found eligible for SEA must engage in full-time self-employment activities in accordance with the state’s SEA program - including entrepreneurial training, business counseling, business plan development, etc. APPLICATION PROCESS SEA is a voluntary state program. To date, there are five SEA states. For more information on each state’s SEA program and requirements, visit the state’s UI agency’s website. } Delaware (Note: See agency “Contact” instructions to obtain SEA program information) } Mississippi } New Hampshire } New York } Oregon ADDITIONAL SEA INFORMATION You can obtain additional SEA information through the Self-Employment Assistance Center. The U.S. Department of Labor, in partnership with the Small Business Administration, created the Self-Employment Assistance Center to provide information, resources, and tools to help build state entrepreneurial programs for individuals eligible for Unemployment Insurance compensation. -

The Theory of Household Behavior: Some Foundations

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Annals of Economic and Social Measurement, Volume 4, number 1 Volume Author/Editor: Sanford V. Berg, editor Volume Publisher: NBER Volume URL: http://www.nber.org/books/aesm75-1 Publication Date: 1975 Chapter Title: The Theory of Household Behavior: Some Foundations Chapter Author: Kelvin Lancaster Chapter URL: http://www.nber.org/chapters/c10216 Chapter pages in book: (p. 5 - 21) Annals a! E won;ic and Ss to!fea.t ure,twn t, 4 1975 THE THEORY OF IIOUSEIIOLI) BEHAVIOR: SOME FOUNDATIONS wt' K1LVIN LANCASTER* This paper is concerned with examining the common practice of considering the household to act us if it were a single individuaL Iconcludes rhut aggregate household behavior wifl diverge front the behavior of the typical individual in Iwo important respects, but that the degree of this divergence depend: on well-defined variables--the number of goods and characteristics in the consu;npf ion fecIJflolOgv relative to the size of the household, and thextent of joint consumption within the houseiwid. For appropriate values of these, the degree of divergence may be very small or zero. For some years now, it has been common to refer to the basic decision-making entity with respect to consumption as the "household" by those primarily con- cerned with data collection and analysis and those working mainly with macro- economic models, and as the "individua1' by those working in microeconomic theory and welfare economics. Although one-person households do exist, they are the exception rather than the rule, and the individual and the household cannot be taken to be identical. -

Unemployment Benefits and Unemployment in the Great Recession: the Role of Macro Effects

NBER WORKING PAPER SERIES UNEMPLOYMENT BENEFITS AND UNEMPLOYMENT IN THE GREAT RECESSION: THE ROLE OF MACRO EFFECTS Marcus Hagedorn Fatih Karahan Iourii Manovskii Kurt Mitman Working Paper 19499 http://www.nber.org/papers/w19499 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 October 2013 We would like to thank Bob Hall, Sam Schulhofer-Wohl and seminar participants at Census Bureau, Edinburgh, EIEF, USC, Maryland, Penn State, UPenn, Princeton, Pompeu Fabra, Toulouse, UCL, UConn, Wisconsin, CUNY Graduate Center, Greater Stockholm Macro Group, Federal Reserve Banks of Cleveland, New York, and Philadelphia, 2013 conference on Macroeconomics Across Time and Space, 2013 SED, 2013 NBER Summer Institute (EFCE, EFMB, EFRSW groups), 2013 North American Summer Meeting of Econometric Society, 2013 Minnesota Workshop in Macroeconomic Theory, 15th IZA/CEPR European Summer Symposium on Labor Economics, Mannheim conference on \Financial Frictions and Real Economy," 4th Ifo Conference on "Macroeconomics and Survey Data", 2014 ASSA Meetings, 2014 NBER Public Economics Program Meeting and 2014 Cowles Foundation Summer Conference on \Structural Empirical Microeconomic Models" for their comments. We are especially grateful to June Shelp, at The Conference Board, for her help with the HWOL data. The opinions expressed herein are those of the authors and not necessarily those of the Federal Reserve Bank of New York or the Federal Reserve System. Support from the National Science Foundation Grants No. SES-0922406 and SES-1357903 is gratefully acknowledged. The opinions expressed herein are those of the authors and not necessarily those of the Federal Reserve Bank of New York, the Federal Reserve System, or the National Bureau of Economic Research. -

Neoliberal Austerity and Unemployment

E L C I ‘…following Stuckler and Basu (2013) T it is not economic downturns per se that R matter but the austerity and welfare A “reform” that may follow: that “austerity Neoliberal austerity kills” and – as I argue here – that it particularly “kills” those in lower socio- economic positions.’ and unemployment The scale of contemporary unemployment consequent upon David Fryer and Rose Stambe examine critical psychological issues neoliberal austerity programmes is colossal. According to labour market statistics released in June 2013 by the UK Neoliberal fiscal austerity policies I am really sorry to bother you again. Office for National Statistics, 2.51 million decrease public expenditure God. But I am bursting to tell you all people were unemployed in the UK through cuts to central and local the stuff that has been going on (tinyurl.com/neu9l47). This represents five government budgets, welfare behind your back since I first wrote to unemployed people competing for every services and benefits and you back in 1988. Oh God do you still vacancy. privatisation of public resources remember? Remember me telling Official statistics like these, which have resulting in job losses. This article you of the war that was going on persisted now for years, do not, of course, interrogates the empirical, against the poor and unemployed in prevent the British Prime Minister – theoretical, methodological and our working class communities? Do evangelist of neoliberal government - ideological relationships between you remember me telling you, God, asking in a speech delivered in June 2012 neoliberalism, unemployment and how the people in my community ‘Why has it become acceptable for many the discipline of psychology, were being killed and terrorised but people to choose a life on benefits?’ arguing that neoliberalism that there were no soldiers to be Talking of what he termed ‘Working Age constitutes rather than causes seen, no tanks, no bombs being Welfare’, Mr Cameron opined: ‘we have unemployment. -

Unemployment in an Extended Cournot Oligopoly Model∗

Unemployment in an Extended Cournot Oligopoly Model∗ Claude d'Aspremont,y Rodolphe Dos Santos Ferreiraz and Louis-Andr´eG´erard-Varetx 1 Introduction Attempts to explain unemployment1 begin with the labour market. Yet, by attributing it to deficient demand for goods, Keynes questioned the use of partial analysis, and stressed the need to consider interactions between the labour and product markets. Imperfect competition in the labour market, reflecting union power, has been a favoured explanation; but imperfect competition may also affect employment through producers' oligopolistic behaviour. This again points to a general equilibrium approach such as that by Negishi (1961, 1979). Here we propose an extension of the Cournot oligopoly model (unlike that of Gabszewicz and Vial (1972), where labour does not appear), which takes full account of the interdependence between the labour market and any product market. Our extension shares some features with both Negishi's conjectural approach to demand curves, and macroeconomic non-Walrasian equi- ∗Reprinted from Oxford Economic Papers, 41, 490-505, 1989. We thank P. Champsaur, P. Dehez, J.H. Dr`ezeand J.-J. Laffont for helpful comments. We owe P. Dehez the idea of a light strengthening of the results on involuntary unemployment given in a related paper (CORE D.P. 8408): see Dehez (1985), where the case of monopoly is studied. Acknowledgements are also due to Peter Sinclair and the Referees for valuable suggestions. This work is part of the program \Micro-d´ecisionset politique ´economique"of Commissariat G´en´eral au Plan. Financial support of Commissariat G´en´eralau Plan is gratefully acknowledged. -

Department of Business, Economic Development & Tourism

DEPARTMENT OF BUSINESS, ECONOMIC DEVELOPMENT & TOURISM RESEARCH AND ECONOMIC ANALYSIS DIVISION DAVID Y. IGE GOVERNOR MIKE MC CARTNEY DIRECTOR DR. EUGENE TIAN CHIEF STATE ECONOMIST FOR IMMEDIATE RELEASE August 19, 2021 HAWAI‘I'S UNEMPLOYMENT RATE AT 7.3 PERCENT IN JULY Jobs increased by 53,000 over-the-year HONOLULU — The Hawai‘i State Department of Business, Economic Development & Tourism (DBEDT) today announced that the seasonally adjusted unemployment rate for July was 7.3 percent compared to 7.7 percent in June. Statewide, 598,850 were employed and 47,200 unemployed in July for a total seasonally adjusted labor force of 646,000. Nationally, the seasonally adjusted unemployment rate was 5.4 percent in July, down from 5.9 percent in June. Seasonally Adjusted Unemployment Rate State of Hawai`i Jul 2019 - Jul 2021 28.0% 24.0% 20.0% 16.0% 12.0% 8.0% 4.0% 0.0% Ma Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr Ma Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr Jun Jul y 19 19 19 19 19 19 20 20 20 20 y20 20 20 20 20 20 20 20 21 21 21 21 21 21 21 Percent 2.5 2.4 2.3 2.2 2.1 2.1 2.0 2.1 2.1 21. 21. 14. 14. 14. 14. 14. 10. 10. 10. 9.2 9.1 8.5 8.0 7.7 7.3 The unemployment rate figures for the State of Hawai‘i and the U.S. in this release are seasonally adjusted, in accordance with the U.S. -

1 John Stuart Mill Selections from on the Subjection of Women John

1 John Stuart Mill Selections from On the Subjection of Women John Stuart Mill (1806-1873) was an English philosopher, economist, and essayist. He was raised in strict accord with utilitarian principles by his economist father James Mill, the founder of utilitarian philosophy. John Stuart recorded his early training and subsequent near breakdown in in his Autobiography (“A Crisis in My Mental History. One Stage Onward”), published after his death by his step-daughter, Helen Taylor, in 1873. His strictly intellectual training led to an early crisis which, as he records in this chapter, was only relieved by reading the poetry of William Wordsworth. During his life, Mill published a number of works on economic and political issues, including the Principles of Political Economy (1848), Utilitarianism (1863), and On Liberty (1859). After his death, besides the Autobiography, his step-daughter published Three Essays on Religion in 1874. On the Subjection of Women (1869) is Mill’s utilitarian argument for the complete equality of women with men. Scholars think that it was greatly influenced by Mill’s discussions with Harriet Taylor, whom Mill married in 1851. The essay is addressed to men, the rulers and controllers of nineteenth-century society, and is his contribution to what had become known as “the woman question,” that is, what liberties should be accorded to women in society. As such, it is a clear and still-relevant contribution to the ongoing discussion of women’s rights and their desire to achieve what Mill announces in his opening thesis, “perfect equality.” Information readily available on the internet has not been glossed. -

Emergency Unemployment Compensation (EUC08): Current Status of Benefits

Emergency Unemployment Compensation (EUC08): Current Status of Benefits Julie M. Whittaker Specialist in Income Security Katelin P. Isaacs Analyst in Income Security March 28, 2012 The House Ways and Means Committee is making available this version of this Congressional Research Service (CRS) report, with the cover date shown, for inclusion in its 2012 Green Book website. CRS works exclusively for the United States Congress, providing policy and legal analysis to Committees and Members of both the House and Senate, regardless of party affiliation. Congressional Research Service R42444 CRS Report for Congress Prepared for Members and Committees of Congress Emergency Unemployment Compensation (EUC08): Current Status of Benefits Summary The temporary Emergency Unemployment Compensation (EUC08) program may provide additional federal unemployment insurance benefits to eligible individuals who have exhausted all available benefits from their state Unemployment Compensation (UC) programs. Congress created the EUC08 program in 2008 and has amended the original, authorizing law (P.L. 110-252) 10 times. The most recent extension of EUC08 in P.L. 112-96, the Middle Class Tax Relief and Job Creation Act of 2012, authorizes EUC08 benefits through the end of calendar year 2012. P.L. 112- 96 also alters the structure and potential availability of EUC08 benefits in states. Under P.L. 112- 96, the potential duration of EUC08 benefits available to eligible individuals depends on state unemployment rates as well as the calendar date. The P.L. 112-96 extension of the EUC08 program does not allow any individual to receive more than 99 weeks of total unemployment insurance (i.e., total weeks of benefits from the three currently authorized programs: regular UC plus EUC08 plus EB). -

Modern Monetary Theory: a Marxist Critique

Class, Race and Corporate Power Volume 7 Issue 1 Article 1 2019 Modern Monetary Theory: A Marxist Critique Michael Roberts [email protected] Follow this and additional works at: https://digitalcommons.fiu.edu/classracecorporatepower Part of the Economics Commons Recommended Citation Roberts, Michael (2019) "Modern Monetary Theory: A Marxist Critique," Class, Race and Corporate Power: Vol. 7 : Iss. 1 , Article 1. DOI: 10.25148/CRCP.7.1.008316 Available at: https://digitalcommons.fiu.edu/classracecorporatepower/vol7/iss1/1 This work is brought to you for free and open access by the College of Arts, Sciences & Education at FIU Digital Commons. It has been accepted for inclusion in Class, Race and Corporate Power by an authorized administrator of FIU Digital Commons. For more information, please contact [email protected]. Modern Monetary Theory: A Marxist Critique Abstract Compiled from a series of blog posts which can be found at "The Next Recession." Modern monetary theory (MMT) has become flavor of the time among many leftist economic views in recent years. MMT has some traction in the left as it appears to offer theoretical support for policies of fiscal spending funded yb central bank money and running up budget deficits and public debt without earf of crises – and thus backing policies of government spending on infrastructure projects, job creation and industry in direct contrast to neoliberal mainstream policies of austerity and minimal government intervention. Here I will offer my view on the worth of MMT and its policy implications for the labor movement. First, I’ll try and give broad outline to bring out the similarities and difference with Marx’s monetary theory. -

July Unemployment Rate Decreases to 5.8 Percent

FOR IMMEDIATE RELEASE CONTACT: September 16, 2021 Margaux Fontaine 401-209-0153 [email protected] Rhode Island-Based Jobs Rose by 800 from July; August Unemployment Rate Increases to 5.8 Percent CRANSTON, R.I. - The state’s seasonally adjusted Aug 21 Jul 21 Aug 20 unemployment rate was 5.8 percent in August, the Department of R.I. Unemployment Rate 5.8% 5.7% 12.6% Labor and Training announced Thursday. The August rate was up one-tenth of a percentage point from the revised July rate of 5.7 U.S. Unemployment Rate 5.2% 5.4% 8.4% percent. Last year the rate was 12.6 percent in August. R.I. Job Count (in thousands) 477.9 477.1 457.3 Highlights: The U.S. unemployment rate was 5.2 percent in August, down two-tenths of a percentage point from July. The U.S. rate was 8.4 The Rhode Island unemployment rate was 5.8 percent percent in August 2020. in August, up one-tenth of a percentage point from last month’s revised rate of 5.7 percent. The number of unemployed Rhode Island residents — those Through August, the Rhode Island economy has residents classified as available for and actively seeking recovered 78,700 or nearly 73 percent of the 108,000 jobs lost during the pandemic shutdown. employment — was 30,900, up 100 from July. The number of unemployed residents decreased by 35,800 over the year. The number of employed Rhode Island residents was 503,800, down 1,500 from July. -

How to Apply for Unemployment Benefits Online Tutorial Content

How to Apply for Unemployment Benefits Online Tutorial Content This tutorial contains the instructions and web page screenshots you need to complete, submit, and confirm your unemployment benefits application online. You can read this tutorial page by page, or you can skip to one of the two main sections by selecting the link: • Applying for Benefits • Next Steps and Requirements Note: You might want to print pages from this tutorial. If you do not have a printer, you can complete and print your application for free at your local Workforce Solutions office. Applying over the Internet is fast, easy, and secure Most people can apply for benefits and manage their unemployment claims online through Unemployment Benefits Services. However, if you worked in Massachusetts, Wisconsin, or Puerto Rico in the past 18 months, you must call the Texas Workforce Commission (TWC) Tele-Center at 800-939-6631 instead. Here’s what you need to get started . When you apply for benefits, you will need your: • Social Security number • Last employer’s business name, address, and phone number • First and last dates (month, day, and year) you worked for your last employer • Number of hours you worked and your pay rate if you worked during the week you apply (including Sunday) • Military employment (service) start/end dates and a copy of your DD Form 214(s)(member copy 4 through 8), if you served in the military during the past 18 months • Alien Registration number (if not a U.S. citizen or national) Return to Contents 3 Applying for Benefits In this section, you will learn how to: • Fill in your application by entering personal information and last employment details • Review and submit your application • Confirm your claim Return to Contents Important Your information will not be saved if you log off before you submit and receive a confirmation number. -

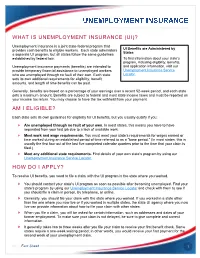

What Is Unemployment Insurance (Ui)? Am I Eligible? How Do I Apply?

WHAT IS UNEMPLOYMENT INSURANCE (UI)? Unemployment Insurance is a joint state-federal program that provides cash benefits to eligible workers. Each state administers UI Benefits are Administered by States a separate UI program, but all states follow the same guidelines established by federal law. To find information about your state’s program, including eligibility, benefits, Unemployment insurance payments (benefits) are intended to and application information, visit our provide temporary financial assistance to unemployed workers Unemployment Insurance Service who are unemployed through no fault of their own. Each state Locator. sets its own additional requirements for eligibility, benefit amounts, and length of time benefits can be paid. Generally, benefits are based on a percentage of your earnings over a recent 52-week period, and each state sets a maximum amount. Benefits are subject to federal and most state income taxes and must be reported on your income tax return. You may choose to have the tax withheld from your payment. AM I ELIGIBLE? Each state sets its own guidelines for eligibility for UI benefits, but you usually qualify if you: Are unemployed through no fault of your own. In most states, this means you have to have separated from your last job due to a lack of available work. Meet work and wage requirements. You must meet your state’s requirements for wages earned or time worked during an established period of time referred to as a "base period." (In most states, this is usually the first four out of the last five completed calendar quarters prior to the time that your claim is filed.) Meet any additional state requirements.