Notice of Convocation Annual General Meeting 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kintetsu Group Holdings Co., Ltd. 6-1-55, Uehommachi, Tennoji-Ku, Osaka-Shi, Osaka, Japan

This document has been translated from the Japanese original for the convenience of non-Japanese shareholders. In the event of any discrepancy between this translation and the Japanese original, the original shall prevail. Securities identification code: 9041 June 1, 2017 To our shareholders: Yoshinori Yoshida President Kintetsu Group Holdings Co., Ltd. 6-1-55, Uehommachi, Tennoji-ku, Osaka-shi, Osaka, Japan NOTICE OF THE 106TH ORDINARY GENERAL MEETING OF SHAREHOLDERS You are cordially invited to attend the 106th Ordinary General Meeting of Shareholders of Kintetsu Group Holdings Co., Ltd. (the “Company”), which will be held as described below. If you are unable to attend the meeting, you can exercise your voting rights in writing or via electromagnetic means (the Internet and others). Please review the Reference Documents for the General Meeting of Shareholders (from page 5 to page 17) and the Information on Exercise of Voting Rights (on page 3 and page 4) and exercise your voting rights by 6:00 p.m. on Wednesday, June 21, 2017 (Japan Standard Time). Meeting Details 1. Date and Time: Thursday, June 22, 2017 at 10:00 a.m. (Japan Standard Time) 2. Venue: 6-1-55, Uehommachi, Tennoji-ku, Osaka-shi, Osaka, Japan Sheraton Miyako Hotel Osaka, 4F “Naniwa” 3. Purposes: Items to be reported: Business Report, Consolidated Financial Statements and Non-Consolidated Financial Statements for the 106th Term (from April 1, 2016 to March 31, 2017), as well as the results of audit of the Consolidated Financial Statements by the Accounting Auditor and the Board of Auditors Items to be resolved: Proposal 1: Dividends of surplus Proposal 2: Consolidation of shares Proposal 3: Election of seventeen (17) Directors 4. -

“Global Top 10 Solution Partner”

Kintetsu World Express ANNUAL REPORT 2019 Annual Report 2019 Kintetsu World Express, Inc. Year Ended March 31, 2019 “Global Top 10 Solution Partner” A Global Brand Born in Japan Corporate Philosophy KWE Group Corporate Guidelines Contribute to the development of a global (1) We strive to further increase corporate value by (4) We are committed to comply with external delivering customers quality services that meet their regulations, and compliance monitoring and community through logistics services – needs and earn their confidence. assessment are built into all levels of the business. by creating new values, sustaining the (2) We strive to be an organization that grows and (5) We ensure a safe and healthy work environment environment and collaborating with our expands through logistics business. where people are treated respectfully and fairly. (3) We promote communications with stakeholders clients, shareholders and employees. (6) We contribute in sustainable community and disclose corporate information accurately and development, with attention to global appropriately. environmental issues. Contents 02 To Become a “Global Top 10 Solution 16 Report by Six Segments Partner” 22 ESG Section 35 Management’s Discussion and Analysis 06 Foundation for Creating New Value 40 Financial Highlights 08 Top Message 41 Financial Statements 59 Investor Information Expectations and Forecasts This annual report contains statements about our expectations and forecasts regarding plans, strategies, and business results related to the future of Kintetsu World Express, Inc. (KWE). These statements reflect our expectations based on personal beliefs and assumptions that were determined Guide to Buttons in light of information that was available at the time the report was prepared. -

Kintetsu Group Holdings

KINTETSU GROUP HOLDINGS COMPANY PROFILE 6-1-55 Uehommachi, Tennoji-ku, Osaka 543-8585, Japan https://www.kintetsu-g-hd.co.jp 2020.06 14 CULTURAL PROGRAMS SURE HOTEL and LEI To quickly respond to changes in the business environment and achieve further growth, Other under the name“Kintetsu Group Holdings Co.,Ltd.” our group companies will go all-out Businesses to satisfy all of our customers, in transportation, real estate, merchandise sales, hotel and leisure and other various businesses relating to people’s everyday life. At the same time, all group companies will work in synergy to display the collective strength of the entire Kintetsu Group. We will continue our sincere efforts to support and enrich our customers’ daily life by providing them with new delights and prosperity, thereby contributing to society’s development. Real Estate Business Hotel and Leisure Business Merchandise Sales Business Transportation Business 01 02 TRANSPORTATION TRANSPORTATION Railway Business TRANSPORTATION Kintetsu Osaka-Abenobashi Station (West gate) Iga Railway Kintetsu Group operates several railways, including Kintetsu Railway, which runs on a total track length of approximately 500 km. Covering six prefectures in the Kinki and Tokai regions, we offer interurban, sightseeing and regional transportation With our well-developed transportation services for commuters, tourists and other passengers. We constantly strive to meet REAL ESTATE customers’ various needs by improving our operation safety level, expanding barrier-free facilities, and promoting the IC ticketing system, to provide safe and comfortable network and capacity, we connect towns transportation services. with towns and people with people. Bus and Taxi Business Kintetsu Bus Kintetsu Taxi MERCHANDISE SALES We manage bus and taxi companies in the Kinki, Tokai, Hokuriku, Chugoku, Shikoku, and Kyushu regions. -

Annual Report 2020 PDF Data

Contents KWE Group Corporate Guidelines (1) We strive to further increase corporate value by delivering 02 Aiming for Sustainable Growth customers quality services that meet their needs and earn their confidence. 06 Foundation for Creating New Value (2) We strive to be an organization that grows and expands through logistics business. 08 Top Message (3) We promote communications with stakeholders and disclose corporate information accurately and 15 Report by Six Segments appropriately. (4) We are committed to comply with external regulations, 21 Sustainability Management and compliance monitoring and assessment are built into all levels of the business. 36 Management’s Discussion and Analysis (5) We ensure a safe and healthy work environment where 43 Financial Highlights people are treated respectfully and fairly. (6) We contribute in sustainable community development, 44 Financial Statements with attention to global environmental issues. 62 Investor Information Guide to Buttons Move Back to Previous Page Expectations and Forecasts This annual report contains statements about our expectations and forecasts regarding plans, strategies, and business results related to the future of Kintetsu World Express, Move Forward to Next Page Inc. (KWE). These statements reflect our expectations based on personal beliefs and assumptions that were determined in light of information that was available at the time Print Search PDF Content the report was prepared. There are innumerable risk factors and uncertainties that could affect the future, including economic trends, competition in the logistics industry, market conditions, fuel prices, exchange rates, and tax or other regulatory system considerations. Go to Contents Page Please be well advised that because of these risk factors, actual results may differ from our expectations. -

Published on 7 October 2015 1. Constituents Change the Result Of

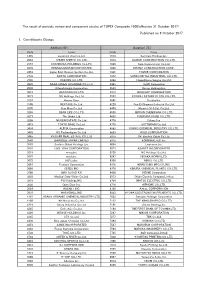

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD. -

Published on 6 October 2017 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 31 October 2017) Published on 6 October 2017 1. Constituents Change Addition( 92 ) Deletion( 73 ) Code Issue Code Issue 1435 investors cloud co.,ltd. 1514 Sumiseki Holdings,Inc. 2053 CHUBU SHIRYO CO.,LTD. 1814 DAISUE CONSTRUCTION CO.,LTD. 2157 KOSHIDAKA HOLDINGS Co.,LTD. 1826 Sata Construction Co.,Ltd. 2378 RENAISSANCE,INCORPORATED 1866 KITANO CONSTRUCTION CORP., 2453 Japan Best Rescue System Co.,Ltd. 1921 TOMOE CORPORATION 2733 ARATA CORPORATION 1972 SANKO METAL INDUSTRIAL CO.,LTD. 2742 HALOWS CO.,LTD. 2286 Hayashikane Sangyo Co.,Ltd. 2899 NAGATANIEN HOLDINGS CO.,LTD. 2485 TEAR Corporation 2930 Kitanotatsujin Corporation 2533 Oenon Holdings,Inc. 3031 RACCOON CO.,LTD. 3313 BOOKOFF CORPORATION 3073 DD Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 3134 Hamee Corp. 3681 V-cube,Inc. 3186 NEXTAGE Co.,Ltd. 4229 Gun Ei Chemical Industry Co.,Ltd. 3230 Star Mica Co.,Ltd. 4404 Miyoshi Oil & Fat Co.,Ltd. 3245 DEAR LIFE CO.,LTD. 4539 NIPPON CHEMIPHAR CO.,LTD. 3271 The Global Ltd. 4620 FUJIKURA KASEI CO.,LTD. 3299 MUGEN ESTATE Co.,Ltd. 4776 Cybozu,Inc. 3415 TOKYO BASE Co.,Ltd. 4779 SOFTBRAIN Co.,Ltd. 3434 ALPHA Corporation 4992 HOKKO CHEMICAL INDUSTRY CO.,LTD. 3445 RS Technologies Co.,Ltd. 5603 KOGI CORPORATION 3465 KI-STAR REAL ESTATE CO.,LTD 5815 Oki Electric Cable Co.,Ltd. 3548 BAROQUE JAPAN LIMITED 5915 KOMAIHALTEC Inc. 3563 Sushiro Global Holdings Ltd. 6054 Livesense Inc. 3564 LIXIL VIVA CORPORATION 6073 ASANTE INCORPORATED 3661 m-up,Inc. 6236 NC Holdings Co.,Ltd. 3667 enish,inc. 6247 HISAKA WORKS,LTD. -

Going to the Next Phase !

http://www.kwe.com Tel: +81-3-6863-6443 Fax: +81-3-5462-8501 Fax: +81-3-6863-6443 Tel: Minato-ku, Tokyo 108-6024, Japan 108-6024, Tokyo Minato-ku, Shinagawa Intercity TowerA-24Fl., 2-15-1 Konan, Konan, 2-15-1 TowerA-24Fl., Intercity Shinagawa Global Logistics Partner Logistics Global Kintetsu World Express ANNUAL REPORT 2017 Going to the Next Phase ! Annual Report 2017 Kintetsu World Express, Inc. Global Logistics Partner Year Ended March 31, 2017 Corporate Philosophy Contribute to the development of a global community through logistics services – by creating new values, sustaining the environment and collaborating with our clients, shareholders and employees. Vision A superior business partner supporting customers’ strategic objectives and activities by providing comprehensive innovative supply chain solutions Guide to Buttons Expectations and Forecasts 02 Going to the Next Phase! 31 Management’s This annual report contains statements about our expectations and forecasts regarding Discussion and Analysis Move Back to Previous Page plans, strategies, and business results relat- 05 Foundation for Creating ed to the future of Kintetsu World Express, New Value 36 Financial Highlights Inc. (KWE). These statements reflect our ex- Move Forward to Next Page pectations based on personal beliefs and assumptions that were determined in light 07 Top Message 37 Financial Statements of information that was available at the time the report was prepared. There are innumer- Print able risk factors and uncertainties that could 14 Report by Six Segments 56 Investor Information affect the future, including economic trends, competition in the logistics industry, market Search PDF Content conditions, fuel prices, exchange rates, and 20 Corporate Governance tax or other regulatory system considerations. -

The Railway Market in Japan

www.EUbusinessinJapan.eu The Railway Market in Japan September 2016 Lyckle Griek EU-JAPAN CENTRE FOR INDUSTRIAL COOPERATION - Head office in Japan EU-JAPAN CENTRE FOR INDUSTRIAL COOPERATION - OFFICE in the EU Shirokane-Takanawa Station bldg 4F Rue Marie de Bourgogne, 52/2 1-27-6 Shirokane, Minato-ku, Tokyo 108-0072, JAPAN B-1000 Brussels, BELGIUM Tel: +81 3 6408 0281 - Fax: +81 3 6408 0283 - [email protected] Tel : +32 2 282 0040 –Fax : +32 2 282 0045 - [email protected] http://www.eu-japan.eu / http://www.EUbusinessinJapan.eu / http://www.een-japan.eu www.EUbusinessinJapan.eu Contents 1. Executive summary .................................................................................................................................................... 2 2. Introduction ............................................................................................................................................................... 3 3. Market structure........................................................................................................................................................ 4 a. Network overview (technical characteristics) ...................................................................................................... 4 b. Public & private operators .................................................................................................................................... 6 c. Large operators ................................................................................................................................................... -

Transparency Report 2018

Transparency Report 2018 2018 9 ______年 月 www.kpmg.com/jp/azsa © 2017 KPMG AZSA LLC, a limited liability audit corporation incorporated under the Japanese Certified Public Accountants Law and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Transparency Report 2018 1 1. Message from the Local Senior Partner As a member of the KPMG network, KPMG AZSA LLC shares a common Purpose - to Inspire Confidence, Empower Change – with member firms around the globe. Based on this Purpose, we aim to establish the reliability of information through auditing and accounting services and support the change of companies and society towards sustainable growth. AZSA Quality 2018 introduces efforts at KPMG AZSA LLC to improve audit quality, the foundation of which is KPMG’s globally consistent audit quality. In this transparency report, we will additionally introduce KPMG’s system for ensuring audit quality. 2. Who we are 2.1 Our business 2.2 Our strategy KPMG AZSA LLC, a member firm of KPMG International, comprises Our firm’s mission is to ensure the reliability of information by approximately 6,000 people in major cities in Japan, providing audit, providing quality audit and accounting services as well as to attestation, and advisory services such as accounting advisory contribute to the realization of a fair society and healthy services, financial advisory services, IT advisory service and other development of our economy by empowering change. In order to advisory services for initial public offerings and the public sector. execute our firm’s mission, we have following vision: We also offer highly specialized professional services that address To be The Clear Choice for our clients, people and society. -

Constituent Changes TOPIX New Index Series (Effective 31 October 2016)

Constituent Changes TOPIX New Index Series (effective 31 October 2016) Published on 7 October 2016 1. Constituents Change (1) TOPIX Core30 Addition( 1 ) Deletion( 1 ) Code Issue Code Issue 6861 KEYENCE CORPORATION 8604 Nomura Holdings, Inc. (2) TOPIX Large70 Addition( 1 ) Deletion( 1 ) Code Issue Code Issue 8604 Nomura Holdings, Inc. 6861 KEYENCE CORPORATION (3) TOPIX Mid400 Addition( 7 ) Deletion( 7 ) Code Issue Code Issue 2201 Morinaga & Co.,Ltd. 1979 Taikisha Ltd. 3938 LINE Corporation 3608 TSI HOLDINGS CO.,LTD. 4043 Tokuyama Corporation 5021 COSMO ENERGY HOLDINGS COMPANY,LIMITED 4095 NIHON PARKERIZING CO.,LTD. 6740 Japan Display Inc. 4587 PeptiDream Inc. 6754 ANRITSU CORPORATION 7458 DAIICHIKOSHO CO.,LTD. 8368 The Hyakugo Bank,Ltd. 8585 Orient Corporation 8544 The Keiyo Bank,Ltd. (4) TOPIX Small Addition(14) Deletion( 7 ) Code Issue Code Issue 1979 Taikisha Ltd. 2201 Morinaga & Co.,Ltd. 3608 TSI HOLDINGS CO.,LTD. 3938 LINE Corporation 5021 COSMO ENERGY HOLDINGS COMPANY,LIMITED 4043 Tokuyama Corporation 6740 Japan Display Inc. 4095 NIHON PARKERIZING CO.,LTD. 6754 ANRITSU CORPORATION 4587 PeptiDream Inc. 8368 The Hyakugo Bank,Ltd. 7458 DAIICHIKOSHO CO.,LTD. 8544 The Keiyo Bank,Ltd. 8585 Orient Corporation * 3221 Yossix Co.,Ltd. * 3445 RS Technologies Co.,Ltd. * 3837 Ad-Sol Nissin Corporation * 3918 PCI Holdings,INC. * 6050 E-Guardian Inc. * 7527 SystemSoft Corporation * 9644 TANABE MANAGEMENT CONSULTING CO.,LTD. * This issue will be newly added to TOPIX new index series after the close of trading on October 28. 2. Number of constituents The Name of TOPIX New Index Current After (As of October 7) (Effective 30 October) TOPIX Core30 30 30 TOPIX Large70 70 70 TOPIX Mid400 400 400 TOPIX Small1 496 500 TOPIX Small2 974 977 Each code means constituents of following index. -

Mizuho BK Custody and Proxy Board Lot Size List DEC 1 , 2020 21LADY

Mizuho BK Custody and Proxy Board Lot Size List DEC 1 , 2020 Board Lot Stock Name (in Alphabetical Order) ISIN Code QUICK Code Size 21LADY CO.,LTD. 100 JP3560550000 3346 3-D MATRIX,LTD. 100 JP3410730000 7777 4CS HOLDINGS CO.,LTD. 100 JP3163300001 3726 A DOT CO.,LTD 100 JP3160590000 7063 A-ONE SEIMITSU INC. 100 JP3160660001 6156 A.D.WORKS GROUP CO.,LTD. 100 JP3160560003 2982 A&A MATERIAL CORPORATION 100 JP3119800005 5391 A&D COMPANY,LIMITED 100 JP3160130005 7745 A&T CORPORATION 100 JP3160680009 6722 ABALANCE CORPORATION 100 JP3969530009 3856 ABC-MART,INC. 100 JP3152740001 2670 ABHOTEL CO.,LTD. 100 JP3160610006 6565 ABIST CO.,LTD. 100 JP3122480001 6087 ACCESS CO.,LTD. 100 JP3108060009 4813 ACCESS GROUP HOLDINGS CO.,LTD. 100 JP3108190004 7042 ACCRETE INC. 100 JP3108180005 4395 ACHILLES CORPORATION 100 JP3108000005 5142 ACMOS INC. 100 JP3108100003 6888 ACOM CO.,LTD. 100 JP3108600002 8572 ACRODEA,INC. 100 JP3108120001 3823 ACTCALL INC. 100 JP3108140009 6064 ACTIVIA PROPERTIES INC. 1 JP3047490002 3279 AD-SOL NISSIN CORPORATION 100 JP3122030004 3837 ADASTRIA CO.,LTD. 100 JP3856000009 2685 ADEKA CORPORATION 100 JP3114800000 4401 ADISH CO.,LTD. 100 JP3121500007 7093 ADJUVANT COSME JAPAN CO.,LTD. 100 JP3119620007 4929 ADTEC PLASMA TECHNOLOGY CO.,LTD. 100 JP3122010006 6668 ADVAN CO.,LTD. 100 JP3121950004 7463 ADVANCE CREATE CO.,LTD. 100 JP3122100005 8798 ADVANCE RESIDENCE INVESTMENT CORPORATION 1 JP3047160001 3269 ADVANCED MEDIA,INC. 100 JP3122150000 3773 ADVANEX INC. 100 JP3213400009 5998 ADVANTAGE RISK MANAGEMENT CO.,LTD. 100 JP3122410008 8769 ADVANTEST CORPORATION 100 JP3122400009 6857 ADVENTURE,INC. 100 JP3122380003 6030 ADWAYS INC. 100 JP3121970002 2489 AEON CO.,LTD. 100 JP3388200002 8267 AEON DELIGHT CO.,LTD. -

NOTICE of the 106Th ORDINARY GENERAL MEETING of SHAREHOLDERS

Translation: Please note that the following is a translation of the original Japanese version, which is prepared for the convenience of investors. In case of any discrepancy between the translation and the Japanese original, the latter shall prevail. Securities Code 1944 June 3, 2020 KINDEN CORPORATION NOTICE OF THE 106th ORDINARY GENERAL MEETING OF SHAREHOLDERS To Our Shareholders: We are pleased to announce the 106th Ordinary General Meeting of Shareholders of KINDEN CORPORATION (the “Company”). To avoid the risk of infection from novel coronavirus disease (COVID-19) at the Meeting, we strongly recommend that you refrain from attending the Meeting in person and that you exercise your voting rights in written form (voting card) or electronically (via the Internet or other means). Please examine the attached Reference Documents for the General Meeting of Shareholders and exercise your voting rights no later than 5:30 p.m. on Tuesday, June 23, 2020, Japan time. Yours very truly, Yukikazu Maeda President and Director KINDEN CORPORATION 2-3-41, Honjo-Higashi, Kita-ku, Osaka Particulars 1. Date and Time: June 24, 2020 (Wednesday) at 10:00 a.m. 2. Place: 2-3-41, Honjo-Higashi, Kita-ku, Osaka, Japan Eleventh floor conference room, KINDEN CORPORATION Head Office 3. Agenda Matters to be reported (1) Reports on the Business Report, the Consolidated Financial Statements and the Non-Consolidated Financial Statements for the 106th Fiscal Year (from April 1, 2019 to March 31, 2020) (2) Report on the Results of the Audit conducted by the Accounting Auditor and the Audit & Supervisory Board with respect to the Consolidated Financial Statements for the 106th Fiscal Year ended March 31, 2020 Proposals to be resolved Proposal No.