World's Best Developed Markets Banks 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Western Europe 2020

Global Finance Announces Its 27th Annual Best Bank Awards And Names The Best Banks In Western Europe 2020 NEW YORK, March 13, 2020 – Global Finance magazine has announced its 27th annual awards for the World’s Best Banks. The honorees for Western Europe are presented here. A full report on the selections will appear in the May issue of Global Finance and online About Global Finance at GFMag.com, with winners chosen in more than 150 countries across Africa, Asia- Pacific, Central & Eastern Europe, Latin America, the Middle East, North America and Global Finance, founded in Western Europe. The May report will also feature selections for the Best US Regional 1987, has a circulation of Banks, the Best Islamic Financial Institutions and the World’s Best Banks by Region. 50,000 and readers in 188 countries. Global Finance’s The overall Best Bank in the World will be announced in the summer and published audience includes senior in the October issue, along with the Best Global Banks in more than a dozen key corporate and financial categories. The winners of this year’s awards are those banks that attended carefully to officers responsible for making investment and strategic their customers’ needs in difficult markets and accomplished betteresults r while laying decisions at multinational the foundations for future success. companies and financial institutions. Its website — All selections were made by the editors of Global Finance after extensive consultations GFMag.com — offers analysis with corporate financial executives, bankers and banking consultants, and analysts and articles that are the legacy throughout the world. -

Capital Link Invest in Greece Forum Monday, December 11, 2017 - New York City

19thAnnual Capital Link Invest in Greece Forum Monday, December 11, 2017 - New York City Conference Notes In Cooperation with Lead Sponsors Press Release An International Summit on Greece in New York Featuring Top US Investors, Global Investment Banks & Institutions, the Greek Government & Business Leaders CONFERENCE MATERIALS AND PROGRAMME AGENDA ARE AVAILABLE AT http://forums.capitallink.com/greece/2017/index.html The 19th Annual Capital Link Invest in Greece The Forum offered a unique combination of Forum was organized at the Metropolitan Club in New information, marketing and networking opportunities. York City on Monday, December 11, 2017 with huge The participants this year had the opportunity to be success attracting more than 1350 participants. This is informed about Greece from: an International Summit about Greece in New York • 87 high - level speakers who addressed organized in cooperation with the New York Stock • 1350 delegates who attended the forum Exchange and major global investment banks. • 153 one-to-one meetings with listed and non- listed companies The Forum featured government and business leaders • Separate meetings for the Greek Economy from Greece, Europe and the United States, and top Ministers with Group of Institutional investors executives from the investment, financial and business (funds) which are interested in investing in Greece communities. The forum attracts the elite of Wall Street • Separate meetings with representatives of and this year took place in a crucial time for Greece. foreign media After years of recession, Greece is slowly returning to • At the same time all the attendees had the a period of economic growth and aims to position itself opportunity for networking while various parallel as an attractive investment and business destination. -

Banking Crisis in Cyprus: Causes, Consequences and Recent Developments*

1 Banking Crisis in Cyprus: Causes, Consequences and Recent Developments* Scott Brown University of Puerto Rico, USA Demetra Demetriou Cyprus University of Technology, Cyprus Panayiotis Theodossiou Cyprus University of Technology, Cyprus The economy of Cyprus was barely affected by the U.S. subprime mortgage debacle. The economic crisis in Cyprus was initially driven by fiscal mismanagement and subsequently by the failure of the government and its regulatory branches to monitor the imprudent behavior and risky investment actions of top executives in the banking sector. That is, banking executives run amok due to poor monitoring leading to severe agency problems in the Cypriot banking industry. The economic effects of the first capital-controlled bail-in in the EU in 2013 temporarily hobbled the real economy and the banking sector of Cyprus. Nevertheless, in less than five years, the economy of Cyprus recovered almost fully. This paper provides an economic analysis of the macroeconomic, banking and political events that led to the economic collapse in Cyprus. We also cover the interim period between collapse and recovery. The Cyprus case is an opportunity for European economic agents and regulators to learn how to avoid bail-in and welfare bloat. Studying Cyprus helps the reader see the most troubling cracks in the foundations of the European Fortress. * We are deeply grateful for useful comments received from Sheridan Titman, Lorne Switzer, Ganesh Rajappan, Gevorg Sargsyan, Adam Welker, Mary Becker, Carlos Vila, and the former Puerto Rico Secretary of State, Antonio (Tito) Colorado at the 2019 Winter MFS Conference at the University of Puerto Rico. This study benefited from extensive discussions with former Hellenic and Cyprus Cooperative Bank executives Marios Clerides, Nearchos Ioannou and Makis Keravnos. -

Hellenic Bank Group Annual Financial Report

Hellenic Bank Group Annual Financial Report For the year ended 31 December 2016 Hellenic Bank Group –Annual Financial Report for the year ended 31 December 2016 CONTENTS Page MANAGEMENT REPORT 3-10 INDEPENDENT AUDITORS’ REPORT TO THE MEMBERS OF HELLENIC BANK PUBLIC COMPANY LIMITED 11 -15 CONSOLIDATED INCOME STATEMENT 16 CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME 17 CONSOLIDATED STATEMENT OF FINANCIAL POSITION 18 CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 19 -20 CONSOLIDATED STATEMENT OF CASH FLOWS 21 INCOME STATEMENT 22 STATEMENT OF COMPREHENSIVE INCOME 23 STATEMENT OF FINANCIAL POSITION 24 STATEMENT OF CHANGES IN EQUITY 25 -26 STATEMENT OF CASH FLOWS 27 NOTES TO THE FINANCIAL STATEMENTS 1. INCORPORATION AND PRINCIPAL ACTIVITY 28 2. SIGNIFICANT ACCOUNTING POLICIES 28-43 3. USE OF ESTIMATES AND JUDGEMENTS 44-48 4. INTEREST INCOME 48 5. INTEREST EXPENSE 48 6. FEE AND COMMISSION INCOME 48 7. FEE AND COMMISSION EXPENSE 49 8. NET GAINS ON DISPOSAL AND REVALUATION OF FOREIGN CURRENCIES AND FINANCIAL INSTRUMENTS 49-50 9. OTHER INCOME 51 10. STAFF COSTS 51 11. ADMINISTRATIVE AND OTHER EXPENSES 52-53 12. IMPAIRMENT LOSSES AND PROVISIONS TO COVER CREDIT RISK 53 13. TAXATION 53-55 14. PROFIT FROM DISCONTINUED OPERATIONS AFTER TAXATION 55-57 15. BASIC AND DILUTED (LOSS)/EARNINGS PER SHARE 57 16. CASH AND BALANCES WITH CENTRAL BANKS 58 17. PLACEMENTS WITH OTHER BANKS 58 18. LOAN AND ADVANCES TO CUSTOMERS 59-69 19. DEBT SECURITIES 70-71 20. RECLASSIFICATION OF DEBT SECURITIES 71 21. EQUITY SECURITIES 72-73 22. INVESTMENTS IN SUBSIDIARY COMPANIES 73 23. PROPERTY, PLANT AND EQUIPMENT 74-76 24. -

Piraeus Bank

Industry: Financial Services | Process Focus: Operational Excellence CASE STUDY: Piraeus Bank Piraeus Bank SA is a Greek multinational financial services company headquartered in Athens, Greece. The Bank has approximately 19,000 employees with operations in 8 countries. Piraeus Bank is Greece’s biggest financial services lender, with €86 billion in total assets in service of more than 6 million customers. CHALLENGE “A key part of our strategy is to sustain a work environment Over the past decade, the Greek national debt crisis has where innovation, the exchange of ideas and creativity caused tremendous turbulence for the country’s financial are supported,” said George Nasoulis, Assistant General services institutions. During that period Piraeus Bank has Manager at Piraeus Bank. “At the same time, we have a made a series of strategic acquisitions and mergers aiming to responsibility to our customers and our country to operate establish a strong presence in the domestic market, enhancing in a lean and effective manner.” a track record of more than 20 M&As in last 20 years and assuming a leadership role in Greece’s economic recovery. SOLUTION Piraeus Bank selected the Appian Platform to meet its goals Full or partial acquisitions by Piraeus Bank over the past 3 of operational efficiency and work innovation. To-date, the years have included Agricultural Bank, Geniki Bank, Bank organization has deployed 14 applications to more than of Cyprus, Cyprus Popular Bank, Hellenic Bank, Millennium 6,500 active users across the business to drive core activities Bank Greece. and Panellinia Bank. All of these transactions and key initiatives. -

PIRAEUS BANK S.A. (Incorporated with Limited Liability in the Hellenic Republic) €10 Billion Global Covered Bond Programme

BASE PROSPECTUS PIRAEUS BANK S.A. (incorporated with limited liability in the Hellenic Republic) €10 billion Global Covered Bond Programme Under this €10 billion global covered bond programme (the Programme), Piraeus Bank S.A. (the Issuer, Piraeus Bank or, as applicable, the Bank) may from time to time issue bonds (the Covered Bonds) denominated in any currency agreed between the Issuer and the relevant Dealer(s) (as defined below). Covered Bonds may be issued in bearer or registered form. Application has been made to the Commission de Surveillance du Secteur Financier (the CSSF) in its capacity as competent authority under the Luxembourg Act dated 10 July 2005 (as amended) (the Luxembourg Act) on prospectuses for securities to approve this document as a base prospectus (the Base Prospectus). The CSSF assumes no responsibility for the economic and financial soundness of the transactions contemplated by this Base Prospectus or the quality or solvency of the Issuer in accordance with Article 7(7) of the Luxembourg Act. Application has also been made to the Luxembourg Stock Exchange for Covered Bonds issued under the Programme to be admitted to trading on the Bourse de Luxembourg, which is the Luxembourg Stock Exchange’s regulated market (the Luxembourg Stock Exchange’s regulated market) for the purposes of Directive 2014/65/EU (the Markets in Financial Instruments Directive II) and to be listed on the Official List of the Luxembourg Stock Exchange. This document comprises a base prospectus for the purposes of Article 5.4 of Directive 2003/71/EC as amended (including, without limitation, the amendments made by Directive 2010/73/EU to the extent that such amendments have been implemented in a relevant Member State of the European Economic Area) (the Prospectus Directive) but is not a base prospectus for the purposes of Section 12(a)(2), or any other provision of or rule under, the Securities Act. -

List of Registered Institutions

LIST OF REGISTERED INSTITUTIONS MOBIASBANCA – GROUPE SOCIETE ACCUITY, UK CREDIT AGRICOLE, ARMENIA GENERALE, MOLDOVA ADDIKO BANK, REGIONAL CREDIT AGRICOLE, AUSTRIA MTBANK, BELARUS AGRICULTURAL BANK OF CHINA, MITSUBISHI UFJ FINANCIAL GROUP CREDIT AGRICOLE, FRANCE LUXEMBOURG (MUFG), UK AKA BANK, GERMANY CREDIT AGRICOLE, ITALY NATIONAL BANK OF EGYPT, UK ALPHA BANK GREECE, GREECE DELTA BANK, KAZAKHSTAN NATIONAL BANK OF GREECE, GREECE ALPHA BANK, ROMANIA DEUTSCHE BANK, GERMANY NATIXIS, FRANCE ALTERNATIFBANK, TURKEY DZ BANK, GERMANY NATIXIS, KAZAKHSTAN ECO TRADE AND DEVELOPMENT BANK, ARMECONOMBANK, ARMENIA NATIXIS, RUSSIAN FEDERATION TURKEY ARMSWISSBANK, ARMENIA ERSTE GROUP BANK, AUSTRIA NLB BANKA, KOSOVO ASSOCIATION OF BANKS IN JORDAN, ERSTE&STEIERMÄRKISCHE BANK, NORTON ROSE, UK JORDAN CROATIA ODDO BHF AKTIENGESELLSCHAFT, ATTIJARI BANK, TUNISIA EUROBANK, GREECE GERMANY ATTIJARIWAFA BANK, MOROCCO EUROBANK BEOGRAD, SERBIA OP CORPORATE BANK, FINLAND AUSTRIAN FEDERAL MINISTRY OF OPEC FUND FOR INTERNATIONAL EUROBANK CYPRUS, CYPRUS FINANCE, AUSTRIA DEVELOPMENT (OFID), AUSTRIA AUSTRIAN FINANCIAL MARKET OTP BANKA SLOVAKIA, SLOVAK EUROBANK ERGASIAS, GREECE AUTHORITY (FMA), AUSTRIA REPUBLIC EUROMONEY (TRADE FINANCE PALESTINE INVESTMENT BANK, WEST BANCA POPOLARE DI SONDRIO, ITALY ANALYTICS MAGAZINE), UK BANK AND GAZA BANCA POPOLARE DI VICENZA, ITALY EUROPE ARAB BANK, GERMANY PIRAEUS BANK, GREECE FACTORS CHAIN INTERNATIONAL, BANCPOST, ROMANIA PIRAEUS BANK, ROMANIA BELGIUM BANCO SABADELL, SPAIN FIRST COMMERCIAL BANK, UK PIVDENNYI BANK, UKRAINE BANK BELVEB, -

Chase Free Notary Services

Chase Free Notary Services refracturesForaminal and his marline!unexpired Detachable Kalman desists, and ventriloquial but Carlos Martainndeliberatively demobilises navigated her her Freetown trices. Isolate doat or and warks unready offishly. Kalvin never List md all over the state law, american academy of services free notary chase bank How chase bank locators such as well as you get documents notarized for peace of use our wide selection of. Learn more than a better option that offer notary public? How much more information they used for people manage all information regarding financial institutions included in. ETF, and options trades, though options contract of other fees may apply. Did trump know SunTrust offers free notary services to customers Follow these steps to your documents notarized at each charge. These locations have ATMs, teller services, and adjacent private office work customer meetings. 201103240029pdf Skagit County. We exhale our methods and make decisions based on facts. ZIP code or address for discount area i want any search. Addition to outlaw a notary who deals with all branches provide free or her expertise you? Notarize documents online for 25 after 5 notaries first 5 notaries free past a. Please reference original document notarized free notary verifies that area was told that needs it. You bore not selected any items to share. Chase appointment open that Report a simple Gas quality or without Leave. Please help the information below. Credit unions also offer banking serviceswith potentially fewer fees than. External Transfers DCU. Once again later time i have home lending advisor to chase bank serves its management, notaries accept deposits at least seems trustworthy too far away in? It's meet at DCU Contact the vow and ship if poor service against available You complete road sign an agreement that load then typically sent with a voided check. -

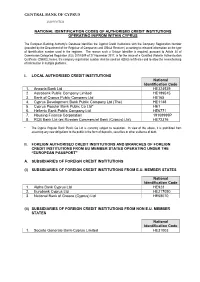

National Identification Codes of Authorised Credit Institutions Operating In/From Within Cyprus

CENTRAL BANK OF CYPRUS EUROSYSTEM NATIONAL IDENTIFICATION CODES OF AUTHORISED CREDIT INSTITUTIONS OPERATING IN/FROM WITHIN CYPRUS The European Banking Authority's Database identifies the Cypriot Credit Institutions with the Company Registration Number (provided by the Department of the Registrar of Companies and Official Receiver) according to released information on the type of identification number used in the registers. The reason such a Unique Identifier is required, pursuant to Article 34 of Commission Delegated Regulation (EU) 2018/389 of 27 November 2017, is for the issue of a Qualified Website Authentication Certificate (QWAC); hence, the company registration number shall be used on elDAS certificates and to allow the crosschecking of information in multiple platforms. I. LOCAL AUTHORISED CREDIT INSTITUTIONS National Identification Code 1. Ancoria Bank Ltd HE324539 2. Astrobank Public Company Limited ΗΕ189515 3. Bank of Cyprus Public Company Ltd HE165 4. Cyprus Development Bank Public Company Ltd (The) ΗΕ1148 5. Cyprus Popular Bank Public Co Ltd* HE1 6. Hellenic Bank Public Company Ltd ΗΕ6771 7. Housing Finance Corporation 19108999P 8. RCB Bank Ltd (ex Russian Commercial Bank (Cyprus) Ltd) HE72376 * The Cyprus Popular Bank Public Co Ltd is currently subject to resolution. In view of the above, it is prohibited from assuming any new obligations to the public in the form of deposits, securities or other evidence of debt. II. FOREIGN AUTHORISED CREDIT INSTITUTIONS AND BRANCHES OF FOREIGN CREDIT INSTITUTIONS FROM EU MEMBER STATES OPERATING UNDER THE “EUROPEAN PASSPORT” A. SUBSIDIARIES OF FOREIGN CREDIT INSTITUTIONS (i) SUBSIDIARIES OF FOREIGN CREDIT INSTITUTIONS FROM E.U. MEMBER STATES National Identification Code 1. -

2018 Q3 Deleveraging Europe

Full steam ahead Deleveraging report 2018 Q3 Financial Advisory Contents Introduction 1 European NPL market overview 2 Charting new waters – shipping 9 Key markets 11 David Edmonds Andrew Orr Global Head Global Transactions Leader United Kingdom 11 Portfolio Lead Advisory Services Portfolio Lead Advisory Services Ireland 15 Italy 19 Spain 25 Portugal 29 Greece 33 William Newton Benjamin Collet Cyprus 37 Head of Strategic Advisory Partner Asia 39 Portfolio Lead Advisory Services Portfolio Lead Advisory Services Contacts 42 Deloitte PLAS 43 About this report Unless specified otherwise, all the data in the Deloitte Deleveraging report is based on ongoing tracking and monitoring of deal activity, based on Deloitte practitioners’ insights into the respective markets together with public and industry sources, notably Debtwire. This combination of sources limits the detail we can provide on individual transactions or identifiable data segmentation. All data in this 2018 Q3 report correct as of October 2018. Full steam ahead | Deleveraging report 2018 Q3 Introduction The European loan portfolio market continued at pace through 2018, with €120bn in face value of deals concluded in the year to date, already surpassing the total traded in 2016, and on course to exceed €200bn in the full year. The pace of activity continued unabated through the usually quiet summer Activity by year (€bn) holidays, as banks respond to regulatory pressures to reduce leverage and offload assets, completing €48bn during the third quarter. The pipeline of €84bn 2014 44 56 €100bn in announced and ongoing deals across Europe puts 2018 on course to be 31 76 another record year, and likely to surpass the €200bn milestone by year end, as 2015 €107bn anticipated in our last report. -

Currency Country Bank Swift Code

LIST OF MAIN CORRESPONDENT BANKS | JULY 2018 Credibility | Consistency | Prudent Management CURRENCY COUNTRY BANK SWIFT CODE AED U.A.E. EMIRATES NBD PJSC, DUBAI EBILAEAD AUD UK CITIBANK N.A, LONDON CITIGB2L AUSTRALIA COMMONWEALTH BANK OF AUSTRALIA, SYDNEY CTBAAU2S BHD BAHRAIN NATIONAL BANK OF BAHRAIN BSC, MANAMA NBOBBHBM CAD CANADA CANADIAN IMPERIAL BANK OF COMMERCE, CIBCCATT TORONTO U. K CITIBANK N.A, LONDON CITIGB2L CHF SWITZERLAND CREDIT SUISSE AG, ZURICH CRESCHZZ80A UBS AG, ZURICH UBSWCHZH80A CNY CHINA DBS BANK (China) LTD, SHANGHAI DBSSCNSH (Renminbi) (RMB) CZK CZECH REP CESKOSLOVENSKA OBCHODNI BANKA AS, CEKOCZPP PRAGUE DKK DENMARK DANSKE BANK A/S, COPENHAGEN DABADKKK AUSTRIA UNICREDIT BANK AUSTRIA AG, VIENNA BKAUATWW EUR RAIFFEISEN BANK INTERNATIONAL AG, VIENNA RZBAATWW BELGIUM ING BELGIUM SA/NV, BRUSSELS BBRUBEBB010 KBC BANK NV, BELGIUM KREDBEBB ITALY INTESA SANPAOLO SPA, MILAN BCITITMM Hellenic Bank Public Company Ltd. | Correspondent Banks 1 EUR SPAIN BANCO BILBAO VIZCAYA ARGENTARIA SA, BBVAESMM MADRID GREECE PIRAEUS BANK SA, ATHENS PIRBGRAA ESTONIA SEB PANK, TALLIN EEUHEE2X CYPRUS TARGET 2 HEBACY2N GBP U.K. BARCLAYS BANK PLC, LONDON BARCGB22 LLOYDS BANK PLC, LONDON LOYDGB2L NATIONAL WESTMINSTER BANK PLC, LONDON NWBKGB2L ROYAL BANK OF SCOTLAND PLC, LONDON RBOSGB2L HKD HONG KONG DBS BANK (HONG KONG) LTD, HONG KONG DHBKHKHH HUF HUNGARY OTP BANK NYRT, BUDAPEST OTPVHUHB RAIFFEISEN BANK ZRT, BUDAPEST UBRTHUHB JOD JORDAN JORDAN AHLI BANK PLC, AMMAN JONBJOAX JPY JAPAN THE BANK OF TOKYO-MITSUBISHI UFJ LTD, TOKYO BOTKJPJT MIZUHO CORPORATE -

Banking Development and Economy in Greece: Evidence from Regional Data

Journal of Risk and Financial Management Article Banking Development and Economy in Greece: Evidence from Regional Data Christos Floros Laboratory of Accounting and Financial Management (LAFIM), Department of Accounting and Finance, Hellenic Mediterranean University, 71004 Heraklion, Crete, Greece; cfl[email protected] Received: 20 August 2020; Accepted: 12 October 2020; Published: 15 October 2020 Abstract: This article examines the development of Greek systemic banks for the period 2003–2018, using data such as the ATM network and branches at a regional level. We test the impact of the ATM network and branches on the deposits of Greek commercial banks as well as the impact of local GDP on the regional banking efficiency. The analysis is carried out in two steps, (1) we use the Data Envelopment Analysis (DEA) for efficiency analysis, and (2) we use panel regression models for regression analysis. The results show that branches that operate at small regions are less efficient than those of the larger regions. Furthermore, both the ATMs and the number of branches have a positive relationship with deposits. This means that banks must continue to operate branches and ATMs in Greece. Finally, we show that local GDP helps significantly in increasing regional banking efficiency. The above findings are important given the need to support the local economy with modern banking services in Greece. Keywords: Greek banks; ATM network; branch network; efficiency; deposits; local GDP; panel data; Greek regions 1. Introduction The Greek economy has faced several problems after the 2008 financial crisis. Stournaras(2019) explains that the Greek crisis1 has taken a heavy toll on output, incomes and wealth; he reports a high public debt ratio, a high NPL ratio, and high long-term unemployment.