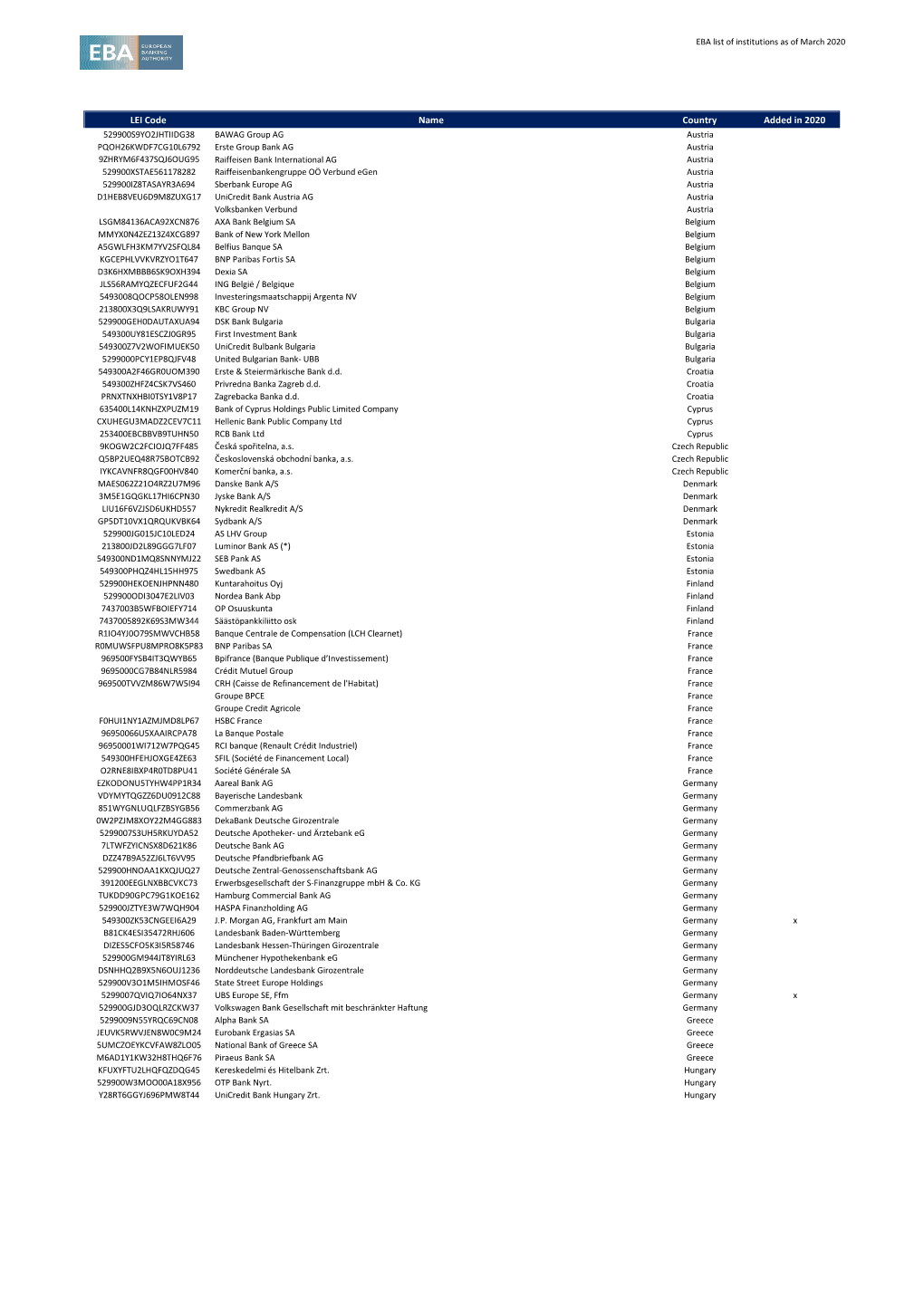

EBA List of Institutions As of March 2020 LEI Code Name Country

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Bank of Greece (NBG) Memo Name: James Zhang Phone #: (757) 788-9962 College/School: CLAS Year: Class of 2017

National Bank of Greece (NBG) Memo Name: James Zhang Phone #: (757) 788-9962 College/School: CLAS Year: Class of 2017 Company Description [NYSE; NGB] is a Greek bank and financial services company that primarily operates in commercial banking, but also has business in retail banking, investment banking, asset management, and insurance. The National Bank of Greece SA previously wrote off huge losses on its balance sheet during the Eurozone debt crisis, it has been on a steady path to recovery since the second half of 2013, and has been expanding its business in various sectors throughout Europe. Specifically, the rise in Greek lending and home loans, diversification by way of improved operations in Turkey and emerging markets, and the general recovery of the Greek economy will propel NGB to huge growth in the long term. Most notably, recent actions by Mario Draghi and the European Central Bank will create a healthy, stable environment for the National Bank of Greece to achieve its upside potential over time. Thesis / Key Points Rise in lending and specific developments in the banking sector in Greece will play to NBG’s advantage As Greece’s largest lender, NBG has acted swiftly in the past year to boost its position financially by increasing loans and retailing banking, as well as increasing capitalization from outside investors and generating domestic confidence. o Its nonperforming loans (NLP) have receded drastically and will contribute to its profitability when compared with its 3 closest rivals, Piraeus Bank, Alpha Bank, and EuroBank, who have all booked operating losses in this field. In addition, NGB now controls a quarter of commercial banking in Greece and 25% of total consumer deposits, and has also proceeded to raise around €2.5 billion in capital to reduce the Greece government’s holding stake in the bank. -

Fitch Places 31 EMEA Bank ST Issuer Ratings Under Criteria Observation

5/7/2019 [ Press Release ] Fitch Places 31 EMEA Bank ST Issuer Ratings Under Criteria Observation Fitch Places 31 EMEA Bank ST Issuer Ratings Under Criteria Observation Fitch Ratings-London-07 May 2019: Fitch Ratings has placed 31 Short-Term (ST) Issuer Default Ratings (IDR) and related ST debt level ratings of EMEA-based banks Under Criteria Observation (UCO) following the publication of its cross-sector criteria for Short-Term Ratings on 2 May 2019. A full list of rating actions is below. Fitch intends to conclude full implementation of the criteria, and resolution of all UCO designations within six months of the designation. KEY RATING DRIVERS The ST ratings of the affected banks are determined primarily by correspondence tables linking short-term to long-term ratings. The new ST rating criteria introduced changes to our correspondence table between long-term and ST ratings. Two new cusp points at 'A' and 'BBB+' have been added to the existing three cusp points ('A+', 'A-' and 'BBB'), where baseline or higher ST ratings can be assigned. For banks with Long-Term IDRs driven by their standalone profile, as reflected by their Viability Ratings (VR), Fitch uses the funding and liquidity factor score as the principal determinant of whether the 'baseline' or 'higher' ST IDR is assigned at each cusp point. The ST IDRs and, where relevant, associated ST debt/deposit ratings of the following issuers have been placed UCO because the ratings could be upgraded by one notch under the new criteria. This is because the latest funding and liquidity scores that feed into their VRs are at least in line with the minimum levels required for a higher ST rating under the new criteria: - Banco Cooperativo Espanol, S.A. -

Evolución De Los Principales Grupos Bancarios Españoles (2009-2021)

Evolución de los principales grupos bancarios españoles (2009-2021) Intervenida por BE (sustitución de administadores) Capital controlado por el FROB Integración SIP Constitución del banco 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Integration processes I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV I II III IV J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D J F M A M J J A S O N D Santander Santander Banco Popular Banco Popular Banco Pastor BBVA Caixa Sabadell BBVA Caixa Terrasa Unnim Unnim Banc Caixa Manlleu BBVA Caixa Catalunya Caixa Tarragona Catalunya Caixa Catalunya Banc CX Caixa Manresa La Caixa Caixa Girona La Caixa Caixabank Caja Sol Caja Guadalajara Caja Sol Caixabank Caja Navarra Banca Cívica Caja Burgos Banca Cívica Caixabank Caja Canarias Banco de Valencia Banco de Valencia Caja Madrid Bancaja Caixabank Caja de Ávila Caja Segovia BFA-Bankia Caja La Rioja Caixa Laietana Caja Insular de Canarias Bankia Caja Murcia Caixa Penedés Caja Granada Mare Nostrum Banco Mare Nostrum BMN Sa Nostra Banco Sabadell Banco Guipuzcoano Banco Sabadell Banco Sabadell Caja de Ahorros del Mediterráneo CAM Banco CAM Banco Sabadell Banco Gallego (Grupo NCG) Banco Gallego Bankinter Bankinter Unicaja Caja Jaén Unicaja Unicaja Banco Caja Duero Unicaja Banco Caja España Caja España de Inversiones Banco CEISS Cajastur Unicaja CCM CCM Cajastur Banco Caja Cantabria Liberbank Liberbank Caja Extremadura Caja de Ahorros Inmaculada CAI Caja Círculo Católico de Burgos Caja 3 Banco Grupo Caja 3 Caja Badajoz Ibercaja Banco Ibercaja Ibercaja Banco Kutxa Caja Vital BBK BBK Kutxabank Kutxabank CajaSur CajaSur Banco Etcheverría Caixa Galicia Abanca Caixa Nova Novacaixagalicia NCGBanco Evo Banco C.R. -

Nota Per Il Direttore Generale

PRESS RELEASE Fintech, ABI: Italian banks are working on blockchain pilot A first group of Italian banks has begun operative testing of a blockchain. Shortly, after an initial test phase, the pilot will be extended to a larger number of banks. ABI Lab, the technological laboratory supported by the Italian Banking Association (ABI), and the banks that are participating in the project are engaged in applying blockchain technology to interbank processes with the objective of attaining the benefits derived from data transparency and visibility, the increased speed in executing transactions and the possibility of performing checks and exchanges directly within the application. Blockchain technology allows for the creation and management of a large distributed database for managing transactions that can be shared across multiple nodes of a network. In other words, it is a database in which data is not stored on a single computer, but on multiple computers, called nodes, that are connected to one another. Without having to rely on a single centralised entity, this new concept of distributed databases, Distributed Ledger Technology (DLT), changes the way we think and design the relationships and the exchange of value between the participants. The scope of application is interbank reconciliation, which verifies the matching of correspondent accounts that involve two different banks that contain transactions executed between two customers of two banks. The project has also verified how the application of DLT technology can improve certain specific aspects of current operations that can result in discrepancies that are difficult for the banks to manage. Among these is the time needed to identify transactions between banks that do not match; the lack of a standard process and a single communications protocol; the limited visibility of the transactions between parties. -

2020 Sample Delegate List

2020 Sample Delegate List Join 600+ institutional and private investors alongside fund managers, developers, telecoms, energy companies and the world's governments for four days of unrivalled networking opportunities and cutting-edge content. Here is a sample of some of the biggest names in the industry who you could meet in March: • Arendt & Medernach • Ancala Partners • 3i Group • APFC • 4IP Group • APG Asset Management • A.P. Moller Capital • Apollo Global Management • Aarden • Aquila Capital Management • Abu Dhabi Investment Authority • Arcus Infrastructure Partners • ABVCAP • Ardian • Access Capital Partners • Arjun Infrastructure • Achmea Investment Management • Arpinge • Actis • ASFO • Africa Investor • Ashurst • Africa50 • Asian Infrastructure Investment Bank • Al Saheal Property Development & • Asper Investment Management Management • Astarte Capital Partners • Alberta Teachers' Retirement Fund • Asterion Industrial Partners • Alberta Teachers' Retirement Fund Board • Astrid Advisors • Allen & Overy • ATLAS Infrastructure • Allianz Capital Partners • ATP • Altamar Capital Partners • AXA Real Estate Investment Managers • AMF Pension • Axium Infrastructure • AMP Capital • Bain & Company • Analysys Mason • Barmenia For more information, visit the website here. Last updated 21/01/2020 • Basalt Infrastructure Partners • Cooperatie • Bases Conversion and Development • Copenhagen Infrastructure Partners Authority (BCDA) • Covalis Capital • BayWa r.e. renewable energy • CPPIB • bfinance • CPV-CAP Pensionskasse Coop • Bimcor • Credit -

Western Europe 2020

Global Finance Announces Its 27th Annual Best Bank Awards And Names The Best Banks In Western Europe 2020 NEW YORK, March 13, 2020 – Global Finance magazine has announced its 27th annual awards for the World’s Best Banks. The honorees for Western Europe are presented here. A full report on the selections will appear in the May issue of Global Finance and online About Global Finance at GFMag.com, with winners chosen in more than 150 countries across Africa, Asia- Pacific, Central & Eastern Europe, Latin America, the Middle East, North America and Global Finance, founded in Western Europe. The May report will also feature selections for the Best US Regional 1987, has a circulation of Banks, the Best Islamic Financial Institutions and the World’s Best Banks by Region. 50,000 and readers in 188 countries. Global Finance’s The overall Best Bank in the World will be announced in the summer and published audience includes senior in the October issue, along with the Best Global Banks in more than a dozen key corporate and financial categories. The winners of this year’s awards are those banks that attended carefully to officers responsible for making investment and strategic their customers’ needs in difficult markets and accomplished betteresults r while laying decisions at multinational the foundations for future success. companies and financial institutions. Its website — All selections were made by the editors of Global Finance after extensive consultations GFMag.com — offers analysis with corporate financial executives, bankers and banking consultants, and analysts and articles that are the legacy throughout the world. -

Outlooks on Five Spanish Financial Groups and Three European Bank Branches Revised Following Outlook Revision on Spain

Outlooks On Five Spanish Financial Groups And Three European Bank Branches Revised Following Outlook Revision On Spain Primary Credit Analyst: Elena Iparraguirre, Madrid (34) 91-389-6963; [email protected] Secondary Contacts: Luigi Motti, Madrid (34) 91-788-7234; [email protected] Carlos Cobo, Madrid +34 91 788 72 32; [email protected] Fabio Mostacci, Madrid +34 91 788 72 09; [email protected] Alexander Ekbom, Stockholm (46) 8-440-5911; [email protected] Nigel Greenwood, London (44) 20-7176-7211; [email protected] Thierry Grunspan, Paris (33) 1-4420-6739; [email protected] E.Robert Hansen, CFA, New York (1) 212-438-7402; [email protected] • On Nov. 29, 2013, Standard & Poor's revised the outlook on the long-term sovereign credit rating on Spain to stable from negative. • Spanish banks continue to rebalance their funding profiles. They are reducing their reliance on funding from the ECB and foreign sources, increasing the weight of more stable domestic retail funding in the mix, and sharply reducing the cost of domestic deposits. We expect this trend to continue, particularly in the context of stabilizing sovereign creditworthiness. • We now see a stable trend for industry risk in Spain. We continue to view the trend for economic risk as stable. • We are revising to stable from negative the outlooks on four Spanish banking groups and three branches of European banks, and to positive from stable the outlook on one institution. We are maintaining negative outlooks on six other Spanish banking groups. • In three cases, the stable outlooks reflect the diminishing likelihood of a rating downgrade as risks in the operating environment in Spain are abating. -

View Annual Report

2008 Annual Report 2008 annual report 2 OTP Bank Annual Report 2008 Contents 4 Message from the Chairman and Chief Executive Offi cer 9 Financial Highlights 10 Macroeconomic and fi nancial environment in 2008 15 Business Reports 16 Activities and business results of the Bank Group in 2008 20 The business operations of OTP Group members in Hungary 31 The business operations of foreign subsidiaries 37 Management’s Analysis 38 Management’s Analysis of developments in the Bank’s fi nancial position 55 Financial Summary 57 Financial Reports 58 Independent Auditors’ Report (consolidated, based on IFRS) 60 Balance Sheet (consolidated, based on IFRS) 61 Statements of Operations (consolidated, based on IFRS) 62 Statement of Cash Flows (consolidated, based on IFRS) 63 Statement of Changes in Shareholders’ Equity (consolidated, based on IFRS) 64 Notes to Consolidated IFRS Financial Statements for the year ended 31 December 2008 109 Independent Auditors’ Report (unconsolidated, based on IFRS) 111 Balance Sheet (unconsolidated, based on IFRS) 112 Profi t and Loss Account (unconsolidated, based on IFRS) 113 Statement of Cash Flow (unconsolidated, based on IFRS) 114 Statement of Changes in Shareholders’ Equity (unconsolidated, based on IFRS) 115 Notes to Unconsolidated IFRS Financial Statements for the year ended 31 December 2008 157 Corporate Governance 158 Senior management of OTP Bank and executive members of the Board of Directors 160 Non-executive members of the Board of Directors of OTP Bank 162 Members of the Supervisory Board of OTP Bank 163 Information for the Shareholders 165 Declaration on Corporate Governance practice 168 Anti-money Laundering Measures 169 Corporate Social Responsibility Contents 3 Message from the Chairman and Chief Executive Offi cer DEAR SHAREHOLDERS, As Hungary’s leading bank and one of the region’s most important financial institutions, every year OTP is faced with a greater set of challenges. -

CAYMAN ISLANDS) LIMITED (Incorporated with Limited Liability in the Cayman Islands) As Issuer and EFG EUROBANK ERGASIAS S.A

– 6:46 pm – mac5 – 3485 Intro : 3485 Intro Prospectus EFG HELLAS PLC (incorporated with limited liability in England and Wales) as Issuer and EFG HELLAS (CAYMAN ISLANDS) LIMITED (incorporated with limited liability in the Cayman Islands) as Issuer and EFG EUROBANK ERGASIAS S.A. (incorporated with limited liability in the Hellenic Republic) as Guarantor €15,000,000,000 Programme for the Issuance of Debt Instruments Under this €15,000,000,000 Programme for the Issuance of Debt Instruments (the “Programme”), each of EFG Hellas PLC and EFG Hellas (Cayman Islands) Limited (each an “Issuer” and, together, the “Issuers”) may from time to time issue debt instruments (“Instruments”) guaranteed by EFG Eurobank Ergasias S.A. (the “Guarantor” or the “Bank”) and denominated in any currency agreed between the relevant Issuer and the relevant Dealer (as defined herein). Application has been made to the Commission de Surveillance du Secteur Financier (the “CSSF”) in its capacity as competent authority under the Luxembourg Act dated 10 July 2005 on prospectuses for securities to approve this document as a base prospectus. Application has also been made to the Luxembourg Stock Exchange for Instruments issued under the Programme to be admitted to trading on the Luxembourg Stock Exchange's regulated market and to be listed on the Official List of the Luxembourg Stock Exchange. References in this Prospectus to Instruments which are intended to be “listed” (and all related references) on the Luxembourg Stock Exchange shall mean that such Instruments have been admitted to trading on the Luxembourg Stock Exchange’s regulated market and have been listed on the Official List of the Luxembourg Stock Exchange. -

OTP Bank Plc. Separate and Consolidated, OTP Mortgage Bank Ltd., OTP Building Society Ltd., Merkantil Bank Ltd

OTP Bank Plc. OTP Bank Plc. separate and consolidated, OTP Mortgage Bank Ltd., OTP Building Society Ltd., Merkantil Bank Ltd. In line with Act CCXXXVII of 2013 on Credit Institutions and Financial Enterprises, and Regulation (EU) No 575/2013 of the European Parliament and of the Council on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (English translation of the original report) Budapest, 12 April 2019. DISCLOSURE BY INSTITUTIONS 31. December 2018 Table of contents I. OTP Group ..................................................................................................................................................... 10 I.1. Risk management objectives and policies ........................................................................................... 10 I.1.1. OTP Group’s riskmanagement strategy and general risk profile ..................................................... 10 I.1.2. Credit risk mitigation ........................................................................................................................ 15 I.1.3. Applied stress test methodologies in the OTP Group ...................................................................... 16 I.2. Information regarding corporate governance system .......................................................................... 17 I.2.1. The number of directorships of OTP Bank’s chief executives ......................................................... 17 I.2.2. Board members’ education data ..................................................................................................... -

Name Address Postal City Mfi Id Head Office Res* Greece

MFI ID NAME ADDRESS POSTAL CITY HEAD OFFICE RES* GREECE Central Banks GR010 Bank of Greece, S.A. 21, Panepistimiou Str. 102 50 Athens No Total number of Central Banks : 1 Credit Institutions GR060 ABN Amro Bank 348, Syngrou Avenue 176 74 Athens NL ABN AMRO Bank N.V. Yes GR077 Achaiki Co-operative Bank, L.L.C. 66, Michalakopoulou Str. 262 21 Patra Yes GR056 Aegean Baltic Bank S.A. 28, Diligianni Str. 145 62 Athens Yes GR014 Alpha Bank, S.A. 40, Stadiou Str. 102 52 Athens Yes GR100 American Bank of Albania Greek Branch 14, E. Benaki Str. 106 78 Athens AL American Bank of Albania Yes GR080 American Express Bank 280, Kifissias Avenue 152 32 Athens US American Express Yes Company GR047 Aspis Bank S.A. 4, Othonos Str. 105 57 Athens Yes GR043 ATE Bank, S.A. 23, Panepistimiou Str. 105 64 Athens Yes GR016 Attica Bank, S.A. 23, Omirou Str. 106 72 Athens Yes GR081 Bank of America N.A. 35, Panepistimiou Str. 102 27 Athens US Bank of America Yes Corporation GR073 Bank of Cyprus Limited 170, Alexandras Avenue 115 21 Athens CY Bank of Cyprus Public Yes Company Ltd GR050 Bank Saderat Iran 25, Panepistimiou Str. 105 64 Athens IR Bank Saderat Iran Yes GR072 Bayerische Hypo und Vereinsbank A.G. 7, Irakleitou Str. 106 73 Athens DE Bayerische Hypo- und Yes Vereinsbank AG GR105 BMW Austria Bank GmbH Zeppou 33 166 57 Athens AT BMW Austria Bank GmbH Yes GR070 BNP Paribas 94, Vas. Sofias Avenue 115 28 Athens FR Bnp paribas Yes GR039 BNP Paribas Securities Services 94, Vas. -

The Competition Council Has Authorized the Merger Between ALPHA BANK AE and EFG EFG EUROBANK ERGASIAS SA

The Competition Council has authorized the merger between ALPHA BANK AE and EFG EFG EUROBANK ERGASIAS SA The Competition Council has authorized the economic concentration consisting in merger by absorbtion of EFG Eurobank Ergasias SA by Alpha Bank AE. The analysis of the competition authority found that the notified economic concentration does not raise significant obstacles to effective competition on the Romanian market, respectively does not lead to the creation or strengthening of a dominant position of the merged company to have as effect restriction, prevention or significant distortion of competition on the Romanian market or on a part of it. Since both Alpha Bank AE and EFG Eurobank Ergasias SA hold in Greece more than 2/3 of turnover at European level, there is no obligation this merger to be notified to the European Commission. Community legislation provides that where each of the companies involved achieves more than 2/3 of total turnover in one of member states, the operation is analyzed by the competition authority of respective state as well as by each of the states where the involved parties activate. The merged company shall be called Alpha Eurobank SA. Alpha Bank AE is a company that is part of Alpha group, one of the most important banking and financial services groups in Greece. Alpha Group offers a wide range of services including retail banking, corporate banking, asset management, private sector banking, distribution of insurance products, investment banking, leasing, factoring, management of brokerage services and of estate assets, and brokerage services. In Romania, Alpha group holds control over Alpha Bank Romania S.A., Alpha Leasing Romania IFN S.A., SSIF Alpha Finance Romania S.A., Alpha Insurance Brokers S.R.L., Alpha Astika Akinita Romania S.R.L.