Triumph Group Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2021 Sustainability and Annual Report FINANCIAL HIGHLIGHTS

Ready TRIUMPH GROUP 2021 Sustainability and Annual Report FINANCIAL HIGHLIGHTS (in millions, except per share data) TOTAL BACKLOG Fiscal Year Ended March 31 2021 2020 2019 $ in billions $ 1,870 Net sales $ 2,900 $ 3,365 $ Ready to fly Adjusted operating income 108 218 166 ( ) Adjusted net income 2 137 115 Adjusted diluted earnings per share $ (0.03) $ 2.69 $ 2.38 ( ) Cash flow from operations 173 97 (174) Total assets $ 2,451 $ 2,980 $ 2,855 Total debt 1,958 1,808 1,489 Total equity (819) (781) (573) AFTER ONE OF THE TOUGHEST YEARS OUR INDUSTRY HAS EVER NON-GAAP RECONCILIATION FACED, IT IS ENCOURAGING TO HAVE AN ABUNDANCE OF GOOD Operating (loss) income – GAAP $ (326) $ 58 $ (275) Loss on sale of assets & businesses 105 57 235 NEWS. TRIUMPH GROUP HAS EMERGED FROM FIVE YEARS OF Forward losses — — 87 SALES BY END MARKET ARDUOUS RESTRUCTURING AS A MUCH STRONGER AND MORE Restructuring 53 25 31 Legal judgment gain, net — (9) — Regional Jet .% .% Non-Aviation AGILE COMPANY. OUR MARKETS ARE POISED FOR GROWTH, AND Impairments 276 66 — Business Jet Other — 21 87 % Adjusted operating income* 108 218 166 WE ARE POSITIONED FAVORABLY AND SUSTAINABLY WITHIN Interest & other (171) (122) (115) % THEM. OUR PEOPLE ARE SUPPORTED AND FOCUSED. OUR Non-service defined benefit income 50 41 57 % 15 Less: Financing charges 3 1 Military Adjusted income before income taxes* 1 140 110 Commercial PROFITABILITY IS IMPROVING. UP IS WHERE WE ARE GOING. (3) Income taxes (6) 5 DECISIVELY, DECIDEDLY UP. Tax effect of adjustments — 3 — Adjusted net income (2) 137 115 ADJUSTED SEGMENT OPERATING INCOME Diluted earnings per share – GAAP $ (8.55) $ (0.58) $ (6.58) Per share impact of adjustments 8.52 3.27 8.96 ( ) Aerospace Adjusted diluted earnings per share $ 0.03 $ 2.69 $ 2.38 Structures Weighted average diluted shares 53.0 52.0 49.7 % *Differences due to rounding ABOUT TRIUMPH % Triumph Group, Inc. -

Rosuvastatin Calcium Patent Litigation

IN THE UNITED STATES DISTRICT COURT FOR THE DISTRICT OF DELAWARE IN RE: ROSUVASTATIN CALCIUM MDL No. 08-1949-JJF PATENT LITIGATION, ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-805-JJF-LPS MYLAN PHARMACEUTICALS INC., Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-806-JJF-LPS SUN PHARMACEUTICAL INDUSTRIES LTD. , Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-807-JJF-LPS SANDOZ INC., Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-808-JJF-LPS PAR PHARMACEUTICALS INC., Defendant. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-809-JJF-LPS APOTEX CORP., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-810-JJF-LPS AUROBINDO PHARMA LTD. AND AUROBINDO PHARMA USA INC., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 07-811-JJF-LPS COBALT PHARMACEUTICALS INC. AND COBALT LABORATORIES INC., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. Civil Action No. 08-359-JJF-LPS AUROBINDO PHARMA LTD. AND AUROBINDO PHARMA USA INC., Defendants. ASTRAZENECA PHARMACEUTICALS LP, ASTRAZENECA UK LIMITED, IPR PHARMACEUTICALS INC., AND SHIONOGI SEIYAKU KABUSHIKI KAISHA, Plaintiffs, v. -

Complaint in Action Manufacturing Co Inc Et Al

SDMS DocID 2037769 IN THE UNITED STATES DISTRICT COURT FOR THE EASTERN DISTRICT OF PENNSYLVANIA ACTION MANUFACTURING CO., INC., ALCOA INC. f/k/a ALUMINUM COMPANY OF AMERICA, ARMSTRONG WORLD INDUSTRIES, INC., CIVIL ACTION ABB INC. f/k/a FISCHER & PORTER COMPANY, NO. 02- BECKETT COMPANY, L.P., GENERAL ELECTRIC COMPANY/RCA, GENERAL MOTORS CORPORATION, HAMILTON TECHNOLOGIES, INC. (BULOVA TECHNOLOGIES, L.L.C.), HAMILTON WATCH COMPANY, INC. (SWATCH GROUP U.S., INC.), HANDY & HARMAN , HAYFORK, L.P. f7k/a HAMILTON PRECISION METALS, INC., TUBE CO., HERCULES INCORPORATED, J.W. REX, LAFRANCE CORPORATION, LUCENT TECHNOLOGIES INC., PENFLEX, INC., PLYMOUTH TUBE COMPANY, REILLY PLATING COMPANY, SIEMENS ENERGY & AUTOMATION, INC. f/k/a MOORE PRODUCTS, CO., SUNROC CORPORATION, SYNTEX (USA), INC., UNISYS CORPORATION, AND VIZ LIQUIDATION TRUST Plaintiffs, v. SIMON WRECKING COMPANY, SIMON WRECKING COMPANY, INC., SIMON RESOURCES, INC., MID-STATE TRADING COMPANY, INC., S & S INVESTMENTS, INC., SCHWAB-SIMON REALTY CORPORATION, TRENTON REALTY CORPORATION, QUAKER CITY CHEMICALS, INC., CENTRAL PENN CHEMICALS, CENTRAL PENNSYLVANIA CHEMICALS, QUAKER CITY, INC., AROOOOOI J & J SPILL SERVICE & SUPPLIES, INC., J & J TRANSPORT, INC., A & A SEPTIC SERVICE, INC., CONTINENTAL VANGUARD, INC., LIGHTMAN DRUM COMPANY, LIGHTMAN DRUM CO., INC., RESOURCE TECHNOLOGY SERVICES, INC. BISHOP TUBE CO., ELECTRALLOY CORP., MERCEGAGLIA USA, INC., AMP INCORPORATED, TYCO ELECTRONICS CORPORATION, TYCO INTERNATIONAL (US), INC., TYCO INTERNATIONAL LTD., PETROCON INC., ANTROL INDUSTRIES, INC. MCCLAPJN PLASTICS, INC., LAVELLE AIRCRAFT COMPANY, AMETEK, INC., LEEDS AND NORTHRUP COMPANY, CSS INTERNATIONAL CORP., CSS METAL FABRICATION CORPORATION, CSS MACHINE & TOOL CO., INC., ECOLOGY SYSTEMS EQUIPMENT MANUFACTURING CO., INC., TECHNITROL, INC., FBF INDUSTRIES, INC., FBF, INC., ARK PRODUCTS CO, INC., MALCO. -

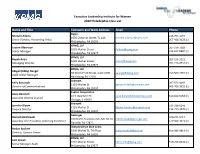

Name and Title Company and Work Address Email Phone 2020

Executive Leadership Institute for Women 2020 Philadelphia Class List Name and Title Company and Work Address Email Phone Cigna Michele Adams 215-761-1467 1601 Chestnut Street, TL 14A [email protected] Senior Director, Accounting Policy 267-418-3629 (c) Philadelphia, PA 19192 KPMG, LLP Lauren Albertson 267-256-3183 1601 Market Street [email protected] Senior Manager 215-817-0889 (c) Philadelphia, PA 07677 KPMG, LLP Rupali Amin 267-256-3221 1601 Market Street [email protected] Managing Director 267-210-4331 (c) Philadelphia, PA 07677 KPMG, LLP Abigail (Abby) Aungst 30 North Third Street, Suite 1000 [email protected] 717-507-7707 (c) Audit Senior Manager Harrisburg, PA 17101 Aramark Kelly Banaszak 267-671-4469 1101 Market St [email protected] Director of Communications 609-760-3332 (c) Philadelphia, PA 19107 Exelon Corporation Anne Bancroft 10 S. Dearborn St [email protected] 610-812-5454 (c) Associate General Counsel Chicago, IL 60603 Aramark Jennifer Bloom 215-238-8143 1101 Market St [email protected] Finance Director 215-779-1025 (c) Philadelphia, PA 19107 Geisinger Hannah Bobrowski 570-271-5417 100 North Academy Ave, MC 28-10 [email protected] Associate Vice President, Achieving Excellence 570-926-3071 (c) Danville, PA 17822 Independence Blue Cross Roslyn Boskett 1900 Market St, 7th Floor [email protected] 856-986-9814 (c) Director, Contact Center Philadelphia, PA 19103 KPMG, LLP Kelli Brown 1601 Market Street [email protected] 610-256-0628 (c) Senior Manager Audit Philadelphia, PA 07677 -

Investor Overview February 2020 Forward Looking Statements

Investor Overview February 2020 Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often, but not always, identified by the use of words such as “anticipate”, “believe”, “expect”, “plan”, “intend”, “project”, “may”, “will”, “should”, “could”, or similar words suggesting future outcomes or outlooks. These forward-looking statements include, but are not limited to, statements of expectations of or assumptions about strategic actions, objectives, expectations, intentions, aerospace market conditions, aircraft production rates, financial and operational performance, revenue and earnings growth and profitability and earnings results. These statements are based on the current projections, expectations and beliefs of Triumph’s management. These forward looking statements involve known and unknown risks, uncertainties and other factors which could cause actual results to differ materially from any expected future results, performance or achievements, including, but not limited to, competitive and cyclical factors relating to the aerospace industry, dependence on some of Triumph’s business from key customers, requirements of capital, uncertainties relating to the integration of acquired businesses, general economic conditions affecting Triumph’s business segments, product liabilities in excess of insurance, technological developments, limited availability of raw materials or skilled personnel, changes in governmental regulation and oversight and international hostilities and terrorism. Further information regarding the important factors that could cause actual results, performance or achievements to differ from those expressed in any forward looking statements can be found in Triumph’s reports filed with the SEC, including in the risk factors described in Triumph’s Annual Report on Form 10-K for the fiscal year ended March 31, 2019. -

Supplier Attendance List

2004 Global Supplier Conference Supplier Attendance List Last Name First Name Company City State Country Sopp Robert AAR Garden City NY USA Jones Alan Able Engineering Inc. Goleta CA USA Henderson Mark Accra Manufacturing Inc Bothell WA USA Lyon Daniela Accra Manufacturing Inc Bothell WA USA Mehus Keith Accra Manufacturing Inc Bothell WA USA Farr Keith Advanced Optical Systems Huntsville AL USA Nelson Kimberly Advanced Optical Systems Huntsville AL USA Magpayo Michael Aerojet General Corp. Aerospace Industries Association Of America, Lewandowski William Inc. Arlington VA USA Feutz John AIM Aviation Auburn Inc Auburn WA USA Larson John AIM Aviation Auburn Inc Auburn WA USA Hendricksen John Air Cruisers Company Inc. Wall Township NJ USA Redento Jose Air Cruisers Company Inc. Wall Township NJ USA Belnoski Lawrence Air Products And Chemicals, Inc. Allentown PA USA McNallen John Air Products And Chemicals, Inc. Allentown PA USA Meyer James Airgas Radnor PA USA Whinfrey Thomas Aitech Chatsworth CA USA Clelland Jim Alcoa Engineered Products Lafayette IN USA Vandedrinck Caroline Alcoa Wheel And Forged Products Cleveland OH USA Thomas Paul Alcoa Chicago IL USA Kiskaddon Harry Alcoa Zappa Giorgio Alenia Aeronautica Rome Italy Assereto Roberto Alenia Aeronautica Spa Torino Italy Braccini Sergio Alenia Aeronautica Spa Pomigliano d'Arco (NA) Italy Caruso Guglielmo Alenia Aeronautica Spa Pomigliano d'Arco Italy Giuseppe Giordo Alenia Aeronautica SPA Caiazzo Vincenzo Alenia Inc. Washington, DC USA McGee Charles All Points Logistics Inc Gainesville GA USA Monkress Phillip All Points Logistics Inc Gainesville GA USA Beard Eric AMI Metals, Inc Brentwood TN USA Cole Cecil Applied Industrial Technologies Cleveland OH USA Geddes Norman Applied Systems Intelligence Inc. -

ACVR NT High Income

American Century Investments® Quarterly Portfolio Holdings NT High Income Fund June 30, 2021 NT High Income - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 94.0% Aerospace and Defense — 1.9% Bombardier, Inc., 6.00%, 10/15/22(1) 1,287,000 1,291,240 Bombardier, Inc., 7.50%, 12/1/24(1) 1,450,000 1,517,070 Bombardier, Inc., 7.50%, 3/15/25(1) 676,000 696,702 Bombardier, Inc., 7.875%, 4/15/27(1) 1,100,000 1,142,636 BWX Technologies, Inc., 4.125%, 4/15/29(1) 525,000 535,521 F-Brasile SpA / F-Brasile US LLC, 7.375%, 8/15/26(1) 600,000 620,250 Howmet Aerospace, Inc., 5.125%, 10/1/24 1,925,000 2,129,493 Howmet Aerospace, Inc., 5.90%, 2/1/27 125,000 146,349 Howmet Aerospace, Inc., 5.95%, 2/1/37 1,975,000 2,392,574 Rolls-Royce plc, 5.75%, 10/15/27(1) 600,000 661,668 Spirit AeroSystems, Inc., 5.50%, 1/15/25(1) 400,000 426,220 Spirit AeroSystems, Inc., 7.50%, 4/15/25(1) 875,000 936,587 Spirit AeroSystems, Inc., 4.60%, 6/15/28 600,000 589,515 TransDigm, Inc., 7.50%, 3/15/27 675,000 718,942 TransDigm, Inc., 5.50%, 11/15/27 6,000,000 6,262,500 TransDigm, Inc., 4.625%, 1/15/29(1) 1,275,000 1,279,195 TransDigm, Inc., 4.875%, 5/1/29(1) 1,425,000 1,440,319 Triumph Group, Inc., 8.875%, 6/1/24(1) 315,000 350,833 Triumph Group, Inc., 6.25%, 9/15/24(1) 275,000 280,159 Triumph Group, Inc., 7.75%, 8/15/25 375,000 386,250 23,804,023 Air Freight and Logistics — 0.3% Cargo Aircraft Management, Inc., 4.75%, 2/1/28(1) 850,000 869,584 Western Global Airlines LLC, 10.375%, 8/15/25(1) 875,000 1,003,520 XPO Logistics, Inc., 6.125%, 9/1/23(1) 1,100,000 1,111,820 XPO Logistics, Inc., 6.75%, 8/15/24(1) 475,000 494,000 3,478,924 Airlines — 1.1% American Airlines Group, Inc., 5.00%, 6/1/22(1) 750,000 751,890 American Airlines, Inc., 11.75%, 7/15/25(1) 2,475,000 3,109,219 American Airlines, Inc. -

FOCUS Government, Aerospace Anddefense Group

FOCUS Government, Aerospace and Defense Group Winter 2017 Report Vol.10, No. 1 In this Issue Strategic, Personal, Dedicated 2 Major Q4 2016 Deals in the GAD Sector 3 Performance: S&P 500 vs. GAD Investment Banking and Advisory Services Government Sector Q4 2016 FOCUS Investment Banking LLC provides a range 4 Aerospace Sector Q4 2016 of investment banking services tailored to the needs Defense Sector Q4 2016 5 M&A Activity in the GAD of government, aerospace, and defense companies. Sector These services include: 6 Selected GAD Transactions Q4 2016 Mergers & Acquisition Advisory 8 Recent FOCUS GAD Corporate Development Consulting Transactions 12 FOCUS GAD Team Strategic Partnering & Alliances Capital Financing, Debt & Equity Corporate Valuations Major Q4 2016 Deals in the GAD Sector GOVERNMENT The transaction is anticipated to accelerate growth and strengthens Rockwell Collins’ position as a leading sup- Huntington Ingalls Industries, Inc. Acquisition plier of cockpit and cabin solutions in the airline OEM of Camber Corporation market and airline aftermarket. The transaction is expected On November 2, 2016, Huntington Ingalls Industries, Inc. to generate pre-tax cost synergies of approximately $160 acquired Camber Corporation for $380 million. Camber million and lead to accretive earnings per share for Rock- provides engineering and technical services, cyber opera- well Collins in first full fiscal year with expected combined tions technology, mission critical support services, and five-year free cash flow generation more than $6 billion. training solutions to United States federal agencies includ- ing the Departments of Defense, the Veterans Administra- The transaction results in multiples of 2.9x based on B/E tion, and the Federal Emergency Management Agency. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

Wilmington Funds Holdings Template DRAFT

Wilmington Large-Cap Strategy Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS APPLE INC 4.97% MICROSOFT CORP 4.69% AMAZON.COM INC 3.45% FACEBOOK INC 1.99% ALPHABET INC 1.80% ALPHABET INC 1.77% BERKSHIRE HATHAWAY INC 1.48% JPMORGAN CHASE & CO 1.35% TESLA INC 1.20% JOHNSON & JOHNSON 1.12% UNITEDHEALTH GROUP INC 0.98% VISA INC 0.96% NVIDIA CORP 0.96% BANK OF AMERICA CORP 0.89% HOME DEPOT INC/THE 0.87% WALT DISNEY CO/THE 0.82% MASTERCARD INC 0.80% PAYPAL HOLDINGS INC 0.77% EXXON MOBIL CORP 0.68% PROCTER & GAMBLE CO/THE 0.67% COMCAST CORP 0.66% ADOBE INC 0.62% INTEL CORP 0.59% VERIZON COMMUNICATIONS INC 0.59% CISCO SYSTEMS INC 0.57% CHEVRON CORP 0.55% PFIZER INC 0.54% NETFLIX INC 0.54% AT&T INC 0.53% SALESFORCE.COM INC 0.53% ABBOTT LABORATORIES 0.51% ABBVIE INC 0.50% MERCK & CO INC 0.48% WELLS FARGO & CO 0.48% BROADCOM INC 0.47% THERMO FISHER SCIENTIFIC INC 0.47% ACCENTURE PLC 0.46% CITIGROUP INC 0.45% MCDONALD'S CORP 0.44% TEXAS INSTRUMENTS INC 0.44% COCA-COLA CO/THE 0.44% HONEYWELL INTERNATIONAL INC 0.44% LINDE PLC 0.43% MEDTRONIC PLC 0.43% NIKE INC 0.43% ELI LILLY & CO 0.42% PEPSICO INC 0.42% UNITED PARCEL SERVICE INC 0.41% WALMART INC 0.40% DANAHER CORP 0.40% UNION PACIFIC CORP 0.40% QUALCOMM INC 0.38% BRISTOL-MYERS SQUIBB CO 0.37% ORACLE CORP 0.37% LOWE'S COS INC 0.36% BLACKROCK INC 0.35% CATERPILLAR INC 0.35% AMGEN INC 0.35% BOEING CO/THE 0.35% MORGAN STANLEY 0.35% COSTCO WHOLESALE CORP 0.35% RAYTHEON TECHNOLOGIES CORP 0.34% STARBUCKS CORP 0.34% GOLDMAN SACHS GROUP INC/THE 0.34% GENERAL ELECTRIC -

Women on Boards the Forum of Executive Women Executive Suites Initiative

Women on Boards The Forum of Executive Women Executive Suites Initiative Improving corporate governance. Increasing shareholder value. The time is NOW. Citizens Bank of Pennsylvania is proud to support The Forum of Executive Women in a variety of ways, including underwriting The Forum's Women on Boards report for 2004. At Citizens Bank, where women comprise 50 percent of our Leadership Team, we believe that diversity, in all of its many manifestations, results in different perspectives, new ideas, and stronger outcomes. In embracing its mission to support colleagues, customers, and community, Citizens Bank applauds The Forum for its leadership in advocating for the advancement of women in our region. About The Forum of Executive Women Founded in 1977, The Forum of Executive Women is a membership organization of 300 women of influence in Greater Philadelphia. Its members hold top positions in every major segment of the community — from finance to manufacturing, from government to healthcare, from not-for-profits to communications, from the professions to technology. As the region's premier women's organization, The Forum fulfills its mission — to advance women leaders in Greater Philadelphia — by supporting women in leadership roles, promoting parity in the corporate world, mentoring young women, and providing a forum for the exchange of views, contacts, and information. The Forum's Executive Suites Initiative advocates and facilitates the increased representation of women on boards and in top management positions of major public companies in our region. Irene H. Hannan, President Sharon Hardy, Executive Director A Four-Year Snapshot of Women On Boards % of women on boards 12% 10% 8% 6% 4% Executive 2% Summary 0% 2000 2001 2002 2003 Ensuring the Research is Current and Comparable Companies in the technology/telecommunications category have the fewest women represented in all levels of Revenues change from year to year. -

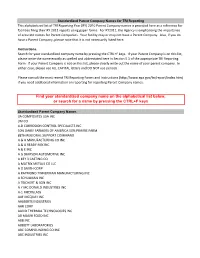

Standardized Parent Company Names for TRI Reporting

Standardized Parent Company Names for TRI Reporting This alphabetized list of TRI Reporting Year (RY) 2010 Parent Company names is provided here as a reference for facilities filing their RY 2011 reports using paper forms. For RY2011, the Agency is emphasizing the importance of accurate names for Parent Companies. Your facility may or may not have a Parent Company. Also, if you do have a Parent Company, please note that it is not necessarily listed here. Instructions Search for your standardized company name by pressing the CTRL+F keys. If your Parent Company is on this list, please write the name exactly as spelled and abbreviated here in Section 5.1 of the appropriate TRI Reporting Form. If your Parent Company is not on this list, please clearly write out the name of your parent company. In either case, please use ALL CAPITAL letters and DO NOT use periods. Please consult the most recent TRI Reporting Forms and Instructions (http://www.epa.gov/tri/report/index.htm) if you need additional information on reporting for reporting Parent Company names. Find your standardized company name on the alphabetical list below, or search for a name by pressing the CTRL+F keys Standardized Parent Company Names 3A COMPOSITES USA INC 3M CO 4-D CORROSION CONTROL SPECIALISTS INC 50% DAIRY FARMERS OF AMERICA 50% PRAIRIE FARM 88TH REGIONAL SUPPORT COMMAND A & A MANUFACTURING CO INC A & A READY MIX INC A & E INC A G SIMPSON AUTOMOTIVE INC A KEY 3 CASTING CO A MATRIX METALS CO LLC A O SMITH CORP A RAYMOND TINNERMAN MANUFACTURING INC A SCHULMAN INC A TEICHERT