Energy Security of APEC Economies and Changing Downstream Oil Environment Michael Ochoada Sinocruz Chrisnawan Anditya Luis Camacho Beas

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Optimizing FCC Operations in a High Rare Earth

August 03, 2011 VOL: 2 ISS: 15 Optimizing FCC Operations in a High Rare Earth Cost Market: Part I Highlights of Recent Grace FCC Webinar Focusing on Unit Operation and Profitability when Re- formulating FCC Catalyst to Lower Rare Earth Higher feed volumes are processed metric ton on the Asian Metal Index, a acid site density and prevents dealumi- through FCC units than ever before, at 2700% increase in price over the course nation. A catalyst designed with a high the same time that more challenging of a year! This is why the industry has RE exchange for high gasoline selectiv- feedstocks have entered the market. demonstrated such a strong response to ity will have more Cont. page 2 The industry has responded with ef- finding solutions to RE inflation. fective catalyst chemistry that has in- Rare earth supplies are expected to In This Issue... cluded adding higher quantities of rare remain in critically short supply until at earth (RE) to the zeolite. However, least 2014, when mines in other parts of FEATURE with the unprecedented inflation in RE the world are fully developed. Lantha- costs, the onus is now on reformulat- Optimizing FCC Operations in a High num (atomic number: 57) is the lightest Rare Earth Cost Market: Part I ing FCC catalysts to lower RE, while of the rare earths as shown on a typical maintaining or exceeding the high lev- Periodic Table of the Elements. Lantha- els of performance achieved by the latest PROCESS OPERATIONS num has been the dominant RE metal ISOCRACKING Technology Update catalyst systems. -

Disaster Management of India

DISASTER MANAGEMENT IN INDIA DISASTER MANAGEMENT 2011 This book has been prepared under the GoI-UNDP Disaster Risk Reduction Programme (2009-2012) DISASTER MANAGEMENT IN INDIA Ministry of Home Affairs Government of India c Disaster Management in India e ACKNOWLEDGEMENT The perception about disaster and its management has undergone a change following the enactment of the Disaster Management Act, 2005. The definition of disaster is now all encompassing, which includes not only the events emanating from natural and man-made causes, but even those events which are caused by accident or negligence. There was a long felt need to capture information about all such events occurring across the sectors and efforts made to mitigate them in the country and to collate them at one place in a global perspective. This book has been an effort towards realising this thought. This book in the present format is the outcome of the in-house compilation and analysis of information relating to disasters and their management gathered from different sources (domestic as well as the UN and other such agencies). All the three Directors in the Disaster Management Division, namely Shri J.P. Misra, Shri Dev Kumar and Shri Sanjay Agarwal have contributed inputs to this Book relating to their sectors. Support extended by Prof. Santosh Kumar, Shri R.K. Mall, former faculty and Shri Arun Sahdeo from NIDM have been very valuable in preparing an overview of the book. This book would have been impossible without the active support, suggestions and inputs of Dr. J. Radhakrishnan, Assistant Country Director (DM Unit), UNDP, New Delhi and the members of the UNDP Disaster Management Team including Shri Arvind Sinha, Consultant, UNDP. -

Synthesis Report

MEGA DISASTER IN A RESILIENT SOCIETY The Great East Japan (Tohoku Kanto) Earthquake and Tsunami of 11th March 2011 SYNTHESIS AND INITIAL OBSERVATIONS International Environment and Disaster Management Graduate School of Global Environmental Studies Kyoto University 25th March 2011 About this Report This report is published on 25th of March 2011, two weeks after the Great East Japan [Tohoku-Kanto] Earthquake and Tsunami. The aim of the report is to synthesize certain existing data with basic situation analysis. The disaster has posed a major challenge to the disaster risk reduction community, which needs to be discussed in future over the course of time. Assistance of Yukiko Takeuchi for providing information, and Kumiko Fujita and Yuta suda in translating parts of the Japanese information is acknowledged. Team Members (Kyoto University) Sunil Parashar Noralene Uy Huy Nguyen Glenn Fernandez Farah Mulyasari Jonas Joerin Rajib Shaw Contact Details Rajib Shaw Associate Professor International Environment and Disaster Management Laboratory, KYOTO UNIVERSITY Yoshida Honmachi, Sakyo-Ku, Kyoto 606-8501, Japan Tel/Fax: 81-75-753-5708 E-mail: [email protected] Web: http://www.iedm.ges.kyoto-u.ac.jp/ Disclaimer The views expressed in this report are the views of the team members and do not necessarily reflect the views or policies of the research field for International Environment & Disaster Management (IEDM) or the Graduate School of Global Environment Studies (GSGES), or Kyoto University, or the organizations, or the countries cited. The report is a compilation from available sources, which are acknowledged. IEDM does not guarantee the accuracy of the data included in this volume and accept no responsibility for any consequences of their use. -

1. Oil and Gas Exploration & Production

1. Oil and gas exploration & production This is the core business of PVN, the current metres per year. By 2012, we are planning to achieve reserves are approximated of 1.4 billion cubic metres 20 million tons of oil and 15 billion cubic metres of of oil equivalent. In which, oil reserve is about 700 gas annually. million cubic metres and gas reserve is about 700 In this area, we are calling for foreign investment in million cubic metres of oil equivalent. PVN has both of our domestic blocks as well as oversea explored more than 300 million cubic metres of oil projects including: Blocks in Song Hong Basin, Phu and about 94 billion cubic metres of gas. Khanh Basin, Nam Con Son Basin, Malay Tho Chu, Until 2020, we are planning to increase oil and gas Phu Quoc Basin, Mekong Delta and overseas blocks reserves to 40-50 million cubic metres of oil in Malaysia, Uzbekistan, Laos, and Cambodia. equivalent per year; in which the domestic reserves The opportunities are described in detail on the increase to 30-35 million cubic metres per year and following pages. oversea reserves increase to 10-15 million cubic Overseas Oil and Gas Exploration and Production Projects RUSSIAN FEDERATION Rusvietpetro: A Joint Venture with Zarubezhneft Gazpromviet: A Joint Venture with Gazprom UZBEKISTAN ALGERIA Petroleum Contracts, Blocks Kossor, Molabaur Petroleum Contract, Study Agreement in Bukharakhiva Block 433a & 416b MONGOLIA Petroleum Contract, Block Tamtsaq CUBA Petroleum Contract, Blocks 31, 32, 42, 43 1. Oil and gas exploration & production e) LAO PDR Petroleum Contract, Block Champasak CAMBODIA 2. -

Refinery Recommendation Report Srgb

Bangladesh Asian Development Bank C1334 – January 2012 RFP HCU/CS-06 Strengthening of the Hydrocarbon Unit in the Energy and Mineral Resources Division (Phase II) Petroleum Refining & Marketing (Package # 06) Refinery Recommendation report in association with srgb Strengthening of Hydrocarbon Unit (Phase II) – Petroleum Refining & Marketing (Package # 06) Refinery recommendation report Table of Contents Abbreviations ........................................................................................................ 4 Refinery Executive summary .............................................................................7 1. Introduction...........................................................................................................13 1.1 Main Assessments of the current Refinery Operation .................................................................................13 1.2 Criteria that will guide the approach to future oil product supply ....................................................... 14 1.3 Assumptions that will underlie the recommendations................................................................................. 15 1.4 Variables that can be changed to increase / change output.................................................................. 15 1.5 Recommendations Structure....................................................................................................................................... 16 1.6 More about Key Considerations and Assumptions .......................................................................................19 -

Microsoft Powerpoint

PIPING Company presentation 2011 1. Introduction 2. Markets 3. Product range 4. Our customers 5. Quality PIPING 6. HS&E 7. Production system 8. Organization chart 9. Recently awarded major projects 10. Why choose ULMA? Main contact Information: AITOR ALBISU – ULMA PIPING EPC PROJECT DIVISION SALES & MARKETING DIRECTOR ([email protected]) 1. Introduction COMPANY PROFILE: • Brand/marketing name: ULMA PIPING • Registered name: ULMA FORJA S.COOP . (Since:1996, former name: ENARA S.COOP) • Organization : Privately owned cooperative company established in 1962 . • Location: Manufacturing plant and headquarters located in Oñati, a town in the centre of the Basque Country, an area in northern Spain and to the west of the French border with a deeply-rooted industrial tradition. Oñati is just 1 hour´s drive from Bilbao (International Airport) ACTIVITY / PRODUCT LINE: Manufacture and supply of: 1- FLANGES (Full range) 2- FORGED STEEL FITTINGS (high pressure fittings ,¼” up to 4”, CS only, only for stockist) 3- OTHER PIPING PRODUCTS: 3-1 LINE BLANKS (Spectacles, Spacers, Paddles) 3-2 WELD OVERLAYED SPOOL FABRICATION 3-3 SPECIALTY FORGINGS 3-4 ENGINEERED PRODUCTs. 1. Introduction BUSINESS – SALES CHANNELS: Currently 2 business divisions: 1. DISTRIBUTION- STOCK BUSINESS Operating since 1970, dealing with both stockist and Stock Business EPC Project Business project oriented distributors as well). Recognized world leader in the approved stock business, largest stocks worldwide, over 70 countries. Main products: • FLANGES and FORGED STEEL FITTINGS • LINE BLANKS (for projects only) 2. EPC PROJECT BUSINESS Operating since 2006 ,dealing directly with EPC contractors worlwide basis, New business division created, manufactured range expanded in materials and sizes , offered products and services range extended, strong investment plan completed. -

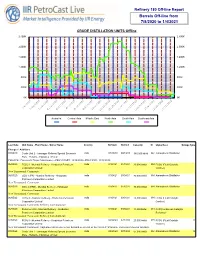

Barrels Off-Line from 7/8/2020 to 1/4/2021

Refinery 180 Off-line Report Barrels Off-line from 7/8/2020 to 1/4/2021 CRUDE DISTILLATION UNITS Offline 2,400K 2,400K 2,000K 2,000K 1,600K 1,600K 1,200K 1,200K 800K 800K 400K 400K 0K 0K 7/8/2020 9/1/2020 7/19/20207/30/20208/10/20208/21/2020 9/12/20209/23/202010/4/2020 11/6/2020 12/9/2020 10/15/202010/26/2020 11/17/202011/28/2020 12/20/202012/31/2020 Australia Central Asia Middle East North Asia South Asia Southeast Asia Last Date Unit Name - Plant Name - Owner Name Country TA Start TA End Capacity St Utype Desc Outage Type Changes / Additions 07/08/20 Crude Unit 2 - Jamnagar Refinery Special Economic India 07/20/20 08/18/20 380,000 bbl/d GU Atmospheric Distillation Zone - Reliance Industries Limited CHANGE: Comments: Major Maintenance--PREVSTART: 10/14/2020--PREVEND: 11/12/2020 06/05/20 FCCU I - Mumbai Refinery - Hindustan Petroleum India 01/04/21 01/15/21 20,000 bbl/d MH FCCU (Fluid Catalytic Corporation Limited Cracker) New Turnaround: Comments: 06/05/20 CDU 1 (FR) - Mumbai Refinery - Hindustan India 01/04/21 03/04/21 80,000 bbl/d MH Atmospheric Distillation Petroleum Corporation Limited New Turnaround: Comments: 06/05/20 CDU 2 (FRE) - Mumbai Refinery - Hindustan India 01/04/21 01/15/21 70,000 bbl/d MH Atmospheric Distillation Petroleum Corporation Limited New Turnaround: Comments: 06/05/20 FCCU II - Mumbai Refinery - Hindustan Petroleum India 01/04/21 03/04/21 28,000 bbl/d MH FCCU (Fluid Catalytic Corporation Limited Cracker) New Turnaround: Comments: Refinery wide shutdown 06/05/20 Reformer Unit - Mumbai Refinery - Hindustan India 01/04/21 03/04/21 11,000 bbl/d MH CCR(Continuous Catalytic Petroleum Corporation Limited Reformer) New Turnaround: Comments: Refinery wide shutdown 07/08/20 FCCU I - Mumbai Refinery - Hindustan Petroleum India 04/26/20 07/18/20 20,000 bbl/d MH FCCU (Fluid Catalytic U Corporation Limited Cracker) New Turnaround: Comments: Unplanned derate due to low demand as a result of the Covid-19 Pandemic and issue in reactor internals. -

Reduction of Greenhouse Gas Emissions from the Oil Refining and Petrochemical Industry Reference Number: PH3/8 Date Issued: June 1999

The reduction of greenhouse gas emission from the oil refining and petrochemical industry Report Number PH3/8 June 1999 This document has been prepared for the Executive Committee of the Programme. It is not a publication of the Operating Agent, International Energy Agency or its Secretariat. Title: The reduction of greenhouse gas emissions from the oil refining and petrochemical industry Reference number: PH3/8 Date issued: June 1999 Other remarks: Background to the Study The IEA Greenhouse Gas R&D programme (IEA GHG) is systematically evaluating the cost and potential for reducing emissions of greenhouse gases arising from anthropogenic activities, especially the use of fossil fuels. Greenhouse gases are produced from a variety of industrial activities. The main sources, not related to power generation, are those energy intensive industries, which chemically or physically transform materials from one state to another. During these processes, many greenhouse gases (carbon dioxide, methane, nitrous oxide) are released. One notable example is oil refining and petrochemicals where considerable amounts of greenhouse gases are produced. Relatively little attention has been focused on the abatement/mitigation of greenhouse gas emissions from the industrial sector. This study is the second in a series looking at greenhouse gas abatement/mitigation options for energy intensive industries. Carbon dioxide, methane and other hydrocarbons are emitted during the refining of oil, production of petrochemicals and the storage of feedstocks and products. The purpose of this study is to consider the abatement/mitigation options in the oil refining and petrochemicals industry. The study was carried out by AEA Technology of the United Kingdom. -

Annual Report 2014

Annual Report 2014 for the year ended March 31, 2014 AcceleratingAccelerating thethe PacePace ofof ReformReform toto RealizeRealize OurOur GoalsGoals President, Chief Executive Offi cer KEIZO MORIKAWA The Cosmo Oil Group is actively in crude oil development, petrochem- engaged in carrying out its fi ve-year icals, and renewable energy. The Medium-Term Management Plan Cosmo Oil Group is driven by its launched in April 2013. In order to mission to fulfi ll the diverse needs of build a robust operating platform society by ensuring the stable supply and transition to a new business of energy. With this as our guiding structure, the Group is working to light, we will embark on a new jour- regain profi tability in the refi ning ney to become a vertically integrated and marketing sector while accelerat- global energy company from a ing the pace at which it expands its long-term perspective. business portfolio, including activities Disclaimer: FORWARD-LOOKING STATEMENTS Certain statements made and information contained herein constitute “forward-looking information” (within the meaning of applicable Japanese securities legislation). Such statements and information (together, “forward looking statements”) relate to future events or the Company’s future performance, business prospects or opportunities. Forward-looking statements include, but are not limited to, statements with respect to estimates of reserves and or resources, future production levels, future capital expenditures and their allocation to exploration and development activities, future drilling and other exploration and development activities, ultimate recovery of reserves or resources and dates by which certain areas will be explored, devel- oped or reach expected operating capacity, that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. -

Eoffice Solution for Enterprise

o365.vn 1 EOFFICE SOLUTION FOR ENTERPRISE Contact: Nguyen Hoang Nhut [email protected] o365.vn 2 About Opus Solution Digital Transformation Solution TASKEN eOffice Platform Case Studies o365.vn About OPUS SOLUTION – o365.vn 3 OPUS SOLUTION ALSO KNOWN AS PARADISE VIETNAM FROM 2013, WE PROVIDE SERVICE ON DESIGN, IMPLEMENT AND MANAGE TAILOR-MADE OUTSOURCING WEB BASE APPLICATION, MICROSOFT CLOUD SOLUTIONS, BUSINESS INTELLIGENT CENTER IN UTILIZING ADEQUATE AND EFFICIENT HUMAN RESOURCES FOR OUR CLIENTS. POSSIBILITIES : •Provide Training and Consult service in Web base application in dot Net, Microsoft Azure, Office365, Business Intelligent (BI), SharePoint solution development, process automation, and management system •Dedicated incremental manpower to process business tasks on your behalf •Development of specific solutions, test or maintenance of existing applications, dedicated offshore team. o365.vn About OPUS SOLUTION – o365.vn 4 Consultant Training Implementation SharePoint, Office 365 SharePoint Saturday Viet Web App, SharePoint App, Nam Community Planning and Designing Mobile App, Branding UI License Advice and SharePoint, Office 365 Custom Workflows Application Recommendation Application Development development SharePoint, Office 365 Azure Administration & Azure Services & SharePoint Sales/Presale Support Management Business Intelligent (BI) Web application, Azure, BI, Business Intelligent Advanced Document SharePoint Support Consultant & training Management System Web App and SharePoint SharePoint, Office 365 Office365 Internal/External Hosting, Maintaining and Maintenance and support System Integration Operating customer Lotus Notes Migration Business Intelligent and Power BI, SSRS, SSAS, Reporting Center Performance Point o365.vn Project methodology 5 Agile methodology (XP/SCRUM) • Regular production of incremental versions of the software and adaptation to customer’s feed-backs and evolutions. • Ensures you that you will obtain exactly the expected result. -

Annual Report 2015 PETROCHEMICAL BUSINESS WIND POWER GENERATION BUSINESS

What sets COSMO Energy Group apart? OIL EXPLORATION AND PRODUCTION BUSINESS PETROLEUM BUSINESS • The Cosmo Oil Company spun off its oil E&P business • Crude oil production volume: 38,031 barrels/day Total Refi ning Capacity (Barrels/day) Marketing Structure by Petroleum Products Features and established Cosmo Energy Exploration & • Crude Reserves Estimate: Total proved and probable • Chiba Refi nery 220,000 Petroleum Product SSs Companies Overseas in Japan in Japan Export Production Co., Ltd. reserves: 167.6 million barrels • Yokkaichi Refi nery 132,000 LP gas © • Announced details of an oil reserves assessment • Reserves-to-production ratio of total proved and • Sakai Refi nery 100,000 • Signed a memorandum of agreement in relation to probable reserves: Approx. 26 years Gasoline © v Total 452,000 strategic comprehensive cooperation with Compañía • New Hail Oil Field: Production scheduled to com- Naphtha © Española de Petróleos, S.A.U. (CEPSA), a major mence from the second half of fi scal 2016. The • Established a joint organization called Keiyo Seisei JV G.K. Kerosene © © integrated oil company based in Spain new Hail Oil Field is expected to produce roughly with TonenGeneral Sekiyu K.K. in January 2015 in order to Jet fuel © v • Cosmo Energy Exploration & Production sold part of the same amount as the other current existing oil increase effi ciency and optimize operations at respective Diesel fuel © © refi neries in Chiba. its stake in the newly established Cosmo Abu Dhabi fi elds of Abu Dhabi Oil Company. Heavy fuel oil A © • Took steps to strengthen competitiveness and decided to Energy Exploration & Production Co., Ltd. -

JCCP NEWS No. 103 February 2009

JCCP NEWS Newsletter of Japan Cooperation Center, Petroleum Topics No. 103 February 2009 H.E. Dr. Maitha Al-Shamsi, In this issue: UAE Minister of State, Topics Visits Japan H.E. Dr. Maitha Al-Shamsi Visits Japan 1 Visits to SE Asia and the Middle East by Mr. Sase 5 Signing Ceremony with QP 11 “Maintenance & Safety Management” for Saudi Aramco 13 JCCP Participants Surpass 18,000 18 Personnel Exchange Programs CPJ on “Refinery Computerization” (CDB OGI) 19 CPJ on “Energy Saving” (LUKOIL) 22 CPO on “Upgrading Process of Heavy Oil” in Colombia and TC Program in Brazil 26 CPO on “HRM” for Kuwait & UAE 29 TC Program in Russia & Azerbaijan 35 TC Program in Iran, Kuwait, Saudi Arabia, Bahrain 38 Dr. Al-Shamsi at JCCP, with Mr. Masataka Sase, Executive Director of JCCP Participant’s Voice 42 JCCP Regular Courses Completed October – December 2008 44 As part of the FY2008 JCCP VIP Invitation Program, JCCP has Technical Cooperation invited H.E. Dr. Maitha Al-Shamsi, UAE Minister of State, to Japan, 18th Saudi-Japan Joint Symposium 46 from November 15 to 21, 2008. Project on In-SAR Technology Before being appointed to Minister of State and Research Advisor at Application in Saudi Arabia 48 UAE University in February 2008, Dr. Al-Shamsi has held prominent Study on Improving Reactor positions at the university. She assumed the positions of Deputy Vice Efficiency in Iran 50 Chancellor in 1990, Vice Chancellor in 2000, and Assistant Provost SQU-Japan Projects Introduced in SQU’s Newsletter 51 for Research in 2004. In these capacities, she actively promoted the Announcement development of higher education in UAE and has made a significant Personnel Changes 52 number of achievements in that area.