Management's Discussion and Analysis

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

September 5, 2019 to All Whom It May Concern Notification Regarding The

September 5, 2019 To all whom it may concern Daiwa Securities Group Inc. Credit Saison Co., Ltd. Notification Regarding the Capital and Business Alliance of Daiwa Securities Group Inc. and Credit Saison Co., Ltd. In order to handle the diversifying needs of the market, Daiwa Securities Group Inc. (Head Office: Chiyoda-ku, Tokyo; President and CEO: Seiji Nakata) and Credit Saison Co., Ltd. (Head Office: Toshima-ku, Tokyo; President and COO: Masahiro Yamashita) are developing and providing next-generation comprehensive financial services utilizing the finance business knowledge and customer networks built up by both companies since their founding. The two companies have entered into a capital and business alliance with the goal of creating the future of finance, and the details of this agreement are as follows. 1. Reasons for the Capital and Business Alliance Through the “Passion for the Best 2020” medium-term management plan started by the Daiwa Securities Group in the last fiscal year, Daiwa Securities Group is aiming to become an integrated securities group with a hybrid business model, providing new value through expansion and strengthening external networks and surrounding businesses, with traditional securities business at its core. Credit Saison started its Medium-term Management Plan in this fiscal year, with “A Finance Company Advancing with Customers for 50 Years: Providing Peace of Mind and Confidence about Money” as its mission statement. With payment and finance platforms as the base, the Company is making efforts to transform into a finance company which provides optimal services which can contribute to improving customers’ quality of life. Up until now, Daiwa Securities Group and Credit Saison have worked to expand the securities and credit card industries as independent major companies. -

CREDIT SAISON CO., LTD. Interim Business Report 70Th Fiscal Year (April 1, 2019 – September 30, 2019) FINANCIAL DATA

Midterm business vision CREDIT SAISON CO., LTD. Interim Business Report 70th Fiscal Year (April 1, 2019 – September 30, 2019) FINANCIAL DATA 304.8 315.5 293.2 57.3 52.2 38.4 42.5 32.0 30.5 29.0 36.2 151.2 159.2 31.2 145.4 27.0 18.6 18.6 5,336.0 4,931.1 5,031.5 2,428.8 2,466.5 2,569.3 Dear Shareholders: I would like to express my appreciation for your continued support and patronage. Let me report on the business results for the first half of the 70th fiscal year (April 1, 2019 – September 30, 2019). Credit Saison has formulated a medium-term management plan to be carried out until the fiscal year ending March 2022 (72nd fiscal year), upholding the midterm business vision of the “Neo Finance Company in Asia.” The plan provides the mission statement “Becoming a finance company advancing with customers for 50 years: Providing peace of mind and discov- ering potentials in money.” To achieve this medium-term management plan, Credit Saison is taking on the challenge of trans- forming itself into a finance company that provides customers with optimum services for their life events that involve financial decisions by using credit cards with long service lives as touchpoints. With the completion of transfer to the Associated Core System in October 2018, which had been a long-term management priority, and with a proactive structure in place that will allow us to aim for future business growth, Credit Saison entered into an alliance with freee K.K. -

Integrated Annual Report CORPORATE PHILOSOPHY

2018 Integrated Annual Report CORPORATE PHILOSOPHY With customer trust as the foundation for all its activities, Tokio Marine Group continually strives to raise corporate value. Through the provision of the highest quality products and services, Tokio Marine Group aims to deliver safety and security to all our customers. By developing sound, profitable and growing businesses throughout the world, Tokio Marine Group will fulfill its mandate to shareholders. Tokio Marine Group will continue to build an open and dynamic corporate culture that enables each and every employee to demonstrate his or her creative potential. Acting as a good corporate citizen through fair and responsible management, Tokio Marine Group will broadly contribute to the development of society. We will be there for our customers, playing our part in society in times of need. We will balance our strength as an organization with compassion as individuals, looking beyond profit to deliver fully on our commitments. Through our collective efforts, we will strive to be a Good Company, living up to the trust placed in us. CONTENTS 2 What’s Tokio Marine Group 2 139-Year History 4 Current Strengths 5 Financial and Non-Financial Highlights Integrated Annual Report 2018 6 Tokio Marine Group’s Value Creation Model 8 Management Strategy Section 9 Message from the President and Group CEO 14 Explanation of Management Strategies by Group CFO 20 Aligned Group Management 22 Message from Group CRO 24 Message from Group CSSO and Group CDO 26 Message from Group CRSO and Group Co-CRSO 28 -

Japan Payment Card Consortium Launches Poc on Sharing Fraud Information Using Blockchain

November 16, 2018 Japan Payment Card Consortium secretariat SBI Ripple Asia Co., Ltd. Japan Payment Card Consortium Launches PoC on Sharing Fraud Information using Blockchain SBI Ripple Asia Co., Ltd. (Head office: Minato-ku, Tokyo; Representative Director: Takashi Okita; “SBI Ripple Asia”), serving as the secretariat of the “Consortium of Payment Card Industry Utilizing Block Chain Technology” (hereafter “Japan Payment Card Consortium”) hereby announces the beginning of a proof of concept (PoC) on sharing fraud information using blockchain technology together with nine major credit card issuers of the consortium (American Express International, Inc., AEON CREDIT SERVICE CO., LTD., EPOS Card Co.,Ltd., Orient Corporation., CREDIT SAISON CO., LTD., JCB Co.,Ltd. TOYOTA FINANCE CORPORATION., Sumitomo Mitsui Card Co., Ltd., SUMITOMO MITSUI TRUST CLUB CO., LTD. ) and two payment-card technology providers (TIS Inc., Hewlett-Packard Japan, Ltd.). The companies participating in the consortium endeavor to prevent the spread of damages caused by fraudulent transactions by sharing information on a real-time basis among related parties using blockchain. The PoC will be conducted on R3's blockchain platform, Corda. Corda takes a unique approach to data privacy and security, ensuring that data is shared only with those that have a “need to know”. Each company will own a Corda node, and while each company implements its own security policy, the data sharing among the nodes is secured by Corda. TIS, a member of R3’s partner ecosystem, will develop a highly secure, convenient and scalable information sharing system on Corda. For the purposes of the PoC, information will only be shared among the participating card companies. -

August 22, 2019 to Whom It May Concern

August 22, 2019 To whom it may concern: Company Name: Mizuho Financial Group, Inc. Representative: Tatsufumi Sakai, President & CEO Head Office: 1–5–5 Otemachi, Chiyoda–ku, Tokyo Stock Code Number: 8411 (Tokyo Stock Exchange (First Section)) Agreement concluded with Credit Saison regarding the dissolution of the Comprehensive Strategic Business Alliance Agreement Mizuho Bank, Ltd. (President and CEO: Koji Fujiwara), a consolidated subsidiary of Mizuho Financial Group, Inc.; Credit Saison Co., Ltd. (President and COO: Masahiro Yamashita); UC Card Co., Ltd. (President and CEO: Nobuaki Kitajima); and Qubitous Co., Ltd. (President and CEO: Keitaro Shigemasa) have concluded an agreement to dissolve (“this Dissolution Agreement”) the Comprehensive Strategic Business Alliance Agreement (“the Alliance”) and have concluded other contracts as outlined below. This follows the conclusion on February 22, 2019 of a Basic Agreement regarding the Termination of the Comprehensive Strategic Business Alliance Agreement (“Basic Agreement”) between Mizuho Bank and Credit Saison. Basic Agreement dated February 22, 2019 Parties to this agreement: Mizuho Bank, Credit Saison This Basic Agreement is based on the contract below. — Comprehensive Strategic Business Alliance Agreement dated December 24, 2004 (including all amendments thereafter) Parties to this agreement: Mizuho Bank, Credit Saison, UC Card This agreement was later amended to add Qubitous as an additional party. 1. Rationale for this Dissolution Agreement In light of changes in the business environment surrounding the credit card industry, Mizuho Bank concluded this Dissolution Agreement in order to respond to these changes and transition to a relationship where all parties can better maximize their strengths and proactively grow their businesses. This follows the conclusion on February 22, 2019 of a Basic Agreement regarding the Termination of the Comprehensive Strategic Business Alliance Agreement. -

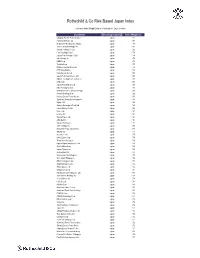

Rothschild & Co Risk-Based Japan Index

Rothschild & Co Risk-Based Japan Index Indicative Index Weight Data as of January 31, 2020 on close Constituent Exchange Country Index Weight (%) Chugoku Electric Power Co Inc/ Japan 1.01 Yamada Denki Co Ltd Japan 0.91 McDonald's Holdings Co Japan L Japan 0.88 Sushiro Global Holdings Ltd Japan 0.82 Skylark Holdings Co Ltd Japan 0.82 Fast Retailing Co Ltd Japan 0.78 Japan Post Holdings Co Ltd Japan 0.78 Ain Holdings Inc Japan 0.78 KDDI Corp Japan 0.77 Toshiba Corp Japan 0.75 Mizuho Financial Group Inc Japan 0.74 NTT DOCOMO Inc Japan 0.73 Kobe Bussan Co Ltd Japan 0.72 Japan Post Insurance Co Ltd Japan 0.69 Nippon Telegraph & Telephone C Japan 0.69 LINE Corp Japan 0.69 Japan Post Bank Co Ltd Japan 0.68 Nitori Holdings Co Ltd Japan 0.67 MS&AD Insurance Group Holdings Japan 0.66 Konami Holdings Corp Japan 0.66 Kyushu Electric Power Co Inc Japan 0.65 Sumitomo Realty & Development Japan 0.65 Fujitsu Ltd Japan 0.63 Suntory Beverage & Food Ltd Japan 0.63 Japan Airlines Co Ltd Japan 0.62 NEC Corp Japan 0.61 Lawson Inc Japan 0.60 Sekisui House Ltd Japan 0.60 ABC-Mart Inc Japan 0.60 Kyushu Railway Co Japan 0.60 ANA Holdings Inc Japan 0.59 Mitsubishi Heavy Industries Lt Japan 0.58 ORIX Corp Japan 0.57 Secom Co Ltd Japan 0.57 Seiko Epson Corp Japan 0.56 Trend Micro Inc/Japan Japan 0.56 Nippon Paper Industries Co Ltd Japan 0.56 Suzuki Motor Corp Japan 0.56 Japan Tobacco Inc Japan 0.55 Aozora Bank Ltd Japan 0.55 Sony Financial Holdings Inc Japan 0.55 West Japan Railway Co Japan 0.54 MEIJI Holdings Co Ltd Japan 0.54 Sugi Holdings Co Ltd Japan 0.54 Tokyo -

TIS Joins the Credit Card Industry Consortium's Proof Of

News Release November 16, 2018 TIS Inc. TIS joins the Credit Card Industry Consortium’s Proof of Concept project on sharing fraudulennt transaction information utilizing the Distributed Ledger Technology (DLT)). ~TIS develops distributed ledger applications using R3’s Corda Blockchhain platform~ Tokyo, November 16, 2018 - TIS Inc. (hereafter, TIS; Headquarters: Shinjuku, Tokyo; President: Toru Kuwano), a member of the TIS INTEC Group, announced TIIS participation as a Development Partner in the Credit Card Industry Consortium’s Proof of Concept (PoC) project concerning the sharing of fraudulent transaction information through Distributed Ledger Technology (DLT). The PoC aims to prevent damages of fraudulent transactions by sharing real time information among all the relevant parties utilizing DLT. The project selected Corda of R3 HoldCo LLC (R3 company), a US enteerprise block chain company that TIS has a capital and business alliance. TIS, a strategic member of R3 ecosystem, will develop the Credit Card Consortium’s information sharing DLT application with high availability, security and scalability. TIS is actively engaged in various blockchain initiatives such as participation in PoC projects, establishment of strategic technology development company, training its engineers and making capital & strategic alliances with blockchain software vendors. Apart from its strategic relationshipp with R3 and its strengths in blockchain technology development, TIS will also contribute to the Credit Card Consortium’s PoC from a functional perspective taking full advantage of itts long-standing credit card industry knowledge and experience. ■About PoC project Corda is a DLT platform which has the feature to share necessary data only between participants of transactions. In the PoC, we will create independent Corda nodes for each participating credit card companies to share and transfer the data securely between them. -

Research Template

Nomura Asset Management U.K. Ltd Nomura Funds JAPAN EQUITY October 2006 Fund Price Changes The fund underperformed the benchmark by 78 basis points over one month from 29 September to 31 Investment Objective October 2006. Since inception the fund has underperformed the benchmark by 187 basis points, To achieve long term capital growth delivering a performance of 43.22% verses 45.09% for the benchmark. In the year to date the fund has through investment in an actively managed underperformed the benchmark by 70 basis points, delivering a performance of 1.48% versus 2.18% for portfolio of Japanese securities listed/dealt the benchmark. on Regulated Markets in Japan and to outperform the Benchmark [Being the Performance for the Fund since Inception (Yen basis) Morgan Stanley Capital International Japan Total Return (Net of Tax) Index]. 1 month 3 month 6 month 1 Year YTD Since Inception* Launch date: 12 April 2005 29/9- 31/7-31/10 30/4-30/9 31/10- 31/12- 12/4-31/10 Base Currency: Japanese Yen NAVps** % change 0.18 3.52 -5.01 19.92 1.48 43.22 ISIN Code: LU0217998821 Index (MSCI Japan)*** 0.96 3.99 -3.90 19.84 2.18 45.09 Bloomberg Code: Excess Return -0.78 -0.47 -1.12 0.08 -0.70 -1.87 NOMJAEQ LX Equity DES *Inception date: 12th April 2005. **Net Asset Value per share (NAVps) is calculated by Nomura Bank (Luxembourg) S.A. according to the prospectus and market standards in Luxembourg. ***MSCI Japan is the Morgan Stanley Capital International Japan Total Return (Net of Tax) Total Net Assets as at 31 October 06: Index Source: Nomura Asset Management U.K. -

List of Donor Companies: Business Sector Emergency Donation for Earthquake Victims in Central Java, Indonesia, on May 27, 2006 (In Alphabetical Order of Companies)

List of Donor Companies: Business Sector Emergency Donation for Earthquake Victims in Central Java, Indonesia, on May 27, 2006 (in alphabetical order of companies) As of August 25, 2006 Nippon Keidanren Total amount contributed: \1,621,520,000.- Nippon Keidanren has been instrumental in soliciting business sector funds when disasters hit hard various parts of the world in the past. On May 27, 2006, central part of Java Island, Indonesia, was struck by a heavy earthquake, claiming more than 5,000 human lives and injuring almost 40,000, creating over 400,000 refugees and causing damages to more than 500,000 houses. Believing that the damages there were extensive, Nippon Keidanren initiated fund raising activities and provided solicited funds and goods such as tents and water purifiers for Indonesian people through Red Cross and NPOs under the auspice of the Japan Platform. Following is the list of donor companies that provided funds and goods through Nippon Keidanren and / or independently. 1 ABB K.K. 40 BOSCH CORPORATION 79 DAIWA HOUSE INDUSTRY CO.,LTD. 2 ACOM CO.,LTD. 41 BRIDGESTONE CORPORATION 80 DAIWA SECURITIES GROUP INC. 3 ADEKA CORPORATION 42 BROTHER INDUSTRIES,LTD. 81 DAIWABO COMPANY LIMITED 4 ADVANEX INC. 43 BUNKYODO CO.,LTD. 82 DENKI KAGAKU KOGYO K.K. 5 ADVANTEST CORPORATION 44 BUSINESS CONSULTANTS,INC. 83 DENSO CORPORATION 6 AEON 45 CALBEE FOODS CO.,LTD. 84 DENTSU INC. 7 AICHI STEEL CORPORATION 46 Canon Group 85 DHC CORPORATION 8 AICHI TOKEI DENKI CO.,LTD. 47 CAPCOM CO.,LTD. 86 DOWA MINING COMPANY,LTD. 9 AIFUL CORPORATION 48 CASIO COMPUTER CO.,LTD. -

Imedia BRAND SUMMIT 23Rd-26Th May 2016 @沖縄残波岬ロイヤル

BRAND SUMMIT 2017 Building Stronger Brand in Digital AFTER SHOW REPORT 25th-28th September, 2017 at The Windsor Hotel Toya Resort & Spa 1 ■Contents 1.BRAND SUMMIT 2017 Summary 2.Sponsors 3.This Year’s Theme & Main Sessions 4.Schedule 5.Photo Report 6.Attendee List 7.Analysis of Brand Attendees 2 1. BRAND SUMMIT 2017 Summary Event Name: BRAND SUMMIT 2017 Date: September 25th (Mon) - 28th (Thu), 2017 Venue: The Windsor Hotel Toya Resort & Spa (Hokkaido, Japan) Organized by: Comexposium Japan K.K. Number of Attendees: 261 ppl (Brands: 84, Partners: 177) 3 2. Sponsors 4 3-1. This Year’s Theme and Main Sessions Building Stronger Brand in Digital With the remarkable evolution of digital technology, not only products and services, but also information contact, purchasing behavior, and information dissemination of consumers themselves are changing dramatically. As companies have become able to obtain huge amounts of data, at the same time, whether they can make use of the data to improve their brand value is a big issue. We will provide a new viewpoint to improve the user experience with various things that digital can bring and lead to the improvement of brand value. ■Opening Keynote (9/25) “How to Get Along with Overflowing Technology” Sam Furukawa Former President of Microsoft Japan / Professor at Graduate School of Media Design, Keio University ■Brand Pannel (9/26) “How Has Digitalization Change the Mass Media Use in the Automobile Industry?” Kazuyoshi Arai BMW Japan Corp. Brand Communications / Digital Marketing Manager Hisao Tsudome Mercedes-Benz Japan Co., Ltd. MBC Marketing Communication Media Communication Atsushi Yasumuro SUBARU Sales Support Department Assistant Manager ■Brand Interview (9/27) “Role of Digital Measures to Improve Brand Value” Shigeyuki Tomomatsu American Express International, Inc Vice President, Digital Marketing, International Consumer Services Fujiyo Ishiguro Netyear Group Corporation President and CEO 5 3-2. -

Stoxx® Asia/Pacific 600 Ax Size Index

STOXX® ASIA/PACIFIC 600 AX SIZE INDEX Components1 Company Supersector Country Weight (%) M3 Health Care Japan 3.07 WUXI BIO Health Care Hong Kong 2.40 AFTERPAY Financial Services Australia 2.30 NIHON M&A CENTER Financial Services Japan 2.21 NORTHERN STAR Basic Resources Australia 2.05 SHENZHOU INTL.GP.HDG. Personal & Household Goods Hong Kong 1.97 Shimadzu Corp. Industrial Goods & Services Japan 1.83 TSURUHA HOLDINGS Retail Japan 1.82 Mirvac Group Real Estate Australia 1.72 TIS INC. Technology Japan 1.71 CAPCOM Technology Japan 1.64 JSR Corp. Chemicals Japan 1.62 NH FOODS Food & Beverage Japan 1.49 Santos Ltd. Oil & Gas Australia 1.48 Cochlear Ltd. Health Care Australia 1.46 Nabtesco Corp. Industrial Goods & Services Japan 1.45 TREASURY WINE ESTATES Food & Beverage Australia 1.42 Marui Group Co. Ltd. Retail Japan 1.33 Henderson Land Development Co. Real Estate Hong Kong 1.29 NICHIREI Food & Beverage Japan 1.21 Casio Computer Co. Ltd. Personal & Household Goods Japan 1.20 NET ONE SYSTEMS Technology Japan 1.19 EVOLUTION MINING Basic Resources Australia 1.18 Comsys Holdings Corp. Construction & Materials Japan 1.17 Amada Co. Ltd. Industrial Goods & Services Japan 1.16 Taiheiyo Cement Corp. Construction & Materials Japan 1.11 ITO EN Food & Beverage Japan 1.06 KAKAKU.COM Retail Japan 1.02 THK Co. Ltd. Industrial Goods & Services Japan 0.99 SUGI HOLDINGS Retail Japan 0.99 FUJI ELECTRIC Industrial Goods & Services Japan 0.99 Boral Ltd. Construction & Materials Australia 0.98 Ibiden Co. Ltd. Industrial Goods & Services Japan 0.97 Nippon Yusen K.K. -

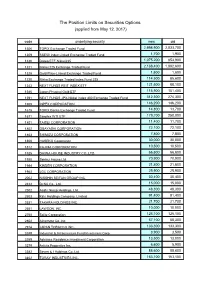

The Position Limits on Securities Options (Applied from May 12, 2017) Code Underlying Security New Old

The Position Limits on Securities Options (applied from May 12, 2017) code underlying security new old 1306 TOPIX Exchange Traded Fund 2,998,900 2,033,700 1309 SSE50 Index Linked Exchange Traded Fund 1,700 1,900 1320 Daiwa ETF-Nikkei225 1,075,200 853,900 1321 Nikkei 225 Exchange Traded Fund 2,168,400 1,882,600 1328 Gold-Price-Linked Exchange Traded Fund 1,600 1,600 1330 Nikko Exchange Traded Index Fund 225 114,500 85,600 1343 NEXT FUNDS REIT INDEX ETF 121,600 88,100 1540 Japan Physical Gold ETF 116,900 101,400 1591 NEXT FUNDS JPX-Nikkei Index 400 Exchange Traded Fund 312,300 274,300 1605 INPEX CORPORATION 146,200 146,200 1615 TOPIX Banks Exchange Traded Fund 14,800 13,700 1671 Simplex WTI ETF 179,700 250,000 1801 TAISEI CORPORATION 11,400 11,700 1802 OBAYASHI CORPORATION 72,100 72,100 1803 SHIMIZU CORPORATION 7,800 7,800 1808 HASEKO Corporation 30,000 30,000 1812 KAJIMA CORPORATION 10,500 10,500 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 66,600 66,600 1928 Sekisui House,Ltd. 70,900 70,900 1944 KINDEN CORPORATION 21,800 21,800 1963 JGC CORPORATION 25,900 25,900 2002 NISSHIN SEIFUN GROUP INC. 30,400 30,400 2432 DeNA Co., Ltd. 15,000 15,000 2502 Asahi Group Holdings, Ltd. 48,300 48,300 2503 Kirin Holdings Company, Limited 91,400 91,400 2531 TAKARA HOLDINGS INC. 21,700 21,700 2651 LAWSON, INC. 10,000 10,000 2768 Sojitz Corporation 125,100 125,100 2802 Ajinomoto Co.,Inc.