Research Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

September 5, 2019 to All Whom It May Concern Notification Regarding The

September 5, 2019 To all whom it may concern Daiwa Securities Group Inc. Credit Saison Co., Ltd. Notification Regarding the Capital and Business Alliance of Daiwa Securities Group Inc. and Credit Saison Co., Ltd. In order to handle the diversifying needs of the market, Daiwa Securities Group Inc. (Head Office: Chiyoda-ku, Tokyo; President and CEO: Seiji Nakata) and Credit Saison Co., Ltd. (Head Office: Toshima-ku, Tokyo; President and COO: Masahiro Yamashita) are developing and providing next-generation comprehensive financial services utilizing the finance business knowledge and customer networks built up by both companies since their founding. The two companies have entered into a capital and business alliance with the goal of creating the future of finance, and the details of this agreement are as follows. 1. Reasons for the Capital and Business Alliance Through the “Passion for the Best 2020” medium-term management plan started by the Daiwa Securities Group in the last fiscal year, Daiwa Securities Group is aiming to become an integrated securities group with a hybrid business model, providing new value through expansion and strengthening external networks and surrounding businesses, with traditional securities business at its core. Credit Saison started its Medium-term Management Plan in this fiscal year, with “A Finance Company Advancing with Customers for 50 Years: Providing Peace of Mind and Confidence about Money” as its mission statement. With payment and finance platforms as the base, the Company is making efforts to transform into a finance company which provides optimal services which can contribute to improving customers’ quality of life. Up until now, Daiwa Securities Group and Credit Saison have worked to expand the securities and credit card industries as independent major companies. -

Csr Report 2017

CSR REPORT 2 0 1 7 CSR REPORT 2017 JFE Holdings, Inc. 2-2-3 Uchisaiwaicho, Chiyoda-ku, Tokyo 100-0011, Japan www.jfe-holdings.co.jp/en Inquiries: Corporate Planning Department JFE Holdings, Inc. Tel: +81-3-3597-4321 Email: [email protected] Contents Editorial Policy This report provides stakeholders with information about JFE’s CSR activities 02 JFE CSR and elicits feedback to support further enhancement of the company’s activities and information disclosure. The 2017 report includes: 03 Message from the CEO • Material CSR issues that JFE is addressing 05 JFE in Society • Interviews of the President and CEO and Outside Directors regarding the reorganization of the Board of Directors and Audit & Supervisory Board 07 Material CSR Issues of the JFE Group • A widened scope of environmental data (e.g., Scope 3 emissions) from Group companies in Japan Management CSR Report Composition and Format 13 FEATURE 1 In the Forefront of Corporate Reader-friendly summary of CSR initiatives Governance (print and PDF) Highlights 19 Corporate Governance (brochure Detailed report on CSR activities and website) 23 CSR Management ( This report and PDF) CSR Report 24 Compliance ( This report and PDF) Extensive data to supplement 26 Risk Management detailed report (PDF) Environmental Data Book (website) Protecting the Environment Scope of Report 29 FEATURE 2 Reporting Period Creating Sustainable Societies with FY2016 (April 1, 2016 to March 31, 2017) Reports on some activities undertaken outside this period are included. World-class Technologies Organizations Covered 35 Environmental Management The report mainly covers the activities of JFE Holdings, Inc. and its three operating companies—JFE Steel Corporation, JFE Engineering Corporation 39 Main Environmental Targets and Results and JFE Shoji Trade Corporation—but it also includes reports on activities of other companies in the JFE Group (376 companies, of which 312 are 41 Material Flow consolidated subsidiaries and 64 are equity-method affiliates). -

Dimethyl Ether) and Its Application Technology†

JFE TECHNICAL REPORT No. 8 (Oct. 2006) New Direct Synthesis Technology for DME (Dimethyl Ether) and Its Application Technology† OHNO Yotaro*1 YOSHIDA Masahiro*2 SHIKADA Tsutomu*3 INOKOSHI Osamu*4 OGAWA Takashi*5 INOUE Norio*6 Abstract: during the 21st century. In realizing sustained growth in Dimethly ether (DME) is a clean fuel that does not this region in the future, energy supply and environmen- produce toxic gases or particulate matter (PM) at burn- tal problems associated with mass energy consumption ing. JFE Group develops a direct synthesis process of will be major problems. High expectations are placed on DME which has advantages in economics. Construction dimethyl ether (DME) as a new fuel which can be syn- of a demonstration plant with 100 t/d capacity was fi n- thesized from diverse hydrocarbon sources, including ished in Nov. 2003. The fi rst demonstrating operation natural gas, can be handled as easily as liquefi ed petro- (Run 100) through Dec. 2003 to Jan. 2004 and the sec- leum gas (LPG), and causes a small load on the environ- ond operation (Run 200) through June 2004 to Aug. ment. Thus, if DME can be produced and distributed 2004 were completed successfully. The conversion of at low cost and in large quantities, this fuel can make synthesis gas, the selectivity to DME and the purity of an important contribution to solving the energy supply DME reached to 96% (Target: more than 95%), 93% problems and environmental problems resulting from (Target: more than 90%) and 99.6% (Target: more than expanded energy consumption expected in Asia in the 99%), respectively. -

Published on July 21, 2021 1. Changes in Constituents 2

Results of the Periodic Review and Component Stocks of Tokyo Stock Exchange Dividend Focus 100 Index (Effective July 30, 2021) Published on July 21, 2021 1. Changes in Constituents Addition(18) Deletion(18) CodeName Code Name 1414SHO-BOND Holdings Co.,Ltd. 1801 TAISEI CORPORATION 2154BeNext-Yumeshin Group Co. 1802 OBAYASHI CORPORATION 3191JOYFUL HONDA CO.,LTD. 1812 KAJIMA CORPORATION 4452Kao Corporation 2502 Asahi Group Holdings,Ltd. 5401NIPPON STEEL CORPORATION 4004 Showa Denko K.K. 5713Sumitomo Metal Mining Co.,Ltd. 4183 Mitsui Chemicals,Inc. 5802Sumitomo Electric Industries,Ltd. 4204 Sekisui Chemical Co.,Ltd. 5851RYOBI LIMITED 4324 DENTSU GROUP INC. 6028TechnoPro Holdings,Inc. 4768 OTSUKA CORPORATION 6502TOSHIBA CORPORATION 4927 POLA ORBIS HOLDINGS INC. 6503Mitsubishi Electric Corporation 5105 Toyo Tire Corporation 6988NITTO DENKO CORPORATION 5301 TOKAI CARBON CO.,LTD. 7011Mitsubishi Heavy Industries,Ltd. 6269 MODEC,INC. 7202ISUZU MOTORS LIMITED 6448 BROTHER INDUSTRIES,LTD. 7267HONDA MOTOR CO.,LTD. 6501 Hitachi,Ltd. 7956PIGEON CORPORATION 7270 SUBARU CORPORATION 9062NIPPON EXPRESS CO.,LTD. 8015 TOYOTA TSUSHO CORPORATION 9101Nippon Yusen Kabushiki Kaisha 8473 SBI Holdings,Inc. 2.Dividend yield (estimated) 3.50% 3. Constituent Issues (sort by local code) No. local code name 1 1414 SHO-BOND Holdings Co.,Ltd. 2 1605 INPEX CORPORATION 3 1878 DAITO TRUST CONSTRUCTION CO.,LTD. 4 1911 Sumitomo Forestry Co.,Ltd. 5 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 6 1954 Nippon Koei Co.,Ltd. 7 2154 BeNext-Yumeshin Group Co. 8 2503 Kirin Holdings Company,Limited 9 2579 Coca-Cola Bottlers Japan Holdings Inc. 10 2914 JAPAN TOBACCO INC. 11 3003 Hulic Co.,Ltd. 12 3105 Nisshinbo Holdings Inc. 13 3191 JOYFUL HONDA CO.,LTD. -

News Release Nomura Holdings Possible Loss Arising From

News Release Possible Loss Arising from Business Activities Tokyo, March 29, 2021—Nomura Holdings, Inc. today announced that on March 26, 2021, an event occurred that could subject one of its US subsidiaries to a significant loss arising from transactions with a US client. Nomura is currently evaluating the extent of the possible loss and the impact it could have on its consolidated financial results. The estimated amount of the claim against the client is approximately $2 billion based on market prices as of March 26. This estimate is subject to change depending on unwinding of the transactions and fluctuations in market prices. Nomura will continue to take the appropriate steps to address this issue and make a further disclosure once the impact of the potential loss has been determined. As of the end of December 2020, Nomura maintained a consolidated Common Equity Tier 1 ratio of over 17 percent, which is substantially higher than the minimum regulatory requirement. Accordingly, there will be no issues related to the operations or financial soundness of Nomura Holdings or its US subsidiary. ends Nomura Nomura is a global financial services group with an integrated network spanning over 30 countries. By connecting markets East & West, Nomura services the needs of individuals, institutions, corporates and governments through its three business divisions: Retail, Asset Management, and Wholesale (Global Markets and Investment Banking), and Merchant Banking. Founded in 1925, the firm is built on a tradition of disciplined entrepreneurship, serving clients with creative solutions and considered thought leadership. For further information about Nomura, visit www.nomura.com. -

Itraxx Japan Series 35 Final Membership List March 2021

iTraxx Japan Series 35 Final Membership List March 2021 Copyright © 2021 IHS Markit Ltd T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List...........................................3 2 iTraxx Japan Series 35 Final vs. Series 34................................................ 5 3 Further information .....................................................................................6 Copyright © 2021 IHS Markit Ltd | 2 T180614 iTraxx Japan Series 35 Final Membership List 1 iTraxx Japan Series 35 Final Membership List IHS Markit Ticker IHS Markit Long Name ACOM ACOM CO., LTD. JUSCO AEON CO., LTD. ANAHOL ANA HOLDINGS INC. FUJITS FUJITSU LIMITED HITACH HITACHI, LTD. HNDA HONDA MOTOR CO., LTD. CITOH ITOCHU CORPORATION JAPTOB JAPAN TOBACCO INC. JFEHLD JFE HOLDINGS, INC. KAWHI KAWASAKI HEAVY INDUSTRIES, LTD. KAWKIS KAWASAKI KISEN KAISHA, LTD. KINTGRO KINTETSU GROUP HOLDINGS CO., LTD. KOBSTL KOBE STEEL, LTD. KOMATS KOMATSU LTD. MARUB MARUBENI CORPORATION MITCO MITSUBISHI CORPORATION MITHI MITSUBISHI HEAVY INDUSTRIES, LTD. MITSCO MITSUI & CO., LTD. MITTOA MITSUI CHEMICALS, INC. MITSOL MITSUI O.S.K. LINES, LTD. NECORP NEC CORPORATION NPG-NPI NIPPON PAPER INDUSTRIES CO.,LTD. NIPPSTAA NIPPON STEEL CORPORATION NIPYU NIPPON YUSEN KABUSHIKI KAISHA NSANY NISSAN MOTOR CO., LTD. OJIHOL OJI HOLDINGS CORPORATION ORIX ORIX CORPORATION PC PANASONIC CORPORATION RAKUTE RAKUTEN, INC. RICOH RICOH COMPANY, LTD. SHIMIZ SHIMIZU CORPORATION SOFTGRO SOFTBANK GROUP CORP. SNE SONY CORPORATION Copyright © 2021 IHS Markit Ltd | 3 T180614 iTraxx Japan Series 35 Final Membership List SUMICH SUMITOMO CHEMICAL COMPANY, LIMITED SUMI SUMITOMO CORPORATION SUMIRD SUMITOMO REALTY & DEVELOPMENT CO., LTD. TFARMA TAKEDA PHARMACEUTICAL COMPANY LIMITED TOKYOEL TOKYO ELECTRIC POWER COMPANY HOLDINGS, INCORPORATED TOSH TOSHIBA CORPORATION TOYOTA TOYOTA MOTOR CORPORATION Copyright © 2021 IHS Markit Ltd | 4 T180614 iTraxx Japan Series 35 Final Membership List 2 iTraxx Japan Series 35 Final vs. -

Research Template

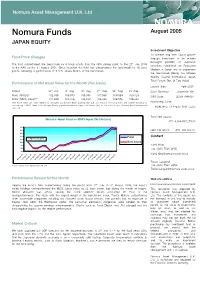

Nomura Asset Management U.K. Ltd Nomura Funds August 2005 JAPAN EQUITY Investment Objective To achieve long term capital growth Fund Price Changes through investment in an actively managed portfolio of Japanese The fund outperformed the benchmark by 6 basis points from the NAV pricing point on the 27th July 2005 securities listed/dealt on Regulated to the NAV on the 31 August 2005. Since inception the fund has outperformed the benchmark by 78 basis Markets in Japan and to outperform points, delivering a performance of 9.12% verses 8.34% of the benchmark. the Benchmark [Being the Morgan Stanley Capital International Japan Total Return (Net of Tax) Index]. Performance of Net Asset Value for the Month (Yen basis) Launch date: April 2005 th rd th th th Period 27 July 3 Aug 10 Aug 17 Aug 24 Aug 31 Aug Base Currency: Japanese Yen Fund (NAVps)* 102,335 103,970 105,080 107,565 109,584 109,123 ISIN Code: LU0217998821 Index (MSCI Japan)** 101,659 102,916 104,224 106,234 108,576 108,340 *Net Asset Value per share (NAVps) is calculated by Nomura Bank (Luxembourg) S.A. according to the prospectus and market standards in Bloomberg Code: Luxembourg. **MSCI Japan is the Morgan Stanley Capital International Japan Total Return (Net of Tax) Index Source: Nomura Asset Management NOMJAEQ LX Equity DES <GO> U.K. Ltd Total Net Assets: Nomura Japan Fund vs MSCI Japan (Net Return) JPY 4,034,857,279.00 110 108 NAV Per Share: JPY 109,123.00 106 104 Fund Contact 102 12-Apr-05, Inception 100 Dt Benchmark 98 Yuhki King 96 +44 (0)20 7521 2635 94 5 5 5 5 [email protected] 5 5 5 5 0 0 0 0 5 5 5 5 5 5 5 -0 -0 -0 -0 - - 05 05 -0 -0 05 0 0 0 05 05 -0 05 05 r r r r y- y- n- n- n n n- l- l-0 l- l- g- g- g- g- p p p ay a a ay u u u u u Ap M M J J J Ju Ju Ju Ju u u ug u u -A -A -A -M -M - - -J -J - - - - - -A -A -A -A -A 0- 1- 8- 1 8 9 6 0 7 7 06 13 2 27 04 1 1 25 0 0 15 22 2 0 13 2 2 03 10 1 24 31 Trevor Langford Source: Nomura Asset Management U.K. -

CREDIT SAISON CO., LTD. Interim Business Report 70Th Fiscal Year (April 1, 2019 – September 30, 2019) FINANCIAL DATA

Midterm business vision CREDIT SAISON CO., LTD. Interim Business Report 70th Fiscal Year (April 1, 2019 – September 30, 2019) FINANCIAL DATA 304.8 315.5 293.2 57.3 52.2 38.4 42.5 32.0 30.5 29.0 36.2 151.2 159.2 31.2 145.4 27.0 18.6 18.6 5,336.0 4,931.1 5,031.5 2,428.8 2,466.5 2,569.3 Dear Shareholders: I would like to express my appreciation for your continued support and patronage. Let me report on the business results for the first half of the 70th fiscal year (April 1, 2019 – September 30, 2019). Credit Saison has formulated a medium-term management plan to be carried out until the fiscal year ending March 2022 (72nd fiscal year), upholding the midterm business vision of the “Neo Finance Company in Asia.” The plan provides the mission statement “Becoming a finance company advancing with customers for 50 years: Providing peace of mind and discov- ering potentials in money.” To achieve this medium-term management plan, Credit Saison is taking on the challenge of trans- forming itself into a finance company that provides customers with optimum services for their life events that involve financial decisions by using credit cards with long service lives as touchpoints. With the completion of transfer to the Associated Core System in October 2018, which had been a long-term management priority, and with a proactive structure in place that will allow us to aim for future business growth, Credit Saison entered into an alliance with freee K.K. -

Nomura Holdings 104Th Fiscal Year First Quarterly Report (PDF)

FORM 6-K U.S. SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Report of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934 Commission File Number: 1-15270 For the month of September 2007. NOMURA HOLDINGS, INC. (Translation of registrant's name into English) 9-1, Nihonbashi 1-chome Chuo-ku, Tokyo 103-8645 Japan (Address of principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F X Form 40-F Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes No X If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- . 1 Information furnished on this form: EXHIBIT Exhibit Number 1. (English Translation) Nomura Holdings 104th Fiscal Year First Quarterly Report 2 SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. -

Briefing for Seventh Medium‐Term Business Plan

JFE Holdings, Inc. Briefing for Seventh Medium-term Business Plan May 7, 2021 Presentation Moderator: We would like to move on to Part 2: JFE Holdings, Inc. Briefing for Seventh Medium-term Business Plan. Mr. Kakigi, Representative Director, President and CEO, will now give an explanation. Kakigi: I am Kakigi from JFE Holdings. I will begin the explanation. First of all, I would like to look back on the Sixth Medium-Term Business Plan. As you are all aware, our earnings deteriorated sharply, mainly in the steel business, mainly due to the effects of trade friction between the US and China and the spread of COVID-19. As you can see here, the steel business was the only one in a very difficult situation. However, looking back, I believe that we have done what we can to establish a foundation to some extent, and one of the things we have done is to announce our individual target of the CO₂ emissions reduction for our steel business last year. The other thing is that each company has been proactive in promoting digital transformation. By operating company, JFE Steel struggled, but it reinforced manufacturing base spending a lot of money. Then, in March last year, it decided to implement structural reform by shutting down the upper process and hot-rolling production lines at Keihin district. 1 JFE Engineering is doing relatively well, and it has expanded its operation business and conducted 2 M&A transactions. JFE Shoji acquired Cogent, a company in Canada, in order to strengthen its electrical steel sheet processing bases, and also promoted SCM* expansion. -

TOBAM Maximum Diversification All World Developed Ex North America USD

TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight BP PLC 0.10% IDEMITSU KOSAN CO LTD 0.21% INPEX HOLDINGS INC 0.07% JX HOLDINGS INC 0.09% NESTE OIL OYJ 1.16% OMV AG 0.08% SANTOS LTD 0.02% SBM OFFSHORE NV 0.05% TGS NOPEC GEOPHYSICAL CO ASA 0.02% VOPAK 0.02% WOOD GROUP (JOHN) PLC 0.02% AIR LIQUIDE 0.23% AIR WATER INC 0.02% AKZO NOBEL 0.12% ALUMINA LTD 0.03% AMCOR PLC-CDI 0.08% AVON RESOURCES LTD 0.53% BORAL LTD 0.02% CHR HANSEN HOLDING A/S 0.08% DAICEL CHEMICAL INDUSTRIES 0.02% DOWA HOLDINGS CO LTD 0.01% EMS-CHEMIE HOLDING AG-REG 0.03% FLETCHER BUILDING LTD 0.02% FORTESCUE METALS GROUP LTD 0.60% GIVAUDAN-REG 0.16% HITACHI CHEMICAL CO LTD 0.03% HUHTAMAKI OYJ 0.03% ISRAEL CHEMICALS LTD 0.02% JAMES HARDIE INDUSTRIES-CDI 0.07% JFE HOLDINGS INC 0.02% KANSAI PAINT CO LTD 0.03% KURARAY CO LTD 0.03% MITSUBISHI MATERIALS CORP 0.02% NEWCREST MINING LTD 1.35% TOBAM Maximum Diversification All World Developed ex North America USD 31/12/2019 Instrument Weight NIPPON PAINT CO LTD 0.05% NIPPON PAPER INDUSTRIES CO L 0.04% NIPPON SHOKUBAI CO LTD 0.01% NISSAN CHEMICAL INDUSTRIES 0.04% NOF CORP 0.02% NORTHERN STAR RESOURCES LTD 0.66% NOVOZYMES A/S-B SHARES 0.07% OJI PAPER CO LTD 0.03% ORICA LTD 0.02% ORORA LTD 0.02% SARACEN MINERAL HOLDINGS LTD 0.32% SMURFIT KAPPA GROUP PLC 0.04% SYMRISE AG 0.04% TAIHEIYO CEMENT CORP 0.02% TAIYO NIPPON SANSO CORP 0.02% TEIJIN LTD 0.02% THYSSENKRUPP AG 0.04% TORAY INDUSTRIES INC 0.02% WIENERBERGER AG 0.02% ADP 0.04% AENA SA 0.09% ALFA LAVAL AB 0.04% ALL NIPPON AIRWAYS CO LTD -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Value Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.9% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 4.2% UCB SA 3,232 367,070 AMP Ltd. 247,119 232,705 Total 13,350,657 Aurizon Holdings Ltd. 64,744 199,177 China 0.6% Australia & New Zealand Banking Group Ltd. 340,950 4,253,691 Baidu, Inc., ADR(a) 15,000 1,898,850 Bendigo & Adelaide Bank Ltd. 30,812 134,198 China Mobile Ltd. 658,000 4,223,890 BlueScope Steel Ltd. 132,090 1,217,053 Total 6,122,740 Boral Ltd. 177,752 587,387 Denmark 1.9% Challenger Ltd. 802,400 2,232,907 AP Moller - Maersk A/S, Class A 160 234,206 Cleanaway Waste Management Ltd. 273,032 412,273 AP Moller - Maersk A/S, Class B 3,945 6,236,577 Crown Resorts Ltd. 31,489 200,032 Carlsberg A/S, Class B 12,199 1,643,476 Fortescue Metals Group Ltd. 194,057 2,279,787 Danske Bank A/S(a) 35,892 485,479 Harvey Norman Holdings Ltd. 144,797 471,278 Demant A/S(a) 8,210 257,475 Incitec Pivot Ltd. 377,247 552,746 Drilling Co. of 1972 A/S (The)(a) 40,700 879,052 LendLease Group 485,961 3,882,083 DSV PANALPINA A/S 15,851 2,571,083 Macquarie Group Ltd. 65,800 5,703,825 Genmab A/S(a) 1,071 388,672 National Australia Bank Ltd.