Walmart Targets Midpoint of Ethnicity Scale by Don Longo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mexican Supermarkets & Grocery Stores Industry Report

Mexican Supermarkets & Grocery Stores Industry Report July 2018 Food Retail Report Mexico 2018Washington, D.C. Mexico City Monterrey Overview of the Mexican Food Retail Industry • The Mexican food retail industry consists in the distribution and sale of products to third parties; it also generates income from developing and leasing the real estate where its stores are located • Stores are ranked according to size (e.g. megamarkets, hypermarkets, supermarkets, clubs, warehouses, and other) • According to ANTAD (National Association of Food Retail and Department Stores by its Spanish acronym), there are 34 supermarket chains with 5,567 stores and 15 million sq. mts. of sales floor in Mexico • Estimates industry size (as of 2017) of MXN$872 billion • Industry is expected to grow 8% during 2018 with an expected investment of US$3.1 billion • ANTAD members approximately invested US$2.6 billion and created 418,187 jobs in 2017 • 7 states account for 50% of supermarket stores: Estado de Mexico, Nuevo Leon, Mexico City, Jalisco, Baja California, Sonora and Sinaloa • Key players in the industry include, Wal-Mart de Mexico, Soriana, Chedraui and La Comer. Other regional competitors include, Casa Ley, Merza, Calimax, Alsuper, HEB and others • Wal-Mart de México has 5.8 million of m² of sales floor, Soriana 4.3 m², Chedraui 1.2 m² and La Cómer 0.2 m² • Wal-Mart de México has a sales CAGR (2013-2017) of 8.73%, Soriana 9.98% and Chedraui 9.26% • Wal-Mart de México has a stores growth CAGR (2013-2017) of 3.30%, Soriana 5.75% and Chedraui 5.82% Number -

Weekly Update Monday, May 11, 2015 U.S

Weekly Update Monday, May 11, 2015 U.S. Stocks Rise Sharply After Jobs Report Mary Burke U.S. stocks rose sharply Friday after the April employment report Partner showed an economy continuing to grow, but at a pace that investors 312.348.7081 [email protected] believe could keep the Federal Reserve from raising interest rates until late this year. William Whipple Partner The Dow Jones Industrial Average increased 0.9% on the week, 312.348.7076 finishing at 18,191. [email protected] The S&P 500 grew 0.4% on the week, finishing at 2,116. Philip Zoloto Partner 312.348.7077 The NASDAQ Composite was flat on the week, finishing at 5,004 [email protected] (down 2.5% from its all-time high of 5,133). Yield on the 10-year Treasury rose four basis points to 2.16%. Lakeshore Food Advisors, LLC 20 North Wacker Drive Crude oil climbed 0.4% on the week, ending at $59.39 per barrel. Suite 1701 Chicago, IL 60606 Corn futures were flat on the week, ending at $3.63 per bushel. NASDAQ Highs: Mondelez, Willamette Valley Vineyards Lows: Keurig Green Mountain NYSE Highs: J.M. Smucker, Syngenta, Yum! Brands Lows: Diageo, Treehouse Foods Featured Stocks of the Week: Monsanto Company (MON) 10-year History Dean Foods (DF) 10-year History 160 120 140 100 120 80 100 80 60 60 40 40 20 20 0 0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 The Lakeshore Food Chain Price Price as Compared to Enterprise Value to Total Debt Price Compared to 52-Week Range YE: Forward LTM: to LTM Company Name 5/8/15 5/1/15 High Low 2014 2013 P/E Revenue EBITDA EBITDA Dow Jones Industrial Average 18,191 0.9% 18,289 15,855 2.1% 9.7% S&P 500 Index 2,116 0.4% 2,126 1,821 2.8% 14.5% NASDAQ Composite Index 5,004 (0.0%) 5,120 4,036 5.6% 19.8% Sector Average: 3.5% 14.7% 18191.10 INPUTS *Agrium Inc. -

Region 001-004

July 2021 Price Region County Store Name Store Address City Zip 001 BASTROP BROOKSHIRE BROS #55 501 NW LOOP 230 SMITHVILLE 78957 001 BASTROP HEB #475 1080 EAST HIGHWAY 290 ELGIN 78621 001 BASTROP HEB #582 104 HASLER BLVD BASTROP 78602 001 BASTROP WAL-MART SUPERCENTER #1042 488 HWY 71 WEST BASTROP 78602 001 BASTROP WAL-MART SUPERCENTER #3170 1320 W HIGHWAY 290 ELGIN 78621 001 BELL BROOKSHIRE BROS #69 215 MILL CREEK DRIVE #100 SALADO 76571 001 BELL HEB #039 2509 NORTH MAIN STREET BELTON 76513 001 BELL HEB #071 1314 WEST ADAMS TEMPLE 76504 001 BELL HEB #182 3002 SOUTH 31ST STREET TEMPLE 76502 001 BELL HEB #381 601 INDIAN TRAIL HARKER HEIGHTS 76548 001 BELL HEB #581 2511 TRIMMIER ROAD STE 100 KILLEEN 76542 001 BELL HEB #721 1101 W STAN SCHULUETER LP KILLEEN 76549 001 BELL KILLEEN NUTRITIONAL CENTER 107 SANTA FE PLAZA DRIVE KILLEEN 76541 001 BELL WAL-MART NBH MKT #6459 960 EAST FM 2410 HARKER HEIGHTS 76548 001 BELL WAL-MART SUPERCENTER #1232 2604 NORTH MAIN STREET BELTON 76513 001 BELL WAL-MART SUPERCENTER #3319 2020 HEIGHTS DRIVE HARKER HEIGHTS 76548 001 BELL WAL-MART SUPERCENTER #407 1400 LOWES BLVD KILLEEN 76542 001 BELL WAL-MART SUPERCENTER #6286 3404 W STAN SCHLUETER LOOP KILLEEN 76549 001 BELL WAL-MART SUPERCENTER #6929 6801 W ADAMS AVENUE TEMPLE 76502 001 BELL WAL-MART SUPERCENTER #746 3401 SOUTH 31ST STREET TEMPLE 76502 001 BELL WALMART NEIGHBORHOOD MKT #3449 3801 E STAN SCHLUETER LOOP KILLEEN 76542 001 BELL WALMART NEIGHBORHOOD MKT #3450 2900 CLEAR CREEK RD KILLEEN 76549 001 BELL FORT HOOD COMMISSARY II WARRIOR WAY & 10TH BLDG 85020 -

Establishment Address Score2 Inspection Date 3 Nations Brewing Co

No Food Prep - 1 inspection/year permitting PER Light Food Prep - 2 inspections/year Complaint COM Heavy Food Prep - 3-4 inspections/year updated 10/19/2020 Followup FOL Heavy Food Prep - 2-3 inspections/year consultation CON pass/fail due to pub. disaster Establishment Address Score2 Inspection Date 3 Nations Brewing Co. 1033 E VANDERGRIFF DR permitting02/25/2020 55 Degrees 1104 ELM ST temp clsd 07/14/2020 7 Degrees Ice Cream Rolls 2150 N JOSEY LN #124 95 06/22/2020 7 Leaves Café 2540 OLD DENTON RD #116 96 12/12/2019 7-Eleven 1865 E ROSEMEADE PKWY 97 01/06/2020 7-Eleven 2145 N JOSEY LN 90 02/19/2020 7-Eleven 2230 MARSH LN 92 03/10/2020 7-Eleven 2680 OLD DENTON RD 96 08/27/2020 7-Eleven 3700 OLD DENTON RD 92 02/05/2020 7-Eleven #32379 1545 W HEBRON PKWY 93 10/13/2020 7-Eleven Convenience Store #36356B 4210 N JOSEY LN 100 09/02/2020 1102 Bubble Tea & Coffee 4070 SH 121 98 10/13/2020 85C Bakery & Cafe 2540 OLD DENTON RD 91 02/18/2020 99 Pocha 1008 Mac Arthur Dr #120 95 09/16/2019 99 Ranch Market - Bakery 2532 OLD DENTON RD 92 07/21/2020 99 Ranch Market - Hot Deli 2532 OLD DENTON RD 96 07/21/2020 99 Ranch Market - Meat 2532 OLD DENTON RD 88 07/15/2020 99 Ranch Market - Produce 2532 OLD DENTON RD 88 07/15/2020 99 Ranch Market - Seafood 2532 OLD DENTON RD 90 07/21/2020 99 Ranch Market -Supermarket 2532 OLD DENTON RD 93 07/15/2020 A To Z Beer and Wine 1208 E BELT LINE RD #118 87 12/11/2019 A1 Chinese Restaurant 1927 E BELT LINE RD 91 02/11/2020 ABE Japanese Restaurant 2625 OLD DENTON RD 95 10/08/2020 Accent Foods 1617 HUTTON DR 97 02/11/2020 -

26 August 24, 2018 Retailer Cash Incentive Program

RETAILER CASH INCENTIVE PROGRAM #26 DRAWING AUGUST 24, 2018 PRIZE RET ID LOCATION NAME LOCATION CITY DRAWING $ 100,000 487505 HEB FOOD STORE #415 SCHERTZ TIER 1 $ 50,000 180751 SUPER TRACK 2 GRAND PRAIRIE TIER 1 $ 50,000 182144 APPLE EXPRESS MANOR TIER 2 $ 25,000 489040 HEB FOOD STORE #428 AUSTIN TIER 1 $ 10,000 126336 MOBIL MART CONVERSE TIER 1 $ 10,000 146853 HANDI PLUS #5 TOMBALL TIER 1 $ 10,000 147432 HWY 71 SHELL COLUMBUS TIER 1 $ 10,000 152416 SHELL SELECT MCKINNEY TIER 1 $ 10,000 155177 Q-WAY MART KYLE TIER 1 $ 10,000 173722 HEAVEN FOOD MART GARLAND TIER 1 $ 10,000 175665 HOWDY SAN ANTONIO TIER 1 $ 10,000 178118 MIKE'S STOP & SHOP KINGSVILLE TIER 1 $ 10,000 180228 TALLEY FOODMART SAN ANTONIO TIER 2 $ 10,000 183600 VALLEY FOOD MART 2 SAN JUAN TIER 1 $ 5,000 140794 RUNDBERG GROCERY AUSTIN TIER 1 $ 5,000 147330 EXPRESS FOOD MART TYLER TIER 1 $ 5,000 152418 DIAMOND EXPRESS TERRELL HILLS TIER 1 $ 5,000 152977 KINGSVILLE FOOD MART KINGSVILLE TIER 1 $ 5,000 153568 TEXAS EXPRESS 1 ABILENE TIER 1 $ 5,000 155166 PETRO MART FARMERS BRANCH TIER 2 $ 5,000 156387 PRIME MART #30 PASADENA TIER 1 $ 5,000 173217 SHOP N DRIVE GALVESTON TIER 2 $ 5,000 173466 Q & Q MART ROUND ROCK TIER 1 $ 5,000 174285 DANISH FOOD MART CLUTE TIER 1 $ 5,000 176680 JIMMY'S FOOD N GAS SMITHVILLE TIER 1 $ 5,000 178849 WATTS GROCERY HACKBERRY TIER 2 $ 5,000 179043 SUNNY'S MART FARMERS BRANCH TIER 1 $ 5,000 179195 CIRCLE 786 LIVE OAK TIER 1 $ 5,000 180627 B AND C CONV FOOD KILLEEN TIER 2 $ 5,000 180849 PIT STOP #2 ROBINSON TIER 1 $ 5,000 181259 969 EXPRESS AUSTIN TIER 1 -

2014 ANNUAL REPORT Within These Pages You’Ll Find Examples of the North Texas Food Bank Mission in Action

FILLING TABLES A Member of Feeding America Improving lives 2014 ANNUAL REPORT Within these pages you’ll find examples of the North Texas Food Bank mission in action. Our passion for ending hunger can only be fulfilled with your support, and we’re so thankful that you partnered with us to make some 62 million meals available for hungry children, seniors, and working families in Fiscal Year 2014. A MESSAGE FROM OUR BOARD CHAIR It’s all thanks to you. Friends, As we close the books on the final year of the ReThink Hunger campaign, the North Texas Food Bank board is celebrating many wonderful accomplishments — most importantly, providing access to some 62 million nutritious meals for hungry North Texans. Through your financial support, volunteer efforts and advocacy, we achieved this important milestone. Thank you! Each day, the team at NTFB provides access to 170,000 meals for hungry children, seniors and families through a network of more than 1,000 programs and 262 Partner Agencies. While this figure is significant, we know that more work needs to be done, as 250,000 meals are needed daily to feed our hungry neighbors. Each year our supporters rise to the challenge and help us provide food for more than 439,000 food-insecure individuals who reside in our 13-county service area. This year was no different. As you flip through the pages of this annual report, you will read about the programs that NTFB has established to provide food and hope to our community, and you will also see the individuals, corporations, organizations and faith communities that brought food, funds and other support to our mission. -

Safeway Fact Book 2006

About the Safeway Fact Book This Fact Book provides certain financial and operating information about Safeway. It is intended to be used as a supplement to Safeway’s 2005 Annual Report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and therefore does not include the Company’s consolidated financial statements and notes. Safeway believes that the information contained in this Fact Book is correct in all material respects as of the date set forth below. However, such information is subject to change. May 2006 Contents I. Investor Information Page 2 II. Safeway at a Glance Page 4 III. Retail Operations Page 5 IV. Retail Support Operations Page 8 V. Finance and Administration Page 12 VI. Financial and Operating Statistics Page 25 VII. Directors and Executive Officers Page 28 VIII. Corporate History Page 29 Note: This Fact Book contains forward-looking statements within the meaning of Section 27A of the Securities Exchange Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such statements relate to, among other things, capital expenditures, identical-store sales, comparable-store sales, cost reductions, operating improvements, obligations with respect to divested operations, cash flow, share repurchases, tax settlements, information technology, Safeway brands and store standards and are indicated by words or phrases such as “continuing”, “on going”, “expects”, “plans”, “will” and similar words or phrases. These statements are based on Safeway’s current plans and expectations and involve risks and uncertainties that could cause actual events and results to vary significantly from those included in, or contemplated or implied by such statements. -

1992-1993 ALPHABETICAL by INDIVIDUAL NAME RANK SCHOOL AREA DEGREE STRT Aabel, Don C

1 1992-93 ACCOUNTING FACULTY DIRECTORY ALPHABETICAL BY SCHOOL NAME RANK PHONE BITNET AREA DEGREE STRT Abilene Christian Univ Abilene, Texas 79699-0001 (915)674-2564 Dept of Accounting Box 8324 College of Business BBA Griggs, Jack Dean 674-2245 PHD 71 Texas 1-91 Wright, William E. C-Pr 674-2071 GFM PHD 56.Texas &1956 Brown, Michael H. Asst 674-2133 FX MBA 84 Pepperdi &8-91 Fowler, Bill E. Asst 674-2080 AC MBA 83 Walsh 1992 Reeves, G. Lynn Asst 674-2571 FX MBA Abilene &1975 Bailey, Jill Inst 674-2558 F MBA 91 Abilene &1991 Fair, Joy Inst 674-2080 FM MAS 85 Illinois 1985 on leave U Washington doctoral program Adelphi University Garden City, NY 11530 (516)877-3347 Dept of Accounting and Law School of Business Adm BBA,MBA,MS Weinstein, Arnold K. Dean 877-4690 Mktg PHD 73 Columbia 1992 Conway, Grace M. C-Ac 877-4620 VGFM MA 77 NY Soc &1978 Angel, Jack Prof 877-4614 X MS 78 C W Post &1981 Kurlander, Neale Prof 877-4625 FXNM JD 68 NY Law &1962 Heiman, Frederick D. Asst 877-4619 FPO MBA 58 NYU &1987 Kreitzman, Alan J. Asst 877-4615 MA MBA 69 Adelphi &1977 Nesi, Robert Asst 877-4618 CTP MBA 81 Adelphi &1986 Novins, Neil L. Asst 877-4612 MA MBA 66 NYU &1979 Adrian College Adrian, Michigan 49221-2575 (517) Accounting Faculty Dept of Atg & Bus Adm BBA 265-5161 phone for all Bachman, William C-Pr 265-5161 Mgt ABD 73 Kentucky 8-81 deLespinasse, Doris Prof Ext 4317 FPAR MA 65 Oregon &1979 Coy, David G. -

Grocery Feb14

Grocery_Feb14 the_geom STORE_NAME ADDRESS CITY Status POINT (- Albertsons 7007 Arapaho Rd Dallas Open 96.7881140000000 8 32.9629860000000 3) POINT (- Albertsons 10203 E Northwest Dallas Open 96.7096630000001 32.8650280000000 Hwy 3) POINT (- Albertsons 3524 McKinney Ave Dallas Open 96.7971240000001 32.8055730000000 3) POINT (- Albertsons 6464 E Mockingbird Dallas Open 96.7504310000000 9 Ln 32.8352860000000 3) POINT (- Albertsons 320 Casa Linda Plz Dallas Open 96.6996595843746 7 32.8340001101060 7) POINT (- Albertsons 4625-4727 Dallas Open 96.8273633995093 4 Frankford Rd 32.9994338483986 9) POINT (- Albertsons 4349 W Northwest Dallas Open 96.8362391817870 9 Hwy 32.8657797486237 16) POINT (- Malone's Cost Plus 333 S Saint Dallas Open 96.6579930314965 Augustine Rd Page 1 of 18 09/28/2021 Grocery_Feb14 9 Augustine Rd 32.7082386079292 8) POINT (- Minyard Food 2223 Singleton Blvd Dallas Open 96.8580576483777 7 Stores 32.7797784702811 2) POINT (- Fiesta Mart 3460 Webb Chapel Dallas Open 96.8636438761354 7 Ext 32.8641974519294 5) POINT (- Fiesta Mart 6401 Abrams Rd Dallas Open 96.7456781994884 4 32.8628798270576 25) POINT (- Central Market 5750 E Lovers Ln Dallas Open 96.7686292391989 6 32.8493918131159 6) POINT (- Fiesta Mart 2951 S Buckner Dallas Open 96.6842349696024 7 Blvd 32.7616769861897 8) POINT (- Fiesta Mart 5334 Ross Ave Dallas Open 96.7708250000001 32.8090290000000 4) POINT (- Fiesta Mart 611 W Jefferson Dallas Open 96.8331312727635 4 Blvd 32.7443195915534 7) Page 2 of 18 09/28/2021 Grocery_Feb14 POINT (- Fiesta Mart 9727 Webb Chapel -

Template for ROUNDUP

News and Ideas for Texas Lottery Retailers TexasTexas LotteryLottery Sets New Sales Record! Page 3 The 50 Top-Selling Texas Lottery Retailers in FY2012 Name City Name City Rudy’s Stop & Shop Rosenberg Nicks Mart San Antonio Town & Country C S Mcallen Rocy’s K W Express Andrews All or Nothing™ – Adrian’s Drive In Grocery Alice Fiesta Mart #29 Dallas Three Star Mart #1 Balcones Heights Sonny Food Mart #4 Dallas To Match or Not to Match? Fiesta Mart #7 Houston Crestway Food Mart San Antonio Page 2 Mr T’s Market Midland One Stop Food Store Dallas Potranco Food Mart TopSan Antonio 50 Retailers7-Eleven #125 inOdessa FY12 Fiesta Mart #14 Winner’sHouston SpotlightMini Mart #66 InsertKerrville Page 1 Zip ‘N Austin Handi Stop #21 Houston E-Z Stop Convenience Del Rio Mercury Drive-In Grocery Jacinto City Stateline Citgo Texarkana Super K-F Store Houston Mobil Mart Converse Jim’s EZ Way Killeen Chucks Grocery Arlington Fina Food Mart Waxahachie Hampton Food Mart Dallas Westchester Food Mart Grand Prairie Fiesta Mart #18 Houston Palmer Food Mart Texas City A-Stop Grocery Copperas Cove Wag A Bag #2 Lake Jackson Nguyen Interests Inc Houston Coys Discount Foods Vernon SK One Stop Desoto Bay City Food Mart Bay City Wes-T-Go #1 Abilene Anyday Grocery Austin Hampton Texaco - 1st Term Dallas Bowen’s Grocery Midland Pearland Food Pearland Exxon Food Store Prom Brownsville Your C Store La Grange Fiesta Mart #2 Houston Yu Mi’s Alice E Z Shop Waco A & B Corner Foodmart Round Rock United Drive In #5 McAllen Quick Shop #1 Dallas Pic-N-Pac San Angelo State Fair Wrap-Up Page 11 December 2012/ January 2013 RoundUp December 2012/ January 2013 Email questions or comments about ALL OR NOTHING ........................................................................................ -

Monitoring and Assessing the Impact of Tax and Price Policies on United States’ Tobacco Use

MONITORING AND ASSESSING THE IMPACT OF TAX AND PRICE POLICIES ON UNITED STATES’ TOBACCO USE Frank J. Chaloupka, Ph.D. University of Illinois at Chicago U01 Advisory Panel Meeting, May 1st 2012, Chicago, Illinois Elizabeth Ginexi STATE AND COMMUNITY TOBACCO CONTROL RESEARCH INITIATIVE BACKGROUND FOR SCTC RESEARCH INITIATIVE Community and social norms favoring tobacco-free lifestyles vary greatly across populations. States and communities have played an important role in implementing tobacco prevention and control policies and programs, as well as in designing and implementing mass media campaigns. Significant knowledge gaps exist about how to best strengthen and reinforce tobacco-free social norms across diverse communities and counteract competing pro-tobacco norms. PURPOSE OF SCTC RESEARCH INITIATIVE NCI established the SCTC Research Initiative in 2009 to address high-priority research gaps in state and community tobacco control research: o Secondhand smoke policies o Tax and pricing policies o Mass media countermeasures and community and social norms o Tobacco industry marketing and promotion PROJECT STRUCTURE FOR SCTC RESEARCH COLLABORATION COORDINATING CENTER FOR THE ADVANCEMENT OF TOBACCO CONTROL RESEARCH AND PRACTICE Research Triangle Institute (RTI) Staff: Carol Schmitt, Project Director; Todd Rogers, Associate Project Director; and Matthew Farrelly, Senior Advisor Role: • Increase scientific and organizational leadership necessary to facilitate interactive and integrative collaboration and communication of the research projects funded by this initiative. Specific Aims: Foster collaboration and communication among research project sites, NCI and the broader public health community. Collaborate with NCI, the Steering Committee and research project sites to identify and facilitate complementary, cross- site developmental research projects. Develop plans for translation and dissemination activities and site-specific and initiative-wide evaluation plans. -

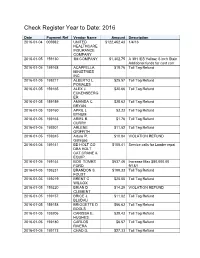

Check Register Year to Date: 2016

Check Register Year to Date: 2016 Date Payment Ref Vendor Name Amount Description 2016-01-04 005982 UNITED $122,462.43 1/4/16 HEALTHCARE INSURANCE COMPANY 2016-01-05 159130 3M COMPANY $1,302.75 A 381 IES Yellow; 6 inch Stain Additional funds for cost corr 2016-01-05 159168 ACAPPELLA $19.76 Toll Tag Refund MINISTRIES INC 2016-01-05 159217 ALBERTO L. $25.57 Toll Tag Refund POMALES 2016-01-05 159165 ALEX J. $20.66 Toll Tag Refund ECKENSBERG ER 2016-01-05 159159 AMANDA C. $25.62 Toll Tag Refund BRYAN 2016-01-05 159160 APRIL L $3.23 Toll Tag Refund BYNUM 2016-01-05 159163 ARIEL B. $1.76 Toll Tag Refund CURRY 2016-01-05 159201 ARLENE $11.52 Toll Tag Refund GRIFFITH 2016-01-05 159245 Arturo R. $10.84 VIOLATION REFUND Gallegos 2016-01-05 159141 BD HOLT CO $108.41 Service calls for Loader repai DBA HOLT CAT,CRANE & EQUIP. 2016-01-05 159144 BOB TOMES $537.46 Increase Max $80,000.00 FORD 9/18/1 2016-01-05 159231 BRANDON S $199.33 Toll Tag Refund FOUST 2016-01-05 159219 BRENT C $25.00 Toll Tag Refund WILCOX 2016-01-05 159220 BRIAN D $14.29 VIOLATION REFUND CLEMENT 2016-01-05 159157 BRICE J. $11.02 Toll Tag Refund BLUDAU 2016-01-05 159158 BRIGGETTE D $86.62 Toll Tag Refund BOOLS 2016-01-05 159206 CARISSA E. $39.43 Toll Tag Refund HUGHES 2016-01-05 159180 CARLOS $6.57 Toll Tag Refund RIVERA 2016-01-05 159173 CHAD D.