Lebanon Is Open to Foreign Direct Investment and Has Many Advantages That Have Encouraged Foreign Companies to Set up Offices in the Country

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The World Bank

Document of The World Bank Report No: ICR2675 Public Disclosure Authorized IMPLEMENTATION COMPLETION AND RESULTS REPORT (TF-58084) Public Disclosure Authorized ON A GRANT IN THE AMOUNT OF US$ 5 MILLION TO THE LEBANESE REPUBLIC FOR THE EMERGENCY POWER SECTOR REFORM CAPACITY REINFORCEMENT PROJECT Public Disclosure Authorized June 20, 2013 Sustainable Development Department Middle East and North Africa Region Public Disclosure Authorized 1 CURRENCY EQUIVALENTS Exchange Rate Effective June 18, 2013 Currency Unit = Lebanese Pound 1.00 = US$ 0.000662 US$ 1.00 = 1,511.51 ABBREVIATIONS AND ACRONYMS CAS Country Assistance Strategy CDR Council for Development and Reconstruction DSP Distribution Service Provider DPL Development Policy Loan EdL Lebanese Power Company (“Electricité du Liban”) ESIA Economic and Social Impact Assessment FM Financial Management FSRU Floating Storage and Regasification Unit GoL Government of Lebanon HCP Higher Council for Privatization ISN Interim Strategy Note ISR Implementation and Status Report LNG Liquefied Natural Gas MMHLC Multi-Ministry Higher Level Committee MOEW Ministry of Energy and Water PDO Project Development Objective PPES Policy Paper for the Electricity Sector PRG Partial Risk Guarantee T&D Transmission and Distribution TFL Trust Fund for Lebanon WB World Bank Vice President: Inger Andersen Country Director: Ferid Belhaj Sector Manager: Charles Joseph Cormier Project Team Leader: Simon J. Stolp ICR Team Leader: Daniel Camos Daurella 2 LEBANESE REPUBLIC Emergency Power Sector Reform Capacity Reinforcement Project CONTENTS Data Sheet A. Basic Information B. Key Dates C. Ratings Summary D. Sector and Theme Codes E. Bank Staff F. Results Framework Analysis G. Ratings of Project Performance in ISRs H. Restructuring I. -

Annual Report 2007

2 Message from the President CDR September 2007 It was in 1995 that I was honored to head the Council for Development and Reconstruction for the first time. Lebanon was in the midst of the reconstruction program launched by the martyred Prime Minister, Rafic Hariri. CDR in collaboration with the government administrations, institutions and community was able to overcome the successive wars and ravages inflicted on our country since 1975. These wars savaged the nation, the government, the institutions, the economy and the infrastructure. Unfortunately, our astonishing achievements for the reconstruction were not accompanied by a determined reform effort to rebuild the country's public institutions and to restore the ties that bind our society together. Equally, serving society should be the ultimate concern of both politics and reconstruction efforts. Just when Lebanon started to move out of the reconstruction phase into an era of economic growth, the July 2006 war broke out transforming existing realities and changing priorities. Following that, and for the second time, I was honored by the Council of Ministers to lead this establishment that forms one of the Council of Ministers' most active tools for implementation. The guiding principles that were set down by the government required the CDR to work on three parallel axes: • Firstly, participate in the efforts to erase the impact of the aggression. • Secondly, continue to implement the development projects started before the aggression. • Thirdly, reformulate investment programs to conform with the government's reform program. Priority is given to the first of these axes, whereby CDR shall seek to modify some of its programs and projects established before the war, to fulfill the urgent needs resulting from the aggression. -

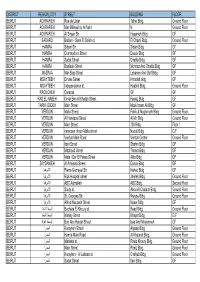

Number Governorate Casa Village 1 Mount Lebanon Kesrouane

Number Governorate Casa Village 1 Mount Lebanon Kesrouane Aachqout 2 Mount Lebanon Kesrouane Ain El Rihani 3 Mount Lebanon Kesrouane Ajaltoun 4 Mount Lebanon Kesrouane Adma and Ain El Defne 5 Mount Lebanon Kesrouane Chnaniir 6 Mount Lebanon Kesrouane Feytroun 7 Mount Lebanon Kesrouane Ghazir 8 Mount Lebanon Kesrouane Ghosta 9 Mount Lebanon Kesrouane Jounieh – Ghadir 10 Mount Lebanon Kesrouane Jounieh – Haret Sakher 11 Mount Lebanon Kesrouane Jounieh - Sarba 12 Mount Lebanon Kesrouane Rayfoun 13 Mount Lebanon Kesrouane Zouk Mosbeh 14 North Lebanon Aakkar Aabboudieh 15 North Lebanon Aakkar El Majdel Aakkar 16 North Lebanon Aakkar Mazraat El Nahrieh 17 North Lebanon Aakkar Qobayat 18 Mount Lebanon Aaley Aaramoun 19 Mount Lebanon Aaley Bchamoun 20 Mount Lebanon Aaley Bleibel 21 Mount Lebanon Aaley Bsous 22 Mount Lebanon Aaley Btater 23 Mount Lebanon Aaley Saoufar 24 North Lebanon Tripoli El Zeitoun 25 North Lebanon Tripoli El Aswaq 26 North Lebanon Tripoli Baal El Wati 27 North Lebanon Tripoli El Chalfe 28 North Lebanon Tripoli El Qobbeh 29 North Lebanon Tripoli El Saqi El Chimali 30 North Lebanon Tripoli El MIna 31 North Lebanon Tripoli Zahrieh 32 South Lebanon Saida Bqosta 33 South Lebanon Saida Kfar Melki 34 South Lebanon Saida El Salhiyeh 35 South Lebanon Tyre Taoura 36 North Lebanon Zgharta Arde 37 North Lebanon Zgharta Kfarhata 38 Bekaa Zahle Ain Kfar Zabad 39 Bekaa Zahle Ablah 40 Bekaa Zahle Bwerej 41 Bekaa Zahle Jdita 42 Bekaa Zahle Taalabay 43 South Lebanon Bint Jbeil Haris 44 Bekaa Baalbeck Bednayel 45 Mount Lebanon Baabda - Louayze -

LEB/9/004 Development of a Country Profile of Environmental Radiation

Lebanese Report 2010 Project Code: RAS7018 Project Title: Upgrading Regional Capability to Assess Marine Contaminants in the ARASIA Member States Counterparts Institute(s): Lebanese Atomic Energy Commission - National Council for Scientific Research (CNRS); Lebanon Counterpart Personnel: El SAMAD Omar I - Country Profile: This project enhances the national capabilities to monitor and assess marine radioactivity as part of a national monitoring program. This will be very beneficial as, the monitoring processes and control of marine pollution is a very strategic important objective of the governments, while many national decrees recently issued includes environmental protection and rehabilitation of the marine environment. A- Potential sources and marine monitoring infrastructure : In Lebanon, the Potential sources of pollutants at the Lebanese coast at the Mediterranean Sea are sewage water, Cheka Cement Industry, Selaata Fertilizer Industry, Zouk and Jieh Electric Power plants, and oil spills are considered also one of the pollution sources. Marine monitoring infrastructure at the Lebanese National Council for Scientific Research (CNRS), Lebanese Atomic Energy Commission (LAEC) consists of radioactivity measurement of natural and anthropogenic radionuclides using nuclear techniques, while the monitoring infrastructure of the National Center for Marine Sciences consists of the determination of physic-chemical parameters (temperature, salinity, PH, O2 dissolved, sulfates, phosphates, nitrates, nitrites), bacteriology, Chlorophylls and phytoplankton and heavy metals. The government plan to extend the studies done on the marine environment in order to cover in addition to the radioactive measurements, the organic pollutants PAH and other Page 1 of 9 pollutants in order to determine their effects on the environment and especially on the fisheries. The Laboratory of Pesticides and Organic Pollutants (LAPPO) at the LAEC is involved in the analysis of different organic pollutants (PAH, pesticides residues, alphatic hydrocarbons …) in different sample matrices. -

Pdf | 435.71 Kb

Lebanon: On the Road to Reconstruction and Recovery A Periodic Report published by the Presidency of the Council of Ministers On the post-July 2006 Recovery & Reconstruction Activities First Issue Date: 21 November 2006 1 Index Page A- Introduction 3 B- Post-war General Economic Situation & Reconstruction Financing 4 C- Assistance, Recovery & Reconstruction Coordination 14 D- Recovery and Rehabilitation Activities 16 E- Reconstruction Activities 21 Appendix 1 – Table 1: List of Damaged Bridges Appendix 1 – Table 2: List of Temporary Steel Bridges Appendix 1 – Table 3: Electricity & Water Damages Appendix 2 – Table 1: List of In-Kind Donations received by HRC Appendix 2 – Table 2: List of In-Kind Donations distributed by HRC Appendix 3: Indemnity Mechanism for Housing & Non-Housing Damages outside Beirut Southern Suburbs Appendix 4: Indemnity Mechanism for Housing & Non-Housing Damages in Beirut Southern Suburbs 2 A- Introduction During thirty-four consecutive days, Lebanon was subjected to the hardest war in its recent history, a war that left around 1,200 people dead and over 4,400 wounded, and caused tremendous physical direct and indirect damages. But the moment the hostilities ceased, the government of Lebanon launched, once again, a giant recovery and reconstruction program, strengthened by the strong will of its people and their unwavering resilience, and supported by the generosity of its Diaspora, and its numerous friends in the Arab World and the international community. To update all involved parties on the developments of the post-war recovery and reconstruction phase, the Presidency of the Council of Ministers (PCM) has launched a periodic situation report on the activities of the involved ministries and governmental bodies. -

Kesrwane El Meten Baabda Jbeil Aley Chouf Beirut

N N " " 0 0 ' ' 2 2 1 1 ° ° 4 4 3 3 WASH CSP completed in 2013 include: 22 generators in 22 locations, 22 pumps in 15 locations and 4 pick up trucks in 2 location. More than 1 million Lebanese and 100,000 Syrian refugees have benefited from the completed Jbiel Union TdH projects. $33500 Jbiel TdH $33500 Jbeil N N " " 0 0 ' ' 3 3 ° ° 4 4 3 3 Hrajel - Keserouane ACTED $6710 Kesrwane Jal el dib - Metn ACTED $14300 Jal el dib - Metn Qornet Hamra ACTED UN Habitat Achrafieh - Beirut $16720 $25795 UN Habitat El Meten Beirut $16240 Jal el dib - Metn ACTED $18772 N Jal el dib - Metn N " " 0 0 ' ' 4 ACTED 4 5 5 ° ° 3 $28050 3 3 3 Malaab Baladi - Beirut Beit Mary UN Habitat UN Habitat $34425 Galerie Semaan - Baabda $5225 ACTED $61798 Daichounieh UN Habitat Daichounieh Forages $29920 ACTED Baabda $30855 Botchay - Botchay UN Habitat $26789 Aley village - Aley UN Habitat $42643 Aaramoun - Baabda Jamhour ACTED ACTED $6820 $21945 Ain Dara UN Habitat $73700 Bedghan - Aley UN Habitat $16118 N N " Aley " 0 0 ' Bennay - Aley ' 5 5 4 4 ° TdH ° 3 3 3 Mechref 3 $18500 ACTED Werhenieh - Chouf $27610 UN Habitat $21983 Baasir - Chouf ACTED - CHF $31581 Barja - Chouf ACTED - CHF Chouf $31581 Debieh UN Habitat $5280 Jieh - Chouf ACTED - CHF Daraya - Chouf Batloun - Chouf $16560 ACTED - CHF UN Habitat $22778 $30319 Jadra - Chouf UN Habitat $16560 Dalhoun - Chouf Aanout - Chouf ACTED - CHF ACTED - CHF $31581 $31581 Chhim Siblin - Chouf UN Habitat ACTED - CHF $60000 Zaarourieh - Chouf $30000 ACTED $12595 N N " " 0 0 ' ' 6 6 3 Rmeileh - Chouf 3 ° ° 3 3 3 ACTED - CHF 3 $16560 Chhim - Chouf Wardanieh - Chouf ACTED - CHF ACTED - CHF Ketermaya - Chouf $44000 $21000 ACTED - CHF $34652 Joun - Chouf UN Habitat $28867 Mghirieh - Chouf ACTED - CHF $21000 35°24'0"E 35°33'0"E 35°42'0"E 35°51'0"E 36°0'0"E 0 5 10 KM Notes The boundaries, names and designations used on this map do not imply official endorsement of the United Nations. -

Integrated Coastal Area Management in Lebanon

UNITED NATIONS ENVIRONMENT PROGRAMME MEDITERRANEAN ACTION PLAN MAP CAMP PROJECT "LEBANON” FINAL INTEGRATED PROJECT DOCUMENT MAP Technical Reports Series No. 160 UNEP/MAP Athens, 2005 Note: The designations employed and the presentation of the material in this document do not imply the expression of any opinion whatsoever on the part of UNEP/MAP concerning the legal status of any State, Territory, city or area, or of its authorities, or concerning the delimitation of their frontiers or boundaries. This report was prepared under the co-ordination of the UNEP/MAP Priority Actions Programme, Regional Activity Centre (PAP/RAC). This series contains selected reports resulting from the various activities performed within the framework of the components of the Mediterranean Action Plan: Pollution Monitoring and Research Programme (MED POL), Blue Plan (BP), Priority Actions Programme (PAP), Specially Protected Areas (SPA), Regional Marine Pollution Emergency Response Centre for the Mediterranean Sea (REMPEC), Environment Remote Sensing Centre (ERS), and Cleaner Production Centre (CP). © 2005 United Nations Environment Programme/Mediterranean Action Plan (UNEP/MAP) P.O. Box 18019, Athens, Greece ISSN 1011-7148 (Paper) 1810–6218 (Online) This publication may be reproduced in whole or in part and in any form for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgement of the source is made. UNEP/MAP would appreciate receiving a copy of any publication that uses this publication as a source. This publication cannot be used for resale or for any other commercial purpose whatsoever without permission in writing from UNEP/MAP. For bibliographic purposes this volume may be cited as: UNEP/MAP: MAP CAMP Project "Lebanon”: Final Integrated Project Document. -

United Nations Environment Programme Mediterranean Action

United Nations Environment Programme Mediterranean Action Plan Priority Action Programme Coastal Area Management Programme Lebanon November, 1999 Note CAMP- Lebanon feasibility study was prepared by the researchers, Ms. Sawsan Mehdi (Study Coordinator), Mr. Fares Sayegh and Ms. Rima Ghannam, with the direct assistance and guidance of the MAP Coordinating Unit Deputy Director, Mr. Arab Hoballah, and PAP/RAC Director, Mr. Ivica Trumbic. This study follows and builds on the operational manual – Formulation and Implementation of CAMP Projects, developed for MAP CAMP Programme. 2 Acknowledgement We would like to extend our appreciation for the contribution of these persons (the list is in alphabetical order): Mr. Abi Said, Chafic, Electricité du Liban Mr. Abou Ghannam, Riad, Deputy Head of Aramoun Municipal Council Mr. Abou Musleh, Ramzi, Head of Ain Ksour Municipal Council Mr. Aql, Ghattas, Ministry of Agriculture Mr. Aql, Ihsan, Member of Damour Municipal Council Ms. Ali Ahmad, Zeina, United Nations Development Programme Ms. Al- Khatib, Dima, United Nations Development Programme Mr. Attalah, Walid, Ministry of Displaced Mr. Awadah, Hussein, Member of Borj el-Chemali Municipal Council Mr. Azzabi, Izzeddine, Consultant, FAO Mission to Ministry of Agriculture Mr. Azzi, George, Dr., Head of Jiyeh Municipal Council Mr. Bu Ghanem, Monir, Capacity 21 Programme Manager Ms. Chamas, Lamia, MAP Focal Point, Ministry of Environment Ms. Charafeddine, Wafa, Dr., Council for Development and Reconstruction Mr. Chehab, Abddelghani, GIS Specialist, Khatib & Alami Mr. Choueiri, Elias, Dr., Advisor, Ministry of Transport Mr. Ekmekji, Jacques, Director, Khatib & Alami Mr. Ghafari, Antoine, Head of Damour municipality Mr. Ghosn, Mansour, Head of Bsatine Municipal Council Mr. Hajjar, Ziad, Head of Chime Municipality Ms. -

Subagents List.Xlsx

DISTRICT REGION_CITY STREET BUILDING FLOOR BEIRUT ACHRAFIEH Rue de Liban Tabet Bldg. Ground Floor BEIRUT ACHRAFIEH Mar Mikhael st. Al Nahr N Ground Floor BEIRUT ACHRAFIEH Al Siryan Str. Hasanieh Bldg GF BEIRUT BADARO Badaro - Sami El Soleh st. El Chami Bldg. Ground Floor BEIRUT HAMRA Sidani Str. Sidani Bldg GF BEIRUT HAMRA Commodore Street Daouk Bldg GF BEIRUT HAMRA Sadat Street Chatila Bldg GF BEIRUT HAMRA Baalbaki Street Momtaz And Chatila Bldg GF BEIRUT MAZRAA Mar Elias Street Lebanon And Gulf Bldg GF BEIRUT MSAYTBEH Dinawi Street Hmadeh bldg GF BEIRUT MSAYTBEH Independance st. Hasbini Bldg. Ground Floor BEIRUT RAOUCHEH Caracas GF GF BEIRUT RAS EL NABEH Omar Ben Al Khatab Street Fawaz Bldg GF BEIRUT TARIK JDIDEH Main Street Mosk Imam Ali Bldg GF BEIRUT VERDUN Malla Street. Fakih & Moghniyeh Bldg Ground Floor. BEIRUT VERDUN Al Handassi Street Al Mir Bldg. Ground Floor BEIRUT VERDUN Main Street 730 Bldg Floor 1 BEIRUT VERDUN caracoun drouz-Malla street Nsouli Bldg G.F BEIRUT VERDUN Verdun Main Road Verdun Center Ground Floor BEIRUT VERDUN Itani Street Shahin Bldg GF BEIRUT VERDUN Mazboud Street Tabara Bldg GF BEIRUT VERDUN Mala / Dar El Fatwa Street Abla Bldg GF BEIRUT ZAYDANIEH Al Arminazi Street Daouk Bldg GF Pierre Gemayel Str Nahed Bldg GF اﻷشرفية BEIRUT Rizk Hospital street Jbeileh Bldg. Ground Floor اﻷشرفية BEIRUT ABC Achrafieh ABC Bldg. Second Floor اﻷشرفية BEIRUT Saidy st. Abou Al Chalach Bldg. Ground Floor اﻷشرفية BEIRUT St. Georges Str. Krayde Bldg. Ground Floor اﻷشرفية BEIRUT Alfred Naccach Street Naser Bldg GF اﻷشرفية BEIRUT Bechara El Khoury st. -

Sustainable Oil and Gas Development in Lebanon, “SODEL” COST BENEFIT ANALYSIS for the USE of NATURAL GAS and LOW CARBON FUELS

J669-ILF-BGE-AD-0021/REV.0 United Nations Development Programme Sustainable Oil and Gas Development in Lebanon, “SODEL” COST BENEFIT ANALYSIS FOR THE USE OF NATURAL GAS AND LOW CARBON FUELS FINAL REPORT 01.11.2016 ILF Business Consult GmbH Joseph-Wild-Strasse 16 81829 Munich Germany Phone: +49-89-25 55 94 - 0 Fax: +49-89-25 55 94 - 550 E-mail: [email protected] Internet: www.ilf-bc.com United Nations Development Programme Final Report REVISION 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 0 19. 08.09.2016 Issue for use 20. F. Baretzky 21. S. Roth 22. S. Roth Rev. Date Purpose Prepared Checked Approved J669-ILFBC-AD-0023-Final Report_Rev0 28.10.2016 01.11.2016 Page 2 of 147 United Nations Development Programme Final Report TABLE OF CONTENTS TERMS AND DEFINITIONS 11 ABBREVIATIONS 11 1 INTRODUCTION 16 1.1 Authorization 16 1.2 Project Description 16 1.3 Work Methodology for the Project 17 1.3.1 Task 1: Overview of the current hydrocarbons in the energy sector in Lebanon 17 1.3.2 Task 2: Assess the existing infrastructure in Lebanon and provide recommendations to implement a new fuel mix in the target sectors 17 1.3.3 Task 3: Conduct Cost benefit Analysis on the possible use of natural gas and LCFs in the target sectors 18 1.3.4 Task 4: provide recommendations to update or develop new legislation to implements the new fuel mix in the target sectors 20 1.3.5 Task 5: Provide policy recommendations 21 1.3.6 Task 6: Conduct consultation workshop to verify the attained results 21 1.3.7 Task 7: Design a pilot study on the use of natural -

Mobility: a Nation Under Siege

MOBILITY: A NATION UNDER SIEGE An insight into mobile communications during the 2006 Lebanon conflict www.mtctelecom.com June 2007 This report was produced by MTC Group To view other MTC Mobility Research Reports, please visit www.mtctelecom.com Cover picture © AP PHOTO It is important to note that the views of the researchers and articles are those of the authors and not those of MTC Group. Whilst every care was taken in the preparation of the editorial content, MTC Group cannot be held responsible for any errors or omissions. Copyright © MTC Group, 2007 All contents copyrighted 2007 by MTC Group. Reprints allowed, all rights reserved. Please note MTC Group copyright in all reprints. © Mohammad Azakir “One call could save a life” The war that took place in Lebanon during July and August 2006 will always remain as a dark stain in the memories of many in the region. Over 1,200 Lebanese perished in a fierce conflict that we hope we will never again witness. And although over 30,000 homes were destroyed, $2.5 billion in physical damages and unmeasured billions in losses were inflicted to the local economy, the Lebanese never lost their dignity and came through with honor. Mobile telecommunications played a critical role in this tragic conflict. Not only was it the main commm munication medium for those stranded after the roads and bridges were bombed, it also helped transmit vital information via SMS for evacuation purposes and allowed people to escape bombardments, find food and fuel, and reunite with family and friends. It added another dimension to the media coverage through the use of phone integrated cameras and it was used to disseminate propaganda messages across borders. -

Assemblée Générale GÉNÉRALE

NATIONS UNIES A Distr. Assemblée générale GÉNÉRALE A/HRC/3/2 23 novembre 2006 FRANÇAIS Original: ANGLAIS/FRANÇAIS CONSEIL DES DROITS DE L’HOMME Troisième session Point 2 de l’ordre du jour provisoire APPLICATION DE LA RÉSOLUTION 60/251 DE L’ASSEMBLÉE GÉNÉRALE DU 15 MARS 2006 INTITULÉE «CONSEIL DES DROITS DE L’HOMME» Rapport de la Commission d’enquête sur le Liban établi conformément à la résolution S-2/1* du Conseil des droits de l’homme * En raison de leur longueur, les notes du texte sont rassemblées à la fin du document et, comme les annexes au présent rapport, distribuées uniquement dans la langue dans laquelle elles ont été reçues. GE.06-15098 (F) 060307 090307 A/HRC/3/2 page 2 Résumé 1. Le 11 août 2006, à sa deuxième session extraordinaire, convoquée pour examiner le conflit en cours au Liban, le Conseil des droits de l’homme a adopté la résolution S-2/1, intitulée «La grave situation des droits de l’homme au Liban causée par les opérations militaires israéliennes», dans laquelle il a décidé «d’établir d’urgence et d’envoyer immédiatement une commission d’enquête de haut niveau». L’objectif, aux termes du paragraphe 7 de la résolution S-2/1: «a) qu’elle fasse enquête sur le ciblage et le meurtre systématique de civils par Israël au Liban; b) qu’elle examine les types d’armes utilisés par Israël et leur conformité avec le droit international; et c) qu’elle évalue l’étendue et les effets meurtriers des attaques israéliennes sur les vies humaines, les biens, les infrastructures essentielles et l’environnement».