Conference & Roadshow Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 June Edition Angela Qu, SVP Head of Procurement

2019 June Edition Angela Qu, SVP Head of Procurement Company: Lufthansa Group 1. How and when did procurement & supply become your passion and career choice? A government job I had in China facilitated working with a Siemens joint venture. I supported the related General Manager (helping to open the factory, hiring people, etc.) and was asked which function I’d like to join - purchasing was my first selection for a personal and career choice. The 9 years at Siemens gave me lot of opportunities working from operational tasks, to category managers and later on as Senior consultants optimizing Supply Chains for Siemens factories and suppliers. 2. How did that lead to your recent roles, and what has occupied most of your time? After being headhunted to set-up the global sourcing department for Leybold Optics, I then moved to ABB firstly in Germany. Later I moved to Switzerland and remained for a total of 13.5 years. I had a lot of focus on harmonizing the sourcing and category management processes across the different fractionated ABB organizations. People development was also significant: career paths, job profiles, high potential programs and knowledge management (in 2014 we won an Award from the Procurement Leaders organization). Recently I was leading the largest business division in ABB, with about 7 Billion purchasing volume and 850 people. 3. What makes you proud of your team? Changing the mind-set of the purchasing community has been a key milestone. From local traditional tactical methods to becoming one of global sourcing excellence. Staying the course over multiple years. -

PRESS RELEASE Frankfurt, May, 20, 2021

PRESS RELEASE Frankfurt, May, 20, 2021 Summer 2022: Seven additional long-haul tourist connections from Frankfurt and Munich − Directly from Munich to Punta Cana, Cancún and Las Vegas − Four additional destinations from Frankfurt: Fort Myers, Panama City, Salt Lake City and Kilimanjaro − All destinations for summer 2022 bookable as of May 26 The Lufthansa Group now already offers exciting vacation destinations on long- haul tourist routes for summer 2022. In addition to four more routes from Frankfurt, the Munich hub will again be integrated more strongly into the Lufthansa Group's long-haul tourist offering. From March 2022, flights will once again depart from Munich to the sunny destinations of Punta Cana in the Dominican Republic and Cancún in Mexico. Each destination will be served twice a week. Moreover, there will be two flights per week from the Bavarian capital to Las Vegas in the United States. Departing from Frankfurt, travelers can look forward to four dream destinations. Back on the flight schedule: Starting in March 2022, the Lufthansa Group will offer three flights a week to Fort Myers in the sunny state of Florida as well as to Panama City in Central America. In addition, Salt Lake City in the western United States will be on the flight schedule for the first time starting in May 2022 - with three flights per week. The Lufthansa Group is also expanding its services to East Africa and will be flying from Frankfurt to Kilimanjaro twice a week for the first time from June 2022. This summer, the flight schedule already includes Mombasa (Kenya) with onward flights to the dream island of Zanzibar (Tanzania). -

Conference & Roadshow Presentation

Conference & Roadshow Presentation June / July 2019 Disclaimer The information herein is based on publicly available information. It This presentation contains statements that express the Company‘s has been prepared by the Company solely for use in this opinions, expectations, beliefs, plans, objectives, assumptions or presentation and has not been verified by independent third parties. projections regarding future events or future results, in contrast with No representation, warranty or undertaking, express or implied, is statements that reflect historical facts. While the Company always made as to, and no reliance should be placed on, the fairness, intends to express its best knowledge when it makes statements accuracy, completeness or correctness of the information or the about what it believes will occur in the future, and although it bases opinions contained herein. The information contained in this these statements on assumptions that it believes to be reasonable presentation should be considered in the context of the when made, these forward-looking statements are not a guarantee circumstances prevailing at that time and will not be updated to of performance, and no undue reliance should be placed on such reflect material developments which may occur after the date of the statements. Forward-looking statements are subject to many risks, presentation. uncertainties and other variable circumstances that may cause the statements to be inaccurate. Many of these risks are outside of the Company‘s control and could cause its actual results (positively or The information does not constitute any offer or invitation to sell, negatively) to differ materially from those it thought would occur. purchase or subscribe any securities of the Company. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

Brussels Airlines Introduces Year Round Service to Washington D.C

Brussels Airlines introduces year round service to Washington D.C. Year round service begins February 20, 2020 Capacity increases to daily service in the summer 2020 schedule February 20, 2020, New York, NY – Today, Brussels Airlines launched year-round flights to and from Washington, DC to Brussels, Belgium. The new service increases the air carrier’s capacity on this important route from a seasonal flight to year-round service. Traveling four times per week, Brussels Airlines flight SN515 will depart from Brussels at 10:15 am with an A330-200 aircraft. It will arrive in DC at 01:00 pm. The return flight, SN516, will depart from Dulles International Airport at 06:10 pm and arrive in Brussels at 07:45 am on the following day. All times are local. Beginning March 29, 2020, Belgium’s home air carrier will increase the frequency of its Washington, DC route to a daily operation. The daily service will also be operated with an Airbus 330-200 aircraft that consists of a seat configuration of 22 Business Class seats, 21 Premium Economy Class seats and 212 Economy Class seats. "North America continues to be one of our most important global regions and Brussels Airlines’ increased flight capacity clearly reflects the Lufthansa Group's strong commitment to the U.S. market," said Frank Naeve, Vice President of Sales, The Americas, Lufthansa Group, "We are pleased to offer our customers an enhanced connectivity between Europe’s capital city and the capital of the United States. Furthermore, with Brussels Airlines’ unique offering of 84 weekly flights and service to 17 destinations in Sub-Saharan Africa – a continent the airline considers its second home – Washingtonians will now be able to visit this spectacular region with great ease, all while experiencing Brussels Airlines premium product and personalized customer service.” “Brussels Airlines strives to provide our customers with top-of-the-line service and on board product. -

Delta Air Lines Inc /De

DELTA AIR LINES INC /DE/ FORM 10-K (Annual Report) Filed 09/28/98 for the Period Ending 06/30/98 Address HARTSFIELD ATLANTA INTL AIRPORT 1030 DELTA BLVD ATLANTA, GA 30354-1989 Telephone 4047152600 CIK 0000027904 Symbol DAL SIC Code 4512 - Air Transportation, Scheduled Industry Airline Sector Transportation Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2015, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. DELTA AIR LINES INC /DE/ FORM 10-K (Annual Report) Filed 9/28/1998 For Period Ending 6/30/1998 Address HARTSFIELD ATLANTA INTL AIRPORT 1030 DELTA BLVD ATLANTA, Georgia 30354-1989 Telephone 404-715-2600 CIK 0000027904 Industry Airline Sector Transportation Fiscal Year 12/31 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10 -K [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED JUNE 30, 1998 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 COMMISSION FILE NUMBER 1-5424 DELTA AIR LINES, INC. (EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER) DELAWARE 58-0218548 (STATE OR OTHER JURISDICTION OF (I.R.S. EMPLOYER INCORPORATION OR ORGANIZATION) IDENTIFICATION NO.) HARTSFIELD ATLANTA INTERNATIONAL AIRPORT POST OFFICE BOX 20706 30320 ATLANTA, GEORGIA (ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) (ZIP CODE) REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE: (404) 715-2600 SECURITIES REGISTERED PURSUANT TO SECTION 12(B) -

Belgian Aerospace

BELGIAN AEROSPACE Chief editor: Fabienne L’Hoost Authors: Wouter Decoster & Laure Vander Graphic design and layout: Bold&pepper COPYRIGHT © Reproduction of the text is authorised provided the source is acknowledged Date of publication: June 2018 Printed on FSC-labelled paper This publication is also available to be consulted at the website of the Belgian Foreign Trade Agency: www.abh-ace.be BELGIAN AEROSPACE TECHNOLOGIES TABLE OF CONTENTS CHAPTER 1 PRESENTATION OF THE SECTOR 4-35 SECTION 1 : BELGIUM AND THE AEROSPACE INDUSTRY 6 SECTION 2 : THE AERONAUTICS INDUSTRY 10 SECTION 3 : THE SPACE INDUSTRY 16 SECTION 4 : BELGIAN COMPANIES AT THE FOREFRONT OF NEW AEROSPACE TRENDS 22 SECTION 5 : STAKEHOLDERS 27 CHAPTER 2 SUCCESS STORIES IN BELGIUM 36-55 ADVANCED MATERIALS & STRUCTURES ASCO INDUSTRIES 38 SABCA 40 SONACA 42 PLATFORMS & EMBEDDED SYSTEMS A.C.B. 44 NUMECA 46 THALES ALENIA SPACE 48 SERVICES & APPLICATIONS EMIXIS 50 SEPTENTRIO 52 SPACEBEL 54 CHAPTER 3 DIRECTORY OF COMPANIES 56-69 3 PRESENTATION OF THE SECTOR PRESENTATION OF THE SECTOR SECTION 1 By then, the Belgian government had already decided it would put out to tender 116 F-16 fighter jets for the Belgian army. This deal, still known today as “the contract of the BELGIUM AND THE century” not only brought money and employment to the sector, but more importantly, the latest technology and AEROSPACE INDUSTRY know-how. The number of fighter jets bought by Belgium exceeded that of any other country at that moment, except for the United States. In total, 1,811 fighters were sold in this batch. 1.1 Belgium’s long history in the aeronautics industry This was good news for the Belgian industry, since there was Belgium’s first involvement in the aeronautics sector was an agreement between General Dynamics and the European related to military contracts in the twenties. -

Airline Alliances

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2011 by Paul Stephen Dempsey Open Skies • 1992 - the United States concluded the first second generation “open skies” agreement with the Netherlands. It allowed KLM and any other Dutch carrier to fly to any point in the United States, and allowed U.S. carriers to fly to any point in the Netherlands, a country about the size of West Virginia. The U.S. was ideologically wedded to open markets, so the imbalance in traffic rights was of no concern. Moreover, opening up the Netherlands would allow KLM to drain traffic from surrounding airline networks, which would eventually encourage the surrounding airlines to ask their governments to sign “open skies” bilateral with the United States. • 1993 - the U.S. conferred antitrust immunity on the Wings Alliance between Northwest Airlines and KLM. The encirclement policy began to corrode resistance to liberalization as the sixth freedom traffic drain began to grow; soon Lufthansa, then Air France, were asking their governments to sign liberal bilaterals. • 1996 - Germany fell, followed by the Czech Republic, Italy, Portugal, the Slovak Republic, Malta, Poland. • 2001- the United States had concluded bilateral open skies agreements with 52 nations and concluded its first multilateral open skies agreement with Brunei, Chile, New Zealand and Singapore. • 2002 – France fell. • 2007 - The U.S. and E.U. concluded a multilateral “open skies” traffic agreement that liberalized everything but foreign ownership and cabotage. • 2011 – cumulatively, the U.S. had signed “open skies” bilaterals with more than100 States. Multilateral and Bilateral Air Transport Agreements • Section 5 of the Transit Agreement, and Section 6 of the Transport Agreement, provide: “Each contracting State reserves the right to withhold or revoke a certificate or permit to an air transport enterprise of another State in any case where it is not satisfied that substantial ownership and effective control are vested in nationals of a contracting State . -

Sustainability 2019 2 INTRO

FACT SHEET ONLINE lufthansagroup.com/en/responsibility FACT SHEET FACT Sustainability 2019 Sustainability 2 INTRO The responsible and sustainable treatment of resources, the environment and society is a prerequisite for the long-term financial stability and attractiveness of the Lufthansa Group for its customers, employees, investors and partners. With its measures and concepts, the Lufthansa Group aims to strengthen the positive effects of its business activities and further reduce the negative impacts in order to consolidate its position as a leading player in the airline industry, including in the area of corporate responsibility. You will find further information, the strategic direction and targets in the non-financial declaration of the annual report 2019. ↗ investor-relations.lufthansagroup.com The Executive Board has been extended to include a position responsible for Customer & Corporate Responsibility since 1 January 2020. This will establish responsibility for environment, climate and society directly at the Executive Board level. The Company has applied the principles of the UN Global Compact for sustainable and responsible corporate governance since 2002. A Supplier Code of Conduct has supplemented the Code of Conduct, which has been binding for all corporate bodies, managers and employees since 2017. The Lufthansa Group supports the Sustainable Development Goals (SDGs) of the Agenda 2030, as adopted by the UN member states in 2015 and is concentrating on the seven SDGs 4, 5, 8, 9, 12, 13 and 17 due to the impacts of its business -

1St Interim Report 2021

1ST INTERIM REPORT January – March 2021 The Lufthansa Group KEY FIGURES Jan - Mar Jan - Mar Change 2021 2020 in % Revenue and result Total revenue €m 2,560 6,441 -60 of which traffic revenue €m 1,542 4,539 -66 Operating expenses €m 3,980 8,162 -51 Adjusted EBITDA 1) €m -577 -540 -7 Adjusted EBIT 1) €m -1,143 -1,220 6 EBIT €m -1,135 -1,622 30 Net profit/loss €m -1,049 -2,124 51 Key balance sheet and cash flow statement figures Total assets €m 38,453 43,352 -11 Equity €m 2,052 7,497 -73 Equity ratio % 5.3 17.3 -12.0 pts Net indebtedness €m 10,924 6,354 72 Pension provision €m 7,821 6,989 12 Cash flow from operating activities €m -766 1,367 Capital expenditures (gross) 3) €m 153 770 -80 Adjusted free cash flow 1) €m -947 620 Key profitability and value creation figures Adjusted EBITDA margin 1) % -22.5 -8.4 -14.1 pts Adjusted EBIT margin 1) % -44.6 -18.9 -25.7 pts EBIT margin % -44.3 -25.2 -19.1 pts Lufthansa share Share price as of 31 March € 11.31 8.56 32 Earnings per share € -1.75 -4.44 61 Traffic figures 2) Flights number 41,011 209,094 -80 Passengers thousands 3,043 21,756 -86 Available seat-kilometres millions 16,843 64,297 -74 Revenue seat-kilometres millions 7,584 47,099 -84 Passenger load factor % 45.0 73.3 -28.3 pts Available cargo tonne-kilometres millions 2,528 3,428 -26 Revenue cargo tonne-kilometres millions 1,940 2,159 -10 Cargo load factor % 76.7 63.0 13.7 pts Employees Employees as of 31 March number 111,262 136,966 -19 1) Derivation -> Financial performance, p. -

Swissair's Collapse

IWIM - Institut für Weltwirtschaft und Internationales Management IWIM - Institute for World Economics and International Management Swissair’s Collapse – An Economic Analysis Andreas Knorr and Andreas Arndt Materialien des Wissenschaftsschwerpunktes „Globalisierung der Weltwirtschaft“ Band 28 Hrsg. von Andreas Knorr, Alfons Lemper, Axel Sell, Karl Wohlmuth Universität Bremen Swissair’s Collapse – An Economic Analysis Andreas Knorr and Andreas Arndt Andreas Knorr, Alfons Lemper, Axel Sell, Karl Wohlmuth (Hrsg.): Materialien des Wissenschaftsschwerpunktes „Globalisierung der Weltwirtschaft“, Bd. 28, September 2003, ISSN 0948-3837 (ehemals: Materialien des Universitätsschwerpunktes „Internationale Wirtschaftsbeziehungen und Internationales Management“) Bezug: IWIM - Institut für Weltwirtschaft und Internationales Management Universität Bremen Fachbereich Wirtschaftswissenschaft Postfach 33 04 40 D- 28334 Bremen Telefon: 04 21 / 2 18 - 34 29 Telefax: 04 21 / 2 18 - 45 50 E-mail: [email protected] Homepage: http://www.iwim.uni-bremen.de Abstract Swissair’s rapid decline from one of the industries’ most renowned carriers into bank- ruptcy was the inevitable consequence of an ill-conceived alliance strategy – which also diluted Swissair’s reputation as a high-quality carrier – and the company’s inability to coordinate effectively its own operations with those of Crossair, its regional subsidiary. However, we hold that while yearlong mismanagement was indeed the driving force behind Swissair’s demise, exogenous factors both helped and compounded -

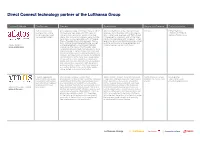

Direct Connect Technology Partner of the Lufthansa Group

Direct Connect technology partner of the Lufthansa Group Company & Website Core Services Overview Target Markets Geographical Presence Contact Information Platform for booking As a system provider of business travel solutions Atlatos‘s clients are on the one hand travel Europa Esther Stehning business trips, online for travel agencies, Atlatos GmbH offers an agencies doing business with corporate cli- +49 6431-212498-10 booking engine, travel online booking engine for serving corporate ents, online travel agencies and TMCs (travel [email protected] management system. clients. Our company‘s business areas include management companies), and on the other the solution components Atlatos Profi Traveller, hand corporate clients with a medium to high Atlatos Traveller, Atlatos Online Agent, Atlatos level of travel activity. Booking business travel Sync and the Atlatos Expense Engine, as well and the optimization of travel expenses and Atlatos GmbH as the development of customized individu- travel processes are our main focus. www.atlatos.com al solutions. The Atlatos Profi Traveller offers companies efficient travel management for easy online booking of flights, hotels, rental cars and train travel while taking company guidelines into account. The relevant travel agency is integrated into the process at the same time. Travel expen- se accounting is also available, in addition to profile management, interactive travel guidelines and authorisation processes. With the Atlatos Expense Engine, a web-based travel expense accounting system, trips can be billed easily online, based on booking information. Content Aggregator - Atriis provides a single, unified Travel Target markets include: Travel Management North America, Europe, David Bishop GDS Content and Direct Management system to TMC‘s and their corporate Companies and Multi-National Corporations.